Eliminating Waste at the Front End of Innovation

Time, money, and effort are often wasted in new product development due to the late discovery of something important. An iterative, exploratory process can avoid such waste.

The front end of innovation (FEI), where research investment generates innovative new product concepts, is crucial to keeping a company’s entire product innovation effort nourished with significant new opportunities. Yet despite its importance, researchers working in the FEI often encounter situations where time, money, and effort seem to be wasted.

This paper considers three typical examples of waste in the FEI and presents an exploratory process designed to avoid such waste. In stark contrast to sequential processes in other stages of product development, the exploratory process is based on iterations and loop-backs.

First, let’s consider three examples from the FEI. These examples are drawn from actual situations in consumer products research, but have been abstracted to highlight common issues and protect proprietary details.

Example 1: Concept Stymied By Top Management

The R&D group of a large global nutritional business was charged to explore development of a functional weight management chocolate product. Global market concept testing had shown functional chocolate as a promising opportunity capitalizing on a strong need for weight loss coupled with a satisfying treat—i.e., a healthy, indulgent snack with strong purchase interest, uniqueness, need satisfaction, and believability. The chocolate product was designed to be part a portfolio of weight management products. The consumer research group, in collaboration with the product development and marketing teams, conducted worldwide research to explore the concept with consumers, looking at functional ingredients, flavor profile, form, and packaging.

Consumers have high expectations of the flavor and texture for chocolate and are unwilling to sacrifice for a lesser sensory experience. Thus, it is difficult to deliver an equitable indulgent chocolate experience with a healthier, functional chocolate, and consumers are suspicious that a chocolate-labeled functional product could be as satisfying (IFT, 2008).

The research goals were to:

• Conceptualize what a functional weight management chocolate means to consumers using qualitative consumer immersion groups;

• Explore features of functional chocolates with consumers—functional ingredients, flavor, texture, shape, calories, packaging, etc.;

• Identify substantial efficacy claims and global regulatory requirements for the active materials identified;

• Determine technical feasibility of development and manufacture of functional chocolates.

Consumer immersion groups were conducted in multiple countries. Consumers discussed consumption of chocolate and evaluated a variety of functional chocolate prototypes varying in composition, flavor, and form that were prepared by R&D.

Numerous prototyping options were identified that satisfied consumers’ expressed interest in the idea of a functional chocolate product. R&D and marketing discussed development options to pursue based on consumer interests and what was technically feasible.

In the end, however, top managers decided (despite the research and consumer sentiment) that a functional chocolate product was contrary to company philosophies, a “contradiction” for those with a weight concern, and that it was impossible for them to develop a marketing message for such a product that would be believable and satisfying for consumers.

This project was halted after significant research investment, not only wasting financial resources, but also demoralizing the research team. While researchers might ask, “How can we convince top management to accept a functional chocolate project?” upper managers might ask, “How can we avoid investing so much in a confusing and incongruous concept for consumers?” In either case, the waste results from discovering the marketing message contradiction late in the project after most of the funds had been spent.

--- PAGE BREAK ---

Example 2: Reaching Beyond Familiar Product Forms

The marketing department of a multinational foods company was interested in meal replacement beverages (IBISWorld, 2011), extending the R&D and manufacturing capabilities of the organization into the unknown territory of the beverage food form. However, a co-manufacturer for the beverage was required as the company had no internal capability to produce and bottle the beverages. R&D set out to work with consultants and suppliers to deliver the beverage with the success hurdle of beating the leading brand in a consumer taste test.

The research goals were to:

• Understand consumer needs, desires, and behaviors regarding meal replacement beverages;

• Develop a beverage that beats the leading brand on overall liking in taste tests;

• Design a bottle fitting the weight management meal replacement beverage concept;

• Establish beverage co-manufacturer production.

R&D led an in-home study to understand consumer needs and conducted bench-top ingredient screening and formula optimization. Sensory descriptive and consumer central location test followed to flavor map prototypes against the competition and to guide formula optimization. Multiple packaging trials were executed to resolve bottle design and microbial issues. Processing variants were tested to evaluate processing constraints applied by the co-manufacturer that affected the sensory quality of the product.

The product was launched in a staged roll-out nationwide—but not without significant stress to the R&D organization and the company.

Dealing with a new product form, the team discovered numerous challenges during this project, including ingredient screening, cost/quality tradeoffs, bottle design, and supply chain development. The co-manufacturer’s safety practices impacted the quality of the finished product, leading to a tense relationship between the marketer and co-manufacturer. Production capacity constraints slowed the product roll-out.

Market launch was delayed, development costs were significantly over budget, and a bottle redesign resulted in capital losses. Finally, the product did not offer a financially sustainable profit, although it did add a consumer valued new product form to the weight management portfolio.

Management failed to terminate the project on multiple occasions and continued to invest with discomfort in an unprofitable product proposition.

There were many unknowns surrounding the new product form, and the team discovered problems one after another. If the problems had been known earlier, the team could have addressed them in a timely manner, or at least management could have made an informed decision weighing the strategic advantage of the product against development cost.

The waste in this case comes from not discovering the whole scope of challenges early in the project.

Example 3: Exploring Performance Tradeoffs

Marketing had favorable concept test results that suggested consumers wanted a low-sodium, 100-calorie savory snack that helped to “keep them feeling fuller longer.” R&D was charged to develop a snack mix that not only offered great taste but with primary focus on the functional benefit of satiety (Holt et al., 1995; Fusaro, 2011).

Delivering functional health benefits in foods is an ongoing challenge. The research team recognized that satiety detracts from “good taste,” and set goals to:

• Define a multi-component savory snack mix containing multiple shapes/sizes and appearance, flavor, and texture variety—soy crisps, rice, corn, and nuts/seeds, etc.—that provides satiety for 3 hours;

• Screen/select components and formulate a savory mix that provides satiety and good taste;

• Conduct satiety research with consumers to establish a 3-hour “makes me feel fuller longer” claim;

• Determine consumer acceptability and satisfaction with the product.

--- PAGE BREAK ---

The consumer research team conducted an analytic hierarchy process (AHP) study (Saaty, 1994) with weight-conscious consumers of savory snacks, which showed satiety was the most important feature of a snack to help them curb their appetite between meals. Satiety was rated a higher priority than “good taste” (ranked second).

Sensory and consumer work followed on a variety of savory mixes (varying in protein and fiber content). Ad lib eating trials were also conducted to determine how much of the new savory mixes were eaten in contrast to traditional less healthy snack mixes.

Products delivering the lowest salt content and most satiety suffered in flavor and/or texture and always resulted in lower acceptability and satisfaction scores compared to less healthy options that were higher in salt and lower in fiber and protein. The ad lib trials found that consumers would eat more of the less healthy product if alternative choices were available.

While the concept was compelling in theory to consumers, the reality was that they wanted a salty snack that contained less fiber and protein (IFT, 2010; Hensel, 2012). After months of failed attempts to reach the satiety goal, the company elected to forego a 3-hour satiety target for a product that delivered only 2 hours of satiety, a higher profit margin, and higher consumer taste satisfaction scores.

Again, the waste results from late discovery. The team spent time and money attempting to meet the 3-hour satiety specification, only to discover later that less satiety and more flavor would be more economically viable.

Another contributor to waste is the mid-project discovery that the AHP study results do not correlate closely with consumer buying preferences. This is discussed further in “Speculate Broadly.”

Process To Accelerate Discovery

The common theme uniting these examples is that waste is caused by late discovery. Discovery is the goal of research, even when the discovery uncovers a fatal flaw. Waste is created when a late discovery invalidates work done earlier. For example, the late discovery of a philosophical concern about a chocolate product in a weight management product line resulted in nullification of the R&D effort and loss of the resources spent on most of the completed research—an earlier discovery would have avoided that waste.

Ironically, many of the late discoveries in research result from shoehorning research work into the sequential processes that serve to eliminate waste in later stages of product development.

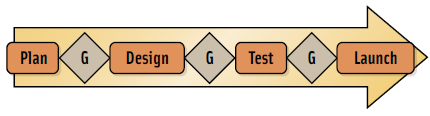

A typical sequential process is shown in Figure 1. In the FEI, sequential processes delay discoveries because teams focus on a single unknown, such as product formulation, and make assumptions about other unknowns, such as processing temperature in an unfamiliar bottling process. Later when the team discovers that the process affects a key ingredient, much of the formulation work is wasted.

A typical sequential process is shown in Figure 1. In the FEI, sequential processes delay discoveries because teams focus on a single unknown, such as product formulation, and make assumptions about other unknowns, such as processing temperature in an unfamiliar bottling process. Later when the team discovers that the process affects a key ingredient, much of the formulation work is wasted.

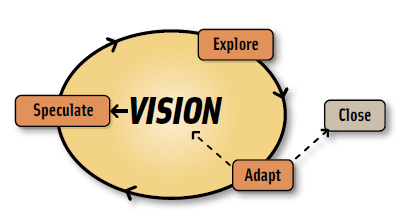

If sequential processes delay discoveries, how should work in the FEI be organized? Although early attempts to define “best practices” in FEI processes met with limited success (Koen et al., 2001), more recent work has identified iterative processes such as that shown in Figure 2, which serve well for exploratory projects (Highsmith, 2004).

Iterative processes differ from sequential processes in two fundamental ways. First, of course, is the fact that circling back to an earlier phase is embraced, rather than attributed to poor planning. Second, the phases are defined only at a high level, postponing detailed planning until the start of each iteration cycle.

Iterative processes differ from sequential processes in two fundamental ways. First, of course, is the fact that circling back to an earlier phase is embraced, rather than attributed to poor planning. Second, the phases are defined only at a high level, postponing detailed planning until the start of each iteration cycle.

For example, the team may devote one cycle to exploring likely ingredients, and then quickly circle back to explore processing temperature effects in the next. If an important ingredient is changed by processing, the team can adapt quickly with little wasted effort.

The research continues through cycles until the project closes in one of two ways. Either a product specification and development business case can be handed off to traditional (sequential) new product development, or the project is abandoned if the research effort no longer seems promising.

--- PAGE BREAK ---

Research Guided By Vision Statement

Effective research demands a clear, consistent direction, but researchers also need the flexibility to adapt to discoveries. Although these two needs at first seem to be contradictory, the vision statement fulfills both by combining a value proposition and boundary conditions (See The Vision Statement).

The value proposition sets a clear direction for the research and defines the business value to justify investment, but does not include premature assumptions about the outcome of the research.

For example, the value proposition for investigating a satisfying savory snack might be “A savory snack with the highest satiety consistent with competitive taste would increase sales significantly.” Then one boundary condition might be “the product must promise to increase product line sales by at least 5%.”

In Example 3 (Exploring Performance Tradeoffs), the team set out with a specific goal to demonstrate 3 hours of satiety, which later proved to be inconsistent with competitive taste and unnecessary for a commercially valuable product. The broad value proposition allows and even encourages researchers to explore a range of possible taste/satiety tradeoffs before committing significant investment to a goal that may change.

While this value proposition “… increase sales significantly” may seem too vague to justify investment, the boundary condition “… increase sales by at least 5%” sets a goal that managers can grasp. Boundary conditions may cover any important aspect of the project and frame the acceptable playing field for the investigation.

It is important that the boundary conditions set limits yet still allow room for adjustment. Boundary conditions are not forecasted outcomes—they set warning points for the research team. If at any time the team loses confidence that a boundary condition can be met, the team will either circle back to review the vision with executives, or move to abandon the investigation entirely. The team’s contract with management is not to meet numerically specific goals, but to act immediately if any part of the vision becomes unlikely.

Exploration In Rapid Cycles

The exploration is carried out in iterative cycles that consist of the three activities: speculate, explore, and adapt.

• Speculate: Iterations begin with a speculation activity. Here, “speculate” does not mean to guess wildly, but rather to conjecture about the state of the research. The team considers what has been learned, what unknowns remain, and looks for new unknowns that may have arisen lately.

The team prioritizes unknowns to be targeted in the upcoming cycle and makes plans to resolve them. Since the focus is on rapid discovery, their thinking should be to reduce the most important unknowns, not to resolve them thoroughly.

For example, if the team is uncertain about how processing temperatures might affect a key satiety ingredient, they might check with processing experts and devise an expedient test to subject familiar product formulations to a likely range of temperatures. These experiments can be done without final formulations or packaging, since their purpose is limited to discovering how processing temperature affects a few select ingredients.

In order to discover flaws as soon as possible, it is vital in this phase for the team to speculate not only about confirming the value proposition, but also about potential threats to the vision.

• Explore: After identifying the top unknowns for an iteration cycle, the team conducts experiments to explore them. To accelerate discovery, the exploration phase must be extremely short and expedient, not thorough. Teams typically will cycle through 5, 10, or more iterations in the course of a project.

Such short explorations are at first uncomfortable for researchers, but they can be effective if the exploration focuses on a single, clearly defined unknown. For example, if it is not known what a “believable marketing message” requires, a marketing team member might arrange short discussions with top managers simply to explore their concerns. The exact message would be crafted later.

• Adapt: The exploratory cycle ends in the adaptation phase, when the team reflects on what has been discovered and where to go next. This phase is particularly important to eliminating waste, because it is where the team reacts to discoveries.

The team must apply open and honest judgment about the future of the project, and may decide to:

• Start a new iteration to resolve further unknowns;

• Close the research project with a product proposal and business case if no significant unknowns remain;

• Circle back with stakeholders and managers to revise the vision if it is in doubt; or

• Abandon the project if the vision is no longer tenable.

--- PAGE BREAK ---

New Roles For Managers

The iterative process described here does not include milestone review gates, where executives are accustomed to reviewing checklists of deliverables.

Instead, status meetings are scheduled at fixed intervals, without predefined milestones. At these meetings, the team discusses its discoveries, the remaining unknowns, and the viability of the vision. Managers apply active judgment about the progress toward reducing unknowns and the commercial value of continuing the research.

Throughout the iterative process, researchers and managers must develop mutual trust. Researchers must honestly and openly review their own progress and monitor the viability of the vision at the end of each exploration cycle, and then take immediate action if the original vision comes into question.

Managers must first participate actively in defining the vision and ensuring their concerns are incorporated into the boundary conditions. Then, if business priorities change during the course of the project, they should hold immediate discussions with the team, rather than waiting until a scheduled project review.

The research team needs a designated executive sponsor to act as an ambassador between the realms of research and management. The sponsor should be a high level manager who is genuinely enthusiastic about the research and who has access to the executive team.

The executive sponsor does not manage the team’s daily activity, but should be readily available for the team to check important questions, to remove roadblocks, and secure external resources.

As the team’s liaison with top management, the executive sponsor should have productive relations with other top managers in order to socialize the research among them and to scout for barriers and changing priorities.

Research projects commonly incur waste when a top manager who has not paid attention to a project raises last minute objections. It is the role of the executive sponsor to minimize the risk of this wasteful situation.

Reviewing The Examples

Looking back at the three examples shows how this iterative process can minimize waste in the FEI.

In the case of Example 1 (Concept Stymied By Upper Management), the concern about the marketing message for a chocolate weight management product lay undiscovered until the end of the project. Was management being unreasonable, or did the team start down a blind alley? In either instance, the vision statement is a tool to generate broad high-level agreement about the project before starting the research, and the executive sponsor works to keep top managers abreast of progress.

In this example, a crucial boundary condition was absent. A believable marketing message was needed to bridge consumers’ perceived doubts about chocolate indulgence and weight management.

Such a boundary condition alerts the team to a potential impasse, so an early iteration would explore the boundary to learn if it can be resolved. The manager’s concern might be dispelled, or the project abandoned before significant costs were incurred.

Although this research process is designed to minimize demands on executives’ time, they must be actively involved with the vision and periodic status reviews to ensure that all their concerns are covered by the team.

Example 2 (Exploring An Unfamiliar Product Form) was plagued by discovering barriers one at a time. The iterative process minimizes this scenario by explicitly encouraging broad speculation about unknowns at the beginning of each cycle. Speculating about potential weaknesses as well as strengths of the value proposition minimizes the too common tendency of researchers to focus only on the strengths, delaying discovery of stumbling blocks.

One of the late-recognized barriers was that bottling process temperatures changed the product taste. Recognizing that the bottling process is unknown to the research team, an early exploration phase might have simply been to call on the bottler’s experts to review the steps in the bottling process.

If the team has trouble involving such experts, it falls to the executive sponsor to ensure timely cooperation from the bottling processor.

--- PAGE BREAK ---

In the case of Example 3 (Exploring Performance Tradeoffs), the team wasted considerable effort before discovering that the 3-hour satiety goal was neither feasible nor necessary. The value proposition was overly specific, leaving researchers no latitude to discover and adapt. The vision statement should be broad enough to allow researchers to explore a reasonable field of possibilities and react quickly to what they discover.

A less narrow value proposition defines a commercially worthwhile vision, but aims early iterations at exploring the relationships among taste, satiety, and market potential. After that, the research could focus in on the commercially optimum balance of satiety and taste.

Discovery & Development

Waste in the FEI often has a common cause—late discovery of something important.

Because the goal of research in the FEI is discovery rather than development, the sequential processes used in product development actually create waste in the FEI. Work in the FEI should follow an iterative exploratory process designed to accelerate discovery.

The exploratory process described here accelerates discovery with fast iterations that focus researchers on expedient exploration across the breadth of unknowns. This process differs significantly from common sequential development processes and requires different roles for both researchers and managers. However, adopting an iterative process will speed new concept research toward commercially effective conclusions.

Speculate Broadly

In Example 3 (Exploring Performance Tradeoffs), a secondary cause of waste was the mid-project discovery of a disparity between research methods. One method indicated that satiety was consumers’ top priority, while the other showed that taste was most important.

This sort of unknown can be eliminated early in a project by broadening the team’s field of speculation.

Speculation should not be limited to product attributes and commercial potential, but should include all aspects of the project. In this example, there was an unknown concerning the research method itself: Would the originally planned method provide reliable data about consumer buying preferences?

Identifying this unknown during an early iteration might have led to a limited pilot study to compare alternative methods. Since the purpose of the pilot study is only to compare methods and not to evaluate candidate formulations, it can be carried out before any product prototypes are formulated, perhaps using existing products from the company or from competitors.

Such a pilot study would have uncovered the disparity between the methods, and spared the team from duplicating larger, more expensive studies.

The Vision Statement

The vision statement guides and sets limits on the research project. A clear, complete vision is critical to an effective research project.

The value proposition defines the potential value of the research and justifies the investment that it will require in a way that is:

• Broad enough to allow researchers to explore and adapt to what they discover;

• Clear enough to focus the work and keep it from wandering aimlessly; and

• Stable enough that it should not need revision except for major new discoveries.

Boundary conditions define the “playing field” for the research and set limits on:

• Product charter;

• Research costs;

• Profit potential for a product;

• Return on the research investment; and

• Timeframe for closure.

John S. Farnbach, Ph.D., is Principal, Silver Streak Partners LLC, a management consultancy, Boulder, CO ([email protected]).

Carla L. Kuesten, Ph.D., a Member of IFT, is Senior Research Scientist in Consumer Product Research, Amway, Ada, MI ([email protected]).

References

Fusaro, D. 2011. A Study of Satiety: Helping Consumers Feel Full with Fewer Calories. Food Processing. March 31.

Hensel, K. 2012. Consumer Education Remains a Challenge in Sodium Reduction. IFTLive. June 27.

Highsmith, J. 2004. Agile Project Management Creating Innovative Products, Addison-Wesley, Boston, MA.

Holt, S.H., Miller, J.C., Petocz, P., Farmakalidis, E. 1995. A satiety index of common foods. Eur J Clin Nutr. 49(9): 675-90.

IBISWorld 2011. Eat and Run: New IBISWorld Industry Research Report Shows Demand for Meal Replacement Products Soaring as Consumers Crave Quick and Healthy Food. Press release. Oct. 11.

IFT 2008. Consumers interested in chocolate’s health benefits. Daily news. March 18.

IFT 2010. Sodium concern increases but low sodium foods not popular. Daily news. April 28.

Koen, P., Ajamian, G., Burkart, R., Clamen, A., Davidson, J., D’Amore, R., Elkins, C., Herald, K., Incorvia, M., Johnson, A., Karol, R., Seibert, R., Slavejkov, A., and Wagner, K. 2001. Providing Clarity and a Common Language to the “Fuzzy Front End.” Research • Technology Management, March-April, 46-55.

Saaty, T.L. 1994. Fundamentals of Decision Making and Priority Theory with the Analytic Hierarchy Process - Vol VI. First Edition. RWS Publications. Pittsburgh, PA.