The Changing Face of Organic Consumers

Connecting with the values that drive consumer behavior can help food and beverage companies provide more meaningful organic products and brands.

Sales of organic foods and beverages reached $16.7 billion in 2006, up from $13.8 billion in 2005. With sales expected to more than double to $35 billion by 2011, it appears that organics are here to stay. But which product categories are poised for growth, who are these organic consumers, and what trends are driving their behavior?

To answer these questions, the Natural Marketing Institute (NMI)—an international strategic consulting, market research, and business development company specializing in health, wellness, and sustainability (www.nmisolutions.com) —obtained information on organics from a number of its proprietary research vehicles, including the Health and Wellness Trends Database™, the LOHAS (Lifestyles of Health and Sustainability) Consumer Trends Database™, the Evolution of Personal Care Study™, HealthBeat Interactive™, and NMI’s Product Attribute Trend Identifier service, along with qualitative insights from NMI in-depth interviews.

These databases contain more than 10 years’ worth of information from more than 400,000 consumers, and together they offer a unique and all-encompassing view of the organic consumer and marketplace.

Trends Driving Consumer Behavior

Each year, NMI develops a list of the top trends that are affecting the health, wellness, and sustainability marketplace. The overriding theme for 2007 was “Consumers in Control.” Consumers express their desire for control across their health, lifestyle, finance, and other critical issues, while at the same time they want new innovative products and more information and show increasingly fragmented behavior. Four of these top trends correlate to organics.

• A Deeper Values Experience. Consumers have come to expect an extremely high level of experience at every touch point, and this trend has evolved beyond the physical and emotional dimensions to the experience of fundamental core values. In other words, it is simply not enough to “have it all” anymore—consumers also want to feel better about what they have.

This is now driving a new emphasis beyond organic to locally grown. One-quarter of organic food and beverage consumers have purchased organic products from a local farm or farmer’s market in the past year; 35% of organic produce users first started using organic products to support local farmers; and 25% of the general population agree completely that it is important for their store to have locally grown produce.

This desire for values is also evolving beyond organics to include interest in Fair Trade Certified and recyclable packaging. This falls under the umbrella of “cradle-to-cradle” corporate social responsibility (CSR) practices, with 80% of consumers agreeing that it is important for companies not just to be profitable, but also to be mindful of their impact on the environment and society.

• Back to the Future. In response to decades of over-massification, including malls and big-box retail chains, consumers are embracing back-to-the-future simplicity, authenticity, hand-crafting, and a belief that quality is better than quantity. Many shoppers are overwhelmed by the nutritional characteristics of foods, beverages, and supplements and are looking for a short list of recognizable ingredients, with key benefits prominently displayed on the packaging—77% of consumers state that package labels influence their purchase decisions. A straight-forward design that reflects simple and believable benefits will be the key to converting new brand users.

--- PAGE BREAK ---

Nowhere is the trend more evident than in the explosive growth of consumer brands such as Cascadian Farm, Organic Valley, Horizon Organic, Odwalla, and Stonyfield Farm. NMI research found that the percentage of growth in consumer usage since 2004 for these companies ranged from 34% to 65%. Although some of these brands are owned by larger corporations, consumers perceive these brands as small and “artisanal” and therefore more authentic. These product offerings, packaging, and marketing all provide a reassuring “back to the future” consumer experience.

• The New Fear Factor. Scandals across religious, government, and corporate institutions began the erosion of trust in the 1990s, while the explosion of widespread technology in a post-911 world is creating fear and driving consumers to take ever-greater control of their environment, property, time, and safety. While they often feel that their lives are out of control, consumers have an increased desire to control things that are within their grasp.

For example, consumers’ pursuit of safer foods and beverages, organic and environmentally friendly products, local farms, and familiarity with the source of the products they use is an attempt to reassure themselves that they have some measure of control. This “fear factor” translates to organic opportunities, as shown in Figure 1. Consumers want to avoid toxins, and 43% now believe that organic foods and beverages are safer to eat.

For example, consumers’ pursuit of safer foods and beverages, organic and environmentally friendly products, local farms, and familiarity with the source of the products they use is an attempt to reassure themselves that they have some measure of control. This “fear factor” translates to organic opportunities, as shown in Figure 1. Consumers want to avoid toxins, and 43% now believe that organic foods and beverages are safer to eat.

• Seize the Moment. From couture-handbag rentals to luxury-car timeshares, consumers are increasingly responding to the temporary in a culture that is less permanent and forever on the move. “Brand-agnostic” retailers such as Sephora, Pacific Sunware, and Urban Outfitters are outpacing their competition by offering an ever-changing array of products and brands under one roof, thereby enabling consumers to discover products for themselves.

This desire for what’s new is translating to faster product lifestyles as consumers demand greater innovation, with 55% of consumers stating that they are willing to try new products regardless of brand. A robust increase of 35% in consumer desire for the “the most innovative, cool products” over the past year underscores the speeding up of product lifestyles.

For example, while organic is forecast to continue its explosive growth over the next few years, its popularity as a “fresh and innovative” concept could be challenged as it becomes co-opted by mainstream brands and retailers. This suggests that organics will need to continue to evolve with ever-expanding product concepts to maintain brand leadership and loyalty.

Growth of Organic Categories Organic introductions across all product categories both in the United States and on a global basis have been on the rise since 2001. Consequently, household penetration has grown—57% of consumers in 2006 indicated usage of some type of organic product, including packaged foods, produce, milk, beverages (excluding milk), personal care items, and clothing/linens.

Of those categories, produce has the highest usage rate, with slightly more than half of all consumers indicating usage in the past year. Produce is often the entry category for shoppers to discover organic products. Two out of five consumers are using organic packaged foods, and household penetration is projected to rise to 51% in 2008.

Of those who used organic produce, packaged foods, or beverages (except milk) in the past year, avoidance of additives, pesticides, toxins, genetically modified ingredients, hormones, or antibiotics was the number-one driver for usage. “Better for me and my family” was second, and promotion of overall health was third.

While NMI predicts that consumer penetration will reach only 65% in the near future, opportunity for sales growth lies in increased frequency. Examination of consumer-segment usage frequency indicates large opportunities within certain categories.

--- PAGE BREAK ---

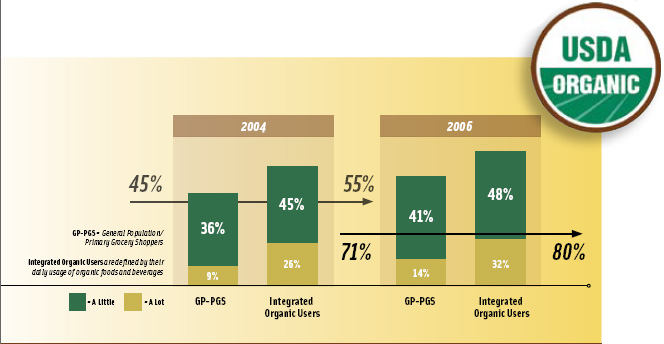

As shown in Figure 2, NMI research also shows that the influence of the U.S. Dept. of Agriculture’s Organic seal on the purchase of foods and beverages has increased by 22% among primary grocery shoppers since 2004.

As shown in Figure 2, NMI research also shows that the influence of the U.S. Dept. of Agriculture’s Organic seal on the purchase of foods and beverages has increased by 22% among primary grocery shoppers since 2004.

In addition, 48% of shoppers say that it is very important for their stores to carry foods and beverages with the seal. That jumps to 71% for integrated organic users, those who use organics at least once a day. The importance of the seal is tied to increased consumer interest in how and where their food is being grown and processed. It assures consumers that the products they consume are processed in an environmentally conscious manner and are free of chemical pesticides and toxins.

With both the importance and influence of the USDA Organic seal growing, its prominent display is key to brand and retail success.

Organic Consumer Segments

Organic Consumer Segments

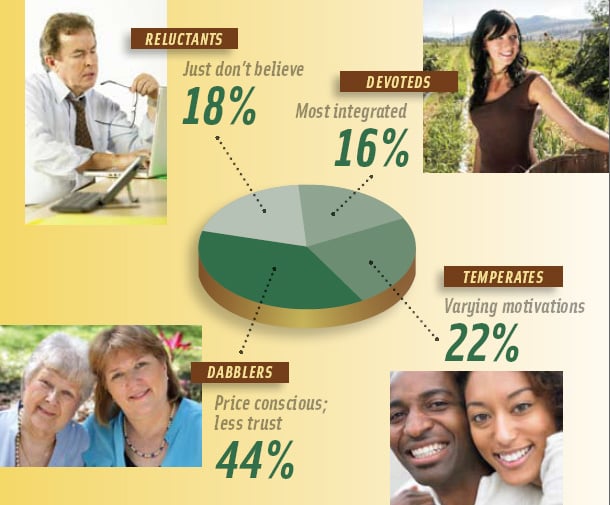

NMI has identified four distinct organic consumer segments: Devoteds™, Temperates™, Dabblers™, and Reluctants™. Figure 3 identifies each segment by percentage of the U.S. general population/primary grocery shoppers, as well as by its associated main characteristic. Understanding the motivations and drivers for each group is critical for manufacturers and marketers to succeed in the organic marketplace.

• Devoteds (34 million adults) are the most integrated of the organic segments and exhibit the highest belief in the diet/health connection. They have the highest usage of organic products and are extremely knowledgeable about what “organic” means. As such, they are the highest spenders in the organic marketplace and are most likely to see the value in paying 20% more to get an organic product.

They also have the highest level of agreement regarding sustainability. They care not only about what the product contains, but also about how it was grown, how the ingredients were sourced, etc. They are passionate on this issue and connect to brands that can substantiate their sustainability efforts.

They are early adopters and tend to influence their friends and family on the virtues of organic. Devoteds are active managers of their health and are truly committed to organic and its ideals.

• Temperates (46 million adults), in comparison, have varying motivations for organic usage. For Devoteds, the more they use a product, the more it has to be organic. They are trying to avoid toxins, pesticides, and residues and are looking for “clean” food and beverages. Temperates differ in that the more they use an organic product, the more it becomes a “treat.” This is due to their more mainstream levels of belief in organics. For them, organics are not a necessity.

• Temperates (46 million adults), in comparison, have varying motivations for organic usage. For Devoteds, the more they use a product, the more it has to be organic. They are trying to avoid toxins, pesticides, and residues and are looking for “clean” food and beverages. Temperates differ in that the more they use an organic product, the more it becomes a “treat.” This is due to their more mainstream levels of belief in organics. For them, organics are not a necessity.

Temperates use organics less frequently and spend less on what they do buy. As opposed to Devoteds, who shop more in natural food supermarkets such as Whole Foods and Trader Joe’s, Temperates are more likely to purchase their organics at Wal-Mart and Target. While this would tend to support the idea that this group would be the most opportunistic for mainstream mass merchandisers, manufacturers and retailers need to be aware that they still use less, spend less, and have a weaker belief system than Devoteds.

--- PAGE BREAK ---

Temperates are less health conscious and less active and are more mainstream in their use of prescription medications. They do have above-average usage in all categories, compared to the general population, and they are most likely to purchase organic milk. This is likely due to their concern for family and the fact that organic milk does not contain hormones and antibiotics. Their use of organic milk is likely the entry point for all other organic product categories.

Together, Devoteds and Temperates represent 75% of all organic spending. There must be buy-in from both of these groups to succeed in the marketplace. Manufacturers and marketers must also understand the motivating and believable features and benefit statements that are common to both groups to effectively resonate with them.

• Dabblers (92 million adults) are the largest segment. As their name implies, they are “dabbling” here and there in organics. Only 36% of this group used an organic product in the past year. They do not believe that organics are worth the money. They buy strictly on price and are more likely to use coupons. They are followers, not leaders. Consumption of healthy and nutritious food is important to them, and while they are willing to try organics and might purchase organic juice or yogurt, they don’t make a habit of using organic products overall.

This group does not exhibit the depth of trust and understanding regarding organic certification or regulations that Devoteds, or even Temperates, have.

• Reluctants (38 million adults) just don’t believe that organic food is a good value for the money. Only 21% indicated that they tried an organic product in the past year, and they were most likely driven to do so by a friend or family member. Their understanding of organic regulations and certifications is extremely limited. They are also less likely to use any healthy products such as vitamins, minerals, or supplements. They know they should eat better, but they just don’t do it; and of all the groups, they are the most likely to be obese.

NMI’s qualitative research found that Reluctants are not necessarily uneducated. They just simply do not believe that there is a difference (even a scientific one) in organics that make them worth the higher purchase price. They are willing to overlook the use of pesticides and other toxins present in many conventional foods and deem these characteristics as not important. Reluctants believe that they can be just as healthy eating other foods and that there is no need to spend the money on organics.

Bright Future for Organics

NMI is predicting that the high double-digit growth the organic market has experienced over the past several years will continue into the near future. Our research indicates that frequency of usage—the number of times per week that a consumer uses organics—is not saturated and that, in fact, there appears to be a big gap between where the market is and what that saturation point might be. As more and more new organic products are introduced, Devoteds and Temperates will likely increase their usage of new products, as well as their frequency. And while there will be an increase in the number of consumers who move from being Reluctants to Dabblers and from Dabblers to Temperates, NMI does not expect that the size of the Devoteds will get much larger.

In terms of specific categories, the future is bright for organic foods, beverages, and personal care. Other categories, such as organic lawn and garden, organic supplements, and organic clothing and linens, will remain strong niche opportunities geared toward specific consumers.

by Maryellen Molyneaux is President, Natural Marketing Institute, 272 Ruth Rd., Harleysville, PA 19438 ([email protected])

This article is based on a presentation at the 2007 IFT Annual Meeting & Food Expo SM , Chicago, Ill., July 28–August 1. More information on this subject is available in NMI’s 2007 Organic Consumer Trends Report. Visit www.nmisolutions.com/r_organic.html for more details.