Gluten-Free Without the Sacrifice

More consumers are encouraged by medical conditions or lifestyle choices to eliminate gluten from their diet. Formulators are responding by turning to a plethora of ingredients to produce tasty gluten-free items throughout the supermarket.

As you shop and navigate the supermarket aisles, it isn’t uncommon to see products labeled “gluten-free” or stamped with the GF logo, which signifies the product has been certified gluten-free by the Gluten Intolerance Group. The term seems to be everywhere, and Americans are taking note; a survey of 1,012 consumers by NSF International shows that 90% have heard of gluten. However, only 35% could correctly identify gluten as a protein found in wheat, barley, and rye (2015). But this lack of knowledge doesn’t seem to be stopping consumers from buying up gluten-free foods and beverages at an increasing rate.

According to Mintel, the U.S. gluten-free food market reached sales of $8.8 billion in 2014—an increase of 63% from 2012 (2014). However, the size of the gluten-free market differs dramatically depending on how you define it. “There are products that are really gluten-free alternatives of products that normally include gluten and others that have a gluten-free claim on them as an aid to help shoppers identify any product that is gluten-free,” explained Lu Ann Williams, director of innovation for Innova Market Insights. “In terms of the size of the gluten-free market, if you look at products that are true gluten-free alternatives, the market is $1.5 billion. If you consider any product that has a gluten-free claim, you could increase that by several multiples.”

What Is Gluten?

As demonstrated by a popular segment on the late-night show Jimmy Kimmel Live, in which people on the street of Los Angeles were asked to define gluten, most people don’t know what it is or what foods it is found in. Some people in the video incorrectly guessed that gluten is wheat. NSF International’s survey confirmed this misconception: 26% believe that wheat-free products are also gluten-free and 15% believe that gluten is wheat (2015).

According to an article in Comprehensive Reviews in Food Science and Food Safety, gluten “defines a very diverse and complex group of two water-insoluble wheat proteins: gliadin and glutenin.” Gliadins are prolamin proteins and provide viscosity to dough, while glutenins are polymeric proteins that give dough its elasticity and strength. Similar proteins can be found in barley and rye and are termed hordein and secalin, respectively (2015). Gluten is also found in related grains such as spelt, kamut, emmer, and faro. While gluten is best known for giving baked goods their doughy, elastic structure, many foods contain gluten for other purposes, such as a thickening agent or flavor enhancer (see Hidden Sources of Gluten sidebar).

Reasons for Going Gluten-Free

While the number of people gravitating toward a gluten-free diet by choice is on the rise, many individuals have to eliminate gluten for specific medical reasons. For those with celiac disease—about 1% of the U.S. population—eating gluten prompts an autoimmune response directed at their small intestine. The result is inflammation and injury to the villi that line the small intestine, thus affecting nutrient absorption and leading to a multitude of symptoms. Diagnosis of celiac involves a screening for anti-gluten antibodies in the blood, most likely followed by a biopsy of the small intestine to identify any inflammation or damage.

Non-celiac gluten sensitivity (NCGS) is the diagnosis given to people who experience symptoms when eating gluten, but have tested negative for celiac disease and/or a wheat allergy. They account for around 6% of the U.S. population—or approximately 18 million people. As the International Food Information Council (IFIC) explains in its gluten-free diet fact sheet, “while the symptoms overlap with celiac disease, the body does not create antibodies to gluten nor are the intestines damaged.” In these cases, a gluten-free diet may reduce symptoms but it is unknown if there are long-term health risks to ingesting small amounts of gluten (2014).

Finally, there is about 0.1% of the U.S. population that suffers from a wheat allergy and experiences a severe allergic reaction if they ingest wheat. While this group can technically eat gluten in non-wheat products, it is often recommended that they avoid all gluten in order to reduce their risk of ingesting wheat through cross contact/contamination.

Although the number of Americans with medical reasons to avoid gluten adds up to just over 7% of the population, about 20% of consumers are taking active steps to avoid/reduce gluten in their diet (Hartman Group 2015). This is a four point increase from 2013. So why is a much larger group of the population choosing to eliminate something that studies have shown causes no adverse effects to those who aren’t celiac, NCGS, or allergic to wheat? “There’s a lot of people that read into the gluten-free claim and think that it may help in other areas—maybe digestion or weight loss,” said Tom Vierhile, innovation insights director, Datamonitor Consumer.

--- PAGE BREAK ---

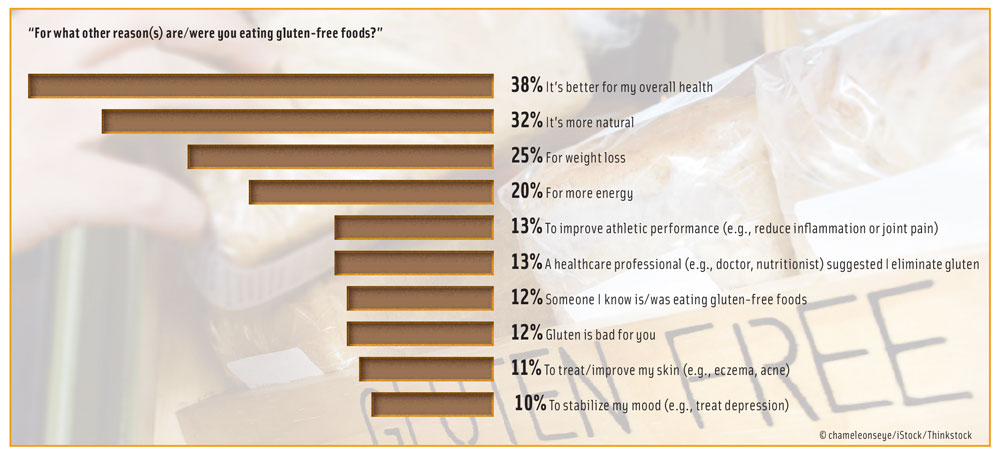

According to Mintel, nearly two in five of those who eat gluten-free foods (38%) do so because they believe it’s better for their overall health, and 25% eat them for weight loss reasons (2015; Figure 1). “We see a lot of overlap with clean label and ‘free from’ now,” said Innova’s Williams. “There are many lifestyle consumers that are looking for products that they think are healthier; this includes gluten-free products.”

In fact, gluten-free food and beverages may not be as healthful as their gluten-containing alternatives, because gluten-free products are often made with white rice flour and starches that may not be enriched. Also, they can contain more fat and sugar to make up for the taste and texture that is missing. Gluten-free products can be lower in fiber, iron, and B vitamins. However, formulators are making great strides in increasing the healthfulness of gluten-free products.

In fact, gluten-free food and beverages may not be as healthful as their gluten-containing alternatives, because gluten-free products are often made with white rice flour and starches that may not be enriched. Also, they can contain more fat and sugar to make up for the taste and texture that is missing. Gluten-free products can be lower in fiber, iron, and B vitamins. However, formulators are making great strides in increasing the healthfulness of gluten-free products.

Deluge of New Products

As consumer demand surges, food and beverage companies are scrambling to launch new products or reformulate existing ones to capture a piece of the market. According to Innova Market Insights, 9% of total global food and drink launches in 2014 contained a gluten-free claim, compared to just 5% in 2010. North America and Latin America lead the pack with 19.7% and 19.8%, respectively, of new products launched in 2014 containing the gluten-free claim (2015). Food companies are putting the gluten-free claim on both products that they have reformulated to take out gluten (such as cakes, breads, cereal, etc.) and the products that may be naturally gluten-free. The increase in new products with the gluten-free claim is partly due to improved labeling restrictions (see FDA Defines Gluten-Free Labeling sidebar).

“When you look at the top categories in the United States in terms of penetration of gluten-free claims, in the past three years bakery doesn’t come up at all,” said Williams. Instead, cereals (including bars) and spreads account for nearly a third of all new products with a gluten-free claim, followed by dairy (12.7%), snacks (11.8%), and meat, fish, and eggs (11.1%) (Innova 2015).

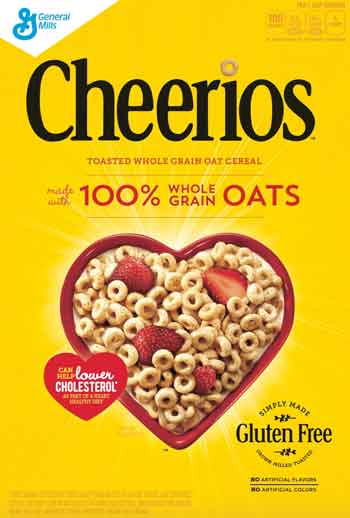

Among the numerous launches in the cereal catalog, General Mills debuted five gluten-free varieties of Cheerios this September (Apple Cinnamon, Frosted, Original, Honey Nut, Multi Grain). The first ingredient in Cheerios is whole grain oats, and while oats are naturally gluten-free, the problem is contamination—when small amounts of wheat, rye, and barley are inadvertently introduced at the farm or during transportation. The company spent three years constructing a new multifloor facility dedicated to oat separation and updating its cereal plants by installing new walls and implementing new cleaning procedures.

Among the numerous launches in the cereal catalog, General Mills debuted five gluten-free varieties of Cheerios this September (Apple Cinnamon, Frosted, Original, Honey Nut, Multi Grain). The first ingredient in Cheerios is whole grain oats, and while oats are naturally gluten-free, the problem is contamination—when small amounts of wheat, rye, and barley are inadvertently introduced at the farm or during transportation. The company spent three years constructing a new multifloor facility dedicated to oat separation and updating its cereal plants by installing new walls and implementing new cleaning procedures.

Larger manufacturers, like General Mills, certainly have the money to invest in going gluten-free. However, smaller companies may be more nimble and therefore able to launch new products to market more quickly. According to Mintel, the gluten-free food category is made up of many smaller brands; 58% of the category is represented by brands within the “other” category of smaller brands (2014). The “big brands” shouldn’t be overlooked though. According to Innova Market Insights, the market may well be shifting away from these specialty companies to the larger players in the food industry. In 2014, 11% of gluten-free launches were attributed to big companies. This is up from 7.6% in 2010 (2015).

Companies such as Boulder Brands and Hain-Celestial Group may not have a large percentage of the total gluten-free market (at just 3% each in 2014), but because they specialize in healthful, often gluten-free brands, their credibility in the category is important to note (Mintel 2014). More than 80% of Boulder Brands’ business is made up of gluten-free products, among which is the popular brand Udi’s. What began in 2008 as a few Colorado bakery cafes selling gluten-free bread, has become the top gluten-free CPG brand in America with products that extend beyond the bakery category into frozen foods, snacks, and desserts.

“In late 2014 and 2015, we have focused on expanding our frozen offerings as it was evident that good gluten-free options with real ingredients were extremely limited,” said Laura Kuykendall, vice president/ general manager, Gluten Free, Boulder Brands. “In the past year, we have launched frozen entrees, skillet meals, breakfast and lunch burritos, and breakfast sandwiches.”

--- PAGE BREAK ---

Udi’s acquisition by Boulder Brands in 2012 helped to reinforce the brand’s No. 1 position and also broaden its distribution. However, acquisition by a larger company isn’t the only way to succeed in today’s food and beverage marketplace. Whole Foods Market, which makes a point to feature locally produced goods in its stores, also provides up to $25 million in low-interest loans to independent local farmers and food artisans. This enables smaller start-ups to get distribution in an upscale, nationwide grocery chain.

Udi’s acquisition by Boulder Brands in 2012 helped to reinforce the brand’s No. 1 position and also broaden its distribution. However, acquisition by a larger company isn’t the only way to succeed in today’s food and beverage marketplace. Whole Foods Market, which makes a point to feature locally produced goods in its stores, also provides up to $25 million in low-interest loans to independent local farmers and food artisans. This enables smaller start-ups to get distribution in an upscale, nationwide grocery chain.

That’s exactly how Feel Good Foods got its start. In 2011, Vanessa Phillips and Chef Tryg Siverson sent blind samples of their gluten-free frozen dumplings to Whole Foods Market’s Northeast regional buyer and they were accepted. Today, the company’s frozen gluten-free Asian meals, egg rolls, and dumplings can be found in more than 2,500 locations throughout the United States.

That’s exactly how Feel Good Foods got its start. In 2011, Vanessa Phillips and Chef Tryg Siverson sent blind samples of their gluten-free frozen dumplings to Whole Foods Market’s Northeast regional buyer and they were accepted. Today, the company’s frozen gluten-free Asian meals, egg rolls, and dumplings can be found in more than 2,500 locations throughout the United States.

The snacks market is also seeing a relatively high proportion of launches with gluten-free claims. “Five of the top 10 categories with gluten-free claims are snacks,” said Datamonitor’s Vierhile. “If you look at all the categories for a period of January 2015 to August 2015, almost 30% of products with a gluten-free claim were snacks.”

Just as in the other segments, gluten-free snack products are being launched by both small start-ups and established food giants. For instance, the Gluten Free Bar (GFB) debuted in 2010 by two brothers with celiac disease who wanted a better-for-you gluten-free snack bar that was also delicious. Now, the company has its own 7,000-square-foot gluten-free facility and earlier this year extended its brand with Gluten Free Bites—bite-sized version of its nut, protein, and dried fruit bars in a range of indulgent flavors. On the other side of the spectrum, in 2012, PepsiCo’s Frito-Lay launched a multi-year initiative to validate many of its products—including Lay’s potato chips, Cheetos, and Fritos—as gluten-free.

Just as in the other segments, gluten-free snack products are being launched by both small start-ups and established food giants. For instance, the Gluten Free Bar (GFB) debuted in 2010 by two brothers with celiac disease who wanted a better-for-you gluten-free snack bar that was also delicious. Now, the company has its own 7,000-square-foot gluten-free facility and earlier this year extended its brand with Gluten Free Bites—bite-sized version of its nut, protein, and dried fruit bars in a range of indulgent flavors. On the other side of the spectrum, in 2012, PepsiCo’s Frito-Lay launched a multi-year initiative to validate many of its products—including Lay’s potato chips, Cheetos, and Fritos—as gluten-free.

A Formulator’s Nightmare?

Ten years ago, a consumer seeking out gluten-free foods in their grocery store would have been hard pressed to find much. And the few products that did tout the attribute were probably dry, bland, and badly textured—overall, not very appetizing. Thankfully, the gluten-free foods and beverages available today have come a long way and at times are indistinguishable from their gluten-containing counterparts. Food technologists, formulators, and chefs have worked hard to “crack the code” of delicious tasting gluten-free foods over the years.

--- PAGE BREAK ---

“Gluten provides structure, strength, elasticity, and extensibility [the ability to be stretched],” said Rajen Mehta, senior director, Specialty Ingredients, Grain Millers. “You really have to think about what gluten brings to the food product you are working on in terms of those four parameters, and the non-gluten ingredients that mimic these.” As Dilek Uzunalioglu, business scientist in bakery and snack applications at Ingredion, explained in her presentation during the IFT15 session “Gluten-Free Applications,” when you take gluten out you face the following four challenges:

Processing: Gluten imparts viscosity or elasticity to batter, allowing ease of processing and machinability.

Taste, Texture, and Appearance: Gluten provides expansion, uniform cell structure, soft cohesive elastic texture, and desired crust color development. Consumers experience a grainy flavor and dry, crumbly texture.

Shelf Life: Gluten helps to manage moisture in foods, and without it they will have a shorter shelf-life and faster staling rates due to increased water mobility.

Nutritional Profile: Gluten delivers proteins, nutrients, and fiber. Additionally, high levels of sugars and fats are often used when gluten is removed to mask the texture and flavor challenges.

It is easier to remove gluten from formulations for cookies and crackers than it is for breads and pizza doughs because gluten has increased functionality in the latter products. “Bakery suffered the most because literally the texture was dependent on gluten formation in doughs and batters,” said Nicole Rees, business development manager at Glanbia Nutritionals. This may help explain why a lot of the new product launches in the gluten-free market are occurring in the cereal and snacks categories, which are easier to formulate than breads and doughs.

The good news for formulators is that there are a lot of new ingredients available to help meet these challenges. “I think there’s a lot of tools out there on the palette of the developers at the consumer product companies that allow them to make a better gluten-free product now than they could five to 10 years ago,” said Chris Spontelli, field marketing manager for North American Food Solutions, Dow Chemical.

According to Mehta, the main types of ingredients that formulators turn to include:

Grains, Flours, and Starches: Ranging from rice flour to potato starch to teff, these form the primary structure of gluten-free foods—especially baked goods.

Hydrocolloids and Proteins: Gums, such as xanthan and cellulose, act as binders to hold baked goods together. Proteins, which often include egg, soy, dairy, or pulse, are important in adding structure.

Fibers: In addition to adding nutritional value back into gluten-free formulations, fibers (low viscosity soluble, high viscosity soluble, and insoluble) can offer a great deal of texture refinement at the end of a formulation.

Fats and Emulsifiers: These help stabilize while also adding back mouthfeel.

Enzymes and Mold Inhibitors: Act as anti-staling ingredients to improve the shelf-life.

Each of the above categories can be addressed by a plethora of ingredients, each with their own unique properties to bring to a gluten-free formulation. That is why, according to Mehta, “it is very important to know the end goal from your marketing department or customer at the very beginning of the project. In normal food products, the formulas are a lot more forgiving, but in gluten-free formulations you need to know up front what the parameters are. For example, the customer may want to use certain grains, or sorghum only, or for the finished item to have a certain nutritional profile. Process modifications typically overlooked are the need for less shear, more resting time, and faster structure-forming ingredients. Similarly, fiber’s unique ability to enhance structure and texture is often not leveraged. You have to have those goals and understanding upfront and then you can efficiently design the food around them.”

Consumers are not only wanting more gluten-free food and beverage products, but they also demand better quality products. This includes better taste, but also improved nutrition. “While a lot of products still rely on tapioca starch and potato starch and rice flour—ingredients that have less fiber, protein, or nutrients than typical bakery products—there’s been an effort to really address that and use other raw materials and ingredients that are more nutritious,” said Rees. Ancient grains—such as flax, quinoa, chia, and buckwheat—is a trend that is appearing in more packaged foods and on restaurant menus and can often easily be incorporated into gluten-free items to add a healthy, nutritious, whole food image.

--- PAGE BREAK ---

Here to Stay?

So, should food companies—large and small—invest in the infrastructure, formulation time, and development costs to reformulate existing products to be gluten-free or create new gluten-free products? While more consumers believe that gluten-free diets are a fad (up from 32% in 2013 to 44% in 2014), more consumers are also eating gluten-free foods and beverages (Mintel 2014). “Manufacturers, retailers, and marketers should consider each audience’s motivations for purchasing gluten-free foods when developing new products,” advised Amanda Topper, food analyst, Mintel. “Although the percentage of consumers who agree gluten-free diets are a fad has increased in the last year, so has the percentage of consumers who are eating gluten-free foods, an indication that there is still room for the category to develop.”

Topper sees the gluten-free category continuing to grow in the near term, especially as the FDA regulations have made it easier for consumers to purchase gluten-free products and trust the manufacturers who make them. Packaged Facts projects U.S. sales of gluten-free foods in the traditionally grain-based categories (salty snacks, crackers, pasta, bread, cold cereal, cookies, baking mixes, frozen bread/dough, and flour) to reach $2.47 billion in 2019. That is a compound annual growth rate of 19.2% and total growth of 140% over the 2014–2019 period (2015). Looking at a much broader definition of the category—to include all foods making a gluten-free claim—Mintel predicts the category to reach U.S. sales of $14.2 billion in 2017.

The growth areas for the category are highest in food segments that typically contain gluten—such as breads and bakery. “I still think there is opportunity in the bread category,” said Innova’s Williams. “I’ve tasted gluten-free cakes and cookies that are good but there is room for improvement in bread. And maybe the best opportunities are in artisan, specialty breads where there is less of a reference for comparison.”

As with most things in the food and beverage industry, it all comes down to taste. As Glanbia’s Rees explained, “The people who are supporting the gluten-free growth are not people who have celiac. It is a whole other group of people, and to keep them engaged it’s really about product quality. If the continuous improvement and development is there, you will continue to have an audience. That’s where the growth comes from.”

Hidden Sources of Gluten

According to the International Food Information Council (IFIC), gluten is often found in foods and beverages that the everyday consumer might not expect. Here are some examples of common foods that may contain gluten:

• Deli meats

• Gravies, sauces, and marinades

• Seasoning blends

• Egg substitutes

• Imitation seafood and bacon bits

• Soups, stocks, broths, and bouillon

• Flavored snacks, chips, and nuts

• Licorice and confections

• Soy sauce

• Flavored grain dishes

• Meat substitutes

• Miso and tempeh

• Flavored hot chocolate, coffee, and tea mixes

• Salad dressings

• Veggie burgers and other vegetable protein products

FDA Defines Gluten-Free Labeling

In August 2013, the U.S. Food and Drug Administration (FDA) issued a final rule defining the term “gluten-free” for voluntary use in the labeling of foods. The final rule defines “gluten-free” as a food that is either inherently gluten-free, or does not contain an ingredient that is:

1. A gluten-containing grain (e.g., spelt wheat), or

2. Derived from a gluten-containing grain that has not been processed to remove gluten (e.g., wheat flour), or

3. Derived from a gluten-containing grain that has been processed to remove gluten (e.g., wheat starch), if the use of that ingredient results in the presence of 20 parts per million (ppm) or more gluten in the food. Also, any unavoidable presence of gluten in the food must be less than 20 ppm.

For more information on the rule and FAQs, visit https://federalregister.gov/a/2013-18813.

Kelly Hensel is Senior Digital Editor of Food

Technology magazine ([email protected]).

References

Hartman Group. 2015. “Gluten-Free Trend.” Infographic. Hartman Group, Bellevue, Wash. hartman-group.com.

Innova Market Insights. 2015. “Free From: Future Strong.” Infographic. Innova Market Insights, Arnhem, the Netherlands. innovadatabase.com.

International Food Information Council Foundation. 2014. “The Gluten-Free Diet: What You Need to Know.” Fact sheet, Dec. 9. International Food Information Council Foundation, Washington, DC. foodinsight.org.

Kucek, L. K., L. D. Veenstra, P. Amnuaycheewa, and M. E. Sorrells. 2015. “A Grounded Guide to Gluten: How Modern Genotypes and Processing Impact Wheat Sensitivity.” Compr. Rev. Food Sci. F. 14(3): 285–302: doi: 10.1111/1541-4337.12129.

Mehta, R. 2015. “Leveraging Fiber and Other Ingredients in Gluten-Free Formulations.” Presented at IFT15, Institute of Food Technologists, Chicago, July 11–14.

Mintel Group Ltd. 2014. Gluten-Free Foods – U.S. September. Mintel Group Ltd., Chicago, Ill. mintel.com.

NSF International. 2015. “NSF International Survey Finds U.S. Consumers Struggle toDefine and Identify Gluten.” Press release, Aug. 24. NSF International, Ann Arbor, Mich. nsf.org.

Packaged Facts. 2015. Gluten-Free Foods in the U.S., 5th Edition. January. Packaged Facts, Rockville, Md. packagedfacts.com.

Uzunalioglu, D. 2015. “Starches and Flours Used as Bulk Flours and Texturizers in Gluten-Free Formulations.” Presented at IFT15, Institute of Food Technologists, Chicago, July 11–14.