Optimizing Bioactive Ingredients

A new route to innovation and efficacy in functional foods development holds promise for food companies.

Functional foods are setting the stage for the next wave of significant growth in the U.S. food industry. If recent estimates prove true, growth of functional foods will dramatically outpace conventional foods over the next several years. Designed to meet the demands and health requirements of an enlightened consumer market, functional foods are breathing new life into the mature food industry.

This potential blockbuster market-in-the-making is alluring to food companies, with major players moving aggressively to identify efficient and cost-effective R&D strategies that can transform this emerging category into a big win in the marketplace. Food and beverage makers have long fortified their products with vitamins and other nutrients to enhance their health benefits. But today rapid advances in nutrition science, technology, and food manufacturing are creating a new arena of opportunities in food products. Once designed only to identify and correct nutritional deficiencies, the functional foods of the future will work to prevent chronic disease and promote optimal health.

According to a recent study by PriceWaterhouseCoopers (August, 2009), functional food sales reached $30 billion in 2007 and now make up 5% of the food industry. The same report also predicts that the U.S. market for functional foods could grow between 8.5% and 20% annually—or five times that of the overall food industry, which currently ranges between 1% and 4% growth per year. Given these numbers, functional foods appear poised to emerge as the next sea change in the U.S. food industry.

Driving this impressive growth in functional foods is a consumer market that is more interested than ever in foods that promote health, increase lifespan, and prevent the onset of chronic diseases. As healthcare trends move toward disease prevention and pharmaceutical companies invest in research and products to manage chronic illness, the light bulb has been turned on in a very significant way for the American consumer.

With a population that includes 76 million Baby Boomers, America is ripe for new foods that enhance health and promote overall well-being. Boomers always have embraced the world with a carpe diem mentality. So it’s no surprise that in the case of their health, they are actively choosing foods over pharmaceuticals as a strategy to optimize their long-term well-being. For today’s enlightened consumer, the old adage, “you are what you eat,” has taken on new meaning. More importantly, it has sparked a major movement to “eat with purpose.” The signals are crystal clear: A market shift of major proportions is coming.

Functional Foods R&D: A New World Order

As this dynamic market evolves, leading food, beverage, and ingredient companies are stepping up their R&D investment to capture a slice of this sizable opportunity. Many are experimenting with traditional pharmaceutical development techniques only to discover that they can’t afford to go down this long and costly path. While pharmaceutical companies routinely spend years in research and multi-millions of dollars on development, the potential payoff from a blockbuster drug is huge. Food products simply do not command the same margins, making Big Pharma’s entrenched R&D approach a big non-starter for food companies.

Nonetheless, there is considerable experimentation with pharmaceutical-like development processes. Most do not translate successfully from pharmaceuticals to food, driving food companies into collaborations with specialized ingredient makers or technology companies to gain a leg up in the market development process. The innovators within the food industry recognize that to compete effectively in the functional foods-driven health and wellness market, they must invest in new research and development capabilities. The R&D departments of traditional food and beverage companies are well equipped to perform taste and sensory tests, shelf-life enhancements, and manufacturing process research, but they are not structured to undertake the rigorous discovery and development functions that are essential to the identification of functional ingredients suitable for use in foods.

--- PAGE BREAK ---

The process to develop and market a functional food product, as outlined by the Institute of Food Technologists in the expert report Functional Foods: Opportunities and Challenges, is essentially new to the research departments of food and beverage companies. For those companies seeking to enter the functional foods market, R&D investments must focus on acquiring two critical capabilities: bioactive food compound discovery and proof of safety for novel food components. Building these capabilities is a big-ticket item, creating a significant barrier to entry for all but the largest food companies and slowing the overall rate of innovation in functional foods.

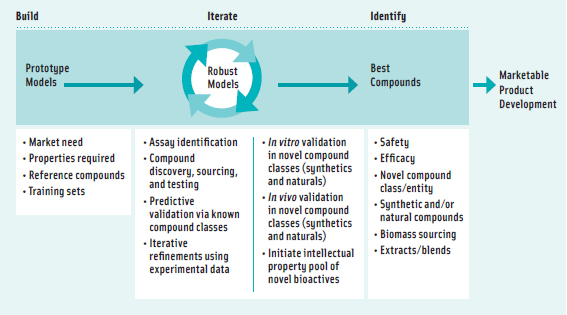

Discovering a new compound that has measurable health effects traditionally has been the province of pharmaceutical companies. The standard practice involves isolating a particular compound, testing the compound for effectiveness against bioactivity targets (both in vivo and in vitro), and determining the appropriate concentration required to generate the desired health effect (Figure 1). While this practice is routine for pharmaceutical companies, it is a whole new world for food and beverage companies. Equally important, it is just one part of the process that a food company must undertake in development of a new functional food. When a new drug compound is discovered and approved, its delivery to the consumer is simple: Swallow a pill and wait for it to work. For a functional food, the process is long and complicated—moving from confirmation of a bioactive agent to extraction from a plant source to inclusion in a food matrix to integration in a functional food product. In many ways, the process for developing a functional food keeps going long after the similar pharmaceutical process ends. And this does not even begin to address issues of consumer taste and purchase decisions.

Discovering a new compound that has measurable health effects traditionally has been the province of pharmaceutical companies. The standard practice involves isolating a particular compound, testing the compound for effectiveness against bioactivity targets (both in vivo and in vitro), and determining the appropriate concentration required to generate the desired health effect (Figure 1). While this practice is routine for pharmaceutical companies, it is a whole new world for food and beverage companies. Equally important, it is just one part of the process that a food company must undertake in development of a new functional food. When a new drug compound is discovered and approved, its delivery to the consumer is simple: Swallow a pill and wait for it to work. For a functional food, the process is long and complicated—moving from confirmation of a bioactive agent to extraction from a plant source to inclusion in a food matrix to integration in a functional food product. In many ways, the process for developing a functional food keeps going long after the similar pharmaceutical process ends. And this does not even begin to address issues of consumer taste and purchase decisions.

The issue of safety also creates potential roadblocks in terms of new uses for existing compounds or entirely new compounds. As part of the 1958 Food, Drug & Cosmetics Act, the U.S. Congress included a list of substances that the FDA deemed “Generally Recognized as Safe” (GRAS). Today, the GRAS list includes more than 2,000 compounds. Food and beverage companies may include these substances at approved levels in their products without prior FDA approval. By contrast, novel compounds that are not on the GRAS list must undergo a rigorous “GRAS determination” process. The importance of GRAS is demonstrated by how it has shaped bioactive compound discovery techniques. Two distinct discovery paths have emerged: 1) screening GRAS compounds to discover new bioactivity toward the desired target and 2) screening novel natural food chain compounds for bioactivity and making a “GRAS determination.”

The first path may lead to new uses for known substances and moderate intellectual property rights. The second approach has the potential to uncover novel compounds with strong intellectual property rights. However, this requires the innovator to undertake the “GRAS determination” process, which adds significant time and expense.

Finally, quantifying the bioavailability of a new compound is an essential part of developing a new food with a measurable health benefit. Many food scientists believe that to achieve a true and accurate measure of biological activity, a compound needs to be evaluated in terms of the assay system—e.g., how closely it mimics intact digestion, absorption, and circulation.

For pharmaceuticals, ADME (Absorption, Distribution, Metabolism, and Excretion) parameters have traditionally been measured in the lab and through human clinical trials to ensure that a bioactive compound would be available to the human system at the desired therapeutic level. For food companies eyeing functional foods, this process is costly and impractical for testing sometimes hundreds of potential bioactive agents under consideration.

--- PAGE BREAK ---

The Road Ahead

Due to the cost, complexity, and high specialization that is required for effective and efficient functional food development, some food and beverage companies are looking outside of their own walls for expert help.

Building the “wet lab” capabilities required to discover novel bioactive food agents and establish sufficient scientific evidence for health and wellness claims involves significant capital investment in facilities, talent, and equipment. Moreover, it means that traditional food and beverage companies must expand their R&D comfort zone by developing scientific disciplines that are new to the food industry.

The concept of Business Process Outsourcing (BPO) is familiar to many business executives. It involves contracting—or outsourcing—the operations and responsibilities of a specific business function to a third party service provider. BPO offers distinct advantages to food and beverage companies, especially in areas that would otherwise require new skills and significant capital investment. The benefit to the bottom line is compelling: BPO transforms fixed costs into variable costs.

Food and beverage companies can partner with BPO vendors to achieve the following objectives.

• Gain access to expertise in bioactive compound discovery.

• Utilize screening facilities and technologies on a variable cost basis.

• Capitalize on the partner’s sourcing capabilities for natural compounds and extracts.

• Enhance their ADME/toxicity screening capabilities.

• Leverage the partner’s public, industry, and proprietary compound libraries.

• Capitalize on discovery strategies and technologies such as High Throughput Screening and in silico analysis.

By partnering with an experienced BPO vendor, a food and beverage client can effectively leverage that vendor’s infrastructure, intellectual property, and expertise—all on a variable cost basis.

Emerging Technologies Enable R&D Innovation

High Throughput Screening (HTS ) is a standard process used in pharmaceutical R&D to screen large numbers of compounds. It provides a method for scientific experimentation that uses robotics, data processing and control software, liquid handling devices, and sensitive detectors. HTS allows a researcher to quickly conduct millions of biochemical, genetic, or pharmacological tests. Through this automated process, a researcher can easily investigate large numbers of compounds in vitro and identify those that are potentially capable of modulating biological targets of interest. This process is now being deployed in the field of natural or bioactive compound discovery for use in functional food development. However, many companies are finding that the cost and the time involved in the HTS process does not translate well to the very different requirements that exist in the food industry.

A second process currently being adopted for discovery of novel bioactive compounds is in silico analysis. There are several approaches to in silico analysis. One approach, which relies on computer power—or computational chemistry, is a standard choice for drug design among pharmaceutical companies. With computational chemistry, a user can manipulate a vast universe of data to include as many variables as possible.

--- PAGE BREAK ---

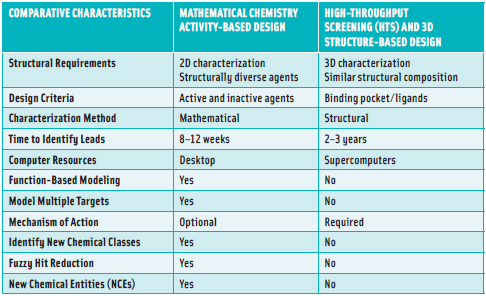

Another approach relies on the power of mathematics—or mathematical chemistry—to zero in on the data that are essential to a project (Figure 2). Mathematical chemistry intentionally discerns the few critical data that matter, making this approach more efficient, faster, and less costly than computational chemistry. In the end, an efficient math algorithm will always outperform brute force supercomputing, especially since the algorithm performs on a computer platform anyway.

Another approach relies on the power of mathematics—or mathematical chemistry—to zero in on the data that are essential to a project (Figure 2). Mathematical chemistry intentionally discerns the few critical data that matter, making this approach more efficient, faster, and less costly than computational chemistry. In the end, an efficient math algorithm will always outperform brute force supercomputing, especially since the algorithm performs on a computer platform anyway.

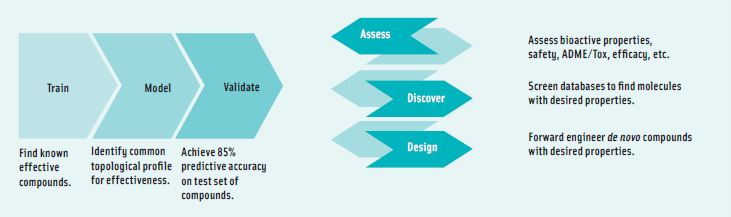

Using mathematical chemistry, a company can create predictive models to analyze vast compound libraries and identify multiple candidates that possess a desired suite of functions and properties for further evaluation. This approach is unique in its ability to discern and conserve desired functions, mechanisms, and properties across diverse chemical space. Assessing very extensive compound databases without the presence of physical samples reduces the time and expense associated with sourcing samples and conducting traditional in vitro and in vivo screens. Mathematical chemistry can front-end the bioassay screening process that further validates bioactivity in a traditional laboratory environment and thereby greatly reduce the number of compounds actually tested by orders of magnitude. ADME/toxicity models based on human systems data can be created to simulate in vivo activity, enabling a fast and accurate determination of bioactivity and bioavailability in the body. Mathematical chemistry has been successfully applied to measure bioavailability of multiple compounds under consideration for bioassay screenings.

Mathematical chemistry is a powerful tool in the discovery process for functional foods as the training sets can be designed to identify molecules with a wide range of properties—for example, smell, taste, and mutagenicity. Compounds can be screened in parallel for safety and effectiveness, helping to mitigate the risk of late-stage failure of lead compounds.

In the food industry, mathematical chemistry can be applied in specific product applications and discovery of novel ingredients to benefit human health. For example, the technology can be used to enhance product performance (taste, flavor, texture) and product safety (preservatives, shelf life, and stability.) It also can be applied to develop new food/beverage products to benefit human health, including mood/memory enhancement, weight loss, blood sugar management, joint and bone health, and many others.

The key benefits of mathematical chemistry are scale, speed, low cost, and risk mitigation—all important considerations for food and beverage companies entering the new world of functional food development (Figure 3).

The key benefits of mathematical chemistry are scale, speed, low cost, and risk mitigation—all important considerations for food and beverage companies entering the new world of functional food development (Figure 3).

--- PAGE BREAK ---

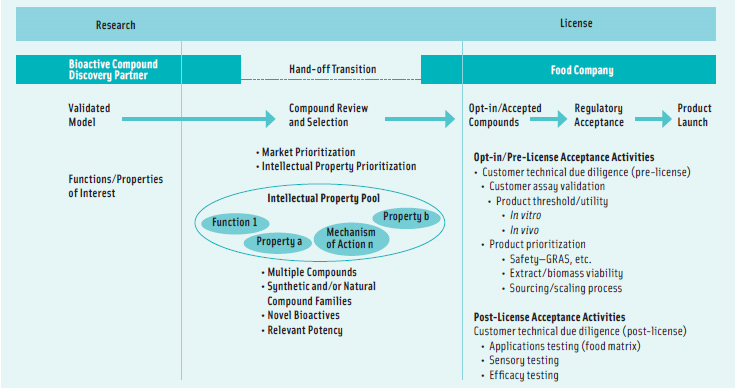

Since December 2008, Kraft Foods has collaborated with Medisyn Technologies as part of a research and licensing agreement. Their work centers on applying mathematical chemistry in the areas of bioactive compound discovery, product performance, product quality, and food safety. Recently, Todd Abraham, Senior Vice President, Research, Development & Quality at Kraft Foods, said that Kraft Foods would evaluate a portfolio of bioactive compounds that the two companies have discovered for future licensing and product applications. The collaboration is part of Kraft Foods’ larger open innovation strategy to seek outside innovators and more quickly meet the latest consumer needs and market opportunities.

In its 2009 study, PriceWaterhouse-Coopers pointed to the Kraft/Medisyn collaboration as an example of how a large, established food company is working successfully with an outside BPO expert to adopt new development paths for its functional foods strategy. BPO companies providing bioactive discovery and development capabilities will offer these leading-edge technologies as part of their capabilities and resource portfolio. Access to these technologies and the specific expertise provided by an experienced BPO company can become a significant differentiator and competitive advantage for food and beverage companies seeking to quickly and efficiently enter this growing and highly dynamic new market (Figure 4).

In its 2009 study, PriceWaterhouse-Coopers pointed to the Kraft/Medisyn collaboration as an example of how a large, established food company is working successfully with an outside BPO expert to adopt new development paths for its functional foods strategy. BPO companies providing bioactive discovery and development capabilities will offer these leading-edge technologies as part of their capabilities and resource portfolio. Access to these technologies and the specific expertise provided by an experienced BPO company can become a significant differentiator and competitive advantage for food and beverage companies seeking to quickly and efficiently enter this growing and highly dynamic new market (Figure 4).

As new BPO companies emerge that specialize in bioactive food agent discovery and proof of safety processes, the functional foods marketplace will likely see fewer barriers to entry and stepped-up innovation in new food and drink products providing a well-defined set of health benefits to the consumer.

This article is based on a symposium presentation made by the author at the 2010 IFT Annual Meeting® in Chicago.

David Land, a Member of IFT, is President, Medisyn Technologies Inc., 6109 Blue Circle Dr., Suite 100, Minnetonka, MN 55343 ([email protected]).