Pandemic Recovery Hits the Pause Button

Despite economic uncertainty and consumers’ spiraling COVID concerns, the current environment offers opportunities for savvy food and beverage companies. Here’s a look at three market trends that will shape what, when, and where America eats in 2022.

Article Content

For some, the pandemic panic of 2020 abated in the first half of 2021 with the rollout of vaccines and a return to more typical consumer behaviors. As the year drew to a close, however, the journey toward a “new normal” stalled for consumers and food and beverage companies, as they ran smack into economic headwinds, supply chain and labor issues, and COVID-19 variants. Test test

COVID concerns have intensified. More than half (51%) of consumers say they are “very concerned” about COVID-19, according to a November report from Datassential. That’s up from 40% who felt that way in July. Three-quarters of those polled by Datassential say that the Omicron variant has influenced their pessimism that the worst of the pandemic is yet to come.

And COVID-19 isn’t the only thing consumers are worried about. Public concern is now equally split between COVID-19 and the economic crisis, Datassential reports. Nearly nine in 10 consumers have noticed inflation at the supermarket; 83% are very concerned, and 80% believe it will get worse. One-third expect inflation to last into 2023 or longer.

Disposable income will grow by only 0.3% in the first half of 2022 versus 6.2% in 2021, IRI forecasts. In this environment, at-home food/beverage’s share of total household expenditures is expected to fall from 8.0% in 2021 to 7.6% in 2022 as inflationary pressures cause consumers to focus on value and spend more on necessities like gasoline, utilities, and childcare.

IRI projects overall inflation of 6%–7% for food in 2022, and 7%–8% for beverages. In October, retail prices for breakfast meat shot up by 20% versus a year ago, the price of frozen and refrigerated poultry was up 15%, and bottled water prices climbed by 10%. Store brands and value channels will gain market share in this environment.

CPG giants including Mondelēz, General Mills, and Smucker’s have announced significant price hikes. Pricing will drive food companies’ revenue growth, but food and beverage sales volume will decline by 1%–5% in 2022, per IRI’s forecast.

Low-income shoppers will face even greater financial pressure in 2022 due to the sunset of federal benefits/stimulus payments. The 42 million consumers enrolled in the U.S. Department of Agriculture’s Supplemental Nutrition Assistance Program spent $104 billion on foods and beverages for the yearlong period that ended in September 2021, according to IRI.

Rising wages, a tight labor market, supply chain issues, and a greater need for promotional expenditures will also counter real food and beverage industry growth. With much of its supply sourced globally, the seafood industry has faced particular challenges. Supply issues coupled with higher costs for logistics, packaging, and ingredients have caused some companies to put new product introductions on hold.

With COVID-19 still in the picture this winter, more shoppers may avoid the grocery store; online shopping is approaching the pandemic high of 20% of all grocery occasions, according to statistics shared in an International Dairy Deli Bakery Association (IDDBA) webcast.

While everyone is ready for the pandemic to be over, COVID churns on, and its influence, coupled with financial pressures, will continue to skew traditional consumer behavior. What’s on the horizon for 2022? An analysis of data from dozens of sources suggests three key areas of opportunity for food and beverage sales growth in an uncertain economy: mealtime solutions, focused premiumization, and tapping into an aggressive self-care movement. Here’s a road map for navigating the opportunities and challenges that the year ahead will bring.

Mealtime Solutions

Eighty-five percent of consumers say they’ll be cooking more at home in 2022, according to Datassential, and that presents opportunities for CPG companies. Retail food and beverage sales will continue to remain elevated compared with pre-pandemic sales. The level of cooking at home as of Oct. 31, 2021, remained 26 share points ahead of pre-pandemic October 2019 levels.

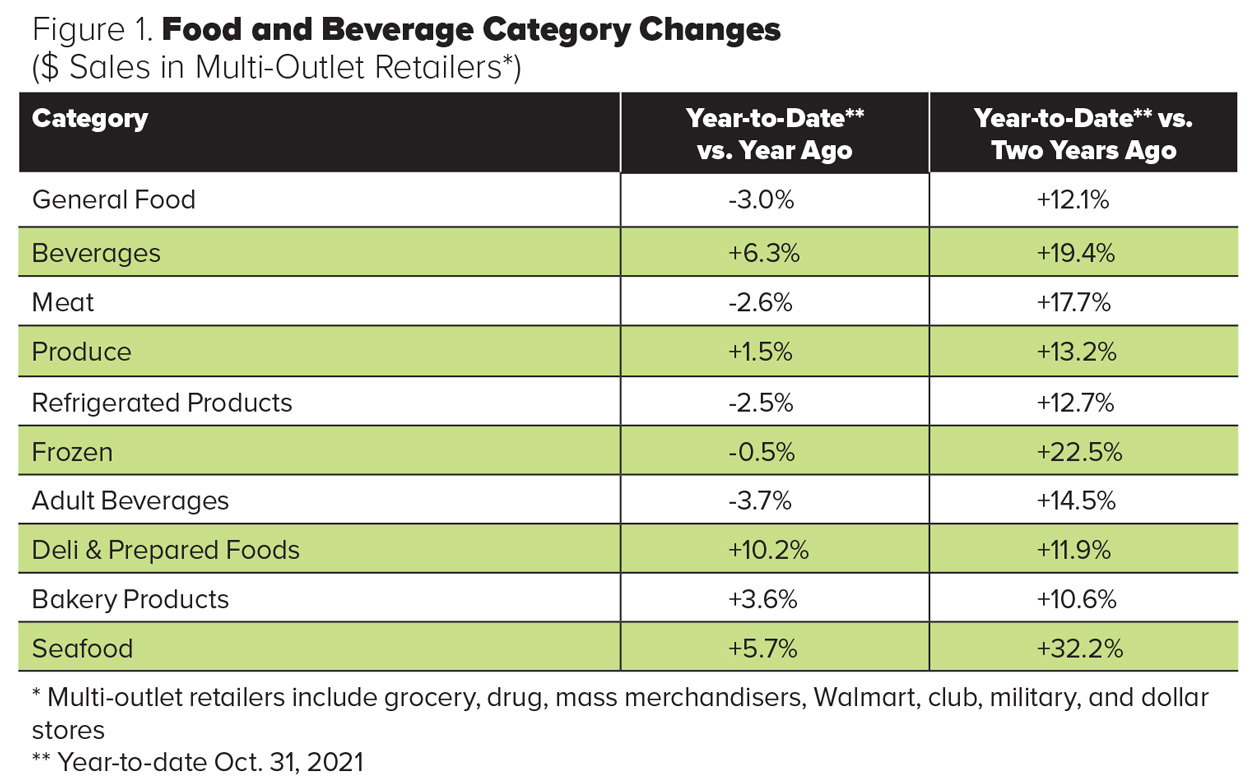

Deli and prepared foods lead dollar sales gains when multi-outlet food sales for January through October 2021 are compared with the prior year, IRI reports. Compared with two years prior, seafood and frozen food show the greatest sales change (Figure 1).

The frozen food category remains red-hot. Frozen multiserve dinners continue to outpace single-serve in unit sales, up 6.6% and 4.2%, respectively, for the 12 weeks ended Oct. 3, 2021, versus the same period a year ago, per SPINS.

Asian frozen appetizers grew 25.6% in unit sales, Asian dessert unit sales were up 9.8%, and unit sales for Asian meat, poultry, and seafood preparations grew 6.8% for the 12 weeks ended Oct. 3, 2021, according to SPINS data.

InnovAsian frozen fried rice, dumplings, and chicken entrée SKUs come with a “make it a meal” tagline. The P. F. Chang Home Menu line added frozen Korean BBQ Protein Skillet Meals. Pacific Seafood’s Tidal Tots are perfect as a side or snack.

DiGiorno Original Rising Crust Mac & Cheese Pizza, White Castle Chicken & Cheese Sliders, and Screamin’ Sicilian S’mores Dessert Pizza are among the fun and filling kid-friendly meal and treat options.

The “other” frozen breakfast category, which includes specialty items like quiche and crepes, posted unit sales gains of 11.3% for the 12 weeks ended Oct. 3, 2021, per IRI; breakfast entrée unit sales were up 10.2%, and unit sales of breakfast handhelds grew by 5.2%, per IRI.

Breakfast, lunch, morning coffee, and easy meals will be the top at-home targets for innovation in 2022. The work-from-home trend is expected to add 33 million home meal occasions in the next four years, according to IRI.

Cooking from scratch has increased during past recessions, but data from Hartman and FMI –The Food Industry Association indicate that this time around, kitchen burnout is real, and convenience will be king. Fresh prepared meals/entrées, deli sandwiches, meat/cheese/cracker kits, and deli salads, pizza, and soups/chili were the fastest-growing fresh categories by volume for the first 10 months of 2021, per IRI.

Unique culinary recipes and assortments are driving growth in prepared deli meals/entrées. U.S., Italian, and Mexican regional cuisines and Mediterranean, Japanese, Greek, and Cuban are among the next “safe” options for global comfort fare, per Datassential.

Barilla’s chickpea spaghetti carries a “good source of plant-based protein” claim. Gardein Plant-Based Turk’y Roast boasts a filling made of rice, cranberries, and kale.

Johnsonville Sausage Strips, Nellie’s Free Range Eggs French Toast Mix, and Actual Veggies’ Actual Morning Burger (made from fruit, vegetables, and seeds) are among the innovative new breakfast products now available. Utopihen Farms has introduced pasture-raised duck eggs from ducks that consume only non-GM feed.

While a large segment of the population is burned out on meal prep and focused on convenience, there’s another group that deserves marketers’ attention. That’s the new generation of “confident cooks” and cooking enthusiasts, who represent 30% of shoppers and account for one-third of dollar sales, according to IRI. One-third of evening meals are cooked mostly from scratch, per FMI.

Packaged food product developers should consider trading up to grains such as durum, teff, quinoa, and bulgur that are gaining traction on menus to entice these cooking enthusiasts, Datassential suggests. Cauliflower, potato bombas, sushi, and black or jasmine rice are also trending.

Although the number of those commuting to work remains 20% below pre-pandemic levels, cutbacks in school and work cafeterias have put on-the-go products and brown bagging back in business. For the 12 weeks ending Aug. 9, 2021, unit sales of Lunchables were up by 15.1%, and unit sales of Sargento Balanced Breaks shot up by 41.1%, IRI reports. Jar Joy desserts packaged in four-ounce jars, Birch Benders’ microwaveable Pancakes a la Cup, and Savencia’s Alouette Gourmet Bites (filled cheese morsels) all are well-positioned for those on the go.

Market Movers

- Sheet Pan Meal Starter Kits from Dole contain four servings of vegetables that may be combined with a protein for a nutritious and easy veggie-forward meal.

- Pacific Foods taps into the popularity of plant-based with Creamy Plant-Based Broths in Herb & Roasted Garlic and Zesty Ginger & Turmeric varieties.

- Primal Kitchen’s No-Dairy Mushroom Gravy is made with cashew butter.

- Happy Baby Made Simple Baking Mixes from Happy Family Organics are formulated with whole grains, iron for brain development, and no added sugar.

Little Luxuries

Although the trend toward premium product purchases is slowing due to inflation, consumers will continue to splurge on small indulgences, at-home restaurant experiences, social occasions, and foods and drinks that align with personal values.

Ten percent of U.S. households have an annual income of over $200,000; 8% are in the $150,000 to $199,000 range, and 16% are between $100,000 and $150,000, according to U.S. Census data.

But purchasing premium products isn’t limited to the affluent. Low-income households make small indulgence food and drink purchases at a rate similar to other households, IRI reports. Along with younger adults, they are twice as likely to splurge on creating a restaurant-style meal experience at home.

Frozen meals, frozen appetizers and snacks, and fresh specialty desserts were among the categories with the highest volume gains for both the low-income and millennial consumer segments; specialty fruits and cheeses had high sales volume gains among millennial consumers, according to IRI.

The Specialty Foods Association reports that eight in 10 millennials (82%) bought gourmet/specialty foods last year, and three in four Gen Z consumers (76%) did so. Gen Z is most likely to buy specialty foods for use at breakfast or lunch, as treats, or as ingredients to upgrade a recipe; this includes ingredients they’ve never tried before. Among millennials, specialty food purchases are most likely for lunch, snacks, special occasions, or to impress guests.

The Martha Stewart Kitchen brand added a new line of restaurant-style entrées that includes Sicilian-Style Beef Stew. The Sweet Earth brand offers an Huevos Rancheros breakfast entrée. Kellogg’s new Frosted Boston Crème Pop-Tarts varieties are inspired by specialty doughnut flavors.

Fresh fish, deli specialty cheeses, deli entrées, deli dips/sauces, and fresh fruit had the highest volume gains among high-income households for the first 10 months of 2021; premixed cocktails, dried fruit, cookies, dried meat snacks, and frozen novelties were the greatest gainers in the center store for this group, per IRI.

Products with a sustainability edge will grab some shoppers’ attention. Applegate Do-Good-Dogs are uncured beef hot dogs made with regeneratively sourced beef. The Urgent Company’s Climate Hero Super Cake Mix is made with Perfect Day’s animal-free milk protein.

Better-for-you spicy snacks like Krave Gold Label Asian Spicy Sesame Ginger Beef Jerky or Cajun Pop Boiled Crawfish Popcorn have the potential to entice consumers with a taste for something different.

Cakes and doughnuts merchandised in the perimeter of the store were among the best-selling categories storewide in the first 10 months of 2021, IRI reports. Perimeter cookies and muffins led in volume growth in the fresh bakery category; snack cakes and filled croissants were top sellers in limited-assortment stores.

Doughnuts, bakery products for morning consumption, and pies led sales in the center-store bakery aisle, per IRI. Bays English Muffins now include a Brioche option.

Global favorites like churros, beignets, and macarons already have a strong presence on U.S. menus, according to Datassential, and they offer high potential for upgrading CPG product assortments.

Frozen cookies/cookie dough was the fastest-growing frozen food category for the 12 weeks ending Sept. 5, 2021, albeit from a small base, up 62% in units, IRI reports; frozen muffins were up 41%.

One-third of consumers say they are planning on entertaining more often at home. Sales of deli products used for entertaining (special occasion meals, deli trays/platters, and dips/sauces) are up 10.3% above 2020 levels and 16.5% above 2019 for year-to-date Oct. 31, 2021, according to data shared in the IDDBA webcast; party tray sales jumped 65% versus 2020. Appetizers have shown robust sales growth for the past three years, according to IRI.

Market Movers

- Athens Steak Fiesta Phyllo Bites are perfect for easy entertaining.

- Brazi Bites Brazilian Cheese Bread is gluten-free.

- Aldi offers a macaron assortment under its Specially Selected label.

A Surge in Self-Care

Among the 40% of adults who say their views on health and wellness have changed this year, two-thirds are more concerned about their immediate and long-term health, per the Hartman Group. Other top concerns include mental health (60%), staying physically active (56%), and aging (42%).

According to a report from IRI and Kline & Co., 28% of the population are now avid self-care consumers. An additional 41% take some daily action, and 24% act occasionally. Preventative care measures are accelerating. Hydration is the top self-care behavior.

Sports drinks, energy beverages, and baby formula enjoyed the fastest center-store volume growth for the year ending Oct. 31, 2021, per IRI. Weight loss/management is the benefit consumers most want from foods, according to International Food Information Council research. They also seek benefits related to energy, digestion, heart health, muscle function, sleep improvement, and immunity.

Hartman reports that two-thirds of consumers are looking for foods and drinks that contain added nutrients. Sales of products that tout higher levels of magnesium jumped a whopping 451% last year, IRI reports; sales of products highlighting vitamin C content were up 24%. In addition, sales of products that carry an “excellent source of potassium” claim grew by 23%, and sales of those that highlight vitamin E were up by 17%.

Four in five adults now take dietary supplements, an all-time high, according to the Council for Responsible Nutrition (CRN). Multivitamins, followed by vitamin D, vitamin C, calcium, B-complex vitamins, zinc, magnesium, vitamin E, iron, and biotin are the most used supplements.

One in five supplement users (21%) took a protein supplement in 2021, led by those aged 18–54, per CRN. More than half (58%) of protein supplement, bar, or drink users choose products with whey protein; 51% use products made with plant protein. Consumers are showing interest in protein completeness, digestibility, and amino acid content.

Nearly one-third are willing to pay 10% more for foods with probiotics, vitamin B12, collagen, vitamin D, antioxidants, and omega-3, per HealthFocus. According to SPINS, elderberry, horehound, cranberry, turmeric, and ginger are the best-selling herbal supplements in mass channels.

Nearly half (48%) of consumers tried a specific healthy eating plan in 2021; 10% followed a low-carb or a vegetarian diet; 7%, Whole30, Mediterranean, gluten-free, dairy-free, or lactose-free; 6%, vegan; and 5%, keto, Hartman reports.

No sugar/low sugar is expected to remain the top avoidance claim. Caulipower Buffa-Whoa Buffalo-Style Chicken Cauliflower Crust Pizza touts the fact that it is 50% lower in sugar than leading pizza brands.

The National Restaurant Association reports that American Culinary Federation chefs are exploring the use of natural sugars such as maple syrup and coconut sugar.

Market Movers

- Bitsy’s Swish is a new hydration and immunity drink mix targeted to kids.

- Mtn Dew Energy is positioned as a morning energy beverage.

- Good Idea is among the first energizing waters to highlight its amino acid content on the ingredients panel.

REFERENCES

CRN. 2021. Consumer Survey on Dietary Supplements. Nov. Council on Responsible Nutrition, Washington, D.C. crnusa.org.

Datassential. 2021. “COVID-19. Report 60: Omicron Rising.” Webcast, Dec. 10. Datassential, Los Angeles. datasssential.com.

Datassential. 2021. “Holidays Ahead!” Webcast, Nov. 9.

Datassential. 2021. “Around the World in 80 Trends.” Webcast, Oct. 28

FMI. 2021. The Power of Foodservice at Retail. FMI—The Food Industry Association, Alexandria, Va. fmi.org.

Hartman. 2021. Health & Wellness. The Hartman Group, Bellevue, Wash. hartman-group.com.

Hartman. 2021. Eating Occasions.

HealthFocus. 2021. USA Consumer Survey. HealthFocus Intl., St. Petersburg, Fla. healthfocus.com.

IFIC. 2021. Food & Health Survey. May. International Food Information Council, Washington, D.C. foodinsight.org.

IRI. 2021. “CPG Growth Strategies in an Inflationary 2022.” Webcast, Nov. 8. IRI Worldwide, Chicago. iriworlwide.com.

IRI. 2020. The Premium Opportunity. Nov.

IRI. 2021. “Winning Strategies for Reaching SNAP Shoppers.” Webcast, Oct. 26.

IRI. 2021. “FMI Fresh Trends: The Balance between Premiumization and Affordability.” Webcast, Oct. 18

IRI. 2021. “Making Center Store Stick.” Webcast, July 23.

IRI. 2021.”CPG Market Review and Outlook.” Webcast, Dec. 3.

IRI. 2021. “Consumers’ Changing Relationship with Meals and Meat.” Webcast, May 5.

IRI. 2021. “IDDBA’s State of the Industry: Deli Meat and Prepared Foods.” Webcast, Nov. 16.

IRI/Kline. 2021 Consumer Healthcare Explosion. IRI and Kline & Company, Parsippany, N.J. klinegroup.com.

Kostyo, M. 2021. “What’s Ahead in 2022?” Webcast, Dec. 9. Datassential for the Food Institute, Upper Saddle River, N.J. foodinstitute.com.

Mattucci, S. 2021. “Embrace Simple Flavors for Thrifty Consumers.” Mintel, Nov. 21. mintel.com/blog/food-market-news/embrace-simple-flavors-for-thrifty-consumers.

NPD Group. 2021. “Dine-in Traffic Remains a Headwind for U.S. Restaurant Industry Recovery.” Press release, Nov. 2. NPD Group, Port Washington, N.Y. npdfoodworld.com.

NRA. 2021. Restaurant Sales Growth Stalled in Recent Months. National Restaurant Assoc., Washington, D.C. restaurant.org.

NRA. 2021. What’s Hot 2022 Culinary Forecast. Dec.

Roerink, A. 2021. “IDDBA COVID-19 Update.” Webcast, Nov. 19. International Dairy, Deli, Bakery Assoc. and 210 Analytics, Madison, Wis. iddba.org.

SPINS. 2021. “Retail Resources.” SPINS, Chicago. spins.com

Technomic. 2021. Technomic Industry Insights. Oct. Technomic, Chicago. technomic.com.

SFA. 2021. Today’s Specialty Food Consumer Report, 2021–22. Dec. Specialty Foods Assoc., New York, N.Y. specialtyfoods.com.

U.S. Census. 2020. U.S. Dept. of Commerce. Washington, D.C. census.gov.

Key Takeaways

- The food and beverage market recovery has stalled thanks to inflation and the advent of new COVID variants.

- To succeed, CPG companies should cater to the demand for easy and interesting at-home meals and also entice cooking enthusiasts with unique ingredients and flavors.

- Despite the economic downturn, there’s a strong niche for premium products that address personal preferences.

- Self-care is a priority for consumers; they seek products that deliver preventive health benefits and support greater functionality.

.jpg?mw=500&hash=D1E2E8B94FED0CCA2F5CEA8243FD787B)