Booster Shots for Energy & Health

Sales of functional shotstyle drinks are on the rise as consumers look for ways to maintain their health and increase their energy levels in a convenient format.

Multitasking has become a necessary skill in today’s hectic world. Just glancing over at the next car in traffic to see a woman applying makeup and eating breakfast all while talking on her Bluetooth makes it frighteningly clear that people are busier today than ever before. We are trying to squeeze more into the same amount of time, and we are on the constant lookout for products that will make this seemingly impossible task possible.

One product that has caught the consumers’ attention is shot-style beverages, typically less than 4 oz, which promise a quick energy boost or much-needed vitamins and immune support in a convenient and quick-to-drink format. Even in this lagging economy, the premium price point isn’t turning consumers off. Perhaps this is because everyone is working harder and longer hours and if a $2.99 shot of 5-Hour Energy keeps them alert and a $1.00 shot of DanActive helps their immune system, maybe it’s worth the price.

According to Innova’s Food and Beverage Database (2009), 221 shot beverage products were on shelves around the world in 2008, up from 159 in 2007. Two popular categories within shot drinks are energy shots, offering a jolt of vitality in around 2 oz, and dairy-based probiotic shots that offer live bacteria and other nutrients to help the body. In addition to taking a closer look at these two categories, this article will examine how developments in food technology have enabled food scientists to formulate these products so that they are effective and palatable.

Shifting Beverage Market

In the past couple of years, there has been a significant shift in the way consumers approach beverages. From 2003 to 2008, Mintel estimated that the regular carbonated soft drink market lost 15.6 million adult drinkers in the U.S. (Mintel, 2009a). People are no longer looking to imbibe “empty” calories; instead, it seems that beverages have been upgraded to “lifestyle” items. “As health and wellness awareness grows, more people are turning away from old-fashioned pop and looking for healthier, lower calorie drinks, as well as drinks that offer functionality to meet their specific lifestyle needs,” said Krista Faron, Senior Analyst at Mintel.

At the heart of this growing trend is the need for convenience. Enter the shot-sized beverages, which address a number of nutritional and lifestyle needs in a quick, convenient, and portable format.

The concept of non-alcoholic miniature drinks is not entirely new. In fact, consumers in Europe and Asia have enjoyed dairy-based probiotic beverage shots for decades. However, with the increasing need for on-the-go, functional, and healthy options, the shots market has taken off in the past year. According to Nielsen, sales for shot beverages in U.S. convenience stores have soared 179% from $105 million in 2008 to $292 million (year ended June 13, 2009) (Nielsen, 2009).

Among the vast variety of shot beverages, one has taken the U.S. by storm—energy shots.

--- PAGE BREAK ---

Energy Shots

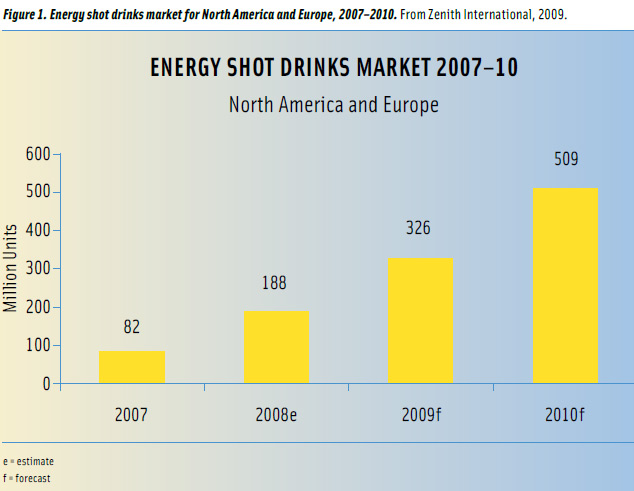

The idea behind the energy shot is pretty straightforward. From a concentrated potion of caffeine, vitamins, and amino acids, consumers get the functional “bang” that they receive from a regular-size energy drink but without the volume and calories. In addition, unlike the full-size energy drinks, these shot-style products are considered to be dietary supplements. The leading message from brands in the energy shots market is that they are differentiated from mainstream energy drinks by having “no added sugar” or being “low in sugar.” Energy shots have so far been predominantly a U.S. phenomenon, but are beginning to rollout in European countries. In 2008, North America and Europe achieved a turbo-charged 130% boost to 188 million units and a sales value of $423 million (Zenith, 2009). In the U.S., sales of energy shots more than doubled from 2007–08, reaching $67 million in the food, drug, and mass merchandisers, excluding Wal-Mart (Mintel, 2009b).

Currently, 5-Hour Energy dominates the energy shot market in the U.S. with more than a 70% share in convenience stores, and about 75% in the food, drug, and mass channels, according to Carl Sperber, Communication Director at Living Essentials, the producer of 5-Hour Energy. Sales for the dietary supplement were over $170 million in 2008, and Sperber says the company is on track to surpass the $300 million mark in sales for 2009. One reason that 5-Hour Energy has such a hold on the U.S. energy shot market may be because it was first introduced in 2004, a time when energy shot drinks were unheard of. This enabled the company to get retail distribution, market aggressively, and build a loyal customer base before other products came onto the scene. In addition, the company set out to differentiate itself from the popular full-size energy beverages that where mainly targeted at young males, age 14–25.

“Our target audience has always been working adults,” said Sperber. “The big energy drink manufacturers seem to be targeting teenage boys, who are probably the last people on Earth that need more energy. Working adults, on the other hand, could really use a boost.”

The top energy drink brands such as Monster, Rockstar, Full Throttle, NOS, and Red Bull have definitely taken notice of 5-Hour Energy’s success and the growing consumer demand for energy shots. All of these brands have introduced an energy shot product in just the last year or two, attempting to take advantage of the new audience for energy drinks that Living Essentials has created. Indeed, there are now more than 60 brands contending for market share in energy shots.

Among the latest to enter the market has been Red Bull’s Energy Shot and Sugarfree Shot dietary supplements, which debuted in the U.S. in June. Red Bull is considered the “king of energy-drink brands” and since its launch in 1997, has been very successful at maintaining a majority share of that market (New Nutrition Business, 2009).

With Red Bull’s decision to enter the energy shot market, it is apparent how much potential and appeal the segment has. The Energy Shot and Sugarfree Shot have the same taste and ingredients of the full-size Red Bull energy drinks, except the shots are not carbonated and have 25 calories and 2 calories per bottle, respectively. The company is currently evaluating rolling out the shots to other countries.

The energy shots beverage category has seen a surge of activity and growth in the past two years, but what does its future look like? Food and drink consultancy Zenith International anticipates that the North American and European markets will reach over 500 million units of energy shots and retail value approaching $1.2 billion by 2010, with the concept also spreading to other regions (Figure 1) (Zenith, 2009). Tom Vierhile, Director of Product Launch Analytics for Datamonitor, agrees that the segment has nowhere to go but up. While he expects most energy drink brands to launch a product within the shots category in the next one to two years, he also believes brands will start to differentiate themselves by “beginning to segment out based on the use or avoidance of certain ingredients.” He continued, “We can probably expect to see more ‘natural’ energy shots in the future as well as some entries with trendy ‘good for you’ ingredients and flavors like acai, hemp, blood orange, and more.”

--- PAGE BREAK ---

Probiotic Dairy Shots

While energy shots offer a quick and low-calorie way to keep us energized through increasingly hectic days, consumers are also becoming more concerned with their health and wellness. Busy schedules mean less time to fit in exercise and nutritionally balanced meals. “With increasing health consciousness amongst consumers, many are solely interested in pure functionality over refreshment, and therefore concentrated shot drinks are an ideal option,” said Jenny Foulds, Zenith International Market Analyst and Editor for functionaldrinks. Globally, these concentrated health shots are mainly appearing in the form of dairy-based drinks, which often contain probiotics to address specific health concerns. In fact, according to the “Zenith Report on Functional Dairy Drinks” (2007), the combined markets of Western Europe, the U.S., and Japan saw functional dairy drinks consumption rise 12% to 999 million L in 2006. In addition, 49% of the reported 221 shot drink products on shelves worldwide in 2008 were dairy/ soy shot drinks (Innova, 2009).

Unlike the energy shot segment, the U.S. has been slower to accept the dairy shot beverages than Asia and Europe. Probiotic dairy shots have strong foundations in Asia thanks to Japan’s Yakult Honsha Co., which first introduced its 2.2-oz probiotic shot beverage— Yakult—in the 1950s. The drink was actually created in 1935 by microbiologist Minoru Shirota, and today it is available in 32 countries and regions. The product was officially launched in the U.S. market in Sept. 2007, available in a 2.7-oz shot. Currently, Yakult’s distribution in the U.S. is limited to the West Coast, but despite that, the company is selling 100,000 bottles per day. Globally, the company sells more than 25 million bottles of Yakult per day. Like many probiotic beverages, Yakult contains a specialty strain—in this case, Lactobacillus casei Shirota—that can only be used in Yakult Co.’s products. According to the company, L. casei Shirota helps suppress harmful bacteria in the intestines, improve digestive function, and help maintain overall health.

Consumers are becoming more aware of the benefits of probiotics in the U.S. with 65% of shoppers saying that they are at least somewhat interested in probiotics for digestive health, and 28% of shoppers saying they are extremely interested (HealthFocus, 2009). As consumers become more educated on probiotics and their benefits, these numbers will likely increase.

Similar to 5-Hour Energy’s hold on the energy shot market, Yakult still holds the lead in the dairy shot market in Asia. However, companies such as Dannon, whose name is well known in the U.S. market for healthful yogurts, are well-positioned to succeed in the probiotic dairy shots category. The company launched DanActive, a 3.1- oz cultured probiotic dairy drink, in the U.S. in Jan. 2007. The drink contains the proprietary probiotic L. casei Immunitas, which the company states has been clinically proven to help naturally strengthen the body’s defenses when consumed daily. The shot was first introduced by Danone, the parent company of Dannon, in Europe in 1994 under the brand name Actimel.

All of the probiotic dairy shots are marketed to be consumed daily in order to allow the “friendly” bacteria a chance to build up and really take effect on digestion and immunity. Priced a little higher than the average yogurt, the health benefits outweigh the premium price. However, unlike energy shots where a consumer can feel the effect almost immediately, U.S. consumers may require more education on the long-term effects of probiotic shots in order to commit to consuming a premium-price product on a daily basis.

--- PAGE BREAK ---

“Traditionally, dairy shot drinks have addressed gut and digestive health, but in recent times new health areas such as cardiovascular health, immune health, weight management, brain health, beauty, and bone health have been targeted,” said Natalie Tremellen, Market Analyst at Innova Market Insights. In 2007, Unilever’s Promise brand launched Promise active SuperShots in the U.S. Each 3-oz dairy-based drink contains 2 g of natural plant sterols, which help lower LDL cholesterol. As the company states, it would take about 100 lbs of fruits, vegetables, and nuts to get the same amount of natural plant sterols that are available in one SuperShots beverage. The brand generated sales of $31 million in the 52-week period ending July 13, 2008, after its launch in June 2007 (Mintel, 2008). In 2008, Unilever released Promise SuperShots for blood pressure. Each shot contains 350 mg of potassium, designed to help adults manage their risk of high blood pressure.

Addressing weight control, Netherlands-based dairy company Campina launched Optimel Control in 2006. Available in select European countries, this 102-mL (3.4 oz) dairy shot claims that it helps you to eat less. As the aging population continues to grow, products such as these that address specific and targeted health needs are going to become more popular. “This mini revolution is just getting started,” said Kara McDonald, Director, U.S. Manufacturing and Ingredient Marketing for Dairy Management Inc. And as Foulds explained, “With consumers becoming increasingly proactive in their attitude towards health, focusing on positive action and prevention over cure, I am sure there will be an expansion of target functions within the shot drink category.”

Formulation Challenges

The growing popularity of shot beverages represents exciting opportunities for food and beverages manufacturers, as well as its challenges. Shot-style products offer a significant high value opportunity given their premium price point. In addition, they offer a way of responding to consumers’ ever-changing needs, while also opening up new channels for distribution and product positioning. However, developing a product that is by definition 4 oz or less but contains high levels of vitamins, minerals, probiotics, and other ingredients, inevitably leads to challenges in formulation. Ram Chaudhari, Senior Executive Vice President and Chief Scientific Officer at Fortitech, explained that there are several variables that manufacturers need to take into consideration when formulating shots. These include taste, texture, stability, mouthfeel, and ingredient selection and interaction. A few of the ingredients that can address specific health concerns include:

• Cholesterol reduction: plant sterols, CoQ10, B vitamins, lycopene, vitamin E

• Weight management: conjugated linoleic acid (CLA), 5-hydroxytrytophan (5-HTP), garcinia, chromium, fiber, green tea

• Energy/fatigue: taurine, B vitamins, omega-3, L-carnitine, rhodiola, caffeine

• Bone health: calcium, vitamin K, manganese, boron, vitamin D

• Enhanced cognition: gamma-aminobutyric acid (GABA), L-theanine, omega-3, choline, Gingko biloba, phosphatidylserine

--- PAGE BREAK ---

Some of these ingredients present sensory challenges. Choline, for example, offers nutritional value but the smell and taste are undesirable to consumers. Vitamin B1 can impart a bitter taste and sulfurous egg aroma, while minerals such as zinc, copper, and iron can present a lingering metallic taste. And consumers today are not simply looking for one or two added beneficial ingredients; they are looking for more complex products formulated to deliver a health benefit to their specific demographic or address a specific health problem. This means not just overcoming the challenges of single ingredients, but overcoming the issues of combining and processing multiple ingredients.

According to Chaudhari, the core challenge when working with multiple functional ingredients is the “complexity of the food matrix.” As he explained, “A food product is comprised of many different ingredients that together form a complete, uniformly balanced physical and chemical nutritional system. Many of these ingredients are multifunctional, so removing or adding new functional food ingredients may disrupt the total balance of the product. Adding in-demand nutrients together may affect taste (flavor), appearance, texture, or all three of these important parameters that together constitute perceived product quality.” This is why it is extremely vital to monitor these functional beverages throughout their shelf life. “It is important to test shelf life on these drinks both for checking levels of nutraceuticals and for monitoring changes in flavor, texture, and settling or separation issues,” said Kimberlee Burrington, Dairy Ingredient Applications Coordinator, Wisconsin Center for Dairy Research, University of Wisconsin, Madison.

At the end of the day, the taste of a product is a major factor in whether a consumer will come back for more. Shot products seem to have a little leeway here as they are sometimes seen as a vitamin supplement or medicinal in nature. “We want to make 5-Hour Energy taste just OK,” said Sperber. “It should never be consumed for the sheer pleasure of its taste. It’s not a beverage. It’s a functional energy shot and should only be used when needed.” However, technologies today have made fortification a viable option for many nutrients that were once considered problematic due to their smell and taste. As Sarah Staley, Vice President Business Development at Friesland Foods Domo USA Inc., explained, encapsulation technology has progressed tremendously in recent years, allowing “certain components to be ‘protected’ within the finished product where before you may have had issues with flavor, mouthfeel, or interaction with other components.” In addition, final product processing has progressed from the very harsh and inefficient heat treatment systems previously used.

The use of probiotics in shot beverages brings new challenges into the mix. According to Staley, the key challenge is to keep a viable cell count throughout the product life span. “Sometimes processors have to over-dose on a functional ingredient to ensure that bioactive levels remain through the shelf life,” said Staley. “This can negatively impact flavor, color, and mouthfeel or cause defects such as grittiness.”

Probiotics are often used in dairy-based foods and drinks because, “the consumption of probiotics with food, including milk, yogurt, and other dairy products, protects the probiotics from stomach acid and bile secreted during digestion,” said Christopher Cifelli, Director of Nutrition Research, National Dairy Council. Scientists are hard at work coming up with innovative solutions for ambient stable beverages. For example, using a probiotic straw to drink the beverage would allow consumption of the probiotic but keep it dry and separated until use. This type of innovation and discovery of new technologies will be key in the growth and success of nutrient-dense shot drinks.

Given recent market trends, it appears that functional shots are here to stay, which means that manufacturers have the opportunity to advance the science in these drinks. As Chaudhari concluded, “Consumer interest in promoting health through shots will force manufacturers to revisit challenging ingredients and figure out how to make them work.”

Kelly Frederick is Digital Media Editor, Institute of Food Technologists ([email protected]).

References

Chaudhari, R. 2009. Personal communication. Fortitech, Schenectady, N.Y. www.fortitech.com.

HealthFocus International. 2009. 2008 Trend Study. HealthFocus International, St. Petersburg, Fla. http://healthfocus.metapharm.net.

Innova Food and Beverage Innovation. 2009. Category given a shot in the arm. May. Innova Market Insights, Duiven, the Netherlands. www.innovadatabase.com.

Mintel. 2008. Yogurt and Yogurt Drinks—U.S. Nov. Mintel International Group Ltd., Chicago, Ill. www.mintel.com.

Mintel. 2009a. Classic Soft Drinks Fall Out of Favor. March.

Mintel. 2009b. Energy Drinks and Energy Shots—U.S. July.

New Nutrition Business. 2009. Energy shots: Birth of a new premium-priced, high-growth category. June. New Nutrition Business, London, England. www.new-nutrition.com.

Nielsen. 2009. Liquid Vitamins, Supplements, and Energy Shots Convenience Stores 52 weeks ending 6/13/09. The Nielsen Co., New York, N.Y. http://en-us.nielsen.com.

Staley, S. 2009. Personal communication. Friesland Foods Domo U.S.A. Inc., Chicago, Ill. www.domo.nl.

Zenith International. 2007. Functional Dairy Drinks Grow by Over 10% a Year. Sept. Zenith International Ltd., Bath, England. www.zenithinternational.com.

Zenith International. 2009. Energy Shot Drinks Double to $423m. March.