Dissecting Demographics

Food Technology Trend Panel participants analyze the potential for products targeted to green, gray, and growing consumers.

Members of Food Technology’s 2008 Annual Meeting & Food Expo® Trend Panel—Diane Crispell, Executive Editor GfK Roper Reports; Tom Vierhile, Director, Datamonitor’s Productscan Online; and Laurie Demeritt, Chief Operating Officer, The Hartman Group—riveted annual meeting-goers with their insights into emerging market opportunities and new consumer attitudes/behaviors and recommendations for positioning new products, coping with the latest issues/terminology, and grasping such uncharted arenas as sustainability.

Panelist Crispell ([email protected]) talked about “New Twists on Mega-Drivers.” The first mega-driver is the aging of society, she said. Although the U.S. population is undoubtedly and inevitably graying, the twist is the notion that all American generations are viable and sizeable markets, each with a unique generational identity.

Crispell suggested that one way to approach generational differences is to look at the personal values people hold because such beliefs drive a lot of consumer behavior. The values of Gen Yers (those age 14–27) revolve around enjoying life, having fun, excitement, curiosity, and individuality, Crispell said. Young people are often hedonistic, but members of Gen Y appear to be even more so than their older siblings. Speaking of whom, Gen X (age 28–43) values center on work and family, according to Crispell. They are strongly focused on maintaining balance between the two as they nurture both careers and children.

Aging baby boomers (age 44–62) have certainly matured, she said, yet they retain at least some of the sense of entitlement they acquired during their indulged and prosperous childhoods. In contrast, their parents, the older pre-boomers (age 63+), have retained the lifelong focus on duty, thrift, faith, and tradition that they acquired during the Depression and World War II.

Turning to the second megadriver—diversity, Crispell reminded attendees that so-called “minorities” will be half of the U.S. population by 2050. Her twist on this well-known demographic inevitability is the fact that diversity extends beyond race and ethnicity; it is also a mindset. Nearly half of Americans feel close to a culture other than local American culture, she pointed out. This share is, not surprisingly, highest for Hispanics, most of whom feel close to Latin culture. But sizable numbers of all groups in the United States display a sense of cultural diversity.

Crispell reported that Americans also express diversity in their attitudes toward globalization, with a balanced mix of those who have positive, negative, neutral, and ambivalent feelings about it. They even show diversity at an individual level— 29% place high value on both internationalism and cultural purity.

Consumers’ paradoxical nature and diverse views also show up in their attitudes toward food. They want tradition and novelty, comfort and adventure, and taste and health, Crispell said. She feels that addressing these paradoxes can result in very innovative products.

GfK Roper Reports® U.S. Surveys confirm that food is a major source of enjoyment in the U.S. and around the world. More than half (55%) of Americans use food/drink to treat themselves after a particularly long day. In addition, 59% really enjoy eating and drinking—even if they eat and drink too much on occasion, and the same percentage enjoy something to eat or nibble on while watching television or reading.

--- PAGE BREAK ---

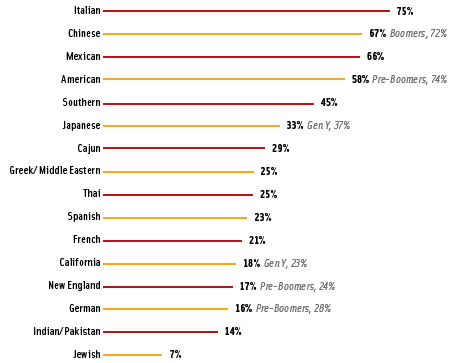

Roper surveys also find that one quarter (24%) of Americans are very interested in food from different countries. Italian, Chinese, Mexican, American, and Southern are the cuisines Americans most enjoy (Figure 1).

Roper surveys also find that one quarter (24%) of Americans are very interested in food from different countries. Italian, Chinese, Mexican, American, and Southern are the cuisines Americans most enjoy (Figure 1).

Boomers index higher than the general population for really enjoying Chinese food; pre-boomers index higher for cuisines of America, New England, and Germany; and young Gen Yers tend to be fans of cuisines of Japan and California. Crispell points out that experiencing the local cuisine is important for nearly two-thirds (62%) of consumers when on vacation.

An experimental approach to food is more common among young adults, but even among older Americans, half enjoy experimenting with foods and drinks. At the same time, about two-thirds of global and U.S. consumers agree they like to stick to the foods they’re most familiar with. This suggests that taste innovations should probably be made within the context of familiar foods.

Crispell reported that snacking has become more popular with American consumers. Two-thirds of consumers say they now eat snacks daily, and 82% feel that convenience foods are important to help them maintain a healthy diet. This means that Americans demand snacks that offer health, taste, and convenience all in one package, which presents another challenge to product developers.

When it comes to what’s in and what’s out with foods, outdoor grilling is “in” with 79% of consumers, bottled water with 78%, specialty coffee 76%, organic products 75%, and gourmet cooking 66%. While 43% say the local food movement is “in” and 41% say the same for Fair Trade, Crispell points out that the jury is still out in these two areas because 37% of consumers don’t know if local foods are “in” or “out” and 32% are unsure about Fair Trade products. She said that consumers are often confused about labeling and that they need clarity to meet their multiple food needs.

‘In’ gredients and Product Concepts

Product trend expert Tom Vierhile ([email protected]) focused on “New Health & Nutrition Concepts and ‘in’ Ingredients.” According to Datamonitor’s Productscan Online, the number of “better-for-you” products continues to grow as a percentage of new U.S. food and beverage introductions. Just over 36% of all new food and beverage products launched in the U.S. year-to-date (YTD) as of 6/10/08 made avoidance (i.e., “no”) claims. Moderation-type claims were also common, with 20% of products making these “low in” claims, while functional (i.e., “high in”) claims were also frequently used, with 23% of 2008’s launches making these claims.

On a global basis, “high in” vitamins, fiber, calcium, protein, minerals, whole grains, antioxidants, omega-3s, iron, and fruit, topped the list of positive nutrition claims YTD 6/10/08. No preservatives, no artificial colors, low fat, low calories, no sugar, no artificial flavor, no gluten, no trans fat, no cholesterol, and low sugar rounded out the top 10 “no” or “low” claims.

--- PAGE BREAK ---

Gluten-free is one of five hot product categories Vierhile cited and one that has quickly moved mainstream. Globally, new gluten-free product reports totaled 1,734 in 2006–07, nearly double that in 2004–05, per Datamonitor’s Productscan Online. Gluten-free beer, ice cream cones, and frozen entrees are among the recently unveiled gluten-free product concepts.

Fueled by celebrity endorsements, detoxifying foods and beverages are also gaining in global popularity. These products tend to contain an eclectic mix of ingredients, including dandelion and artichoke extracts. Other ingredients used in detoxifying products and thought to be helpful in liver cleansing are amino acids, ginger, schisandra extract, and damiana.

Vierhile cited “mood foods” as another evolving market. With a Datamonitor 2006 Consumer Survey reporting that 64% of Americans and Europeans find it difficult to find time to relax and manage their daily obligations, stress-reducing foods and beverages are growing in popularity. VitaminWater’s B-Relaxed drink in the U.S. is one such example. Mental enhancement foods designed for brain health vs physical enhancement represent another fast-growing segment. Nestlé’s Milo B-Smart in Australia and Unilever’s Kissan Amaze Brain food in India, both targeted to children, are two important market entries.

Vierhile pointed to the shot size/daily dose concept as a viable and fast-emerging way to deliver specific health benefits. Slim-Fast’s Hunger Shot in the UK adds satiety. Well Naturally AntiOx Mangosteen & Pomegranate Juice Shots in Australia are a potent source of antioxidants. Each 100 ml serving of Valio’s HeVi Fruit & Vegetables Shots in Finland contains 200 g of fruits and vegetables.

Vierhile reported that plant sterols are poised for a breakthrough in the U.S. market with the rollout of products such as Corozona’s Heart Healthy Potato Chips and Bayer Aspirin with plant sterols. In Portugal, Benecol introduced the world’s first cholesterol-lowering olive oil.

Although consumer awareness of probiotics and prebiotics is low, it has not stopped proliferation of products that contain probiotics, prebiotics, or plant sterols. Vierhile reported that the number of new probiotic and/or prebiotic foods tracked globally by Productscan Online more than doubled to 289 in 2007, up from just 141 in 2004. Vierhile cited 2007 data from the NPD Group indicating that 78% of consumers had never heard of prebiotics, 71% were unfamiliar with plant sterols, and 65% were not familiar with probiotics. In addition, 62% were unfamiliar with polyphenols, 34% with lycopenes, 12% with omega-3 fatty acids, and 5% with antioxidants. He pointed out that probiotic condiments such as Zukay’s salsas, chili relishes, and ketchup in the U.S. represent a peripheral trend.

Vierhile said he expects to see increased use of superfruit ingredients and pointed to the dramatically increased use of pomegranate in new product introductions; pomegranate-containing product entries nearly doubled from 2006 to 2007, he said. Açai, goji berries, and mangosteen are quickly following suit as key superfruit ingredients for new foods and beverages. Vierhile reported that high-antioxidant purple and black carrots are also gaining ground. The Maqui superberry, found in the Patagonia region of Argentina and known for increasing stamina and strength, is the latest superfruit to claim antioxidant superiority. The Maqui berry is claimed to have the highest anthocyanin, polyphenol, and Oxygen Radical Absorbance Capacity values of any berry; its values are estimated to be 4–30 times higher than goji and açai.

--- PAGE BREAK ---

With nearly 300 new food product reports globally, ancient grains such as quinoa, kamut, chia, spelt, and amaranth are getting substantial attention. Barnhouse’s Quinoa Muesli in Germany and Ruth’s Chia Goodness Cereal in the U.S. are new additions. Flaxseed is also gaining strength. Archer Farms’ Cereal with Flax and Simply Original Flax Seed Drink in the U.S are two noteworthy examples.

Agave syrup is another ingredient to watch, according to Vierhile. Agave-sweetened yogurt in Germany and Agave ketchup in the U.S. are two product applications. Black or brown rice vinegar is also enjoying the spotlight in Japan.

Raw ingredients are another hot trend, with new product introductions up four-fold from 2004 to 2007 for a total of 400 new product reports, according to Productscan Online. Nature’s Family Sun Crystals Sweetener in the U.S. and Pepsi Raw drink in the UK are indicative of this new interest.

Vierhile reported that lactoferrin, an immune-boosting milk protein that also improves the bioavailability of iron, is another emerging global ingredient. Lactoferrin can reduce bacteria that cause skin impurities, preventing the formation of blemishes. Beauty Skin Water in the UK contains lactoferrin.

Magnolia bark extract, which Wrigley has added to its Eclipse gum in the U.S. to kill the bacteria that cause bad breath, is another new ingredient. Florals in general and hisbiscus flowers in particular are getting worldwide attention. Astaxanthin—a carotenoid said to be 1,000 times more effective than co-enzyme Q10 in terms of antioxidant power—is hot in Japan. Korean pine nut oil, gaining popularity in Germany, is a novel new ingredient to help enhance satiety.

Going Green?

The Hartman Group’s Laurie Demeritt ([email protected]) discussed the “New Greening of the Food Industry,” reminding attendees that an earlier environmental movement occurred in 1996–97, and talked about sustainability from a 2008 consumer perspective. According to in-depth research by The Hartman Group, sustainability is not a word to use in consumer marketing messages.

Although just over half (54%) of consumers claim some familiarity with the term sustainability, most can’t define it appropriately upon probing, Demeritt reported. Unaided, only 5% of consumers knew which companies supported sustainability values; only 12% knew where to buy products from companies that embrace sustainability values.

Demeritt explained that the most-relevant language consumers use to describe sustainability includes terms such as hope, connection, responsibility, similar values, reliability, care/nurturing, control, health, authenticity, simplify, efficiency, and simple living. The most relevant linguistic themes and imagery for food specifically are local, fresh, organic, artisanal, unpackaged, and seasonal.

--- PAGE BREAK ---

Most people operate with varying degrees of sustainability consciousness. “Sustainability consciousness is not just about eco-conscious consumers and the environment,” Demeritt said. “It is about everyday people, and it encompasses a range of values and is broadly distributed across society. Sustainability consciousness emerges as consumers gain experience dealing with risks in everyday life.”

Consumer sustainability activities are focused on avoiding risk, according to Demeritt. For example, organic food consumption is seen as mitigating risk. According to consumers, the term organic implies absence of pesticides; artificial flavors, colors, and preservatives; herbicides; hormones; antibiotics; and GMOs.

The Hartman Group’s “World of Sustainability” can be segmented according to how consumers make sense of risks. More than 90% of the population falls into this “world” as they have attitudinal or behavioral attributes that make them current or potential consumers of sustainable products. Periphery consumers (17%), the least involved in sustainability, tend to concentrate their awareness of risk on their personal lives and bodies. Midlevel consumers (65%)—the biggest opportunity group—tend to focus on the body, but also include their surroundings at home and their immediate community. Core consumers (18%) tend to extend their risk awareness outward from the body to broader environments.

What is important, noted Demeritt, is that members of the mid-level group are changing their attitudes and behavior regarding sustainable products. Periphery consumers aren’t putting their money where their mouth is, and members of the core group are going entirely outside of mainstream distribution channels to buy sustainable products.

Hartman’s research found that food and beverages are the “gateway category” into sustainability. In terms of initial use, consumers think about sustainable products as related to their physical body and personal health. Therefore, food and beverage is top of mind because they see a personal benefit to consuming sustainable food.

In phase one, consumers purchase natural, organic, local, and fresh foods and beverages; water filters; and air purifiers. In phase two, they move into locally made products, personal care products, natural household cleaners, etc. In phase three, the focus includes hybrid cars, renewable energy sources, and other big ideas.

--- PAGE BREAK ---

Organic consumers are most willing to pay a premium for fresh categories, Demeritt said. When questioned as to what organic food categories they’d be willing to pay 30% more for, meat/poultry topped the list, cited by 65% of organic product purchasers. Fresh fruit was cited by 64%, soymilk by 62%, milk 62%, fish/seafood 61%, breads 61%, fresh vegetables 60%, and eggs 60%, according to The Hartman Group.

When it comes to narratives on food quality, 52% say it is very important for them to buy local whenever possible, 37% say it is important to know if the milk they buy is from cows given growth hormones, and 36% believe it is important that the meat they purchase was produced without the routine use of antibiotics.

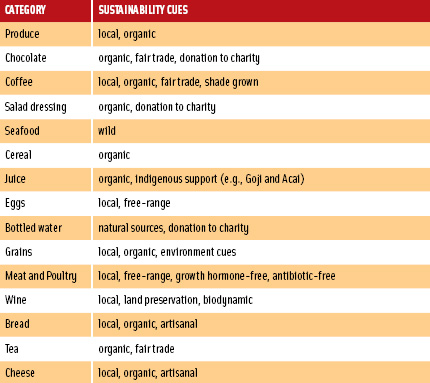

Demeritt cautioned that sustainable food cues differ by product category, such as wild for fish/seafood and local, organic, and artisanal for cheese (Figure 2).

Demeritt cautioned that sustainable food cues differ by product category, such as wild for fish/seafood and local, organic, and artisanal for cheese (Figure 2).

She concluded by telling attendees that most companies are only talking about environmental initiatives when it comes to sustainability and that human ethics and social responsibility are equally, if not more, important to consumers.

She further observed that “business practices regarding social sustainability are highly influential for product purchase.” Safe working conditions for employees are important for nearly two-thirds (65%) of consumers. About one-half of consumers (51%) are concerned about good wages/benefits for workers and efforts to reduce the environmental impact of production. Avoiding unnecessary packaging is important to 44%, distributing and producing in an energy-efficient manner concerns 42%, minimizing the use of non-renewable resources 42%, and utilizing green building techniques 26%.

by A. Elizabeth Sloan, a Professional Member of IFT and Contributing Editor of Food Technology, is President, Sloan Trends Inc., 2958 Sunset Hills, Suite 202, Escondido, CA 92025 ([email protected]).