Why Cannabis Edibles Are Creating a Buzz

The ongoing legalization of cannabis, coupled with growing interest in the recreational and functional properties of infused edibles, has some food and beverage companies dashing to the drawing board to create new products that fill a growing niche while navigating complex regulatory and safety issues.

Article Content

The Times They Are a-Changin,” Bob Dylan’s 1964 anthem, could easily be the theme song for the budding cannabis edibles industry, which has gone from nearly nonexistent to a bona fide food and beverage category in the space of only a few years. Research from Technavio (2018) shows that the global market for cannabis edibles products, valued at $8.4 billion in 2017, is on track to register a compound annual growth rate of more than 25% between 2018 and 2022, to reach $25.7 billion. Holding the largest market share in 2017 was the food segment, which accounted for more than 60% of the market and is expected to increase by an additional 4% to maintain its domination through 2022.

As more consumers dip their toes into the world of infused edibles, awareness of the potential cannabis holds as a recreational and functional food ingredient has grown considerably. Among 1,000 U.S. and 1,000 Canadian consumers recently surveyed by A. T. Kearney (2018), 79% have used, or know someone who has used, cannabis in some form. In addition, more than half of respondents indicated they would try recreational cannabis if or when it becomes legal.

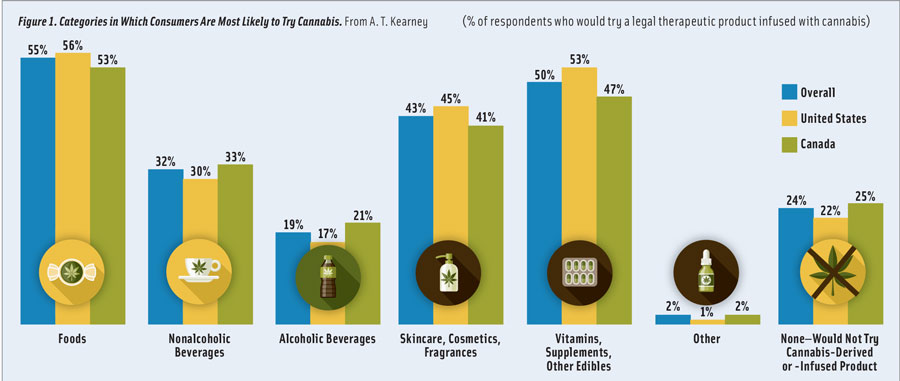

“Of the survey respondents who said they’d be willing to try a product infused with cannabis, 55% said they would be willing to try a food product, such as snacks, candy, or packaged food; 32% said they’d be willing to try it in a nonalcoholic beverage; and 19% said they’d be willing to try it in an alcoholic beverage,” says Randy Burt, partner in A. T. Kearney’s consumer products and retail practice. When asked whether they believed that products derived from or containing cannabis could offer wellness or therapeutic benefits, 79% of respondents strongly agreed or agreed, a perception, believes Burt, that can translate into marketing opportunity.

In 2017, the Specialty Food Association predicted that cannabis would be among the top 10 food trends of 2018. Since then, a multitude of startup companies, as well as major food and beverage companies such as Molson Coors and Heineken, have begun exploring opportunities to launch new cannabinoid-infused products in locations in which it is legal. Currently, 33 states have legalized cannabis for medical use, and 10 states, as well as Washington, D.C., have legalized recreational cannabis for adults over the age of 21. However, laws governing the sale of edibles differ from state to state.

According to research from BDS Analytics (2018), an estimated $1 billion was spent in 2017 on cannabis-infused food and drink in the United States and Canada, the majority of which fell into the candy and chocolate categories. The company estimates that cannabis-based food and beverage spending in the United States and Canada will total $1.5 billion for 2018, with sales on track to reach more than $4.1 billion by 2022. Although the Canadian government legalized cannabis on a national basis in October of 2018, edibles are not expected to be legalized for recreational use until sometime after July of 2019, with provincial regulations differing according to individual policies, standards, and regulatory structures.

The ABCs of CBD and THC

Edibles are defined as food or beverage products that have been infused with cannabis extract. Baked foods, candies, chocolates, wine, and tea are a few examples. Although cannabis has more than 100 chemical compounds, called cannabinoids, the two used in edibles are cannabidiol (CBD), which is not psychoactive, and tetrahydrocannabinol (THC), which is.

Currently about 20% of Americans have legal access at the state level to products with both compounds. Although the recent passage of the 2018 Farm Bill removed hemp, defined as Cannabis sativa L. and derivatives of cannabis with extremely low concentrations of THC, from the Controlled Substances Act, it remains unlawful under the Federal Food, Drug and Cosmetic Act to introduce food containing added CBD or THC into interstate commerce.

In states where cannabis is legal, companies are investigating an array of consumer niches in their quest to develop new products. “We strongly believe that cannabinoids—especially nonpsychoactive cannabinoids like CBD—will become a new category of functional ingredients alongside probiotics and omega-3s,” says Keith Woelfel, research and development and supply director at Stillwater Brands, a company specializing in the processing, manufacturing, and distribution of soluble cannabinoid-infused consumer packaged goods and commercial ingredients.

Although research is currently limited, cannabinoids show promise toward ameliorating a wide range of common ailments safely and naturally, believes Woelfel. “With such broad applicability, it’s no wonder that CBD and THC have begun to fill the void between pharmaceuticals and homeopathy,” he says. “To name just one specific area of interest, we’ve already seen an influx of current and former athletes turning to CBD-enriched edibles for everything from endurance to recovery. And boomers are beginning to consume THC- and CBD-infused edibles for relief from everyday pain and insomnia. These are non-toxic bioactives with as much promise as any compound to hit the market in a generation. Though we have much to learn, the potential is undeniable.”

One of the challenges in formulating new products, especially those marketed for their functional benefits, is ensuring the proper dosage of CBD and THC. “For products that feature THC, dose control is very much a matter of consumer safety,” notes Woelfel. “Dosing THC accurately is as difficult as it is important. Homogeneous mixing and rigorous QC testing are absolutely essential. For most consumers, the difference between 5 mg and 10 mg is the difference between feeling better and feeling useless. There is very little room for error, so developing and adhering to rigorous SOPs is of the utmost importance.”

With CBD-infused products, dosing accuracy is less about safety than trust, explains Woelfel. “According to the World Health Organization’s Expert Committee on Drug Dependence (2018),” he says, “CBD ‘exhibits no effects indicative of any abuse or dependence potential’ and ‘is generally well tolerated with a good safety profile’ so a little extra CBD won’t hurt (though a little less will certainly lead to a negative brand experience). This is a new industry, and brands can’t afford to sell consumers on a bill of goods they can’t deliver.”

Another challenge that occurs as consumers try edibles for the first time is educating them about how long it will take for their body to digest and metabolize the food or beverage. Because edibles are absorbed through the digestive system and processed by the liver, it can take anywhere from 30 minutes to several hours for the consumer to feel the effects.

“A user must be prepared to wait until their body metabolizes the ingested cannabis,” says Carol Culhane, president of International Food Focus, a business development firm specializing in regulatory compliance services and market assessments for the food and allied industries. “There are several documented cases in which users of cannabis mistook this lag as inefficacity of the ingested cannabis and subsequently consumed additional cannabis, which resulted in unintended negative effects. Caution must accompany each and every ingestion of edible cannabis.”

“Educating consumers, particularly new consumers, can be a challenge,” says Scott Riefler, vice president of science at Tarukino, a company that provides materials development and edible product forms within the cannabis space. “We put a heavy investment into our brand ambassadors, who educate and train the dispensary staff known as budtenders. The budtenders are the interface between the consumers and products. These are professionals who guide consumers to specific products and product forms, similar to seeking guidance from a sommelier when selecting a wine.”

Nancy Whiteman, founder and CEO of edibles company Wana Brands, sees effective partnerships as essential when it comes to educating consumers. “In terms of education challenges, cannabis-infused products companies such as Wana can provide educational support, but are dependent on their supply chain of local license partners and dispensaries to educate the consumer,” she explains.

“Cannabis brands have to remain hands-on in the new markets they are entering to ensure quality and consistency,” she adds. “With the growth of the infused product industry and more brands entering the marketplace every day, budtender education is essential. Dispensary budtenders are our industry gatekeepers, so providing them with in-depth training on our products and how they work in the body enables sales associates to provide consumers with accurate and appropriate recommendations, ensuring consumers have the best possible experience when they leave the store. This also helps to ensure the brand’s message is being translated accurately at the point of sale.”

A New Frontier

With consumers’ curiosity about cannabis-infused products on the rise, food and beverage companies have an opportunity to explore and define an entirely new category. Manufacturers and retailers, says Burt, “are scrambling to calculate the impact on their businesses and whether or not they should engage with a broad range of goods that, up until a few years ago, were controversial.”

Currently, a great deal of new product development is originating with smaller companies, which have the nimbleness, flexibility, technical know-how, and creativity to experiment and lead the way. And one of the fastest-growing product categories is beverages, which, according to Riefler, “are exploding as a delivery platform. We are seeing terrific innovation across almost all types and forms, marrying cannabinoids with the full array of beverage options, both in ready-to-drink (RTD) and reconstituted powdered forms.”

Among the areas in which Riefler sees significant activity are lightly to fully flavored carbonated waters, barley sodas (nonalcoholic beer analogs), recovery drinks (vitamin or electrolyte fortification) as well as tea- and coffee-based platforms. “Powder forms for reconstituted beverages are growing as well,” he says, “with the expected forms: protein or meal replacements through flavored powders to add to a water bottle.”

Among the popular products produced by Stillwater Brands are organic teas and Colombian coffee, which are paired with 10 mg of CBD and 0.5 mg THC per individual tea stick or coffee packet to deliver “relaxation without intoxication.” Mellow Mint Tea is marketed as being great for “decompressing after a long day,” while Gentle Green Tea, which also contains 50 mg of caffeine, is billed as appropriate for “Pitch Perfect screenings, bullet journaling, working, and ‘working.’” Clockwork Coffee, which contains 100 mg of caffeine, promotes “more wakey, less shakey mornings, noons, and nights.”

Among the popular products produced by Stillwater Brands are organic teas and Colombian coffee, which are paired with 10 mg of CBD and 0.5 mg THC per individual tea stick or coffee packet to deliver “relaxation without intoxication.” Mellow Mint Tea is marketed as being great for “decompressing after a long day,” while Gentle Green Tea, which also contains 50 mg of caffeine, is billed as appropriate for “Pitch Perfect screenings, bullet journaling, working, and ‘working.’” Clockwork Coffee, which contains 100 mg of caffeine, promotes “more wakey, less shakey mornings, noons, and nights.”

In California, House of Saka recently launched the world’s first luxury line of cannabis-infused, alcohol-removed wines from Napa Valley, including Sparkling Brut Rosé and still Rosé wines blended with a proprietary formulation of tasteless, odorless water-soluble ratio of THC and CBD derived from organic craft cannabis.

House of Saka’s CEO, Tracey Mason, believes that cannabis-infused products represent the future in adult beverages, especially when paired with other clean ingredients. “We’re passionate about being as clean and green as possible,” she says. “It’s at the center of our luxury positioning. That’s why our base wine is made from grapes grown from a single vineyard in Napa Valley, and our cannabis infusion is derived from the highest-rated, green-certified soil-to-oil producer in the country. Our infused wines boast a fraction of the calories of standard wines and are alcohol-free.”

House of Saka’s CEO, Tracey Mason, believes that cannabis-infused products represent the future in adult beverages, especially when paired with other clean ingredients. “We’re passionate about being as clean and green as possible,” she says. “It’s at the center of our luxury positioning. That’s why our base wine is made from grapes grown from a single vineyard in Napa Valley, and our cannabis infusion is derived from the highest-rated, green-certified soil-to-oil producer in the country. Our infused wines boast a fraction of the calories of standard wines and are alcohol-free.”

Although many cannabis-infused spirits are formulated without alcohol, Humboldt Distillery’s award-winning vodka is crafted from a food-grade hemp, without any detectable THC. Humboldt’s Finest, which features an herbal character, won a Double-Gold Medal at the San Francisco World Spirits Competition and, according to the company, has been a growing favorite among bartenders at restaurants and bars that feature innovative cocktails.

Although many cannabis-infused spirits are formulated without alcohol, Humboldt Distillery’s award-winning vodka is crafted from a food-grade hemp, without any detectable THC. Humboldt’s Finest, which features an herbal character, won a Double-Gold Medal at the San Francisco World Spirits Competition and, according to the company, has been a growing favorite among bartenders at restaurants and bars that feature innovative cocktails.

At the 2018 Beverage Digest Awards, mood33, a California-based cannabis-infused beverage brand, won in the Best Premium Drink and Best New Drink Concept categories, the first time that a cannabis beverage was granted an award. The sparkling tonics come in three formulations and are marketed as social, wellness-focused products, with naturally derived ingredients and mood-enhancing terpenes, or essential oils extracted from the cannabis plant.

Joy, made from an infusion of yerba mate leaves, peppermint, and dried lemon peel, contains 10 mg of THC per 12-ounce bottle to promote “positivity, happiness, and elation,” according to the company. Passion boasts flavors of sparkling green tea, sweet passion fruit, and tart lime, and is formulated with 10 mg of THC and 2.5 mg of CBD for “radiance, enthusiasm, and desire.” Calm, made from dried chamomile buds, rose hibiscus flowers, and ripe raspberries, is boosted with 10 mg of THC and 5 mg of CBD to bring “harmony, contentment, and peace of mind.”

Joy, made from an infusion of yerba mate leaves, peppermint, and dried lemon peel, contains 10 mg of THC per 12-ounce bottle to promote “positivity, happiness, and elation,” according to the company. Passion boasts flavors of sparkling green tea, sweet passion fruit, and tart lime, and is formulated with 10 mg of THC and 2.5 mg of CBD for “radiance, enthusiasm, and desire.” Calm, made from dried chamomile buds, rose hibiscus flowers, and ripe raspberries, is boosted with 10 mg of THC and 5 mg of CBD to bring “harmony, contentment, and peace of mind.”

In addition to the profusion of new beverages being launched by entrepreneurial startups, major players, including Constellation Brands, Molson Coors, and Anheuser Busch InBev, are testing the waters through strategic partnerships with cannabis growers and distributors. Among the areas ripe for investigation is the use of CBD, in both alcoholic and nonalcoholic beverages. “This nonpsychotropic cannabinoid,” notes Riefler, “is associated with anti-anxiety, calming, and anti-inflammatory effects and represents a major growth arena, both when combined with THC or used alone.”

Mood Food

Alongside beverage innovations are new developments in CBD- and THC-infused edibles, including gummies, chocolates, baked goods, snacks, and even jerky. When participants in A. T. Kearney’s survey were asked if they would be likely to try a legal therapeutic product infused with cannabis, 76% said they would, with the majority choosing food as their preferred method of consumption (Figure 1).

“Our No. 1 product by far is our Wana Sour Gummies,” says Whiteman, who finds that customers are consuming the gummies to enhance their lives. “This might mean popping a gummie and going for a hike or doing yoga,” she says. “It may mean going to a concert or even cleaning the house. But we also hear that our consumers are consuming Wana gummies to treat symptoms such as insomnia, anxiety, and pain. Because we have a range of THC/CBD ratio options, users have many options for symptom relief without high levels of intoxication.”

Colorado-based Weller, a startup focused on CBD-infused food and beverages, recently debuted its first product, CBD Coconut Bites, which are available in Dark Chocolate, Caramel, and Original flavors. Each five-bite serving contains 25 mg of CBD from hemp extract and delivers a lightly sweet taste coupled with a crispy crunch. Cofounder Matt Oscamou, part of Weller’s team of athletes, engineers, foodies, and yogis, says the company is “all about enabling people to be the best version of themselves and snack into wellness by delivering the natural benefits of hemp CBD through convenient, trusted products that people love.”

Colorado-based Weller, a startup focused on CBD-infused food and beverages, recently debuted its first product, CBD Coconut Bites, which are available in Dark Chocolate, Caramel, and Original flavors. Each five-bite serving contains 25 mg of CBD from hemp extract and delivers a lightly sweet taste coupled with a crispy crunch. Cofounder Matt Oscamou, part of Weller’s team of athletes, engineers, foodies, and yogis, says the company is “all about enabling people to be the best version of themselves and snack into wellness by delivering the natural benefits of hemp CBD through convenient, trusted products that people love.”

Another new entry in the infused edibles category is Body and Mind’s THC Infused Beef Jerky, crafted, according to the company, from “a premium distillate, which is used to infuse the various flavors of beef jerky with an accurate, measured dosage of about 10 mg of THC per piece of jerky.” Offered in Pepper, Teriyaki, and Sriracha flavors, the jerky is available at dispensaries in Nevada.

“We believe edibles will continue to outperform the combustibles sector, which is already growing at a 23% to 27% cumulative annual growth rate,” says Riefler. “This high growth rate will be amplified by edibles containing CBD. This is a very exciting new, rapidly expanding and nonparasitic arena for food science and scientists. Initially the space was filled with entrepreneurs, who often purchased pallets of brownie mixes at big box stores, stirring in actives and reselling. We are now seeing a migration of food scientists into this space, bringing their product development and food safety skills to bear. Product safety, quality, and range are benefiting greatly.”

Sorting Out Health and Safety Claims

There’s no question that cannabis-infused foods are going mainstream and that consumer interest is being piqued in large part because of cannabinoids’ association with health and wellness. However, as Culhane points out, “There are no clinical studies which validate a role for edible cannabis in sustaining good health. There are no clinical studies which validate a therapeutic role for edible cannabis.”

“When it comes to cannabis products, perception seems to have become the new market reality,” observes Burt, who notes that 78% of respondents to A. T. Kearney’s survey agreed or strongly agreed that products derived from cannabis or containing cannabis can offer wellness or therapeutic benefits.

“Consumers are curious about the potential health benefits that might be offered by cannabis products, especially edibles,” agrees Linda Gilbert, founder and CEO of EcoFocus Worldwide. “Smoking or inhaling does not make sense for many consumers as a delivery means when health is the objective—so edibles are the healthier choice. Consumers are also curious about the variety of experiences offered by different strains and compositions of cannabinoids, from creative energy to relaxation and sleep.

“Many also have trepidations about becoming too inebriated or even incapacitated,” she adds, which is why individuals wary of the psychoactive effects of THC are finding functional foods and beverages containing CBD to be a more appealing way to test the effects of cannabinoids. Whether seeking a recreational experience or a wellness product, the bottom line for consumers, says Gilbert, “is sorting out what is ‘right for me.’ And that is leading to a great deal of curiosity and confusion.”

“Ensuring that customers get the right product for their needs is really, really hard,” says Woelfel. “That’s why, as a company, we focus our energy on consistency: if one of our products has a certain effect for you today, it’s likely to have the same effect for you tomorrow. To accomplish that, we take a quantitative approach to everything we do. It’s not enough to eyeball a batch and say, ‘Yeah, looks like the last one.’ We measure everything we can about every batch, right down to the sizes of the molecules within our mixtures. We only use distilled cannabinoids because it removes strain variance from the process. Everywhere we can stamp out variance, we do.”

As for communicating these measures to consumers, Woelfel admits that it’s a challenge. “Consumers are used to buying regulated products. They’ve developed the habit of believing labels. In general, that’s a good thing. Food safety and bioactive efficacy are complex topics, and it’s unreasonable to put the onus on consumers to understand them. So we just hammer on our core values—consistency and reliability—again and again. As consumers get more educated, they start to get it.”

At Wana, safety starts with adherence to Good Manufacturing Practices. “Our products are tested at third-party labs to ensure that they are free of contaminants, residual solvents from extraction, and pesticides,” says Whiteman. “They are also tested for potency to ensure that consumers know exactly what they are getting in their dosage. Next, the packaging and labeling needs to support safety. In Colorado, we are required to use child-resistant, reclosable packaging for products that have more than one serving, and there are many labeling requirements. We also must individually stamp or mark each edible with a universal THC symbol so that consumers know that it is a cannabis-infused product.”

Kicking It Up a Notch

Safety and innovation go hand in hand when formulating edibles, which is why a strong consumer focus must include potency, product uniformity, and experience consistency. “In years past, edibles were notorious for unpredictable lift-off times, extremely long experiences, which often would last until sleep or into the next day,” says Riefler. “More than anything else, consumers of edibles are seeking short and repeatable lift-off times coupled with specific half-lives, meaning predictable length of experience. Additionally, consumers require edibles where active CBD or THC is uniformly dispersed in the food or beverage, making the first sip/bite the same as the last.”

In addition to safety and predictability, consumers are seeking a great sensory and culinary experience, adds Riefler, which is why much innovation is occurring at the ingredient level. “Cannabinoid extracts are notoriously bitter oils and are difficult to work with due to their tar-like nature,” he explains. “This creates significant sensory and uniformity challenges for the edibles sector. Advances in converting these oils into a water miscible and flavor-free platform, such as our SōRSE [emulsion] technology, transforms them into a ubiquitous ingredient where one no longer needs to mask the intense bitter flavor notes or worry about product uniformity. As flavor masking is no longer necessary, this opens up a range of product categories, including low- to no-sugar, lightly flavored, or even flavor-free beverages. This permits the product developer to focus on the development of the food or beverage system.”

Another trend on the rise is products containing low or micro-dose levels of THC (5 mg or less). “When edibles first appeared on the scene, there was a focus on ‘bang for the buck’ or high potency,” says Riefler. “As the markets mature, we see significant growth in first-time consumers. Many of these new consumers have never smoked anything and prefer a smoke-free delivery such as edibles. Additionally, many of these folks are seeking mild experiences analogous to a weak cocktail or beer and wine, something they can consume all afternoon in a social setting, at a party or barbecue, for example.”

Along with prospects for innovation come numerous challenges. Woelfel points to the need for greater traceability, along with standardized QC policies and procedures. Underdeveloped regulatory systems surrounding testing are also problematic. “Lab testing standards and oversight are in their infancy, with little agreement as to extraction/sample prep methodology, methods of detection, and detection limits,” he says. “The presence of heavy metals is generally tolerated, and micro requirements are not fully thought through or enforced. Controls around adulteration, foreign materials, and allergens are left up to the manufacturers, too many of whom are more interested in pushing product than building and adhering to a culture of safety.

“Finally, there’s the uncertainty surrounding labeling claims and ingredient transparency,” he says. “As just one example, a number of manufacturers are labeling emulsifiers as natural flavors rather than calling them out on the label. Health claims are often made recklessly, and allergen claims are often made without commensurate certifications. It’s all very nascent and very in need of further development and enforcement.”

Irregular Regulations

For manufacturers that operate in multiple states, challenges are compounded. Take Wana, whose products are currently available in Colorado, Oregon, Nevada, and Arizona, and are onboarding in Illinois, Michigan, and Florida. “Since cannabis is still federally illegal, product cannot cross state lines and must be manufactured locally with cannabis that is grown in the local state,” says Whiteman. “Additionally, every single state has different regulations on dosage and what delivery systems are permissible—for example, Colorado allows 10 mg of THC for a single-serving dose, while Oregon’s single-serving limit is 5 mg.

“Wana’s most popular product is our consistent and potent gummies, but Florida won’t allow gummies as a delivery system yet, so in the Sunshine State, Wana’s offerings will include our extended-release capsule, WanaCapsXR,” she explains. “Each state has its own regulations on packaging, requiring each state to have different packaging. Each state is a local initiative, with care to remain compliant while delivering an effective product. This means there’s no way to have one central location to produce products, packaging, or collateral. Everything is multiplied by the number of markets you serve.”

“Wana’s most popular product is our consistent and potent gummies, but Florida won’t allow gummies as a delivery system yet, so in the Sunshine State, Wana’s offerings will include our extended-release capsule, WanaCapsXR,” she explains. “Each state has its own regulations on packaging, requiring each state to have different packaging. Each state is a local initiative, with care to remain compliant while delivering an effective product. This means there’s no way to have one central location to produce products, packaging, or collateral. Everything is multiplied by the number of markets you serve.”

Despite regulatory, safety, and formulation challenges, manufacturers who are committed to a high standard of excellence and can provide a consistent experience stand to gain a loyal customer base. “Successful brands will do their homework to segment target consumers; understand the occasions, situations, and need states to identify where consumers see a fit for infused foods and beverages from the category and brand points of view; and develop the science to reliably deliver desired benefits,” says Gilbert, who expects that virtually every category of food and beverage will be impacted by cannabis edibles.

“We’re already building out a robust business on the CBD side of the market via Stillwater Ingredients to sell standardized, clean label forms of soluble CBD to functional food and beverage manufacturers across the country,” says Woelfel. “We’ve invested heavily in quantitating quality, consistency, and stability because we understand that good manufacturers don’t play games with consumer safety or brand integrity.”

At Saka Wines, Mason says she and her R&D team are actively investigating “reactivity and interactivity—environmental and physical reactivity—things like UV light, temperature, packaging materials, etc., and internal interactions with other pharmaceutical products and the like.

“The future for infused products is unlimited at this stage,” she believes, “and we’re beyond excited about it. But at House of Saka, we believe that, as an industry, our long-term success is hinged on working together to create a joint message around responsible consumption and hold one another accountable to that.”

In the end, believes Culhane, “The edible market will belong to manufacturers who can profitably operate within the legislative restrictions which can and will govern cannabis in edible form. Edible cannabis is, and will remain, a controlled substance.”

Manufacturers must also be prepared to lobby regulatory authorities for approval to conduct edible cannabis clinical trials, she adds, “and be prepared to finance these investigations. Accordingly, this market, when mature, will be characterized by a limited number of manufacturers with intimate, hard-earned knowledge of the technical demands required to deliver on an edible cannabis promise.”

Disclaimer Regarding Cannabis: IFT provides the opportunity for members to post information and opinions on many subjects, including cannabis. Please understand that this action by IFT does not constitute any opinion by IFT regarding the use of cannabis in any form or for any purpose, and such information and opinions are only those of the persons posting and not of IFT. IFT is not and does not provide any legal advice regarding cannabis. Possessing, using, distributing, or selling cannabis is subject to varying international laws, and is a crime under U.S. federal law and that of many states. IFT does not advocate or support violating any such laws.

Margaret Malochleb is associate editor of Food Technology magazine ([email protected]).

References

A. T. Kearney. 2018. The Cannabis Opportunity. A. T. Kearney, Chicago. atkearney.com.

BDS Analytics. 2018. “Big Brands Will Be a Game-Changer in $1.5 Billion Cannabis Edibles Market.” Press release, Oct. 11. BDS Analytics, Boulder, Colo. bdsanalytics.com.

Flanagan, R. 2019. “U.S. Surgeon General Suggests Making It Easier for Researchers to Get Marijuana.” CTVNews.ca, Jan. 7.

National Academies of Sciences, Engineering, and Medicine. 2017. The Health Effects of Cannabis and Cannabinoids: The Current State of Evidence and Recommendations for Research. Washington, D.C. The National Academies Press, Washington, D.C. https://doi.org/10.17226/24625.

Technavio. 2018. Global Cannabis-infused Edible Products Market 2018-2011. Technavio, London. technavio.com.

WHO. 2018. Cannabidiol (CBD) Critical Review Report. World Health Organization, Geneva, Switzerland. who.int.