Raising a Glass to Healthier Drinks

Global trends in beverages spotlight products with various health attributes—from sugar-free, low-calorie, and natural to vitamin & mineral fortification, added protein, fruit & vegetable smoothies, and organic.

Health continues to be a key area of interest in the global drinks market, where some products, such as juices and water, have an inherently healthy image, while others are formulated for specific benefits beyond hydration—notably sports and energy drinks. Furthermore, companies continue to position all types of products on various health platforms—from the passive, such as sugar-free, low-calorie, natural, etc., to the active, such as vitamin- and mineral-fortified, added calcium and functional, as well as offering specific health benefits (e.g., immune health, heart health, oral health).

Many consumers around the globe place greater value on products with a healthy halo. According to the 2010 HealthFocus International study of primary household shoppers conducted in 17 countries, more than 50% of all respondents agree to some level that it is worth paying more for foods and beverages that are fortified for extra nutrition.

Health Claims

Health Claims

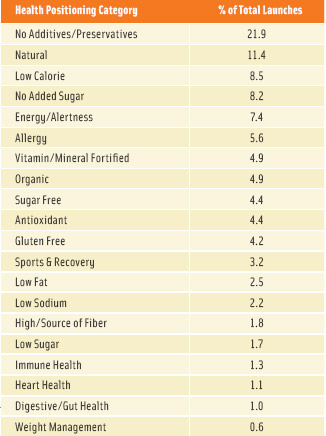

Nearly 60% of the beverage launches recorded by Innova Market Insights in the 12 months ending March 2012 had a health positioning of some kind, with over half using passive health claims and nearly 20% active health claims, indicating that a significant number also use both types of claims. The most popular health-related claims recorded were undoubtedly concerned with naturalness and freedom from artificial additives and preservatives, and encompassed a wide range of products, led by water and juices, which tend to be seen as inherently natural.

Over 23% of launches were marketed as free from additives and preservatives, while about 12% used natural claims. Combining the two categories resulted in over 30% of total beverage launches using either one or both claims. If organic claims, used for over 5% of launches, are added, the total rises to nearly 35% for one or more of the three claims (Table 1).

The more traditional area of low-calorie and diet drinks also remains very popular, with reduced-sugar product lines taking second place overall in terms of health claims, ahead of low-calorie products. According to the HealthFocus International Global Trend Study, those extremely or very interested in seeing “low calorie” on the label increased from 35% in 2003 to 49% in 2010. Between 2003 and 2010, interest in “sugar free” increased from 30% to 45% while during the same period, interest in “lower in sugar” increased from 32% to 48%. In the U.S., “lower in sugar” is still growing while “sugar free” has leveled off.

According to Innova Market Insights, organic claims took fourth place, ahead of “with antioxidant” claims. The number of antioxidant claims has fallen over the past few years, while the total number of soft drinks launches has risen. This may be attributable to regulatory issues regarding antioxidant claims, particularly in Europe, where the European Food Safety Authority (EFSA) has rejected many health claim petitions.

According to Innova Market Insights, organic claims took fourth place, ahead of “with antioxidant” claims. The number of antioxidant claims has fallen over the past few years, while the total number of soft drinks launches has risen. This may be attributable to regulatory issues regarding antioxidant claims, particularly in Europe, where the European Food Safety Authority (EFSA) has rejected many health claim petitions.

When analyzing tracked new product launch activity over the past five years, the shares of carbonated soft drinks, juices and juice drinks, concentrates, and mixes, and iced tea and coffee have risen, while the shares of bottled water (flavored and unflavored) and sports and energy drinks have fallen.

A declining share of launch activity does not necessarily indicate a poor market performance overall, however, with sports and energy drinks remaining one of the fastest growing sectors of the market over that period. Consolidation in the market, particularly the greater dominance of multinational brands and the disappearance of many smaller brands, is probably the main reason for slowing activity rates, although actual launch numbers did still climb over the five-year period.

--- PAGE BREAK ---

Mid-Calorie Rise

“Beating the Sugar Demon” is one of Innova Market Insights’ key trends for 2013. The market researcher reports that sugar is being demonized in the tradition of trans fats, arguably even more so than salt. Companies are looking to strategically reduce the sugar content of products through new combinations of new technologies and sweeteners. Advances in natural sweeteners such as stevia and monk fruit allow for higher innovation. Obesity has reached a tipping point and taking unnecessary sugar out of products may be one of the pathways to success in combating it. Government pressure is also mounting on manufacturers to reformulate or cut back on the package sizes of their products.

In January 2013, it emerged that as part of the U.K. government’s drive to curb obesity levels, leading GSK soft drinks brands’ Lucozade and Ribena will reduce the amount of sugar and calories in their products by up to 10%. AG Barr, which produces IrnBru, will reduce the caloric content across their portfolio of drinks by 5%.

One recent trend aimed at regenerating interest in the cola market is mid-calorie soft drinks, led by PepsiCo’s Pepsi Next cola, with 60% fewer calories than regular Pepsi and sweetened with high-fructose corn syrup, aspartame, acesulfame K, and sucralose. It is targeted at individuals not wanting to choose between zero-calorie and full-calorie soft drinks. The brand was launched nationally in the United States in April 2012, following testing, and PepsiCo claims the brand is performing ahead of expectations and attracting new cola drinkers as well as lapsed consumers.

Meanwhile, carbonated drinks market leader Coca-Cola is also reported to be testing its own mid-calorie soft drinks in the U.S. using Sprite and Fanta under the Select name. The products, featuring natural sweeteners, including sugar, stevia, and erythritol, are said to have 50% of the calories of standard lines. According to the HealthFocus International 2012 study, consumers have greater interest in reduced sugar than in sugar free because the perception of better taste still remains the most important.

Protein Powers Sports Drinks

Another Innova Market Insights’ key trend for 2013 is “Protein Overdrive,” as the trend towards making “high protein” claims only gathers pace, with numerous mainstream brands addressing this marketing opportunity. Greek yogurts and meat snacks are two examples of categories playing off this positioning. Protein claims have been tracked in markets as diverse as sports & recovery drinks, breads, pretzels, soups, biscuits, and even ketchup.

Growing interest in protein products has been driving the sports drinks market, resulting in a convergence of the categories to create one overall sports performance market. Ready-to-drink (RTD) protein products, such as Gatorade Recover with protein for muscle replenishment, are increasing in popularity, particularly for casual users, although RTD products are still just a fraction of the size of the bulk protein powder sector traditionally associated with protein drinks for athletes and bodybuilders.

Growing interest in protein products has been driving the sports drinks market, resulting in a convergence of the categories to create one overall sports performance market. Ready-to-drink (RTD) protein products, such as Gatorade Recover with protein for muscle replenishment, are increasing in popularity, particularly for casual users, although RTD products are still just a fraction of the size of the bulk protein powder sector traditionally associated with protein drinks for athletes and bodybuilders.

Light Focus for Juice

One of the top reasons that shoppers buy juices and juice drinks is for their health benefits, and this persona of the products continues to be at the forefront in new product development, with vitamin and mineral fortification and no-added-sugar attributes particularly popular. This was reflected by U.S. market leader Minute Maid’s launch of a new orange juice line under the Pure Squeezed name, featuring four varieties, including one 100% juice and one juice drink with calcium and vitamin D fortification.

PepsiCo’s Tropicana Pure Premium has been focusing on presenting a more premium image and recently launched a clear PET flip-top container for its orange juice, offering an update on the convenient opaque flip-top HDPE container launched in 2008. Tropicana has also found success with its Trop50 reduced-calorie juice drinks line sweetened with stevia, which was extended further in April 2012 with Peach with White Tea, Raspberry with Green Tea, and Pear Lychee with White Tea options. The products are marketed as 35–45 calories per 8-oz glass, a full day’s supply of vitamin C, and a good source of vitamin E antioxidants.

The children’s juice and juice drinks market has also been the focus of some interest in recent months. Launches have included Kraft’s Capri Sun Super V fruit and vegetable juice drink, with one serving of fruit and vegetables per 6-oz pouch, plus fiber. Britvic of the United Kingdom has also been extending the presence of its Fruit Shoot children’s brand in the U.S. In about one year on the U.S. market, the brand, marketed via PepsiCo bottlers (Britvic is the U.K.’s Pepsi bottler), has seen its footprint grow from one to eight states.

With the increasing interest in natural products, juice-based alternatives are appearing to target the dynamic energy drinks market and 2011 saw the appearance of a number of products in the U.S., including Campbell’s V8 Fusion + Energy drinks and V8 Energy shots, comprising no-added-sugar fruit and vegetable juices with green tea, caffeine, and B vitamins for the energy drink and with additional A, C, and E vitamins for the shots. Likewise, Starbucks in 2012 extended its interest in the energy drinks market, with the launch of Starbucks Refreshers, made with green, unroasted coffee beans.

With the increasing interest in natural products, juice-based alternatives are appearing to target the dynamic energy drinks market and 2011 saw the appearance of a number of products in the U.S., including Campbell’s V8 Fusion + Energy drinks and V8 Energy shots, comprising no-added-sugar fruit and vegetable juices with green tea, caffeine, and B vitamins for the energy drink and with additional A, C, and E vitamins for the shots. Likewise, Starbucks in 2012 extended its interest in the energy drinks market, with the launch of Starbucks Refreshers, made with green, unroasted coffee beans.

--- PAGE BREAK ---

Resurgence for Smoothies

Odwalla, part of Coca-Cola, extended its range in mid-2012, with a line of smoothies for kids, featuring a serving of fruit per 6.75-oz carton, as well as 110–120 calories, vitamin C, and no added sugar. There has also been considerable interest in the use of juice and cereal blends in the smoothies market in 2012, with recent launches including PepsiCo’s Naked Apple Raisin Oat, Blueberry Oat, and Peach Mango Oat smoothies, incorporating a serving of fruit, plus 5 g of fiber and 12–13 g of protein per 9.5-oz bottle; and Oatworks juice and oat smoothie blends in Strawberry & Banana, Mango & Peach, and Pomegranate & Blueberry, featuring PromOat branded beta glucan.

The Spanish juice brand Don Simon, which has been on the U.K. market since 2006, issued a challenge to its competitor Innocent in April 2012, with the announcement that it was to launch its own range of low-cost smoothies in the U.K. to compete by selling below the price of even some own-label ranges. The company had already launched a line of children’s smoothies using Disney licensing in 2011, in direct competition with Innocent’s children’s products. Meanwhile, Innocent has continued to develop its smoothie offerings, as exemplified by the March 2012 introduction of its limited-edition Golden Smoothie, featuring a blend of oranges, mangoes, and sweet baby carrots.

The Spanish juice brand Don Simon, which has been on the U.K. market since 2006, issued a challenge to its competitor Innocent in April 2012, with the announcement that it was to launch its own range of low-cost smoothies in the U.K. to compete by selling below the price of even some own-label ranges. The company had already launched a line of children’s smoothies using Disney licensing in 2011, in direct competition with Innocent’s children’s products. Meanwhile, Innocent has continued to develop its smoothie offerings, as exemplified by the March 2012 introduction of its limited-edition Golden Smoothie, featuring a blend of oranges, mangoes, and sweet baby carrots.

In Continental Europe, the smoothie market is generally less well developed, but has also seen fluctuating sales. In Spain, per capita consumption is 0.06 liters, compared with 0.8 liters in the U.K., and the sector accounts for just 0.2% of the total Spanish juices and nectars market with a value of just over €20 million. This is a similar value to the French smoothie market, where Innocent is a major player, with a share of over 40% in 2010, although it is being challenged by launches such as Pierre Martinet’s vegetable smoothies, introduced in 2011 and now also available on the Spanish market.

Iced Coffee & Tea

Demand for iced coffee drinks, including ambient and chilled lines, appears to be growing not only geographically but also beyond its original home in the foodservice sector of many countries, particularly the U.S. With the growth of the retail market and the need to compete with alternative beverages, such as soft drinks and sports and energy drinks, more traditional coffee varieties have been joined by flavors such as vanilla and caramel, as well as light options. Added value products, such as organic and fair trade coffees, as well as coffees of specified type and origin, are gaining more shelf space along with a growing range of convenient packaging formats, including cartons, bottles, and lidded cups.

In January 2012, Nestlé and Coca-Cola Co. announced that they are cutting back the scope of their RTD tea joint venture, Beverage Partners Worldwide, to focus on Europe and Canada. In Taiwan and Hong Kong, Coca-Cola will license the Nestea brand from Nestlé, while the joint venture will be phased out in all other areas in a transition that was completed at the end of 2012. The Nestea license Coca-Cola holds in the U.S. terminated at the end of 2012. The companies stated that they are committed to developing the business in Europe and Canada, where a concentrated focus will be more effective in developing the market, and both companies will be free to develop the RTD category in other markets.

This new arrangement means that they will be focusing on markets where Nestea has been successful; it is the leading brand in Canada and Eastern Europe and No. 2 in Western Europe after Lipton (mainly sold by the Pepsi Lipton joint venture). It is only No. 4 in the U.S. and has been losing share to other brands. The Taiwan and Hong Kong markets, where the licensing agreement will be in place, are large markets with high per capita consumption and also relatively successful for Nestea, where it is in third place behind two local brands.

The tea sector also saw the appearance of stevia-sweetened RTD lines, initially with Lipton Natural, a range of 100% natural tea drinks sweetened with stevia. Coca-Cola followed in early 2012 with its organic, fair trade Not Too Sweet Tea from its Honest Tea operation, featuring 40% less sugar and 100 calories per bottle, sweetened with a blend of organic cane sugar and stevia. More unusual launches included the rollout of tea drinks combining green tea with aloe vera pulp under the Chantea name from Gourmetti brands, emphasizing the digestive health and immune support benefits.

In Continental Europe, France has been seeing considerable activity in RTD teas. Lipton Ice Tea leads the €120 million market and is also the No. 4 drinks brand overall with two-thirds of value, gaining three percentage points in 2011 alone. Launches in recent months include Pierre Martinet’s chilled Green Tea drinks with fruit in pomegranate-white grape and cranberry-lemon varieties and Herbalist tea drinks from La Dynamique des Fluides combining specific types of tea with fruit juices to create 100% natural drinks in the style of homemade infusions. Germany follows fairly closely behind Italy in terms of per capita consumption of RTD tea, with sales of over 800 million liters annually.

In Continental Europe, France has been seeing considerable activity in RTD teas. Lipton Ice Tea leads the €120 million market and is also the No. 4 drinks brand overall with two-thirds of value, gaining three percentage points in 2011 alone. Launches in recent months include Pierre Martinet’s chilled Green Tea drinks with fruit in pomegranate-white grape and cranberry-lemon varieties and Herbalist tea drinks from La Dynamique des Fluides combining specific types of tea with fruit juices to create 100% natural drinks in the style of homemade infusions. Germany follows fairly closely behind Italy in terms of per capita consumption of RTD tea, with sales of over 800 million liters annually.

--- PAGE BREAK ---

Emerging Tea Platforms

The established nature of the tea market is reflected in the number of larger package sizes sold, with less developed markets tending to focus on single-serve lines in cans and bottles. Coca-Cola extended its Nestea iced tea range in Germany with two sugar-free varieties in 1.5-liter PET bottles, offering Weisser Pfirsich (white peach) and Zitronen (lemon) flavors. It also saw the launch of two bottled tea drinks in March 2012, claiming to be the first in the country to use stevia as a sweetener. The range includes black tea with organic peach juice and green tea with organic lemon juice. Austrian juice drink and RTD tea specialist Pfanner also extended its tea drinks range in Germany with the launch of Der Weisse white tea with lemon and elderflower, sold in a 2-liter gable-top carton.

There has also been interest in drinks made with tea extracts, as exemplified by Thuringer Waldquell’s May 2012 launch of its Rooibos Tea Erdbeere-Rhabarber and Weiss Tee Pfirsich (Rooibos Tea with Strawberry-Rhubarb and White Tea with Peach), featuring natural mineral water and free of artificial colors and sweeteners and lower in calories than traditional iced tea.

The U.K. has a very limited market for RTD tea, and the battle to get British consumers to try drinking their tea cold rather than hot has been a difficult and relatively longstanding one. Lipton Ice Tea has over 90% of the market, but there has been activity from other suppliers, particularly retailer own brands. Marks & Spencer, for example, launched three infusion tea drinks featuring white, green, and rooibos tea extracts made with spring water flavored with mint, lemon, and raspberry, respectively.

Stevia Circles the Globe

Stevia-based sweeteners, with their natural positioning, have taken the food and drinks industry by storm over the past few years, filling a gap in the market as demand for “clean label” products has risen. They offer an alternative for those interested in sugar and calorie reduction in soft drinks, but also worried about the “artificial” status of many high-intensity sweeteners, including the established alternatives of aspartame, acesulfame K, and saccharin.

In Europe, France was an early mover in the use of stevia, using transition arrangements prior to full EU approval. The use of Truvia-branded 97% purity Reb A was approved and one of the first applications was in the reformulated Fanta Still soft drink by Coca-Cola France, launched in early 2010. By mid-2011, it accounted for 8% of Fanta sales and had been joined by a number of other soft drink formulations with stevia, including dilutable syrups from two key players: Teisseire with 0% du Sucre Stevia and Routin with its Fruiss Stevia sub-range. Coca-Cola France announced in March 2012 that, following the success of Fanta Still, it was to use stevia in its Nestea and Sprite brands in France, reducing calories and sugar content by 30%. Coca-Cola is reported to have used Truvia in over 30 products in seven countries over the past three years, but mainly in line extensions to smaller brands. The use of the Nestea and Sprite brands marked its move into headline brands in a major soft drinks market.

Stevia-sweetened introductions in other European markets include Fritz-Kola in Germany and Hartwall Jaffa Super in Finland. More recently, in April 2012, Eckes-Granini Iberica launched its Granini Light juice drinks onto the Spanish market, using stevia sweeteners and containing just 30 calories per serving. It was Pepsi bottler Britvic that won the race to launch the first stevia sweetened drink in the U.K., however, when it announced in April 2012 that it was to reformulate its SoBe V-Water, previously criticized for its high sugar levels, using stevia, which has been used in SoBe drinks in the U.S. since 2008. The reformulated drink will have lower calorie content and appeal to people who want to avoid sugar and artificial ingredients. It is likely to herald further launches of stevia-based drinks in the U.K., with Coca-Cola almost certain to follow in due course.

Stevia-sweetened introductions in other European markets include Fritz-Kola in Germany and Hartwall Jaffa Super in Finland. More recently, in April 2012, Eckes-Granini Iberica launched its Granini Light juice drinks onto the Spanish market, using stevia sweeteners and containing just 30 calories per serving. It was Pepsi bottler Britvic that won the race to launch the first stevia sweetened drink in the U.K., however, when it announced in April 2012 that it was to reformulate its SoBe V-Water, previously criticized for its high sugar levels, using stevia, which has been used in SoBe drinks in the U.S. since 2008. The reformulated drink will have lower calorie content and appeal to people who want to avoid sugar and artificial ingredients. It is likely to herald further launches of stevia-based drinks in the U.K., with Coca-Cola almost certain to follow in due course.

Lu Ann Williams, a Member of IFT, is Head of Research, Innova Market Insights, Marketing 22, 6921 RE Duiven, The Netherlands ([email protected]).

Barbara Katz, a Member of IFT, is President, HealthFocus International, Suite 220, 100 2nd Ave. N, St. Petersburg, FL 33701 ([email protected]).