A New Crop of Plant Protein Pioneers

Move over animal protein. Developers of plant-based products are getting down to the molecular level to build burger and chicken alternatives that taste and chew like the real thing.

Pull a package of Beyond Meat chicken-free strips or beef-free crumbles from the freezer case and a two-word product descriptor catches the eye: real meat. Yes, real meat—not meat alternative or meat replacement. The term makes perfect sense to company founder Ethan Brown and his team of product developers and marketers, who like to think of the plant-based protein products they’re bringing to market as meat—just meat that’s even better than the animal protein varieties to which the term has traditionally been applied.

“We argue that animal meat and plant meat are one and the same,” says Tim Geistlinger, vice president of R&D for the El Segundo, Calif.–based company. “They’re all constructed of proteins, fats, nucleic acids, carbohydrates. All of these things exist in living things, and plants are living. Animals are living. Now it’s just a matter of reconstructing things. You’re assembling them in a way that is similar to what animal meat is like in terms of density and structure and fiber.”

“Whoever said that meat had to come from a cow?” Bob Connolly, Beyond Meat marketing vice president, asks rhetorically. “We can make meat from plants.” The home page of the Beyond Meat website maintains that this is so; it invites website visitors to “meet America’s newest meat.”

“Whoever said that meat had to come from a cow?” Bob Connolly, Beyond Meat marketing vice president, asks rhetorically. “We can make meat from plants.” The home page of the Beyond Meat website maintains that this is so; it invites website visitors to “meet America’s newest meat.”

Merriam-Webster suggests that the Beyond Meat argument has merit. While the first dictionary listing defines meat as “the flesh of an animal used as food,” follow-up definitions describe it as “the part of something (such as a nut) that can be eaten” and “solid food as distinguished from drink.”

The plant meat terminology is provocative, says Jaime Athos, president and CEO of Turtle Island Foods, Hood River, Ore., maker of Tofurky brand meat substitutes. He thinks that is a good thing. Athos is a fan of Brown and Beyond Meat and appreciates the interest in meat alternatives that the high-profile company is generating. “It’s fantastic for us,” he says. “I love the attention that they’re bringing to our types of products.”

--- PAGE BREAK ---

Welcome to the exciting new realm of plant-based protein products, a world where R&D teams are scrutinizing animal and plant protein at the molecular level in a bid to create plant-based offerings with taste and textural properties comparable to beef and chicken. Their efforts have drawn the attention—and capital—of investors as notable as Bill Gates as well as recognition from culinary superstars like Alton Brown. The chef said in a recent magazine article that Beyond Meat chicken-free strips could be substituted for chicken in about 30% of all recipes that use the real thing (Brown, 2013). Gates is also an investor in San Francisco–based Hampton Creek, where scientists reportedly screened 3,000 plants to arrive at the optimal ingredients for the company’s plant-based egg substitute, which is used in its Just Mayo and Just Cookies refrigerated cookie dough (Packaged Facts, 2014).

In another California-based entrepreneurial venture, scientists and culinary professionals at Impossible Foods in Redwood City are laboring to perfect the taste of a plant-based burger so authentic that it “bleeds” in a way that is akin to a rare beef burger. The burger incorporates “plant blood” that Impossible Foods scientists have bioengineered from the heme molecule found in hemoglobin, the compound in animal blood that gives red meat its characteristic taste. The heme that Impossible Foods uses, however, is reportedly extracted from the roots of legumes (Nosowitz, 2014). Impossible Foods is the brainchild of Stanford University biologist and physician Patrick Brown (no relation to Beyond Meat’s Brown), who says that he hopes to have the Impossible Foods burger available at retail as early as the end of 2015 (Rusli, 2014). The fact that it currently costs $20 to produce one of the burgers may mean that the timetable will need to be adjusted, however.

Beyond Meat has a new burger offering waiting in the wings as well. Its soy-free Beast Burger, formulated from a mixture of plant proteins, including pea, moringa, and hydrilla (an aquatic plant), is slated to arrive in supermarkets early in 2015. The Beast boasts a nutritional profile that Geistlinger says has more omega-3s than a serving of salmon, more calcium than a glass of milk, more iron than a serving of steak, more protein than a beef burger, and more antioxidants than a serving of blueberries. Connolly says that Beyond Meat will introduce a total of eight new products, including chicken-free nuggets and plant-based meatballs, in the first quarter of 2015.

Beyond Meat products are made using a proprietary extrusion process developed by University of Missouri professor and IFT member Fu-hung Hsieh and licensed to the company. (See sidebar on page 24 for Hsieh’s description of the way in which the chicken-free product concept originated.)

Geistlinger describes the manufacturing process as a “very gentle cooking process” that uses steam, pressure, and heat to partially cook the plant proteins. “What that means,” he says, “is that it makes the proteins unfold in a very controlled way.” Then they’re cooled, also in a controlled way, which causes the proteins to integrate and fold upon each other in a way that creates the desired fibrous texture of meat. “It’s balancing texture and moisture to create mouthfeel,” says Geistlinger.

A Look at the Market

A Look at the Market

U.S. per capita meat consumption has been declining since 2007 (NCC, 2014). Meanwhile, sales of meat alternatives climbed by 8% between 2010 and 2012 (Mintel, 2013).

Mintel 2013 survey data show that more than a third (36%) of consumers use meat alternatives; those in the 18–24 age range have the highest usage rate—46%, followed by those aged 25–34 with a usage level of 43%.

Such statistics come as no surprise to marketers at Garden Protein International, Vancouver, Canada, which introduced what is now an extensive line of center-of-the-plate Gardein brand meat substitutes to the U.S. market in 2009. “The drive is really coming from Millennials,” says Russell Barnett, vice president of marketing, Garden Protein International. “That’s because they grew up with plants as an option. They grew up turning over the package and identifying ingredients.”

Among those who are purchasing meat alternatives, 16% are using them alongside animal protein, suggesting that the products can stand on their own as food options and are not merely meat substitutes in the minds of many consumers (Mintel, 2013). Vegetarians and vegans represent about 4% of the U.S. population, but 47% of consumers eat at least one vegetarian meal a week (VRG, 2012). It’s this latter segment of the market that makers of meat alternatives tend to get excited about.

--- PAGE BREAK ---

“Who we are really targeting with the brand,” says Beyond Meat’s Connolly, “are people outside the category. We are really targeting mom, who is faced with the challenge of serving up dinner to the family seven days a week.”

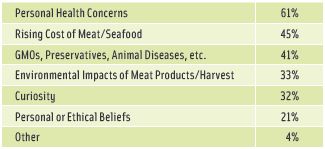

Personal health concerns are the number one motivation for going meatless, according to a recent consumer study conducted by Acosta Inc., a Jacksonville, Fla., sales and marketing company. The high cost of meat and seafood, worries about genetically modified organisms (GMOs) and preservatives, and concern about the environmental impact of meat production were other factors survey respondents cited (Acosta, 2014; Figure 1). June Lim, president of StarLite Cuisine, a Seal Beach, Calif.–based maker of vegan Mexican entrees, started learning about her father’s vegetarian foods business as a child. She says she’s seen a major evolution in mainstream consumer response to vegetarian/vegan products over the course of the past few decades. It’s gone from “ewww” to “wow,” she notes. StarLite Cuisine has been slowly but steadily expanding its taquitos and tacos from their West Coast retail base; last year, the company added gluten-free enchiladas to the lineup, says Lim.

June Lim, president of StarLite Cuisine, a Seal Beach, Calif.–based maker of vegan Mexican entrees, started learning about her father’s vegetarian foods business as a child. She says she’s seen a major evolution in mainstream consumer response to vegetarian/vegan products over the course of the past few decades. It’s gone from “ewww” to “wow,” she notes. StarLite Cuisine has been slowly but steadily expanding its taquitos and tacos from their West Coast retail base; last year, the company added gluten-free enchiladas to the lineup, says Lim.

While purveyors of plant-based products like Beyond Meat and Hampton Creek have been making headlines in the past year or two, more established players like Turtle Island Foods and Garden Protein International are showing strong growth. Garden Protein saw sales surge 37% for the 52-week period ending Sept. 7, 2014, according to IRI Infoscan data, and Turtle Island Foods’ sales climbed by 18% while overall frozen/refrigerated meat substitute sales in supermarkets, drug stores, mass merchandisers, and select club and dollar stores were up 1.8% to $402 million for the period. Garden Protein’s performance was apparently not lost on executives at Pinnacle Foods, Parsippany, N.J., which markets Birds Eye vegetables and a variety of other brands. Pinnacle last month announced plans to acquire Garden Protein for $154 million with the goal of leveraging the complementary Birds Eye and Gardein brand equities.

While purveyors of plant-based products like Beyond Meat and Hampton Creek have been making headlines in the past year or two, more established players like Turtle Island Foods and Garden Protein International are showing strong growth. Garden Protein saw sales surge 37% for the 52-week period ending Sept. 7, 2014, according to IRI Infoscan data, and Turtle Island Foods’ sales climbed by 18% while overall frozen/refrigerated meat substitute sales in supermarkets, drug stores, mass merchandisers, and select club and dollar stores were up 1.8% to $402 million for the period. Garden Protein’s performance was apparently not lost on executives at Pinnacle Foods, Parsippany, N.J., which markets Birds Eye vegetables and a variety of other brands. Pinnacle last month announced plans to acquire Garden Protein for $154 million with the goal of leveraging the complementary Birds Eye and Gardein brand equities.

A new player in the meat substitute segment, Lancaster, Pa.–based Neat Foods, founded by husband-and-wife team Phil and Laura Lapp, is attempting to crack the market by going the shelf-stable route. The company offers a variety of meat substitute mixes made primarily from pecans and garbanzo beans as well as a Neategg mix derived from chia and garbanzo beans. The concept was born after Laura, a former neuroscientist, started getting experimental in the kitchen. Phil, a sales executive for Auntie Anne’s Pretzels at the time, thought he saw a niche in the marketplace for the products, which are currently available in about 1,500 retail outlets, including Whole Foods and Wegmans, with Target scheduled to roll out Neat mixes in several hundred stores this fall. The company hopes to move into the frozen food aisles in the first quarter of 2015 with the launch of Neatballs, a meat-free version of meatballs.

A new player in the meat substitute segment, Lancaster, Pa.–based Neat Foods, founded by husband-and-wife team Phil and Laura Lapp, is attempting to crack the market by going the shelf-stable route. The company offers a variety of meat substitute mixes made primarily from pecans and garbanzo beans as well as a Neategg mix derived from chia and garbanzo beans. The concept was born after Laura, a former neuroscientist, started getting experimental in the kitchen. Phil, a sales executive for Auntie Anne’s Pretzels at the time, thought he saw a niche in the marketplace for the products, which are currently available in about 1,500 retail outlets, including Whole Foods and Wegmans, with Target scheduled to roll out Neat mixes in several hundred stores this fall. The company hopes to move into the frozen food aisles in the first quarter of 2015 with the launch of Neatballs, a meat-free version of meatballs.

“The idea of using nuts and beans as a meat substitute has been around for decades, but no one thought about doing it commercially,” says Phil Lapp.

--- PAGE BREAK ---

Protein Power

Consumers’ mounting interest in plant-based protein is clearly part of a bigger-picture trend: their ongoing love affair with protein. More people now look for protein on the Nutrition Facts Panel even as fewer of them check labels for fat and calorie content, says Darren Seifer, food and beverage analyst for Chicago-based NPD Group. NPD data show that more than three-quarters (78%) believe that protein contributes to a healthy diet, and more than half of adults want to consume more of it.

“Protein is the new black,” says consultant Kantha Shelke, principal of Chicago-based Corvus Blue LLC. “Just as people believe that black makes one look slimmer, people have come to believe that protein can make them thinner.”

“There are only three macronutrients,” says Rachel Cheatham, president and CEO of Chicago-based Foodscape Group LLC. “You’ve got protein, fat, and carbohydrates. If you really think about it, protein is the one that arguably has never been demonized.

“I don’t think the average consumer is thinking, ‘I need to get more plant protein in my diet,’” says Cheatham. “But they’re starting to put it together: I know I need to eat more plant-based food, and I know that I need to eat protein to feel full.”

Although the market potential for plant-based protein products is clear, formulating with plant proteins brings with it a variety of challenges, starting with taste. “Most plant proteins come with marked off-tastes from the plant source,” says Shelke. “They are generally bitter and not easily accepted by finicky consumers.”

Texture can also be an issue. “Proteins love water, and most foods made with plant protein ingredients require additional ingredients for moistness and better taste,” Shelke says. In addition, many consumers miss the familiar taste of dairy or eggs.

Developing the next generation of plant-based protein products requires substantial investment in product research and new manufacturing equipment. Food scientists have not yet come up with all of the technologies needed to make these foods palatable, according to Shelke. Hampton Creek has raised $30 million in capital so far, and a $50 million round of financing was in progress this fall (Buhr, 2014).

The Plant Protein Palette

Expect to see product developers incorporating multiple plant protein sources into their formulations and experimenting with up-and-coming plant protein ingredients.

“We like to blend a variety of proteins in our products,” says Beyond Meat’s Geistlinger. “The drive is definitely in that direction so there’s a better balance of protein sources. Ultimately, they have to meet the requirements in terms of digestion and true nutritional value, which is measured by essential amino acid scores and digestibility. Our goal is to meet that through a mixture of proteins from a variety of sources.” It also adds flexibility to the supply chain, marketing executive Connolly notes.

Demand for plant protein is booming, says David Janow, CEO of Axiom Foods, Los Angeles, Calif., a supplier of brown rice protein and other plant-based ingredients. He contends that plant-based formulations are moving from a niche positioning in nutritional products into the mainstream thanks to the fact that plant proteins are sustainable, allergen-friendly, healthful, and often cheaper than animal proteins. “Axiom Foods has been asked to meet with multibillion-dollar manufacturers—all of whom have protein initiatives,” says Janow. Here’s a look at some of the currently popular and emerging ingredient options for plant-based product formulation.

--- PAGE BREAK ---

• Soy Protein. This versatile protein powerhouse has a long history as an ingredient in vegetarian foods. It has a complete amino acid profile (i.e., it contains all nine essential amino acids, which the body cannot synthesize on its own and so must be consumed in the diet) and is available in a wide variety of forms, including textured protein; concentrates, which include fiber as well as protein; and highly refined isolates, which can be harder to digest than concentrates and textured soy protein.

Soy protein applications include everything from traditional vegetarian options such as burgers, nuggets, and hot dogs to products like beef tips, tenders, and fillets that have more of a “whole muscle” presentation, says Annette Higgins, director, protein solutions, DuPont Nutrition & Health, St. Louis, Mo.

The U.S. Food and Drug Administration–approved health claim that consuming 25 g of soy protein daily may help to reduce the risk of heart disease has been in place for 15 years, and 41% of consumers are aware of it (USB, 2014).

Soy does have a few image problems, however. Shelke notes concerns about hormone effects and solvent residues from the extraction process, for example. Because the vast majority of the U.S. soybean crop is genetically modified, many manufacturers of soy-based meat alternatives are careful to use only non-GMO soybeans.

Soy does have a few image problems, however. Shelke notes concerns about hormone effects and solvent residues from the extraction process, for example. Because the vast majority of the U.S. soybean crop is genetically modified, many manufacturers of soy-based meat alternatives are careful to use only non-GMO soybeans.

According to the United Soybean Board, soy consumption is increasing 5% annually and only 2% of those polled in its most recent annual survey cited GMOs as a barrier to consuming soy foods or beverages (USB, 2014). Almost three-quarters (74%) of those polled by the United Soybean Board reported consuming soy foods or beverages.

Athos of Turtle Island Foods says consumer concerns about soy tend to be cyclical. Tofurky product developers opt for the least-processed versions of the soy and other ingredients it uses because they are more nutritionally complete than more-processed ingredients, according to Athos. “At the end of the day, soy has been part of the human diet for thousands of years,” Athos continues. “I think by now we’d know if it had profound health consequences.”

• Pea Protein. A somewhat new addition to the plant protein array, pea protein is quickly assuming a higher-profile position. “Among plant-based proteins, pea proteins are an increasingly popular choice as they are prepared from non-GMO source material, and peas are not considered a major allergen,” says Kevin Segall, director of research and intellectual property management for Burcon NutraScience Corp., the Vancouver, Canada–based developer of Peazazz® pea protein isolates.

• Pea Protein. A somewhat new addition to the plant protein array, pea protein is quickly assuming a higher-profile position. “Among plant-based proteins, pea proteins are an increasingly popular choice as they are prepared from non-GMO source material, and peas are not considered a major allergen,” says Kevin Segall, director of research and intellectual property management for Burcon NutraScience Corp., the Vancouver, Canada–based developer of Peazazz® pea protein isolates.

“The demand for Roquette’s pea protein has dramatically increased over the past few years,” says Neelesh Varde, senior product manager with Geneva, Ill.–based Roquette America Inc. He notes that snack applications are particularly popular.

In addition to its use in Beyond Meat’s products, pea protein appears prominently on the ingredient label for Hampton Creek’s Just Mayo, LÄRABAR ALT bars, and Post’s Great Grains Protein cereal (Cheatham, 2014). When StarLite Cuisine was working to formulate its frozen vegan enchiladas, the company opted for pea protein from Roquette instead of soy, says Lim. “We’re very pleased with the pea protein,” says the company president, adding that its neutral flavor is a plus. StarLite even highlights the fact that the enchiladas are made with pea protein on the front of its packaging.

--- PAGE BREAK ---

• Rice Protein. Sales of its Oryzatein® brown rice protein have climbed by nearly 400% since it was launched in 2009, according to Axiom Foods. Oryzatein protein, which can be incorporated into beverages, baked goods, confections, sports nutrition products, and more, is enzymatically extracted from whole-grain rice using proprietary processes that do not require the use of hexane. It is gluten-free and GMO-free.

• Microalgae. Right on the cutting edge of plant-based protein ingredients is microalgae, a microscopic form of algae produced using fermentation technology.

• Microalgae. Right on the cutting edge of plant-based protein ingredients is microalgae, a microscopic form of algae produced using fermentation technology.

Microalgae food ingredients deliver wholefood nutrition because they are derived from single-cell organisms. Microalgae ingredient marketers include Solazyme, South San Francisco, Calif., with AlgaVia™ and Roquette with algility™ HP whole algal protein.

“Because Solazyme’s AlgaVia is a whole-food ingredient, it offers more to customers and consumers than just protein,” explains Sally Aaron, AlgaVia marketing director, Solazyme microalgae food ingredients. “It is a unique source of protein, fiber, healthy lipids, and micronutrients such as lutein and zeaxanthin.

“The macronutrients are completely protected by the microalgae cell wall, so the protein has limited interaction with other ingredients,” says Aaron. This makes it easy to use in a broad range of applications including beverages, bakery, soups, sauces, and cream—with minimal impact on the product texture and function.”

In addition to its strong nutritional profile and versatility, microalgae are a planet-friendly, renewable resource, according to Roquette, which this summer opened a new facility in France that is dedicated to microalgae production.

Beyond Meat is among the companies that have begun to experiment with microalgae. “We’re looking at incorporating microalgae, and we’re looking at how it responds in our products,” says R&D head Geistlinger. “We’re definitely testing that.”

The fact that it is processed without the use of chemical solvents will enhance the appeal of microalgae, according to Shelke. She predicts that it will initially make market inroads in pet foods and performance products like nutritional bars and beverages.

--- PAGE BREAK ---

• Hemp, Alfalfa, and Fava Bean Protein. Ingredients like hemp, alfalfa, and fava (also known as faba) bean protein powders have been attracting more attention among food and beverage manufacturers seeking to shift their formulations away from soy protein and whey protein, says Jim Saunders, president of Ingredient Alliance LLC, El Segundo, Calif., a supplier of plant-based ingredients. He notes that all are gluten-free, nonallergenic, free of GMOs, and easily digestible.

The company has several R&D projects in the works that use the ingredients in applications such as meal replacements, cereals, baked goods, and beverages. Among the most notable are cookies, muffins, and brownies made with hemp protein powder for Starbucks supplier La Boulange and a high-protein probiotic beverage for Amway made with fava bean protein.

“There’s a tremendous growth cycle right now for hemp protein in particular, and I’m very confident that fava bean will be in as much demand as pea and brown rice protein because of its characteristics, its costs, and the fact that we are growing and processing it in North America,” says Saunders.

Alfalfa protein, which Ingredient Alliance is sourcing from France, has a nutritional profile that is very similar to egg white protein and is high in omega-3s, beta-carotene, lutein, and more, according to the company.

Keeping It Clean

Marketers of products formulated with plant protein frequently cite their clean label benefits, including their use of non-GMO ingredients.

Beyond Meat made a conscious decision to steer clear of genetically engineered products. Genetic engineering “opens up a lot of possibilities” for product development, says Geistlinger, but he adds that “we’ve made a very specific choice not to do that because we know that’s not what our audience wants.”

Besides, he emphasizes, it’s not necessary. “What’s really great is that we have learned by sourcing different materials and applying first principle rules of chemistry and protein folding that we can create a lot of things that we need to create using existing natural sources. It’s made it clear to us that we don’t need to go GMO.”

Consultant Cheatham observes that while the spate of new plant-based products arriving in the marketplace can deliver bona fide nutrition benefits, the health-conscious consumers who are drawn to them will most likely be paying close attention to what is on the label. So product developers will be well-advised to keep ingredient labels as simple and clean as possible. “It’s the consumer that is tuned into the idea of plant-based eating that’s tuned into clean label and tuned into non-GMO,” says Cheatham. “I do think they track together.

“What I would hope would happen is that we’ll see more products come out that have various plant-based proteins in them—whether it’s soy, or pea, or rice bran—but don’t have any extras that aren’t needed—whether it’s artificial flavors or colors or different kinds of fillers. The [plant protein–based] products with the lesser amounts of those ingredients will probably triumph in sales with the public.”

Exactly what packaged products and plant protein ingredients will prevail in the marketplace? That remains to be seen. With a host of emerging plant ingredients now available and a variety of plant-based packaged food products set to arrive in supermarkets in 2015, what is clear is this: there’s a brave new world out there for plant protein. And if marketers at companies like Beyond Meat have their way, mainstream consumers may soon be thinking of plant protein products not merely as substitutes for burgers, bacon, or pork chops but as delicious and healthful “plant meat” that is every bit as good as the real thing.

--- PAGE BREAK ---

IFT Member Fu-hung Hsieh on the Story Behind Beyond Meat

IFT Member Fu-hung Hsieh on the Story Behind Beyond Meat

The entrepreneurial venture Beyond Meat has been gaining traction in the marketplace and attracting a fair amount of media attention in recent months. But the story of Beyond Meat’s vegetable protein–based meat alternatives really starts with softspoken IFT professional member Fu-hung Hsieh, a professor of bioengineering at the University of Missouri.

It’s a story that goes back more than two decades, years in which Hsieh labored in his lab to create a soy-based meat analog that chewed like chicken. Eventually he met with Ethan Brown, who was looking for a way to bring a sustainable meat substitute to market, and in 2009, Beyond Meat licensed Hsieh’s technology from the University of Missouri. Hsieh, an IFT Fellow, took some time out to explain how everything came together.

When did you start working on developing a meat alternative?

It was in the late 1980s and early 1990s, shortly after I left Quaker Oats and came to the University of Missouri and had a new APV Baker 50 mm twin-screw co-rotating extruder set up and in operation.

What got you interested in using plant protein in this way?

When I was a graduate student at the University of Minnesota in the early 1970s, I was fascinated by the development of texturized vegetable protein products and I was also aware of some of the shortcomings. For example, these products require hydration. They do not have the whole-muscle appearance, and more importantly, they do not have the mouthfeel of real meat. I also recognized that plant protein is generally much more resource-friendly than meat protein. A meat alternative made from plant protein that meets the needs of consumers could have a significant impact in many areas.

How did you zero in on the ingredients used in Beyond Chicken Strips?

Soy protein and pea protein were selected because they are high in protein quality and also abundant. Amaranth and carrot fiber were used due to their functionality and images for health-conscious consumers. Many other similar ingredients could be used too.

What else can you share about the process of creating this product?

The dry ingredients are mixed in a blender and fed to a twin-screw extruder. Within this piece of equipment, the ingredients are mixed with water, kneaded, heated, and finally pushed through a specially designed long cooling die where the final fibrous meat analog product is formed. The process is continuous, and it takes about one minute from powdery dry mix to a fibrous product resembling cooked chicken breast meat.

How did the licensing connection with Ethan Brown and Beyond Meat come about?

It was initiated by Ethan. He became aware of our work through the introduction of Jason Matheny, founder of New Harvest (a charitable organization dedicated to building a sustainable, healthy, and humane food system). After several visits, he decided to proceed with the licensing agreement with the University of Missouri.

Did you ever get discouraged over the course of the years that it took to create the chicken-free strips?

No, not at all. Having conducted many other research projects in the laboratory, I know there are always unexpected challenges here and there.

Did you think that the outcome would be what it is—a product that has been so successfully commercialized?

Yes, when I was developing the process and the product, it was my dream that someday they would be commercialized and be beneficial for consumers. I did not know what to expect, however, when this became a reality because I have never had this kind of experience.

Watch a video about Fu-hung Hsieh’s experience creating the chicken substitute now marketed by Beyond Meat.

--- PAGE BREAK ---

Doctors Embrace Plant-Based Diet Paradigm

This past summer Chicago-based cardiologist Kim A. Williams wrote a blog about the health benefits of the vegan lifestyle he had adopted more than a decade earlier. The blog generated some serious buzz because Williams is president-elect of the American College of Cardiology.

In his blog Williams wrote that when he went vegan in 2003, replacing the chicken and fish he was consuming at the time with meat substitutes, his LDL cholesterol plummeted by 80 points within six weeks. Although Williams acknowledges that more research is needed to document the heart health benefits of a vegan diet, he says that he regularly recommends this approach to his patients.

Williams is not the only medical professional to advocate the benefits of plant-based eating. The second annual International Plant-Based Nutrition Healthcare Conference drew more than 400 physicians and clinicians to San Diego, Calif., this fall for sessions presented by prominent advocates of plant-based eating including Dean Ornish and T. Colin Campbell.

The conference was sponsored by The Plantrician Project, a St. Louis–based nonprofit organization established to communicate the benefits of plant-based eating to medical professionals. Its website (www.plantricianproject.org) describes a plantrician as a “physician or clinician empowered with knowledge of the benefits of whole food, plant-based nutrition.” The Plantrician Project’s board of directors includes Beyond Meat CEO and founder Ethan Brown.

Online Exclusive

For more information on some of the basics of plant protein and diet, see Food Technology ‘s Online Exclusive, “Demystifying Plant Protein Nutrition,” which can be found at http://www.ift.org/food-technology/online-exclusives.aspx.

Mary Ellen Kuhn is Executive Editor of Food Technology magazine ([email protected]).

References

Acosta. 2014. The personalization of protein. October. Acosta Sales & Marketing, Jacksonville, Fla. www.accosta.com.

Brown, A. 2013. Tastes like chicken. Wired. Sept. http://www.wired.com/2013/09/fakemeat. Accessed Oct. 16, 2014.

Buhr, S. 2014. Hampton Creek in a management pickle as it seeks to raise $50 million in funding. TechCrunch. Sept. 17. http://techcrunch.com/2014/09/17/hampton-creek-in-a-management-pickle-as-it-seeks-to-raise-50-million-in-funding. Accessed Oct. 20, 2014.

Cheatham, R. 2014. Leveraging the power of plant proteins. Presented at SupplySide West, Las Vegas, Nev., Oct. 7.

Mintel. 2013. Meat alternatives—U.S. Mintel Group Ltd., Chicago, Ill. www.mintel.com.

NCC. 2014. Per capita consumption of poultry and livestock, 1965 to estimated 2014, in pounds. National Chicken Council, Washington, D.C. www.nationalchickencouncil.org.

Nosowitz, D. 2014. The problem with veggie burgers so real they bleed. Modern Farmer. Oct. 24. http://modernfarmer.com. Accessed Oct. 25, 2014.

Packaged Facts. 2014. Proteins: classic, alternative, and exotic sources. June. Packaged Facts, New York, N.Y. www.packagedfacts.com.

Rusli, E. 2014. The secret of these new veggie burgers: plant blood. WSJ.D. Oct. 7. http://online.wsj.com. Accessed Oct. 23, 2014.

USB. 2014. Consumer attitudes about nutrition, health and soyfoods. United Soybean Board, St. Louis, Mo. www.soyconnection.com.

VRG. 2012. How often do Americans eat vegetarian meals? And how many adults in the U.S. are vegetarian? Press release, May 18. Vegetarian Resource Group, Baltimore, Md. www.vrg.org.