Blockbuster New Products: What’s Selling and Why

CONSUMER TRENDS

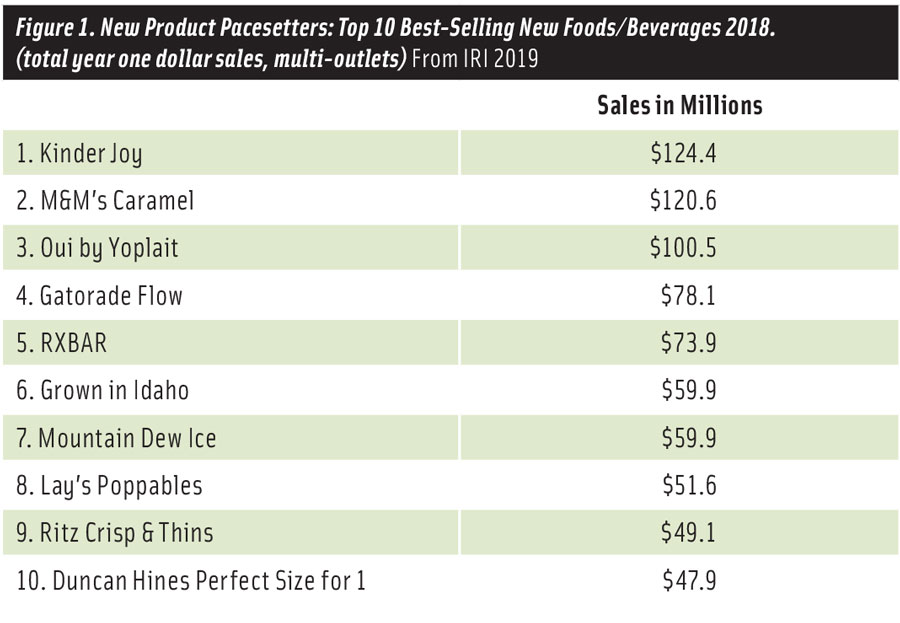

Italian confectioner Ferrero’s Kinder Joy, an interactive candy egg that includes a toy, was America’s best-selling new food/beverage product last year with year one sales of $124.4 million, per IRI’s May 2019 New Product Pacesetters* report, which tracked the top 100 new products with a full year of sales in 2018. M&M’s Caramel and Oui by Yoplait also posted year one sales of over $100 million (Figure 1).

For the first time, just over half (51%) of the best-selling Pacesetters were developed by smaller companies (revenues < $1 billion) versus 22% introduced by companies with sales in the range of $1–$5 billion and 14% from companies with sales of more than $5 billion.

The largest companies, however, still accounted for over half (54%) of new Pacesetters dollar sales; medium-sized companies accounted for 27%; and smaller companies, 19%. Per IRI and the Boston Consulting Group’s 2019 7th Annual Growth Leaders Report, nearly $20 billion in consumer packaged goods (CPG) industry sales have shifted from large and medium-sized to smaller and private label manufacturers over the past five years.

One-third of 2018’s best-selling new food/drink Pacesetters were new brands versus line extensions, up from less than 10% five years ago.

While total Pacesetters revenues for new foods/beverages has declined over the past six years due to the success of more targeted/niche products, the good news is that new food products are staying relevant longer. In 2018, 70% of IRI’s 2017 New Product Pacesetters grew or maintained sales in year two, according to IRI.

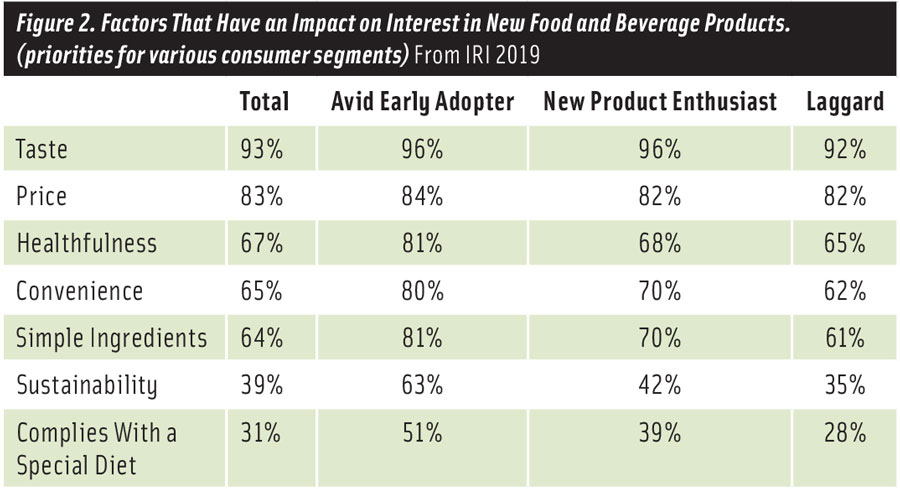

One-quarter (26%) of adults are classified by IRI as “early adopters” of new foods/beverages; 61% take a “wait and see” approach. Those in very high-income households, older Millennials, and those with children at home are the most likely to be early adopters, per IRI. Early adopters dramatically over-index for new products that promote sustainability, healthfulness, convenience, simple ingredients, and, for some, compliance with a special diet (Figure 2).

Market Drivers

Indulgent offerings accounted for nearly $800 million in year one Pacesetters product sales. Five of the top 10 best-selling food/beverage Pacesetters featured sweet/savory indulgence. Duncan Hines Perfect Size for 1 ranked tenth on the Pacesetters list. Hershey’s Gold, Ben & Jerry’s Pint Slices, Blue Bunny Frozen Bunny Snacks, and Hostess Bakery Petites were also among 2018’s best-sellers.

The concept of small indulgences as a reward continues to gain traction. According to IRI’s 2019 New Products Survey, 38% of consumers say they try to eat healthy half of the time and eat whatever they want the rest of the time; 35% try to eat healthy 80% of the time and leave room for little indulgences. One in five (22%) eat pretty much what they want all the time; 5% follow a strict diet.

Snacks with a healthy halo are also hitting the mark. Portion control (Duncan Hines Perfect Size for 1), more nutritious ingredients (RXBAR), and healthier manufacturing methods (e.g., baking versus frying for Lay’s Poppables and Ritz Crisp & Thins) were among factors driving last year’s best-sellers.

Snacks with a healthy halo are also hitting the mark. Portion control (Duncan Hines Perfect Size for 1), more nutritious ingredients (RXBAR), and healthier manufacturing methods (e.g., baking versus frying for Lay’s Poppables and Ritz Crisp & Thins) were among factors driving last year’s best-sellers.

Two-thirds of the general population who were surveyed in IRI’s product survey reported that convenience (65%) and healthfulness (67%) were very influential in their new product purchases; 64% cited simple ingredients; 39% noted sustainability; and 31% said it was because the product complies with a specific healthy diet or eating style.

Coupling high protein, added vitamins/minerals, and natural ingredients with ease of use (e.g., Birds Eye Veggie Made Mashed Eating Well Dinners and Quaker Overnight Oats) was a successful combination.

Categorically Speaking

The dinner and breakfast solutions category had the most Pacesetters in 2018 (36) and accounted for nearly 40% of total Pacesetters new food dollar sales. Protein-rich Jimmy Dean Simple Scrambles, Healthy Choice Power Bowls, and Barilla Ready Pasta meals delivered on the convenience factor.

Grab-and-go mini-meals/snack kits like Keebler’s Townhouse Pita, Crackers and Hummus Snack Box were another strong category. IRI data confirm that products conveniently eaten on the go are important to 56% of consumers. Refrigerated meat/cheese/cracker/dessert snack kit sales jumped 8.5% in 2018 and are up 6.5% year-to-date in 2019.

According to IRI, 47% of consumers eat snacks more than three times a day. Nearly two-thirds sometimes have a beverage as a snack. In 2018, wellness snacks accounted for 36% of dollar sales, up 1.6%; true indulgence accounted for 26%, +2.9%; permissible indulgence accounted for 24%, +3.9%; and treats were 14%, +1.2%.

Fresh eggs, ready-to-eat cereal, “other” salted snacks, nonchocolate candy, cookies, tortilla chips, nutrition bars, frozen novelties, full-fat yogurt, and refrigerated snack kits led raw dollar snack growth, per IRI. Albeit from a very small base, snacks with a vegan/vegetarian positioning jumped 16% in dollar sales.

All 18 beverage Pacesetters combined contributed $327.3 million in year one revenue. Energy and sports drinks outpaced traditional soft drinks and alcoholic beverage products.

Sales of energy beverages in the United States jumped 8.4% in retail dollars in 2018 and 8.6% in volume, making them the second fastest-growing major beverage category after value-added water in 2018, according to data from the Beverage Marketing Corp.

Gatorade Flow topped the list of convenience store Pacesetters in 2018, with year one sales of $145 million, followed by Core Hydration with $123 million in sales; Monster Hydro, $57 million; Red Bull Purple Edition, $53 million; M&M’s Caramel, $48 million; Mountain Dew Ice, $46 million; Kinder Joy, $42 million; Red Bull Lime Edition, $37 million; Starbucks Cold Brew, $32 million; and Pure Leaf Tea House Collection, $32 million, per IRI.

Clean eating was the most-cited diet in 2019, adopted by 10% of consumers. Other top diet approaches, according to the International Food Information Council’s (IFIC) 2019 Food & Health Survey, included intermittent fasting, gluten-free, low-carb and ketogenic, a specific weight loss plan, the Mediterranean diet, plant-based, vegetarian or vegan, paleo, and whole 30.

Looking Ahead

According to IFIC, among the factors that have a significant impact on food product purchase decisions, taste (86%) has increased 5% versus 2018 while environment/sustainability (27%) has fallen 13%. Price and convenience each increased 3%; healthfulness remained stable at 62%.

If IRI’S “Rising Stars” (which track early 2019 Pacesetters as of May 2019) stay on pace, it appears that bread, more daypart solutions, all-day refreshment, healthy indulgences, and baby food will remain on trend. Brownberry Sandwich Thins, PepsiCo’s Bubly, Corona Premier, Eight O’Clock K-Cups, Enfamil NeuroPro, Halo Top Dairy-Free, Michelob Ultra-Pure Gold, Nature’s Own Perfectly Crafted, ONE Bar, and Ore-Ida Just Crack an Egg would take “top 10” honors.

IRI’s Early View 2019: Food & Beverage Trends report confirms that in the first quarter of 2019 in-store fresh bakery sales grew 13.6% in dollars and 8.7% in pounds. In 2018, center store/general food sales gained $3.4 billion; liquor, $2.6 billion; refrigerated foods, $2.3 billion; frozen food, $1.6 billion; and the perimeter, $1.0 billion.

In 2019, one-third of Millennials say they’re trying to eat a more plant-based diet; one-quarter of non-Millennials make that claim, according to IFIC.

FMI’s 2019 U.S. Grocery Shopper Trends report states that 34% of consumers are looking for a low-sugar claim at point-of-purchase, 33% seek a no artificial ingredient claim, and 32% are looking for a non-bioengineered/non-GMO claim.

Lastly, IRI projects that small households will represent $22 billion in incremental food/drink sales over the next three years.

*Note: Pacesetters are the top 100 new foods/beverages that have a full year of sales in 2018, at least 30% ACV at the end of year one and have a multi-outlet geography, including supermarkets, drugstores, mass market retailers, military commissaries, and select club and dollar retail chains.