Keeping Consumers Sweet on Frozen Treats

Although ice cream and frozen novelties are mature categories, they keep reinventing themselves through new flavors, snack formats, and healthier options.

From the days when only the wealthy could afford it, to the popularity of soda fountains in the late nineteenth century and ice cream trucks in the early twentieth century, and finally, thanks to refrigeration technologies, mass production in the 1940s and 1950s, ice cream has been the quintessential treat. It is an indulgence icon consumed, in one form or another, by 87% of American adults (Mintel, 2013).

In fact, according to NPD, 55% of Americans have consumed ice cream or a frozen novelty at least once in the past two weeks. It’s obvious that the ice cream and frozen novelties category remains stable; however, it is a mature market under pressure by various factors. To succeed in the market, manufacturers of ice cream and frozen novelties must offer innovative flavors, create new occasions for consumption, offer healthy options where appropriate, and maintain affordability.

Sales Grow Slowly

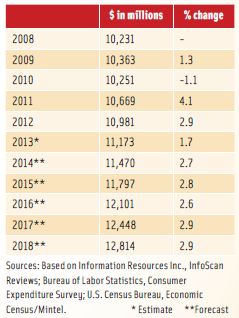

As with all segments of the food industry, ice cream is not immune to economic conditions. The category experienced a dip in U.S. sales in 2010 due to the recession. Mintel predicted U.S. sales for 2013 to total $11.2 billion—a 1% loss from 2009 sales when taking inflation into account. However, the market research firm forecasts steady growth for sales through 2018 to reach $12.8 billion (Figure 1).

These figures only account for retail sales, but certainly foodservice sales of ice cream suffered as well during the recession. Consumers often cut back on desserts when money is tight, or turn to more affordable options, such as private label bulk varieties. Euromonitor predicts that with an improving economy, foodservice sales of ice cream will grow. “We’ve found that when the economy is better people tend to treat themselves by going out for ice cream,” said Virginia Lee, Senior Research Analyst at Euromonitor International. “People also tend to treat themselves to ice cream when they’re on vacation, whether it’s a day trip or long vacation.”

While the foodservice environment has seen a proliferation of new outlets—focused primarily on the popularity of frozen yogurt—Harry Balzer, Chief Industry Analyst and Vice President at The NPD Group, stressed that the majority of consumption takes place at home. “Only 16% of consumers are eating ice cream away from home,” said Balzer.

Fro-Yo Craze

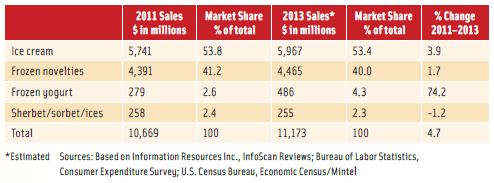

Spurred by the popularity of new food-service outlets focused on frozen yogurt, such as Pinkberry, Red Mango, Menchie’s, and Orange Leaf, the segment saw a slew of new product releases in the supermarket freezer case. Mintel reports strong growth of 74.2% from 2011 to 2013. However, it should be noted that while the growth was significant, frozen yogurt still only makes up 4% of retail sales in the ice cream/frozen novelties category. Mintel forecasts continued growth in the frozen yogurt segment through 2018, although much slower than the high growth it saw in 2012 and 2013. Overall, the segment is estimated to reach sales of $747 million by 2018 (Mintel, 2013).

--- PAGE BREAK ---

Frozen yogurt is a natural extension of refrigerated spoonable yogurt products, which reached $5.7 billion in sales in 2011, up 40% from 2007 (Mintel, 2012). Food companies have noted the recent explosion in Greek yogurt in the dairy aisle and have launched frozen Greek yogurt products to capitalize on the trend. “I think that just as in the dairy aisle, the Greek yogurt varieties within frozen yogurt will be leading the sales for the next few years,” said Lee.

New frozen Greek yogurt products have been launched by ice cream and yogurt makers alike. For example, in 2012, Ben & Jerry’s, known for its premium ice creams, introduced a frozen Greek yogurt. In addition, Yoplait—a leader in the spoonable yogurt category—launched Greek Low Fat Frozen Yogurt Bars.

Healthy halo. The popularity of frozen yogurt is noteworthy because it points to some overarching consumer trends affecting every aspect of the food industry. First, it addresses consumers’ growing desire for healthier food products. Yogurt, especially Greek yogurt, has lower fat and higher protein content than traditional ice cream. In addition, products such as the Yoplait Greek Low Fat Frozen Yogurt Bars market the product’s live and active cultures, which consumers are familiar with in the spoonable yogurt format.

Companies are also adding to this health halo for their frozen yogurt products by incorporating ingredients that consumers already deem healthy. Fruits—such as blueberry and strawberry—offer a natural connection to health for consumers. Apollo Food Group’s popular Yasso brand launched its Coconut Flavored Frozen Greek Yogurt Bars in April 2013. Not only does this product contain low calorie and high in protein claims, but it also contains coconut, which plays into the current trend in coconut water that consumers view as healthy.

Snackability. The immense growth that the segment has seen recently means that marketers can no longer differentiate themselves by simply offering frozen yogurt. They will have to stand out by introducing unique flavors and formats. This gives manufacturers the opportunity to tap into another overarching consumer trend—snacking. Consumers are eating fewer formal meals and, instead, are snacking more throughout the day. Offering a frozen yogurt product in the form of a frozen novelty—a stick, bar, etc.—may position the product more as a snack than a dessert. This may also prove successful since many frozen yogurt products are not positioned as alternatives to ice cream, but instead as their own unique, tart-flavored product.

“I don’t think frozen Greek yogurt should be positioned as an indulgent dessert,” said Donna Berry, Consultant and Owner of Dairy and Food Communications Inc. “I think it should be positioned as a meal replacement or a health snack.”

However, there are still some producers walking the line between health and indulgence by offering frozen yogurt in decadent flavors, aimed at taking some of the dessert share away from ice cream. Turkey Hill Dairy, for example, will roll out four limited-edition flavors of Greek frozen yogurt this year. Currently, consumers can find Turkey Hill’s Baklava Greek Frozen Yogurt, which contains vanilla Greek frozen yogurt with crunchy baklava pieces and a honey cinnamon swirl, in the freezer case. Later in the year, the company will introduce Lemoni Biskoti, Raspberry Chokolata, and Sea Salt Caramel Truffle. While containing more fat and calories than other Greek frozen yogurt products, they offer more protein than traditional frozen yogurt and ice cream. It is up to consumers how healthy or indulgent they want to be.

However, there are still some producers walking the line between health and indulgence by offering frozen yogurt in decadent flavors, aimed at taking some of the dessert share away from ice cream. Turkey Hill Dairy, for example, will roll out four limited-edition flavors of Greek frozen yogurt this year. Currently, consumers can find Turkey Hill’s Baklava Greek Frozen Yogurt, which contains vanilla Greek frozen yogurt with crunchy baklava pieces and a honey cinnamon swirl, in the freezer case. Later in the year, the company will introduce Lemoni Biskoti, Raspberry Chokolata, and Sea Salt Caramel Truffle. While containing more fat and calories than other Greek frozen yogurt products, they offer more protein than traditional frozen yogurt and ice cream. It is up to consumers how healthy or indulgent they want to be.

--- PAGE BREAK ---

We All Scream For Ice Cream

The frozen yogurt segment has grown over the last few years, but when it comes to an indulgent dessert, most consumers turn to ice cream. According to Mintel, ice cream dominates the category with 53.4% of sales, followed by frozen novelties with 40% (Figure 2). However, the category has suffered from a dip in sales due to the economic downturn, an expanding array of snacks offered throughout the retail store, a lack of product innovation, and the popularity of frozen yogurt. While vanilla and chocolate are expected to remain the most popular flavors, ice cream companies know that to differentiate themselves, they have to produce new and exciting flavors.

Creating crave-ability. One approach to attracting consumers’ attention in an overwhelming sea of frozen dessert choices is to launch limited edition flavors. As Lee explained, “You’re trying to create crave-ability with these limited edition flavors. So even if something is not on sale, I will buy that red velvet cake limited edition flavor because I want it so much.” Ice cream makers have certainly tapped into this trend; consumers are likely to see a selection of limited edition products in their freezer section throughout the year. Probably the easiest point of entry for a processor is to introduce a limited edition flavor that ties in with major holidays.

For example, in November 2013, Blue Bell Creameries announced that it would be releasing its Holiday Favorites line of ice cream, which included Fudge Divinity, Christmas Cookies, Peppermint, and Spiced Pumpkin Pecan. Marketers create buzz surrounding these limited edition flavors by promoting their uniqueness and their limited production time. Sometimes, as is the case for Blue Bell’s Fudge Divinity flavor, companies use limited editions to reintroduce a popular flavor from the past. “We first produced this flavor [Fudge Divinity] in 1975, but retired it a few years later,” said Paul Kruse, Blue Bell CEO and President. “We brought it back a few more times over the years, but it has not been sold in stores since 2000.” With offerings such as this, consumers are urged to buy the product while it lasts, creating that sense of urgency and crave-ability.

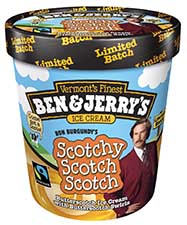

Manufacturers are also having success by introducing limited edition flavors that tie into popular culture through movies, books, television shows, and the like. In October 2013, Ben & Jerry’s announced the introduction of its limited edition Scotchy Scotch Scotch flavor, which was tied to the December release of the movie Anchorman 2: The Legend Continues. The butterscotch ice cream with ribbons of butterscotch swirl played on the movie’s main character’s penchant for all things scotch.

Manufacturers are also having success by introducing limited edition flavors that tie into popular culture through movies, books, television shows, and the like. In October 2013, Ben & Jerry’s announced the introduction of its limited edition Scotchy Scotch Scotch flavor, which was tied to the December release of the movie Anchorman 2: The Legend Continues. The butterscotch ice cream with ribbons of butterscotch swirl played on the movie’s main character’s penchant for all things scotch.

Culinary inspired. In addition to limited edition flavors, ice cream producers can attract consumers’ attention by looking to the culinary world for inspiration. Consumers have a greater interest in food than they did 10 years ago thanks to the popularity of the Food Network and social media sites such as Pinterest. Playing off the notion that chefs are now celebrity figures, Blue Bunny brand ice cream partnered with television personality, celebrity cake baker, and owner of Charm City Cakes, Duff Goldman, in 2011 to create a chef-inspired line of ice cream. The products contain ice cream combined with cake pieces and have included flavors such as Red Carpet Red Velvet Cake, Chocolate Lovers Triple Chocolate Cake, I Do! I Do! Wedding Cake, and Strawberries are Forever Shortcake.

“They are portraying to the customer that we have a chef that’s creating these flavors for you so you can have a dessert experience rather than just a dish of ice cream,” explained Cary Frye, Vice President of Regulatory Affairs for the International Dairy Foods Association.

--- PAGE BREAK ---

In addition to highlighting consumers’ love for chefs, the Blue Bunny product line showcases another trend that is on the rise in ice cream—bringing other dessert categories into ice cream. In this case, it is cake, but other ice cream makers have showcased cookie and candy inclusions. For example, the Breyers brand brought America’s love for Girl Scout cookies to the next level by incorporating them into ice cream. Girl Scout cookies have always been popular because of their flavors but also because they are only available one time a year.

In addition to highlighting consumers’ love for chefs, the Blue Bunny product line showcases another trend that is on the rise in ice cream—bringing other dessert categories into ice cream. In this case, it is cake, but other ice cream makers have showcased cookie and candy inclusions. For example, the Breyers brand brought America’s love for Girl Scout cookies to the next level by incorporating them into ice cream. Girl Scout cookies have always been popular because of their flavors but also because they are only available one time a year.

Offering consumers the chance to extend their Girl Scout cookie addiction, Breyers debuted two flavors within its Blasts! line of ice cream in 2013: Girl Scout Cookies Thin Mints and Girl Scout Cookies Samoas. The Breyers Blasts! line also features partnerships with candy and cookie brands, such as M&M’s, Snickers, Reese’s, Heath, Oreo, Mrs. Fields, and Chips Ahoy. This is an attempt to take back some of the dessert sales that other categories, such as cookies and candy, have taken away from the ice cream/frozen novelties category.

Ice cream companies should also use consumers’ love of all things culinary and introduce flavors that may previously have been seen only in high-end restaurants. Ethnic flavors are very popular on restaurant menus, and there are examples of ice cream producers launching products aimed at fulfilling that consumer need. Wells Enterprises has developed four Hispanic-inspired flavors for its Blue Bunny ice cream brand, which are expected to hit the freezer case in March 2014. They are Coconut Mango Swirl (coconut ice cream with mango swirl); Cuatro Leches (vanilla ice cream with tres leches cake pieces and swirls of dulce de leche); Flan (flan-flavored ice cream with swirls of caramelized sugar); and Hot Chocolate con Churros (cinnamon-spiced chocolate ice cream with cinnamon sugar churro pieces). Blue Bunny is the first brand to introduce a platform of Hispanic-inspired ice cream flavors. However, given that Hispanic foods are one of the most dominant ethnic flavors in the United States, there may soon be more appearing in the freezer case.

There are other examples of ethnic-flavored ice cream introductions, but they are often from smaller players. For example, Bhakti Chai introduced an Indian-inspired flavor with its Chip ice cream with cardamom, ginger, and chocolate in July 2013. In September 2013, Mikawaya USA, the creator of Mochi ice cream, debuted its Exottics ice cream line inspired by Asian cuisine and fruits. Among the 14 flavors are Black Sesame, Ginger, Green Tea Matcha, Lychee, Plum Wine, Red Bean, and Taro. Small players may have the advantage in addressing consumers’ interest in ethnic flavors because they are nimble enough to try something new and get it into stores quickly, while not having to produce the amount that would be required of large companies such as Nestlé and Unilever.

There are other examples of ethnic-flavored ice cream introductions, but they are often from smaller players. For example, Bhakti Chai introduced an Indian-inspired flavor with its Chip ice cream with cardamom, ginger, and chocolate in July 2013. In September 2013, Mikawaya USA, the creator of Mochi ice cream, debuted its Exottics ice cream line inspired by Asian cuisine and fruits. Among the 14 flavors are Black Sesame, Ginger, Green Tea Matcha, Lychee, Plum Wine, Red Bean, and Taro. Small players may have the advantage in addressing consumers’ interest in ethnic flavors because they are nimble enough to try something new and get it into stores quickly, while not having to produce the amount that would be required of large companies such as Nestlé and Unilever.

Specialty formulations. In addition to flavors, manufacturers should look at their formulations to produce new ice cream products. In some cases, processors can use technology to advance their formulation. In 2004, Nestlé’s Dreyer’s/Edy’s brand debuted Slow Churned varieties. Using low-temperature extrusion, the company was able to significantly reduce the size of the fat globules and ice crystals in ice cream. This produced an ice cream that is lower in calories and fat, but delivers the same creamy mouthfeel of regular ice cream. In fact, the technology was so successful with consumers that today the brand’s Slow Churned products lead Nestlé’s sales in the category, second only to its Haagen-Dazs portfolio. Since its debut by Nestlé, other companies have implemented the technology and introduced their own product lines, such as Unilever’s Breyers Double Churned.

“I feel like outside of Dreyer’s slow-churn technology many years ago, there hasn’t been any blockbuster technology,” said Lee. “Nowadays, it’s more about ingredients.” This focus on ingredients can mean new flavors, as discussed previously, but it can also mean more focus on ingredients’ origins. Consumers want, more than ever before, to know where their food comes from. This is where smaller brands can distinguish themselves in the retail market.

“We can learn a lesson from artisanal cheese or micro-brewed beers … That a small player can differentiate and really show how they were crafted and made specially,” said Frye. “Using value-added packaging and simple, or sometimes complex, flavors, they can stand out as being something special.”

--- PAGE BREAK ---

An example of this is Snoqualmie Ice Cream. Founded in 1997 by Barry and Shahnaz Bettinger and located in Maltby, Wash., Snoqualmie grows some of its own ingredients and obtains the rest from local sources. In addition, the company has a fully sustainable manufacturing plant. The company has succeeded in building its sustainability efforts and local ingredients into its brand. In addition, it promotes its handcrafted process of making all of its ice cream in-house in small batches. Snoqualmie tells a story with its product. While the company’s ice cream originally was a West Coast regional product sold in foodservice locations and local grocers alike, it has grown and is now distributed to specialty retailers throughout the United States.

“We want our customers to experience the Pacific Northwest with every bite of Snoqualmie, so locally sourced ingredients are a must,” explained Barry Bettinger, Owner and CEO of Snoqualmie Ice Cream. “Sustainability is part of our mission and values, which is the backbone of our company, so it is just a part of who we are.”

“We want our customers to experience the Pacific Northwest with every bite of Snoqualmie, so locally sourced ingredients are a must,” explained Barry Bettinger, Owner and CEO of Snoqualmie Ice Cream. “Sustainability is part of our mission and values, which is the backbone of our company, so it is just a part of who we are.”

All of these factors contribute to the brand being perceived as a premium product. In addition, the company promises its ice cream is what it calls a “true pint.” This alludes to its high cream content. Premium ice cream tends to have a very low over-run (the amount of air that is whipped into the ice cream mixture), a high fat content, and quality ingredients.

Premium on the rise. As is the case with Snoqualmie Ice Cream, the popularity of premium ice cream products is growing. Premium and superpremium ice creams make up 41.4% of total dollar sales in the segment, outselling regular ice cream. The popularity has been driven by new, smaller brands emerging on the scene, but also holds true for larger companies, such as Unilever and Nestlé. According to Mintel, Ben & Jerry’s is Unilever’s second-leading brand, and while the company saw a 4.6% drop in sales in the category from 2012 to 2013, the Ben & Jerry’s brand gained 2.9% in sales. For Nestlé, the Häagen-Dazs brand represents its largest sales in the ice cream category.

When it comes to premium ice cream, indulgence is the name of the game. Consumers turn to premium because they want the ultimate decadent dessert and often are willing to pay more for it. Ben & Jerry’s is a brand that has been capitalizing on premium ice cream since it began, and it continues to introduce new indulgent flavors to meet the growing consumer desire for premium ice cream. For example, in June 2013, it launched its Truffle Trifecta ice cream. Made with marshmallow, fudge, and caramel truffles, it doesn’t get much more indulgent.

Among the premium products, there is one segment that has catapulted into popularity recently—gelato. Once limited to Italian restaurants, the popularity of gelato has grown in the United States as more foodservice operators and supermarkets begin to offer it. “Gelato really complements so many of the trends consumers are looking for in the food industry today,” said Berry. “First, authenticity—there are clean, simple, and identifiable ingredients. And gelato tends to be packaged in clear containers, allowing consumers to see the layers and actual pieces of fruit, whole nuts, or curls of dark chocolate.”

In addition, American consumers like gelato because it is denser and creamier than traditional ice cream, offering a “richer” taste experience. And yet it usually has less fat than traditional ice cream, giving consumers “permission to indulge,” as Berry calls it. Talenti was one of the first companies to have a broad distribution to the country’s freezer section. The company began as a gelateria in 2003, expanding to retailers and becoming one of the best-selling gelatos in the United States.

--- PAGE BREAK ---

Not to be left behind, in April 2013, Nestlé debuted Haagen-Dazs gelatos. Featuring a marketing campaign celebrating “la dolce vita”—the sweet life—the company highlighted the product’s Italian roots and craftsmanship. The line had seven flavors at launch, which included Limoncello, Black Cherry Amaretto, Sea Salt Caramel, and Stracciatella.

Not to be left behind, in April 2013, Nestlé debuted Haagen-Dazs gelatos. Featuring a marketing campaign celebrating “la dolce vita”—the sweet life—the company highlighted the product’s Italian roots and craftsmanship. The line had seven flavors at launch, which included Limoncello, Black Cherry Amaretto, Sea Salt Caramel, and Stracciatella.

Frozen Novelties: Not Just for Kids

As mentioned previously, the frozen novelties segment is nipping at the heels of ice cream, with 40% of category sales (Mintel, 2013). While the category—defined as separately packaged single servings of a frozen dessert that may or may not contain dairy—has traditionally been linked to kids’ products, this is no longer the case. Yes, this segment is still home to kids’ favorites, such as the iconic Popsicle, but it has become much more of an adult’s playground than in the past.

One reason for this shift is because while the ice cream category’s sales lagged during the recession, sales of frozen novelties remained strong. Consumers were looking for ways to indulge in occasional low-cost treats, without having to invest in an entire half gallon of ice cream. They also wanted to enjoy their favorite premium products but with portion control. This is why many ice cream makers starting offering single-serving cups of their popular premium ice cream brands.

Additionally, in a mature market, manufacturers look to introduce popular concepts in new formats to maintain consumer interest. As the gelato segment has become inundated with new brands, the established brands—such as Ciao Bella—needed to give consumers new ways to enjoy their products. This is why Ciao Bella introduced Gelato Squares in 2013. The line features three flavors of gelato sandwiched between wafers, offering consumers a gourmet version of the ever-popular ice cream sandwich novelty treat. Expanding into the novelties segment is also a way for marketers to promote the snackability of their products. Making an item easier to consume at different dayparts grows sales.

Additionally, in a mature market, manufacturers look to introduce popular concepts in new formats to maintain consumer interest. As the gelato segment has become inundated with new brands, the established brands—such as Ciao Bella—needed to give consumers new ways to enjoy their products. This is why Ciao Bella introduced Gelato Squares in 2013. The line features three flavors of gelato sandwiched between wafers, offering consumers a gourmet version of the ever-popular ice cream sandwich novelty treat. Expanding into the novelties segment is also a way for marketers to promote the snackability of their products. Making an item easier to consume at different dayparts grows sales.

“Consumers aren’t holding off on dessert until after dinner; instead, they’re reaching for easily accessible, handheld, and portable treats at just about any time of day,” said Darren Tristano, Executive Vice President of Technomic Inc. “Desserts are also functioning as snacks and even meal replacements. [Foodservice] operators will need to look at flavors, portion sizes, and evolving needs to satisfy a broad range of consumers’ dessert expectations and preferences.”

Challenges and Opportunities

The ice cream and frozen novelties category is no stranger to challenges. During the recession, input costs—the price of ingredients such as milk and sugar—were extremely volatile, inflating costs that were, to an extent, passed on to the customer at a time when they were already tightening their purse strings. Thankfully, while business intelligence provider IBISWorld predicts that the price of milk is expected to increase, the volatility of the price will be subtle when compared to the previous five-year period. Furthermore, a projected decline in the price of sugar in 2014 will boost manufacturers’ profit margins (2013).

While opportunities for manufacturers to offer new flavors and new formats have been discussed at length here, there are some trends on the cusp of developing that may offer future opportunities for innovation. A growing number of consumers are seeking organic and natural food products throughout the grocery store. Currently, their priority is food items they eat on a daily basis, but it is possible that the desire will extend to the ice cream/frozen novelties segment in the near future. Some companies are already differentiating themselves from the competition by positioning their products as organic. For example, Strauss Family Creamery continues to extend its line of organic ice cream. It now offers nine organic ice cream flavors, which include Cookies & Cream, Vanilla Chocolate Chip, Caramel Toffee Crunch, and Vanilla Bean. In addition to being certified organic, the company’s products are made without any gums, thickeners, additives, artificial ingredients, or coloring agents.

Another consumer trend that may offer possibilities for the ice cream/frozen novelties category is the desire for gluten-free products. “There are certainly challenges with some of the ingredients, such as bakery inclusions, but depending on the ingredients you’re selecting, ice cream could be successfully marketed as a gluten-free food,” said Frye.

Finally, there is also potential growth for dairy-free ice cream/frozen novelty products. Many consumers have chosen to eliminate dairy from their diets for health or dietary reasons. The sorbet and water ice segments haven’t been discussed here but there are opportunities to reinvigorate these segments by positioning those products as options for consumers looking for a frozen dessert without dairy. In addition, there may be formulation opportunities using almond or soy milk to replace dairy milk in ice cream or frozen yogurt products. For example, in January of this year, TCBY—the largest foodservice frozen yogurt brand—announced a partnership with the Silk brand to create Silk Vanilla Almond Fro-Yo made with almond milk to address consumers’ dietary restrictions.

Kelly Hensel is Senior Digital Editor of Food Technology magazine ([email protected]).

Kelly Hensel is Senior Digital Editor of Food Technology magazine ([email protected]).

References

Euromonitor International. 2013. Ice Cream in the U.S. December. Euromonitor International, Chicago, Ill. www.euromonitor.com.

IBISWorld. 2013. Ice Cream Production in the U.S. December. IBISWorld, New York, N.Y. www.ibisworld.com.

Mintel Group Ltd. 2012. Yogurt and Yogurt Drinks U.S. August. Mintel Group Ltd., Chicago, Ill. www.mintel.com.

Mintel Group Ltd. 2013. Ice Cream and Frozen Novelties U.S. July. Mintel Group Ltd., Chicago, Ill. www.mintel.com.