Rethink, Retool, Reinvent

How the food chain is (finally) adopting and embracing digital transformation.

Article Content

Danone is crunching data to learn how thousands of nutrients activate metabolic pathways. Bolthouse Farms has applied cameras and sensors to make carrot processing vastly more efficient. PepsiCo is leading the charge for a digital definition of retail “category management.”

In these and countless other ways, digital transformation is occurring apace at CPG giants and startups alike, all along the food production chain—from product formulation to retail distribution. A flurry of initiatives and strategies designed to take advantage of artificial intelligence (AI), machine learning, big data and data analytics, the internet of things (IoT), e-commerce, and other digital technologies and platforms are overhauling the way many companies do business.

More than just the latest management buzzword, digital transformation has emerged as a strategic imperative that cuts across organizations. At its core, digital transformation is about leveraging digital technologies to either create or modify business processes, cultures, and customer experiences based on fast-changing market dynamics. And while time and cost efficiencies are often a welcome byproduct, the endgame is less about incremental improvement than spurring new types of customer-focused innovation.

They’re mostly playing catch-up, but that imperative is now rapidly impacting food companies. “Both at the consumer-brand level and the supply-chain level, we were behind other industries, no question,” says Jeff Dunn, chief executive officer of Bolthouse Farms. “As an industry, we didn’t think we had to do it, based on the nature of how people bought food. It just wasn’t as important for us as for others.”

Some sectors have lagged more than others. “Foodservice has been historically better at adopting technology and more in tune and agile about what’s going on in the consumer market,” says Kishan Vasani, co-founder and chief executive officer of AI startup Spoonshot. “But CPG is a different beast entirely, subject to a lot more regulation and checkpoints.” Vasani says digitization of the packaged goods business accelerated significantly only a couple of years ago.

The COVID-19 pandemic accelerated many of these efforts, as food and beverage companies were forced to adapt to not just what consumers were eating, but how they sourced it in a disrupted environment. The pandemic-driven rush of at-home dining gave CPG companies revenue flows and financial certitude for the major digital investments they began accelerating, sometimes telescoping years of anticipated initiatives into a matter of just a few months.

“It took the pandemic to really shake the behavior of the CPG industry,” says Mike Gervasio, vice president of category leadership for PepsiCo. “Were we prepared to go from zero to 60 in a few months? No. Some categories were caught in supply chain and packaging issues. No one expected that level of growth or was prepared for that.”

Indeed, digital transformation represents a neck-snapping revolution for much of the industry. Some of the change represents legacy companies adapting from within. But mostly the revolution is occurring from without, as startups bring fresh ideas with accompanying technologies to the forefront, often getting big companies to fund and partner with them.

It’s a broad landscape. In a 2019 report, technology consultant Lux Research identified “six core outcomes” that food companies are trying to achieve through digital transformation: uncovering invisible insights, predicting the future, optimizing operations, upskilling humans, making information accessible, and automating. Food companies are pursuing combinations of these goals, but implementing digital technologies to achieve them “is non-trivial, and finding a suitable business impact is even harder,” the report said.

But Howard Dorman, the national food and beverage sector leader for Mazars management consultants, sees the pandemic triaging companies. “COVID brought a whole new aspect to the velocity of change, especially on the retail side,” he says. “But I still see a lot of older, family-owned businesses that haven’t updated their equipment or their [enterprise resource planning software] systems. They will be challenged.” And, he adds, much of the foodservice industry has been shattered.

Here’s a sampling of how the food industry’s digital transformation is unfolding across a number of fronts, in CPG and retailing, from research and development, to operations, to marketing, to distribution:

Trendspotting Transformed

The traditional, pre-digital way for the CPG industry to glean hints about product trends is to invite panels of consumers to test concepts and prototypes. But that is expensive, time-consuming—and often wrong.

“Things like focus groups are like Blockbuster—amazing tools, but simply not relevant anymore,” says Ron Harnik, vice president of marketing for Tastewise, an AI-powered “food prediction and intelligence” platform. “In our food and beverage world, what was relevant in February this year no longer was relevant in March.”

Instead, new firms such as Tastewise are mining growing troves of data about consumers. This information has been generated over the last few years, in exponentially increasing amounts, because of a decisive “shift of the internet generation to purchasing online” and because of a similarly consequential movement by younger consumers to mobile computing from laptop machines, says Spoonshot’s Vasani.

These mammoth feeds of new data reside in social media, research papers, weather information, agricultural reports, background knowledge, and many more sources—a total of 22 data types that Spoonshot accesses, across more than 23,000 locations. “The first generation of internet-insight companies were focusing on social media only,” Vasani says. “But the more diverse your data is, the more relevant it is, and the more relevant and validated your answers are.”

Clients use the information to align more closely with emerging trends, Vasani says, both for tweaking existing products and brands and introducing new ones, saving them weeks or months—and lots of money. “So they can go with safer choices and have more confidence in their decisions,” Vasani says.

Harnik says Tastewise goes beyond simply knowing what’s trending to understanding why. For example, it’s one thing to know that sauerkraut is trending, but much more valuable to understand it’s trending because more people are turning to fermented, probiotic-rich foods for their positive effects on gut and brain health. Besides informing product development, Harnik says, such insights also help companies optimize their product and brand positioning and marketing.

“We’ve found that recipes as content marketing can be an incredibly effective tool to align your product with the motivations of consumers, for instance,” he says. “Recipes that call out specific diets or specific customer motivation—such as ‘easy to make for kids’ or ‘gluten-free’—get 4.5 times more exposure. Giving consumers the right recipes will increase their consumption frequency."

Mining Ingredient Benefits

Ingredient informatics, as defined by Lux Research, combines genomics and evolutionary algorithms for effective data mining and modeling for new ingredient or food product development. It’s a huge and growing discipline, harnessing much of the arsenal of digital transformation, including AI, machine learning, and data analytics.

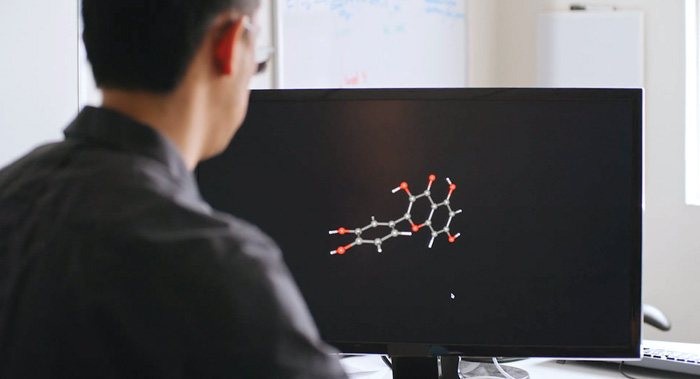

Danone, for example, has turned to ingredient informatics to help bolster its high-profile bet on soymilk. One of the world’s biggest dairy companies, the yogurt and infant formula giant also has been the globe’s largest seller of plant-based beverages since its mammoth diversification via the $12.5-billion acquisition of WhiteWave in 2016. Soy-based beverages, such as Dannon’s Silk brand, have been battered lately by other plant-based platforms, including coconut and cashew milks. So while also participating in those new segments, Danone remains eager to renew consumer appreciation for soy, where it has a huge sunk investment.

That’s why Danone last summer invested in Brightseed, a startup that uses AI and machine learning to identify “new and hidden nutrients in foods and ingredients” and match them with “metabolic pathways in the human body,” explains Takoua Debeche, Danone’s vice president of research and innovation. “Only a very small percentage of molecules in plants have been explored. (See sidebar on this page.)

“It would take us hundreds and thousands of years to be able to identify and map all the nutrients” presented by nature’s biodiversity and to predict “how they will work in the body,” Debeche continues. “The beauty of an AI tool like the one Brightseed has built is we can do that in a much shorter period of time and with a higher level of acuity, at a scale and speed not possible without AI.”

Danone wants to “uncover health benefits and formulate our products to optimize the amounts of healthy nutrients in our brands and be able to communicate those benefits,” she says. Potentially, Danone could apply the same AI-based approach to plumbing the yet-unknown benefits of its animal products as well, Debeche says.

Journey Foods, meanwhile, brings a different approach to informatics: Its AI platform analyzes an existing or proposed food product and comes up with recommendations for optimizing production, nutrition, shelf stability, affordability, and sustainability.

“So you might have a protein bar, and it’s too high-cost and it’s got too much sugar, and the packaging isn’t what it needs to be—both the bottom line and consumers are complaining,” says Riana Lynn, founder and chief executive.

A holistic overhaul typically might take a corporate R&D department two years, she says.

“We look at your overall goals and your supply chain metrics, and we don’t just say, ‘Take out some sugar,’” Lynn says. “We look at hard and aggregate data to make recommendations that are real and actionable and scalable. Maybe you want to switch over to make it wholly plant-based—we can make sure you’re in the right cost and margin range and maybe use ingredients with the least greenhouse gas emissions."

Optimizing Operations

CPG companies are using digital technologies including data analytics, IoT, and robotics to make their manufacturing and processing safer, less labor-intensive, and more productive.

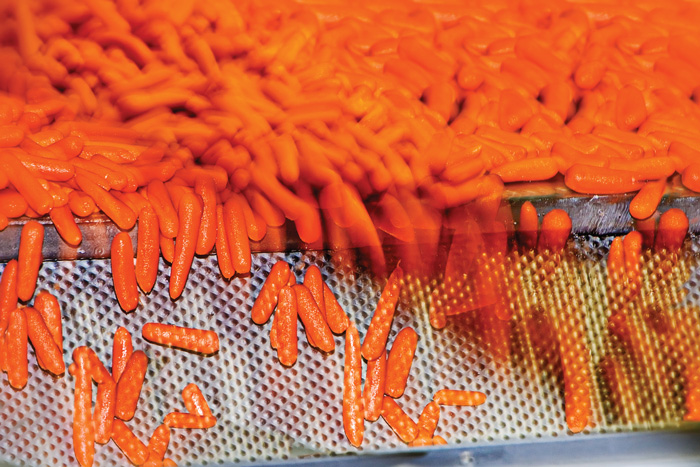

Consider Bolthouse Farms. Long before the company became known for pioneering juice products, and for being acquired (and later divested) by Campbell Soup, Bolthouse was one of the world’s largest producers of carrots and processed carrot products.

Now, under Dunn, a former chief who returned to the helm after Campbell divested Bolthouse in 2019, the company is digitizing carrot production. Bolthouse has begun using about 400 cameras, Bluetooth connectors in each employee’s ID badge, and machine learning algorithms to make processing more efficient through optimizing the movement of employees and the functioning of equipment. This gets down to which bins collect different-sized pieces of carrots after they’re cut up, and how those containers move within the plant.

“If we can start to understand the manual parts of the process that aren’t machine driven, we can automate them,” Dunn says. “We can see where humans are interfacing and start to build machine solutions to that.”

Tetra Pak, the Swedish-Swiss company best known for its shelf-stable beverage packaging, also works with customers and suppliers to optimize filling lines based on data and AI. For example, Tetra Pak worked with a cheese manufacturer that faced variability in the moisture content of its cheddar cheese.

“We applied data science and AI to create an engine that used historical data and real-time data to train the model, and it increased the moisture of the product by about 1%,” says Sasha Ilyukhin, vice president. “That saved the manufacturer almost $1 million a year.”

Tech-Enabled Cold Chains

Technology manufacturer Emerson sees “a gold mine of opportunity” in using big data and algorithms with food vendors and retailers to optimize cold chain supply systems that utilize IoT via the company’s temperature and humidity sensor networks, says James Froedge, executive vice president of commercial and residential solutions. Suppliers of delicate products, such as strawberries, and very pricey ones, such as high-end nuts, are especially interested.

Trimble Transportation also is helping digitize the cold chain. Its sensors already tell vendors and stores whether their goods have been maintained at the right temperatures for an entire journey and inform drivers whether they’ve got a problem in the trailer they’ve got to address.

“With historical data telling you there’s a 99.9% certainty a carrier will deliver your goods at the prescribed temperature, you as a shipper may pay an extra 10 to 15 cents a mile for that,” says Chris Orban, vice president of data science for Trimble’s transportation division.

Digitizing Food Safety

Digital tools have helped immensely advance the safety of food. The industry and regulators already do a pretty good job of creating traceability data so that when a problem occurs, such as the bacteria outbreaks involving romaine lettuce a few years ago, food companies and governments can react quickly. But the U.S. Food and Drug Administration and other government agencies are pressing companies to become more proactive.

That’s why customers are turning to Crème Global, which “pulls a company’s research and food safety data all together and sees what it tells them,” says Clare Thorp, senior vice president of North America for the IT startup.

With the data organized, and working with meat and dairy processors, Crème Global applies machine learning to create proactive, predictive, and even prescriptive solutions that avoid pathogen outbreaks before they occur.

“We can use the existing data and tools and modeling to actually start predicting the likelihood of a pathogen and whether or not, if you change something like a sanitizer, it would have enough of a positive effect on the cleanliness and hygiene of a plant, or whether it would make no difference,” Thorp says.

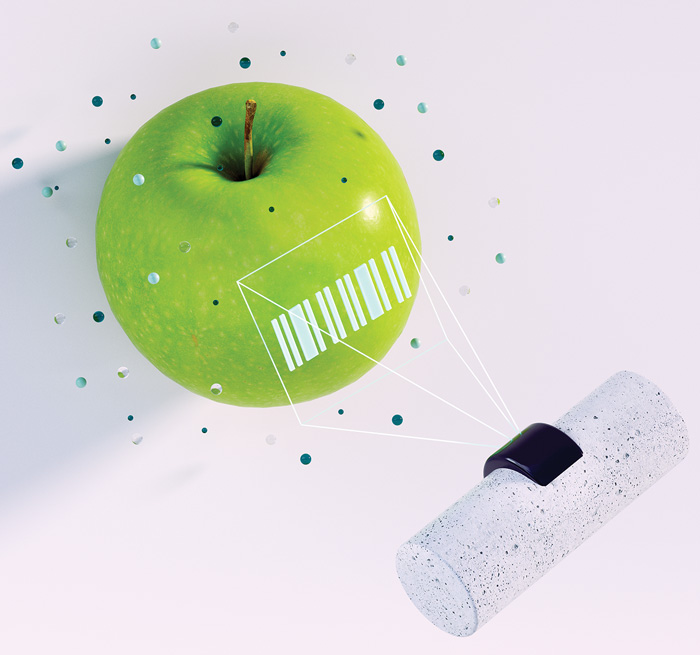

Another player helping companies get more proactive about safety is GS 1 US, which is standardizing digital data and working with clients on applying digital techniques to their own systems. For example, GS 1 US recently worked on a pilot with Aanika Biosciences, a startup that creates naturally produced biomolecular tags that are included in the washes used in processing leafy greens that come in from the field, thereby increasing their traceability.

“With this DNA, not only can you serialize each head of lettuce, but you can embed the location of where each head was grown, in Salinas or Tucson, say,” says Melanie Nuce, senior vice president of corporate development at GS 1 US. “The industry has never explored digitization of the supply chain at this molecular level before. As soon as you unwrapped lettuce, you lost what anyone knew to be the identity of the product.”

The Rise of E-Commerce

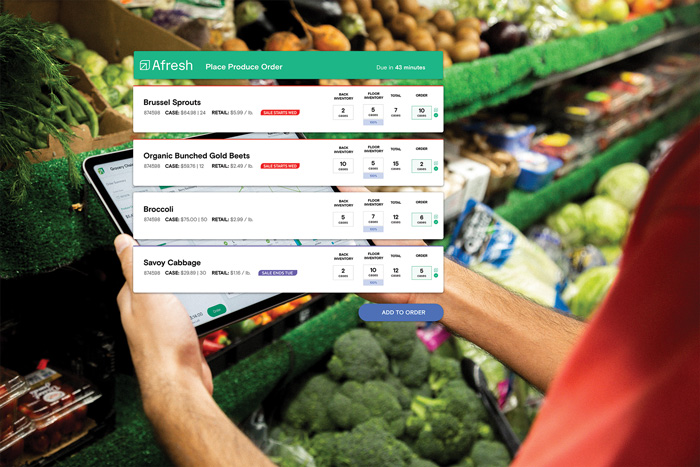

The pandemic has been especially disruptive to major CPG players, such as PepsiCo, Hershey, and others that are “category captains” at bricks-and-mortar retail chains, essentially charged by the retailers with helping optimize sales within their entire category. To adapt to the surge of e-commerce, Gervasio says PepsiCo has been working closely with retailers “as e-commerce becomes a bigger part of the solutions set and goes from more specialized to more generalized.”

The Category Management Association (CMA), whose members are big CPG companies and major food retailers, has rapidly “reinvented” traditional category management to respond to what CMA calls “an increasingly omnichannel world.” The group last summer named Gervasio its first chairman, a position the association added specifically to boost its new digital efforts, called Cat Man 2.0.

“We have lots of capabilities and tools and inherent knowledge for category management in a bricks-and-mortar environment,” Gervasio says. “But now consumers can buy their products anytime, anywhere, and in any way, a reality that’s been accelerated by five years over the last five months.”

Gervasio says companies have to “acquire whole new sets of data and tools, hire data scientists, and get new skill sets. Then, members need to make sure data is consistent and accessible across all retailing channels.”

He adds that retailers need to solve challenges such as “figuring out how digitally curated search engines can create the category management equivalent of the front page of a newspaper ad or a lobby display or a [selected] assortment of products in a store. It’s all the same [goal], but digital is different, with different levers.

“AI and machines are going to carry the ‘what just happened’ and help us decide what to do next, and how we should grow, and what choices to make and accelerate in regard to shopper behavior,” Gervasio concludes.