Dietary Fiber Moves Back into the Mainstream

CONSUMER TRENDS

Dietary fiber—most often associated with whole grains by consumers—appears to have quietly shaken its “ho-hum” status, moving back into the mainstream with a new list of health benefits and unexpectedly strong sales. Even trendy supplement users are paying attention!

According to IRI, fiber/bran supplement sales jumped 20.4% in the mass market for the year ending 10/10/2000, while Whole Foods magazine’s annual survey of October 2000 reported that one in five natural channel shoppers bought a fiber supplement and 44% bought a whole-grain product last year. And interest is likely to continue. Sloan Trends’ EWATTS media-tracking system confirms that dietary fiber is enjoying extremely heavy ongoing media coverage—on a par with antioxidants, cholesterol, and soy—and whole grains aren’t far behind.

Further mass market attention to dietary fiber and whole grains will result from a new National Academy of Sciences/Food and Nutrition Board definition of dietary fiber which will likely permit physiological associations for “added fiber” products, a formal Recommended Daily Intake (RDI) for dietary fiber and carbohydrates expected this fall, and a flurry of emerging health linkages, including a link to the trendy “Syndrome X” phenomenon. The increased recognition of whole grains as a source of other “in-demand” nutrients such as folic acid and the B vitamins and as a source of energy and an aid to weight loss and diabetes (glycemic index) control will give this age-old category a new lease on life. It’s going to be the perfect time to reposition old stand-bys and introduce new dietary fiber additives.

According to Multi-Sponsor Surveys, one-third of Americans said they tried to increase their dietary fiber intake last year and were more aware of a wider variety of health benefits associated with dietary fiber and whole grains than ever before.

With the origin of dietary fiber’s popularity in the 1980s connected to its positive role in preventing constipation—and its strong association with “whole grains”—it is not surprising that, according to a 2001 Gallup Poll for the Wheat Foods Council and the American Bakers Association, “Help maintain proper bowel movements” tops the list of consumer health connections for whole grains in 2001, with 94% of the respondents agreeing with that statement. Most likely as a result of the Food and Drug Administration’s approval of a heart-health/cholesterol-lowering claim for whole grains, “Help prevent heart disease” has become the third most familiar linkage, with 77% of the respondents agreeing; “Give energy” was agreed to by 83% and “Help prevent cancer” 71%. Prior to approval of the health claim in 1999, Gallup reported that 58% of consumers were already aware of fiber’s positive role in constipation, 43% weight loss, 43% digestive aid, 23% appetite suppressant, and one-third about cholesterol.

According to the NAS Committee on Dietary Fiber, dietary fiber intakes in the United States are well below the “Nutrition Facts” label recommended Daily Value of 25 g/day, averaging 14–15 g/person/day. Men consume an average of 18.6 g/day and women 13.9 g/day. In terms of the Food Guide Pyramid, since 1992 Americans have fallen short of the recommendation of 6–11 servings of grain foods/day. The U.S. Dept. of Agriculture’s Continuing Surveys of Food Intakes by Individuals (1994–98) confirm that consumers are barely meeting their recommended minimum daily consumption of grains, averaging 6.8 servings/day—7.9 for men and 5.5 for women.

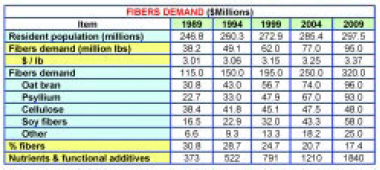

The demand for unique fiber ingredients will continue. According to the Freedonia Group’s study, “World Nutraceuticals” (see Table), the demand for nutraceutical chemicals will increase more than 10% per year to $11.2 billion in 2004. Functional food additives will generate the fastest growth, stimulated by new products, growing price flexibility, and an increasing number of health-conscious consumers. Isolated soy protein, oat bran, psyllium, and calcium will provide the best opportunities among nutrients and minerals, based on proven health benefits and broadening end-use applications. The demand for soy and fiber nutrients for liquid meal substitutes, energy-boosting shakes, sports beverages, and fortified foods will provide the strongest growth opportunities, based on consumer preference to obtain nutritional requirements through normal dietary practices.

Last, a global flurry of new product activity, including major trends toward oat drinks, rye-based heart-friendly products, heart-disease-preventative cereals/bars, whole-grain menopause products, as well as the acceptance of designer fibers, including prebiotics such as inulin and fructooligosaccharides, will open a new world of product options and make for exciting consumer news.

Large established markets already exist worldwide. In Japan, high-fiber drinks and food products represent a strong FOSHU category, with approval for a wide variety of fibers and prebiotics. While the European market—led by the United Kingdom, France, and Spain—is currently less developed, interest in whole grains and fiber is rising, as evidenced by the strong markets for wholegrain cereals last year and the prominence of the desire for health claims related to heart disease—and, in some countries such as France, even to constipation. With such a well-established market for dietary fiber, it is quite clear that a new ingredient, particularly one that could be linked to these emerging and exciting health claims, would be very well received.

by A. ELIZABETH SLOAN

Contributing Editor