Frozen Foods Stage a Comeback

Driven by mounting interest among Millennials, along with innovative offerings from both startups and longtime category leaders, the market for frozen foods is heating up.

Article Content

The entire consumer packaged goods (CPG) world was excited by one of the industry’s blockbuster acquisitions of 2018: Conagra Brands bought Pinnacle for $8.2 billion, largely because of Pinnacle’s strength in the freezer case. For decades, that icy cavity largely had been ignored as the linchpin of any deal.

It turns out that Conagra may have overpaid because of performance window dressing by Pinnacle executives. (See sidebar on Pinnacle Doesn’t Deliver as Anticipated.) But Conagra’s early disappointment didn’t diminish the fact that the industry’s most talked about new deal was in a category that had been considered moribund as recently as three years ago.

Long regarded as a relic of the highly processed food era, frozen foods have been making a big comeback over the past couple of years. In what has become a $54 billion market, U.S. sales of frozen foods advanced by 2.1% for the year ended in November 2018, according to Nielsen data, while unit sales were also up, by 1.2%. Those results followed a decline of 1% for the comparable 52-week period that ended in 2016 and a decline of 1.4% in 2017.

And sales have increased lately across frozen categories. Frozen pizza receipts, for instance rose by 4.8% for that period, per Nielsen, novelties by 3.9%, seafood by 3.2%, and prepared foods by 3%. Frozen vegetable sales rose by a whopping 4.9% as imports of such goods to the United States grew by 7% year-over-year through October, while frozen fruit imports surged by 16%.

“The category is promising,” says Sergio Eleuterio, general manager of Kraft Heinz’s Springboard Brands unit, which includes its legacy Boca meatless burger line as well as the new Devour brand aimed at men. “There are lots of launches and lots of novelty. … There are a lot of new flavors and colors and new brands, and products can deliver. So the frozen market now can advance.”

Market Growth Factors

In fact, several factors have been driving the surprising renaissance of frozen foods in the U.S. supermarket. Millennial shoppers have been lured by products such as new plant-based burgers and riced cauliflower, improved quality up and down the aisle, reasonable prices, and the convenience of frozen.

Meanwhile, companies big and small have been flooding the freezer case with on-trend new varieties, flavorful and even exotic ingredients, and helpful packaging innovations. And supermarket chains have latched onto frozen food as an e-commerce beater and an area ripe for private label expansion.

“They’re making the food better—the stuff in the box is just better now,” says Ken Harris, managing director of Cadent Consulting and an advisor to CPG companies. “It’s better for you, and it tastes better. The small companies have been crushing it, and now the big guys like Healthy Choice and Smart Ones and Lean Cuisine are all making better food too.”

Frozen even has acquired a new aura of currency in pop culture. Daily Harvest, for instance, is a direct-to-consumer service based in New York that delivers frozen, plant-based, one-step-prep foods to consumers, and the startup brand has acquired celebrity hangers-on in the mode of a coconut water or cold-pressed juice brand: Actress Haylie Duff, Olympic gold medalist Shaun White, and restaurateur and chef Bobby Flay were early investors in Daily Harvest.

And at Food Technology’s press time, Kraft Heinz’s Devour brand was scheduled to run a television commercial on marketing’s biggest stage, Super Bowl LIII, marking the first time a frozen brand had done so, according to Advertising Age magazine. Devour planned to build on its positioning of crave-worthy frozen food for guys during a Big Game telecast that is the most reliable male-viewing beacon on the planet.

The most important driver of renewal in the freezer case has been demand for frozen foods by Millennial shoppers, who, of course, have become the predominant consumer generation in America. This has been a somewhat surprising development, because before they revived prospects in the frozen aisle, Generation Y transformed the CPG industry with its overwhelming call for more nutritious foods and beverages and those that were minimally processed, with “clean” ingredient labels, and preferably fresh or even “farm-to-table.

But Millennials have found no damning contradiction in also embracing today’s frozen foods, seeming to agree with a message that frozen food purveyors have been trying to get out for several years now—since a $30 million marketing campaign launched by an industry association in 2015 that was called “Frozen: How Fresh Stays Fresh.” Just as the campaign maintained that freezing was “nature’s pause button,” Millennials by and large seem to have accepted the idea that freezing doesn’t rob foods of nutrients and can actually be a preserved proxy for freshness.

And for this most budget-conscious cohort since the Greatest Generation, there are other considerations in addition to the integrity of frozen foods: convenience, price, and portion control.

For an entrée or a snack, it doesn’t get much more convenient for a time-crunched young mother or a busy single than popping a frozen product in the microwave for a few minutes.

“When they have the time, Millennials want to eat fresh and they go for farm fresh types of meals,” says Bob Allen, principal and food and beverage leader for Grant Thornton management consultants.

“But the reality is that they’re staying single longer and are heavily into their careers, and they’re wanting something that is convenient and fits into their lifestyle,” Allen continues. “Also, women in the workforce have changed the dynamic of eating habits, and their hectic lifestyle is affording an opportunity for frozen foods to fill in that space.”

Another advantage: Despite more high-end offerings in the freezer case these days, frozen foods by and large are less expensive than fresh and typically comparable in price to shelf-stable offerings in the center aisle of supermarkets. And the generally smaller portions in frozen offerings help Millennials control their intake—and avoid food waste, which is something they generationally are coming to despise.

“Millennials look for sustainable products and less waste,” says Howard Dorman, partner and food and beverage practice leader at CPG consultancy Mazars USA. “You can package what you don’t eat and put it back in the freezer and use it next week. And it’s significantly cheaper than meal kits and takeout.”

Also, while frozen food sales are rising across the board, a few explosively growing categories have been drawing American consumers to the freezer aisle like a magnet. The most prominent include new “healthy” ice creams such as Halo Top and Arctic Ice, which have succeeded in making the case that they can offer tasty and satisfying dietary indulgence, reasonable levels of calories, and bonus nutritional value through their protein and calcium content—and that eating even a whole pint at a sitting isn’t such a sin.

“Better-for-you options are driving the growth in frozen desserts, and there’s a proliferation of brands attempting to get a share of that market,” says Amit Pandhi, CEO of San Diego-based Arctic Zero, which offers a low-sugar line of ice creams that emphasizes clean and natural ingredients, such as only monk fruit extract and cane sugar for sweeteners. Arctic Zero also has fielded a line of plant-based ice cream analogs.

Plant-Based Products Proliferate

Plant-based foods overall are also commandeering more space in the freezer aisle. New offerings include Sweet Earth artisan pizzas, made by a plant-based frozen food startup that recently was acquired by Nestlé and got help from its new owner in developing the popular new product line.

“Nestlé has great expertise at crusts and line efficiencies, so we developed four distinctive crusts that reflect modern food sensibilities,” says Bob Swette, president of Moss Landing, Calif.–based Sweet Earth. The lineup includes Truffle Lover’s, with a psyllium fiber crust and a topping finished with a caramelized onion truffle sauce, and Protein Lover’s, whose crust is comprised of wheat, chia, quinoa, and flax seed.

“Nestlé has great expertise at crusts and line efficiencies, so we developed four distinctive crusts that reflect modern food sensibilities,” says Bob Swette, president of Moss Landing, Calif.–based Sweet Earth. The lineup includes Truffle Lover’s, with a psyllium fiber crust and a topping finished with a caramelized onion truffle sauce, and Protein Lover’s, whose crust is comprised of wheat, chia, quinoa, and flax seed.

“You actually get a better [eating] experience if you pop that little sucker in the oven than you do having a pizza delivered in a cardboard box,” he says. “The smell permeates the household, and you feel like you’re making something.”

Another big factor, as hinted at by Swette: Across segments, the freezer case finally is catching up with the rest of the store in terms of product innovation, nutrition, and quality.

“The overall trends in food and beverage were toward health and wellness, all natural, and simpler ingredients, and frozen was notorious for not doing any of those things,” says Greg Wank, practice leader for food and beverage at consultancy Anchin Block. “That has been changing over the last few years.”

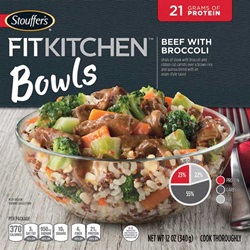

Indeed, three of Nielsen’s 25 top food product breakout innovations for 2018 were frozen lines: Green Giant riced vegetables, Stouffer’s Fit Kitchen bowls, and Halo Top ice cream.

Indeed, three of Nielsen’s 25 top food product breakout innovations for 2018 were frozen lines: Green Giant riced vegetables, Stouffer’s Fit Kitchen bowls, and Halo Top ice cream.

As in the rest of the food and beverage business for the last quarter-century, new companies began driving the change in frozen foods.

Kidfresh has been one; it’s a New York City–based startup that offers a variety of staple frozen snacks and other products aimed at kids’ tastes but including “hidden vegetables” that please parents. (See sidebar on Catering to Kids—and Their Parents.)

“Frozen has been the last food category to evolve toward better-for-you ingredients, and be clean and organic,” says Matt Cohen, Kidfresh founder and CEO. “A lot of entrepreneurs, the driving force behind innovation, went toward shelf-stable products first, and had a lot of innovation there. Then there were snacks and dairy foods, and more refrigerated in general.

“The last one is frozen. It was seen as fairly stale, and the supply chain as more complex than others, so it’s been lagging behind from an innovation standpoint. Now we’re catching up.”

Frozen Gets Disruptive

Frozen Gets Disruptive

A frozen innovator who agrees with this assessment is Angela Mavridis, CEO of Tribali Foods, which sells frozen burgers, chicken, and pork patties and sliders made only from grass-fed beef, birds nurtured on organic feed, and “humanely raised” pigs.

“Most independent, transparent, and disruptive brands had gone into other aisles, but nobody had gone into the freezer aisle,” says Mavridis, whose San Marino, Calif.–based startup began selling its sliders and other products into supermarkets in 2017. “There was no disruptive brand saying you can eat just as well in the freezer section.”

In her segment, she says, that meant the availability of only “frozen meat patties with fillers, binders, and sub-par ingredients. I figured, ‘Why can’t someone make them without all of these bad things?’ If you can do it in your kitchen with a meat grinder, you can do it in a plant,” she continues. “So I watch how we make Tribali products: We grind it, blend it, vacuum-pack it, and box it. So our customers have no fear of packaged or frozen food.”

Another like-minded newbie is Evol Foods, which has become known for applying some of Millennials’ non-negotiable, new era fresh food criteria—no antibiotics, artificial ingredients, or GMOs—and “functional” designations to the freezer case.

So Evol offers breakfast meals that include Smoked Uncured Ham Benedict and Creamy Basil Veggie bowls. The brand also has latched onto the nomenclature of specific types of health benefits with other SKUs in its lineup of bowl meals: Warrior: Be Powerful, Balance: Be Centered, Vitalize: Be Energized, and Boost: Be Well. Boost is soba noodles with vegetables in a creamy cashew sauce, and Balance is grilled chicken with red rice and vegetables in a basil pesto sauce.

So Evol offers breakfast meals that include Smoked Uncured Ham Benedict and Creamy Basil Veggie bowls. The brand also has latched onto the nomenclature of specific types of health benefits with other SKUs in its lineup of bowl meals: Warrior: Be Powerful, Balance: Be Centered, Vitalize: Be Energized, and Boost: Be Well. Boost is soba noodles with vegetables in a creamy cashew sauce, and Balance is grilled chicken with red rice and vegetables in a basil pesto sauce.

Happi Foodi is a new brand that sells “restaurant-quality frozen meals” and entrées such as Barbacoa Mac & Please and Mozzarella & Jalapeno Arepas. Samuel Rockwell, cofounder and CEO of the Nutley, N.J.–based company that also makes frozen waffles, says Happi Foodi’s products typically “contain eight to 10 ingredients to give them a foodie flair.”

Meanwhile, existing midsize players have been improving their offerings, such as Amy’s and Ian’s, which were early pioneers in better-for-you frozen; ethnic brands such as Indian-inspired Tandoori Chef; and traditional better-for-you lines such as Dr. Praeger’s.

Just as important has been renewed attention to frozen by traditional major players that lately have invested heavily in overhauling their brands and products and introducing new ones, capitalizing on the fact that the frozen category is affording them the kind of growth that has been difficult to find in other parts of the supermarket since the Great Recession.

B&G Foods, for example, relaunched its Green Giant line of frozen vegetables with new products and an innovative marketing campaign in 2016, not long after acquiring the under-appreciated brand from General Mills, and sales began improving within a year.

And while Nestlé acquired Sweet Earth Foods and recently launched its own frozen food brand called Wildscape, what’s even more significant is what Nestlé has accomplished with legacy brands such as Lean Cuisine.

Reinventing Frozen Fare

Lean Cuisine, of course, helped remake the freezer case into a repository for “diet” foods a couple of decades ago before losing more than $400 million in sales between 2011 and 2016 and forfeiting its currency with consumers. So about two years ago, Nestlé reformulated all Lean Cuisine products and packaging and switched to modern messaging.

The makeover was a major success with sales increasing by $58 million just a year after the overhaul, giving Lean Cuisine confidence to step forward with its latest product innovation: meatless entrées Coconut Chickpea Curry and Sicilian-Style Pesto with Lentil Pasta.

Kellogg has a big frozen portfolio in addition to its Kellogg’s cereals and Keebler snacks. Recently it began focusing on its Eggo frozen waffles and MorningStar Farms soy-based meat analogs. Based on new consumer research, Eggo revamped its Thick & Fluffy Waffles, for instance, and MorningStar introduced Meat Lover’s Vegan Burgers and Veggie Burgers.

But there’s more than new SKUs. Kellogg’s research also motivated the company to begin eliminating artificial ingredients from the Eggo line and to revamp MorningStar Farms products to be 100% non-GMO, removing artificial ingredients and simplifying ingredient lists overall.

“We’re giving shoppers more options that meet lifestyle needs,” says Dick Podiak, vice president of frozen foods marketing and innovation for Kellogg. The MorningStar Farms makeover, for example, “will be complete across the full portfolio by 2020. We’re also innovating to deliver vegan options: 65% of our portfolio will be vegan by 2020.”

Kraft Heinz introduced Devour in 2016 as its first “edgy” brand and now has an extensive line of about two dozen SKUs aimed at hungry men with options ranging from Sharp Cheddar Mac & Cheese with Bacon to Bacon-Topped Turkey with Garlic Sauce, from Italian Sausage Lasagna to Buffalo Chicken Grilled Cheese sandwiches.

“It’s really about bringing mouth-watering meals in categories not traditionally associated with frozen meals,” says Katy Marshall, Devour brand manager. “We felt there was a chance to bring more interesting products to a group of consumers who were purchasing the category but were looking for foods and flavors they love.”

Retailers Play a Role

Retailers have been playing a role in the unexpected boom. Increasingly, they favor giving space to frozen foods in part because they can participate in the growth of the category in a larger way than e-commerce companies have been able to do up to this point. E-commerce is limited when it comes to delivering frozen goods intact: Companies must do so either via in-market local deliveries or by using expensive dry ice.

“Bricks-and-mortar stores are investing in frozen because it’s where they can get a leg up on e-commerce platforms,” says Rockwell of Happi Foodi. “Jet and Amazon can’t efficiently deliver frozen meals to consumers.”

At the same time, retailers are devoting more private label resources to frozen than to other categories even as store brands overall keep taking market share from traditional CPGs. Frozen private label sales grew by 6.3% through November last year, per Nielsen, which accounted for only 11% of the overall frozen category but for 16% of the industry’s gains in frozen sales.

Freezing is still freezing as it has been since time immemorial. But processors have gradually introduced ways to freeze foods more quickly, thoroughly, and inexpensively to preserve freshness and nutrients and to increase shelf life, including the use of spiral freezers.

“Within a half hour, these freezers take a product up through a chamber and it comes out perfectly frozen and wrapped and packaged, and it preserves the healthy attributes,” Wank explains.

Happi Foodi employs “laser scoring” of the plastic wraps inside the boxes around its products that help it control steam buildup and release and, therefore, texture. Micro-perforations in the plastic allow the bag to inflate as it builds up pressure but allow enough steam to be released to ensure that the bag doesn’t explode. It’s part of the evolution of frozen food packaging from the innovative steaming systems pioneered by Birds Eye vegetables, and by Conagra with its Healthy Choice Café Steamers entrées.

“It creates a sort of Instapot environment for heating food, where the combination of pressure buildup and steam keeps all the ingredients more moist and facilitates that restaurant-like experience,” explains Gary Laney, vice president of product development for Happi Foodi’s parent company.

Is the frozen food boom sustainable for more than a year or two? Anchin Block’s Wank believes one positive sign for the frozen aisle is the amounts of venture capital being invested in relevant brands.

Several years ago, private equity groups “wouldn’t touch” frozen foods, he says. “But now they’re making strategic investments there, and that speaks well; it’s a leading indicator for what’s going to happen down the road with frozen.”

Adds Grant Thornton’s Allen: “I’m anticipating this trend is going to stay for a bit. As long as better foods are being purchased, and food companies continue to be creative—or go buy companies that are being creative in the frozen space—I don’t see anything getting in the way.”

Dale Buss is a freelance writer based in Rochester Hills, Mich. ([email protected])

Kidfresh has moved to the vanguard of the frozen aisle with its line of 18 SKUs targeted to kids with the temptation of childhood staples—chicken nuggets, fish sticks, and pizza among them—that also make a promise to moms: up to a half cup of hidden veggies in each serving.

Kidfresh has moved to the vanguard of the frozen aisle with its line of 18 SKUs targeted to kids with the temptation of childhood staples—chicken nuggets, fish sticks, and pizza among them—that also make a promise to moms: up to a half cup of hidden veggies in each serving.