Total Transparency: Inviting Consumers Inside

As consumers’ demand for information about their food grows, so does the need for food companies to draw back the curtain on everything from how they source ingredients to the manufacturing processes used. Companies that embrace authentic transparency will maintain or regain consumers’ trust.

Article Content

Consumers control the food system more than ever before, and they are demanding more from it. Gone are the days when consumers might select a food item from the grocery store based on brand name alone or without looking at the ingredient list. Today, technology gives consumers access to a wealth of information, allowing them to make informed choices based on their values and desires. Unfortunately, some food manufacturers have been unable or unwilling to keep up with the ever-growing consumer demand for information. The result? Consumers no longer trust the food system. In fact, according to a global Nielsen survey, only 44% of respondents strongly or somewhat agree that they trust industrially prepared foods (Nielsen 2016).

How do food companies rebuild trust and regain market share? With 94% of consumers responding that “it is important to them that the brands and manufacturers they buy from are transparent about what is in their food and how it is made,” the solution seems pretty obvious (Label Insight 2016). The time has come for food companies to invite their customers inside so they can see for themselves how companies source ingredients, treat their employees, and everything in between. But transparency goes beyond making information accessible; it needs to be delivered in the right way, at the right time, and with authenticity. Only then will food companies gain consumers’ trust and brand loyalty.

Who Do They Trust?

Nearly two-thirds (65%) of consumers want more information about the way their food is produced, and in an age of constant connectivity, many of them are seeking out the answers online (Sullivan Higdon & Sink 2016). “An increasing number of consumers are going online as their number one source for food and agriculture information,” explains J. J. Jones, director of development, Center for Food Integrity (CFI). “Prior to 2008, CFI research demonstrated that consumers’ primary source for food system information was television—local to be precise. However, with the rise in digital communication, consumers are feeling more empowered to find the information they need to make food-related decisions for themselves and their loved ones.”

More consumers are crowdsourcing information from a variety of places, including websites, friends, and family. Armed with that information, they synthesize it with their values and beliefs to form an opinion. So when consumers can’t find the information they want from a brand or are confused by the information presented to them, their trust in that brand and food company diminishes.

To top it off, consumers don’t always trust the information they do find. There is a disconnect between the sources of information consumers trust and who they hold responsible for delivering that knowledge. According to the 2016 Label Insight Food Revolution Study, only 12% of Americans ranked food brands as their most trusted resource for information about what is in their food. Similarly, food companies are at the bottom of the list (No. 10) of who consumers trust to ensure good nutrition (CFI 2016). Instead, shoppers look to their doctors, family, dietitians, nutrition advocacy groups, and university scientists to get nutrition information they can trust. And it goes beyond lack of trust; 33% of shoppers believe food manufacturers are working against them when it comes to eating and staying healthy, while only 13% of buyers feel like food companies are working for them (FMI 2016).

The public may not trust the food industry, but they do hold it accountable: 67% believe the responsibility for providing information about food lies with the brand or manufacturer (Label Insight 2016, Figure 1). Likewise, food companies ranked No. 3 on the list of who consumers hold responsible for ensuring good nutrition, following state regulatory agencies and family (CFI 2016). This credibility gap may cause consumers to look elsewhere for information, which means brands are losing control of their messaging. It could also lead people to abandon the brand altogether for a competitor that does offer the information they are looking for. In fact, more than a third (37%) said they would be willing to switch brands if another shared more detailed product information (Label Insight 2016).

Some companies may see this desire for more information as burdensome, but it should be viewed as an opportunity. Providing product transparency presents the chance for brands to emerge as the trusted resource consumers expect, and to take back control of their messaging. What’s more, they can grow market share by attracting new customers who were previously loyal to the competition simply by providing additional product information.

The good news is that the industry is slowly improving. More than half (55%) of consumers believe the food system is moving in the right direction, compared to only 40% in 2015 (CFI 2016). In addition, even though most consumers continue to feel there’s a lack of transparency in the food industry, the perception of food companies’ transparency is on the rise—from 19% in 2012 to 34% in 2016 (Sullivan Higdon & Sink 2016). This is likely due to the food industry’s willingness to be more open about its production practices and increasing media attention and dialogue about food production.

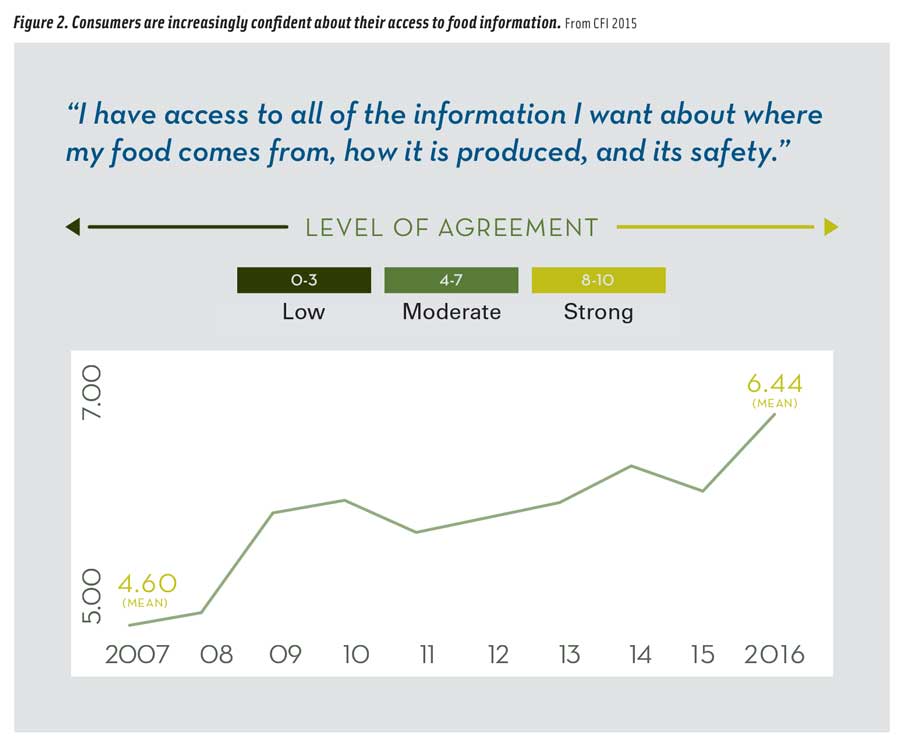

As discussions become mainstream, more people are finding the information they want. The Center for Food Integrity’s 2016 trust research reveals that 40% of U.S. consumers believed they had access to all of the information they wanted about where their food comes from, how it is produced, and its safety; their mean level of agreement with a statement about adequate access to such information has increased substantially since 2007 (Figure 2). The increasing transparency has also directly impacted trust levels. According to Sullivan Higdon & Sink’s Evolving Trust in the Food Industry report, consumers’ trust in food companies has increased by 17 percentage points from 2012 to 2016. It’s apparent that the food industry has begun to answer consumers’ cries for more information, but there’s still more to be done.

As discussions become mainstream, more people are finding the information they want. The Center for Food Integrity’s 2016 trust research reveals that 40% of U.S. consumers believed they had access to all of the information they wanted about where their food comes from, how it is produced, and its safety; their mean level of agreement with a statement about adequate access to such information has increased substantially since 2007 (Figure 2). The increasing transparency has also directly impacted trust levels. According to Sullivan Higdon & Sink’s Evolving Trust in the Food Industry report, consumers’ trust in food companies has increased by 17 percentage points from 2012 to 2016. It’s apparent that the food industry has begun to answer consumers’ cries for more information, but there’s still more to be done.

The Ingredients

Transparency seems like it should be self-explanatory, but as the industry is discovering, it can be quite elusive. Consumers have different views on what information they want from food brands and, as discussed previously, who can be trusted to share that information. Perhaps the most obvious place to start is with what goes into the food products—the ingredients.

When it comes to ingredients, a back-to-basics mindset, focused on simple ingredients and fewer artificial or processed foods, is a priority for the majority of consumers. Among the top ingredients that global shoppers say they try to avoid are artificial flavors (62%), artificial preservatives (62%), artificial colors (61%), antibiotics or hormones used in animal products (59%), and artificial sweeteners (53%). Roughly eight in 10 respondents to Nielsen’s global survey say they avoid these ingredients because they believe them to be harmful to their own or their family’s health (2016).

Food manufacturers are responding by reformulating their products to eliminate these unwanted ingredients. This “clean label” movement is often the first step toward transparency for companies. “To many consumers, simple is beautiful, and foods with a short list of recognizable ingredients resonate strongly,” says Andrew Mandzy, director of strategic health and wellness insights, Nielsen. “Savvy manufacturers are responding to this trend by modifying product portfolios by simplifying food ingredient lists and creating natural and organic alternatives to existing offerings.”

In just the past couple of years, many of the big food companies have embraced the clean label movement. For example, Mondelez is working to remove artificial flavors and colors from its brands by 2020, while General Mills and Kellogg are well on their way to doing the same for their cereals. Every week it seems like another company announces its reformulation efforts.

The Why Behind the Ingredients

Beyond this chain of public pronouncements of removal of artificial flavors, colors, and preservatives, there are other examples of companies proactively being transparent on the ingredient front. For example, Campbell Soup’s “What’s in My Food” website details the story of each ingredient and carefully explains the reason for its use. “We’re on a journey to set the standard for transparency in the food industry and the launch of whatsinmyfood.com was just the first step,” says Jeff George, vice president, Americas R&D, Campbell Soup.

The website not only discusses the ingredients it uses for flavor, texture, and color, it talks about the company’s use of genetically modified organisms (GMOs), going as far as to state, “We are comfortable using these genetically modified crops because scientists and the FDA, who have been studying genetic engineering for many years, agree that food ingredients made with these methods are safe and aren’t different from other ingredients.” Yet, at the same time, the company was one of the first to support mandatory national GMO labeling. Supporting an often vilified process such as genetic engineering while also upholding the belief that consumers deserve to know how their food is made points to a larger strategy. Campbell’s doesn’t want to just throw information at its consumers; it wants to help educate them.

“There was a day when an ingredient listing alone, especially if properly tidied up, could suffice for saying here is what is in our product,” says Rachel Cheatham, CEO and founder of Foodscape Group. “This is no longer adequate. Now, each ingredient on the label listing must have a pedigree and convincing story to tell in its own right. And the company behind that ingredient listing must tell its story of the who, how, and why about each ingredient choice.”

Hershey is doing just that. In addition to reformulating its products where possible, it debuted an extensive glossary on its website to educate consumers on all of the ingredients used across its 80+ brands and why they are used. For example, the company uses lecithin in its new Hershey’s Cookie Layer Crunch Caramel bar, and in its online glossary it explains that lecithin is a substance found in the oil component of certain plants and eggs that acts as an emulsifier to prevent ingredients from separating. It goes on to list sources of lecithin, which include soy, rice, sunflower, and eggs. In addition, Hershey’s website enables consumers to search or browse by product to discover its ingredients, why they are used, potential allergens, and nutrition information.

How Was It Made?

Transparency goes beyond ingredient information. In an age when processed foods are demonized, consumers want to know exactly how the ingredients are handled to become the product they see on the grocery store shelves. “Transparency is most powerful when the visual metaphor feels true; when consumers feel they have been allowed to truly see how companies are and how products come to be,” Hartman Group experts write in the consultancy’s recent report on transparency (2015). This goes back to the idea of inviting customers inside to see for themselves the quality, integrity, and safety behind each product.

For large companies like Hershey and Campbell Soup, which are known for their enormous portfolios of food brands, easing consumers’ minds about how a chocolate bar or chicken noodle soup is made may seem daunting. The good news is that consumers don’t expect perfection; they just expect honesty. “Consumer research showed that people felt better about a brand when it is being honest and they feel empowered to make better decisions with more information,” says George. In fact, according to the 2015 Cone Communications/Ebiquity Global CSR Study, 87% of consumers say it’s okay if a company is not perfect as long as it is honest about its efforts.

Campbell’s whatsinmyfood.com offers shoppers a peek inside how the 148-year-old company makes its soup using a four-step process: prepping, mixing, cooking, and packaging. With accompanying explanations and video clips, the website offers a simplified look at the company’s processing. It is understandable that companies might be hesitant to provide a fully detailed look at their processes and procedures in order to ensure that trade secrets are protected, but perhaps this is an area where companies can improve their transparency efforts. Consumers may not continue to be satisfied with just a glance inside.

Through a new video series, Mars Chocolate North America is offering customers a look at how it makes Dove chocolates from bean to bar. The series unveils the transformation process through the eyes of Morou Ouattara, executive chef and owner of Kora Restaurant in Virginia. The first three videos, released in October 2016, show Ouattara learning from Mars experts about the flavor profile of Dove chocolate, the use of traditional European roasting techniques, and the processing that goes into making the finished product. The video series will continue this year as Ouattara travels to Cote d’Ivoire to learn how Dove chocolate sustainably sources its cocoa beans (Mars 2016a). This video series is a great way to bring consumers into the company, showing them the process while educating them at the same time.

Sourcing and Sustainability

Sourcing and Sustainability

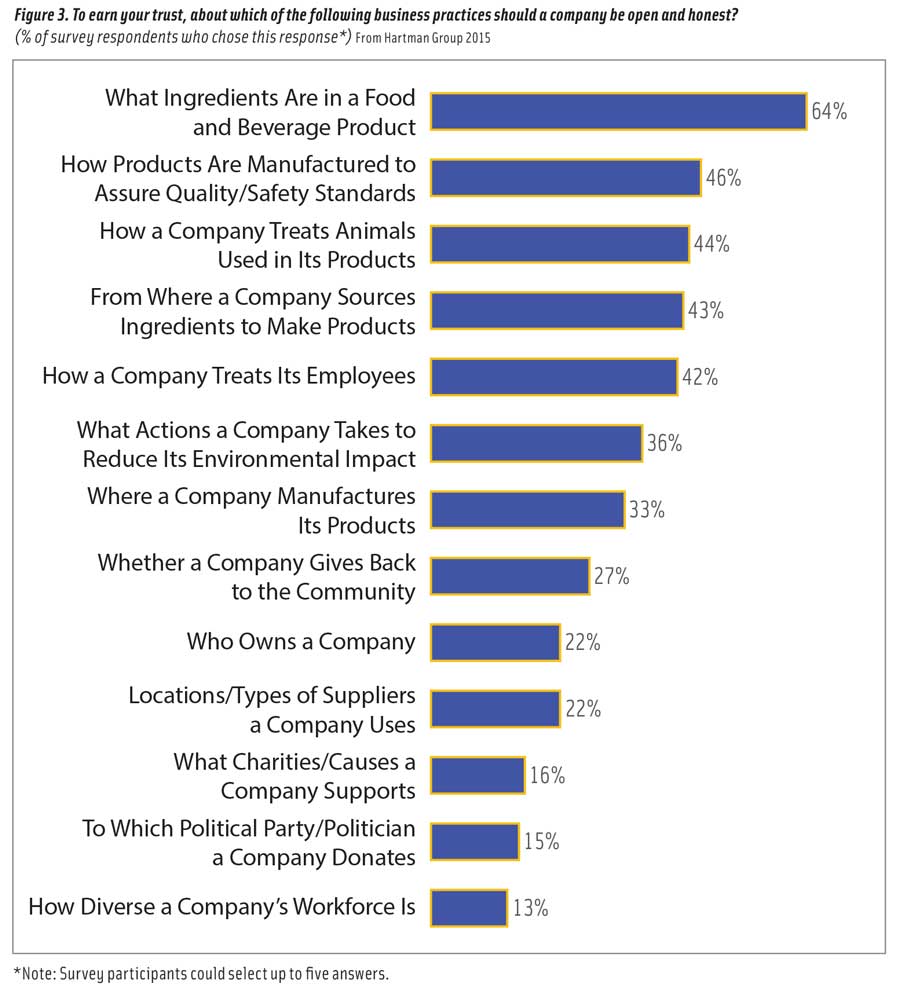

A big part of understanding how a product is made involves the question, “How are the ingredients sourced?” This is important in terms of sustainability (i.e., sustainable sourcing of cocoa beans) all the way through to overall quality and food safety. Consumers want to know where the ingredients came from and that the company is responsible to its workers, farmers, and the environment in sourcing those ingredients. According to The Hartman Group’s 2015 report—Transparency: Establishing Trust with Consumers—the top five ways companies can earn consumers’ trust is by providing information on the ingredients used, the manufacturing process, animal welfare, sourcing, and the treatment of employees (Figure 3).

Corporate Social Responsibility (CSR) initiatives have been around for a long time, but as consumers demand more information, manufacturers are realizing the need to bring their CSR efforts front and center. “Hershey has articulated clear goals for responsible sourcing for ingredients like cocoa, palm oil, and sugar, and has published positions on key issues such as animal welfare,” says Deb Arcoleo, director, product transparency, Hershey. “For example, we have a stated goal to achieve 100% certified and sustainable cocoa in all our chocolate products by 2020, and we actually met our 2016 milestone towards this goal a year early in 2015. We also have a stated goal to trace 100% of our purchases of palm oil to the plantation level by 2020, to ensure that it is deforestation free and grown and processed sustainably.”

In addition to disclosing its annual CSR report through a dedicated website, Campbell’s has also launched its Real Food Index, which is a way to track and report on its progress against the commitments it has made. This includes removing ingredients such as MSG, artificial flavors, and BPA linings from its cans, to eliminating pork from farms with gestation crates and sourcing 100% cage-free eggs. “Removing ingredients is only one part of what we call our Real Food Philosophy,” says George. “The other part is adding more benefits to our food, making our products better and more accessible to people at an affordable price.” The company is also taking steps to disclose supply chain details for its four signature ingredients: tomatoes, carrots, poultry, and wheat, as well as packaging.

Another company making strides in disclosing all aspects of its supply chain is Chicken of the Sea. In September 2016, the 100-year-old company launched a seafood digital traceability initiative, allowing customers to trace the source, processing location, and fishing method for its seafood. The program is part of SeaChange, the company’s global sustainability strategy with initiatives encompassing marine conservation, responsible sourcing and operations, caring for communities, and safe and legal labor standards.

Another company making strides in disclosing all aspects of its supply chain is Chicken of the Sea. In September 2016, the 100-year-old company launched a seafood digital traceability initiative, allowing customers to trace the source, processing location, and fishing method for its seafood. The program is part of SeaChange, the company’s global sustainability strategy with initiatives encompassing marine conservation, responsible sourcing and operations, caring for communities, and safe and legal labor standards.

By providing thorough and concrete commitments to improving sustainability and sourcing methods and then continuously reporting on the progress made, companies can show consumers that they are listening and adapting to the public’s needs and wants. “Both ‘big food’ and ‘big ag’ need to be ready to take positions and make public commitments on issues consumers care about or risk losing their business,” elucidates Arcoleo.

Communicate Authentically

None of the work that companies do to improve sourcing and to reformulate products to make them healthier will make a difference if people don’t see them as credible. “If any company sets out to be transparent, then authenticity is a must,” says Arcoleo. “Consumers’ radar is tuned for anything they perceive to be window dressing or ‘spin.’”

Some companies are lucky enough to have that authenticity baked in from the very beginning. KIND launched with eight varieties of its Fruit & Nut snack bars in 2004 and now offers nine different products, from bars and clusters to snack bites, in a variety of sweet and savory flavors. While KIND bars are priced higher than many competing snack/nutrition bars, the company had still sold more than 1 billion bars and clusters as of 2014. It could be said that much of the company’s success is due to its straightforward brand name, descriptive product names, simple ingredients, and forthright marketing style. Products like Dark Chocolate Nuts & Sea Salt contained in clear wrappers show and tell consumers exactly what they will be getting. In fact, “Ingredients You Can See & Pronounce” is the company’s trademarked promise to its customers.

Some companies are lucky enough to have that authenticity baked in from the very beginning. KIND launched with eight varieties of its Fruit & Nut snack bars in 2004 and now offers nine different products, from bars and clusters to snack bites, in a variety of sweet and savory flavors. While KIND bars are priced higher than many competing snack/nutrition bars, the company had still sold more than 1 billion bars and clusters as of 2014. It could be said that much of the company’s success is due to its straightforward brand name, descriptive product names, simple ingredients, and forthright marketing style. Products like Dark Chocolate Nuts & Sea Salt contained in clear wrappers show and tell consumers exactly what they will be getting. In fact, “Ingredients You Can See & Pronounce” is the company’s trademarked promise to its customers.

Another company taking advantage of packaging innovations to provide consumers with a transparent view of their food is McCall Farms. The company has partnered with packaging firm Sonoco to launch the TruVue clear can for its new Glory Farms slow-cooked vegetables. The TruVue can is composed of a multilayer plastic substrate that allows consumers to see the product inside. Found in the canned food aisle among a sea of traditional metal cans, the new clear cans are sure to grab shoppers’ attention and appeal to their desire to know what’s in their food (Sonoco 2016).

Another company taking advantage of packaging innovations to provide consumers with a transparent view of their food is McCall Farms. The company has partnered with packaging firm Sonoco to launch the TruVue clear can for its new Glory Farms slow-cooked vegetables. The TruVue can is composed of a multilayer plastic substrate that allows consumers to see the product inside. Found in the canned food aisle among a sea of traditional metal cans, the new clear cans are sure to grab shoppers’ attention and appeal to their desire to know what’s in their food (Sonoco 2016).

“Transparency and authenticity may be the values consumers most associate with KIND, largely because of the literal transparency of the clear wrappers we introduced into the nutrition and healthy snack bar category,” wrote Daniel Lubetzky, founder and CEO of KIND, in his book Do the KIND Thing. “But transparency is about a lot more. It relates to the authenticity that KIND conveys across every aspect of our operations.”

For example, KIND relies on Lubetzky’s original mission—spreading kindness—to drive awareness of its product. Rather than rely on direct sampling, the company distributes #kindawesome cards to reward random acts of kindness. Once a person has requested a card from howkindofyou.com, he or she can give it to someone they see doing a kind act. In turn, KIND will send the Good Samaritan a couple of bars as well as another card to pay the kindness forward.

“If used properly, #kindawesome cards are a very effective business and social tool for us,” wrote Lubetzky. “Can traditional advertising approximate the human warmth we can create by merging our business and social objectives—celebrating KIND people by letting them try our products and share KIND with others?”

Another important aspect of authenticity is being honest about successes and limitations. “We will continue to assess how to simplify our products’ ingredients wherever possible, and to inform consumers when we can’t and why,” says Hershey’s Arcoleo. “We will be fully transparent about our entire portfolio and all of our products, regardless of where they are on the journey to simplicity.”

Authenticity can also be a manufacturer owning up to the fact that the products it produces may not be the healthiest choice for a consumer to make. Don’t try to fool the public into believing that chips are “healthy” because they are low in sugar, for example. “Consumers will choose a ‘fun’ brand (say Doritos) that is authentic in just being indulgent before they choose a ‘fun’ brand that pretends to be something it isn’t,” wrote Lubetzky.

For example, Mars Food has announced it will begin labeling some of its products—such as its pasta sauces that are high in sugar, salt, and fat—as “occasional” foods. Over the next five years, the company will implement new on-pack guidance on its “occasional” food products. The new labeling will indicate how often it is recommended the products are consumed, based on how long it takes the body to restore balance after eating these meals. According to the company, the “occasional” label is reserved for foods that it suggests should be eaten only once a week (2016b). While it could be said that Mars is basically admitting that some of its products are bad for consumers, the company is also getting the chance to be transparent while controlling the language (“occasional” instead of “unhealthy”) and how it is implemented.

Make It Accessible

Half of the battle in building trust through transparency is in making sure consumers can find the information they are looking for when they want it. It doesn’t do anybody any good to reformulate products and improve sustainability if consumers don’t know about it. The product label seems like it would be the obvious first choice for providing that information to customers. And when it comes to GMOs or added sugars, this may well be the case. But given the ubiquitous use of digital communication, there is an opportunity to provide more information and engage with consumers across multiple digital channels.

Campbell’s whatsinmyfood.com is a perfect example of making more information easily accessible and understandable to consumers. “We know we have a role to play in restoring an intimate connection with people and their food,” says George. Platforms like whatsinmyfood.com are a key part of this process, he says, noting that work is also underway to strengthen Campbell’s digital marketing and e-commerce capabilities, which he describes as “other critically important ways to connect with the next generation of consumers.”

Manufacturers’ websites are a good place to start providing more information, as long as it’s easy to find, use, and understand. The Hershey website’s glossary of ingredients has been used to communicate what’s inside its products, including nutritional information, ingredients, and sourcing practices. “Knowing we could do more, and that consumers expected more, we took the lead to develop a mobile and web-based solution to bring a full suite of product information to consumers with QR codes on packaging and links to those same web pages accessible via search engines and our own sites,” says Arcoleo. “That solution is now the industry-wide SmartLabel program, and we will complete execution of SmartLabel across our product portfolio by the middle of 2018.”

Developed with the Grocery Manufacturers Association (GMA), SmartLabel includes a product’s nutritional information, ingredients, allergens, third-party certifications, social compliance programs, usage instructions, advisories and safe handling instructions, and company/brand information, along with other pertinent information. According to the GMA, more than 30 companies are cooperating in the project, and it expects to see SmartLabel on 30,000 products by the end of 2017 (2015). If consumers accept the program and find it useful, perhaps SmartLabel presents a consistent way to deliver vast product information at the point of purchase.

It’s a Two-Way Street

The impetus for change in the food industry is being driven by consumers. They show food companies what they value with their wallets, and as companies strive to meet these new expectations, it is vital that manufacturers continue to listen. “Today’s consumers do not want to be told what they should eat or whom they should trust,” says CFI’s Jones. “Rather, today’s consumers are looking for the opportunity to engage in two-way conversations to better understand a food company’s values and actions surrounding topics like food safety, impact of foods on health, animal well-being, environmental impact, etc.”

Companies need to ensure their approach to transparency is constantly evolving as consumers’ values progress. It’s important for companies to provide forums that allow customers to share their thoughts and then engage with them on a one-on-one level. In 2012, McDonald’s Canada debuted the “Our Food. Your Questions.” program to address consumers’ questions about its food. Instead of a straightforward frequently asked questions (FAQ) page, the fast-food giant took the opportunity to showcase individual questions asked via Facebook or Twitter and answer every single one, often within a few days of being asked.

“Transparency involves sharing information that transforms traditionally arm’s-length relationships into a strategic trading partnership,” said Lubetzky in his book. By inviting consumers inside, showing them the processes, and listening to what they want, companies can regain trust and, ultimately, market share. “Exaggeration and deception in the food industry have jaded many consumers,” wrote Lubetzky. “But that provides an opportunity to companies that commit to being transparent and authentic.”

Kelly Hensel is Senior Digital Editor of Food Technology magazine ([email protected]).

Latest News

How to Achieve EPR-Forward Packaging

In this two-part series, the author explores the history of Extended Producer Responsibility (EPR), what is needed to help EPR succeed, and how brands can best prepare for EPR.

Vickie Kloeris Shares NASA Experiences in New Book, Consumers Are Confused About Processed Foods’ Definition

Innovations, research, and insights in food science, product development, and consumer trends.

Top 10 Functional Food Trends: Reinventing Wellness

Consumer health challenges, mounting interest in food as medicine, and the blurring line between foods and supplements will spawn functional food and beverage opportunities.

Keeping the ESG Promise

An infographic describing food and beverage companies’ outlooks regarding ESG initiatives.

Better-for-you products on display at Natural Products Expo West

A photo overview of products shared at the 2024 Natural Products Expo West in Anaheim, Calif.