Funding Hurdles for Female Founders

START-UPS & INNOVATORS

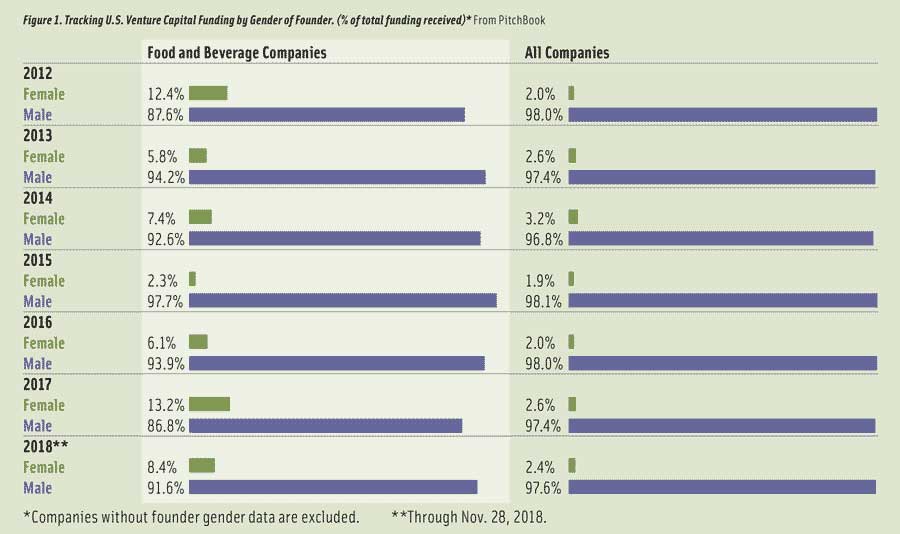

Developing proof of concept, recruiting a leadership team, negotiating with retailers . . . entrepreneurs have their hands full as they launch their businesses. And in one of the most critical areas—obtaining funding—often-cited statistics show that female founders are likely to have it even tougher than their male counterparts, obtaining just a small percentage of all venture capital. And that is true for female-led food and beverage start-ups as well—but not to the same degree. In fact, an analysis conducted for Food Technology by private capital market data provider PitchBook shows that while overall women-led companies in the United States received just 2.4% of venture capital funding for the first 11 months of 2018 (through Nov. 28), the picture is somewhat brighter in the food and beverage category sector, where female-founded companies netted 8.4% of the venture capital in that time frame.

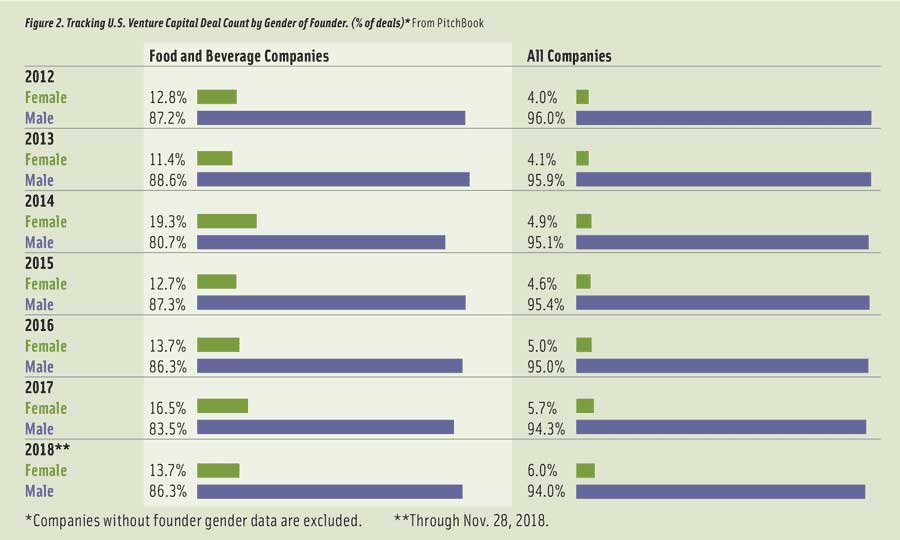

The investment pattern is fairly consistent for the years from 2012 through 2018; while female food and beverage company founders received a share of venture funding that ranged from a low of 2.3% in 2015 to a high of 13.2% in 2017, the share of venture capital that went to women founders across all industries never topped 3.2% during the same time frame. (See Figure 1 for additional details.) Similarly, breaking out the number of venture capital deals closed annually according to the gender of the founder shows that across the years, deals by women founders represented a noticeably greater percentage in the food and beverage sector than in industry at large. (See Figure 2.)

The investment pattern is fairly consistent for the years from 2012 through 2018; while female food and beverage company founders received a share of venture funding that ranged from a low of 2.3% in 2015 to a high of 13.2% in 2017, the share of venture capital that went to women founders across all industries never topped 3.2% during the same time frame. (See Figure 1 for additional details.) Similarly, breaking out the number of venture capital deals closed annually according to the gender of the founder shows that across the years, deals by women founders represented a noticeably greater percentage in the food and beverage sector than in industry at large. (See Figure 2.)

Of course, even with the rosier picture that is apparent in the food and beverage category, women food company founders are receiving a much smaller share of the venture capital pie than male founders. Traditionally, part of the explanation for gender funding inequity has been the fact that the venture capital industry is male dominated—just 9% of the decision makers at U.S.-based venture capital funds are women and 74% of venture capital firms are all male, according to statistics from All Raise, an organization that promotes opportunities for female and minority funders and founders.

Initiatives to bring more women into the venture capital fold and to provide more support for women entrepreneurs are underway. All Raise is working to double the percentage of female partners in U.S.-based venture capital firms over the next decade as well as to increase the percentage of venture funding awarded to companies with at least one female founder. Unilever, which has worked with nearly 10,000 start-ups to date in its incubator program, wants to direct 50% of its start-up funding to female-led businesses by 2023.

Initiatives to bring more women into the venture capital fold and to provide more support for women entrepreneurs are underway. All Raise is working to double the percentage of female partners in U.S.-based venture capital firms over the next decade as well as to increase the percentage of venture funding awarded to companies with at least one female founder. Unilever, which has worked with nearly 10,000 start-ups to date in its incubator program, wants to direct 50% of its start-up funding to female-led businesses by 2023.

No Quick Fixes

Increasing the number of female investors doesn’t necessarily mean a quick fix for the challenges that female founders face, however, says Tinia Pina, whose start-up Re-Nuble converts organic food waste into fertilizer for hydroponic growers and soil-based gardeners. The company was closing its seed funding round when Pina spoke to Food Technology late last year. “There are more female-led investment funds that have a mandate to invest in women,” Pina observes. “However, the experience that we’ve had, and, I think, the experience that a lot of our colleagues have had, is that those funds tend to be more risk averse.”

It’s understandable, Pina maintains. “Not only is it really hard for female founders to raise money,” she reflects, “but we’re also looking at the female limited partners and managing partners of these funds also having to raise money and ask that their general partners … or the individuals that they raise money from take a risk on them. So it’s kind of like this perpetuating cycle where everyone [each woman] is held to a higher standard than normal.”

Unconscious bias may also be playing a role in gender funding inequity. A study by a group of researchers from Columbia University and Harvard Business School who analyzed question-and-answer interactions between venture capitalists and entrepreneurs at the TechCrunch Disrupt New York start-up competition over the course of seven years provides an intriguing perspective on investor gender bias.

Their analysis, which appeared in Harvard Business Review, found that male and female pitch presenters were questioned differently by the venture capitalists they were pitching (40% of whom were female). Male entrepreneurs were asked “promotion-oriented” questions related to their hopes, achievements, and ideals about two-thirds (67%) of the time, while 66% of the questions asked of women were “prevention-oriented,” that is, associated with safety, responsibility, and security. The study used linguistic analysis software to analyze video recordings of the conversations between the entrepreneurs and venture capitalists.

Lead study author Dana Kanze says she was motivated to conduct the study because of her own experiences as an entrepreneur. She found that potential investors framed questions they addressed to her differently than those addressed to the company’s male co-founder.

Linking the data on questions to the amount of venture capital raised showed that entrepreneurs faced with mostly prevention questions raised an average of $2.3 million while those who were asked primarily promotion questions raised significantly more—an average of $16.8 million.

There’s some potential good news in all of this, however. The article authors suggest that entrepreneurs who change the question-and-answer dynamic may be able to improve funding outcomes. Among the entrepreneurs they tracked, those who were presented with mostly prevention questions but offered mostly promotion responses raised an average of $7.9 million versus those who responded to mostly prevention questions with mostly prevention answers, who raised an average of only $563,000.

Staying Positive

Re-Nuble founder Pina tackles fundraising head-on and avoids dwelling on challenges like gender bias.

“I’ve never used me being female or me being a minority as an example of why funding has always been challenging,” she says. Instead she stays laser-focused on what she can control. She conducts extensive research on potential investors and seeks out those for which Re-Nuble is a good fit—funders that have an appetite for risk and a demonstrated track record of working with diverse teams.

Finally, although issues of gender inequity aren’t going to be corrected overnight, some female founders are heartened simply by the fact that the issue has begun to get some attention. “I think, honestly, the first step is talking about it and diagnosing the issue and trying to figure out what the obstacles are,” says Katlin Smith, who founded leading natural baking mix maker Simple Mills nearly six years ago and considers herself fortunate to have taken the company through two successful fundraising rounds. Now, says Smith, she makes time to participate in a number of women’s groups “and the whole idea is women lifting other women up. That’s a really important part of the puzzle because if we can help make introductions for each other and help other women entrepreneurs …. with funding, that can also help change the picture.”

IFTNEXT content is made possible through the generous support of Ingredion, the IFTNEXT Platinum Content Sponsor.

Mary Ellen Kuhn,

Mary Ellen Kuhn,

Executive Editor

[email protected]