Global Migration: Emerging Opportunities in Food and Drink

Global look-a-likes of favorite foods, prep-less meals, and a new pseudo-vegan lifestyle are among the megatrends reorienting the global food industry.

Article Content

Global sales of packaged foods and drinks topped $2.1 trillion in 2017 and are projected to increase at a compound annual growth rate (CAGR) of 2.2% through 2022. Asia Pacific and the Middle East/Africa are the fastest-growing sectors (Euromonitor 2019a).

Dairy is the largest global packaged food category followed by baked goods, processed meat/seafood, confectionery, savory snacks, rice/pasta/noodles, sauces/dressings/condiments, sweet biscuits/snack bars, ready meals, and edible oils (Euromonitor 2019a).

Based on revenue, profit, assets, and market value, Anheuser-Busch, Nestlé, and PepsiCo were the world’s largest food/beverage companies last year (Forbes 2018).

Fueled by growth in emerging markets, quick-service restaurants continue to outperform full-service eateries worldwide, with sales of $856 billion in 2018—up 2.9% versus 2017. Healthier menu options, skyrocketing use of delivery, and competition from convenience stores— especially in Asia—remain major industry issues (IBISWorld 2019).

With 37,855 locations in 2018 and sales of $95.1 billion, McDonald’s is by far the world’s largest restaurant chain, followed by Starbucks at $33.7 billion, KFC at $26.2 billion, Burger King at $21.6 billion, Subway at $16.2 billion, Domino’s at $13.5 billion, Pizza Hut at $12.2 billion, Taco Bell at $10.8 billion, Wendy’s at $10.5 billion, and Dunkin’ Donuts at $10.0 billion (Technomic 2019).

Dramatic demographic changes, widespread electronic connectivity, and shifting personal values are continuing to reshape consumer lifestyles along with food/beverage purchase decisions around the world.

Half of the Japanese population will be over age 50 by 2025; close to 40% in China, Russia, the United Kingdom, the United States, Canada, and Italy; 30% in Brazil; and over 20% in Mexico and India, per Euromonitor (Angus and Westbrook 2019).

Life expectancy has increased to 83 years in Australia, 81 in Germany, 79 in the United States, 76 in China, and 69 in India (World Bank 2018).

U.S. marketers frequently focus their attention on young adults despite the fact that their incomes are often limited. The developing regions are home to the largest Gen Z and Millennial populations in the world, per Euromonitor (Angus and Westbrook 2019).

Although birth rates are declining in developed markets, the global population will reach 8.2 billion by 2025, up from 7.7 billion in 2019. China, with more than 1.4 billion people, is the largest country, followed by India with nearly 1.4 billion, the United States with 329 million, Indonesia with 271 million, Pakistan with 217 million, and Brazil with 212 million (Dadax 2019).

Global infant formula sales are projected to top $90.5 billion by 2025 with a CAGR of 9.4%, and infant formula remains one of the fastest-growing global food categories (Hexa 2019).

Persons living alone represent the fastest-growing global household unit, followed by couples without children, single-parent families, and married couples with children. Single households will increase by 70% in France by 2030, 60% in England, 43% in Korea, and 26% in Japan (OECD 2018).

Moreover, global households increasingly include a pet. In 2018, global pet food sales reached $91 billion. Dog food sales in Asia Pacific are projected to increase by $4 billion by 2023; cat food sales are expected to increase by $2 billion (Euromonitor 2019b).

By 2030, 61% of the world’s population will live in urban settings. China will house one-fifth of all city dwellers, reports Euromonitor. Urban consumers are much more likely to dine out, be convenience oriented, and buy organic foods (Angus and Westbrook 2019).

Specialty foods and drinks represent the third fastest-growing luxury category worldwide, after electronics and cars. Global specialty food sales are expected to jump 28% by 2023; sales of high-end alcoholic beverages are projected to increase by 26%, per Euromonitor (Roberts and Hodgson 2018).

We live in an increasingly well-connected world. Just over half (53%) of the world’s population, or 3.9 million people, are on the internet (Angus and Westbrook 2019).

As of July 2019, global consumer confidence is rising, albeit slowly. Those in major markets, including China, India, Indonesia, the United States, and Germany, remain confident in their economies. Confidence has greatly improved in France, South Korea, and Turkey, but it has declined in Brazil, Canada, Mexico, and the United Kingdom. Their own health, global warming, and job security are consumers’ top concerns (Conference Board 2019).

Culinary Creativity

Italian food was the world’s most tried and liked cuisine in a survey of 20,000 consumers in 24 global markets; pizza and pasta were among the world’s favorite foods. Chinese cuisine ranked second, followed by Japanese, Thai, French, Spanish, American, and Mexican (YouGov 2019).

Only 59% of Chinese consumers chose Italian as their favorite cuisine; Japanese are the hardest diners to please. Ironically, Japan has the highest number of restaurant visits per capita (YouGov 2019).

Half of Americans have tried Japanese foods and like them. Other popular ethnic cuisines among American consumers include Thai, liked by 43%; Korean, 36%; Indian, 34%; Vietnamese, 28%; Indonesian, 24%; Filipino, 20%; and Malaysian/Singaporean, 12% (Technomic 2018).

With the 2020 Olympics scheduled for Tokyo, expect Japanese fare—beyond sushi—to move into the culinary spotlight (e.g., soufflé pancakes, donburi rice bowls, katsu sando milk bread sandwiches, Japanese whiskeys, natto, togarashi (a seven-spice blend), and yuzu kosho, a condiment that has increased 40% on U.S. menus over the past four years (Datassential 2019).

Sesame, tahini, cardamom, clove, Korean gochujang, and Middle Eastern spice blends (e.g., hawajj, baharat, and urfa biber (a Turkish chili pepper) are poised to add exotic savory/spicy notes to familiar fare (Mintel 2019a).

Muhammara, toum, and zhug will meet demands for more intensely flavored dipping/cooking sauces. Indian masala sauces and kasundi mustard, as well as marine greens (e.g., seaweed) are mainstreaming onto global menus (Mintel 2019a).

Samosas, pastelitos, calzones, qatayef, piroshki, falafel, Jamaican beef patties, Australian meat pies, and Japanese takoyaki are poised to meet the explosive demand for handheld pocket meals and appetizers.

Georgian khachapuri, Vietnamese bánh xéo, Indian vada pav and kati roll, and French galettes will fuel a new trend to handheld open-faced sandwiches. Super spicy is the hot pizza trend as are wine-infused sauces and unique crusts (e.g., flaky French pastry crusts).

Arepas, Indian paratha, El Salvadorian pupusas, and crepes of all denominations are high-potential carriers. Ethnic soups are a missed opportunity; think East European borscht, Jamaican pepper pot, Asian miso, and Palestinian red lentil/squash soup.

Foreign fruits, including mangosteen, cherimoya, lingonberries, young coconut, red dragon fruit, and nearly any mushroom species, are among the trendy produce items (Frieda’s 2019). Foraging is a growing trend, as is selling nuts with the skin on to improve their nutritional value.

Triticale, millet, spelt, teff, freekeh, sorghum, kamut, amaranth, red wheat, and black rice are among the global grains moving onto menus (Datassential 2018a). A/S Crispy Food International offers granola with chia, beetroot, and carrot; its ingredients are 100% Danish.

Single-serve ethnic desserts are dominating indulgent bakery sales with a focus on French patisserie and Italian mini treats, such as mille-feuille, macaroons, and limoncello tarts. Watch for chef-inspired versions of classic Greek baklava, Japanese mochi, Chinese egg tarts/custard, Polish paczki (filled doughnuts), and Russian tea cookies.

Asian iced desserts (e.g., Thai rolled ice cream and Taiwanese ice), liquor-added Portuguese rum cakes, and pastel cookies are other fast-emerging global dessert directions.

Favor for fermented foods continues to skyrocket beyond kimchi and kombucha. Kefir, tempeh, and natto are up-and-coming naturally functional foods (Datassential 2018b).

Global sales of tofu are projected to reach $24.3 billion by 2022, and tempeh sales are expected to be $5.8 billion by 2026 (Persistence 2019; Market Insights 2019). Miso, koji, fish sauce, and gochujang are fermented foods/condiments gaining in global popularity (Mintel 2019a).

Italy, South Africa, Indonesia, Mexico, India, and Brazil have the highest share of consumers who say they’re passionate about food/cooking. Meal preparers in India, Ukraine, South Africa, Indonesia, Italy, and Spain spent the most time cooking per week (GfK 2016).

Convenience Matters

With women now accounting for 37% of the global workforce, the demand for convenient meal sourcing/preparation continues to grow among consumers around the globe (World Bank 2019). Over half of Chinese consumers are willing to spend money to save time, as are 60% of Indian adults (Mintel 2019b).

Globally, frozen food consumption is also on the rise with sales projected to reach $282 billion by 2023, up from $219 billion in 2018. Western Europe is expected to lead growth (MarketsandMarkets 2019).

Europe and North America dominate the fresh prepared and frozen sandwich categories, accounting for 70% of new product launches and 90% of dollar sales in 2018. Avocado, sweet corn, bacon, onion, garlic, curry, and mayonnaise are among the sandwich toppings/sauces gaining popularity around the globe (Innova 2018a).

Plain pasta/noodles, instant noodles, prepared salads, and instant pasta are the most active ready-meal categories for new global product launches (Innova 2018a). Sold in a tall, sealed paper cup, grab-and-go Mashed Potatoes with Forest Mushrooms and Rice with Ginger and Soy Sauce from Just Inn are available in the United Kingdom.

Sales in the global snack market topped $514 billion in 2018; growth of healthy snacks continues to outpace their indulgent and sugary counterparts (Euromonitor 2019a).

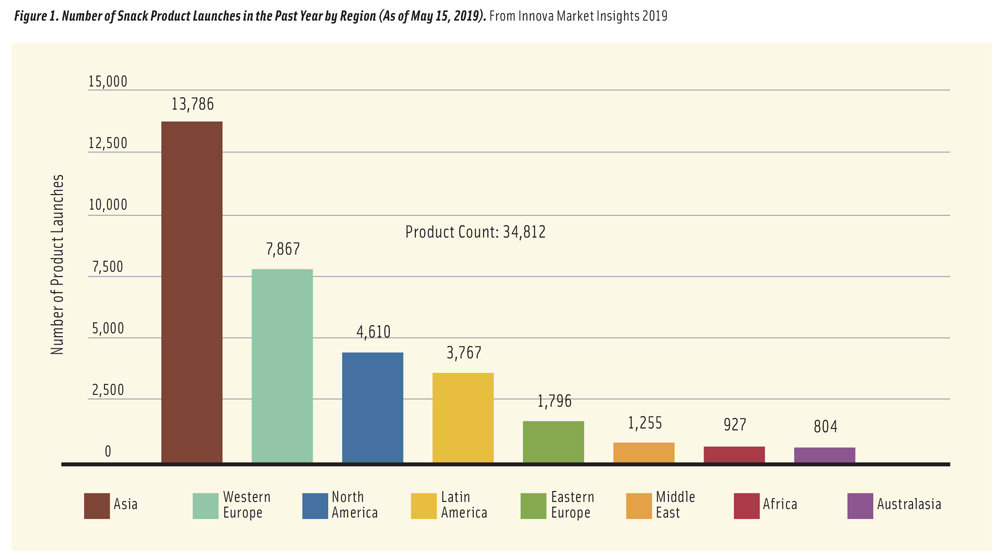

In the year ending May 15, 2019, Asia had the highest number of new snack product introductions (13,786), a total that was double the second most active market, Western Europe (Innova 2019a; Figure 1). Chili was the most added flavor (Innova 2019a).

With sales of $191 billion, confectionery is the largest global snack category. Over the past five years, savory snacks, followed by sweet biscuits/cookies, snack bars, and fruit snacks were the fastest-growing categories. Japan is the leading bar market in the Asia Pacific; India is the fastest growing (Euromonitor 2019a). Just over half of Chinese consumers aged 20–49 who eat cookies and crackers say coatings, fillings, and layering are important qualities in their purchase decisions (Mintel 2019b).

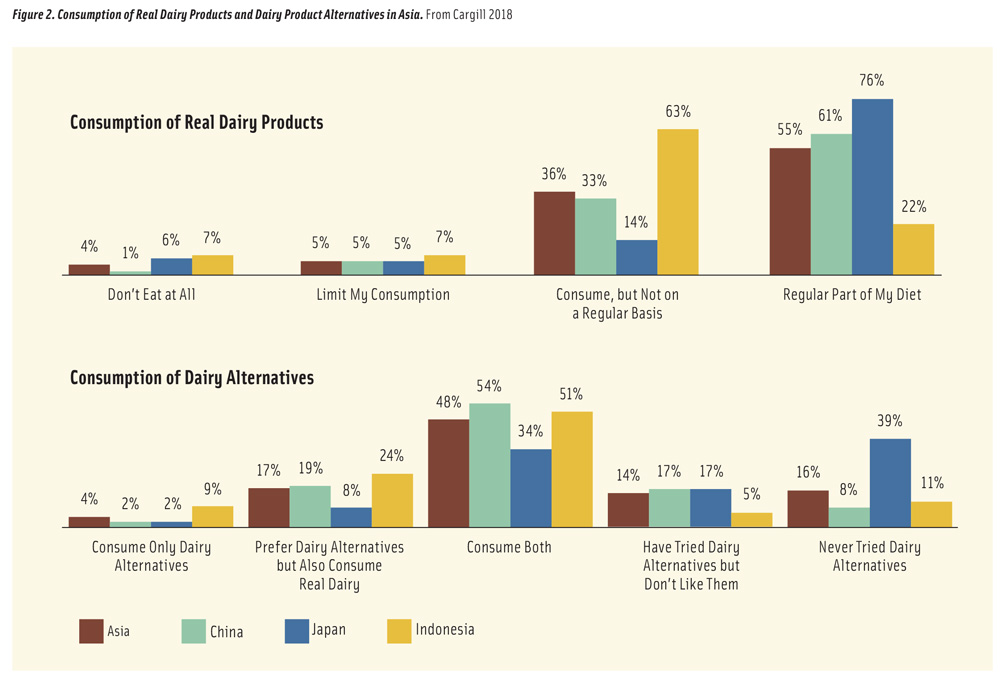

Global dairy sales in 2018 topped $500 billion, increasing by more than $90 billion over the past five years, per Euromonitor. The United States, China, Brazil, Germany, and Russia are the largest dairy markets (Warner 2019). Asia is an enormous opportunity for both real and plant-based dairy products (Cargill 2018; Figure 2).

For 2018, fluid milk was the largest global dairy category, followed by cheese, yogurt/sour milk products, other dairy, and butter/spreads; other dairy, butter/spreads, and cheeses were the fastest growing (Euromonitor 2019c).

High-protein, plant-based, gut health, dairy snacks, allergy-free, sustainably positioned, and indulgent are the major dairy trends. Use of non-bovine milks, such as goat milk in France and Spain, is on the rise.

Premiumization, organic, lactose-free/sugar-free, reduced fat, and fortification (e.g., calcium, protein) have stimulated growth in the milk category, delivering an 8.5% CAGR over the past five years. Digestive health, protein, low fat, no additives, and gluten-free are the top claims on new milk product introductions (Innova 2019b).

The yogurt market in Western Europe is slowing with fewer children, a shift to drinking yogurts, avoidance of sugary flavored offerings, and experimentation with plant-based options (Euromonitor 2019c). Actimel offers cheese-flavored drinkable yogurt and a yogurt superfoods line.

Milk intolerance is a widespread issue in Latin America, and countries including Brazil, Mexico, and Argentina have high demand for dairy alternatives and lactose-free milks. Cheese is one of the most purchased categories in Latin America (Innova 2019b).

The global dairy alternatives market is projected to grow from $17.3 billion in 2018 to $29.6 billion in 2023 (ResearchandMarkets 2019). Fortifying plant-based milks is a big idea. In the United States, 83% of consumers would drink more plant-based milks if they were fortified (Packaged Facts 2017).

In descending order, water, tea, coffee, beer, milk, orange juice, wine, and soft drinks are the most-consumed beverages worldwide (Chevada 2019). Iced beverages (e.g., cold-brewed coffees), slushies, smoothies, and handmade drinks are fast getting global attention. Drinks made with purified seawater are another growing trend.

Taiwanese bubble tea topped with tapioca pearls, Asian cheese teas, and brown-sugar milk teas swirled with caramel are trending out of Asia as are textural beverages with pulp and extra carbonation (Innova 2019c). Forty-three percent of Chinese consumers aged 20–49 want teas that contain fruit bits (Mintel 2018).

Protein, collagen, fortified, and alkaline waters are posting strong sales. In Asia, jelly nutritional pouch drinks, often heavily fortified, are attracting moms and sports enthusiasts alike. Yakult Beauty+ Drinking Yogurt delivers skin care from the inside out.

Healthy and Holistic

Naturally healthy foods and drinks, with sales of $275.6 billion in 2018, and fortified/functional fare with sales of $261.6 billion, remain the world’s largest healthy food categories; organic and “free from” are the world’s fastest growing, per Euromonitor. Asia Pacific continues to lead global health/wellness growth in food and nutrition (Barbalova 2019).

China tops the list of markets with the highest growth potential for fortified foods; it is followed by Indonesia, Japan, Hong Kong, India, Vietnam, Saudi Arabia, Mexico, Malaysia, and Brazil (Mascaraque 2018).

Global sales of organic food/drink topped $100 billion last year, up 6% versus 2017. The United States, with 45% of sales, is the largest market, followed by Germany, France, Italy, and Canada. The highest per capita spenders on organic live in Switzerland, Denmark, Sweden, and Austria. Globally, organic farmland increased 20% in 2017, the largest growth ever recorded (Ecovia 2019).

Of the 20,000 consumers surveyed by Euromonitor in 20 core global markets, 19% followed a low-sugar regimen, 10% calorie-restricted, 9% low/no carbs, 8% high-protein, 8% halal, 6% vegetarian, 5% high-fat, 5% intermittent fasting, 5% gluten-free, 4% pescatarian, 4% dairy-free, 3% raw food, 3% vegan, 3% grain-free, and 2% kosher (Barbalova 2019).

Worldwide sales of clean label packaged foods reached $195.7 billion in 2018; clean label soft drink sales were $48.2 billion, and clean label hot drink sales were $5.0 billion, per Euromonitor. Half (48%) of global consumers cite “all natural” as their preferred food attribute (Shridhar 2019). One in five (22%) of UK adults follows a clean diet (Mintel 2019c). Worldwide, 57% of consumers are extremely/very concerned about genetically modified organisms; 18% say they’ve become more important over the past year (HealthFocus 2018).

Despite 39% of adults worldwide suffering from high cholesterol levels and 16% experiencing hypertension, heart disease and weight management are no longer on the top 10 list of health concerns consumers are extremely/very concerned about (WHO 2017; HealthFocus 2018).

The ability to maintain mental sharpness and to continue with normal activities with age remain the top global health concerns, followed by eye health, tiredness/lack of energy, stress, immunity, appearance/skin health, back/neck pain, bone health/strength, and cancer.

When health concerns are plotted against issues that personally affect consumers, conditions that fall into the “unresolved afflictions” quadrant are the most marketable—with consumers displaying high interest in trial and less price sensitivity. They include tiredness/lack of energy, vision, stress, back/neck pain, digestive issues, sleep, and joint/muscle/skin health (HealthFocus 2018).

While weight management is no longer among the top 10 concerns, 52% of global consumers are looking for new solutions to manage weight, per Euromonitor (Oster 2018). Worldwide, 1.9 billion adults are overweight and 650 million obese; 340 million children are overweight or obese (WHO 2018a).

Weight management markets are projected to grow the fastest in Asia Pacific and Latin America. Meal replacements and supplement nutrition drinks are posting the strongest gains (Oster 2018).

Half of global consumers are looking for new solutions to prevent stress and anxiety, 48% want help with sleep problems, and 42% seek assistance with memory issues. Poland, Italy, Japan, Brazil, Turkey, and Germany have the highest percentage of consumers currently experiencing stress and anxiety (Barbalova 2019).

Forty-two percent of Brazilians would buy foods/drinks that help them to reduce their stress (Mintel 2019b). Watch for B vitamins, omega-3s, choline, and L-theanine to get more attention globally for brain health.

Over half (52%) of Chinese parents with children aged 4–12 would buy kids’ foods/drinks if they helped with intellectual development (Mintel 2019b). Nesquik’s powdered drinks aim to improve cognitive health in kids.

In 2017, 425 million people globally had diabetes; 352 million were at risk of developing type 2 diabetes (IDF 2018). With nearly 200 million adults suffering from mild vision impairment, eye health is a missed functional food opportunity (WHO 2018b).

Asia Pacific led new product introductions with a gut health claim in 2018; India, China, and Vietnam were the largest markets. With research increasingly linking the microbiome to a variety of benefits, (e.g., mental health and skin), expect more attention to probiotics, prebiotics, synbiotics, and fiber (Mintel 2019d).

The global probiotic markets are projected to grow from $42.5 billion in 2017 to nearly $74.7 billion by the end of 2025, with a CAGR of 7.3%; functional foods/beverages held a 76.4% market share in 2017. Dairy, baby foods/formula, drinks, and snacks are still the leading probiotic categories (Future Business Insights 2019).

One-third of Chinese parents are interested in high-fiber foods for their children; 54% of Indian consumers want to get more fiber in their diet (Mintel 2019b).

Globally, gut health, fiber/regularity, support for probiotics, immunity, and antioxidant properties are the benefits most associated with prebiotics by global consumers (Monheit 2018).

In 2017, Asia surpassed the United States as the world’s largest dietary supplement market; global supplement sales reached $128.3 billion. China, Eastern Europe/Russia, Latin America, and Africa were the fastest-growing markets, each with over 9% sales growth last year (NBJ 2018). Vitamin C, vitamin D, calcium, and multivitamins are the most popular supplements taken worldwide (Shridhar 2019).

Herbal/traditional health product sales are projected to reach a hefty $63 billion globally by 2023 (Barbalova 2019). After vitamins/minerals, herbals/botanicals are the largest supplement category in China, Australia, and India (NBJ 2018).

Almost half (48%) of global consumers say they almost always/usually choose foods/beverages because they are high in protein. Natural is by far the top indicator of a good source of protein, followed by a complete source, and clean label. Although interest in plant-based protein is high, only 27% of global consumers selected it as an indicator of a good source of protein. Beans/legumes, eggs, and seafood topped the list of good proteins globally (HealthFocus 2018).

Mainstream fit consumers who exercise at least three to five days a week and are trying to live a more active lifestyle are fast becoming a global phenomenon, often buoyed by government health initiatives. In 2018, about 40% of consumers exercised regularly in China (Han 2018). One-third of Brazilians exercise three to six hours per week (Cint 2018).

The global sports nutrition market is projected to reach $53.1 billion by 2026, with a CAGR of 6.7% from 2018 to 2026 (MarketWatch 2019). In descending order, ready-to-drink, low-in-sugar, and clean ingredients are the most important sports nutrition product features (Shridhar 2019).

Wearable technology, high-intensity interval training, fitness training for older adults, exercise as medicine, and bodyweight training are among the top global fitness trends for 2019 (ACSM 2018).

Muscle loss with aging, known as sarcopenia, is a growing concern; over 40% of adults 65 years and older in Japan are afflicted. Forty percent of urban consumers in Thailand link high-protein food/drink with replacing muscle loss due to aging (Mintel 2019b).

Globally, the lure of personalized nutrition apps and genetically based diet regimens are on the rise. Forty-two percent of UK consumers would be interested in a personalized diet based on their genes/DNA (Mintel 2019c), despite the fact that 40% of DNA analyses may be inaccurate.

In Japan, Nestlé’s Wellness Ambassador Program had 100,000 users in 2017. Nestlé’s app provides a nutritional meal analysis/eating plan based on pictures taken by consumers of the foods they eat and a genetic analysis by blood sample. The company offers eating/lifestyle recommendations and sells customized supplements for diet, skin, and sports.

Ethical Living

There were 375 million vegetarians worldwide in 2016, including 31% of the Indian population and 10% in Western Europe (Quora 2019). The Philippines, Germany, Brazil, Turkey, Thailand, and Italy were among the top 10 countries with the largest increase in the vegetarian population in 2017 (Euromonitor 2019b).

But it’s the new trendy pseudo-vegan lifestyle that is sweeping the globe, especially among younger adults who are cruelty conscious/concerned about sustainability. Cereal/energy bars led new global launches that carried a vegan claim in 2018 (with 4.9% of new bar launches making such a claim), followed by meat substitutes (4.0%), dairy alternatives/drinks (3.8%), chocolate blocks (2.9%), and fruit-based snacks (2.9%) (Innova 2018b).

Bobeldijk offers Vegan Cordon Bleu frozen ready meals in the Netherlands. Vegan high-end cuisine is a fast-emerging full-service global restaurant trend.

Four in 10 people (42%) across 29 countries surveyed by IPSOS said they would eat a plant-based substitute for meat (IPSOS 2019a). Those in Asia (China 73% and India 63%) were most willing to do so, followed by those in Latin America (Mexico 58%, Columbia 56%, and Peru 55%). Those in Eastern Europe (Romania, Serbia, and Hungary) were the least willing to try the alternatives, followed by Japan and France (IPSOS 2019a).

Meat substitutes accounted for 14% of global meat launches in the first nine months of 2018, double the number in 2013 (Innova 2019). The United States was the largest meat alternative market in 2018 followed by the United Kingdom, Germany, Canada, and the Netherlands. France, Argentina, and Australia will be the fastest growing through 2022, per Euromonitor (Barbalova 2019).

Over a third of consumers in a survey of 38 global markets by IPSOS think that global warming/climate change (37%), air pollution (35%), and the amount of waste we generate (34%) are among the top three environmental issues facing their country; concern about these issues has grown since last year (IPSOS 2019b).

Japan, Spain, Germany, Canada, and South Korea are the countries where concern about global warming appears to be highest, with just over half of consumers saying it is a top issue; the United States ranks sixth. Germany, Belgium, Great Britain, Poland, France, and Sweden lead in terms of concern about overpackaging of consumer goods, with 25% of consumers saying it is a top issue (IPSOS 2019a).

Sustainable practices on the farm are also gaining importance, including regenerative agriculture, soil health/fertility, improved water quality, and more biodiverse ecosystems (Mintel 2019e).

European brands lead on-pack agricultural claims, including Jordans cereal that supports British wildlife and French Bonneterre milk with fair wages for farm workers. Hydroponics and urban farms are helping to reduce food miles (Mintel 2019e).

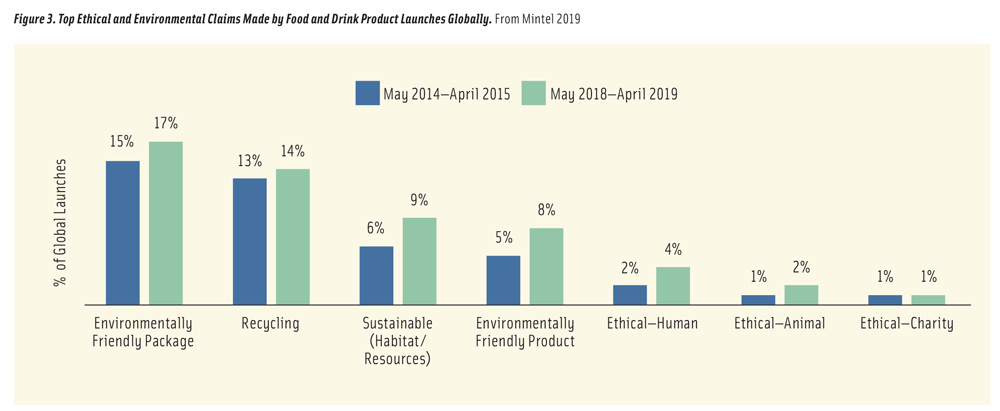

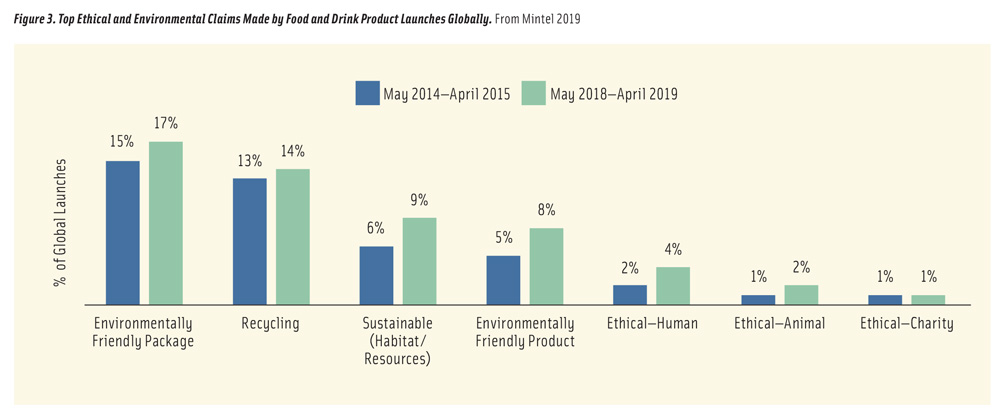

In 2018, 17% of new global food/drink launches made an environmentally friendly claim, 14% made a recycling claim, 9% a sustainability claim, 4% an ethical human claim, 2% an ethical animal claim, and 1% a charity claim (Mintel 2019f; Figure 3).

One-third of global consumers surveyed by Euromonitor look for a free-range claim on fresh products; over one-fifth look for cruelty-free and/or 100% vegan claims (Euromonitor 2019b).

REFERENCES

ACSM. 2019. Worldwide Survey of Fitness Trends for 2019. American College of Sports Medicine, Indianapolis.

acsm.org.

Angus, A. and G. Westbrook. 2019. Top 10 Global Consumer Trends 2019. Euromonitor, London. euromonitor.com.

Barbalova, I. 2019. Healthy Living; Prevention and Self Care as a Lifestyle. Euromonitor.

Cargill. 2018. The Shifting Global Dairy Market White Paper. Cargill, Minnetonka, Minn. cargill.com.

Chevada, R. 2019. The Most Consumed Beverages in the World. Toptenslist.com.

Cint. 2018. Exercise and Sports Participation in Brazil 2016–18. Cint Insights Connected, Stockholm.

cint.com.

Conference Board. 2019. Global Consumer Confidence Index. July. The Conference Board, New York N.Y. conference-board.org.

Dadax. 2019. Worldometers Population Clock. Aug. Dadax, London.

worldometers.info.

Datassential. 2018a. Trending Grains: Ancient Grains Overview. Datassential, Los Angeles. datassential.com.

Datassential. 2018b. Functional Foods. Nov.

Datassential. 2019. Top Global Flavors. Datassential’s Menu Adoption Cycle. Sept.

Ecovia. 2019. “Global Organic Foods Sales Break $100 Billion.” Press release, April 26. Ecovia Intelligence, London. ecoviaint.com.

Euromonitor. 2019a. Global Trends in Packaged Food and Snacks.

Euromonitor. 2019b. Shifting Market Frontiers: How Emerging Markets Will Reshape Global Pet Care.

Euromonitor. 2019c. “Revitalizing the Yogurt Market in E. Europe.” Euromonitor Blog, May 14. https://blog.euromonitor.com/revitalising-the-yoghurt-market-in-western-europe/.

Forbes. 2018. “2018 Forbes Global 2000.” Forbes June. Forbes.com. https://www.forbes.com/sites/maggiemcgrath/2018/06/06/worlds-largest-food-and-beverage-companies-2018-anheuser-busch-nestle-and-pepsi-top-the-list/#6c2df6bc1b08.

Frieda’s. 2019. Frieda’s Specialty Produce. Frieda’s, Los Alamitos, Calif. friedas.com.

Future Business Insights. 2019. “Global Probiotics Market is Projected to Reach US $74.69 Bn by the end of 2025.” Press release, June 19. Future Business Insights, Pune, India.

futurebusinessinsights.com.

GfK. 2016. Cooking: Consumers’ Attitudes, Trends & Time Spent Cooking. March. GfK, New York, N.Y. gfK.com.

Han, Y. 2018. “Fit to Grow.” China Daily, Dec. 10. dailyhk.com/articles.

HealthFocus. 2018. Global Consumer Trends Survey. HealthFocus Intl., St. Petersburg, Fla. healthfocus.com.

Hexa. 2019. Global Infant Formula Market. Feb. Hexa Market Research, Fulton, Calif. hexaresearch.com.

IBISWorld. 2019. Global Fast Food Restaurants. April. IBISWorld, Los Angeles. IBISWorld.com.

IDF. 2018. IDF Diabetes Atlas 2017 Global Fact Sheet. Intl. Diabetes Federation, Brussels, Belgium. idf.org.

Innova.2018a. Sandwiches Sub-category Report. Innova Market Insights. Arnhem, The Netherlands. innovadatabase.

Innova 2018b. “Plant-based Meats Trend amid Global NPD Shift in the Meat Market.” Food and Beverage Innovation Newsletter. 16(8): 1–3.

Innova. 2019a. Asia has a Healthy Snacking Appetite. July.

Innova. 2019b. Latin America: Plant-based Dairy. July.

Innova. 2019c. How Convenient Functional Drinks are Shaping to Meet Consumer Demand in Asia. Aug.

IPSOS. 2019a. “Food for thought: Would you like real or fake meat with that?” Press release, Aug. 12. Ipsos Group, Paris. ipsos.com

IPSOS. 2019b. “Climate Change Increases in Importance to Citizens Around the World.” Press release,

Aug. 12.

MarketsandMarkets. 2019. “Frozen Food Market worth $282.5 billion by 2023.” MarketsandMarkets, Ltd. Northbrook, Ill. marketsandmarkets.com.

MarketWatch. 2019. “Global Sports Nutrition market is Projected to Reach US$53.O7 Billion by 2026.” MarketWatch, San Francisco.

marketwatch.com.

Mascaraque, M. 2018. Top 5 Trends Shaping Health and Wellness. Oct. Euromonitor.

Mintel. 2018. Global Food & Drink Trends 2018. Mintel Intl., Chicago. mintel.com.

Mintel. 2019a. “Flavor Evolution: International Flavors 2.0.” Presented at IFT19, Institute of Food Technologists, New Orleans, June 2–5, 2019.

Mintel. 2019b. Global Food and Beverage Trends 2019.

Mintel. 2019c. “Live Panel: Diet Trends and Fads.” Presented at IFT19.

Mintel. 2019d. Gut Health: Today’s Hot Health Issue.

Mintel. 2019e. “Eyes on Agriculture.” Presented at IFT19.

Monheit, L. 2018. Global Prebiotic Consumer Survey. Global Prebiotics Assoc. Spring, Texas.

prebioticassociation.org.

NBJ. 2018. “Big Numbers and Big Opportunities: The Global Issue.” Nutrition Business Journal. XXIII (11).

OECD. 2018. The Future of Families. International Futures Program. Organization for Economic Cooperation and Development, Paris. oecd.org.

Oster, M. 2018. “Global Trends and Innovations in Weight Management.” Presented at SupplySide West, Las Vegas, Nov. 6–10.

Packaged Facts. 2017. Dairy and Dairy Alternative Beverage Trends. Oct. Packaged Facts, Rockville, Md.

packagedfacts.com.

Persistence. 2019. “Tempeh Market to Reach US $5,846.9 Mn by 2026.” June. Persistence Market Research, New York NY. persistencemarketresearch.com

Quora. 2019. Vegetarian Consumer Survey. Quora, San Francisco. quora.com.

ResearchandMarkets. 2019. “Global Dairy Alternatives Market Forecast to 2023.” Jan. ResearchandMarkets, Dublin. researchandmarkets.com.

Roberts, F. and A. Hodgson. 2018. Luxury Goods: Global Trend Watch. Dec. Euromonitor.

Shridhar, A. 2019. Top Consumer Trends Impacting Health and Nutrition. Euromonitor.

Technomic. 2018. Ethnic Food & Beverage Consumer Trend Report. Technomic, Chicago. technomic. com.

Technomic. 2019. Top 500 Chain Restaurant Report.

YouGov. 2019. Global Cuisines Survey. YouGov, New York, N.Y. yougov.com

Warner, D. 2019. Dairy in 2019. Euromonitor.

WHO. 2017. Cardiovascular Diseases: Key Facts. May. World Health Org., Geneva. who.int.

WHO. 2018a. Obesity and Weight: Key Facts. Sept.

WHO. 2018b. Blindness and Vision Impairment: Key Facts. Oct.

World Bank. 2019. Life Expectancy at Birth: Data for 2017. The World Bank, Geneva. data.worldbank.org.

Food Technology Articles

Vickie Kloeris Shares NASA Experiences in New Book, Consumers Are Confused About Processed Foods’ Definition

Innovations, research, and insights in food science, product development, and consumer trends.

Top 10 Functional Food Trends: Reinventing Wellness

Consumer health challenges, mounting interest in food as medicine, and the blurring line between foods and supplements will spawn functional food and beverage opportunities.

Better-for-you products on display at Natural Products Expo West

A photo overview of products shared at the 2024 Natural Products Expo West in Anaheim, Calif.

Adapting to Change: Insights From the RCA Conference

An overview of insights shared at the Research Chefs Association (RCA) Annual Conference & Culinology Expo in Quincy, Mass.

True Colors

A visually oriented overview of food color and colorant ingredient trends.

IFT Podcasts

EP 4: Consumers Don’t Want to Change, So Why Are They

With up to 40,000 products in a grocery store, many consumers are on auto-pilot when deciding what products to buy.

Episode 26: Food Industry Trends We're Predicting in 2021

Today’s podcast features Kelly Hensel, IFT’s senior digital editor, and John Ruff, IFT’s Chief Science and Technology Officer. This high-level discussion previews a few of the major trends that both Food Technology Magazine’s editorial team as well as IFT’s Science, Policy, and Innovation team expect to play a major role in 2021.