Demographic Disruption

Unmet needs of older consumers, a new generation of cooks, and high-end tastes among lower-income shoppers are spawning a wealth of new food and beverage opportunities.

Article Content

COVID-19 is not the only disruptor of the U.S. food and beverage marketplace. Major demographic transitions related to birth rate, a dramatic bifurcation of older/younger consumers, unprecedented growth in minority populations, and the increasing impact of urban shoppers are reshaping it as well.

The U.S. birth rate is declining rapidly. The Centers for Disease Control and Prevention reported the largest single-year drop in U.S. births in 50 years last year; 3.6 million babies were born in 2020 versus more than 3.7 million in 2019. As recently as 2007, there were 4.3 million births annually.

Gen Z is now the nation’s largest generation, but it is the older cohorts that are the fastest growing. From 2010 to 2020, the number of adults aged 55–64 years increased by 19%, according to U.S. Census Bureau data. The number of those aged 65–75 increased by 49%.

While food marketers appear to be disproportionately focused on developing “experiential” products for young adults, they are ignoring one of the most dramatic opportunities of all time: the emerging food and nutrition needs of one of the largest and wealthiest populations in the world—aging baby boomers. The U.S. population included 120 million Americans over 50 years old in 2020.

In 2020, Gen Zers numbered 86.4 million; millennials, 82.2 million; boomers, 68.7 million; Gen X, 65.1 million; and the matures, 25.4 million, the Census Bureau reports.

According to the 2020 Census, for the first time, the nation’s children are now a majority-minority, with more than half of those under age 16 being from a racial/ethnic minority. Latino or Hispanic and Black or African American children together comprise nearly 40% of the U.S. child population. Also according to the census, six in 10 adults identified themselves as white; 19%, Hispanic or Latino; 14%, Black or African American; and 6%, Asian American.

With cultural backgrounds significantly impacting the types of spices/condiments used and ethnic groups significantly more likely to make cultural foods at home, according to the Hartman Group’s food diversity study, it will be essential to incorporate new taste profiles into product development.

More Demographic Data of Note

• Couples with no children at home account for 32% of America’s 123 million households; those with at least one child account for 29%; and those living alone account for 28%, per the 2020 U.S. Census. The average household size is 2.6.

• As of February 2021, 42 million Americans were enrolled in the U.S. Department of Agriculture’s Supplemental Nutrition Assistance Program (SNAP). SNAP households accounted for $77 billion or 12% of all food/beverage sales in 2020, per IRI data.

• In contrast, 10% of U.S. households have an annual income over $200,000, 8% are in the $150,000–$199,000 range, and 16% have incomes of $100,000–$149,000. The U.S. median income was $68,703 in 2020.

• Urbanites are becoming an increasingly influential food demographic. They are most likely to be high-frequency core frozen food users and to be flexitarian, vegan, or vegetarian, Packaged Facts reports.

• While the profile of the online shopper skews younger, those aged 76 and up doubled their use of online shopping since the advent of COVID-19, according to FMI research. Online shoppers also tend to be urban, have kids, and have higher than average incomes.

• Pet parents are another fast-emerging demographic segment of significance. Seventy-one million U.S. households own at least one dog (96 million dogs) or cat (32 million cats), per a Packaged Facts pet report. Pet food/treat sales reached $42 billion in 2020, up 9.7% over the prior year.

Five key consumer trends cut across most demographic segments.

1. CULINARY SOPHISTICATION

Almost across the board, consumers are becoming more culinarily sophisticated. Low-income consumers are buying premium foods, and Gen Zers are buying nearly as many gourmet foods as millennials. Half of cooks in all demographic segments say they discovered new ingredients, flavors, and brands last year. Gen Z was most likely to do so, according to a cooking survey conducted by the Hunter public relations firm.

Low-income households make small indulgence food/drink purchases at a rate similar to other households, IRI reports. Along with younger adults and minorities, they are twice as likely to splurge on premium foods in order to create a restaurant-style meal experience at home.

Nearly eight in 10 millennials (82%) bought gourmet/specialty foods last year. For Gen Z, it is 76%, and 59% for boomers. Seasonings and sauces were the fastest-growing categories, according to the Specialty Foods Association.

Millennial and Gen Z cooks are twice as likely to experiment with a diversity of preparation methods compared with their older counterparts, and they are three times more likely to seek out unique flavors and ingredients, per FMI—the Food Industry Association.

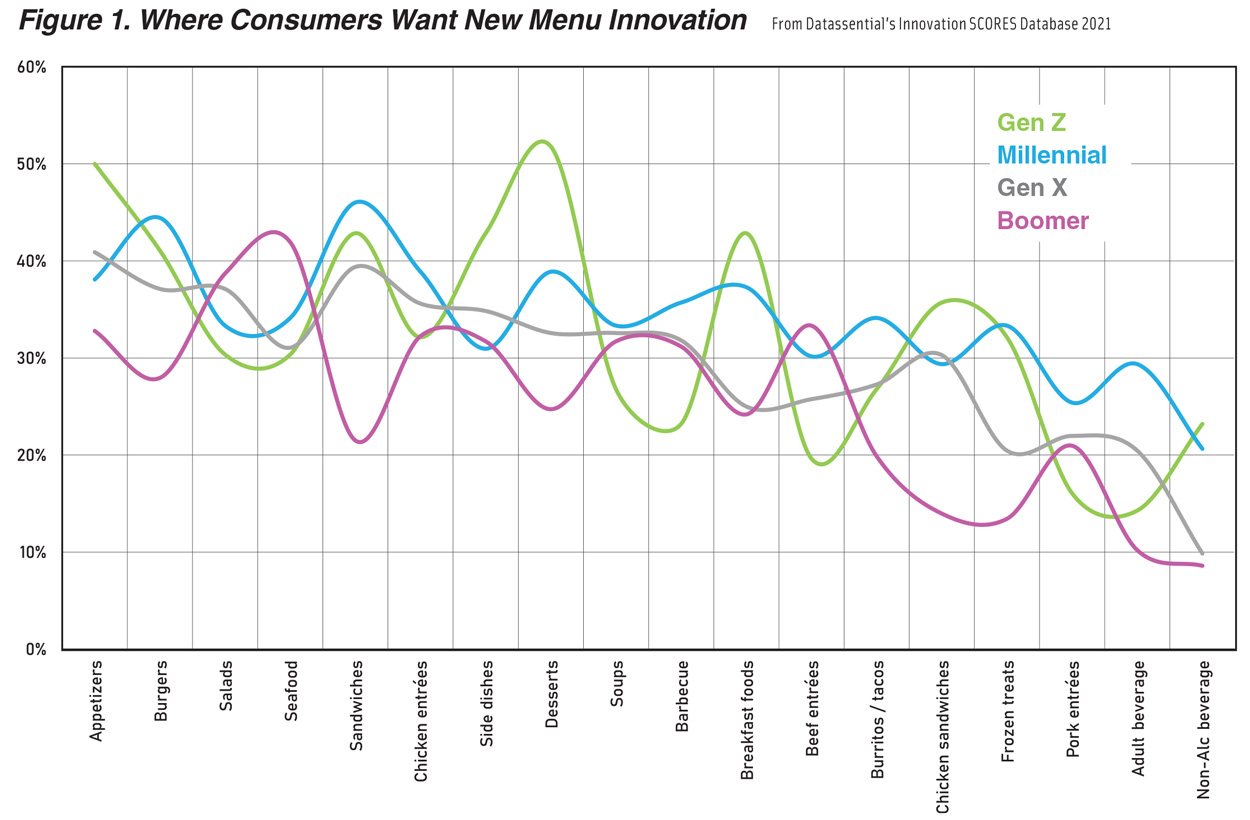

Boomers are the segment that would most like to see more menu innovations/flavor upgrades for seafood and beef entrées. Millennials want sandwich and burger innovation, and Gen Z seeks innovative desserts, appetizers, and breakfast items, per Datassential (Figure 1).

Smoothie bowls, ramen, savory pancakes, mashups, chocolate chip pancakes, dessert, and gluten-free pizza are among the current trendy menu favorites for Gen Z, according to a Datassential report.

Although young adults are most interested in global cuisines, half of boomers would like to try Moroccan, West African, and Ethiopian flavors, an analysis by flavor and fragrance company T. Hasegawa shows.

Massaman curry, caramelle pasta, kofta, pozole, chicken Vesuvio, yakisoba, and katsu are the latest trending globally influenced menu items for Gen Z, per Datassential. Chicken tinga, tacos al pastor, drunken noodles, Thai chicken, and Sicilian pizza are trending with millennials.

More classic ethnic items such as moo goo gai pan, gorditas, antipasto, Asian tacos, spanakopita, and caprese paninis index highest for Gen X. Barbecue and mesquite are favorite Gen X preparations, per Datassential.

For boomers and matures, ethnic favorites tend to be of European origin and are among the biggest missed menu opportunities. Think beef bourguignon, sauerbraten, coq au vin, scaloppine, beef Wellington, cacciatore, and cabbage rolls. Chinese is their favorite ethnic cuisine; blintzes, knishes, and Waldorf salad are also popular.

Market Movers

• Kodiak Cakes’ nut butter syrups are blazing new territory, blending maple syrup with other syrups as in Maple Almond Nut Butter Syrup.

• P. F. Chang’s Drunken Noodles frozen entrées are sure to be a favorite, especially for millennials.

• Stonewall Kitchen’s Everything Aioli sandwich spread is a crunchy mix of black sesame seeds, dried onions, garlic, and sea salt.

2. CONFIDENT COOKS

As consumers sheltered at home during the COVID-19 pandemic, many acquired new cooking skills—either for fun or by necessity. Half of those aged 18–39 were cooking more in late spring 2021 than they were in 2020, per Ypulse’s cooking study. Going forward, millennials, followed by Gen Z, say they are most likely to continue cooking more frequently.

More than half (56%) of young adults say they love or like to cook compared with one-third of boomers, according to a report from FMI. Nonetheless, boomers and matures cook from scratch more frequently than younger demographic segments, per data from Mintel.

The ability to cook healthier meals topped the list of most improved cooking skills for 39% of millennials and Gen Z consumers and 27% of boomers/matures, FMI reports. One-third of younger adults polished up their baking skills, and one-quarter improved their ability to cook fresh seafood and a wider variety of meat/poultry.

Millennials, higher-income consumers, urbanites, and households with kids are driving sales of value-added, pre-prepared, and fully cooked meats/poultry, FMI data show.

Half of young adults bought a meal kit during the pandemic, per Ypulse. And three-quarters of young adults say they would order a meal kit from their favorite restaurant, per a National Restaurant Association (NRA) industry report.

Older millennials are the most likely to frequently use a grill for cooking meat and poultry. Gen Xers are most likely to use a slow cooker. Millennials are twice as likely as boomers to use an instant pot, air fryer, pressure cooker, or sous vide preparation, per FMI.

Three-quarters of millennials order dinner for takeout or delivery weekly; 71% of Gen Zers also do so, as do 66% of Gen Xers, and 51% of boomers/matures, NRA reports.

One-quarter of young adults who bake are making their own snacks, according to IRI’s Sally Lyons Wyatt. Frequent bakers are most likely to be under age 50, have kids at home, and be Hispanic, vegetarian, flexitarian, or vegan, per a Packaged Facts study.

Six in 10 households with kids want more frozen food options for lunch, half want more for snacks or breakfast, and one-third seek more frozen dessert options, according to the American Frozen Food Institute. Seven in 10 younger adults buy frozen foods to try a new food or cuisine.

Market Movers

• Suji’s fully cooked refrigerated Korean BBQ Style Beef Bulgogi is ready to serve in five minutes.

• Hormel’s Herb Rubbed Italian Style Beef Roast Au Jus is likely to be a favorite among boomer consumers.

• The Fresh Express Gourmet Kits line includes a Chimichurri Chicken variety.

3. EATING PATTERNS AND FOOD CHOICES SHIFT

Consumers’ food choices and preferences are evolving. Snacking behavior is one good example of a pattern shift. The number of adults aged 18–44 who are snacking five or more times daily has increased over the past three years, according to IRI’s Lyons Wyatt. Early morning, midmorning, and evening were the fastest-growing dayparts. Single-person households continue to snack at elevated levels since the advent of COVID, per the Hunter survey.

Four in 10 younger consumers and one in five older adults would like more international and seasonal snacks, according to a T. Hasegawa survey. Adobo, kimchi, sesame, curry, olive, manuka honey, chili varietals, and maca are among the emerging snack flavors attracting younger adults.

After chips, parents are most likely to buy cheese snacks, microwave popcorn, corn snacks, meat snacks, pretzels, and alternative salty snacks, per T. Hasegawa’s research.

One-quarter of consumers say they are eating more seafood than a year ago, the International Food Information Council (IFIC) reports. Boomers and minorities are most likely to do so, per FMI.

Millennials, Gen Z, those with kids at home, urbanites, and higher-income consumers are the most likely to be among the 23% of adults who eat plant-based meat alternatives, according to data from Packaged Facts.

Plant-based product consumers are foodies; three-quarters enjoy cooking, and 69% regularly seek new products to try. Two-thirds will pay more for gourmet, clean foods and organic and non-GMO products, per Packaged Facts.

Nearly half (48%) of all consumers followed a diet/eating plan in the past year; Gen Zers and millennials were the most likely to do so.

About one-third of millennials regularly consume energy drinks, ready-to-drink (RTD) coffee, smoothies, and performance drinks; one-quarter drink RTD tea; and one in five consume sparkling water, carbonated soft drinks, and dairy milk, according to T. Hasegawa data.

Millennials are driving a new movement toward lower-caffeine coffee, prompted by a desire to enjoy coffee without the jitters or crashes, according to the National Coffee Association.

Market Movers

• Oggi Foods’ Plant-Based California Pizza features a cauliflower crust and a Beyond Meat alternative meat topping.

• Kind has entered the frozen case with Kind Frozen Pints nondairy frozen desserts, which deliver 4–6 grams of protein per serving.

• Plant-based seafood brand Good Catch has introduced a new portfolio of breaded products that includes frozen fish sticks, fillets, and crab cakes.

4. HOLISTIC HEALTH

Health concerns vary by age, but, in general, consumers continue to embrace some of the more healthful behaviors they adopted during the pandemic.

Just over two-thirds (69%) of households with kids say they are trying to eat healthier; 40% of those without children are doing so, according to FMI.

Half of millennials, four in 10 Gen Zers and Gen Xers, and one-third of boomers and matures want food/drinks to contribute to both their physical and mental health, per T. Hasegawa’s analysis.

Millennials and Gen Zers are much more likely than their older counterparts (71% versus 44%) to eat foods with specific health benefits, per FMI’s shopper report. Over half of young adults use foods/drinks that offer three or more benefits, T. Hasegawa says.

COVID-19 has fallen to second place behind stress as the health issue those aged 18–29 are concerned about, according to a HealthFocus report. Healthy appearance (hair, skin, and nails), followed by anxiety, back/neck pain, oral health, tiredness/lack of energy, retaining mental sharpness with age, eye health, mood swings/irritability, and cancer, round out their top 10 worries. A weak immune system ranks 14th.

The ability to continue normal activities with age/mobility has overtaken COVID-19 as the top health concern for those aged 65 and older. That is followed by retaining mental sharpness with age, eye health, joint health, bone health/strength, hypertension, memory, arthritis, and heart issues, per HealthFocus.

In descending order, vitamin C, vitamin D, B vitamins, and calcium are the most sought-after nutrients from foods and drinks across all demographic segments. Those aged 65 and older are twice as likely to look for foods with calcium, potassium, magnesium, and zinc; those under age 45 look for vitamin A, per IFIC.

Those aged 65 and older are just as likely as those under age 45 to increase their protein intake for muscle health/strength and satiety. Young adults do so for reasons of appearance and athletic performance, per IFIC.

Although it’s trending down from earlier in the pandemic, one-third of all generations, with the exception of Gen Z, report that they are still struggling with COVID weight gains, per Hunter’s survey.

Weight control tops the list of health benefits millennials most want to get from foods/beverages; it is followed by energy, digestive health, and immunity. Muscle health, brain function, and emotional/mental health tied for fifth place in IFIC’s health survey.

Boomers most look to foods for weight management, heart health, diabetes, energy, and digestive health benefits. Prebiotics is the ingredient claim boomers and matures are most interested in, according to Mintel data.

Market Movers

• For those who prefer to be less than fully caffeinated, Buzz Lite Lightly Caffeinated Coffee in whole-bean and ground formats reduces caffeine to 20 mg per serving.

• Targeted to carb-conscious consumers, Hilo Life chips from PepsiCo are tortilla-style chips that contain 3 grams of carbs and 9 grams of protein per serving.

• Maple Hill Creamery has added an ultra-filtered variety to its Zero Sugar milk line.

5. PLANETARY HEALTH

The environment/sustainability is a food/beverage purchase driver for 31% of consumers, per IFIC survey data; animal agriculture and plastic bottles remain the top issues. Millennials/Gen Z, parents of young children, and affluent households continue to drive concern.

Among those aged 13–39, four in 10 say they worry about climate change every week, per Ypulse. Parents of young children are most concerned about a food product’s carbon footprint, FMI reports.

Millennials/Gen Z, parents with kids at home, urbanites, flexitarians, and affluent shoppers are the most likely to look for meat and poultry products that are better for the planet, worker, and animal, per FMI.

Households with young children at home, Asian Americans, Hispanic Americans, and affluent households continue to drive sales of organic foods and beverages, which were up 12.8% in 2020, according to the Organic Trade Association. Millennial moms with young children are the most likely to avoid GMOs; 40% of all consumers try to do so, per Hartman.

Baby boomers prioritize claims related to “antibiotic/hormone-free,” “raised in the USA,” and “locally raised.” Young adults are more focused on natural and organic fare.

Market Movers

• Organic Valley Fat-Free Grassmilk comes from cows that are humanely pasture-raised, contains vitamins A and D, and is USDA Certified Organic.

• The new Consider Pastures eggs from Pete & Gerry’s are produced with a focus on humane treatment of animals and earth-friendly regenerative agriculture practices.

REFERENCES

AFFI. 2021. The Power of Frozen in Retail. American Frozen Food Institute. Feb. Arlington, Va. affi.org.

CDC. 2021. Provisional Estimates for Selected Maternal and Infant Outcomes by Month, 2018–2020. https://www.cdc.gov/nchs/covid19/technical-notes-outcomes.htm.

Childstats.gov. 2020. America’s Children in Brief: Key National Indicators of Well-being. 2020. Federal Interagency Forum on Child and Family Statistics. https://www.childstats.gov/americaschildren/tables/pop1.asp.

FMI. 2019. The Power of Seafood Report. FMI—The Food Industry Association, Alexandria, Va. fmi.org.

FMI. 2021. U.S. Grocery Shopper Trends: Cooking. May.

FMI. 2021. The Power of Meat Report. March.

Frey, W. H. 2020. 2010 U.S. Census and 2020 Census Bureau Demographic Analysis Estimates. census.gov.

Datassential. 2021. Innovation SCORES Database. May. Datassential, Los Angeles. datasssential.com.

Datassential. 2021. Flavor Dishes by Generation. MenuTrends INFINITE. May.

Hartman. 2020. Exploring the Diversity of American Foodways. The Hartman Group, Bellevue, Wash. hartman-group.com.

Hartman. 2020. Beyond Organic.

HealthFocus. 2019. USA Consumer Survey. HealthFocus Intl., St. Petersburg, Fla. healthfocus.com.

Hunter. 2021. HUNTER Food Study Special Report Wave Two: America Keeps on Cooking. Jan. Hunter, New York, N.Y. hunterpr.com.

IFIC. 2021. IFIC. Food & Health Survey. May. International Food Information Council, Washington, D.C. foodinsight.org.

IFIC. 2021. Consumer Perspectives on Vitamins and Minerals and Food and Beverage Fortification. April.

IRI. 2020. The Premium Opportunity. Nov. IRI, Chicago. iriworlwide.com.

IRI. 2021. “Top Trends in Fresh: Perishables’ Roles in a Pandemic Retail Landscape.” Webcast, March 3.

Lyons Wyatt, S. 2021. “The Snacking Frenzy in 2021 & Beyond.” Webcast, April 1.

Mintel. 2020. Cooking in America—U.S. Dec. Mintel Intl., Chicago. mintel.com.

Mintel. 2020. Food and Drink Nutrition Claims—U.S. Dec.

NCAUSA. 2021. National Coffee Data Trends Survey. National Coffee Assoc., New York, N.Y. ncausa.org.

NRA. 2021. The State of the Restaurant Industry. National Restaurant Assoc., Washington, D.C. restaurant.org.

NRA. 2021. “A Look Back at Consumers’ Restaurant Activity.” Press release, March 19.

OTA. 2021. “U.S. Organic Sales Soar to New High of Nearly $62 Billion in 2020.” Press release, May 25. Organic Trade Assoc., Washington, D.C. ota.com.

Packaged Facts. 2020. Vegan, Vegetarian and Flexitarian Consumers. Sept. Packaged Facts, Rockville, Md. packgedfacts.com.

Packaged Facts. 2020. Meat, Poultry and Seafood Alternatives. Oct.

Packaged Facts. 2021. Pet Market Outlook 2021–2022.

Packaged Facts. 2021. Home Baking: U.S. Trends & Opportunities. Feb.

SFA. 2020. “Understanding Category Trends & Consumer Insights.” Webcast, June 2. Specialty Foods Assoc., New York, N.Y. specialtyfoods.com.

T. Hasegawa. 2021. Regional and International Flavor Flash. Jan. T. Hasegawa USA, Cerritos, Calif. thasegawa.com.

T. Hasegawa. 2021. Functional Ingredients Flavor Flash. May.

T. Hasegawa. 2021. Snacks Flavor Flash. April.

Ypulse. 2021 Cooking and Diets. March. Ypulse, New York, N.Y. ypulse.com.

Ypulse. 2021. Sustainability. March.

U.S. Census. 2020. U.S. Dept. of Commerce. Washington, D.C. census.gov.