What’s Hot in Hispanic Foods

In our globally connected world, consumers are ever more exposed to the flavors and cuisines of other cultures, including those of Latin America. Today’s Hispanic food consumers value better-for-you foods and beverages that are easy to prepare yet packed with authentic, high-quality flavors and ingredients.

Article Content

Consumers are hooked on Hispanic foods. These foods and beverages are part of the regular diet of at least a third of the population and a familiar presence for another third, according to research firm Packaged Facts (Packaged Facts 2017). More than nine in 10 Americans say they have tried and liked Mexican foods, and 41% say they seek out Latin cuisine because they enjoy trying regional variations of similar foods (Technomic 2017). Packaged Facts estimates the Hispanic food and beverages market reached roughly $17.5 billion in 2015, representing an increase of 3.9% over 2014; it predicts a compound annual growth rate of 3.8% between 2015 and 2020 (Packaged Facts 2016).

So what is it about these foods that makes them appeal so broadly across both Hispanic and non-Hispanic populations?

“There is a universal consistency associated with Hispanic and Latin American flavors,” suggests Jeffrey Troiola, corporate chef/research and development for Woodland Foods. “They provide the essence of what makes any cuisine appealing—the flavors are bold and bright, sweet and savory, and rich with umami. Latin America’s exotic ingredients, bold flavors, and multicultural influences provide infinite opportunities for creativity limited only by the imagination of the chef.”

The core of this market may be Hispanic—nine out of 10 Hispanic households enjoy Hispanic foods, and more than half buy more Hispanic foods than American ones (Packaged Facts 2016). Hispanic foods and beverages, though, have gained traction as consumers have become increasingly exposed to world regions and their associated cuisines, whether through the internet or global travels that Packaged Facts calls flavor tourism (Packaged Facts 2014, 2016).

Together, both groups of consumers are shaping the wealth of products available on store shelves and in restaurants, though they may appeal to individuals within these groups for different reasons. “In our increasingly multinational world, the dish that represents flavor adventure and flavor tourism to one table of diners might, at the next table, be the nostalgic favorite that Grandmother used to make,” writes Packaged Facts research director David Sprinkle (Packaged Facts 2014).

Whatever their background, diners are turning to Hispanic foods that convey a sense of authenticity, place, and tradition while also embracing the flavors celebrated in these cuisines in the everyday foods they love, making for an interesting and exciting culinary landscape that blends the exotic with the familiar. At the same time, consumers are demanding the same attributes from these products as they do in the rest of their diets: clean, better-for-you ingredients that can be prepared simply and easily—all while delivering on taste and enjoyment.-

Seeking Authenticity and Quality

Hispanic-influenced foods and beverages have long been part of the U.S. food culture, but today’s consumer is increasingly drawn to hyperspecific regional cuisine on restaurant menus from chefs they trust, like Chicago’s Rick Bayless, who has turned educating others on the nuances of Mexican food into his life’s work.

“Consumers are definitely drawn to more ‘authentic’ flavors that represent both local and regional cuisines,” says Troiola, who notes that he has been working to transform the seven classic Mexican mole sauces into dry versions that maintain each variety’s unique blend of ingredients.

This introduction of lesser-known dishes, flavors, and ingredients is trickling down into the retail market as well, as consumers expect that sense of specificity and authenticity to continue in the products they buy. “Dishes that used to be more exotic are becoming more mainstream. People are talking about those dishes and maybe even experimenting at home,” says La Tortilla Factory chief innovation officer Sam Tamayo.

In response to that desire, companies are providing authentically inspired, artisanal, handcrafted goods that highlight their use of family recipes, traditional techniques, and simple ingredient lists. Cabo Chips are cut from real tortillas with flavors influenced by authentic Mexican street foods, while the company’s partially cooked tortillas were inspired by those eaten by the company’s founders in Baja California, Mexico. Technomic advises companies and restaurants to promote the specific city or region that inspired a dish or product whenever possible (Technomic 2017).

Los Cantores’ tortilla chip recipe, meanwhile, was passed down from generation to generation; its name references the family’s hacienda in Mexico. The premium chips are available in seven varieties, including ancient grains, and feature bilingual packaging. In the tortilla and tortilla chip category, many companies are also embracing the traditional stone-grinding method, a trend that was on display at this year’s Natural Products Expo West and is used by family-owned chip company RW Garcia.

Companies that don’t have Latin roots or a family recipe should not be afraid of venturing into Hispanic products as long as they are invested in learning about the culture and products they will be selling. “It doesn’t come from a shallow understanding; it comes from a deep understanding,” says Bayless, a non-Hispanic from Oklahoma whose authority on the subject has sometimes been questioned (Godoy 2016). “I’ve done everything I can to make it my own.”

Sarah Pike founded frozen empanada company Buen Sabor when she saw “a hole in the market for more traditionally inspired Latin food” that could also serve as solutions for consumers’ busy lifestyles while delivering premium, clean label ingredients. A self-proclaimed farm girl from Maine, Pike is continually learning about nuances of Latin American cuisine and says she is on a journey alongside her customers “to discover new and delicious flavors that can elevate the everyday.”

“As long as we remain true to the cultures we are drawing inspiration from,” she says, “we hope people will appreciate products for what they are—delicious, junk-free, and convenient.”

Sometimes, though, authentic food companies may choose to downplay their products’ history when trying to reach audiences who may be wholly unfamiliar with the foods they are selling. Wooden Table Baking Co., for example, is aiming to hook North American audiences on its alfajore, an Argentinian cookie made with two shortbread cookies filled with caramelly dulce de leche. Instead of relating the cinnamon flavor to churros—Hispanic cinnamon-sprinkled street treats—the company chose to name the flavor Snickerdoodle, which instead references the familiar American cookie.

Evolving Flavors

The Hispanic marketplace is bursting with multicultural food mashups that include the sushi burrito, Korean taco, and Walmart’s forthcoming Marketside brand crotilla, a tortilla-croissant combo—not to mention the myriad envelope-pushing creations Taco Bell has introduced over the years. While many Americans are embracing the opportunity to learn about the intricacies of traditional Hispanic foods, others are looking to hybrid products that blend this cuisine’s staple foods with those of other cultures for an entirely new food. At the same time, some Hispanic consumers, especially Millennials, are becoming increasingly open to plays and spins on the traditions they grew up with, says Troiola. “While there is always a demand for authenticity of flavors of a particular cuisine, there is also a demand for unique flavors and ingredients that can be combined with the traditional flavors of other cuisines,” he says.

Gardel’s, a Southern California company making traditional Argentine herb-based chimichurri sauces from a family recipe, has also put its own spin on these traditional flavors by introducing its Chimichurri Aioli, which replaces the sauce’s traditional olive oil with a mayonnaise base that plays on flavors Dutch soccer players introduced during the 1978 World Cup.

Seeing a void in the market for healthy taco sauces, condiment company Red Duck decided to create clean label versions. One variety, Uniquely Korean, was inspired by the bulgogi taco recipes the Red Duck team had tasted in its Portland, Ore., headquarters. Chief operations officer Shannon Oliver also notes that she has seen a growing appreciation for Latin foods beyond burritos and quesadillas and thinks the market will see even more hybrids evolve as more consumers become aware of other authentic Hispanic staples to mix them with.

Urban Accents is also drawing on this hybrid phenomenon to offer Taco Simmer Sauces in a variety of hybrid flavors, including Korean BBQ, Jamaican Jerk, and Thai Chili. Sweet Earth Natural Foods’ line of frozen burritos includes traditional flavors like Southwest as well as more unusual combinations like the Kyoto, a vegan Japanese-style wrap filled with bok choy and edamame, and the Greek, filled with white beans and spinach.

Yai’s Thai, meanwhile, offers its Thai Salsa as a condiment that “has all the familiarity of a salsa but with an inherently Thai flavor profile,” according to the company, drawing on consumers’ exposure to accepted Hispanic staples to introduce them to other flavor types. Salsas themselves are also becoming hybridized, with fruit flavors like pineapple and peach appearing on the shelf. Mrs. Renfro’s president Doug Renfro explained that the company’s new craft beer salsa was intended to be a seasonal flavor, but interest at the 2017 Winter Fancy Food Show was so great that the company decided to make the flavor permanent. Renfro says that the company also encourages consumers to think of their salsas as a cooking sauce, and the pumpkin variety features a soup recipe on the bottle.

In addition, the flavors associated with some traditional Hispanic foods have found currency in more mainstream products by integrating traditional spices and seasonings in new ways and tapping into the popularity of chili peppers and spicy foods (Packaged Facts 2016). Some of the ingredients found in Hispanic foods, such as mango, lime, tamarind, and guava, were seen in a number of products at this year’s Winter Fancy Food and Natural Products Expo West shows. Horchata, a ground almond drink, and hibiscus, another traditional flavor, have been gaining traction, and the latter can be found in everything from beer to tea to yogurt, according to Pamela Oscarson, consumer insights manager for FONA International. She also points to the rise of feijoa, a fragrant fruit with notes of quince, pineapple, and mint that her team has begun to see fresh in chain stores and canned in Trader Joe’s; manufacturers should keep an eye on this flavor.

Chuao Chocolatier drew on some of these flavors when it introduced two Latin-inspired chocolate bars this year. Totally Tangy Mango features ripe mangos dusted with chamoy, a mixture of lime, sea salt, and pasilla chile, and Cheeky Cheeky Churro is studded with cinnamon-and-sugar churro bits. Speaking of churros, this deep-fried street sweet seems to have become mainstream recently, with J&J Snack Foods offering an OREO-flavored version and Pillsbury introducing Cinnamon Sugar Churro Bites.

According to Mintel, including exotic or unfamiliar flavors in a familiar format can help increase consumers’ willingness to try a new product (Mintel 2017a). POP! Gourmet has released a Tajin-flavored potato chip featuring the classic Mexican seasoning blend, and the chips and dips category’s strong overall performance is an indication that consumers are as open as ever to small indulgences even as they try to eat fresher and more healthful food (Mintel 2017b).

Delivering Authentic Convenience

Consumers across the market are looking for solutions to help them prepare tasty and quality meals quickly and easily, and Hispanic foods are no exception. Bayless’s Frontera Foods brand, which was recently acquired by Conagra, has long provided high-quality salsas, cooking sauces, and other products intended to help home cooks re-create the authentic and exotic dishes Bayless is known for. “Foodies around the country know Rick Bayless as the premier authority on gourmet Mexican cuisine,” says Conagra CEO Sean Connolly, and most recently, the brand has expanded into frozen meals, including skillet meals and single-serve bowls (Trotter 2017).

“Most consumers in our society are pressed for time,” says La Tortilla Factory’s Tamayo, and packaged sauces and mixes help consumers quickly create something special and different without asking them to stock their whole pantry with unfamiliar ingredients they may not use again.

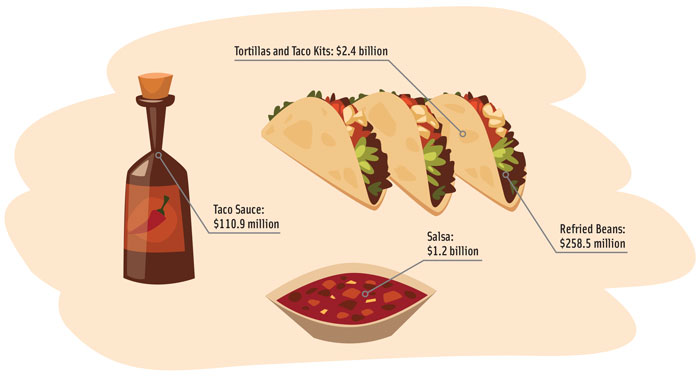

There’s no shortage of products designed to assist consumers in this task. Mexican-inspired cooking sauces and marinades accounted for $208.8 million in dollar sales over the 52-week period ending April 16, 2017, up 1.6% over last year, according to IRI. Taco sauces saw $110.9 million in sales, up 3.5%, and taco kits containing tortillas and seasoning mixes saw sales of $2.4 billion, up 2.2% over last year. These kinds of products likely appeal to consumers because they give them the tools they need to create exotic dishes at home and put their own spin on them.

There’s no shortage of products designed to assist consumers in this task. Mexican-inspired cooking sauces and marinades accounted for $208.8 million in dollar sales over the 52-week period ending April 16, 2017, up 1.6% over last year, according to IRI. Taco sauces saw $110.9 million in sales, up 3.5%, and taco kits containing tortillas and seasoning mixes saw sales of $2.4 billion, up 2.2% over last year. These kinds of products likely appeal to consumers because they give them the tools they need to create exotic dishes at home and put their own spin on them.

“Food-savvy consumers appreciate convenience, but they crave customization; it validates that they had an active role in preparation,” explains Pozole to the People founder Chris Bailey. He transformed pozole, a comforting soup traditionally created via an all-day simmering process, into a convenient heat-and-eat dish. Each variety is vegetarian, but consumers can add any meat or other toppings they desire.

While convenience was a driving force behind this product, Bailey maintains that authenticity is vital. “For many, our product serves as a window to a component of Mexican/Southwestern cooking that they didn’t realize existed. It makes the consumer feel on trend and in the know,” he says.

Authenticity and convenience also come together in Amalia’s Cocina sauces, which cofounder Jamie Norwood calls “Grandma’s authentic recipe modernized for today’s consumer.” These cooking sauces pair with store-bought rotisserie chicken to create easy tacos, enchiladas, and more and are merchandised alongside the rotisserie. Packaged Facts encourages other companies to consider creating meal kits or products like these that allow consumers to easily create speed-scratch meals that let them feel like they’ve made something sophisticated and complicated. Several companies are already providing a protein component in the refrigerated section, such as Del Real’s shredded chicken and beef, and it seems a simple proposition for manufacturers or retailers to bundle these with salsa and fresh tortillas for an easy meal solution.

Transforming for Health

Transforming for Health

As all consumers become more aware of health and wellness considerations, Hispanic foods, which have sometimes been associated with high levels of salt and fat, are also getting cleaned up, something that Packaged Facts advises all companies making Hispanic foods to consider doing (Packaged Facts 2016). “There are and there will continue to be Hispanic foods and beverages that are deemed natural, gluten-free, non-GM, and organic,” it writes. This trend of promoting all-natural products ties into that of authenticity as well, as these real-ingredient products may more closely echo traditional recipes (Packaged Facts 2016).

Chipotle recently eliminated added colors, flavors, and preservatives from all the ingredients it uses to prepare its food, including its tortillas, and there are a wealth of companies in retail focusing on the same, particularly in the chip aisle. Tortilla chips outpaced potato chips over the five-year period between 2011 and 2016 and generated $5.7 billion in sales in 2016—a 29% growth in five years—making it the fastest-growing segment in the category 2016 (Mintel 2017b).

The trend toward embracing ancient grains such as quinoa and amaranth works well in Hispanic foods, as these grains have Latin origins, and tortillas and tortilla chips are especially well-suited to these ingredients (Packaged Facts 2016), which have also been included in sprouted forms. La Tortilla Factory offers sprouted tortillas, as well as low-carb, whole wheat, and blue and purple corn, which can also boost antioxidant content. Tamayo notes that today’s consumer is more open to new varieties and textures, and the company is looking toward cassava for future innovation and working to convert all of its product lines to be non-GM.

When Veronica Garza, the founder of allergy-friendly tortilla company Siete, was diagnosed with an autoimmune disease and had to give up wheat and corn, her family helped create a line of grain-free tortillas and chips made from coconut and almond that the company says are “abuela approved”; her grandmother says these are, in fact, even better than the ones she made.

Indeed, grocery shelves are teeming with tortilla chips made with better-for-you ingredients, such as beans, lentils, chickpeas, and rice. GimMe seaweed chips also include brown rice, and Hip Chips corn and edamame chips contain 3 grams of protein per serving and 30% less fat than potato chips. RW Garcia recently launched a line of pulse chips with no additives or preservatives that deliver 2–3 grams of protein and other popular health-boosting ingredients like turmeric.

While consumers are open to trying new varieties and innovative flavors, there may be a limit to how far healthful chips can go—only 23% of consumers say they’d like to see even more chips made from unusual ingredients. Manufacturers should make sure they do not oversaturate supermarket shelves with more of these options than the market can handle (Mintel 2017b). There is opportunity, though, when it comes to the dips they pair with their chips. Half of purchasers of dips and salsas say they’d prefer more fresh options, which they tend to view as more healthful than shelf-stable (Mintel 2017b). Chips brands might consider exploring partnerships with fresh salsa makers.

Overall, the boost in cleaner, more healthful Hispanic foods can be seen across categories, from beet-flavored salsa to lard-free Texas Tamale Co. tamales to Better Bean, a line of refrigerated beans that are BPA-free, fully cooked, and digestive-friendly. In addition, Butterball recently introduced a chorizo-seasoned ground turkey product for foodservice intended to offer the flavor and heat of the traditional pork or beef sausage with half the calories, fat, and sodium, according to the company.

What’s Next

What’s Next

As part of today’s trend of embracing regional Mexican cuisine, consumers are also more open to exploring the dishes native to other Latin American countries. “Hispanic foods have traditionally been viewed through a Mexican or Southwestern lens,” writes Sprinkle, “but times are changing, and as Mexican cuisine has become more regionalized, there’s a yearning for something new, something south of south of the border. The time is right for introducing more dishes and ingredients from South American cuisine to a broader swath of consumers” (Packaged Facts 2014).

According to Troiola, Peruvian flavors will continue to heat up, and the recent opening of Cuba to Americans should only add to the palette of flavors available to formulators. Packaged Facts observes there is an opportunity for manufacturers to provide consumers who are already accepting of Hispanic foods and beverages with new taste experiences from these cultures that offer an aura of authenticity (Packaged Facts 2016). Such delicacies from around Latin America can already be seen on some store shelves, such as Tres Latin Foods Pupusas, a line of El Salvadorian gluten-free stuffed masa pockets.

As consumers metaphorically continue to cross these borders and become more familiar with the wealth of options that Hispanic cultures have to offer, it’s up to companies to take that journey with them and find ways to create products that provide authenticity, convenience, and healthfulness.

“The industry is continuing to evolve with modern flavors and consumer preferences,” says Tamayo. “It’s just the world we live in. We understand and totally respect authentic tradition and where we came from, but we’re evolving with the consumer.”

www.ift.org

Online Exclusive: Inside the New Mexican Restaurant

Read an online exclusive about what’s trending on today’s Hispanic menus at ift.org/food-technology/current-issue.

Melanie Zanoza Bartelme is associate editor of Food Technology magazine ([email protected]).

Fifty-nine percent of consumers enjoy the heat and 67% the bold flavors of Latin food (Technomic 2017), and chili peppers provide one way to offer consumers a taste of something both exotic and authentic. There are more than 200 chili varieties available globally, and about 100 of these are native to Mexico. Manufacturers and foodservice operators should spend some time exploring the nuances of these peppers and incorporate them into their dishes and products to create something special and spec…

Fifty-nine percent of consumers enjoy the heat and 67% the bold flavors of Latin food (Technomic 2017), and chili peppers provide one way to offer consumers a taste of something both exotic and authentic. There are more than 200 chili varieties available globally, and about 100 of these are native to Mexico. Manufacturers and foodservice operators should spend some time exploring the nuances of these peppers and incorporate them into their dishes and products to create something special and spec…