The Meal Solution Evolution

Makers of meal kits and prepared meals pivot to capitalize on the demand of distribution in multiple channels while meeting consumer's expectation for quality, variety, value, and healthfulness.

Article Content

Despite consumers’ apparent preoccupation with just about anything and everything food related (think celebrity chefs, television food shows, and trendy cookbooks), the reality is that most people don’t enjoy the meal-making process all that much. A high-profile study published a couple of years ago found that only 10% of consumers said they loved to cook while 45% said they hated it, and another 45% were somewhere in between on the love/hate spectrum (Yoon 2017).

Over the course of the past decade, enterprising product developers have responded to such market dynamics with a broad array of meal kit subscription programs that bring all the ingredients for a home-cooked meal to the consumer’s doorstep. Options vary from higher-end subscriptions that emphasize organic, carefully sourced ingredients to budget-focused meal kit plans like the one from Dinnerly, which touts a price per serving that starts at $4.49 and bills itself as “America’s most affordable meal kit.” Consumers also have access to an increasingly large assortment of ready-to-heat-and-eat fresh prepared meals delivered directly to their homes or offices.

But competing in the meal solutions sector is fraught with complexities related to profitability, customer retention, and the challenges of refrigerated distribution —issues that have led a number of companies to exit the market and likely will contribute to a shakeout in the months and years ahead.

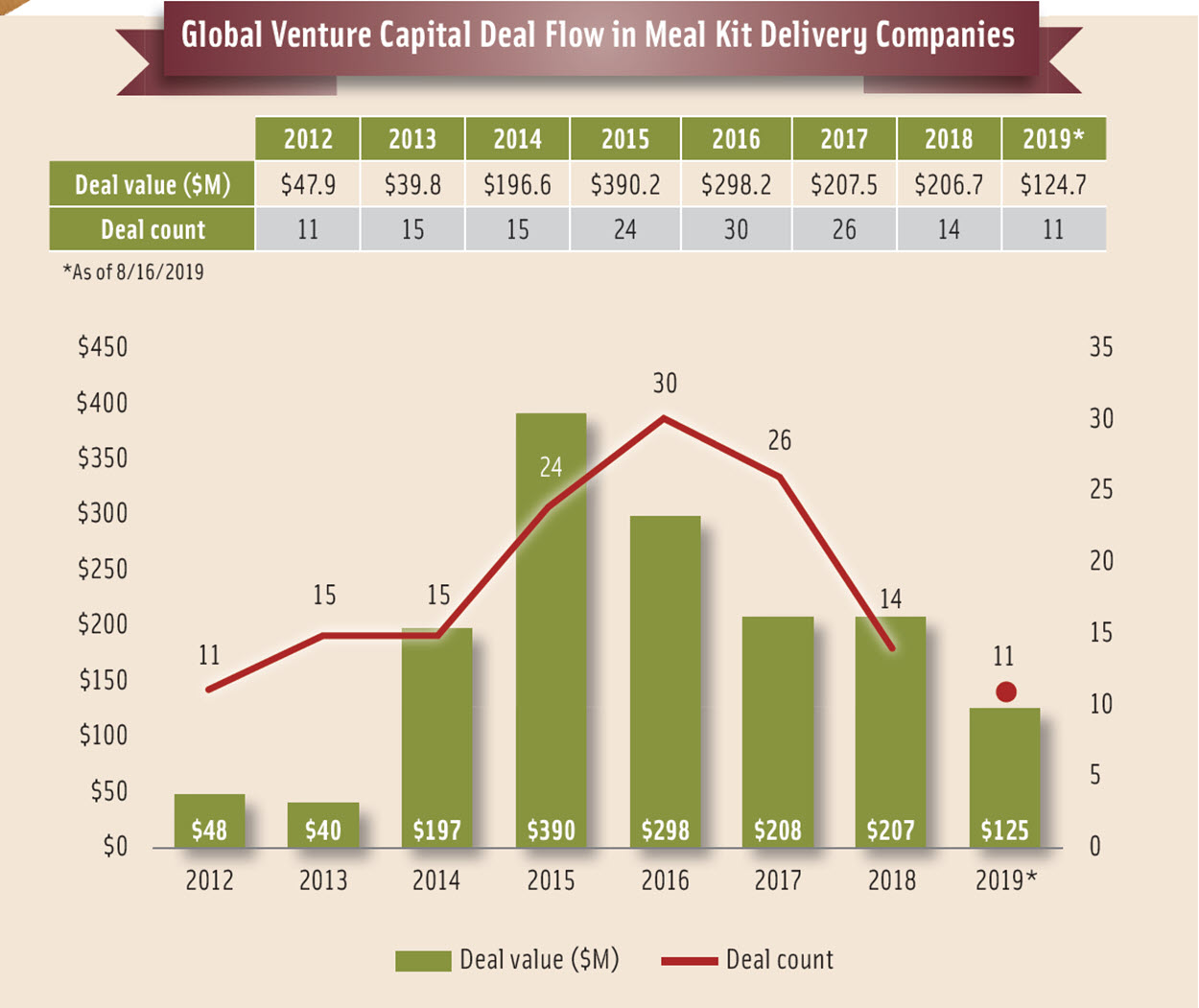

Investor enthusiasm for the sector has waned. A look at venture capital investment in meal kit delivery companies between 2012 and 2019 provided by private capital market data tracker PitchBook shows that the dollar value of deals peaked in 2015 and the number of deals peaked in 2016. (See the figure on this page for more detailed statistics.)

“The meal kit sector seems a lot like the dot-com boom and bust of the late ‘90s—lots of competitors are jockeying for market share and not focusing on the bottom line,” observes Darren Seifer, food and beverage industry analyst for market research firm The NPD Group. “Those who can win over consumers while also streamlining their business models will likely survive.”

There are a number of encouraging indicators for the meal solutions market, however. This summer, meal kit market leader HelloFresh reported its first profitable quarter since the company’s initial public offering in 2017. With the trends toward an increasing number of smaller households and growth in urban populations, meal kit market watchers anticipate continued growth for the market in the United States and globally.

Hexa Research put the value of the global meal kit delivery service market at $2.5 billion in 2017 and estimates that it will reach $8.9 billion by 2025, with a compound annual growth rate of nearly 17.2% (Hexa Research 2018). For the U.S. marketplace, which is the largest meal kit market globally, Packaged Facts forecasts average annual sales growth of 12.2%, with the market reaching $5.5 billion in sales by 2023 (Packaged Facts 2018)

Breaking Out the Benefits and Challenges

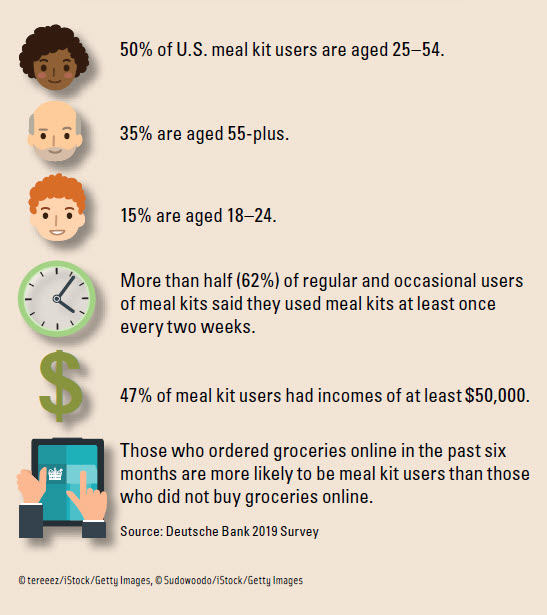

The clear benefit of meal kits is their ability to give time-strapped consumers a quicker route to a home-cooked dinner. In a 2019 Deutsche Bank survey of U.S. consumers, the No. 1 reason meal kit users gave for choosing them was to save time cooking, cited by 42%, followed by saving time shopping, noted by 38%. Healthfulness was third on the list, with 37% of respondents agreeing with the statement that “meals are often healthy.” The ability to discover new recipes and types of meals also came in high on the list of benefits in the study.

On the flip side, however, is the fact some consumers aren’t comfortable with the commitment a meal kit subscription requires; orders must be placed days ahead of time, and once the food arrives it needs to be prepped within days. As Mintel global food and drink analyst Melanie Zanoza Bartelme reflects: “It’s in your fridge and you’re already committed to it, but what if something comes up—you get busy or what if you just don’t feel like making it on that day?”

There’s also the issue of price. Cost was the No. 1 reason that U.S. consumers surveyed by Deutsche Bank gave for not using meal kits; 31% of respondents said that meal kits are too expensive.

“Given that many consumers view their pricing as expensive, they need to prove their value,” says Seifer. “There is value in saving consumers a trip to the store, saving them from buying too much produce that goes bad, and answering the daily question of ‘what’s for dinner?’”

Delivering on the value proposition is precisely what meal kit company Home Chef is attempting to do. “As we’ve grown and we’ve been able to take advantage of economies of scale in terms of sourcing ingredients, we’ve tried to pass as much of that savings along to consumers in the form of higher quality—so that may be a slightly better cut of meat or a slightly higher-quality set of ingredients in a particular meal,” says Rich DeNardis, Home Chef chief revenue officer.

Making It Even Easier

For consumers seeking even simpler ways to feed themselves healthfully, fresh ready-to-eat meal programs like those from Snap Kitchen and Fresh n’ Lean are an option.

Snap Kitchen offers healthy ready-to-eat breakfasts, lunches, and dinners that are made fresh daily and are available in Snap Kitchen retail outlets located in Philadelphia and several cities in Texas. This past June, Snap Kitchen extended its reach substantially when it announced the availability of direct shipping to households in 15 states.

“Prepared meals take convenience to the next level, and consumers tell us this is what they want,” says Laureen Asseo, the founder of meal prep delivery service Fresh n’ Lean, which ships healthful, preportioned meals directly to consumers across the United States. Meals are ready to eat after just two to three minutes of microwaving.

Neither Asseo nor Jon Carter, CEO of Snap Kitchen, view their offerings as directly competitive with meal kits. “I see meal kits as more of an occasion whereas ready-to-eat/ heat-and-eat meals are routine daily, weekly things that are more of a lifestyle thing,” says Carter.

“I think at the end of the day, all of these concepts are trying to solve a fundamental problem, which is to give people their time back,” Carter continues. “There’s a distinction in terms of the amount of time that the consumer is getting back as a function of those product formats.”

Meal kit makers are also sensitive to consumers’ time constraints, of course. DeNardis says Home Chef strives to limit the number of pots and pans required to prepare the company’s meal kits. And this spring Home Chef debuted Oven-Ready meal kits, which come with the cooking pan included. They require about 30 minutes of cook time but very minimal prep time. After combining a few ingredients, “all you do is slide that tin into the oven to bake,” says DeNardis. “It bakes while you can go check your emails or chase after your kids.” The company also offers Home Chef Heat & Eat precooked meals that can be heated in the microwave in minutes.

DeNardis isn’t convinced that there’s a distinct subset of consumers for each kind of product. “I think what we’re finding—and the data are still coming in—[is that] it’s really more the same customer that just has different needs that they’re looking to address based on their schedule throughout the week.”

Reaching Consumers Where They Are

Arguably the most significant recent development in the meal solutions category is the move that both meal kits and prepared meals are making into the supermarket. Grocery retailer Albertsons got into the game early with its 2017 acquisition of meal kit service Plated and began offering Plated meal kits in its stores the following year. The NPD Group estimates that more than one-fourth of recent meal kit users are buying products both online and in a retail setting (NPD Group 2019).

Home Chef was acquired by Kroger in 2018 and currently sells meal kits in more than 1,000 Kroger supermarkets and expects to be in 2,000 stores soon. “It’s important to be able to address that ‘dinner tonight’ need state and being able to do so with product on-shelf is super beneficial,” says DeNardis. “Looking at where people are buying their groceries, there’s still a vast preponderance of folks that are going to the store to buy their groceries, and a vast preponderance of dollars in the grocery category are still in-store. So, I think it’s safe to say that it’s definitely a channel that we didn’t think we could overlook.”

Although Home Chef’s meal kit sales volume currently skews “pretty heavily toward online,” DeNardis expects supermarket sales to be roughly equal to online subscription sales within the next year and to potentially overtake them.

Snap Kitchen began selling a 35-SKU selection of prepared products in six Austin Whole Foods Market stores this fall. The Snap Kitchen and Whole Foods brands align well, says Carter. “It’s a perfect match in many ways,” he notes. “We find from our own consumer research that many of our customers are Whole Foods customers.”

Carter adds that offerings like Snap Kitchen’s can help a retailer differentiate itself in the crowded grocery retail marketplace. “I think a lot of grocery stores are starting to look at the fresh prepared food aisle and really see that as a strategic advantage relative to one another,” he observes. “If that offering is really great, then consumers have a reason to come to one grocery store versus another.

Deutsche Bank’s analysis finds that on average both those who use meal kits and those who don’t use them cook with fresh ingredients just two nights a week—with frozen food, takeout, and restaurant visits accounting for meals on the other nights. “If you look at the week of a meal kit user, meal kits have simply taken share out of those nights where people would have cooked with fresh ingredients to begin with,” the company’s analysts write (Deutsche Bank 2019). Their conclusion is that meal kit services are primarily stealing share from the grocery market, so it should not be surprising that supermarket companies are getting into the meal kit game.

Supermarkets aren’t the only new venue for meal kits. Chick fil-A tested “mealtime kits” in 150 of its Atlanta-area restaurants last fall, offering two-serving kits for $15.89 in varieties that included Chicken Parmesan, Dijon Chicken, and Chicken Flatbread.

Even retailing behemoth Amazon has gotten into the meal kit act, selling meal kits in its checkout-free Amazon Go convenience stores. A new menu of “dinner for two” meal kits is offered monthly. The marketing tagline is “We do the prep. You be the chef."

What About Waste?

Because it’s necessary to keep many components of meal kits separate and to ensure that those components survive shipping intact, meal kits tend to go heavy on the packaging, which doesn’t always sit well with environmentally conscious consumers. So, it’s not surprising that meal solutions companies are working hard to reduce packaging and ensure that it’s as earth friendly as possible. All Snap Kitchen containers, for example, are compostable and have recyclable lids.

According to Mintel, environmentally friendly or eco-responsible packaging is the claim that’s made second most often on meal kits in Europe and third most often in North America (Luttenberger 2019).

The amount of primary and secondary packaging meal kits require may be a barrier to purchase for some consumers, Bartelme notes. “Basically, [meal kit users] are sacrificing environmental friendliness for convenience, and that might be something that some consumers struggle with,” she says. “It may not be a universal problem, but I think it’s definitely something that anybody working in this space will need to be thinking about.”

Interestingly, however, a recent study in an environmental journal suggests that the bad rap on meal kit packaging may be unwarranted. Researchers from the University of Michigan who made a study of meal kits found that they had a carbon footprint that was, on average, 25% smaller than the footprint associated with preparing a comparable meal from scratch. While meal kits contributed more packaging to the waste stream, they scored favorably in terms of carbon footprint thanks to their reduction in ingredient waste, streamlining of supply chains, and the economies of bulk preparation (Heard, Bandekar, Vassar, and Miller 2019).

Subscription meal services also deserve credit for minimizing food waste thanks to their sophisticated data analytics. “They know in most markets which recipes they intend to offer each week well in advance, and they have demand forecasting models that tell them what the order rate for each recipe is likely to be,” write Deutsche Bank analysts Nizla Naizer and Tiffany Kanaga (2019). Thus, only about 3% of food produced is waste versus about 23% for a traditional grocery retailer, according to the analysts.

What’s Cooking for the Category

Fresh food sales are driving grocery retail growth, and the majority of consumers at least claim to be trying to eat healthfully (Nielsen 2018; Steingoltz, Picciola, and Wilson 2018). And that freshness- and wellness- focused climate bodes well for the meal solutions category.

“I like to say that for years the pendulum was swinging in the direction of convenience at the expense of quality—things like fast food and frozen dinners,” says DeNardis of Home Chef. “Now I think what’s great about the space that we’re trying to develop is that we’re able to deliver on both convenience and quality at the same time.”

Meal kits and fresh meal delivery services also give consumers the opportunity to address specific health concerns and tailor their food choices to a particular lifestyle, whether it be vegan, paleo, carbconscious, or one of many others. Healthy, upscale meal kit provider Sun Basket, for example, offers 11 different meal plans, including options such as Lean & Clean, Diabetes-Friendly, and Carb-Conscious. Fresh n’ Lean meal delivery service has five wellness-oriented meal platforms, including Performance Protein+, Standard Keto, Performance Paleo, Standard Plant-Based, and Low Carb/Low Cal Plant-Based. About 40% of customers opt for a plant-based plan, founder Asseo says.

Today’s consumers tend to define health in very individual ways, so offering them a variety of wellness-oriented options is a good idea, says Mintel’s Bartelme. “Consumers want to feel that they have some way to personalize their food. They want to have some say in what they’re eating.”

She’d like to see meal delivery plans that give consumers even more options for customizing their food selections. “What I really want to see happen—and I think we’re starting to see some signs of it—is meal kits really going outside the box—taking all those elements you would put into a composed meal kit and presenting them in a different way.” This would allow consumers the opportunity to “mix and match” their menu choices, she says.

On its website, Sun Basket expands the options it provides customers by including the ability to order a carefully curated selection of branded “pantry” items such as Nona Lim bone both, Equal Exchange coffee, and La Tourangelle olive oil in addition to its meal kits. To be included, products must meet the taste and quality standards established by the Sun Basket team; each ingredient label is reviewed to ensure that it does not contain any of the more than 75 ingredients the company considers unacceptable. Snap Kitchen invites website visitors to “snap a little, snap a lot,” clearly giving them the option to order individual items à la carte, create their own meal menus, or opt for a particular lifestyle meal plan such as High Protein or Whole30.

Research firm Packaged Facts sees market opportunities for meal kit companies that focus on addressing the needs of specific demographic segments, including older consumers who may need assistance with meal preparation and members of the Millennial and Generation X cohorts, who are comfortable with ordering food online and more likely to be single and thus see the appeal of limited portions. In the United Kingdom, Bartelme says, grocery retailer Tesco offers private label single-serving meal kits, a savvy move given the strong growth forecast for the single-household sector in coming years.

Consumers with special dietary needs are another high-potential market, according to Packaged Facts, and it’s a niche that healthy meal kit providers are well positioned to tap into. Sun Basket is currently testing an option in which at-risk populations can access meals through an insurer-subsidized program. The company also offers discounts to employees of health insurance providers Kaiser and BlueCross BlueShield. Featuring meal kits in hospital cafeterias would allow weary and emotionally drained hospital visitors a quick and easy dinner solution, Bartelme suggests.

Awareness of meal kits is high, but market penetration is still fairly low, which suggests good growth potential (Deutsche Bank 2019). The NPD Group estimates that there are 93 million U.S. adults who have not tried meal kits but are interested in doing so. “There is an untapped market for meal kits, and it’s up to meal kit providers and retailers to find out what it will take to get a potential meal kit user to become one,” says Seifer. “The subscription model is likely to remain relevant, but it’s important to remember consumers are looking for meal solutions both online and in stores.”

“Fresh prepared meal solutions and meal kit solutions are part of reality now. … I think they’re here to stay,” says Snap Kitchen’s Carter. He’s convinced, however, that the meal solutions category must continue to evolve. “I think what it [the category] is today is not necessarily what it will be two to five years from now. In order to stay relevant, I think brands in the category, including us, will continue to need to move to where the consumer is.”

REFerences

Deutsche Bank. 2019. Compare the Meal Kit: Surveyors of Taste. May 31. Deutsche Bank Research, London. dbresearch.com.

Heard, B. R., M. Bandekar, B. Vassar, and S. A. Miller. 2019. “Comparison of life cycle environmental impacts from meal kits and grocery store meals.” Resources, Conservation and Recycling 147: August. https://doi. org/10.1016/j.resconrec.2019.04.008.

Hexa Research. 2019. Global Meal Kit Delivery Service Market Size and Forecast by Type (Fresh Food, Process Food) and Trend Analysis 2015–2025. Feb. Hexa Research, Felton, Calif. hexaresearch.com.

Luttenberger, D. 2019. On-Pack Cues Are a Key Component of Ready Meal Kits. July. Mintel International, Chicago. mintel.com.

Naizer, N. and T. Kanaga. 2019. “What are you having for dinner?” Periodical Thematic Research. July 4. Deutsche Bank Research.

Nielsen. 2018. Total Consumer Report. June. The Nielsen Co., New York, N.Y. www.nielsen.com.

NPD Group. 2019. “93 Million U.S. Adults Have Yet to Use a Meal Kit but Are Interested in Giving Them a Try.” Press release, March 13. The NPD Group, Port Washington, N.Y. npdgroup.com.

Packaged Facts. 2018. Meal Kits: U.S. Trends & Opportunities. Nov. Packaged Facts, Rockville, Md. packagedfacts.com.

Steingoltz, M., M. Picciola, and R. Wilson. 2018. “Consumer Health Claims 3.0: The Next Generation of Mindful Food Consumption.” L.E.K. Insights. XX: 51. https://www.lek.com/insights/ei/ next-generation-mindful-food-consumption.

Yoon, E. 2017. “The Grocery Industry Confronts a New Problem: Only 10% of Americans Love Cooking.” Harvard Business Review, Sept. 22