Why Gluten-Free Is Here to Stay

The category may have lost some of its luster, but ongoing strong demand continues to spur product development in diverse product segments.

Article Content

Once ballyhooed as a leading culinary and dietary trend, the gluten-free movement has lost some steam in recent years. In its 2018 culinary forecast, the National Restaurant Association (NRA) reports that 44% of surveyed chefs deem gluten-free cuisine a hot trend versus 61% in 2016 and 74% in 2013 (NRA 2018, 2016, and 2013).

“The data show that the trend is cooling off,” notes Caroline Sluyter, program director of the Oldways Whole Grains Council, citing the NRA’s statistics.

Despite the movement’s diminishing sizzle, however, demand for gluten-free products remains strong in both the foodservice and retail sectors, driven largely by consumers who voluntarily avoid or limit gluten in their diets. Indeed, the gluten-free food market is expected to reach nearly $7.6 billion in the United States by 2020 (Arcadia 2018).

Restaurants are more likely today to serve dishes identified as gluten-free. “The term ‘gluten-free’ is currently mentioned on 26% of U.S. restaurant menus, up 182% over the past four years and 10% in the past year alone,” shares Joe Garber, marketing coordinator for Datassential. “We expect the trend to continue to increase significantly for at least the next four years.”

When it comes to retail food purchases, “products labeled as gluten-free are showing up more often during in-home meal occasions,” says Darren Seifer, NPD Group’s food and beverage industry analyst.

In 2013, only about 2.5% of in-home meal occasions included a product labeled as gluten-free, according to NPD data, while the proportion rose to 9% in 2017, Seifer points out. “About 30% of people in this country say they are trying to cut down on or avoid gluten completely,” he adds. “This is interesting when you contrast how many people have a physical need to avoid gluten, which is in the single digits in terms of percentages.”

Just over 7% of the U.S. population must avoid gluten for medical reasons, including the 1% who have celiac disease, the 6% who have non-celiac gluten sensitivity, and the 0.1% who are allergic to wheat (Hensel 2015).

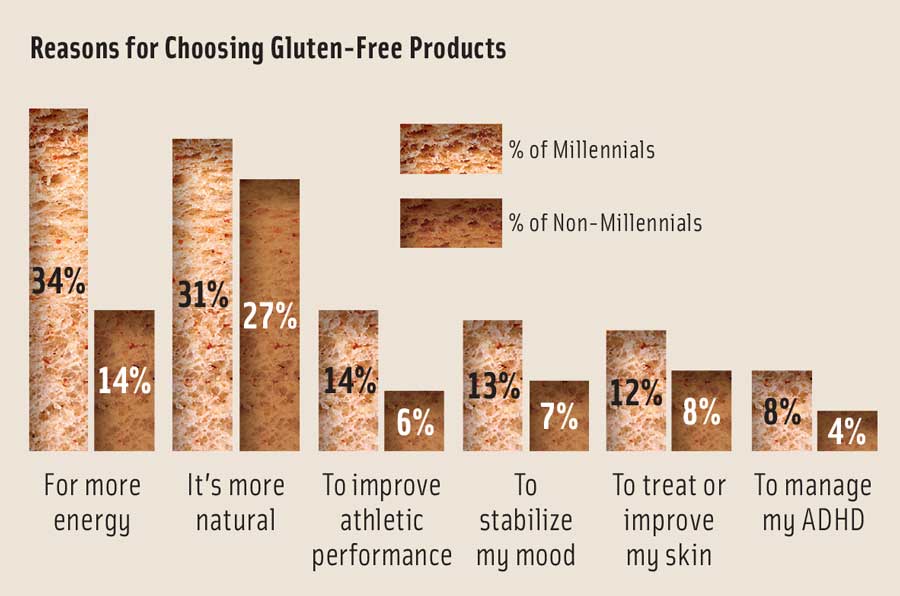

“There is a younger skew for those who are trying to avoid gluten,” Seifer says, citing NPD research indicating that consumers under the age of 55 are more likely to live in a gluten-free household than are older consumers. Mintel, in turn, stresses that Millennials more than other generations buy gluten-free products for reasons other than medical necessity (Mintel 2016).

“Avoiding gluten has become a true lifestyle choice for many Americans,” according to David Sprinkle, research director for Packaged Facts, which published Gluten-Free Foods in the U.S.—6th Edition in November 2016. “These consumers may not have a specific health-related motive necessitating the switch to gluten-free,” he stated in a press release promoting the report. “Yet for gluten-free advocates, there’s often a satisfaction from furthering one’s overall health and nutrition goals. Wellness, as they say, begins in the mind” (Packaged Facts 2016).

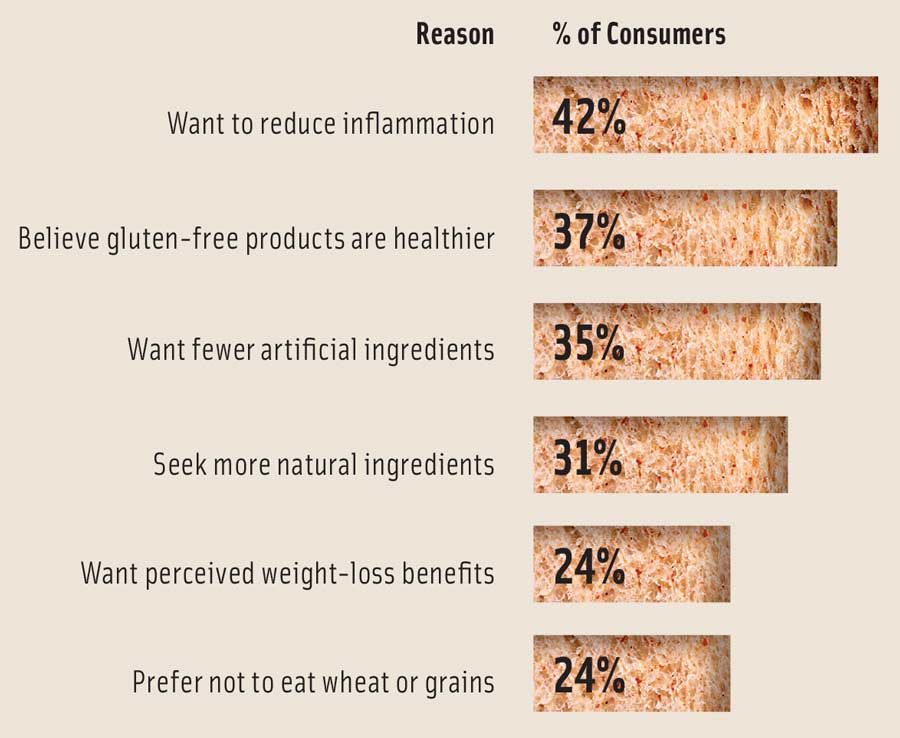

More specifically, consumers who eschew gluten as a dietary option are doing so for reasons ranging from reducing inflammation to losing weight, concluded a study by Ingredion of 1,000 U.S. and Canadian consumers (Figure 1; Ingredion 2017).

“According to our study, the typical non-celiac gluten-free consumer is an affluent, well-educated married woman who is responsible for her household’s grocery shopping,” Ingredion states in its report Going Gluten-Free By Choice (Ingredion 2017). “She always reads product labels before purchasing and is focused on bringing home food she believes to be healthy and made with natural ingredients.”

Yielding somewhat different results, a Mintel/Lightspeed study of adult consumers in the United States compared Millennials with non-Millennials on why they eat gluten-free foods if not for gluten intolerance (Mintel 2016). Reasons they cited ranged from managing ADHD to improving athletic performance

(Figure 2).

Although the late chef and television personality Anthony Bourdain disparaged such consumers as boring and ignorant (Granatstein 2016), gluten-free evangelists who voluntarily and vocally shun the predominant protein found in wheat, barley, and rye have greatly expanded the gluten-free market and spurred much product innovation. In food categories that normally contain gluten—from cookies to meatballs and crackers to pizza—manufacturers are responding with diverse gluten-free offerings that draw upon ancient and sprouted grains, pulses, and other increasingly available ingredients.

As Angela Ichwan, Ardent Mills’ senior director for research and technical solutions, observes, the gluten-free product trend is similar to the plant-based protein movement, which is fueled by flexitarians who want to reduce their animal product consumption rather than strict vegans or vegetarians. The many Millennials and other consumers who believe there are health benefits to limiting gluten have made the gluten-free market much more lucrative for food and ingredient companies and farmers to invest in. As a result of the increased research and development, those individuals who actually must restrict their gluten consumption have many more delicious and nutritious products to choose from today, Ichwan emphasizes.

Fortunately for gluten-intolerant consumers, more and more manufacturers are going through the rigorous steps to obtain gluten-free certification for their products that are labeled gluten-free. The Gluten-Free Certification Organization (GFCO), a program of the Gluten Intolerance Group, reports tremendous growth in the number of food and beverage products and manufacturing facilities undergoing the certification process. Certified products, which display a logo featuring “GF” inside a circle, meet the GFCO’s standard of 10 parts per million (ppm) or less of gluten. The U.S. Food and Drug Administration, in contrast, requires that food products that are labeled gluten-free contain no more than 20 ppm of gluten.

Robust Realms for Gluten-Free

Gluten-free has become an expectation for consumers seeking clean label products, notes Seifer, although even items that have been certified as gluten-free aren’t necessarily minimally processed with the fewest possible ingredients (to use a common definition for “clean label”). “It’s almost like ‘gluten-free’ is a checklist item now—just like ‘non-GMO,’ ‘low sugar,’ and ‘high protein,’ ” he observes.

Among food and beverage product introductions worldwide, gluten-free claims continue to rise, though not as steeply as in 2013 to 2015, reports Innova Market Insights. Between 2013 and 2017, gluten-free–labeled new products as a percentage of global food and beverage launches experienced an average annual growth rate of 24%. And in 2017, 14.5% of new food and beverage launches tracked by Innova had a gluten-free claim (Innova 2018).

Last year, the top categories for new gluten-free claims, ranked by percentage of international food and beverage launches, were baby and toddler foods (31%), cereals (25%), spreads (21%), dairy (19%), and snacks (18%), Innova points out (Innova 2018). Given the popularity of the gluten-free lifestyle among Millennials, many of whom are starting families, the relatively large proportion of gluten-free claims in the baby and toddler segment comes as no surprise. Ingredion’s 2017 survey of U.S. and Canadian consumers, however, showed a different ranking for the top categories in which voluntarily gluten-avoiding shoppers were buying products labeled as gluten-free. Crackers led this list, followed by pasta, bread, cereal, chips, baked goods, cookies, dairy, condiments, and pizza (Ingredion 2017).

In the restaurant world, gluten-free pizza has become increasingly prominent; it is currently featured on 9% of U.S. menus, up more than 200% over the past four years, according to Datassential. What is more, Datassential’s Garber notes, 15% of restaurants that have pizza on the menu offer gluten-free pizza—up from 5% in 2013 and less than 1% in 2007. In addition, gluten-free bread and gluten-free pasta are featured on 2% of U.S. menus, an increase of more than 200% compared with four years ago, Garber says.

Given Millennials’ penchant for snacking and the versatility of typical wheat-containing crackers, it’s easy to understand why so many consumers seek gluten-free options in this category. Both established companies and start-ups have responded by rolling out gluten-free cracker lines.

Given Millennials’ penchant for snacking and the versatility of typical wheat-containing crackers, it’s easy to understand why so many consumers seek gluten-free options in this category. Both established companies and start-ups have responded by rolling out gluten-free cracker lines.

Milton’s Craft Bakers, founded 20 years ago as a fat-free multigrain bread manufacturer, introduced its gluten-free cracker line in 2014. The four varieties of non-GMO–verified baked crackers include Crispy Sea Salt, Cheddar Cheese, Multi-Grain, and Everything. Depending on the flavor, these crackers include a wide range of ingredients, such as brown rice flour, corn flour, gluten-free oats, potato starch, millet, and various seeds.

Taste reigns supreme in gluten-free product development today, and it’s crucial for new lines to offer trending and unique flavors that capture modern-day consumers’ more adventurous palates, says Milton’s President and CEO John Reaves. The company’s gluten-free Everything cracker, for example, was inspired by the “everything bagel,” which is popular in Manhattan delis. Everything bagels have multiple toppings to enhance flavor, such as poppy seeds, caraway seeds, onion flakes, pretzel salt, pepper, and garlic flakes.

Many new gluten-free products leverage the popularity of authentic ethnic cuisine, especially Latin American. Leonardo Cotter, the founder of Craize Maize Crafters, drew inspiration from both Venezuela, where he grew up, and Europe as someone of Romanian descent.

Many new gluten-free products leverage the popularity of authentic ethnic cuisine, especially Latin American. Leonardo Cotter, the founder of Craize Maize Crafters, drew inspiration from both Venezuela, where he grew up, and Europe as someone of Romanian descent.

Arepa, a staple bread of Venezuela and Colombia, is a fried or baked cornbread patty made with maize flour. “The inside is soft and doughy, and the outside is really crispy,” Cotter explains, noting that the product has a very mild flavor on its own but can be combined with stronger flavors. While there are now many Venezuelan restaurants in U.S. cities that serve arepas—as sandwich filling carriers or with various toppings—Cotter saw an opportunity to create something unique: arepa crackers.

Striving to make a clean label, gluten-free product that would resonate with contemporary consumers, Cotter developed a non-GM corn flour while spending time in Italy. He later came up with a proprietary patented toasting process that allowed him to create an almost paper-thin but rigid maize crisp. The product name Craize plays off of the words “maize,” “craze,” and “craving,” he points out.

Launched in stores in April 2017, Craize Maize Thins come in six flavors: two new flavors, Guava and Coco (coconut), as well as Plantano, Roasted, Sweet, and Seeded. The crackers, which are packaged in plastic tubs to ensure crispness, are sturdy enough to hold any topping, but are also delicious eaten alone as a snack, Cotter maintains.

Farther south on the South American continent, Bolivia is home to Royal Quinoa, which contains the highest percentage of protein and essential amino acids among all quinoa varieties, according to Ingrid Hirstin Lazcano, CEO of Andean Dream, a U.S. firm that manufactures gluten-free quinoa cookies and pasta.

The wife of a now-retired Bolivian diplomat, Lazcano founded her company in 2006 as a way to help the indigenous farmers who produce Royal Quinoa and had been living in extreme poverty. “I started playing around with the quinoa in my kitchen at home, and I came up with the quinoa cookies,” she remembers. She then contracted with a group of 280 Bolivian farming families that had just received organic certification for their quinoa.

The wife of a now-retired Bolivian diplomat, Lazcano founded her company in 2006 as a way to help the indigenous farmers who produce Royal Quinoa and had been living in extreme poverty. “I started playing around with the quinoa in my kitchen at home, and I came up with the quinoa cookies,” she remembers. She then contracted with a group of 280 Bolivian farming families that had just received organic certification for their quinoa.

Today, Andean Dream produces four varieties of quinoa cookies that are allergy friendly (without dairy, eggs, soy, corn, or nuts), non-GM, and vegan as well as gluten-free and organic: Coconut, Cocoa Orange, Chocolate Chip, and the company’s latest flavor, Café Mocha. The firm also makes six varieties of quinoa pasta, including its newest product, organic elbows, plus organic fusilli, organic macaroni, organic shells, organic orzo, and organic spaghetti.

Although quinoa is an ideal ingredient nutritionally because it is naturally gluten-free and high in protein, this ancient grain can be challenging to work with, notes Lazcano. “Quinoa doesn’t have starch or gluten, so it does need a binder,” she explains. Andean Dream uses organic white rice as the binder in both its cookies and pastas.

Another challenge is removing quinoa’s saponins, a phytochemical that coats the seeds and leaves a bitter taste if not rinsed off well. “The quinoa flour that we work with has been processed and cleaned and the saponin removed as much as possible,” Lazcano says.

The effort is certainly worthwhile, however, as the market for quinoa products continues to explode. “From 2012 to 2016, sales of products containing quinoa grew 702%,” Lazcano observes.

For many entrepreneurs, gluten-free is just one market they are eyeing with their new food products. When Ashanty Williams and Lauren Feingold founded Organically Raw in 2012, they aimed to capture several dietary demographic groups with their nutrient-dense Shanti Bar: athletes and other individuals who enjoy an active lifestyle, gluten-intolerant and gluten-sensitive consumers, Paleo diet and raw food aficionados, vegans, and people who simply want to eat “clean,” minimally processed food.

For many entrepreneurs, gluten-free is just one market they are eyeing with their new food products. When Ashanty Williams and Lauren Feingold founded Organically Raw in 2012, they aimed to capture several dietary demographic groups with their nutrient-dense Shanti Bar: athletes and other individuals who enjoy an active lifestyle, gluten-intolerant and gluten-sensitive consumers, Paleo diet and raw food aficionados, vegans, and people who simply want to eat “clean,” minimally processed food.

Initially offering three items, the company now produces nine gluten-free Shanti Bar SKUs, the latest addition of which is the Recover Turmeric Bar. The other flavors range from açai to coconut, from spirulina to mulberry. The certified gluten-free products, which are manufactured using a proprietary process, contain tree nuts, seeds, dried fruit, nectar, and syrup, Feingold says.

Now a $9.8 billion category, frozen pizza saw a 0.8% sales decline overall from 2016 to 2017 (SPINS 2018). But frozen pizzas labeled gluten-free grew 14.6% in sales during that same time period to become a $259.6 million market, SPINS reports. In addition, nontraditional pizza crusts increased 6.7% in sales that year, and many of those crusts were gluten-free, according to SPINS.

Trader Joe’s has a huge fan base for its award-winning gluten-free frozen Cauliflower Pizza Crust. Cappello’s, in turn, makes frozen Naked Crust Pizza, which includes such ingredients as cage-free eggs, arrowroot flour, coconut milk, coconut flour, lemon juice, apple cider vinegar, sea salt, and raw unfiltered honey. This product also contains organic psyllium husk powder, a functional ingredient known for its high fiber content and digestion benefits.

Psyllium has been studied “for the ability to reduce inflammation and cholesterol and regulate blood sugar levels in people with diabetes,” states SPINS in its recent Natural Frozen Foods Trendwatch report (SPINS 2018). “SPINS predicts [that there will be] more functional fibers, seeds, and grains, in frozen pizzas in the future.”

New certified gluten-free products can also be found in less obvious categories, such as sauces and marinades, condiments, juices, and salad dressings. Although meat and poultry are naturally gluten-free, processed meat products from sausages to meatballs frequently contain gluten, so gluten-free options are gaining traction in this segment as well.

Butterball’s foodservice division recently debuted gluten-free turkey meatballs. The enterprise’s entire turkey product line is now gluten-free, according to Richie Jenkins, Butterball’s senior director of foodservice marketing. The meatballs, which used to incorporate bread crumbs as a binder, contain a variety of ingredients such as Romano cheese, rice flour, oregano, and rosemary extract.

Butterball’s foodservice division recently debuted gluten-free turkey meatballs. The enterprise’s entire turkey product line is now gluten-free, according to Richie Jenkins, Butterball’s senior director of foodservice marketing. The meatballs, which used to incorporate bread crumbs as a binder, contain a variety of ingredients such as Romano cheese, rice flour, oregano, and rosemary extract.

“We didn’t go in trying to find a replacement for the bread crumbs,” Jenkins notes. “We reconfigured the formulation from top to bottom to get a good binder and bite.”

Gluten and Health

While people with celiac disease can suffer severe intestinal damage and increase their risk of cardiovascular disease and other medical conditions if they consume gluten, adopting a gluten-free diet is not a healthier choice for most people, according to several recent studies.

A prospective cohort study of more than 100,000 U.S. adults without celiac disease, published in BMJ in May 2017, indicated that individuals who voluntarily minimize their gluten intake may not be consuming enough whole grains, thereby increasing their risk for coronary heart disease (BMJ 2017). In addition, a Harvard University School of Public Health study presented during an American Heart Association scientific meeting last year showed that eating less gluten may be associated with a higher risk of developing Type 2 diabetes mellitus (AHA 2017).

What’s more, research published in Consumer Reports in 2014 suggested that gluten-free versions of many food products have more calories, more sodium, and more sugar than their regular gluten-containing counterparts (Consumer Reports 2014).

“A lot of times when people switch to a gluten-free diet, they’re eating a lot of foods that are full of refined grains and other starches like tapioca starch and potato starch, which don’t have all of those associated minerals and vitamins that are so beneficial in whole grains,” comments Sluyter on the results of those studies.

People who follow a gluten-free diet should make a concerted effort to consume whole grains, Sluyter advises. When consumed with all of their bran, germ, and endosperm, the following are gluten-free whole grains, according to the Whole Grains Council: amaranth, buckwheat, corn, millet, oats (when not cross-contaminated with wheat), quinoa, rice, sorghum, teff, and wild rice.

Recognizing the importance of gluten-free whole grain flours, Ardent Mills last year established a specialty grain business unit that is cultivating North American sources for teff, quinoa, and other ancient grains, Ichwan notes. The company currently produces many gluten-free flours, such as the Eagle Mills Gluten-Free All-Purpose Multigrain Flour Blend, which includes sorghum, brown rice, corn, amaranth, quinoa, millet, and teff. This product is ideal for breads, breakfast foods, cookies and cakes, and coatings and batters, among other applications, according to Ardent Mills.

Different varieties of each ancient grain have different properties and characteristics, Ichwan says, noting that Ardent Mills can customize blends to suit any application.

Although whole grains are important, other plant-based proteins—such as lentil flour, pea flour, and chickpea flour—are viewed as “natural” and “desirable” by consumers and play an important role in enhancing the nutritional content of gluten-free food products (Ingredion 2017).

The gluten-free movement’s growth has slowed, but it is still significant, insists Ricardo Rodriguez, Ingredion’s marketing manager for confectionery and bakery. “While it’s not growing at 30% like years ago, if you look at 2016 IRI numbers (excluding potato chips and ready-to-eat popcorn, which are inherently gluten-free), the overall category grew by 16.6%,” he says.

Rodriguez believes the gluten-free trend is here to stay for the foreseeable future. “Unlike other trends, gluten-free has a core group of consumers that need to buy gluten-free,” he notes. “And as the ‘free from’ movement continues to grow among consumers, gluten-free is becoming a standard that is increasingly expected.”

Carolyn Doris Schierhorn is a freelance writer based in Wheaton, Ill. ([email protected])

Gluten, which makes up approximately 75% of the protein content of wheat, barley, and rye, can cause severe intestinal damage and increase the risk of cardiovascular events for people with celiac disease (Lebwohl 2017). Individuals with non-celiac gluten sensitivity also can suffer adverse health reactions when gluten is consumed.

Gluten, which makes up approximately 75% of the protein content of wheat, barley, and rye, can cause severe intestinal damage and increase the risk of cardiovascular events for people with celiac disease (Lebwohl 2017). Individuals with non-celiac gluten sensitivity also can suffer adverse health reactions when gluten is consumed.