Boom Times for Breakfast

Consumers want it all: portability, high protein, and great taste. By delivering that and more, food companies are boosting sales in several breakfast food categories.

She microwaves a breakfast burrito while she blow-dries her hair, then grabs it and a bottle of kefir and dashes to her car. Her husband, who has a longer commute, is already eating a protein bar on the train.

For many families, the weekday morning rush allows little time for breakfast, so portable convenience foods are flourishing. But consumers increasingly expect these products to be intriguing, nutrient-packed, and delicious, says Kara Nielsen, culinary director of Sterling-Rice Group, Boulder, Colo. At the same time, many Americans are eating traditional breakfast fare later in the day, snacking on cereal and having pancakes or scrambled eggs and bacon for dinner. “It’s the Millennial attitude of ‘I can do whatever I want whenever I want,’” Nielsen explains. McDonald’s much-advertised, extremely popular rollout of all-day breakfast in October 2015 both reflects and fuels this trend.

In fact, McDonald’s CEO Steve Easterbrook attributes the fast-food giant’s 5.7% jump in U.S. same-store sales for fourth quarter 2015 largely to the launch of the all-day breakfast menu (La Monica 2016). Fast-food breakfast was also the top food news story of 2015, according to an annual survey of more than 1,000 people by Hunter Public Relations (Wohl 2015a). “Breakfast is still the fastest-growing foodservice daypart and accelerating,” NPD Group restaurant industry analyst Bonnie Riggs said in a statement in December (NPD Group 2015).

Americans everywhere are talking about breakfast, once considered a somewhat humdrum meal category. The surge in interest prompted Instantly, a Los Angeles-based market research firm, to poll 10,000 people about their breakfast habits last June. “One of the things we found is that 28% of consumers usually eat breakfast away from home,” says Instantly content strategist Jared Smith. “Ten years ago, that figure was 11%, according to a survey published at the time. We think this is indicative of our busier lifestyle today. People are not necessarily working in a 9-to-5 model anymore, and they need flexibility with their daily activities in order to integrate them into their work schedule.” Instantly’s study indicates that 63% of consumers might grab something from home when eating on the go while 45% would go to a drive-through restaurant and 31% would stop at a convenience store or gas station (Instantly 2015).

There has been a lot of buzz over breakfast in consumer packaged goods (CPG) as well as foodservice, says Susan Viamari, vice-president of thought leadership for Chicago-based IRI. “When you look at breakfast solutions as a percentage of total CPG dollar sales, they account for about 12.5%,” she says. “But in terms of the most powerful new product launches, breakfast solutions are 37%.”

Indeed, breakfast products constitute the three fastest-growing categories in the grocery sector, according to Nielsen’s “Tops of 2015: U.S. Grocery” data. Ranked No. 1, shelf-stable convenient breakfast items posted gains of 40.5% over the previous year, followed by frozen egg substitute products at 25%, and eggs at 22.4% (Nielsen 2015).

“Egg sales are the highest they’ve ever been, growing by $1.3 billion to $6.9 billion in 2015,” notes Kevin Burkum, senior vice president of the American Egg Board. “Rising egg prices due to avian influenza impacting supply played a role in that growth. But it’s important to note that unit sales [dozens] of eggs also went up that year, proving that consumers are willing to pay more for them. Clearly, eggs are on trend, with consumers’ growing interest in protein, especially at breakfast. Eggs are an all-natural nutritional powerhouse, with nothing artificial, which is increasingly important to Americans.”

Handhelds Prevail in Frozen Realm

Approximately 80% of consumers eat frozen breakfast foods, with 25% eating these foods as a snack and 25% eating them on the go, according to a report on this category issued by Mintel in July 2015 (Mintel 2015a). Second only to cold cereal, frozen breakfast items draw a larger percentage of American consumers than hot cereal, nutritional bars, yogurt, and bagels. (See table on this page.)

A $3.1 billion market, frozen breakfast entrées grew 2.7% in 2015 over the prior year, notes IRI’s Viamari, citing data that has not yet been published. In contrast, the entrée subset of frozen breakfast handhelds, a $1.6 billion market, increased by 4.6% over 2014. “The frozen handheld segment is growing very well,” she says. “This is a trend that has been gaining momentum for several years now because of on-the-go eating. People are taking these items from the home, whether to eat in the car or at work or school.”

Dividing the frozen domain somewhat differently than IRI, Mintel considers frozen breakfast handhelds and entrées to be two separate segments. In its July 2015 report, Mintel emphasized that handhelds, then 36% of the frozen breakfast market, were the only segment to experience year-over-year retail sales growth. “Other category segments, including frozen breakfast entrées, waffles, and other frozen breakfast goods, have struggled to grow as a result of consumer concerns about the healthfulness and ingredients of these products,” the report stated.

Although good sources of protein, frozen breakfast sandwiches have been criticized by Consumer Reports for having high sodium and fat content (Consumer Reports 2014). Glendale, Calif.–based Nestlé USA, for one, has responded to health concerns by vowing in June 2015 to remove artificial ingredients from its Hot Pockets and Lean Pockets, as well as its pizza lines, and to reduce sodium in these products by 10% in comparison to 2013 levels (Wohl 2015b).

Although good sources of protein, frozen breakfast sandwiches have been criticized by Consumer Reports for having high sodium and fat content (Consumer Reports 2014). Glendale, Calif.–based Nestlé USA, for one, has responded to health concerns by vowing in June 2015 to remove artificial ingredients from its Hot Pockets and Lean Pockets, as well as its pizza lines, and to reduce sodium in these products by 10% in comparison to 2013 levels (Wohl 2015b).

Be that as it may, many major food companies have been seizing on the popularity of frozen handhelds with new product offerings. For example, in February 2015, Kellogg’s, Battle Creek, Mich., introduced Eggo Breakfast Sandwiches in three varieties: egg and cheese alone or with bacon or sausage. Featuring waffle-style bread and a hint of maple flavoring, these sandwiches have 9 grams of protein per serving, more than twice that of Eggo frozen waffles. Kellogg’s also added two new sandwiches to its frozen Special K Flatbread Medley line, one with egg, bacon, and cheese and the other with egg, spinach, and cheese.

Bite-size frozen breakfast products are also gaining traction, given Millennials’ penchant for snacking throughout the day and parents’ desire for fun, easy-to-prepare foods for their children. Last May, Nestlé added Hot Pockets Breakfast Bites to its more than 30-year-old frozen line. Around the same time, Chicago-based Kraft Heinz launched Bagel Bites Breakfast, which has four variations of eggs, cheese, and bacon or sausage. “Bagel Bites Breakfast [products] are primarily being consumed by kids in the morning,” says associate brand manager Seth Frischknecht, noting that each serving contains 8 to 10 grams of protein. “We know that parents want to feed their kids savory, protein-filled foods. At the same time, mornings are often so busy that breakfast needs to be convenient.”

Bite-size frozen breakfast products are also gaining traction, given Millennials’ penchant for snacking throughout the day and parents’ desire for fun, easy-to-prepare foods for their children. Last May, Nestlé added Hot Pockets Breakfast Bites to its more than 30-year-old frozen line. Around the same time, Chicago-based Kraft Heinz launched Bagel Bites Breakfast, which has four variations of eggs, cheese, and bacon or sausage. “Bagel Bites Breakfast [products] are primarily being consumed by kids in the morning,” says associate brand manager Seth Frischknecht, noting that each serving contains 8 to 10 grams of protein. “We know that parents want to feed their kids savory, protein-filled foods. At the same time, mornings are often so busy that breakfast needs to be convenient.”

Other frozen handheld lines are adding new flavors to broaden their appeal and give customers more choices. For instance, Springdale, Ark.–headquartered Tyson Foods’ Jimmy Dean brand in 2014 added “apple cinnamon” and “very berry” to the 15-year-old Pancakes & Sausage on a Stick line, which also includes original and blueberry varieties. “This product is targeted toward the busy mom who is looking for great-tasting, convenient breakfast options with protein that their kids will love,” says Jimmy Dean brand director Karmen Conrad.

Today’s passion for protein definitely benefits Jimmy Dean, the longtime leader in the frozen protein breakfast category, contends Conrad. “Protein tops the list of health and wellness attributes consumers want most during the breakfast occasion, and this is certainly a core competency of our brand,” she says. “There are consumer segments looking for better-for-you options at breakfast that keep them fuller longer, so we are continuously looking for innovation opportunities on the Jimmy Dean Delights platform to satisfy those needs.”

Hispanic consumers, who make up more than 20% of Millennials, are having a major influence on young adults’ taste preferences. A number of CPG manufacturers are responding with flavorful combinations of high-protein foods not traditionally consumed by Americans for breakfast. Health-focused companies and product lines, such as Amy’s Kitchen, Santa Rosa, Calif., and Parsippany, N.J.-based Pinnacle Foods’ Evol brand, represent an ever-growing presence in supermarket freezer cases with various breakfast burritos, sandwiches, and bowls. Made with organic black beans and tomatoes, Amy’s Breakfast Burrito is aimed specifically at vegans. Similarly, Kellogg’s MorningStar Farms line has a meatless high-protein sandwich featuring a spicy black bean and egg patty with potatoes and pepper jack cheese on an English muffin. A survey a few years ago by The Hartman Group revealed that 12% of Millennials are faithful vegetarians compared with 4% of those in Generation X and 1% of Baby Boomers.

“Evol has been doing a lot of product development in the frozen space,” Sterling-Rice Group’s Nielsen points out. “They offer breakfast burritos, but they also offer breakfast sandwiches, some with egg whites. There’s a lot of creativity.” She notes that one Evol product is a Lean & Fit open-face flatbread sandwich with egg whites, roasted tomatoes, kale, and goat cheese.

Ruiz Foods, Dinuba, Calif., which produces the El Monterey Signature line of frozen burritos, as well as other frozen Mexican food, offers six varieties of breakfast burritos (including one with egg, cheese, and jalapeno peppers). Rachel P. Cullen, Ruiz president and CEO, notes that sales of El Monterey breakfast items increased 81.4% in the past 52 weeks. “Consumers continue to enjoy Mexican food. Busy lifestyles, however, don’t make it easy to prepare Mexican meals or snacks from scratch,” she explains. “Also fairly recent is the trend toward heat and spice. Today’s consumer has become more sophisticated in the tastes they expect from the Mexican food they eat at home.”

Ruiz Foods, Dinuba, Calif., which produces the El Monterey Signature line of frozen burritos, as well as other frozen Mexican food, offers six varieties of breakfast burritos (including one with egg, cheese, and jalapeno peppers). Rachel P. Cullen, Ruiz president and CEO, notes that sales of El Monterey breakfast items increased 81.4% in the past 52 weeks. “Consumers continue to enjoy Mexican food. Busy lifestyles, however, don’t make it easy to prepare Mexican meals or snacks from scratch,” she explains. “Also fairly recent is the trend toward heat and spice. Today’s consumer has become more sophisticated in the tastes they expect from the Mexican food they eat at home.”

Shelf-Stable and Sous Vide Convenience

For some consumers, frozen breakfast foods take too long to microwave, especially during manic mornings when minutes count. Other individuals may want breakfast entrées they can keep in their briefcase or backpack for later consumption at work or school.

Hormel Foods, Austin, Minn., introduced its shelf-stable Hormel Compleats Breakfast lineup in 2014 to satisfy the craving for high protein and convenience in the morning. The line’s Breakfast Scramble products include scrambled eggs or egg whites, roasted potatoes, and a choice of meat, from bacon and sausage to ham, Spam, and turkey. The first shelf-stable meals with eggs on the market, these entrées boast 17 to 20 grams of protein and are ready to eat after just one minute in a microwave. Hormel spent five years developing the proprietary technology used to produce the shelf-stable eggs.

Hormel Foods, Austin, Minn., introduced its shelf-stable Hormel Compleats Breakfast lineup in 2014 to satisfy the craving for high protein and convenience in the morning. The line’s Breakfast Scramble products include scrambled eggs or egg whites, roasted potatoes, and a choice of meat, from bacon and sausage to ham, Spam, and turkey. The first shelf-stable meals with eggs on the market, these entrées boast 17 to 20 grams of protein and are ready to eat after just one minute in a microwave. Hormel spent five years developing the proprietary technology used to produce the shelf-stable eggs.

“We found that the need for a quick and satisfying meal existed during all parts of the day, which led us to expand our Hormel Compleats microwave meals line into the breakfast occasion,” says Jason G. Baskin, Hormel’s senior brand manager for grocery products. “We knew that eggs were a critical part of delivering a hearty breakfast.” Among the Breakfast Scramble products, bacon is the top meat choice, followed by sausage, Baskin says.

Bacon has soared in popularity during the past decade, but it’s generally considered too time-consuming to prepare for a weekday morning breakfast. Several manufacturers, including Hormel, Tyson, and Kraft Heinz’s Oscar Mayer division, produce fully cooked, shelf-stable bacon that is ready to eat or heat in a microwave.

“Hormel has always been a leader in making protein more convenient to enjoy,” says Brett T. Johnson, the company’s brand manager for breakfast meats and fresh meats. “We understand that consumers are very busy but still need their bacon fix. Our Hormel Black Label Fully Cooked Bacon is the perfect solution.” Hormel, moreover, recently added fully cooked bacon to its Natural Choice line of uncured, preservative-free bacon and other meats. “We’re really excited that we’ve attracted new customers to the category with this item,” Johnson adds.

At Cincinnati-based SugarCreek Packing, the nation’s largest independent bacon processor, precooked bacon now constitutes nearly 70% of the firm’s bacon sales (Aylward 2015). The company also recently opened a large-scale sous vide cooking operation, the centerpiece of its new 435,000-square-foot facility in Cambridge City, Ind., and is looking to partner with other firms to develop new products, including those in the breakfast category. The French words for “under vacuum,” sous vide is a cooking process that involves placing food sealed in airtight plastic bags into a temperature-controlled water bath for significantly longer-than-usual cooking times. Although sous vide meats are not shelf-stable, they can be stored for three to four weeks in the refrigerator, according to the USDA Food Safety and Inspection Service. Popular in Europe, sous vide products are simple and quick for consumers to prepare, says Lance Layman, SugarCreek’s vice president of business development.

Reinvigorating Cereal

Reinvigorating Cereal

Even though 93% of Americans say they consume ready-to-eat (RTE) cold cereal (Mintel 2015a), this $8.9 billion category continues to decline in sales—dipping 1.1% in 2015 compared with the prior year, according to IRI’s Viamari. In contrast, oatmeal, a $1.3 billion segment, posted a small increase of 0.9%, she says.

An August 2015 report by Mintel analyzed the attitudes of Millennials, Generation X, Baby Boomers and the Swing (World War II) Generation toward cold and hot cereal as a product category. Among the respondents, 68% of Millennials said they agreed with the statement “I wish cereals would keep me fuller longer,” compared with 52% of Generation X, 46% of Baby Boomers, and 33% of the Swing Generation. In addition, 56% of Millennials think cereal should be more portable, in contrast to 38% of Generation X, 26% of Baby Boomers, and 12% of the Swing Generation. But when it comes to adding extra ingredients to cereal, such as fruit and nuts, the tables were turned, with the Swing Generation and Boomers more likely to do so than Millennials or Generation X (Mintel 2015b).

What’s more, consumers in general have become more concerned about the nutritional aspects of cereal and its ingredients, according to Mintel. “They are turned off by high sugar content and artificial ingredients,” the report noted (Mintel 2015b).

The nation’s largest cereal manufacturers are taking these concerns seriously, responding with new products and a commitment to research and development. Minneapolis-based General Mills grabbed headlines last June when it pledged to remove artificial flavors and colors from its cereals by 2017, with 95% of the reformulations to be completed by the end of 2016. The company has been experimenting with vegetable juices, fruit juices, and spice extracts to replace chemicals such as Red Dye No. 40 and Yellow Dyes No. 5 and No. 6 (Isidore 2015). Kellogg’s followed suit in August when it made a similar announcement. In addition, responding to consumer demand, both Kellogg’s Special K and General Mills’ Cheerios brands now offer gluten-free varieties.

Cereal manufacturers, furthermore, are increasing the protein and fiber content of their products, adding more whole grains and decreasing sugar (Schaeffer 2015). “We see a fair amount of innovation going on in the RTE cereal category, with a lot of breakfast cereals trying to get in on the protein craze,” says Viamari.

Almonds remain an ever-growing source of protein and fiber in cold cereal. General Mills’ new Cheerios Protein line, for example, includes cinnamon almond, as well as oats and honey, options. “According to a recent AAU [awareness, attitudes and usage] survey by Sterling-Rice Group, almonds were the No. 1 nut that consumers associate with breakfast cereal, selected by 53% of survey participants as the nut that first comes to mind when thinking about cereal,” the Almond Board of California reports.

Full of antioxidants, real blueberries are an important ingredient in a number of packaged cereals as well, such as St. Louis–based Post Foods’ Post Selects Blueberry Morning line and Eugene, Ore.–headquartered Attune Foods’ Peace Cereal Blueberry Pomegranate variety. Of course, blueberries continue to be one of the most popular fresh fruits Americans add to cold cereal and milk.

An excellent source of fiber and flavonoids, dried cranberries increasingly are taking center stage in the cereal aisle, appearing in such products as Post’s Great Grains Cranberry Almond Crunch, Kellogg’s Special K Granola Cranberry, and Purchase, N.Y.-based PepsiCo’s Quaker Real Medleys Granola dark chocolate cranberry almond variety. In fact, Kellogg’s new Origin line of cereal, granola, and muesli features cranberries in several products, and its recently launched Nourish line of multigrain flakes with quinoa has a coconut cranberry almond variety.

In the oatmeal realm, the focus has been more on improving portability, variety, and ease and speed of preparation. Both General Mills’ Nature Valley Protein Oatmeal and Quaker Real Medleys Super Grains Oatmeal, for example, come in individual lidded containers that fit in most car cup-holders. To prepare the products, consumers simply add water to a line in the cup and microwave it for a minute or so.

“Cereal sales are expected to decline through 2020,” Mintel reported in August. But there is good news too. The vast majority of Americans of all generations agree that cereal makes for a great snack and can be eaten at any time of day. Mintel recommends that manufacturers package “unique, healthful mix-ins” with cereal that allow for customization (Mintel 2015b).

Raising the Bar

Arguably the easiest breakfast products to grab and eat on the go, cereal and nutrition bars as a category are expected to reach $6.2 billion in the United States in 2018, up from $5.5 billion in 2013, Mintel projected in a report on cereal and nutrition bars published in March 2014 (Day 2015).

Many of the health-focused cereal lines, such as Special K Protein and Quaker Real Medleys have companion cereal bars that reflect similar ingredient innovations and commitment to protein and fiber enhancement. In addition, several specialized companies are major players in this category. In September, New York City–based KIND unveiled its first line of breakfast bars. Made of gluten-free oats, millet, buckwheat, amaranth, and quinoa, KIND Breakfast bars come in five flavors: blueberry almond, dark chocolate cocoa, honey oat, peanut butter, and raspberry chia. “They are delicious and have a lot of protein,” Viamari notes.

Annie’s Homegrown, Berkeley, Calif., which makes a number of products for special diets, has added two new flavors to its gluten-free, organic line of granola bars—oatmeal cookie and double chocolate chip. Expanding its reach beyond nutrition-conscious athletes, Rise Bar, Irvine, Calif., manufactures an assortment of gluten-free, high-protein energy bars that are free of genetically modified organisms (GMOs), preservatives, soy, and peanuts. The Rise Protein Bar line now includes lemon cashew in addition to almond honey, cacao banana, and crunchy carob chip bars. Emeryville, Calif.-based Clif Bar & Co. makes energy bars that are popular with children and adults alike. The company recently rolled out two new flavors—berry pomegranate chia (made with organic chia seeds) and nuts and seeds (made with organic almonds).

Almonds, in fact, are even more popular in cereal bars than in cereals. “Energy and cereal bars are the top consumed product containing almonds, with 51% of consumers stating that they have eaten them,” reports the Almond Board of California. “A key trend for cereal and energy bars is clean labeling. Manufacturers are limiting the amount of ingredients in their products, in favor of recognizable ingredients such as almonds.”

Yogurt in the Morning

Yogurt in the Morning

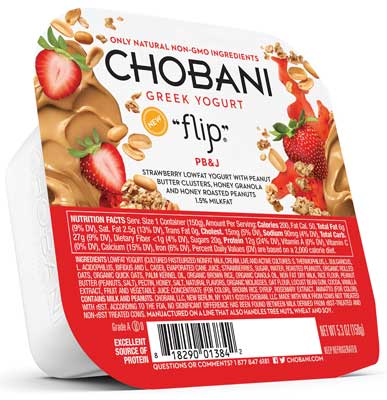

A $7.6 billion market, yogurt posted gains of 3.3% in 2015 over 2014, according to Viamari. Greek-style yogurt’s once-dramatic year-over-year growth has leveled, Hartman Group recently reported (Hartman 2015). But the segment continues to gain market share and has considerable untapped potential, insists Niel Sandfort, vice-president of new product development at Chobani, Norwich, N.Y.

“The Greek yogurt category is still young in this country,” Sandfort maintains. “We consume on a per capita basis one-quarter the amount of yogurt as some European countries and one-half that of Canada. Over two-thirds of the country doesn’t know about our category and the benefits of our food. Due in large part to where yogurt has been made in this country, consumption is higher in the Northeast. As we continue to raise our profile and raise awareness for the category, that gap is decreasing.”

Convinced of the segment’s potential, General Mills’ Yoplait brand last year launched a Greek yogurt line called Plenti. Containing whole grain oats, flax, and pumpkin seeds, Plenti comes in black cherry, blueberry, and coconut flavors. Early this year, the company extended the brand with the rollout of a refrigerated oatmeal-yogurt combination that it calls Plenti Oatmeal Meets Greek Yogurt. Six flavors are offered.

Convinced of the segment’s potential, General Mills’ Yoplait brand last year launched a Greek yogurt line called Plenti. Containing whole grain oats, flax, and pumpkin seeds, Plenti comes in black cherry, blueberry, and coconut flavors. Early this year, the company extended the brand with the rollout of a refrigerated oatmeal-yogurt combination that it calls Plenti Oatmeal Meets Greek Yogurt. Six flavors are offered.

Because women consume roughly 65% of yogurt in the United States, men represent a market with big growth potential. This realization prompted Miami-based Powerful Yogurt to introduce its line of high-protein, low-fat Greek yogurt in 8-ounce cups designed to have a masculine look. The product comes in lemon and chia, blueberry açai, and banana flavors. Dannon, White Plains, N.Y., is also targeting men with its Oikos Triple Zero line of Greek yogurt.

Children remain the principal target for squeezable yogurt products, a segment dominated by General Mills’ Yoplait Go-Gurt line. In 2015, Chobani introduced Chobani Kids and Chobani Tots Greek yogurt pouches in Disney and Marvel superhero designs. Because these products don’t require a spoon and can be consumed easily while driving, Viamari notes that she is starting to see more adult-positioned yogurt tubes.

Extremely convenient vehicles for protein and great taste, yogurt drinks continue to become more prevalent, Viamari says. A longtime leader in this segment, Stonyfield Farm, Londonderry, N.H., introduced its high-protein Stonyfield OP Organic Protein line of yogurt drinks last year. Powerful Yogurt also makes a high-protein Greek yogurt drink that is available in several flavors.

Hartman Group predicts that the next wave of yogurt growth will be in three areas of innovation: “super indulgent” full-fat brands, high-density probiotics, and more targeted nutrition profiles (Hartman 2015). Chobani has forayed into these segments, adding new flavors to its low-calorie Chobani Simply 100, dark chocolate Indulgent, and toppings-included Flip lines. Other players include Denver-based White Wave Foods, which last year rolled out Yulu, a new brand of high-protein Australian-style yogurt, giving competition to Noosa Finest Yoghurt, Bellvue, Colo. Known for its velvety texture and creaminess, this type of yogurt often contains large, identifiable pieces of fruit.

Breakfast’s Bright Future

Already dynamic and high-growth, the breakfast category as a whole is replete with opportunities for innovation and expansion, food industry analysts agree. As Instantly’s survey highlighted, 21% of Americans skip breakfast when time is limited in the morning (Instantly 2015). By continuing to improve on convenience and portability, addressing consumer health concerns with flavorful offerings, and recognizing the all-day consumption trend in traditional breakfast items, food manufacturers can realize the full potential of this category.

Carolyn Schierhorn is a freelance writer based in Wheaton, Ill. ([email protected]).

References

Aylward, L. 2015. “Beyond bacon.” Meat+Poultry, Oct. 13. http://www.meatpoultry.com/Writers/Other%20Contributors/Beyond%20bacon.aspx?p=1&cck=1/.

Consumer Reports. 2014. “A healthy frozen breakfast sandwich is hard to find with 16 varieties.” Consumer Reports, Sept. 13. http://www.consumerreports.org/cro/news/2014/09/a-healthy-frozen-breakfast-sandwich-is-hard-to-find/index.htm.

Day, B. 2015. “Fit club: Tracking nutrition bar trends,” Food Business News, April 1. http://www.foodbusinessnews.net/articles/news_home/Consumer_Trends/2015/04/Fit_club_Tracking_nutrition_ba.aspx?ID=%7B023A1C99-94A0-46EB-9C9F-8FDCC2BC0A6C%7D.

Hartman. 2015. “It’s Not All Greek for the Yogurt Category. What’s Next? Innovation Is a Key Answer.” Sept. 15. Hartman Group, Bellevue, Wash. hartman-group.com.

Instantly. 2015. “National Breakfast Study by Instantly Reveals Evolution of American Breakfast Habits.” Press release, Aug. 18. Instantly Inc., Los Angeles. instant.ly.

Isidore, C. 2015. “General Mills to nix artificial flavors and colors from its cereals.” CNNMoney, June 22. http://money.cnn.com/2015/06/22/news/companies/general-mills-artificial-flavors-colors.

La Monica, P. R. 2016. “McDonald’s sales soar thanks to all day breakfast.” CNNMoney, Jan. 25. http://money.cnn.com/2016/01/25/investing/mcdonalds-earnings.

Mintel. 2015a. Frozen Breakfast Foods—U.S. July. Mintel International, Chicago. mintel.com.

Mintel. 2015. Hot and Cold Cereal—U.S. Aug.

Nielsen. 2015. “Tops of 2015: U.S. Grocery.” Dec. 28. http://www.nielsen.com/us/en/insights/news/2015/tops-of-2015-us-grocery.html.

NPD. 2015. “Breakfast Food, Quick Service Restaurants, and All Things Meat Are Among Foodservice Growth Drivers in 2015.” Press release, Dec. 21. NPD Group, Chicago. npd.com.

Schaeffer, J. 2015. “Breakfast cereal innovations.” Today’s Dietitian, March. http://www.todaysdietitian.com/newarchives/031115p36.shtml.

Wohl, J. 2015a. “Biggest Food Story of 2015. Did Someone Say Breakfast?” AdAge, Dec. 14.

Wohl, J. 2015b. “Nestlé dropping artificial flavors from pizzas, Hot Pockets, Lean Pockets.” Chicago Tribune, June 2. http://www.chicagotribune.com/business/ct-nestle-artificial-flavors-0603-biz-20150602-story.html.