A Plant-Based Paradigm Shift for Packaged Foods

Consumers who are eating less meat on health and sustainability grounds fuel new growth in soy-, pulse-, and nut-based vegetarian prepared food offerings.

Vegetarian foods are positioned for success in the marketplace as public health advocates highlight the benefits of plant-based diets and a growing number of consumers embrace meat-free or meat-reduced lifestyles. Earlier this year, for example, the 2015 Dietary Guidelines Advisory Committee (DGAC) report included adopting a vegetarian diet among its recommended approaches to healthful eating. So it’s hardly surprising that mainstream food industry brands like Boca from Kraft Foods, Northfield, Ill., and MorningStar from Kellogg Co., Battlecreek, Mich., are expanding their offerings in order to increase market share and appeal to a greater consumer base.

In describing the DGAC report’s unprecedented vegetarian-focused advice, co-author Frank Hu, a professor of nutrition and epidemiology at the Harvard T.H. Chan School of Public Health, says, “It’s a breakthrough that would cause a paradigm shift in eating patterns with an increase in demand for healthy, plant-based packaged foods and meals in restaurants.” An expected rise in the number of people seeking to eat less animal-based food on health or sustainability grounds can also be regarded as an opportunity for manufacturers of vegetarian packaged foods, Hu said.

The DGAC report was welcome news for Nancy Chapman, registered dietitian and executive director of the Soyfoods Assoc. of North America. “The report offered suggestions on increasing plant-based foods and includes soy among the sources of plant protein throughout the document,” she says. Along with other sources of plant-based protein—such as pulses, nuts, and seeds—soy protein stands out as an ingredient with a great deal to gain from consumer trends moving toward meat-reduced and meat-free diets.

To be sure, more consumers in industrialized nations like the United States are adopting vegetarian diets than ever before. In part they’re making the switch due to health, ethical, and environmental concerns. But another reason is that the food industry’s technological developments have made an impact by offering a greater variety of vegetarian prepared foods—in the form of shelf-stable, refrigerated, and frozen products, making them more available and accessible, and also bringing about improvements in taste and texture.

“In the early stages, products that have been developed might have been lacking texture and flavor, but as technologies are evolving and new ingredients are being developed, new products have significantly improved and are more appealing to a larger base of consumers,” says Agnes Jones, savory marketing manager for Ingredion, Westchester, Ill.

Vegetarian Foods Market Size

In the United States, younger consumers are leading the way in adopting vegetarian diets. Based on SPINS survey data, Mintel estimates that some 13% of Millennials describe themselves as vegetarian (9%) or vegan (4%), which is more than any other generational demographic. In comparison, only 5% of Generation X consumers and not more than 2% of Baby Boomers and the Swing Generation consider themselves vegetarians. Of all respondents, a total of only 7% consider themselves vegetarian (5%) or vegan (2%), according to Mintel’s January 2015 The Protein Report—Meal Alternatives.

In the United States, younger consumers are leading the way in adopting vegetarian diets. Based on SPINS survey data, Mintel estimates that some 13% of Millennials describe themselves as vegetarian (9%) or vegan (4%), which is more than any other generational demographic. In comparison, only 5% of Generation X consumers and not more than 2% of Baby Boomers and the Swing Generation consider themselves vegetarians. Of all respondents, a total of only 7% consider themselves vegetarian (5%) or vegan (2%), according to Mintel’s January 2015 The Protein Report—Meal Alternatives.

Millennials are also the most frequent consumers of meat alternatives, while older consumers—who may have most to gain in terms of heart health—tend to ignore them. Mintel reports that roughly a quarter of the younger demographic are turning to the products at least a few times a week, while 90% of the Swing Generation and 75% of Baby Boomers say they never consume meat alternatives aside from eggs. The vast majority of the two groups of older consumers (69%) say they prefer real meat versus meat substitutes, although 38% and 39%, respectively, say they are likely to eat less meat for heart health. In addition, a quarter of Millennials, 24% of Generation X, and 18% of both Baby Boomers and the Swing Generation report that they’re looking for protein from sources other than meat, such as from tofu, beans, nuts, or eggs.

Rapidly changing consumer trends, however, have made forecasting the actual market growth of vegetarian foods a little tricky. Historically, unreliable trend data has made it difficult to predict just how many consumers will adopt vegetarian diets, Euromonitor reports in a 2011 briefing titled “The War On Meat: How Low-meat and No-meat Diets Are Impacting Consumer Markets.” For example, a survey by Vegetarian Times found that more than 5% of non-vegetarians say they are “definitely interested” in following a vegetarian-based diet, which suggests another 12 million U.S. consumers.

--- PAGE BREAK ---

In fact, the demand for vegetarian products could be much larger than it initially appeared, says Eric Pierce, Director of Strategy & Insights, New Hope Natural Media. “When a lot of people think of vegan they think of niche consumers—niche products for niche consumers and not much opportunity. The reality is we’re beginning to see a lot more opportunity than what might be obvious,” he told attendees at Natural Products Expo West in Anaheim, Calif., earlier this year.

Based on survey data collected by Nutrition Business Journal, Pierce estimates that a lot more U.S. consumers, as much as 26% more, fall into the categories of “flexitarians,” who prefer a more plant-based eating pattern when vegetarian foods are available, or “lessitarians,” who have reduced meat consumption within the past 12 months. Additionally, Pierce said that up to 36% of consumers are currently buying milk and meat alternative products.

Leading brands in vegetarian foods are Kellogg Co.’s MorningStar Farms, Kashi, and Gardenburger, with an estimated 64% share of the frozen meat substitutes sector, Euromonitor reports. In the United States, other key players are Hain Celestial Group’s Yves Veggie Cuisine of Boulder, Colo., Kraft’s Boca Foods, and Canadian company gardein, Richmond, British Columbia. Family-owned Amy’s Kitchen, Petaluma, Calif. (originally from the United Kingdom), has also become one of the nation’s largest manufacturers of vegetarian frozen packaged foods and is principally credited for helping to push plant-based dishes into the mainstream. The company offers more than 30 different products that include entrées, pizzas, burritos, and veggie burgers.

Leading brands in vegetarian foods are Kellogg Co.’s MorningStar Farms, Kashi, and Gardenburger, with an estimated 64% share of the frozen meat substitutes sector, Euromonitor reports. In the United States, other key players are Hain Celestial Group’s Yves Veggie Cuisine of Boulder, Colo., Kraft’s Boca Foods, and Canadian company gardein, Richmond, British Columbia. Family-owned Amy’s Kitchen, Petaluma, Calif. (originally from the United Kingdom), has also become one of the nation’s largest manufacturers of vegetarian frozen packaged foods and is principally credited for helping to push plant-based dishes into the mainstream. The company offers more than 30 different products that include entrées, pizzas, burritos, and veggie burgers.

But consumers don’t appear to have decided on any brand preference when it comes to vegetarian packaged food products. Mintel reports that fewer than 3% of consumers report having tried Boca Foods’ products and of those that did, 2.8% say they would describe the company as the category’s leading brand. In addition, Gardenburger, Amy’s Kitchen, and MorningStar Farms all had similar consumer penetration of 2.8%, while Lightlife, Turners Falls, Mass. (2.2%), Yves (2.2%), and WhiteWave Foods, Broomfield, Colo. (2%), followed close behind. With brands having such low consumer penetration, the market segment finds itself open to companies positioning themselves for fierce competition to obtain a loyal consumer base in the next few years.

Soy Solutions

Soy Solutions

A lot of the leading brands capitalize on soy as their tried-and-true source of plant-based protein. The Boca brand, which is best known for its veggie patties, just launched its new Boca Essentials line of meatless patties that boast a complete protein profile formulated with a mix of soy protein, vegetables, and whole grains. The varieties include Breakfast Scramble with potatoes, scrambled eggs, and vegetables; Roasted Vegetables and Red Quinoa with brown rice; and Chile Relleno with green chile peppers, black beans, and brown rice. Gardein also uses soy protein concentrate in several of its products, including Chipotle Black Bean Burgers, Meatless Meatballs, and Fishless Filets. In addition, the company just launched its new Crabless Cakes and Sweet & Sour Porkless Bites at Expo West. “Gardein’s new mini Crabless Cakes and Sweet & Sour Porkless Bites are a delicious and convenient way to have protein from plants at the center of your dinner plate,” says Yves Potvin, gardein’s founder.

Other products include MorningStar’s Buffalo Chik Patties, Roasted Garlic and Quinoa Burgers, and Mediterranean Chickpea Burgers that use organic soy protein flour or textured soy protein as part of their base of ingredients. The Tofurky Company, Hood River, Ore., also uses textured soy protein as a base for its Tofurky Deli Slices, tofu for Tofrick’n Chick’n products, and tempeh in its Traditional Tempeh and Organic Five Grain Tempeh products. In addition, Nate’s Meatless, San Francisco, offers a line of meatless meatballs, including Zesty Italian and Savory Mushroom, that also use textured soy protein.

“There are many new and wonderfully flavored soy-based chicken nuggets, fishless fillets, veggie burgers, and deli options in the produce, deli, or frozen sections of the grocery store,” Chapman says. She also suggests that more food manufacturers look to add soy when capitalizing on the consumer trend toward preferring products higher in protein for satiety and weight loss. Examples include combining tofu with whole grain noodles for frozen meals, soy protein in cereals, and edamame with frozen vegetables. Tempeh is another traditional soy food that is growing in popularity and can be sautéed and combined in an Asian, Mediterranean, or Italian meal in frozen or ready-to-eat form. Soy chorizo is also popular, Chapman says, as an option for those who enjoy Latin American cuisine but seek options that are lower in saturated fat.

“There are many new and wonderfully flavored soy-based chicken nuggets, fishless fillets, veggie burgers, and deli options in the produce, deli, or frozen sections of the grocery store,” Chapman says. She also suggests that more food manufacturers look to add soy when capitalizing on the consumer trend toward preferring products higher in protein for satiety and weight loss. Examples include combining tofu with whole grain noodles for frozen meals, soy protein in cereals, and edamame with frozen vegetables. Tempeh is another traditional soy food that is growing in popularity and can be sautéed and combined in an Asian, Mediterranean, or Italian meal in frozen or ready-to-eat form. Soy chorizo is also popular, Chapman says, as an option for those who enjoy Latin American cuisine but seek options that are lower in saturated fat.

--- PAGE BREAK ---

Nonallergenic Protein Ingredients

While vegetarian consumers have historically been limited to soy and wheat for protein in most meat-free products, the rising allergen-free trend has sparked technological developments that include the use of a greater variety of plant-based protein sources such as pulses, beans, ancient grains, and nuts.

Ingredion recently announced that it has entered into an agreement with Alliance Grain Traders (AGT), Regina, Saskatchewan, Canada, to distribute its pulse flours, protein, and bran ingredients. Pulses include peas, lentils, chickpeas, and faba beans and are thought to be more sustainable, Jones says. The crops have less need for nitrogen fertilizer and need significantly less water when compared to other sources of protein. They use only about half the amount of nonrenewable energy relative to crops like wheat.

The company also has a culinology team available to facilitate fast-tracking innovation of food concepts. “The goal here is to make sure that meat alternative products are close in look and taste to real meat,” Jones says.

Ancient grains offerings like flax and chia in forms ranging from protein crisps to powders are offered by Glanbia Nutritionals, Fitchburg, Wis. The ingredients can be incorporated into everything from beverages, bars, baked goods, to a variety of gluten-free foods. HarvestPro crisps offer protein in levels ranging from 50% to 60% and come either as a combination of quinoa, chia, and sorghum; chia and amaranth; or organic quinoa flax varieties. HarvestPro Chia 30 is chia protein concentrate containing 30% protein, while HarvestPro Flax 35 contains 35% protein and 32% fiber. The new introductions allow food manufacturers to take advantage of incorporating ancient grains while still maintaining a valuable gluten-free, all-natural, and GMO-free positioning, says Linda Wilson, the company’s director of business development.

A company with a reputation for being a little “nutty” is OneTeam Humanity Foods, Newport Beach, Calif. The company’s line of Carla Lee’s NutBurgers, NutBalls, NutYummms, and NutTacos appear to live up to their claim of “Nuttin but goodness” with a healthier nutritional profile. The base ingredients for these products are a mixture of cashews, sunflower seeds, brown rice, organic carrot juice (for coloring), coconut, and spices. Rosalie Cebreros, director of sales and marketing, reports that Carla Lee’s is growing its portfolio with a forthcoming launch of NutQuitos, a nut-based version of taquitos.

A company with a reputation for being a little “nutty” is OneTeam Humanity Foods, Newport Beach, Calif. The company’s line of Carla Lee’s NutBurgers, NutBalls, NutYummms, and NutTacos appear to live up to their claim of “Nuttin but goodness” with a healthier nutritional profile. The base ingredients for these products are a mixture of cashews, sunflower seeds, brown rice, organic carrot juice (for coloring), coconut, and spices. Rosalie Cebreros, director of sales and marketing, reports that Carla Lee’s is growing its portfolio with a forthcoming launch of NutQuitos, a nut-based version of taquitos.

Trend Drivers: Health, Vegan, Ethnic Flavors

Health rules as the main reason why people switch to plant-based eating. More than a third (34%) of consumers say they eat less meat out of concern for heart health, with less than a quarter saying they limit meat to lose weight, Mintel reports. Additionally, about 22% report that they would consider eating less meat if it meant saving money on their total grocery expenses.

Newly launched product label claims are still centered around “vegan” and “no animal ingredients” as would be expected. These have topped the list of most popular claims on vegetarian foods for a while, growing from just over half (51%) for 2010 launches to more than three-quarters (81%) for 2014 launches, according to Mintel. Allergen positioning has also now gained a greater foothold. It was highlighted on more than one in 10 vegetarian product launches (12%) in 2011, and by 2014, that total had reached almost two-thirds (65%).

Newly launched product label claims are still centered around “vegan” and “no animal ingredients” as would be expected. These have topped the list of most popular claims on vegetarian foods for a while, growing from just over half (51%) for 2010 launches to more than three-quarters (81%) for 2014 launches, according to Mintel. Allergen positioning has also now gained a greater foothold. It was highlighted on more than one in 10 vegetarian product launches (12%) in 2011, and by 2014, that total had reached almost two-thirds (65%).

Some manufacturers, however, are now steering clear of putting the vegan label on the front of their packages in order to appeal to a broader base of consumers, according to Carlotta Mast, executive director of content and insights at New Hope Media. Examples are San Francisco–based Hampton Creek’s Just Mayo and Los Angeles–based Beyond Meat’s products such as Beef-Free Crumbles. Vegan may sound a little too militant to some consumers, she says. “What we’ve seen observationally is that many of the products that are launched or exhibited at Expo West are definitely vegan or vegetarian, with no obvious meat-based ingredients, but you don’t necessarily see them positioned [as] vegan or vegetarian,” she says.

In 2014, Mast reports, about a third of product launches at Expo West were vegetarian products. These included everything from a variety of veggie burgers to frozen entrees to coconut milk ice cream launched by Amy’s Kitchen to vegan cashew gelato from Vixen Kitchen, Garberville, Calif., and dairy-free cheeses from Treeline, Kingston, N.Y. Trends appear to be headed toward more simple, clean label packaged products with less “chemically sounding” ingredient lists, Mast says.

There was also a notable rise in products with ingredients such as pea protein, rice protein, almond, coconut, and quinoa, as food companies attempt to reach out to those who avoid both gluten and soy and are embracing either vegan or paleo diet regimens. “We call this the ‘pegan’ trend, the blending of paleo and vegan,” Mast says. This year coconut was the superstar in several products, including a chocolate mousse made with coconut milk from Zaza, Boulder, Colo.

The food tribe cultures, vegan and paleo, have stirred up a “good bit of social buzz,” according to Pierce, and it has been part of what’s fueled growth of the vegetarian foods category. Consumers are also attracted to “mission-based brands” with millennial values such as engaging in ethical causes and environmental concerns, he said.

--- PAGE BREAK ---

Globally inspired flavor profiles are also becoming more the norm as they appeal not just to vegans and vegetarians, but also to the flexitarians and lessitarians. “There were a lot of new frozen offerings with interesting takes on ethnic foods, such as Indian, Middle Eastern, and Mediterranean this year,” Mast says. In addition, foods from the Philippines, Burma, and other parts of Asia were also well represented.

Globally inspired flavor profiles are also becoming more the norm as they appeal not just to vegans and vegetarians, but also to the flexitarians and lessitarians. “There were a lot of new frozen offerings with interesting takes on ethnic foods, such as Indian, Middle Eastern, and Mediterranean this year,” Mast says. In addition, foods from the Philippines, Burma, and other parts of Asia were also well represented.

Counting on the growing popularity of Mediterranean-based vegetarian fare is Dominex Natural Foods, of Omaha, Neb. Known for its Eggplant Cutlets, Veggie Angel Fries, and Veggie Angel Meatballs, Dominex’s current bestseller is Angel Bowls Mediterranean Eggplant Parmesan, says Tammy Ross, the company’s director of marketing. The Angel Bowls line also includes Corkscrew Pasta & Creamy Tomato Vodka Sauce, Penne Pasta in Parma Rosa Sauce, and Vegetable Bruschetta & Mozzarella, all featuring diced battered or breaded eggplant, and a just launched new flavor, Roasted Vegetable & Goat Cheese Gratin with roasted potatoes, red bell peppers, and eggplant.

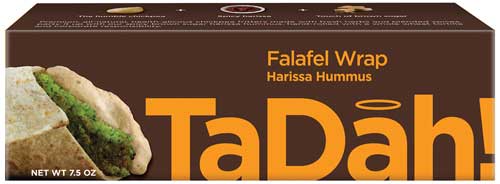

Among the other favorites at Expo West were traditional-style falafel wraps from TaDah Foods, Fairfax, Va., available in varieties like Harissa Hummus, Sweet and Spicy Harissa, Feta Salsa, and Lemony Roasted Garlic Hummus. “The response from consumers has been overwhelming. Consumers were telling us ‘you can only have a bean and cheese burrito so many times a week,’” says John Sorial, company founder. “The pent-up demand for innovative, great-tasting vegetarian foods is staggering. We’re happy to be one company fulfilling that demand.”

Among the other favorites at Expo West were traditional-style falafel wraps from TaDah Foods, Fairfax, Va., available in varieties like Harissa Hummus, Sweet and Spicy Harissa, Feta Salsa, and Lemony Roasted Garlic Hummus. “The response from consumers has been overwhelming. Consumers were telling us ‘you can only have a bean and cheese burrito so many times a week,’” says John Sorial, company founder. “The pent-up demand for innovative, great-tasting vegetarian foods is staggering. We’re happy to be one company fulfilling that demand.”

Veggies Seek Stardom on Menus

Uniquely prepared vegetables are taking a starring role on some restaurant menus, declared Chef Gerry Ludwig, corporate consulting chef with Gordon Food Service, Grand Rapids, Mich., during a presentation at the Research Chefs Association’s Annual Conference and Culinology Expo in New Orleans in March.

As these vegetables move to the center of the plate, they are receiving preparation methods that have been traditionally reserved for meat, such as searing, charring, grilling, and smoking, said Ludwig. Some restaurants are even poaching their vegetables in meat broth or adding small amounts of meat protein. These techniques enhance flavor and add “meaty” notes to the dishes.

Ludwig referred to this culinary trend as “veg-centric” and noted that some of the offerings are not meatless.

Who are leaders in this culinary movement? Los Angeles and New York City are home to several restaurants elevating vegetables on their menus, said Ludwig. For example, the Ladies Gunboat Society in Los Angeles serves such veg-centric dishes as warm beets with horseradish, endive, walnut, and tarragon; roasted sunchokes with shaved pecorino, chimichurri, and sunchoke puree; and white grits with black Perigord truffle, poached egg trumpet and Maitake mushrooms, broccolini, and Parmesan.

At the Chalk Point Kitchen in New York City, diners can order cauliflower steak with tahini, golden raisins, and pickle Thai chilies; roasted heirloom carrots with feta, black truffle, and lemon; and grilled watermelon with sweet chili, feta, Thai basil, and lime. Chalk Point Kitchen’s menu features 18 specialty vegetable dishes that are positioned as “Vegetables to Share.”

David Despain, a member of IFT, is a freelance writer and nutritionist based in Gilbert, Ariz. ([email protected]).