Building Better Pizza

To appeal to today’s informed consumer, pizza makers are drawing on global inspiration to create uniquely flavored, high-quality pizzas with a better-for-you twist.

Who doesn’t like pizza? Americans consume 350 slices every second, according to CNBC, and a recent Harris Poll found that 15% of Americans deem it their top comfort food. Pizza is equal parts convenience and indulgence, and it’s appropriate for easy weeknight meals and special celebrations alike. “People have a lot of joy around pizza,” says Kendall Bruns, creator of the Chicago-based U.S. Pizza Museum, which collects and presents memorabilia related to the cheesy dish.

Pizza “is ideally suited for nearly universal appeal,” writes Euromonitor. Depending on an individual’s likes, nearly everything about pizza can be modified to fit his or her desires, from the shape and style of its crust to the sauce that’s slathered on top to the plethora of meats, veggies, and cheese that crown it. While there’s no chance that pizza’s going anywhere, it does face competition from healthy alternatives and other convenient offerings. To ensure that sales remain strong, more and more companies are experimenting with crusts, sauces, and toppings to provide consumers with exciting, innovative, and delicious offerings.

Pizza at Home

Dollar sales for frozen pizza sold in mainstream retail channels reached nearly $4.7 billion, according to IRI data for the 52-week period ending Aug. 7, 2016, up 1.3% over a year ago. Private label frozen pizza is performing well; sales were up 13.5% in 2015. The U.S. frozen pizza category appears to be somewhat stagnant when it comes to product innovation, however (Packaged Facts 2015); new pizza product launches in the United States have dropped by half since 2011, accounting for just 10% of new pizza launches globally in 2015 compared with 19% in 2011 (Mintel 2016). In addition, the percentage of consumers eating frozen pizza in the past 30 days dropped 3% from 2010 to 2014 (Packaged Facts 2015).

As in most other food categories, pizza consumers are looking for more premium options, and according to Mintel, 58% of U.S. pizza eaters say they would buy more frozen pizza if it had more premium or gourmet ingredients (Mintel 2016). Frozen pizza may also be losing momentum as people look for healthier food and options that don’t feel processed, says Packaged Facts, but Sanjay Gummalla, vice-president of regulatory and technical affairs for the American Frozen Foods Institute, argues that frozen pizza is the opposite of processed. “Other than mixing the dough, there’s nothing else processed. Ingredients are literally put on the base,” he says. “Freezing … makes sure it’s safe till it’s cooked. I don’t think frozen pizza should ever be connected with the word processed.

Refrigerated pizza may enjoy more opportunity for growth, according to Packaged Facts. While sales for refrigerated pizza sold in supermarkets, drugstores, mass merchandisers, convenience stores, club stores, and dollar store chains are down 3.6%, per IRI figures for the year ending Aug. 7, 2016, Packaged Facts sees growth potential for chains like Papa Murphy’s as well as private label grocery store offerings (Packaged Facts 2015). If this growth happens, though, it will likely be slow. These categories may be slowing because of the availability of healthier options in the grocery store, as well as home-cooked meals (Packaged Facts 2015).

In addition, a stronger economy means more people are dining out, and increased restaurant visits hurt frozen and fresh pizza sales. Frozen pizza is competing with all the other ways consumers procure pizza, says Gummalla. This now includes a growing number of fast-casual restaurants such as Persona Pizzeria. “I want [the frozen pizza] demographic,” says founder Glenn Cybulski. “I want the people who can’t afford to take their kids out for pizza.”

Pizza in Restaurants

Pizza in Restaurants

While frozen pizza consumption may be slowing, consumers are still choosing pizza when they dine out. Chain pizza restaurants are growing because of the value they deliver to consumers, according to the online publication Eater. According to Technomic, pizza consumption in restaurants is trending at its highest level in the past four years and showing growth across channels (Eater 2016, Technomic 2016). Seventy-six percent of consumers have eaten at a pizza restaurant in the past 12 months, suggesting broad appeal and a strong value proposition (Packaged Facts 2015).

In restaurants, unique toppings are increasingly key; 39% of consumers say new and innovative toppings are highly important (Technomic 2016), and restaurants have an advantage when it comes to selling their creations, says Dax Schaefer, director of culinary Innovation at Asenzya. There, a detailed menu and knowledgeable servers can explain the intricacies behind an unusual concept, while frozen pizza makers are limited to what they can fit on the box. Restaurant chefs can also more easily repurpose ingredients from poorly selling experimental pizzas than packaged goods manufacturers can, he claims.

At fast casuals—restaurants similar to Chipotle where consumers craft their own pizzas while walking along a counter—consumers get an opportunity for customization and creativity. Customers at Pasadena, Calif.–based Blaze Pizza can include unlimited toppings from the prep bar on their pizza, giving them the freedom to try something new, be as healthy or indulgent as they desire, and see exactly what they’re ordering. “Fast pizza that you can build yourself has been an eye-opener for people,” says Greg Dunn, owner of Persona Pizzeria’s Chicago location.

This uptick in restaurant visits may have some positive points for retail manufacturers, though. “Restaurant brands continue to enter the retail landscape as a way to keep consumers engaged with the brand when dining at home,” says Packaged Facts, and Schaefer agrees. “When people know a restaurant, they’ve already been educated about the quality of its products and trust it, so they may be more willing to try its retail products,” he observes.

--- PAGE BREAK ---

Creating the Perfect Pie

Consumers are looking for certain things when it comes to their pizzas, including all-natural ingredients, authentic preparation styles, and premium, innovative toppings. Let’s take a deeper dive into how these trends are affecting each component of the pizza.

• Crust. “What’s great about pizza dough is that it’s a blank canvas, waiting for chefs to jump in and innovate,” says Daniel Marciani, executive development chef for Ardent Mills. “While many people stick to what they know, there is an emerging culture of experimentation, with chefs connecting different styles of pizza with global and regional ingredients and inspiration.”

Marciani observes several big crust trends, including organic, using Italian-style flours like “00” and durum, and different versions of gluten-free, and he sees heritage wheats like spelt and triticale emerging in pizza applications. “Beyond the grains, I’ve seen dough ingredients include additions like butter, buttermilk, sour cream, and milk for a softer, richer flavor,” he adds, noting that soft-textured pies are gaining in popularity.

When deciding on a crust type, manufacturers have to understand who their customer is, says Charlie Baggs, president, CEO, and executive chef for Charlie Baggs Culinary Innovations. “Consumers are wanting a range of crust types, which is a reflection of the various usage occasions that frozen pizza is consumed,” adds Tricia White, vice-president of product development for Schwan’s Shared Services, noting that there is a place and time for nearly any kind of crust, depending on the audience.

Pizzas are trending toward thinner crusts, perhaps because of the reduced calories and health association they offer, and 52% of consumers prefer to go thin, says Kelly Weikel, director, consumer insights, for Technomic. Hand-tossed, however, is the No. 1 crust type found on restaurant menus, preferred by 57% of consumers, says Weikel, because it signals artisanal and handcrafted qualities. A handcrafted feel is key to Rustic Crust’s pizza crusts, which are hand-formed in individual pans. In addition, the crusts in the company’s American Flatbread brand pies are aged at least 24 hours before being hand-stretched and baked in a wood-fired oven, providing them with a point of differentiation, says the company’s national foodservice sales manager, Tony Wallace.

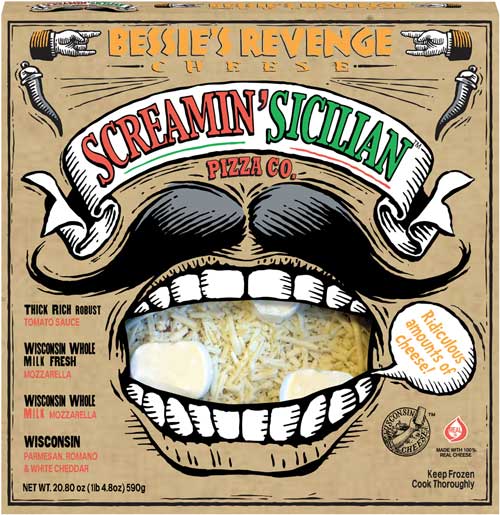

Calling out regional crust styles like Sicilian and Neapolitan is also on trend because of their appearance of authenticity, according to Technomic (Technomic 2016). “Italian classics are making a comeback,” says Gummalla, and he says that companies are exploiting the differences in regional Italian styles to imbue a feeling of local, authentic Old World stories into these pies. In addition, flatbreads, which came on strong a few years ago, are up almost 50% over the last three years, according to Schaefer. These elevated crusts allow pizza makers to be more creative because there’s no preconceived notion of what a flatbread must be the way there tends to be with traditional pizza, he says. “Flatbreads are meant to feel fancier. [They’re] like the sexy sister to the pizza,” says Schaefer.

Calling out regional crust styles like Sicilian and Neapolitan is also on trend because of their appearance of authenticity, according to Technomic (Technomic 2016). “Italian classics are making a comeback,” says Gummalla, and he says that companies are exploiting the differences in regional Italian styles to imbue a feeling of local, authentic Old World stories into these pies. In addition, flatbreads, which came on strong a few years ago, are up almost 50% over the last three years, according to Schaefer. These elevated crusts allow pizza makers to be more creative because there’s no preconceived notion of what a flatbread must be the way there tends to be with traditional pizza, he says. “Flatbreads are meant to feel fancier. [They’re] like the sexy sister to the pizza,” says Schaefer.

Crusts are also increasingly being flavored, with restaurants and manufacturers brushing flavors like buffalo sauce and herbed oils around their edges. They can also be stuffed with ingredients such as cheese and hot dogs for another point of differentiation, and the options are nearly limitless.

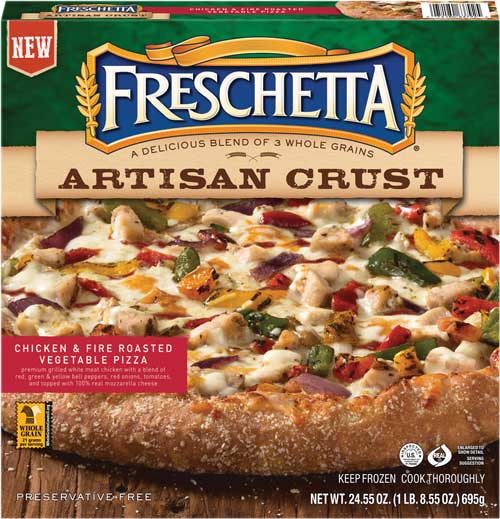

Pizza crusts are also increasingly incorporating grains other than just wheat. Little Caesar’s offers a pretzel crust, and globally, crusts tend to echo what’s popular in that region, such as blue corn crusts featured in Mexico City and black rice dough that’s used by South Korean chain Pizza Alvolo (Technomic 2016). Other companies, such as Schwan’s, are focusing on whole grains; its new Freschetta Artisan Crust, which is made with three whole grains, is the first time a rising-dough pizza has been launched with whole grains in retail frozen, according to White.

Pizza crusts are also increasingly incorporating grains other than just wheat. Little Caesar’s offers a pretzel crust, and globally, crusts tend to echo what’s popular in that region, such as blue corn crusts featured in Mexico City and black rice dough that’s used by South Korean chain Pizza Alvolo (Technomic 2016). Other companies, such as Schwan’s, are focusing on whole grains; its new Freschetta Artisan Crust, which is made with three whole grains, is the first time a rising-dough pizza has been launched with whole grains in retail frozen, according to White.

Sprouted grains, meanwhile, offer a feeling of health. “When consumers see the word ‘sprouted’ on the menu, they associate that with the idea of their food being alive and healthy. That’s a powerful image … for health-minded pizza fans,” says Marciani. When it comes to ancient grains, he advises formulators to call out the specific grains and their origins rather than simply saying “multigrain.” “Along with health benefits, great flavor, and texture, ancient grains bring great origin stories to menus and tables,” he says.

Another trend in pizza crust centers on gluten-free. Gluten-free launches increased 58% between 2012 and 2015 (Mintel 2016), and these allergen-friendly pies show no sign of slowing down. Pete Asta, research and development manager for Ardent Mills, notes that formulating gluten-free pizzas can be difficult but says that including a combination of ancient grains can help. “People have to experiment with different ingredients to find what works for their needs,” he says.

For Charlie Pace, owner of Smart Flour Foods, these ancient grains are the key to the company’s crust. Smart Flour uses sorghum, amaranth, and teff to create a gluten-free dough that tastes like whole wheat. These crusts serve as the base for Smart Flour’s frozen pizza line, and they can also be found in restaurants around the United States. Idahoan, meanwhile, bases its crusts on potatoes, and Garden Harvest uses sweet potatoes.

The beauty of pizza is that high-quality toppings can drive taste even when the base doesn’t shine as brightly, says Gummalla, and using better toppings with a stronger flavor and more mouthfeel can help overcome low expectations. “You’ve got to use your ingredients and exploit them as much as you can in these allergen-free products,” he says.

• Sauce. Tomato-based red sauce remains the most common topping on pizzas, but nontraditional sauces such as ranch, alfredo, and white sauce are also appearing (Packaged Facts 2015), sometimes in conjunction with ethnically inspired toppings. “Sauce has come a long way,” says Schaefer, and it is now a flavor driver and selling point for many pizzas. He has seen garlic, nacho cheese, and hot sauces on pies.

• Sauce. Tomato-based red sauce remains the most common topping on pizzas, but nontraditional sauces such as ranch, alfredo, and white sauce are also appearing (Packaged Facts 2015), sometimes in conjunction with ethnically inspired toppings. “Sauce has come a long way,” says Schaefer, and it is now a flavor driver and selling point for many pizzas. He has seen garlic, nacho cheese, and hot sauces on pies.

“We’ve seen an interest in sauces that are not necessarily tomato-based, and if they are tomato-based, it has a unique profile, like taco, Indian, pesto, or chimichurri,” says AnnMarie Kraszewski, Wixon R&D lab manager.

“I think vegetables overall are underutilized in pizza,” adds Marciani. “Why not make a pizza with a well-made corn cream or cauliflower cream as the sauce?” California Pizza Kitchen takes this approach with a roasted garlic and chickpea sauce in its Crispy Thin Crust Mediterranean Style Veggie pizza, and it employs a spicy black bean sauce in its Slow Cooked Pork pie.

--- PAGE BREAK ---

• Cheese. Mozzarella is the most commonly used pizza cheese, with 71% menu penetration, with ricotta and Parmesan at a distant two and three (35% and 32%, respectively), but alternate cheeses are on the rise, says Packaged Facts (Packaged Facts 2015). These include goat, gorgonzola, and fontina, and Schaefer has seen Romano, asiago, provolone, feta, and even pepper jack gaining traction. In addition, preference for gouda is increasing, and it is among the fastest-growing cheeses on restaurant menus (Technomic 2016). These cheeses provide an upscale feel, something people are willing to spend more money on, and unlike 10 years ago, consumers are more familiar with these named varieties and aren’t scared to pick up a package that contains these words, Schaefer says.

Of course, some consumers cannot eat dairy, and Mintel anticipates that a rise in lactose-free claims in pizza could come soon (Mintel 2016). Plant-based food company Daiya’s gluten-free pizzas come topped with its dairy-free mozzarella- and cheddar-style shreds, while Oh Yes! offers vegan versions of its pizzas, which also contain 12 veggies and fruits in their crust and sauce.

• Toppings. Pizza is meant to be shared, so pizza makers have to be careful about the toppings they include to try to appeal to the widest audience, says Schaefer. However, just like with other food categories, Millennials are driving change, and their desire for unique flavors and premium ingredients is spurring new toppings and combinations.

Sausage and pepperoni are still the top meats, being featured on 73% of restaurant menus, but bacon is also widely available, and chicken breast is up 22%, likely due to its perception as a healthier meat (Technomic 2016). Prosciutto is growing, up 27% since 2010, according to Packaged Facts, and premium ingredients like this are a growing trend on frozen and fresh pizzas alike. Companies can include uncured pepperoni, higher-end Italian sausage, and seasoned ground beef to separate themselves from the competition, and this combination of quality and convenience may especially appeal to Millennials, who don’t feel bad spending more, says Schaefer. Other emerging meat toppings include meatballs, salami, and anchovies (Packaged Facts 2015). One thing not likely to top a frozen pie anytime soon? Shellfish. In Europe, seafood appears on pizza, but people in the United States are not ready for it, says Schaefer.

On the vegetable side, onion, tomato, mushroom, and peppers are featured on at least 73% of restaurant menus (Technomic 2016), and these toppings can add a healthful feel to pies. Veggie-centric menus at restaurants bode well for pizza, says Baggs, and some restaurants are focusing on seasonal ingredients. This focus on fresh and seasonal can also work for retail pizza. “The advantage that frozen pizza manufacturers have is that they can take seasonal ingredients and have them available throughout the year,” says Gummalla, “and I’m not sure they have exploited that.”

In addition, herbs such as basil, cilantro, and oregano are growing, up 20% since 2010 (Packaged Facts 2015). “These ingredients have strong alignment with authentic Italian flavors and communicate ‘fresh,’” says Packaged Facts. This link with global flavors extends across the pizza world, in fact. “I truly think we are at a stage in the history of pizza innovation that is about taking different, already existing inspirations from different regions or cuisines and combining them into something that feels authentic and is new,” says Marciani.

Asian, Cajun, and Mexican flavors are evident in pizzas, as are Mediterranean and Greek. Spicy flavors are on trend across all food categories, and here they take the form of chorizo, giardiniera, and chipotle, according to Schaefer. He also says that harissa, a hot chili pepper paste, will soon be very popular, as could pies that draw on specific regional styles of American barbecue.

On the restaurant side, fast casual Persona Pizzeria sources spices from Africa and Malaysia for its sausages, and Pizza Hut launched a “Flavor of Now” theme, a nod to the fact that consumers are embracing different foods and flavors; new options include premium toppings like cherry peppers as well as crust flavors like Honey Sriracha and Ginger Boom.

Another kind of unique topping may signal a change in the daypart associated with pizza; brunch pies topped with eggs, breakfast sausage, and cheese have appeal for both breakfast and brunch as well as later eating occasions, as ingredients such as bacon and eggs are often accepted as appropriate throughout the day, says Weikel.

Looking Forward

Pizza makers, particularly those in the frozen category, face a difficult proposition. Pizza is associated with indulgence, but more and more consumers are looking for healthful options. It is also linked with convenience, but ease of use is no longer enough; according to Technomic, to compete with foodservice, frozen pizza makers will need to “make quality a more significant component of the value equation.”

“Similar to other products in the grocery store, consumers want pizzas that are healthier and have more real and authentic food attributes,” says White. While consumers may have accepted frozen pizza as a convenience food in the past, today that pizza must also feel premium and be perceived as good for you. “Essentially, [consumers] do not want to sacrifice the eating experience just because they don’t have the time to make a pizza from scratch or don’t want to go out,” she says.

Packaged Facts advises manufacturers to focus on using premium, natural products when possible to provide a health halo and appeal to Millennial moms and utilize interesting toppings that can draw Millennials and urban consumers (Packaged Facts 2015). Urban Pie, a brand launched by Palermo Villa, illustrates this concept well. This line, which is inspired by the pizza found in different cities around the country, targets Millennials, aiming to provide the uniqueness and shareability they like using better versions of ingredients and flavors they are familiar with, say Nick Falluca, vice-president of marketing and R&D, and Landon Terry, R&D manager. Palermo also attempts to reach this demographic through its marketing techniques, which include social media campaigns and a mobile pizza tour.

While it certainly seems to be in manufacturers’ best interests to create better pizzas with quality ingredients, it is important that they not take their consumers too far outside of their comfort zones and continue to provide familiar—though better-quality—versions of the pizzas they know and love.

“Consumers are looking for more interesting flavors and textures in their frozen pizzas,” says White. “However, meeting those consumer needs is a delicate balance between following trends and focusing on core offerings. While there is a desire to launch breakthrough, innovative flavor offerings, it is important to critically assess the long-term viability of these more unique flavors.”

--- PAGE BREAK ---

Innovations in Pizza Technology

Innovations in Pizza Technology

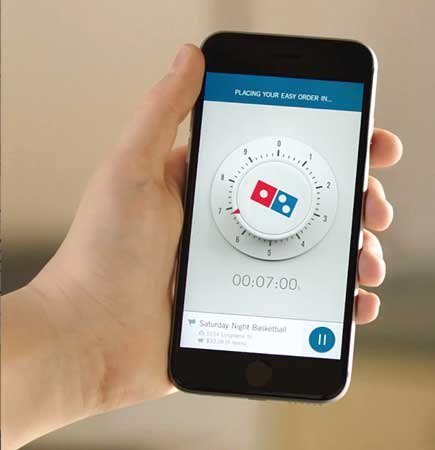

“Technology is changing how people order pizza,” says Kelly Weikel, director, consumer insights, for Technomic. Consumers have more options than ever when it comes to pizza delivery, with delivery services like GrubHub and Postmates helping full-service restaurants and smaller chains get into the game. To help combat that challenge, large pizza chains are turning to innovations in pizza ordering and delivery to stay competitive.

Domino’s is “inspiring a culture of digital convenience, mobile ordering, and effective delivery,” according to Euromonitor. About 50% of Domino’s U.S. sales come through its digital ordering channels, the company says, and in recent years, Domino’s has introduced a number of ordering innovations. These include the option to order by Tweeting a pizza emoji, a one-click app that simply orders a pizza after 10 seconds, and a partnership with Amazon’s Echo, which lets consumers order a pizza via voice command. On the delivery side, Domino’s has built some souped-up Domino’s DXP delivery vehicles that keep pizzas hot and cold items cold, and the company most recently tested drone delivery in New Zealand.

Domino’s isn’t the only one embracing technology. Papa John’s recently teamed up with Apple TV to let consumers order pizza directly from their TV, and Pizza Hut provides a “Visible Promise Time” on its digital orders, letting consumers see just how long their pizza will take to arrive even before they’ve placed an order.

These technological innovations are more important than ever, since today’s delivery services mean that any kind of food can be fair game for delivery. Pizza delivery is also competing with fast-casual options, where consumers can get an instant, personalized pie. It’ll be interesting to see what these chains continue to do to stay competitive, says Weikel, and she wonders if these outlets might consider adding more dine-in options to better compete with the fast-casual boom.

These technological innovations are more important than ever, since today’s delivery services mean that any kind of food can be fair game for delivery. Pizza delivery is also competing with fast-casual options, where consumers can get an instant, personalized pie. It’ll be interesting to see what these chains continue to do to stay competitive, says Weikel, and she wonders if these outlets might consider adding more dine-in options to better compete with the fast-casual boom.

The Pizza Maker’s Toolbox

The challenge [in frozen pizza] is maintaining the flavor profile as well as freeze-thaw functionality,” says AnnMarie Kraszewski, Wixon R&D lab manager. And Zak Otto, Wixon technical R&D manager, Protein Division, says pizza makers must pay attention to a range of formulation considerations, including shelf life, crust consistency, color bleed out, oxidation and rancidity with meat toppings, and sauces that freeze and reheat without consistency issues. The company’s blends of starches and gums maintain dough crust and integrity, and Wixon also incorporates specific light-sensitive ingredients to help products maintain color integrity longer.

Consumers increasingly are demanding healthier versions of their favorite foods, and some may be concerned about the salt and sugar levels in their pies. Wixon offers some solutions to these challenges. Its Reduced Sodium System and KClean Salt can reduce sodium without affecting flavor or functionality, and Sweetlift can help achieve sweet notes in certain sauces, such as those intended for children, says Otto. Also likely related to health concerns, the pizza category has seen a rise in alternative grain and gluten-free crusts. In gluten-free, most formulations use a combination of starches, proteins, and hydrocolloids, explains Pete Asta, research and development manager for Ardent Mills. “Combinations of ancient grains can also help with gluten-free doughs, and people have to experiment with different ingredients to find what works for their needs.”

BENEO can help produce better gluten-free crusts with its Remyflo R7 90 T CP wet-milled rice flour, which produces finer particles and can improve mouthfeel, texture, and crispiness. Pulse proteins and flours from Ingredion can also be used to achieve a chewy texture and softer bite in free-from applications, says Igor Playner, vice-president of innovation and strategy for North America. These ingredients are sustainable, affordable, and can also be used to enhance protein content in wheat doughs. In addition, the BeneGrain line of sprouted grains from Bay State Milling allows for greater dough volume and makes nutrients more bioavailable, says account executive Mark Orlowsky. The whole grain ingredient is sweet without bitterness and provides a pleasing texture, he says, and gluten-free options are available.

A number of other ingredients offer benefits for pizza dough. Bunge North America offers Silos de Oro, a shortening designed for tortillas that can extend shelf life and provide great texture by replacing traditional shortening saturates with phytosterols, which can reduce the retrogradation process by stabilizing the water/starch matrix. IOI Loders Croklaan provides a range of fats and oils ideal for creating flaky crusts, including Aratex NT and K.L.X. NT, which are both hydrogenated vegetable oils in flake form. The SansTrans line of nonhydrogenated oils and flakes provides a range of functionalities; SanTrans 25 increases elasticity while SanTrans 55 promotes a crumbly crust. SanTrans RS39, meanwhile, can be used to reduce saturated fat, says Gerald McNeill, vice-president of global nutrition and development.

Cheese, probably the most crucial of pizza toppings, can also be one of the most expensive, and Ingredion offers a cost-saving solution in its PRECISA 600 series starch. The ingredients reduce protein, hydrocolloids, and fat to allow for savings while providing firmness, melt, and emulsification, says marketing director Ivan Gonzalez.

Melanie Zanoza Bartelme is associate editor of Food Technology magazine.

References

Eater. 2016. “Is Pizza Recession-Proof?” Eater, Aug. 3. eater.com.

Euromonitor. 2016. “As Pizza Goes Global, Some Chains Remain Grounded.” Blog post. Euromonitor International, Chicago. euromonitor.com.

Mintel. 2016. “Gluten-free pizza launches soar 58% globally between 2012 and 2015.” Press release, Feb. 9. Mintel, Chicago. mintel.com.

Packaged Facts. 2015. Pizza Market in the U.S., Foodservice and Retail, 2nd Edition. January. Packaged Facts, Rockville, Md. Rockville, Md. packagedfacts.com.

Technomic. 2016. Pizza Consumer Trend Report. April. Technomic, Chicago. technomic.com.