The Dynamics of Recycling Food Packaging

PACKAGING

Recycling is one of the pillars of reduce, reuse, and recycle and benefits the environment. Because reducing food waste has a more significant environmental impact than increasing recycling and using recycled packaging, efforts to address package recycling are often diminished. This perspective is a fallacy; both initiatives are important. Moreover, consumers are increasingly environmentally conscious and interested in recycling. Progress in recycling efforts has reduced the environmental impact of food packaging. Brands, recyclers, the packaging industry, and consumer education are fueling the circular economy to enable more recycling.

Brands Take Action

Packaged food manufacturers are setting targets, pledging to use recycled content, and developing more packaging that is recyclable. These targets and pledges align with corporate values and consumer interest in reducing the impact of packaging on the environment; they are also fueling the circular economy. Food companies such as Anheuser Busch, Coca-Cola, Danone, Kellogg, McCormick, McDonald’s, Nestlé, Starbucks, and PepsiCo have specific goals to use recycled content and ensure that their packaging is recyclable. Targets are often explicit. For example, Danone pledged to increase recycled material in water bottles from the current 25% to 100% by 2025. McDonald’s has promised to have recycling in place at its 36,000 locations around the world by 2025. And through its “World Without Waste” plan, Coca-Cola pledges that its packaging will contain 50% recycled material by 2030. There are also aggressive targets for collection and recycling of polyethylene terephthalate (PET). Further, Target, via its “Design Tomorrow” initiative, has also incorporated recycling targets into larger sustainability goals; other retailers are following suit.

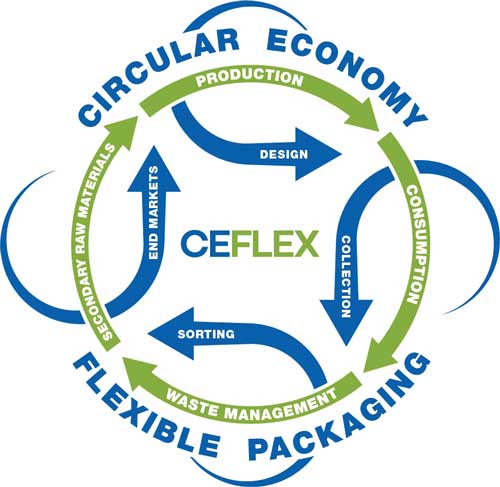

Alliances with common goals unite companies and optimize resources spent on recycling efforts. For example, more than 250 organizations have joined the Ellen MacArthur Foundation’s global commitment to increase the use of recycled content and aid in efforts to ensure that recyclable packaging is actually recycled by 2025. This commitment has led to more focused, packaging-specific global and national alliances such as Alliance to End Plastic Waste, Circular Economy for Flexible Packaging (CEFLEX), Materials Recovery for the Future Collaborative, New Plastics Economy, North American Plastics Recycling Alliance, and the Recycling Partnership. Many alliances highlight the importance of the value chain for robust and comprehensive systems solutions. For example, CEFLEX focuses on the design of recyclable and/or recycled content packaging as well as the collecting, sorting, and recycling processes. Other alliances focus on a more specific goal. For example, the Recycling Partnership, funded by large brands, distributes recycling bins and guides recycling efforts. Fulfilling targets and pledges has fueled research in design for recycling, research on how to clearly communicate recyclability to consumers, recycle-ready packaging that is easily separable at recycle centers, mitigation and assessment of the migration of compounds from recycled packaging, and fast detection methods to determine the quality of recycled packaging for food contact.

Alliances with common goals unite companies and optimize resources spent on recycling efforts. For example, more than 250 organizations have joined the Ellen MacArthur Foundation’s global commitment to increase the use of recycled content and aid in efforts to ensure that recyclable packaging is actually recycled by 2025. This commitment has led to more focused, packaging-specific global and national alliances such as Alliance to End Plastic Waste, Circular Economy for Flexible Packaging (CEFLEX), Materials Recovery for the Future Collaborative, New Plastics Economy, North American Plastics Recycling Alliance, and the Recycling Partnership. Many alliances highlight the importance of the value chain for robust and comprehensive systems solutions. For example, CEFLEX focuses on the design of recyclable and/or recycled content packaging as well as the collecting, sorting, and recycling processes. Other alliances focus on a more specific goal. For example, the Recycling Partnership, funded by large brands, distributes recycling bins and guides recycling efforts. Fulfilling targets and pledges has fueled research in design for recycling, research on how to clearly communicate recyclability to consumers, recycle-ready packaging that is easily separable at recycle centers, mitigation and assessment of the migration of compounds from recycled packaging, and fast detection methods to determine the quality of recycled packaging for food contact.

Ensuring Quality PCR Packaging

A more genuinely circular economy can be achieved if recyclers can provide quality post-consumer recycled (PCR) packaging that can be used for food packaging. As supply tightens in response to corporate targets and consumer pressure, access to and sourcing of quality recycled feedstock is becoming strategic. “Sustainability strategies will drive more use of recycled content, and demand for quality suitable recycled packaging material is projected to increase,” says Susan Hansen, global strategist, F&A Supply Chain for Rabobank. “In the [European Union], we are seeing brand owners invest in recycling processes to ensure they will have a source of recycled content. For example, to help achieve the vision of a World Without Waste, Coca-Cola has invested in the PET recycling processing by Ioniqa Technologies, which produces high-grade recycled content from hard-to-recycle PET. The acquisition and/or investment of Faerch Plast, ALPLA, and Indorama in 4PET Recycling, TexPlast, and Sorepla Technologie, respectively, also demonstrates the need to secure recycled content. The focus is on ensuring the quality of recycled feedstock to enable brands to achieve sustainability targets.” In terms of paperboard recycling, Natasha Valeeva, analyst, F&A supply chain, Rabobank, states, “As the demand [for] recycled content increases the value for recycled packaging, recyclers are expected to achieve more economically viable operations through consolidation, better guidance for consumer[s] on what is recyclable, and the incorporation of technology to separate packaging material.”

Aspirations to increase the quality of recycled feedstock do not always come to fruition. For example, Loop Industries’ process of recovering monoethylene glycol after separation, purification, and then recombining it with dimethyl terephthalate to produce PCR PET has low efficiency and has not secured a no-objection letter (NOL) from the U.S. Food and Drug Administration (FDA). Further, shipping of recyclable and nonrecyclable packaging by consumers in the single-stream recycling program by TerraCycle does not provide clear direction for consumers on what is recyclable and is duplicative of existing sustainable curbside recycling alternatives.

Fortunately, many processes can produce quality PCR packaging that can be used for direct food contact. For example, in 2018 alone, the FDA granted NOLs for secondary recycling processes by Veolia, Polymetrix AG, Kreyenborg Plant Technology, and Reifenhäuser Cast Sheet Coating. PET produced from these processes is considered safe for contact with food requiring high-temperature sterilization (212°F), hot-filling above 150°F, and storage at room temperature and refrigerator temperatures. In addition, the FDA granted an NOL to Resipol Comércio de Resíduos e Polímeros Plásticos for direct contact with certain products for a maximum storage time of 35 days at a room temperature of 25°C.

A projected 2020 import ban related to the recycled content paper in China is expected to increase the demand for regional infrastructure to process PCR paperboard outside of China just as this need grew after the restriction on contaminated plastic. Indonesia has tripled the amount of recyclable paperboard shipped from the United States since 2018, and a proposed import restriction that would match China’s policy was not imposed. However, recent Chinese and Indian legislation restricting the import of impure recycled packaging has resulted in a shortage of recycled paperboard, and this has driven consolidation and investment in the U.S. paperboard recycling industry. For example, Green Bay Packaging and Pratt industries have built recycled-content paper mills, and Chinese Nine Dragons Paper and Shanying International companies have purchased more than four paper mills. These and other investments in new capacity are projected to increase the availability of recycled paperboard by 10% in the United States by 2020.

Guidance on Recycling

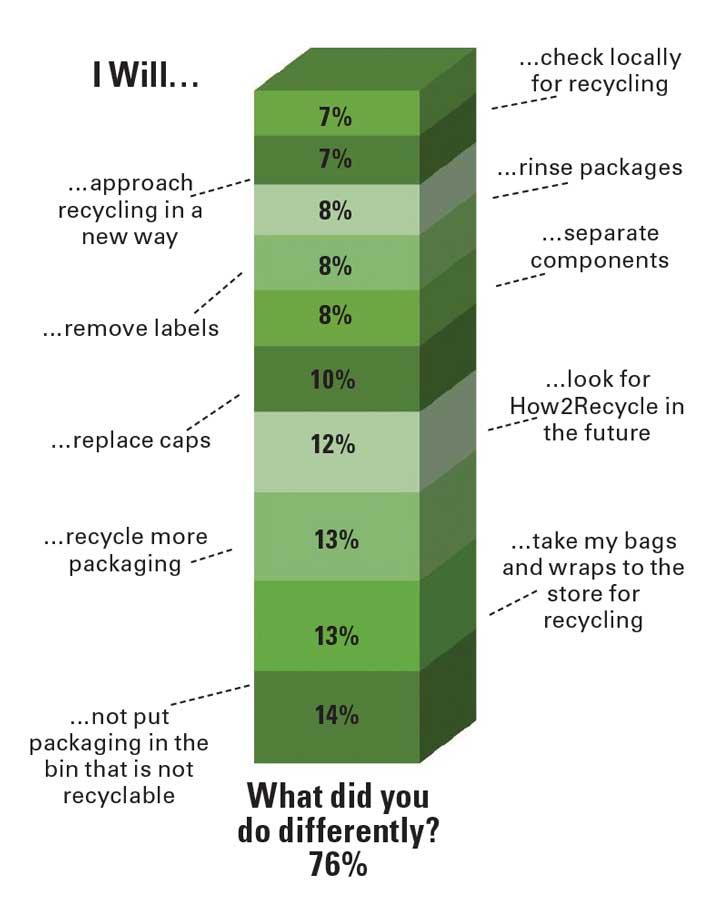

The lack of regulatory harmonization on the collection of packaging has led to consumer confusion on what is recyclable and what is not. Guidance for consumers on what can and cannot be recycled is thus needed, and brand owners have responded. For example, the placement of How2Recycle labels by the Sustainable Packaging Coalition on food packaging has grown each year since 2012. According to Kelly Cramer, lead of How2Recycle and director of program management at GreenBlue, the program adds integrity to the recycling process. “We conduct a custom recyclability assessment based on the package composition to assign the correct How2Recycle label,” Cramer says. “And since late 2017, we have issued over 50,000 specific recommendations for packaging design improvement for recyclability to our How2Recycle members.” Surveys indicate that 57% of consumers may be more likely to purchase a product featuring the How2Recycle label.

Recycling rates have increased due to the simplicity of single-stream recycling that requires separation by recyclers; currently, 55% of U.S. consumers recycle. However, 25% of recyclable material collected from consumers is contaminated. Securing an uncontaminated supply of recycled packaging can help fuel a lower cost supply of PCR packaging.

Package deposit legislation within some U.S. states and other countries result in increased recycling rates because of the consistent guidance and financial incentive to consumers. For example, in Oregon, recycling rates of beverage containers reached 90% after passage of a bottle deposit program. The use of extended producer responsibility to link package disposal to package design and choice of materials is another way to provide guidance to consumers on the cost of disposal and recycling.

Harmonization of regulations approving recycled content for direct food contact would allow global companies to use PCR packaging consistently and enable the sourcing of PCR packaging to reach the volume pricing of virgin packaging materials. However, regulations on the permitted use of recycled content in direct content with foods are not globally harmonized.

In the United States, an NOL from the FDA indicates that the agency has reviewed migration data and that the specific recycled material can be used in direct contact with food. Critically, although processes are often shared in submissions to the FDA, materials versus recycling methods are approved. In the European Union, packaging for food contact is assessed by the method in which they are produced in a series of steps involving the European Commission as well as the European Food Safety Authority. However, member states can also have separate regulations, so there is an additional need for harmonization. China’s regulations on food-contact materials align with most European directives.