Top 10 Functional Food Trends

Instant nutrition, everyday performance foods, and health-enhancing food processing are among the trends defining the functional food and beverage sector.

Article Content

Health and wellness continue to drive growth in the global food and beverage industry. Worldwide sales of naturally healthy foods reached $253 billion in 2017; functional/fortified foods totaled $247 billion (Euromonitor 2018).

Organic foods and beverages led global retail value growth with a compound annual growth rate of 7% from 2012–2017, followed by free-from products at just over 6%; naturally healthy, 3%; and fortified/functional, 2%.

In developing countries, organic food and drink sales grew 9%, and free-from product sales were up 5%. Although the United States is the largest functional food and beverage market, Asia and Eastern Europe are driving sales (Euromonitor 2018).

Better-for-you options, however, posted slightly negative growth as global consumers continue to associate products formulated with reduced fat, sugar, salt, and caffeine with overprocessed foods. In North America, sales of reduced-fat packaged foods and reduced-sugar soft drinks each fell 5% in 2017 (Euromonitor 2017).

A Functional Future

In the United States, nearly two-thirds of adults said that healthfulness had a significant impact on their food and beverage purchase decisions last year (IFIC 2017).

More than half (55%) of adults said they lived a healthier lifestyle last year; feeling good was the top motivation for doing so (Mintel 2017a). Seven in 10 Millennials say they’re taking a more holistic approach to their health; 60% of Gen Xers and 64% of Baby Boomers are doing so (Wyatt and Levin 2018).

High in nutrients/healthy components is the No. 1 way consumers define a healthy food, followed by free from artificial ingredients (IFIC 2017). Eight in 10 are concerned about the nutritional content of their food; 29% are very concerned (FMI 2017).

Drinking more water, eating more fruits and vegetables, and making small dietary changes were the steps consumers took in 2017 to eat more healthfully. Weight concerns were the top reason they made dietary changes (IFIC 2017).

Sales in the fresh perimeter of the store continue to outpace other food and beverage categories, per IRI, but growth slowed to 1.0% in 2017; volume growth was flat (Wyatt and Levin 2018).

Half of consumers bought more natural and organic foods and beverages last year; the number of those who prefer to eat foods that are free from artificial additives was at an all-time high at 50% (Packaged Facts 2018a). One-third of adults shopped in a natural food store in 2017 (Packaged Facts 2017a).

Sales of foods and beverages with a “nothing artificial” claim rose 3.6% for the year ending May 20, 2017; all-natural products, +7.8%; and those “free of additives and artificial ingredients,” +8% (Nielsen 2017a). One-third of all U.S. foods and beverages and 25% of dairy offerings are now clean label (Nielsen 2018).

Members of the maturing Millennial generation are having children of their own; about 45% of U.S. adults are aged 50 and older, with the oldest Boomers aged 73. Given these demographics, expect consumer emphasis to begin to shift toward fortified, functional foods and naturally nutrient-dense fare. Concerns about getting older, a new health condition, lack of energy, and having a baby are among the top motivators for taking action for health (Hartman 2015).

Perhaps most important, Americans have shifted their food buying decisions from one based primarily on form (e.g., water or coffee) to one based on the product’s benefits (e.g., Cheerio’s Protein), thus allowing marketers to increase potential revenue by competing across multiple categories for the same benefit (IRI 2017).

What follows is a look at the top 10 trends in the functional foods and ingredients market for the year ahead.

1. Instant Nutrition

Quick and easy ways to ensure a healthier lifestyle are in high demand, and highly fortified nutritionals, functional snacks, and naturally nutrient-dense munchies (e.g., nuts) are getting the nod.

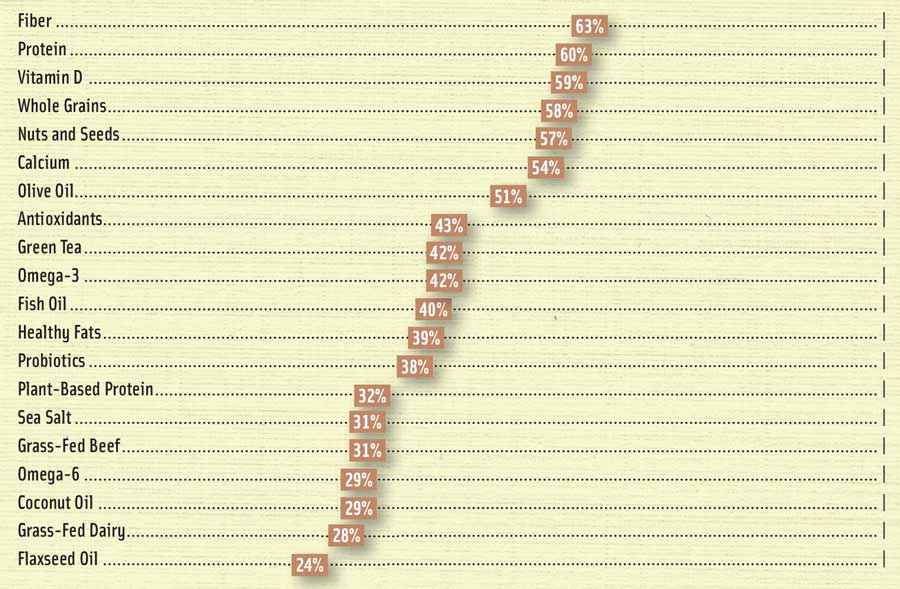

Two-thirds (65%) of adults looked for foods and beverages that had added vitamins/minerals last year. Sixty-three percent tried to add more fiber, and 60% sought more protein (Hartman 2017, Figure 1).

Dollar sales of meal replacements and liquid nutritionals jumped 9% in mass channels for the year ending April 16, 2017, per IRI. Sales of adult nutritional products (e.g., Ensure) climbed by 25%, and nutrition/health bars were up 18% (Chain Drug 2017).

Dollar sales of Premier Protein drinks shot up 84%; SlimFast, +51%; and PediaSure, +12% (Chain Drug 2017). Kind Nuts & Spice nutrition bars led the bar category, with sales up 16%; Think Thin bar sales were up 20% (Johnson 2017).

Sports nutrition and protein powders are projected to reach sales of $5.4 billion, up 6.6% in 2018 (NBJ 2018). Functional beverages were the fastest-growing specialty food item over the past two years (SFA 2017).

Beyond general nutritional support, 56% buy nutritional shakes for protein, 36% for weight loss, 23% for athletic performance, 21% for superfood ingredients, and 16% for a specific health condition. Half (48%) buy nutrition bars for protein, 26% for weight loss, 20% for athletic performance, 19% for superfood ingredients, and 10% for a specific condition (Packaged Facts 2017b).

Two in five adults skip breakfast in favor of drinking a meal replacement beverage; four in 10 say high protein is most important at breakfast time (Mintel 2016). Van’s Foods’ Power Grains frozen waffles contain 10 grams of protein.

In 2017, 76% of adults used dietary supplements, an all-time high (CRN 2017). Supplement sales reached $49 billion, up 6.2%, driven by increased use among Millennials (NBJ 2018). Seventy-three percent of adults took a multivitamin (CRN 2017).

Sales of functional snacks are projected to reach $8.5 billion by 2020, up 11% per year (NBJ 2018). Six in 10 want snacks that deliver health benefits beyond nutrition, up 8% over 2016; 59% want vitamins/minerals, and 57% seek an energy boost (Wyatt 2017).

Sales of functional snacks are projected to reach $8.5 billion by 2020, up 11% per year (NBJ 2018). Six in 10 want snacks that deliver health benefits beyond nutrition, up 8% over 2016; 59% want vitamins/minerals, and 57% seek an energy boost (Wyatt 2017).

No-/low-sugar fruit snacks, smoothies, appetizer rolls/snacks, low-sugar trail mix, snack-size fresh produce, refrigerated handheld non-breakfast entrees, and meat snacks/jerky were among the top 10 dollar-growth snack categories for the year ending Feb. 26, 2017, per IRI (Wyatt 2017).

Seventy-five million households buy nuts as a healthy snack, 47 million buy jerky, and 27 million buy fruit snacks (Packaged Facts 2016a). Jif Power Ups are a wholesome, new peanut butter–based snack for kids.

Dannon introduced Activia Probiotic Dailies drink shots. Ehrmann introduced High Protein Milk Shots with 20 grams of protein.

2. Fit Consumers

There’s a new demographic of active and fit consumers who incorporate exercise into their daily routine, and they’re driving the $42 billion sports nutrition sector mainstream. In 2017, 45% of U.S. adults described themselves as active. Perhaps ironically, those aged 65 and older are most likely to do so, with 55% making that claim versus 38% of those aged 18–34 (Mintel 2017a).

Just over half (53%) of adults exercised for at least 30 minutes three or more days per week in 2017. Although those under age 40 are most likely to exercise, older adults are the fastest-growing group of exercisers (Gallup 2017).

Just over half (53%) of adults exercised for at least 30 minutes three or more days per week in 2017. Although those under age 40 are most likely to exercise, older adults are the fastest-growing group of exercisers (Gallup 2017).

Walking—with 106 million participants—is America’s top sport/exercise activity; 56 million people exercise with equipment, 45 million do aerobics, and 44 million jog (NSGA 2017).

While being able to maintain normal activity and mental sharpness with age are the top health concerns in the United States and around the world, issues affecting everyday performance are getting attention. Lack of energy, muscle tone, stress, back/neck pain, and mental sharpness are now among the top U.S. health concerns (HealthFocus 2016).

Four in 10 manage their diet to ensure they have sustained energy to get through the day (Hartman 2016). Thirty-seven percent of adults consume sports beverages; 13%, energy drinks; and 4%, energy shots (Packaged Facts 2017c). Sales of sports and energy drinks are projected to reach $23 billion in 2018, up 5%; hardcore sports beverages will reach $928 million, up 15% (NBJ 2018).

Ready-to-drink coffee and tea, with sales up 14% and 7%, respectively, for the year ending May 14, 2017, have become formidable competitors. Sports beverage sales grew 5% and energy drinks 4%; shot sales fell 7%, per IRI (BI 2017).

Phocus is a new sparkling energy water with as much caffeine as an 8 oz cup of coffee. Trimino protein-infused water was Beverage Industry magazine’s pick for best new beverage in January 2018. BPI Sports has a new line of liquid water enhancers ranging from Best Aminos to Best Energy and Carnitine.

Eight in 10 Millennials and 67% of Gen Xers and Boomers believe that food impacts their energy and mental clarity (Brush 2017). Seventy percent of consumers want more foods and beverages to help with maintaining/improving brain health (FMI 2016).

Brain health/cognition/alertness topped the list of the biggest new opportunities for targeted nutrition products in a 2017 survey of nutraceutical manufacturers, followed by gut health, anti-aging, weight management, diabetes, immunity, joint health, mood, and heart health (Polito 2017).

Two-thirds of consumers are looking to foods and beverages to help build their physical strength and muscle (FMI 2016). Only 30% of those aged 18–34 meet the National Institute of Health’s (NIH) guidelines for muscle-strengthening activities (AAOS 2016).

Stress and sleep are other emerging functional food and drink opportunities. Eighty-two percent of adults have trouble sleeping at least once a week. Expect more late-night snacks and calming drinks, especially teas (Packaged Facts 2017d).

3. Role Reversals

After decades on the “most wanted list” of nutritional villains, full-fat foods, including butter, are back in dietary vogue; fat-rich weight loss diets (e.g., Keto and Paleo) are contributing to this trend.

Whole milk sales jumped 4% to $4.8 billion for the year ending Nov. 5, 2017, per IRI (Canning 2018). The percentage of yogurt eaters who prefer regular full-fat yogurt increased to 48% last year (Packaged Facts 2018b).

Volume growth for fat-free cheese fell 18% in 2017, lowfat was down 14%, and light/reduced fat fell 9%; full-fat cheese now accounts for 82% of cheese sales (IDDBA 2018). Sales of dairy ice cream are up 4.3% to $6.6 billion for the year ending May 27, 2017; sales of ice cream with a “good source of protein” claim rose 207% (Nielsen 2017b).

Nearly half (47%) of adults now believe that unprocessed meat is good for your health (Nielsen 2017c). Three-quarters of Millennials associate meat and poultry with providing nutrients (e.g., protein, iron). Only 17% say that plant-based protein offers superior nutritional value versus animal protein (Nielsen 2017d).

Vegetable spaghetti, carrot/zucchini fries, riced cauliflower, and spinach pizza crusts are moving produce to the center of the plate. Veggie-centric cuisines and vegetable carbohydrate substitutes are No. 7 on the list of hot culinary trends for 2018 (NRA 2017). Green Giant Veggie Spirals are sure to find a welcome market.

Vegetable spaghetti, carrot/zucchini fries, riced cauliflower, and spinach pizza crusts are moving produce to the center of the plate. Veggie-centric cuisines and vegetable carbohydrate substitutes are No. 7 on the list of hot culinary trends for 2018 (NRA 2017). Green Giant Veggie Spirals are sure to find a welcome market.

Eight in 10 consumers are eating more fish and seafood. Fish tops the list of proteins served in meatless meals (FMI 2018). Shrimp is America’s most eaten seafood, followed by salmon, canned tuna, tilapia, Alaska pollock, Pangasius, cod, crab, catfish, and clams (NFI 2017). Seafood appetizers and frozen meals remain missed fish opportunities; sushi is the fastest-growing item in the deli (IDDBA 2018).

Better-for-you and clean labels have breathed new life into frozen foods. In fact, the frozen department has the highest incidence of free-from claims, more than twice the share of total sales in the dairy or deli (Hale 2017a). One-quarter (26%) of consumers are shopping for frozen foods more often than last year; 43% of Millennials are doing so (Acosta 2017).

Sales of frozen side dishes with vegetables/pasta/grain were up 43% for the year ending Aug. 3, 2017, per Nielsen; Asian side dishes, +31%; healthy frozen breakfast items, +20%; and multiserve entrées, +5% (Hale 2017b). Conagra’s new Healthy Choice Power Bowls have expanded into the breakfast daypart.

Sales of frozen side dishes with vegetables/pasta/grain were up 43% for the year ending Aug. 3, 2017, per Nielsen; Asian side dishes, +31%; healthy frozen breakfast items, +20%; and multiserve entrées, +5% (Hale 2017b). Conagra’s new Healthy Choice Power Bowls have expanded into the breakfast daypart.

For the first time in 10 years, sweet snacks are on the rise. Moreover, consumers are snacking on more sweet treats as the day goes on (NPD 2018). With indulgent outpacing healthier snacks in 2017, snack marketers need to find a way of offering sweeter, but healthier, fare (Wyatt 2017).

Perhaps most startling is the reversal back to naturally sweet sweetening agents including sugar, honey, maple syrup, coconut syrup, and dried fruit. On the global stage, monk fruit, erythritol, and maltose are gaining steam.

Only one in five has a positive opinion of low-calorie sweeteners; 76% are trying to avoid or limit sugars (IFIC 2017). Just over one-half are trying to avoid artificial sweeteners (Nielsen 2017e).

Sales of foods that contain noncaloric sweeteners and are free from artificial sweeteners grew 16% in dollar sales in 2017 (Nielsen 2018). Stevia claims have driven nearly $2.2 billion in sales. Sales of beverages with stevia claims have grown 21% for the year ending Nov. 4, 2017 (Nielsen 2017f).

4. Naturalization

The clean label and natural food movements have mainstreamed; 53% of consumers say the exclusion of undesirable ingredients is more important than the inclusion of beneficial ones (Nielsen 2017a). Half of all grocery shopping trips now include a clean label food and/or drink (Nielsen 2017g).

New age beverages posted the highest dollar gains for clean labels for the year ending Dec. 9, 2017, up $145 million (Nielsen 2017g). Ninety percent of the milk/dairy alternatives category is now clean label, 83% of sugar/sweeteners, 57% of baking supplies, and 40% of diet/nutrition products (Nielsen 2017a).

Categories that under index for clean labels have an opportunity to differentiate themselves. Only 24% of fresh meat is clean label, 19% of salad dressings, 12% of pizza, 8% of sweet goods, and 5% of lunch meat (Nielsen 2017a).

Clean label ranks second only to natural in the top 10 most high-demand beverage attributes for 2018, followed in descending order by healthy, organic, convenient, low sugar, energy boosting, low calorie, high protein, and probiotic/prebiotic (Jacobsen 2018).

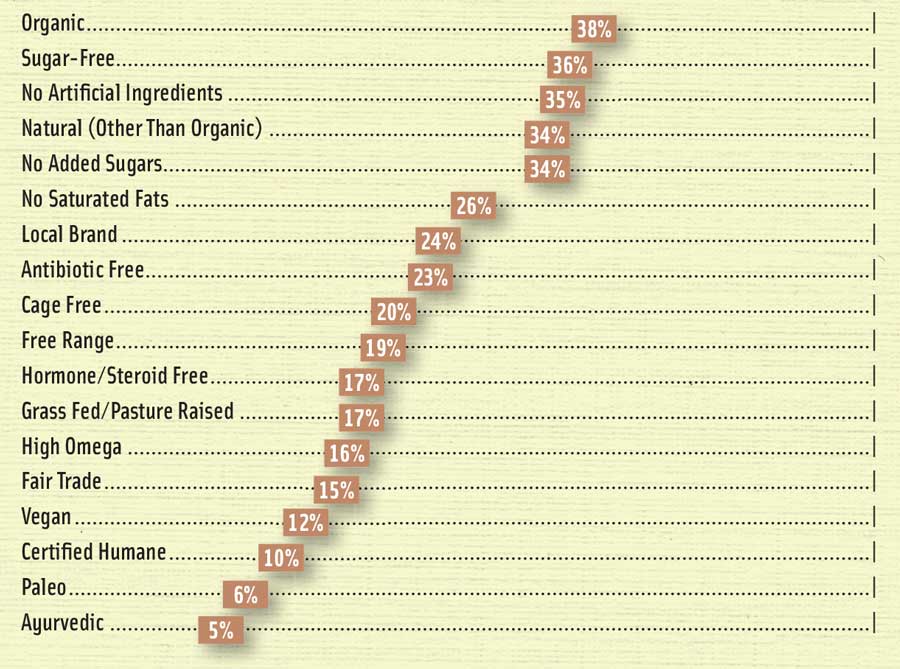

More than 70% of adults bought foods and drinks labeled natural or organic in a typical month last year. Sugar-related claims and “no artificial ingredients” are the only other product claims cited by more than one-third of adults (Figure 2, Packaged Facts 2018a).

Sales of organic foods and beverages reached $43 billion in 2016, up 8.4%. Meat was the fastest-growing category, up 17% (OTA 2017). Produce, followed by eggs, milk, meat/poultry, yogurt, and bread are the largest fresh organic categories; juice, snacks, cereal, pasta, canned fruits and vegetables, soup, condiments, and frozen prepared meals are the largest categories in the center store (Senzamici 2017).

Nearly half (46%) of adults and 72% of natural food channel shoppers are actively seeking non-GMO foods and beverages (Packaged Facts 2018a). By September 2018, all labels in Whole Foods Stores will provide GMO transparency.

Nearly half (46%) of adults and 72% of natural food channel shoppers are actively seeking non-GMO foods and beverages (Packaged Facts 2018a). By September 2018, all labels in Whole Foods Stores will provide GMO transparency.

Over half of consumers are trying to avoid antibiotics and/or hormones (Hartman 2017). Meat with special production claims, such as organic, grass-fed, or antibiotic-free, had dollar sales gains of 26% and volume growth of 38% in 2017, per IRI (FMI 2018).

Grain free, cruelty free, grass fed, corn free, and stevia were the fastest-growing health and wellness claims by dollar sales growth for the year ending Sept. 30, 2017 (Nielsen 2018).

Foodborne illness and chemicals remain the top food safety issues; worries about carcinogens and pesticide residues are on the rise (IFIC 2017). Consumers say they’d like to see more claims about monosodium glutamate, sulfite, phosphate, gelatin, carrageenan, casein, tree nuts, and sesame (Mintel 2017b). Bis-phenol A free, paraben free, and nitrites/nitrates are other upcoming hot-button issues.

5. Diet Watchers

Half of Americans are watching their diet: 65% of those aged 65 and older versus 38% of those aged 18–34. One-third of adults over age 45 tried to lose weight last year compared to 20% of those aged 35 or younger (Packaged Facts 2018a).

Women over index for watching their diet for fat intake, food allergies, gluten/lactose intolerance, and wanting to lose weight; seniors over index for blood sugar control, diabetes, and weight maintenance (Packaged Facts 2017b).

Women over index for watching their diet for fat intake, food allergies, gluten/lactose intolerance, and wanting to lose weight; seniors over index for blood sugar control, diabetes, and weight maintenance (Packaged Facts 2017b).

The 16 million U.S. households who have a member who is diabetic are spending $60 billion on food; the 7.4 million with someone lactose intolerant are spending $28 billion; and the 3.6 million with gluten negativity are spending $15 billion (Nielsen 2017h).

Sixty-nine percent, or 157 million U.S. adults, are overweight; one-third, or 82 million, are obese (AHA 2018). Just watching calories, practiced by 42%, remains the top diet/eating style (FMI 2016). Twenty-eight percent of consumers tried to lose weight by dieting in 2017 (Packaged Facts 2017e).

The Keto diet (lower carbohydrate, good fats) was among Google’s high-growth search phrases for food, diet, and health in 2017, with searches up 300% over 2016. Whole30 diet searches were up 50%, while Paleo diet inquiries have declined steadily (Google 2018). Home-delivered diet meal sales topped $910 million in 2016 (Marketdata 2016).

Just over one-third of U.S. households say they’re following a specific protein-focused diet. Sales of foods and beverages labeled an “excellent source of protein” grew 12% (Nielsen 2017i).

One in five (22%) are following a heart-restricted diet; 12%, high fiber; 8%, dairy-free; 7%, Paleo or Weight Watchers; 6%, Mediterra-nean; 5%, Atkins or anti-inflammatory; 4%, raw food or Whole30; and 2%, the South Beach diet (Label Insight 2017).

Six percent of U.S. consumers described themselves as vegetarian in 2017; 3% said they were vegan (Nielsen 2017d). One in five (18%) are eating more meatless meals (FMI 2018).

Nearly half of consumers say that food allergies, intolerances, or sensitivities impact the way they shop for food items (Label Insight 2017). Only 7% looked for allergen claims on the label in 2017 (FMI 2017).

Seven percent of food shoppers sought out products with a gluten-free claim in 2017. Millennials and those aged 72 and older were most likely to do so (FMI 2017).

6. Taking Root

Consumers continue to experiment with plant-based meals, eating regimens, and meat/dairy alternatives. Thirty-nine percent of Americans are trying to incorporate more plant-based foods into their diet (Nielsen 2017d).

Nondairy beverage sales are projected to reach $11 billion by 2019, up from $7 billion in 2017. One-third of adults drink nondairy milks. While younger adults are most likely to do so, use is growing with those aged 55 and older (Packaged Facts 2017f). Eight in 10 users say they would drink more nondairy beverages if they were fortified with greater nutritional benefits (Packaged Facts 2017f).

Sales of plant-based dairy excluding milks (e.g., cheese, yogurts, and ice cream) jumped 20% to $700 million for the year ending Aug. 12, 2017; plant-based foods grew 8.1% overall (PBFA 2017).

Sales of alternative snacks are projected to reach $1.7 billion by 2019. Over half of adults bought snacks made from whole grains; 51%, multigrain; 36%, vegetables; 27%, chickpeas/garbanzos, lentils, beans, or dried peas; 22%, ancient grains; and 16%, seaweed (Packaged Facts 2017g).

Although two-thirds of consumers don’t use meat analogs, sales of plant-based “meats” topped $585 million for the year ending Aug. 12, 2017 (Mintel 2018, Nielsen 2017k).

Of the households preparing meatless meals at least once a week in 2017, 37% used beans, lentils, and legumes as part of the main course; 18% used quinoa/plant-based protein; 17%, seeds/nuts; 13%, veggie burgers; and 8%, soy/tofu (FMI 2017).

Desserts, yogurt, cereal/granola, salty snacks, cookies/crackers, and prepared foods are also among the high-growth categories for high-protein, plant-based foods (Nielsen 2017d).

Field Roast’s grain-based Fruffalo Wings and No Evil Foods’ Pit Boss plant-based barbecued pulled pork are among the innovative meat lookalikes.

Field Roast’s grain-based Fruffalo Wings and No Evil Foods’ Pit Boss plant-based barbecued pulled pork are among the innovative meat lookalikes.

Six in 10 shoppers (62%) bought a food product because it contained fruits/vegetables last year (Nielsen 2017b). Garden Lites Blueberry Pancakes are “made with veggies”; Good Food Made Simple Southwestern Veggie burritos contain meat alternatives.

Lastly, while some believe cannabis edibles are a functional food, marijuana is still illegal at the federal level.

7. Conditionally Speaking

One in five grocery shoppers is trying to manage a health condition that affects his or her food choices (FMI 2017). An on-pack endorsement by a health organization is important to more than half (55%) of consumers (Hartman 2017).

Three-quarters of adults look for foods that are good for their heart; 64% seek products to help lower their cholesterol (Hartman 2017). Thirty-seven percent of U.S. adults have coronary vascular disease, and 34% have high blood pressure (AHA 2018).

Ninety-five million adults have cholesterol levels greater than 200 mg/dL, and 71 million have unsatisfactorily high LDL cholesterol levels (over 130 mg/dL) (AHA 2018).

Digestive issues are an unfortunate but common experience for many. In 2017, 83% experienced some type of digestive issue (Mintel 2017c). Young adults are significantly over reporting digestive issues (Mintel 2017c). Digestive health is expected to be the fastest-growing condition-specific supplement category through 2020 (NBJ 2018).

Digestive issues are an unfortunate but common experience for many. In 2017, 83% experienced some type of digestive issue (Mintel 2017c). Young adults are significantly over reporting digestive issues (Mintel 2017c). Digestive health is expected to be the fastest-growing condition-specific supplement category through 2020 (NBJ 2018).

With 1.5 million new cases per year, diabetes remains a growing health threat; 30 million have diabetes, with 23 million doctor diagnosed and 7.2 million undiagnosed (CDC 2017).

One-third of adults (82 million) have prediabetes. Glucose Health Diabetic-Friendly Iced Tea Mix is a nutritional supplement targeting diabetics that claims to help the body block absorption of dietary sugars and fats.

One-third of women aged 55 and older take supplements for bone health. Bone health supplement sales are projected to reach $1.2 billion in 2018 (CRN 2017, NBJ 2018). Osteoporosis is expected to rise in men aged 70 and older (NIH 2016).

Three-quarters of adults aged 50 and older are aware of losing muscle with age; 34% are extremely concerned. Loss of mobility and strength are their top concerns about muscle loss (Abbott 2016).

In the United States, 45% of those over 65 years old already have sarcopenia, which is defined by low muscle mass and low muscle quality/function. Only 17% meet the NIH muscle strength guidelines. Over half (55%) of those age 50 and older have trouble rising from a chair (NIH 2016).

One in four adults have doctor-diagnosed arthritis; two-thirds of those with arthritis are under age 65 (AF 2017). Half of all consumers suffer from joint pain (Packaged Facts 2017e). One-quarter of those aged 55 and older take a supplement for joint health; this market reached $1.7 billion in 2017 (CRN 2017, NBJ 2018).

Eye health is a missed opportunity for food marketers. Bausch + Lomb’s PreserVision remains the third best-selling multivitamin supplement (Chain Drug 2017).

Stroke, circulation, mobility, diverticulitis, and regularity will be other more prevalent conditions as our nation ages. Nonalcoholic fatty liver is another fast-emerging condition that affects all ages.

8. Uniquely Processed

More so than ever before, shoppers are making purchase decisions based on how the food was made and the extent, type, and effects of processing.

Two-thirds of consumers overall look for claims that convey minimal processing, and 72% of Millennials do so (FMI 2017). Foodies rank less processing among their three most important healthy food attributes (Packaged Facts 2018a).

Savvy food manufacturers are opting for processing techniques that enhance the product’s nutritional benefits. And it’s paying off.

Coca-Cola’s fairlife milk, which uses a patented filtration process to deliver more protein and calcium and less sugar and is a lactose-free product, posted the largest gains among the top 10 milk brands, with dollar sales up 65% for the year ending Nov. 5, 2017, per IRI (Canning 2018).

Dean Foods’ DairyPure milk was the best-selling new food/beverage in 2017, touting a “Five-Point Purity Promise,” which guarantees no artificial growth hormones or antibiotics, continual testing for purity, that the cows were fed a healthy diet, and that the milk was cold-shipped fresh. Year one sales topped $1.2 billion (IRI 2017b).

Household penetration of juices cold-pressed under high pressure (e.g., Evolution) doubled in 2017 to reach 6% for the year ending Dec. 30, 2017 (Nielsen 2018).

Household penetration of juices cold-pressed under high pressure (e.g., Evolution) doubled in 2017 to reach 6% for the year ending Dec. 30, 2017 (Nielsen 2018).

Cold-pressed oils (e.g., Primal Kitchen Cold Pressed Avocado Oil) have redefined premium for specialty oils. Cold brewing has captured a significant share of the ready-to-drink coffee and tea sector.

Elmhurst Milked Peanuts peanut milk drink uses a patented cold milling process. Waterloo Sparkling Water delivers mouthwatering fruit aromas based on a process that captures the essential oils from steaming fresh fruits.

New extrusion technologies are revolutionizing all things puffed, popped, dried, and crisped; air-popped and baked are mainstream snack categories. Jica Chips “crispy baked root chips” are made with a process that results in five times more fiber (inulin oligosaccharide prebiotic) than potato chips.

Dang Sticky Rice Chips start with Thai sticky rice. Each chip is soaked in watermelon juice then crisped and seasoned, resulting in 30% less fat than regular potato chips; varieties include Coconut Crunch and Sriracha Spice.

Hydroponic production is poised to produce the ultimate in locally grown produce and to provide revenue to farmers in off-seasons. Hyper-local gardens are the top hot culinary concept for 2018; farm/estate-branded foods rank No. 10 (NRA 2017).

Dietitians ranked fermented food (e.g., kefir, sauerkraut, kimchi, and tofu) as the top superfood for 2018 (Pollock 2018). For the year ending November 4, 2017, sales of kombucha reached $43 million, up 111% versus the previous year (Nielsen 2017g).

Longer-fermentation artisan breads are another growing trend, claimed to be more suitable for those who are gluten-sensitive or diabetic. Pinsa, a flatbread Roman-style pizza with a longer fermentation time, is gaining in popularity. Heirloom starter cultures (e.g., sourdough bread and yeast strains) are also trending.

Four in 10 consumers believe that sprouted grains deliver more vitamins, minerals, and protein; 27% think that they’re more easily digested (Packaged Facts 2015). Food for Life’s slow-baked 7 Sprouted Grains bread is a high-protein and high-fiber option that is diabetic-friendly and yeast-free.

Lastly, traceability remains an important food attribute. Pole & Line’s canned albacore tuna is traceable to the exact captain and vessel that caught the fish. Heritage-breed meats are the 13th hottest culinary trend; new cuts of meat are the No. 1 overall trend for 2018 (NRA 2017).

9. Seeking Bioactives

While one in five adults admit they don’t think they get enough of their basic vitamins/minerals, even more consumers—30% of Millennials and 24% of adults overall—feel they don’t get enough special nutrients (FMI 2017).

After vitamins/minerals, specialty supplements are the most used dietary supplement, taken by 38% of adults, followed by herbals/botanicals, sports nutrition supplements, and weight management supplements (CRN 2017).

Fiber is the specialty supplement most often used by Millennials; it is followed by probiotics, digestive enzymes, collagen, and keratin (CRN 2017).

Probiotics are projected to be the fastest-growing supplement/specialty nutritional ingredient, reaching sales of $2.4 billion in 2018. Omega-3s will grow from $1.2 billion to $1.4 billion. Plant-based forms of these ingredients are a hot new trend (NBJ 2018).

Vitamin D, turmeric, selenium, magnesium, chromium, zinc, bee products, melatonin, digestive enzymes, magnesium, and zinc are also projected to enjoy explosive growth, along with marine ingredients (NBJ 2018).

With 38% of consumers trying to get more probiotics in their diets in 2017, innovative marketers are incorporating probiotics into waters, frozen yogurt, cereals, breads, spreads, bars, and even coffee/tea (Packaged Facts 2017h).

High-fiber foods, powders, and drinks remain in high demand. Procter & Gamble’s Metamucil Free powder supplement is all natural and carries claims for heart and digestive health, as well as blood sugar and appetite control.

High-fiber foods, powders, and drinks remain in high demand. Procter & Gamble’s Metamucil Free powder supplement is all natural and carries claims for heart and digestive health, as well as blood sugar and appetite control.

Blueberries top the list of superfoods that consumers seek out when shopping for food, followed by avocado, green tea, kale, cinnamon, coconut, ginger, quinoa, flax, and turmeric (Label Insights 2017).

Turmeric, jackfruit, manuka honey, erythritol, arrowroot powder, cumin seeds, ginger, and flaxseed were the most popular topics searched on Google among those inquiring about food with a function (Google 2017). Functional mushrooms (e.g., chaga, reishi, and cordyceps) are among the top trends Whole Foods has identified for 2018. Matcha, ginger, yerba mate, moringa, acerola, and MCTs as a natural source of quick energy are also getting attention.

Sales of herbal/botanical supplements are projected to reach $8.3 billion in 2018, up 6% versus 2017 (NBJ 2018).

Horehound, cranberry, echinacea, green tea, black cohosh, garcinia, flaxseed/flax oil, ginger, ivy leaf, and turmeric are the best-selling herbal supplements in mass channels; turmeric, wheatgrass/barley, flaxseed/flax oil, aloe, elderberry, milk thistle, maca, Ashwanganda, echinacea, and saw palmetto are best sellers in the natural channel (Smith 2017).

Florals such as lavender are moving into the spotlight. Ginger, honey, cinnamon, coconut, hibiscus, elderflower, mint, cardamom, and chamomile are just a few of the botanicals being added to beverages for 2018 (Jacobson 2018).

Cultures, vitamins/minerals, botanicals/bioactives, and polysaccharides/oligosaccharides/prebiotics will be the fastest-growing global specialty food/beverage ingredients through 2019 (Euromonitor 2017).

In Australia, the county’s leading breakfast cereal, Weet-Bix, added a cholesterol-lowering variety, using plant sterols to reduce LDL cholesterol (Innova 2017).

Collagen is the new superfood being added to beauty drinks, powders, and supplements to enhance skin, hair, and nails. Protein’s popularity may open the door for more interest in specific amino acids, especially L-theanine and arginine.

Caffeine, green tea, carnitine, garcinia cambogia, and protease are among the top weight loss ingredients. The promise of metabolic enhancers is once again appearing in foods; SlimFast’s Belly Busting Shakes is one example.

10. Kids’ Health

The market for products for babies, toddlers, and kids looks promising as Millennials continue to drive a new baby boom. The number of children aged one to three is projected to grow 6.7% from 2015 to 2020; about 4 million babies are being born in the United States every year (NCHS 2017).

Infant formula remains the largest- and fastest-growing healthy food category in the world and is projected to grow at an annual rate of 9.5% from 2017 to 2027 (GIA 2018). Follow-on toddler milks are one of the fastest-growing sectors.

Gerber Good Start Soothe powder is the first formula with “comforting probiotics” (L. reuteri); it is designed to ease colic, excessive crying, fussiness, and gas while providing complete nutrition. Abbott’s Similac 2’-FL Human Milk Oligosaccharides is now available in ready-to-feed bottled formula.

Gerber Good Start Soothe powder is the first formula with “comforting probiotics” (L. reuteri); it is designed to ease colic, excessive crying, fussiness, and gas while providing complete nutrition. Abbott’s Similac 2’-FL Human Milk Oligosaccharides is now available in ready-to-feed bottled formula.

U.S. baby food sales reached $6.4 billion for the year ended August 2017, per IRI (PG 2017). Happy Family’s Love My Veggies Organic Chickpea Straws and Plum Organics’ culinarily inspired Baby Bowls with a spoon are perfect for little toddlers. Vitamin D, vitamin E, fiber, iron, and calcium are the most common nutrient deficiencies found in young American children; vitamins D, E, A, magnesium, and calcium are most often deficient in teens. For some kids, protein, iron (for teen girls), and vitamin C may also be a concern (USDA 2015). One-third of kids aged 2–19 are overweight; 12.5 million of them are obese (AHA 2018).

While parents expect teens to eat what the rest of the household eats, kid-specific products are in high demand by parents of those aged 6–12 (Packaged Facts 2016b).

Half of moms (49%) say that nutrition is the top food selection factor; 23% want foods with hidden vegetables (Packaged Facts 2016b).

Sixty-one percent of parents say they seek out fresh foods/beverages. “No artificial ingredients” is the most sought claim in households with kids younger than age 18, followed by all natural, no/low sugar, no added sugars, non-GMO, and organic (Packaged Facts 2016b).

One in 13, or 5.9 million children under age 18, have food allergies (FARE 2017). Eighteen percent of parents with kids/teens at home seek out gluten-free products; 16% look for dairy-free; 15%, vegetarian; and 12%, allergen-free (Packaged Facts 2016b).

Families with children are one of the most important demographic groups for driving sales of alternative-ingredient snacks (Packaged Facts 2017g). Households with kids account for 40% of all snack sales. Frozen entrées/appetizers, egg rolls/wonton/wraps, popcorn, dried meat snacks, specialty butters, and salsa are among the top 10 favorite snacks in households with kids older than age 5 (Wyatt 2017).

Prepared lunch kits top the list of the most often used kid-specific foods, followed by fruit snacks, toaster pastries, nutrition bars, breakfast pastries, snack cakes, frozen pizza, orange juice, chips, and cold cereal (Packaged Facts 2016b).

A. Elizabeth Sloan, PhD, a member of IFT and contributing editor of Food Technology, is president, Sloan Trends Inc., Escondido, Calif. ([email protected]).