Navigating the Natural Marketplace

Clean labels, chemical- and preservative-free, products with ‘natural goodness,’ and close-to-the-farm positioning are driving explosive growth in the natural foods & beverages sector.

Consumer demands and retailer preferences for more naturally nutritious, no additives/preservatives, and less-processed foods are restructuring the global food industry and sending U.S. sales of natural foods & beverages soaring, up 7.7% in 2010 (NFM, 2011). Examples of these marketplace trends include Lay’s Classic Potato Chips “made with three simple ingredients: Grade A potatoes, all-natural oil, and a dash of salt,” Oscar Mayer’s Hot Dogs with no artificial preservatives, nitrate or nitrite; and Simply Heinz Tomato Ketchup minus high-fructose corn syrup and “grown, not made” and “never genetically modified.”

In 2010, nearly one-third (30%) of the top-selling new foods/beverages launched in the U.S. carried a natural/organic claim; four out of the top 10 bore a “clean label” (IRI, 2011a). Food retail executives in the U.S. and Canada cited natural/organic as the fifth hottest grocery trend for 2011, right behind social media, mobile marketing, value shopping, and health/wellness (FMI, 2011a).

In 2010, nearly one-third (30%) of the top-selling new foods/beverages launched in the U.S. carried a natural/organic claim; four out of the top 10 bore a “clean label” (IRI, 2011a). Food retail executives in the U.S. and Canada cited natural/organic as the fifth hottest grocery trend for 2011, right behind social media, mobile marketing, value shopping, and health/wellness (FMI, 2011a).

Despite the weak economy, two-thirds of U.S./Canadian food retailers added natural/organic items to their product offerings, and 65% of retailers enjoyed increased natural/organic dollar sales for the year-ended (Y/E) May 2011 (FMI, 2011a). Furthermore, eight in 10 U.S./Canadian grocers promote their organic/natural food sections as a competitive strategy. Nearly three-quarters (73%) of U.S. shoppers use the organic/natural section at least occasionally (FMI, 2011a).

Sales of foods/beverages in natural product stores reached $21.3 billion (b), up 7% in 2010. In conventional food, drug, and mass merchandisers, sales of natural/organic foods are $16.5 b, up 7.6% in 2010. Natural product retailers hold a 44% market share, while mass channels garner 36% (NFM, 2011).

Organic/natural specialty stores have the highest average market basket of any food store format—$120.60 per week vs $97.80 for supermarkets (FMI, 2011a). In 2010, Whole Foods stores enjoyed a 12% sales gain (NFM, 2011).

Ironically, this seemingly pure and simple market has become amazingly complex with overlapping terminology, industry misperceptions as to the size and priority of specific market demands, and the reality of facing some long-ignored issues, such as humane animal treatment, antibiotic practices, natural fortification, and genetically modified organisms (GMOs). Addressing these issues may change the way we do business going forward.

--- PAGE BREAK ---

Here is a look at some of the macro-segments of natural foods and tips to navigate the uncharted waters of this lucrative but minefield-laden marketplace.

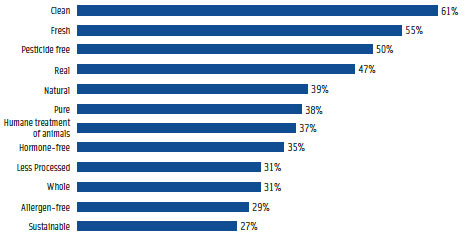

Clean & Chemical-Free  Clean edged out fresh as the most important product label/phrase when purchasing shelf-stable foods/beverages (e.g., cereal, canned vegetables, soda, etc.) in 2010 (Figure 1).

Clean edged out fresh as the most important product label/phrase when purchasing shelf-stable foods/beverages (e.g., cereal, canned vegetables, soda, etc.) in 2010 (Figure 1).

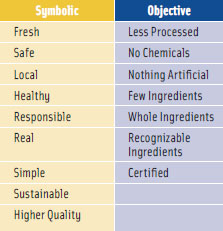

Shorter ingredient lists, recognizable ingredients, and no additives/preservatives are the toptier food selection attributes in the natural sector, while whole foods, organic, local, and seasonal rank second. To consumers, clean has both symbolic and objective associations (Figure 2).

Half of consumers look for natural ingredients on the ingredient statement. They also examine labels for artificial ingredients (44%), low-calorie sweeteners (44%), preservatives (43%), order of the list (36%), length of the list (24%), food colors (21%), ability to pronounce the ingredient (18%), and allergens (16%) (IFIC, 2011).

Half of consumers look for natural ingredients on the ingredient statement. They also examine labels for artificial ingredients (44%), low-calorie sweeteners (44%), preservatives (43%), order of the list (36%), length of the list (24%), food colors (21%), ability to pronounce the ingredient (18%), and allergens (16%) (IFIC, 2011).

In 2010, 39% of consumers, up 9% in one year, cited chemicals in foods as the most important food safety issue while 44% noted bacteria, down 8% (IFIC, 2010). Half of consumers deliberately avoid preservatives, 49% shun MSG, 47% eschew artificial flavors, 44% stay away from colors/dyes, 43% avoid hormones/antibiotics, and 29% steer clear of GMOs (Hartman, 2010b). One in five made a strong effort to avoid food additives and artificial colorings last year (MSI, 2010).

Label claims declaring no chemical additives are very important to about half (47%) of food shoppers; no preservatives claims are attractive to more than one-third (FMI, 2011b). Sales of foods/drinks carrying a no preservatives claim topped $14.5 b in 2009, while sales of natural claims reached $22 b (Nielsen, 2010a).

--- PAGE BREAK ---

Globally, no additives/preservatives led the list of better-for-you claims on new foods/drinks in 2010. In the U.S., this claim ranked third, behind natural and organic. Juice/drinks, salty snacks, bouillon/stock, cookies, and soup are the top U.S. new product categories for natural/no additives/preservative claims (Innova, 2011).

Over-processed food, possible use of chemical ingredients detrimental to health, and high-fructose corn syrup ranked just behind healthfulness and safety as America’s top five food concerns in 2010 (Deloitte, 2010a). Limiting processed foods is now the third most important component of healthy eating, after eating more vegetables/fruits (Mintel, 2009).

Natural/unprocessed—a highly desired attribute of households with incomes of <$35,000—is projected to deliver $115 billion in new incremental CPG growth in the next 10 years (IRI, 2010a). Less processed is also helping to drive interest in gluten-free foods. Nearly half (48%) of gluten-free buyers perceive that gluten-free processors have stricter processing standards, making them healthier and of higher quality (Pkg. Facts, 2011a).

Private label/store brands have also come “clean,” accounting for 40% of all foods/drinks with no preservative, 25% of organic, and 20% with natural claims (Nielsen, 2010b).

With more than a dozen U.S. states debating whether to mandate labeling for GMO foods and ongoing attempts to limit antibiotics to medical use, these issues will remain in the spotlight, spawning a new era of third-party certified foods. Non-GMO verified food sales hit $472 million in the U.S. in 2010, up 25% (Clute, 2011).

Natural Gains on Organic

Products claiming all natural took the highest share (12%) of all CPG product sales with wellness claims in 2010, followed by low/less fat (5%), any grain claim (4%), five or more grams of fiber/serving (2%), and low/less calories, any low sodium claim, and any organic claim (all tied at 1%), according to IRI (IDDBA, 2011).

Nearly seven in 10 (69%) shoppers are extremely/very interested and aware of natural foods vs 58% for organic foods/drinks, 56% for natural beverages, 51% for foods with fewer ingredients, and 44% for beverages with fewer ingredients (HealthFocus, 2010). One-quarter of adults (26%) made a strong effort to eat more foods/drinks made from all-natural ingredients vs 15% for organically grown last year (MSI, 2010).

--- PAGE BREAK ---

Natural topped the list of descriptors consumers looked for when purchasing foods/drinks at retail in 2010. 100% natural was preferable to other descriptors, including natural or all-natural (Hartman, 2010a).

Cost remains a key barrier to organic purchases, as 85% of consumers see organic as too expensive and 32% see no difference between organic and regular foods (FMI, 2011b).

Consumers rank the top six associations with natural or organic in the same order—the absence of 1) pesticides; 2) herbicides; 3) hormones; 4) no artificial flavors, colors, preservatives; 5) GMOs; and 6) antibiotics. The only difference is that they more strongly link no artificial flavors, colors, or preservatives to natural, which might help to explain natural’s continued growth in the current chemical-phobic environment.

Consumers connect organic with what happens to food at its origins (e.g., the farm, the plant, the animal) and associate natural with what happens (or doesn’t) to food after its place of birth, for example, in terms of production and processing. The absence of herbicides, synthetic fertilizers, hormones, antibiotics, and GMOs are more strongly linked to organic foods as they relate to the growing process and are applied to whole foods, such as fruits, vegetables, grains, meat, etc. (Hartman, 2010a).

In natural food stores, produce remains the largest food/beverage category, with sales of $4.9 b, up 13% in 2010, followed by packaged grocery $3.7 b (7%); dairy $1.7 b (12%); frozen/refrigerated $1.7 b (8%); bulk/packaged bulk $1.5 b (3%); foodservice deli/juice bar $1.4 b (2%); fresh meat/seafood $1.1 b (7%); nutrition/cereal bars $1.1 b (8%); and snack foods $1.0 b (6%) (NFM, 2011).

Organic food sales reached $9.4 b, up 6.6% in 2010, in natural food stores (NFM, 2011). Produce remains the largest category with sales of $2.9 b, gaining 9% in 2010; followed by packaged grocery $2.3 b (6%) and dairy $1.2 b (11%) (NFM, 2011). Across all retail channels, organic fruits/vegetables remain the largest category with sales of $10.6 b, rising 11.8% in 2010; dairy is No. 2 at $3.9 b, up 12% (OTA, 2011).

--- PAGE BREAK ---

Beverage developers named natural as the No. 1 need/interest state for 2011. Only 7% of drink developers will not be using at least some natural flavors/colors this year (Zegler, 2011). Natural is the most important criteria in the juice/juice drink category (Mintel, 2010a).

Natural (no additives) is an important attribute to 98% of frequent snackers and to 62% of all snackers. In contrast, organic is an important attribute to 36% of snackers and local/made in a state is favored by 35%, a virtually untapped positioning for snacks (Mintel, 2011).

Natural was the second most popular claim on new frozen food introductions in 2010, after microwaveable. No preservatives, fresh, real, no artificial colors/flavors/ingredients also were more prevalent. Organic claims grew but did not reach the 2008 level (Pkg. Facts, 2011b).

One in five shoppers buy natural and/or organic meat/poultry; 31% when it is on sale (FMI, 2011c). Two-thirds (65%) of users buy chicken; half (48%) purchase beef (FMI, 2011c). About 1,245 new items with a natural tag/claim were introduced into the meat counter in 2010 (Perishable Group, 2011).

In 2010, sales of specialty/gourmet natural products showed considerable growth, especially in the natural channel, up 15.6% in 2010, excluding Whole Foods Market (Blackwell, 2011).

Fresh, Simple, Homemade

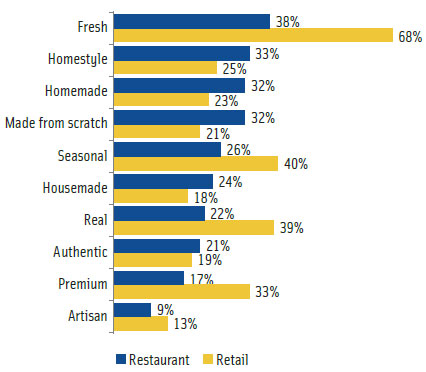

More than any other major food product descriptors relating to quality and freshness, consumers are most willing to pay extra for options that are fresh, premium, and artisan (Technomic, 2010). Over two-thirds (68%) look for fresh descriptors when purchasing foods/beverages at grocery/retail. About 40% of shoppers seek out seasonal, 39% look for real, 33% favor premium, 25% prefer home-style, 23% look for homemade, 19% want authentic, and 13% hunt for artisan. Seven in 10 believe that describing food as fresh means it is healthier. Interest in real, premium, authentic, and artisan descriptors skew male, while fresh and home-style are favored more by females (Figure 3).

More than any other major food product descriptors relating to quality and freshness, consumers are most willing to pay extra for options that are fresh, premium, and artisan (Technomic, 2010). Over two-thirds (68%) look for fresh descriptors when purchasing foods/beverages at grocery/retail. About 40% of shoppers seek out seasonal, 39% look for real, 33% favor premium, 25% prefer home-style, 23% look for homemade, 19% want authentic, and 13% hunt for artisan. Seven in 10 believe that describing food as fresh means it is healthier. Interest in real, premium, authentic, and artisan descriptors skew male, while fresh and home-style are favored more by females (Figure 3).

--- PAGE BREAK ---

With 48% of consumers still cooking more from scratch this year, interest in convenient fresh ingredients continues to grow (IRI, 2011b). For the Y/E 12/27/10, prepared cut fresh fruit and vegetable volume rose 11% and 4.9%, respectively; dollar sales of fresh-cut vegetables for meal preparation grew 7.4% for the Y/E 6/30/10 (Perishables Group, 2010, 2011).

U.S. retail sales of fresh convenience foods topped $22 billion in 2009 (Pkg. Facts, 2010). Supermarkets supplied 20% of all take-out meals in 2010, their best sales in six years for ready-to-eat and heat-and-eat takeout meals (FMI, 2010).

Fresh continues to be the most purchased form of organic, led by fresh fruit and vegetables (49% each) and followed by milk (39%), eggs (37%), and breads (23%) (Hartman 2010a). Fresh is the most important factor when shopping in the in-store deli (IDDBA, 2011). In 2010, 580 new natural items were introduced into instore delis (Perishables Group, 2011). With natural being of greatest appeal to those age 18–29, more natural items will help delis better compete with fast food restaurants (Mintel, 2010b).

Natural/organic, healthy, fresh, local, and functional/added ingredients are the most desired positioning for new dairy products. Natural cheese sales are projected to rise 11.7% to $15.9 b by 2014 and yogurt will maintain strong growth (IDDBA, 2011).

For the first time, freshness outpolled convenience as the No. 1 reason to shop in-store bakeries. In 2010, 69% of bakery operators enjoyed increased sales of natural/organic baked goods (IDDBA, 2011).

Marketers are now smartly touting the use of “fresh,” “handpicked,” and “fresh-from-the-field” ingredients in their processed foods/drinks. Fresher taste/texture are among the newest claims appearing on the best-selling new foods/beverages of 2010 (IRI, 2011a).

Local, Artisan & Ethical

Local and state-branded foods continue their explosive growth. While just under half (47%) of supermarkets offer local items, a whopping 82% of shoppers buy them at least occasionally and 38% now prefer local to organic (FMI, 2011b). In specialty stores, local products posted the second-largest sales gains overall (Wolfe, 2010). Last year, 29% of adults bought more local foods/drinks; 13% bought much more than in 2009 (Hartman, 2010a). Three-quarters of adults would like to use local/seasonal foods whenever possible, 61% source only from U.S. farms/ranches, and 49% buy foods/drinks that support charities/causes (Hartman, 2010c).

--- PAGE BREAK ---

Two-thirds of U.S./Canadian food retailers increased their selection of local products; local supermarket SKUs increased 30% last year. Wal-Mart plans to increase sales of locally grown produce from 4.5% to 9% in the U.S. by 2015 (FMI, 2011a). While produce, dairy, beef, and bread are the local products most offered in supermarkets, other meats, salsas, sauces, jams, and cheese are coming on strong. Juice, wines, water, and beer are other popular state categories (Hartman, 2011).

For the first time this year, more shoppers defined local by state border lines versus producing the product within a certain mile radius. About 44% of shoppers define local as “state,” up from 30% in 2009 (FMI, 2011b). State-produced foods are a strong draw; the use of the descriptor “Alaska” on packaging increased likelihood of purchase with 76% of consumers (TRD, 2009).

Locally sourced meats/seafood, locally grown produce, sustainability as a culinary theme, hyper-local items, sustainable seafood, back-to-basics cuisine, and farm-branded ingredients are among the top culinary trends for 2011 in restaurants; locally grown produce ranks 4th overall among the hot trends for fast food restaurants (NRA, 2011).

While 44% actively seek out local in food retail stores, 43% look for farm-raised (Technomic, 2010). Learning how a local product is made, the people behind it, and seeing pictures are strong purchase motivators for 6 in 10 consumers; a similar number have shopped in a farmers’ market in the past year (Hartman, 2011).

Artisan cheese was named the No. 1 hot ingredient for 2011 by American Culinary Federation (ACF) chefs; artisan/specialty bacon was No. 3. Artisan/homemade ice cream topped the list for trendy desserts. In the alcohol/cocktail category, artisan/micro-distilled liquor was at the top of the list, and signature cocktails were No. 7 (NRA, 2010). After buns/rolls and whole grain, artisan is the most frequently purchased bread in the U.S., up 15% since 2009 (IDDBA, 2011).

Positive Eating

Getting nutrients naturally by eating foods that are naturally high in specific nutrients is increasingly becoming the desired way for consumers to get their nutrition. In the industry, this trend embraces the concepts referred to as natural goodness, inherent nutrition, and naturally functional (Sloan, 2010). In 2010, one-third (32%) of consumers made a strong effort to eat foods/drinks naturally rich in nutrients; 28% naturally rich in antioxidants versus 19% fortified foods with nutrients (MSI, 2010). Eight in 10 consumers want their supermarket to carry more foods naturally high in nutrients vs fortified; 79% vs 59%, respectively (NMI, 2009).

While 65% of adults are still making a strong/some effort to eat more fortified foods, the number has fallen for the first time in history. Those making no effort rose 7% from 2009 to 2010 to 35%; those making some effort fell 6% to 46% (MSI, 2010).

--- PAGE BREAK ---

And a big opportunity it will be. In 2010, 70% made a strong effort to consume more vitamins/minerals, 66% more antioxidants, 41% more whole grains, 36% more dietary fiber, and 35% more protein (MSI, 2010). Moreover, nearly two-thirds (63%) of Americans are interested in learning what to eat, instead of what not to eat, up 7% over the last two years (IFIC, 2011).

Whole grains followed by dietary fiber top the list of the most sought after health claims in 2011 (FMI, 2011b). Whole grains also rank first on the “front of pack” health claims shoppers look for at point of purchase; antioxidants and super foods rank 8th (FMI, 2011b).

ACF chefs named ancient grains, e.g., kamut, spelt, amaranth, quinoa, buckwheat items, couscous, and barley among the hot grain trends for 2011, along with black, Forbidden, brown, wild, and red rice (NRA, 2010). Sales of kamut (heritage khorasan wheat) rose 18% in 2010 (Budgar, 2011).

Phytochemicals continue to move mainstream, and some polyphenols are beginning to drive sales. In 2010, one-third of consumers made a strong effort to consume more polyphenols (MSI, 2010). Welch’s credits their promotion of polyphenols in their grape juice with driving sales to a record 120-year high.

Polyphenols and flavonoids are among the phytochemicals that have reached mainstream status; anthocyanins, carotenoids, and resveratrol are the next wave of mass market opportunities (Sloan, 2011). In 2010, 26% of consumers were aware of the health benefits of polyphenols/resveratrol, whereas 24% noted flavonoids (HealthFocus, 2010).

Super foods rank behind whole grains, “low-in,” and natural foods as the most used strategies for maintaining good health (IRI, 2008). Expect spices, American fruits, and pulses to be among the next wave of super foods.

While ACF chefs still cite acai, goji berry, mangosteen, and purslane as the hot super fruits, in the beverage industry, exotic super fruits gave way to more traditional flavors. Lemon and orange ousted pomegranate and acai from the “top 5” flavors, mango fell 10 slots, and tea inched back above green tea (NRA, 2010; Zegler, 2011).

“A serving of fruit/vegetables” is a very import claim to two-thirds (67%) of consumers (IRI, 2010b). Pulp and bits of fruit are returning as popular additions in beverages and desserts (Innova, 2011).

--- PAGE BREAK ---

New varietals, e.g., Opal apples, hybrid fruit/vegetables (plumcot, grapple, and broccoflower), heirloom produce varieties, micro-vegetables/micro-greens, and pickles are other up-and-coming produce trends (NRA, 2010).

Exotic fruit (e.g., durian, passion fruit, dragon fruit, paw paw, guava), Asian pear, avocado, pomegranate, and coconut were among the hot fruit trends for 2011 (NRA, 2010).

Root vegetables, e.g., parsnips, rutabaga, beets; specialty potatoes, e.g., purple, fingerling, Baby Dutch Yellow; fresh beans/peas, e.g., fava, sweet, snow; dark/bitter greens, e.g., collards, kale, beet tops, broccoli rabe; cabbage, e.g., red, green, boy choy, Napa; and eggplant/aubergine will add more excitement in 2011 (NRA, 2010).

Asian mushrooms, e.g., shiitake, straw, enokitake, cloud ear fungus; hot peppers, e.g., habañero, chipotle, ancho, jalapeño; edamame; Jerusalem artichoke/sunchoke; radish/daikon; tomatillos; and kale were also selected by ACF chefs as cutting-edge culinary produce ingredients for 2011 (NRA, 2010).

Braised, steamed/grilled/roasted, mashed/pureed vegetables, e.g., potatoes, cauliflower, parsnip, and vegetables ceviche are among the new vegetable preparation trends for 2011 (NRA, 2010).

In 2010, 15% of adults made a strong effort to eat more vegetarian foods; 16% more soy products (MSI, 2010). In the U.S., 7 million adults are vegetarians, or 3% of the adult population. Vegans, those who don’t eat meat, poultry, seafood, dairy, and eggs, are growing rapidly and now make up one-third of vegetarians (Budgar, 2011b).

Ethical & Humane Treatment

Animal welfare and factory farming have become important issues with terms including free-range, cage-free, and grass-fed growing in popularity.

Nearly three-quarters (72%) say that humanely treated animals/cruelty free is important to them when shopping for food (Hartman, 2011). The second reason for buying organic/natural meat is the health and treatment of the animal (FMI, 2011c).

--- PAGE BREAK ---

In addition to the humane aspects, 59% of consumers think that food that is grass-fed, 57% farm-raised, 53% free-range, and 52% cage-free is healthier as these animals consume a more natural diet. All four attributes are of greatest interest to older consumers (Technomic, 2010).

Farm-raised is an important food selection for 44% of consumers when shopping for food. In 2010, 16% of consumers purchased cage-free eggs and 9.4% bought Fair Trade foods or beverages (MSI, 2010).

While consumer awareness of Fair Trade in the U.S. is only about 34% today, Fair Trade verified sales reached $361 million in 2010, up 16.6% (Clute, 2011). About half (52%) of consumers purchased Fair Trade coffee or tea last year; 36% bought Fair Trade chocolate (Mintel, 2010c).

Nearly six in 10 (58%) Americans say they have read or heard at least “a little” about sustainability in food production (IFIC, 2010). However, 45% are not sure what the term sustainability means (Technomic, 2010). The ability to last over time; recycle, reuse; conserving natural resources; and the ability to support oneself are the top consumer definitions of sustainability (Hartman, 2011).

While sustainability is shaping up as a macro trend that will continue to do well in the future, it will be a tie-breaker role at best when it comes to consumer purchase decisions in 2011. With the exception of the truly eco-minded shoppers, most are not willing to pay more or accept lesser functionality and performance for sustainability or the environment at this time (FMI, 2011b).

What’s Next in Natural

With nearly three-quarters of young adults age 18–29 having the highest interest in natural and in ethical and sustainable practices, the future of the natural marketplace is sound. Moreover, as consumers shift to positive eating strategies, naturally functional products will move into the spotlight. A quick look at college campus foodservice priorities confirms that the eating habits of young Americans have already shifted to more natural, less processed, and more humane eating.

A. Elizabeth Sloan, Ph.D., a Professional Member of IFT and Contributing Editor of Food Technology, is President, Sloan Trends Inc., 2958 Sunset Hills, Suite 202, Escondido, CA 92025 ([email protected]).

References

Blackwell, K. 2011. Gourmet/natural market sees 2010 boost. Nat. Foods Merch. newhope360.com. May 24.

Budgar, L. 2011a. The value of heritage and heirloom foods. Nat. Foods Merch. newhope360.com. May 23.

Budgar, L. 2011b. Veganism on the rise among health-conscious consumers. Nat. Foods Merch. newhope360.com. May 22.

Clute, M. 2011. Sales of third party-certified products explode. Nat. Foods Merch. newhope360.com. May 20.

Deloitte. 2010. Consumer food safety survey. April. Deloitte Development LLC. New York City. deloitte.com.

FMI. 2010. U.S. grocery shopper trends. May. Food Marketing Institute. Washington, D.C. fmi.org.

FMI. 2011a. The food retailing industry speaks! May.

FMI. 2011b. U.S. grocery shopper trends. May.

FMI. 2011c. The power of meat.

Hartman. 2010a. Beyond organic & natural report. Feb. The Hartman Group, Bellevue, WA. hartmangroup.com.

Hartman. 2010b. Reinventing health & wellness.

Hartman. 2010c. Marketing sustainability-bridging the gap between consumers and companies.

Hartman. 2011. Understanding local from a consumer perspective.

HealthFocus. 2010. U.S. trend study. HealthFocus, Intl. St. Petersburg, FL. healthfocus.com.

IDDBA. 2011. What’s in store? International Dairy, Deli, Bakery Assn., Madison, WI. iddba.org.

IFIC. 2010. Food & health survey. May. International Food Information Council Foundation. Washington, D.C. ific.org.

IFIC. 2011. Food & health survey, May. Innova. 2011. Innova Market Insight Database.innova-food.com.

IRI. 2008. Consumer trend watch. Times & Trends. Feb. SymphonyIRI Group. Chicago, IL. infores.com.

IRI. 2010a. Low income report. Nov.

IRI, 2010b. SymphonyIRI, Customer Expectation & Satisfaction Survey.

IRI. 2011a. New product pacesetters. Times & Trends. March.

IRI. 2011b. CPG 2010 year in review. Times & Trends. Feb.

Mintel. 2009. Healthy eating and weight attitudes towards food: weight and diet – U.S. May. Mintel International Group Ltd. Chicago, IL. mintel.com.

Mintel. 2010a. Fruit Juice and Juice Drinks: The Consumer – U.S. Jan.

Mintel. 2010b. Consumer attitudes toward natural and organic food and beverage – U.S. March.

Mintel. 2010c. Sustainable food and drink – U.S. Aug.

Mintel. 2011. Salty snacks – U.S. May.

MSI. 2010. The 2010 Gallup study of nutrient knowledge and consumption. Multi-Sponsor Surveys, Princeton, NJ. multisponsor.com.

NFM. 2011. Natural Foods Merchandiser’s 2010 market overview, Natural Foods Merchandiser, VXXXII(6) all pages. naturalfoodsmerchandiser.com.

Nielsen. 2010a. U.S. Healthy eating trends: part 1. Press release. Jan. 26. The Nielsen Co., Schaumburg, IL. nielsen.com.

Nielsen. 2010b. U.S. healthy eating trends part 4: store brands expand healthy offerings. NielsenWire. Feb. 2. http://blog.nielsen.com.

NMI. 2009. Natural Marketing Institute, Harleysville, PA. nmi.com.

NRA. 2010. What’s hot chef survey. National Restaurant Assn. Washington, D.C. restaurants.org.

NRA. 2011. 2011 Restaurant industry forecast.

OTA. 2011. U.S. organic industry valued at nearly $29 billion in 2010. Press release. April 25. Organic Trade Assn. Brattleboro, VT. ota.com.

Perishables Group. 2010. Fresh-cut produce in the U.S.A. Presented by Beth Padera at inhouse client meeting. Oct. 8. The Perishables Group. Chicago, IL. perishablesgroup.com.

Perishables Group. 2011. 2001 Fresh food outlook. Fresh Perspective. Jan.

Pkg. Facts. 2010. Fresh convenience foods in the U.S. August. Packaged Facts. New York City. packagedfacts.com.

Pkg. Facts. 2011a. Gluten-free foods & beverages in the U.S. Feb.

Pkg. Facts. 2011b. Frozen foods in the U.S. Jan.

Sloan, A.E. 2010. Top 10 functional food trends. Food Tech. 65(4): 22-41.

Sloan, A.E. 2011. TrendSense model report. Sloan Trends Inc. Escondido, CA. sloantrend.com.

Technomic. 2010. The healthy eating consumer trend report. Technomic, Inc. Chicago, IL. technomic.com.

TRD. 2009. Alaska seafood survey. TRD Frameworks. Seattle, Wash. trdframeworks.com.

Wolfe, A. 2010. State of the gourmet retail market 2010. Gourmet Retailer 31(9): 12-16.

Zegler, J. 2011. New product development survey. Beverage Industry. 102(1): 52-62.