Accelerating Innovation

Establishing incubators and accelerators to nurture entrepreneurial ambitions is paying off for food industry giants as well as the disruptive start-ups that they are supporting.

Article Content

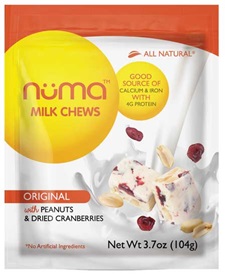

Joyce Zhu used an old family recipe to concoct a candy she calls “Asian nougats” out of egg whites, peanuts, dried cranberries, butter, and milk powder. As she was still working out initial production and distribution arrangements for Nüma Milk Chews, Zhu entered the second class of start-ups at the Land O’Lakes incubator program in Minnesota last summer.

The 24-year-old management consultant went home to New Jersey a ball of enthusiasm. “The experience and the wealth of knowledge would have been hard to surpass, both what I learned from Land O’Lakes and experienced with other members of the group,” Zhu says. “I just tried to absorb as much as possible, and it far exceeded my expectations.”

Zhu’s two-month visit within the walls of the dairy industry leader also was a surprisingly positive thing for Land O’Lakes, although Nüma is a pre-launch company.

“She’s making this unique product, and the first or second ingredient is milk powders; we in the butter business consider dried milk powders to be a commodity by-product,” says Raquel Melo, vice president of innovation and new business development for Land O’Lakes. “But she’s not burdened by that. She’s just trying to recapture this wonderful dessert that her mother made. And it’s a very authentic way to approach the marketplace. We should all be approaching it that way, but we get a little disillusioned.”

This kind of win-win scenario is popping up more frequently as legacy packaged goods companies pivot earnestly into nurturing start-up companies with various forms of incubators and accelerators that are meant to benefit both the new entrepreneurs and the consumer packaged goods (CPG) titans. General Mills, Kraft Heinz, Chobani, Coca-Cola, PepsiCo, Johnson & Johnson, and Kellogg are among the many major players that have joined Land O’Lakes in this pursuit, and new participants are being added regularly.

More than 75 food industry accelerators or incubators have been founded in the United States and Canada over the past 10 years, according to consultants A.T. Kearney. That number includes food and beverage incubator programs sponsored by non-corporate entities such as universities and industry groups including the Specialty Foods Association and the Food Marketing Institute.

The terms and even concepts are sort of interchangeable, but accelerators typically provide a set-duration program in which a cohort of selected early stage companies get access to a business development curriculum and mentor or investor network, while independent or corporate incubators give start-ups access to capital and resources on a more relaxed schedule.

“We believe the future of food is built on collaboration,” says Seth Kaufman, president of North America Nutrition for PepsiCo, which is aggressively experimenting with incubators and accelerators. “All of these efforts tie back to three critical ideas: embracing the entrepreneurial mindset, seeding future growth, and mutual mentorship.”

Of course, by now legacy packaged goods companies are overhauling nearly everything to get themselves in closer harmony with the fast-changing U.S. and global food and beverage consumer. Their relatively sudden reactions have included stripping down ingredient lists, introducing organics and plant-based alternatives, diversifying into better-for-you lines, and acquiring small companies that already have accomplished all of that.

‘Big-to-Small’ Tactics Vary

At the same time, their transformation strategies include other “big-to-small” tactics that take a longer-term view, creating potential benefits that may unfold more slowly and in less predictable ways. This part of the response spectrum involves taking minority stakes in promising small firms and start-ups, creating a corporate venture capital arm (see sidebar on page 35), working with or even launching their own small company incubator or accelerator programs, or aspects of all three approaches.

“This gives them a head start to be on the front lines of innovation,” says Dave Donnan, partner at A.T. Kearney and leader of the global food and beverage sector of its consumer products and retail practice. “These big companies can provide help to the small ones in the supply chain, distribution, and R&D. But what they’re really looking to do is to get bleed-over from the small company culture into the corporate world.”

In other words, Donnan explains, for CPG giants, the big idea behind most incubators is “cultural transfer more than technology or product transfer. In a lot of cases, it’s about getting their employees to be part of the environment to see how these companies make decisions and go to market, to see how they handle the problems they’re facing, how they raise money, how they deal with production issues. It’s less linear, more agile and adaptive.”

Melo says incubated companies “are giving us insight into the way the marketplace is evolving, the kinds of questions they’re getting from consumers, the kind of vehicles they’re using to enter the marketplace. My own personal understanding of how companies are using e-commerce to break into new marketplaces is far more advanced at this point than it was before we launched the incubator—and we have an entire department for that at Land O’Lakes.”

Johnson & Johnson’s Tom Luby says that the JLABS incubator program he heads “gets our people closer to start-ups, and there’s lots of learning both ways. People who work in our larger corporate environment can be engaged and see the world through a start-up’s perspective, and vice versa.” The company plans to open its tenth incubator worldwide in early 2019 in Shanghai.

Identifying Opportunities

Yet in addition to cultural exchange, Johnson & Johnson unapologetically treats the incubators in part as farm teams, to scout out the best investment opportunities among the small fry they’re helping. The consumer goods and pharma giant now has continuing relationships with about 80 of the 420 companies it has incubated over the past six years.

“There are no strings attached for our incubator companies, but for us the key thing is we want to find companies that are looking to be successful and are on strategy for Johnson & Johnson, and tie a string around them,” Luby explains. “For a certain subset of those, we’d like to partner with them for late-stage development and commercialization.”

“There are no strings attached for our incubator companies, but for us the key thing is we want to find companies that are looking to be successful and are on strategy for Johnson & Johnson, and tie a string around them,” Luby explains. “For a certain subset of those, we’d like to partner with them for late-stage development and commercialization.”

And while Land O’Lakes didn’t start its accelerator as “an acquisition seedling program,” Melo says, “there is opportunity for long-term partnership with the most robust ideas, and ultimately there is opportunity to bring some of these organizations into the fold or just to help them in their own growth journey and identify a mutually beneficial relationship.”

Long before they may sign a financial deal with a CPG, incubator participants typically reap huge benefits. Land O’Lakes incubator participants are “getting hands-on experience in finance and brand-building, manufacturing, sales and distribution, and leadership development,” Melo says. “Also part of what they’re gaining is a sense of the interconnected nature of those elements.” They also learn about the importance of company governance and connecting with valuable advisors.

From JLABS, Luby says, entrepreneurs receive “insight that they might not be able to get elsewhere, mentorship, investors they might not otherwise be able to meet, and access to social channels." And some entrepreneurs quickly convert their learnings into traction for their companies. The initial eight grant recipients in PepsiCo’s Nutrition Greenhouse incubator in Europe, for instance, experienced combined sales growth of more than $11 million, a fourfold increase in their revenues, over the course of the six-month program in 2016. Meanwhile, Chobani’s first two classes of incubated companies have seen a 250% increase in total average growth in distribution as well as an average 147% percent increase in quarterly revenue, the company reported. Alumni also have launched more than 30 new SKUs, and several have achieved successful rebrands.

What’s more, companies can promote the fact that they’re incubator alumni. “It might be easier to raise investment capital and get technical expertise,” says Rusty Schwartz, head of KitchenTown, an independent accelerator in San Francisco.

Accelerator participants also typically benefit in ways that are unique to their needs. For example, Health Warrior, a maker of bars and other nutrient-dense products from seeds and other ingredients, was a member of Nestlé’s first incubator cohort and quickly enlisted the company’s product development experts “in a three-day innovation sprint around Health Warrior’s new product innovation pipeline,” says Ashlee Adams, head of open innovation at Nestlé. By the end of the “sprint,” Health Warrior had a handful of new prototype products to test with consumers.

To be sure, incubators and accelerators aren’t for every CPG company, and Health Warrior is an example of why. After Nestlé advised and, arguably, helped Health Warrior as an incubator project, rival PepsiCo announced a deal in October to acquire Health Warrior—and to benefit PepsiCo at large by doing so.

This is the kind of scenario that explains why Tyson Foods, for example, has declined to set up an incubator program in favor of making equity investments in small companies via its Tyson Ventures arm and by spurring intrapreneurism with its Innovation Labs division.

“The idea of incubating a brand is to grow it into something you want to eventually own,” says Tom Mastrobuoni, chief financial officer of Tyson Ventures. “The philosophical question we run into is how much work are we really willing to put into a company in an incubator, and then a competitor comes in and swoops it up.”

With more-affirming answers to that dilemma, here are the approaches to incubating and accelerating taken by six other major CPG companies.

Kraft Heinz Takes an Aggressive Approach

The Kraft Heinz accelerator strategy is one of the most aggressive in the business. The company even has moved three major existing brands—Jell-O, Boca, and Devour—under the umbrella of its just created Springboard Brands incubator division.

Springboard wants to “nurture, scale, and accelerate growth of disruptive brands” with its incubator selections as well as by overhauling the three preexisting brands, the company says. Kraft Heinz designated four “pillars shaping the future of food” to help curate its inaugural incubator class: natural and organic, specialty and craft, health and performance, and experiential brands. From among about 200 applications, Springboard selected five start-ups for four months of a “dynamic program composed of learning, funding, infrastructure access, and mentorship” at Kraft Heinz’s headquarters in Chicago.

They include Ayoba-Yo, a two-year-old company that created a high-quality beef jerky with a 400-year-old family recipe from South Africa, and Cleveland Kraut, positioned within the burgeoning fermented foods market.

Kraft Heinz isn’t necessarily planning to invest in any of these start-ups, but it’s been learning from them already. For example, incubator members demonstrate remarkable savvy in e-commerce. “We have more to learn from them there than from other big brands,” says Sergio Eleuterio, Springboard’s general manager.

Kraft Heinz also is observing how the start-ups leverage digital, social, and experiential marketing—really all they can afford. Eleuterio says a key is unleashing the passion, expertise, and insights of the founders of start-ups on the rest of Kraft Heinz. “These people live and breathe their companies all the time,” he says.

He acknowledges that Kraft Heinz’s established brands “can’t scale the stories of individuals” to market themselves. “But I think we can use what we are learning to tell better product stories.”

JLABS Helps Solve Food Industry Challenges

JLABS participants pay rent on a sliding scale, by size, to locate for a time in one of the JLABS facilities. They have Johnson & Johnson experts as mentors, and the potential to pursue a deal with the company.

“Companies enjoy the access we provide to facilities: lots of lab space, prototyping and office space, and fully functional sites with complete operational team support and access to the expertise of the world’s largest healthcare company,” says Luby, who began helming JLABS in 2017.

After incubating hundreds of startups, Johnson & Johnson now knows how to look for “companies that will bring products forward that really make a difference in patients’ lives, not things on the margin,” he says. “We like to see companies taking riskier approaches and bigger bets.”

But there’s no requirement on either side regarding the intellectual property, research, or product having to go to Johnson & Johnson. “This was a key feature from the start,” says Luby.

One current JLABS tenant in Toronto is Tellspec, which has developed real-time food safety monitors that analyze quality, freshness, and the authenticity of products, ensuring that gluten-free products are, in fact, free of gluten, for example.

A participant in JLABS in Houston is Glycos Biotechnologies, which modifies foods to address digestion problems and malnutrition. For example, the company has developed a nutritional shake for patients going through chemotherapy who have a hard time ingesting food.

“For the future of medicine, you have to consider patients holistically, because the impact of under-nutrition is significant,” says CEO Richard Cilento. “We simulate normal digestion and restructure fundamental building blocks of food outside the body and reformulate them into nutritional formats that are palatable or that align with the condition of the patient.”

Nestlé Offers Strategic Support

In 2017, Nestlé teamed with financial services firm Rabobank as the CPG linchpin to create the Terra Food + Ag Tech Accelerator, with plans to support about 20 U.S. start-ups during two six-month programs and “develop relationships that would be supportive of eventual investment or acquisition,” explains Adams, a digital health innovation veteran who joined Nestlé USA in 2017.

Along with Health Warrior, members of the first cohort included Remedy Organics, a maker of plant-based protein beverages, and Know Brainer, a maker of “ketogenic” coffee creamers.

“We’re taking more of a partnership approach, recognizing that capital is a little easier to come by, and what we can offer brands is strategic support,” Adams says.

PepsiCo is among the CPG companies most experimental with incubators. It launched an accelerator program called Nutrition Greenhouse in the fall in North America, two years after initiating Nutrition Greenhouse in Europe.

Last summer, the company rolled out The PepsiCo Hive, a new internal operating entity with the authority to develop and accelerate small brands outside of the company as well as inside. Health Warrior will become the first investment that will “dock” into The Hive, as the company put it. In addition, in May, PepsiCo launched a partnership with The Hatchery, a not-for-profit food and beverage incubator in Chicago.

Last summer, the company rolled out The PepsiCo Hive, a new internal operating entity with the authority to develop and accelerate small brands outside of the company as well as inside. Health Warrior will become the first investment that will “dock” into The Hive, as the company put it. In addition, in May, PepsiCo launched a partnership with The Hatchery, a not-for-profit food and beverage incubator in Chicago.

“These efforts are all slightly different but very much complementary,” explains Seth Kaufman, president, PepsiCo North America Nutrition and The Hive. “The PepsiCo Hive is about enabling emerging brands to test and learn new models and move quickly. The Nutrition Greenhouse is about identifying external brands that have a lot of potential but need more resources—whether financial or expertise—to grow while exposing us to emerging trends and business models.”

The Hatchery, meanwhile, harnesses PepsiCo’s large-scale expertise for smaller-scale businesses, and PepsiCo can learn from them in the process. Linking with The Hatchery also is an interesting tactic because its nonprofit status makes the possibility of working with a giant like PepsiCo more benign in the eyes of some entrepreneurs who initially linked up with The Hatchery.

“We spend a lot of time talking with the [big CPGs] we partner with, to learn their mission and incentives,” says Natalie Shmulik, chief executive officer of The Hatchery. “If we find their intentions aren’t good, and they’re only there to observe the entrepreneurs and not connect with them or give back, we’re not interested.”

Land O’Lakes recently completed its second accelerator class of five companies, each under $5 million in annual revenues, gracing them with days of learning and $25,000 stipends each.

“It’s set up almost like a mini MBA course,” Melo explains. “We want to teach and mentor: ‘Here are all the things as small dairy entrepreneurs you might want to think about,’” Melo says. “And they’re learning.”

“It’s set up almost like a mini MBA course,” Melo explains. “We want to teach and mentor: ‘Here are all the things as small dairy entrepreneurs you might want to think about,’” Melo says. “And they’re learning.”

Land O’Lakes limits its cohorts to companies utilizing dairy as a primary ingredient—but not butter, which is the company’s own main bailiwick. The company doesn’t “spend much time internally on innovation outside the butter category,” says Patrick Aaberg, the company’s marketing director for innovation and new business development. “So we’re looking to see innovation across dairy categories. There hasn’t been as much visibility to us of dairy innovators, and we wanted to bring more visibility to us and to the broader industry.”

So Land O’Lakes brought Britton Welsh and her Beehive artisan cheese company on board the accelerator. A mentor provided by the company helped Welsh understand that intra-family dynamics within the ownership group were thwarting growth.

“So afterward we restructured our leadership team, and now we actually have a more concise, well-communicated idea of what our vision is, where we’re going and how we’ll get there,” Welsh says.

SmashPack, a maker of high-protein puddings and smoothies, was “blown away” by the Land O’Lakes accelerator program. “It was like we were in an executive MBA program specifically for a food company, which you don’t get as a young brand,” says co-founder Kari Simpson.

What’s more, SmashPack’s participation came at the same time it was in active capital raising mode. “Being involved with Land O’Lakes was an extra benefit, giving us a bit of extra validation compared with so many other start-ups out there,” says co-founder Rob Simpson.

Peter McGuinness, chief marketing and commercial officer at Chobani and a key incubator mentor, professes that its incubator is different than others “because it’s a pay-it-forward, no-strings-attached program and premise.” Chobani grants each company $25,000, free and clear.

Peter McGuinness, chief marketing and commercial officer at Chobani and a key incubator mentor, professes that its incubator is different than others “because it’s a pay-it-forward, no-strings-attached program and premise.” Chobani grants each company $25,000, free and clear.

The two-year-old incubator platform stemmed from founder Hamdi Ulukaya’s own experience as an entrepreneur. “He wants to share lessons and mistakes and good things about his journey with fellow entrepreneurs, so maybe they can accelerate faster than Chobani did and make fewer mistakes.”

And, McGuinness says, “We’re not developing an incubator so that we can take an equity stake in companies and offset declines in our core business like some other big companies are.&rdquo

Would-be enrollees must be a “natural food company that wants to sell products to the masses” and apply with a video about themselves and their operation. Chobani has received 2,500 applications and has accelerated a total of 30 companies in four classes, each with a four- to six-month program. They cover every part of the supermarket “except yogurt,” McGuinness says.

Indeed, Chobani incubator alumni include Misfit Foods, a start-up that makes juice and other foods from produce that otherwise would go to waste, and Wildway, a maker of grain-free granolas.

Some CPG companies are more ad hoc about their incubation efforts, leveraging relationships with existing accelerators that have been in the arena for a while instead of starting their own programs.

Barilla pays an annual scouting fee to KitchenTown to “find projects and companies, and then maybe help them build relationships and get pilot projects going,” Schwartz explains. Through that relationship, for example, the pasta giant recently became an investor in ReGrained, a start-up that “rescues” grain after it’s processed in brewing and repurposes it into flour for its nutrition bars.

The CPGs are learning on the fly how to run a successful incubator. For example, for the second cohort of the Terra program, Nestlé shifted from its initial focus on just small CPG consumer brands to a broader interest in start-ups that work “earlier in the value chain,” Adams says. “Maybe there are digital technologies or an ingredient or a new packaging material. How can we support these companies [that work] at the functional level instead of just a brand?”

At the same time, Nestlé also decided to select companies that were a bit larger than its first Terra classes—start-ups that already were in the $5 million to $20 million range in annual revenues. “These are the companies that have the ability to scale that could take better advantage of some of the support by Nestlé,” Adams says.

For Land O’Lakes, one early lesson was to realize “that we don’t have to be quite so scripted,” Melo says. “We had a number of phenomenal outside speakers for the first class; we didn’t trust ourselves so much that we could deliver the goods. But now we’re realizing that at the teaching and mentorship level, what we have in house is good enough to help get these start-ups learning.

“And even for mentors who are internal, we’re finding that we don’t have to go quite so high in the senior ranks; you don’t need to have a fancy supply-chain mentor. In fact, folks who are at manager or director level have more time to give, and that’s where the deep value exists for these entrepreneurs.”

In any event, says Donnan of A.T. Kearney, CPGs shouldn’t treat incubators and accelerators half-heartedly. “This has got to be part of your business model,” he says. “It’s got to be part of R&D, your innovation cycle, and your corporate culture, or within two or three years most of these will be disbanded.”

The seriousness of most CPGs about such programs is reflected partly in the fact that some start-ups are qualifying for multiple incubator opportunities. “The power in the marketplace is with brands, and they have a lot of opportunities now for partnerships and capital,” says Adams of Nestlé.

Still, mammoth corporations hold the overall upper hand in these relationships. Legacy CPGs “are getting beat up by these start-up companies, and with incubators they’re able to see what is coming,” says Schwartz. “They’re able to see hundreds and hundreds of applications and new projects. They only engage with a few of them. But no doubt they’re going to use all of that information in their messaging, in their packaging—across the board.”

Dale Buss is a freelance writer based in Rochester Hills, Mich. ([email protected]).

IFTNEXT content is made possible through the generous support of Ingredion, the IFTNEXT Platinum Content Sponsor.

Irina Turcan was a 30-year-old investment banker in the United Kingdom, for instance, when she launched Erbology more than two years ago, resuscitating dormant Western interest in forgotten plant ingredients such as milk thistle, amaranth, and Jerusalem artichoke and turning them into oils, powders, and juices.

Irina Turcan was a 30-year-old investment banker in the United Kingdom, for instance, when she launched Erbology more than two years ago, resuscitating dormant Western interest in forgotten plant ingredients such as milk thistle, amaranth, and Jerusalem artichoke and turning them into oils, powders, and juices.