Wellness 12: A Dialogue on Diet and Health

Fifth annual IFT conference examines the science behind nutrition, wellness, and disease and explores consumers’ attempts to eat more healthfully.

Just how much do consumers really know about eating healthfully? For food product developers and marketers, the answer to that question is important but elusive. That was the message delivered by speakers and consumer participants in sessions at IFT’s Wellness 12 conference held earlier this spring in Rosemont, Ill.

This year’s event brought the 275 attendees up close with eight baby boomer and millennial consumers who were asked to shop for healthful products prior to the conference and to analyze their choices as part of a wide-ranging panel discussion that touched on topics including meal preparation, purchase decisions, and viewpoints about diet and health.

This year’s event brought the 275 attendees up close with eight baby boomer and millennial consumers who were asked to shop for healthful products prior to the conference and to analyze their choices as part of a wide-ranging panel discussion that touched on topics including meal preparation, purchase decisions, and viewpoints about diet and health.

Fruits and vegetables, moderate portions, lower-sodium products, and fresh minimally processed foods all fit into a healthy eating plan, the participants agreed. But digging a little deeper into the panelists’ nutritional knowledge provided some surprises. It quickly became clear that the panelists—four of whom were ages 56 to 66 and four who were in the age range of 26–29—were more than a little confused about food and nutrition terms that some consumer research suggests is well understood by the majority of the population.

For example, when the discussion turned to antioxidants, most did not appear too sure what benefits they provided. “It kills germs and bacteria in your body,” one ventured. Nor were they clear on the concept of probiotics. And while one of the millennial panelists said she buys only “100% natural” products, another millennial was less convinced of the importance of the natural label. “I don’t even know what that means,” he said.

Comments from the baby boomer and millennial panelists contrasted with some of the findings in the International Food Information Council (IFIC) 2011 Functional Foods/Foods for Health Consumer Trending Survey. In that survey, conducted online with a representative sample of Americans ages 18 and older, 81% of respondents were aware that probiotics contribute to a healthy digestive system and 76% linked them to immune system support, reported conference presenter Elizabeth Rahavi of IFIC.

The survey defines functional foods broadly as foods or food components thought to have health benefits beyond basic nutrition. With one or two exceptions, consumer panel members said they consciously shopped for healthful food, but two panelists expressed frustration at the high cost of healthful products. “Sometimes I feel like you’re being punished for trying to take better care of yourself,” said one.

--- PAGE BREAK ---

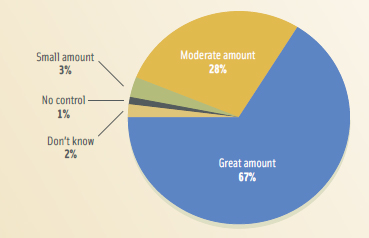

The IFT panelists’ interest in eating well matches up with IFIC survey findings in which 73% of those polled said they believe that food and nutrition play a “great role” in health. “Food and nutrition is the top factor that consumers believe affects their health,” said Rahavi. An impressive 95% of IFIC survey respondents think they have a great amount (67%) or a moderate amount (28%) of control over their own health (Figure 1), Rahavi reported.

The IFT panelists’ interest in eating well matches up with IFIC survey findings in which 73% of those polled said they believe that food and nutrition play a “great role” in health. “Food and nutrition is the top factor that consumers believe affects their health,” said Rahavi. An impressive 95% of IFIC survey respondents think they have a great amount (67%) or a moderate amount (28%) of control over their own health (Figure 1), Rahavi reported.

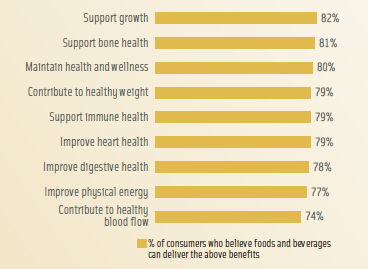

Asked about some specific benefits foods and beverages can provide, 82% said they can support bone health, 79% noted improved heart health, 78% cited better digestive health, and 74% said they contribute to healthy blood flow (Figure 2). Of course, just because consumers are aware of the benefits a food or ingredient provides doesn’t mean that they’ll change their diets to incorporate it. “We don’t necessarily see awareness matching up with reported behaviors,” said Rahavi. IFIC data show that 85% of consumers know that omega-3 fatty acids are beneficial for heart health, but among those who are aware of this benefit, only 48% are consuming them, Rahavi pointed out.

IFT panelists’ bewilderment about probiotics notwithstanding, digestive health appears to be a hot topic among consumers. “This is an area where we’re seeing really big jumps in terms of consumer awareness,” Rahavi said. Three-fourths (79%) of U.S. consumers say they’re aware of fiber and digestive health benefits, Rahavi reported. And 58% are aware that consuming whole grains contributes to a healthy digestive system.

In a session titled “Linking Nutrition, Health, and Wellness to Consumer Behavior,” presenter Kathy Hopkinson of Canadian research firm ACCE shared data that painted a picture of consumers as informed and taking active steps to improve their health in some areas but confused in others.

The message about the need to reduce dietary sodium intake seems to be reaching consumers, Hopkinson said. ACCE asked consumers what they’re looking for when they review the nutrition facts panel on products, and sodium was third on the list, behind calories and fat.

--- PAGE BREAK ---

“Sodium was nowhere near that top tier five years ago,” said Hopkinson. More than a quarter (28%) of U.S. and Canadian consumers polled by ACCE said they no longer add salt to their food. In addition, 42% reported using it only when cooking, and 30% said they use it at the table.

Still, however, nutritional confusion apparently reigns in many areas. Among U.S. consumers ACCE polled, only 10% said they didn’t know what antioxidants are, but an additional 12% said, “I know what this is, but I’m confused.” For prebiotics and probitiotics, knowledge levels were lower—34% didn’t know what they are, and 27% said they knew but were confused.

“What’s worse than not knowing?” Hopkinson reflected. “It’s thinking you know what it is, but actually you’re confused.”

Hopkinson urged government and industry to do a better job of working together to raise consumers’ nutritional IQs and eliminate confusion. “We have to educate consumers,” she said. “Don’t just sell to them. We have to try as an industry not to pull the wool over consumers’ eyes.”

Protein Power

One of the nutrients that consumers are particularly interested in incorporating into their diets is protein. According to IFIC survey data, 87% of consumers are aware that protein plays a role in supporting overall health and well-being, and 86% believe it can be helpful for weight management and in providing a feeling of fullness.

“Almost half of shoppers … are telling us about the importance of protein to them,” said presenter Barbara Davis of HealthFocus International, citing data the research firm compiled in its 2010 U.S. Trend Study.

According to survey data, respondents with and without children appear equally interested in protein; 46% of the respondents in each category indicated that the statement “good source of protein” is important to them. When it comes to translating attitude into behavior, survey respondents with kids ages 13 to 17 were doing the most—41% of them reported increasing their use of protein vs 34% of those with kids up to age 11, and 25% of those with no kids.

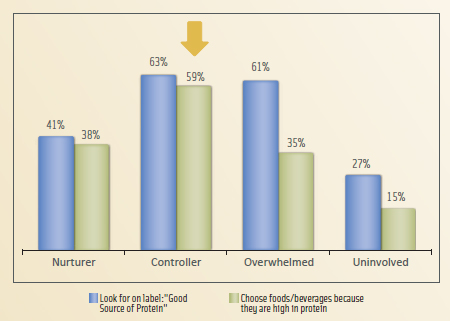

Speaking in a session titled “Protein for Kids,” Davis explored the way that parenting style affects decisions about incorporating protein into the family’s diet. HealthFocus breaks out four parental gatekeeping styles. The Nurturer approaches the role with quiet ease, parenting in a natural style; the Controller strives to always be in control and is vigilant about making healthful choices for family members; the Overwhelmed parent is concerned but unsure how to go about feeding the family nutritiously; and finally, the Uninvolved parent is not defined by the gatekeeper role and not overly concerned about how well the family eats.

--- PAGE BREAK ---

Davis suggested that marketers take the type of parents they’re targeting into consideration as they make decisions about how to pitch the protein content of their products in the marketplace. “Knowing your target is important,” said Davis, “especially when it comes to parents. There are several different approaches parents take to health and wellness, and understanding the type of information and how much information your consumer is looking for could be the key to product success or failure.”

While a Controller would welcome details and be likely to accept higher prices, an Overwhelmed parent would tend to seek lower-cost products that a child is likely to find appealing, so more emphasis on taste and fewer details about the nutritional profile would probably work best. “Telling a parent in the Overwhelmed segment the number of grams of protein really doesn’t help them out and could confuse and frustrate,” Davis observed. But including a “good source of protein” descriptor on a product would meet the needs of parents in both the Controller and the Overwhelmed segment.

In addition, Davis said, “Convenience, better nutrition, natural ingredients, fortification with extra nutrients, and health benefit claims are all things that influence these parents when making purchase decisions. So focusing on these product attributes would work for both types of parents.” (See Figure 3 for more details on how the “good source of protein” claim would affect purchase decisions within each of the four HealthFocus parental gatekeeper segments.)

In addition, Davis said, “Convenience, better nutrition, natural ingredients, fortification with extra nutrients, and health benefit claims are all things that influence these parents when making purchase decisions. So focusing on these product attributes would work for both types of parents.” (See Figure 3 for more details on how the “good source of protein” claim would affect purchase decisions within each of the four HealthFocus parental gatekeeper segments.)

The Benefits of Protein for Breakfast

In another segment within the “Protein for Kids” session, Heather Leidy of the University of Missouri presented findings from her research on the value of high-protein breakfasts for overweight and obese teen girls who normally skipped breakfast. The study showed that eating a protein-rich breakfast can improve appetite control, increase satiety, and curb food cravings later in the day, resulting in less snacking on junk food.

The teenagers in the study were given a normal protein breakfast of ready-to-eat cereal and milk (13 g of protein) for a seven-day period and a protein-rich, home-cooked breakfast (35 g of protein) for another seven days. Blood tests, questionnaires, and magnetic resonance imaging were used to monitor the teens’ perceived hunger and to gauge how breakfast consumption would affect the neural activity in those regions of the brain associated with food motivation and reward.

Both breakfasts suppressed appetite for several hours in the morning, but the high-protein breakfast was especially effective in reducing hunger throughout the day. The hunger-stimulating hormone ghrelin was lower throughout the day among those who consumed the high-protein meal, with an especially notable dip in the early afternoon.

--- PAGE BREAK ---

Skipping breakfast is a dietary risk factor for obesity, Leidy said, pointing out that between 1970 and 2008, there was a marked rise in breakfast skipping as well as a dramatic increase in obesity within the U.S. population, although a causal relationship between the two has not been demonstrated conclusively. People who are obese are twice as likely as the non-obese to skip breakfast.

Unfortunately, six months after the study concluded, the teenage participants had all returned to their pattern of breakfast skipping, Leidy reported. “It really does suggest that something needs to happen in terms of availability of food and parental involvement,” said Leidy. “This study suggests that if healthy food is available to teens, they will eat it.”

Beyond Health Concerns

Despite the context in which speakers shared their insights—a conference on diet and wellness—more than one of them reminded those in attendance that interest in health and wellness is only one part of the consumer behavior picture.

“Food choice isn’t just about nutrition and health,” said Davis of HealthFocus. “Health doesn’t always win out,” she added, citing the HealthFocus survey data, which show that 64% of consumers make choices the family will enjoy.

Rahavi made a very similar point, noting that it’s important not to overestimate the influence of diet and health on consumer decisions. “It’s not always about health,” she said. Expense and taste are the top barriers to consumption of functional foods, followed by availability/convenience, IFIC research has found.

Tackling ‘Diabesity’

Several sessions at Wellness 12 explored dietary factors in managing weight and blood glucose levels. In the session “Dietary Management of Glycemia and Body Weight in Humans,” presenter Rick Mattes with Purdue University discussed the growing prevalence of type 2 diabetes and impaired glucose tolerance (IGT) or pre-diabetes. By 2030, one in six people around the globe will have elevated blood glucose levels, Mattes remarked.

Some foods can moderate swings in blood sugar. Mattes referenced a Nurses’ Health Study that showed nut consumption is inversely related to the risk of developing type 2 diabetes. According to the study, consuming more than 5 servings/week of nuts reduced the risk 27% compared to no consumption. In addition, Mattes stated that various components of almonds have the potential to reduce the risk of diabetes. For example, almond protein and magnesium increase insulin sensitivity. He also pointed to several studies where almond consumption decreased both post-prandial glucose and post-prandial insulin. In another study looking at the second-meal response, the consumption of whole almonds or almond oil in the morning attenuated glucose levels throughout the day.

In the presentation “Leveraging the Glycemic and Digestion Properties of Wholesome Ingredients as an Effective Aid for Consumers to Manage Their Middles,” presenter Kantha Shelke with Corvus Blue revealed that the glycemic response of foods can play an important role in managing hunger and weight, reversing pre-diabetes, and preventing type 2 diabetes.

--- PAGE BREAK ---

Certain macronutrients can affect blood glucose and appetite, Shelke declared. Opportunities abound for foods, especially breakfast foods, that satiate and blunt the glycemic response.

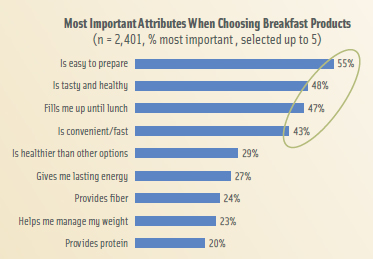

According to a 2009 Sterling Rice Group report, about 30% of Americans skip breakfast one to three times per week, noted Shelke. That same 2009 report also revealed the top drivers for consumers when choosing breakfast foods. They are “is easy to prepare” (55%), “is tasty and healthy” (48%), “fills me up until lunch” (47%), and “is convenient/fast” (43%) (Figure 4).

According to a 2009 Sterling Rice Group report, about 30% of Americans skip breakfast one to three times per week, noted Shelke. That same 2009 report also revealed the top drivers for consumers when choosing breakfast foods. They are “is easy to prepare” (55%), “is tasty and healthy” (48%), “fills me up until lunch” (47%), and “is convenient/fast” (43%) (Figure 4).

Shelke referenced a 2012 Mintel study which found that cold or ready-to-eat cereal is the most popular breakfast item, followed by eggs. Another 2012 Mintel study uncovered that consumers are most interested in savory breakfast items.

Taking into account the factors of health, taste, and convenience, Shelke postulated that the ideal breakfast food would be savory, portable, low- and non-glycemic, satiating and filling, affordable, and delicious with no guilt. Shelke listed examples of low- and non-glycemic foods that provide satiety. They include rolled oats & groats, pulses, whole grains, nuts and seeds, sweet potato, barley ß-glucan, yam flour, glucomannan, durum pasta, vegetable flours, chia/flaxseed, and resistant starch.

In the session “Metabolism Matters as Much as Calories,” presenter Christine Pelkman with Corn Products/National Starch pointed out how the steep uptick in obesity in the United States has coincided with a steep increase in diabetes, giving rise to the term “diabesity.” Obesity contributes to insulin resistance and IGT, which leads to type 2 diabetes.

Fiber, especially fermentable fiber such as resistant starch (RS), increases insulin sensitivity, Pelkman explained. RS is found in whole grains, beans, bananas, and cooked and cooled starchy foods. On average, Americans consume 4.9 g/day of RS. Pelkman presented data from five clinical trials that demonstrated resistant starch from high-amylose (70%) maize improved insulin sensitivity, even in overweight and obese individuals.

Understanding Phytonutrients

A number of sessions at this year’s conference focused on how dietary intake affects health issues as well as consumers’ burgeoning reliance on food to address health problems. In the session “Phytonutrients from Plant-Based Foods,” Rashmi Tiwari of Pepsico Inc. pointed out that many epidemiological studies have concluded that the consumption of vegetables and fruits has a positive effect on human health. The health benefits of plant-based foods are attributed to the phytonutrients and other essential micronutrients they contain. Researchers have isolated certain phytonutrients and studied their individual effectiveness against disease, but the results have been disappointing.

In fact, because the touted benefits of phytonutrients have been difficult or impossible to replicate in vivo, Carl Keen of the University of California-Davis said that the European Food Safety Authority has barred the advertising of health claims in conjunction with antioxidants. Nevertheless, no one disputes that diets high in vegetables and fruits are associated with better health outcomes, he added.

--- PAGE BREAK ---

Tiwari said the failure to find a “magic bullet” among isolated phytonutrients is probably because many, if not most, phytonutrients lose bioactivity once removed from the plant foods in which they naturally occur. In addition, although fresh vegetables and fruits are considered the most nutritious, they present challenges with respect to stability and shelf life. She advised food professionals to reconsider other equally potent sources of phytonutrients: herbs and spices. Herbs and spices can be added to food products liberally, eliminating the need to rely primarily on salt/sodium. And when dried, herbs and spices are quite stable with long shelf lives.

Connie Diekman of Washington University cautioned that the science on phytonutrients is still evolving, so it is still too soon for definitive conclusions. The extreme focus on antioxidant phytonutrients has caused consumers to shift from eating whole nutritive plant foods to taking supplements, she said. Consumers need to be informed that phytonutrients are only one part of the nutritive benefit system of plant foods: It is the synergy between phytonutrients, other nutrients, and all the other components of plant foods that are likely responsible for improved health outcomes. “Until we can truly understand every aspect of a plant, we need to emphasize that the whole food gives the benefit. We have much to learn about all the phytochemicals in plants,” she said.

The debate over plant-based foods and the properties and benefits of phytonutrients may be moot since recent data indicate that most U.S. consumers do not eat vegetables, fruits, and whole grains as often as they should. In the session “Foodservice Responds to Global Nutrition Issues,” Adam Drewnowski of the University of Washington revealed that Americans receive most of their calories (66%) through food purchased at grocery stores. Nonetheless, the blame for America’s rising obesity epidemic has been unfairly placed on fast food restaurants, he said. According to data from the National Health and Nutrition Examination Survey (NHANES), Americans obtain only 12% of their calories from fast food.

Exploring Legume Applications

The NHANES data also indicate that legumes are infrequently eaten by U.S. consumers. During the session “Health for Better Living with Beans, Pulses, Legumes,” Joanne Slavin of the University of Minnesota discussed how the 2010 Dietary Guidelines for Americans introduced the MyPlate icon, which places greater emphasis on the intake of vegetables, fruits, and whole grains. Within the context of MyPlate, legumes fit into two categories: vegetables and protein. Slavin advised food professionals to consider using beans and other pulses in novel ways to increase consumers’ dietary intake, and Tanya Der of Pulse Canada agreed.

Nutrient-dense, low in fat, and high in fiber and protein, pulses are traditionally used in soups, sauces, dips, and spreads. But as Der pointed out, they can also be used to make flours and fractions for breads and other bakery items. She said that pasta made from a blend of chickpea flour and wheat flour has higher levels of protein, fiber, and RS than conventional pasta made from durum semolina. She also revealed that pulse ingredients added to yogurt products serve as nutritive sources for probiotic cultures and that processed navy bean powder added to various food products (e.g., pizza dough) stabilizes blood glucose levels and increases satiety. The nutrition in various foods can thus be boosted with novel applications of beans and other pulses, she concluded.

Developing Products for Aging Consumers

Clearly, protein-packed legumes should be part of everyone’s diet, but they may be particularly beneficial to consumers as they age. According to LuAnn Williams of Innova Market Insights, there is a big opportunity for protein foods targeted to consumers over 40. This is because most people lose muscle and increase body fat as they age. During the session “The Next Generation of Nutrition,” Williams said that humans lose up to 37% of their muscle tissue as they progress from age 25 to age 70. In addition, body fat increases by 114% as age progresses, but for some people, the rise may not be so apparent. Individuals whose weight escalates as they age experience a visual increase in body fat. However, those who appear slender with no obvious weight gain can still have high body fat. Such individuals are called skinny-fat because their lean muscle mass is being displaced while their weight stays the same.

--- PAGE BREAK ---

Decreased bone mass, diminished eyesight, reduced joint flexibility, and declining cognitive abilities also occur as consumers age. All of these issues present product development opportunities, Williams said, advising that low-calorie snacks and diet plans are counterintuitive for aging consumers as low-calorie foods increase muscle loss and cause metabolic slowdown. For decreased bone mass, products with added calcium should be considered. Products with vitamin A to address eye health, glucosamine or chondroitin to address joint health, and omega-3 fatty acids or choline for cognitive health are also within the range of new product ideas.

What is not needed in new product offerings are more solid fats and added sugars (SoFAS). In the session “Replacing SoFAS with Healthy Oils: New Science and Innovative Solutions,” Peter Jones of the University of Manitoba discussed how U.S. consumers are eating excessive amounts of SoFAS. SoFAS encompass up to 35% of calories consumed daily by Americans, yet U.S. dietary guidelines recommend that SoFAS constitute no more than 5% of daily calories. Data from NHANES indicate that the biggest sources of solid fats in the American diet are (in descending order) grain-based desserts, pizza, cheese, and preserved processed meats (i.e., sausage, franks, and bacon). The biggest sources of added sugars in the American diet are (in descending order) soda, energy drinks, and sports drinks; grain-based desserts; and fruit drinks, Jones said. He added that the best substitutions for solid fats are oils with high levels of monounsaturated fat, such as olive oil, safflower oil, and canola oil, or those high in polyunsaturated fat, such as sunflower oil and soybean oil.

Replacing SoFAS in the American diet is easier said than done, according to William Dietz of the Centers for Disease Control and Prevention. During the session “What Consumers around the World Will Want from Food Companies in 2020,” Dietz pointed out that SoFAS make foods highly palatable yet contribute significantly to adverse health outcomes. The high palatability, convenience, and quality of foods made with SoFAS cause consumers’ taste preferences to be at odds with their health and wellness goals. Even though researchers and regulators use food policy and guidelines to address this dichotomy, it has become increasingly clear that consumers prefer to obtain information about food, nutrition, and health from non-authoritative sources on the Internet or friends and family, he said. This causes personal anecdotes and beliefs to supersede evidence-based science.

Dietz added that although consumers are highly distrustful of food scientists and policy makers, they maintain high regard for physicians. Unfortunately, physicians have very little training in nutrition science. The solution, he suggested, may be to increase physicians’ training in nutrition science and urge them to dole out more dietary advice to their patients.

Hummus Snack Made with Canola Oil Wins Student Competition

One of the trendiest Mediterranean snacks just got a bit healthier, thanks to food science students at Cornell University. Three members of a six-member team accepted the first-place prize for Hummus+ in the second annual Heart-Healthy Product Development Competition at the IFT Wellness 12 conference. Hummus+ is a nutritional snack made from chickpeas, sweet potato, butternut squash, roasted red bell peppers, canola oil, lemon juice, tahini (sesame paste), and garlic cloves. It contains higher potassium, fiber, and beta-carotene content and lower sodium and saturated fat than similar hummus products on the market.

“Hummus+ is applicable in the growing market of young consumers,” said Cornell team member Nicolas Apollo. “We took a healthy product and made it healthier.”

--- PAGE BREAK ---

Three finalist student teams were selected out of eight entries from across the United States to present their product concepts at Wellness 12. IFT Student Association members throughout North America were charged with using canola oil to develop heart-healthy products low in saturated fat and free of trans fat to help consumers adhere to the 2010 Dietary Guidelines for Americans. The products could be for any meal of the day or a snack. During the conference, the three teams participated in a closed poster and tasting session for the judges and also delivered oral presentations to an open audience.

“Number one, presentation skills and the ability to sell the product came into play,” explained Shaunda Durance-Tod, a competition judge and Program Manager of CanolaInfo, which established and sponsored the contest. “Two, taste matters, and by sampling the products, we really got a sense of that. Thirdly, the ability to think through the process and problem-solve was important for the students to demonstrate.”

Real-world promise was another significant consideration for the judges.

“At the end of the day, we had to ask, ‘Is this product going to make it?’” said IFT President-Elect John Ruff, who judged the competition. “The students had to show why their products would succeed in the marketplace.”

“You know hummus works well because the product category is still growing,” noted Cornell team member Alexander Lo. “If a food company wanted to start making Hummus+ tomorrow, it could.”

Lo and Apollo, in addition to team captain Chong-Hyun (John) Kim, accepted a check for $3,500, a trophy, and complimentary registration to the 2012 IFT Annual Meeting & Food Expo® in Las Vegas on behalf of their team, which also included Laura Sokil, April Whitney, and Cedric Ahn, who were not in attendance. The second place team from The Ohio State University received a check for $2,500 for its Morning Glory spiced sweet potato waffle, and the $1,000 third place prize went to the University of California-Davis team for Torteoat, a mini yogurt-based pie with an oat crust topped with fruit purée.

“I spent a lot more time on this product than I did on actual schoolwork,” confessed Cornell team captain Kim. Clearly, the students’ efforts paid off.

—Brittany Farb, Communications Specialist, Inkovation Inc., representing CanolaInfo

Mary Ellen Kuhn is Managing Editor of Food Technology ([email protected]).

Toni Tarver is Senior Writer/Editor of Food Technology ([email protected]).

Bob Swientek is Editor-in-Chief of Food Technology ([email protected]).