Border Crossings

From intense flavor shots for cooks to pop-up toaster hamburgers and microwaveable cans, global shopping carts are full of innovative product options with excellent potential for adapting to new markets.

Despite a very tough economy worldwide and regulatory issues affecting the development of healthful new foods in the European Union, the global food and beverage marketplace remains full of cutting-edge product concepts and promising ingredients that might successfully be adapted for sale in new markets.

In June 2011, global consumer confidence fell to its lowest level in six quarters. Despite a nine point quarterly decline, Asia Pacific remains the region where consumers demonstrate the most optimism; Indian consumers are the most positive. Six in 10 global consumers surveyed by Nielsen in 56 countries believe they are still in a recession; more than half (51%) think they will still be in a recession in a year’s time (Nielsen, 2011a).

In June 2011, global consumer confidence fell to its lowest level in six quarters. Despite a nine point quarterly decline, Asia Pacific remains the region where consumers demonstrate the most optimism; Indian consumers are the most positive. Six in 10 global consumers surveyed by Nielsen in 56 countries believe they are still in a recession; more than half (51%) think they will still be in a recession in a year’s time (Nielsen, 2011a).

Food prices now top the list of global consumer concerns, followed by the economy; increasing utility/gas bills rank fifth, and health concerns are sixth (Nielsen, 2011a). One-quarter (25%) of consumers in the Middle East/Africa and 22% of Europeans say they have no spare cash vs 31% of U.S. consumers who make the same claim (Nielsen, 2011a).

Nearly half (47%) of global consumers have cut back on away-from-home eating/entertainment, and 37% have reduced their use of take-out foods; 24% and 20%, respectively, plan to continue these behaviors in 2012, causing consumers to indulge more at home and demand more restaurant-style foods such as Morrisons Italian Deli Tortelli Salami & Chianti fresh meal in a bag, which is offered in the UK (Nielsen, 2011a).

More than half of global consumers purchased more private label brands this year; 91% said they will continue to do so when the economy improves (Nielsen, 2011b).

But it’s not all doom and gloom. Global supermarket sales of food and beverage products are projected to reach $1.74 trillion by 2015; foodservice sales will be $2.2 trillion (GIA, 2010).

Because consumers around the world are taking action for health, global sales of functional foods are projected to reach $130 billion by 2015, diet foods $200 billion, foods for food allergy/intolerance $26 billion, and ingestible nutracosmetics $4.2 billion. Other global food segments, including kids foods, which are projected to top $89 billion in sales by 2015, will enjoy strong gains through 2015; snacks will reach $334 billion, hot beverages and tea $69 billion, pet foods $56 billion, and infant foods $23 billion (GIA, 2010).

--- PAGE BREAK ---

With 40% of the world’s population, the BRIC countries—Brazil, Russia, India, and China—are fast becoming a lucrative market for consumer packaged goods including food. Innova Market Insights reports that convenience, “passive health claims” (e.g., “low in”), pleasure, and active health (e.g., functional) are the top product positionings in BRIC countries. Vitamin-/mineral-fortified, digestive health, calcium, immunity, DHA, and brain health are the top “active claims” (Innova, 2011).

Globally, male shoppers offer new opportunities. In developed countries, men and women share in food purchase/preparation; 43% do so in emerging nations. In the Netherlands, the positioning for Tons Mustard for Men, which is made with extra-strong flavor, could not be clearer—it’s targeted to males.

And lastly, the global network of television and celebrity chefs such as Jamie Oliver will ensure that there’s no end in sight to the foodie movement as these chefs create a new global category of healthy gourmet foods.

It is the intent of this worldwide expedition to share some of the most interesting concepts and market directions. This global review of new products was made possible by Innova Market Insights and its Food & Beverage Database.

Pronto Prep

With more than half (54%) of women in developed countries feeling pressured for time and 38% feeling stressed/overworked (62% and 49%, respectively, in emerging countries) food products that make meal preparation faster and easier remain in high demand (Nielsen, 2011c).

Tillman’s Toast Me! Beef Burgers from a German meat processor are non-drip frozen burgers that heat up in the toaster. Samyang has perfected microwaveable baking with its brownie mix in South Korea. Ye Olde Oak Beef Bolognese spaghetti, available in the United Kingdom, can be microwaved in its own can. Wok-specific sauces have become commonplace in the UK.

Dried spice blends with lids that double as measuring cups, marinades/stocks sold in six-pack tubs, and cooking sauce pouches that pour easily from a recloseable side spout are designed to prevent mess and keep foods fresher longer.

Fresh meal starters such as Tesco’s Simply Add line allow home chefs to make easy additions such as a pastry topping for a pie or a noodle base to “create a tasty meal of your own choice.”

--- PAGE BREAK ---

Fresh, natural/organic, low-fat, and vegetarian options are top positionings in the ready meal category (Innova, 2011). More sophisticated Indian, Spanish, and North African recipes now compete with more established flavors, e.g., Italian and Thai. Expect more authentic regional ethnic dishes (e.g., paella and bouillabaisse), aromatic components (e.g., jasmine rice and sweet and sour sauces), stuffed items (e.g., Chicken Cordon Bleu), and wine/liquor to provide upscale pizzazz.

Sandwich fillers (e.g., Australia’s Always Fresh Sandwich Fillers in Classic Curried Egg or Grilled Vegetables & Feta varieties), make restaurant-style sandwiches and wraps a snap. Samosas, pupusas, torta Cubana, bocadillos, tartine, and empanadas are among the international sandwiches grabbing worldwide attention.

Dipping sauces and spreads exclusively for sandwiches are a hot trend in Asia, e.g., Dongwon Dipping Cheese Sauce in a “dipable” tray, which is available in South Korea. Nature’s Best Salad Shakers in the UK contain mozzarella, tomato, pesto pasta, and a fork—just shake and go. In France, Bjorg Chili Con Quinoa in a cup gets a new twist with white quinoa. Also in France, Panzani Food Service offers the Lunch Box line of cold “cup” pasta salads. Sodebo, which enjoyed success with its Pastabox grab-and-go line, has introduced a Chinese Wok lunch-cup line and an individual Giant Pizza slice in a triangle box, which is microwaveable in 2½ minutes.

Pasta and macaroni/cheese kits are being infused with chili, herbs, and spices. Barilla’s Piccolini contains 25% vegetable puree, and sausage and broccoli are now included in some dinner sauces in Italy.

Some French, Italian, and Indian oils are now enhanced with omega-3s, vitamins A, D, E, and B-6. Avocado, sea buckthorn, and pumpkin seed are among the trendy oils. Prebiotics and fiber have entered the noodle category.

The Next Course

Fish is fast gaining in popularity as a main dish around the world—from premium products such as Schwartz for Fish, a prepared sauce in varieties such as French White Wine & Tarragon, which is available in Ireland, to Wow! Pinoy Fiesta Fish Kebab Spicy Garlic Flavor in the Philippines. And breaded fish nuggets seem to be available in every conceivable form—even zoo animals.

Watch for fish from specific regions (e.g., Tasmanian salmon), less known individual species (e.g., Blue-Eyed Cod), and The Marine Stewardship Council seal to get more attention. A new twist for breaded fish (and chicken, too) is to include a layer of vegetables under the crust (e.g., Findus Capitan Croccole Agli Spinaci Breaded Alaska Pollock Fillets with Spinach Filling from Italy.

--- PAGE BREAK ---

In the UK, Woolworth’s offers a fresh whole/half marinated chicken to cook at home. Along with a horsepower race for “super crispier” chicken, savvy marketers are upping the omega-3 content of their poultry naturally through feed selection and by experimenting with aromatic, chef-inspired marinades (e.g., yogurt/dill); in Finland, one company offers a pineapple rose pepper marinade.

All natural, real ingredients, and minimal processing are key international positionings for meat (Innova, 2011). Specialty sausages (e.g., chorizo), a focus on texture (e.g., “course-cut” sausages in the UK), “flavor drizzles,” and claims citing specific woods are among the key trends.

Toppings/crusts of seeds, herbs, and spices with different size crumbs are another new direction for meats (e.g., salami bell pepper or spicy chili cheese). Look for more skewered meats and sauce packets in fresh meat packages. Tomato, honey, and exotic Chinese are among the chic flavors for meat marinades.

Traditional flavors for pasta sauces such as carbonara and Bolognese are being upstaged by more sophisticated offerings, such as arrabiata, boscaiola, and puttanesca. New pasta styles include orecchiette and panzerotto.

Cholesterol-free fried potato sides (e.g., Israel’s Bisball Crispy Mashed Potato Balls with Vegetables) and gluten-, lactose-, and cholesterol-free waffle-fried potatoes in Finland are among the exciting international potato trends. Super-crunch fried options, upgraded potato fillings with herbs/spices, and mini-potato concoctions of all kinds are among the new directions that product developers are taking with potatoes. Canada’s McCain Crinkle Cut Sweet Potato Superfries tout the fact that they are oven-baked and a good source of vitamin A.

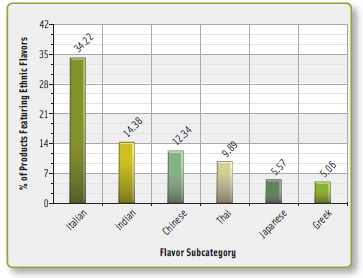

Flavor and Flair  Italian, followed by Indian, were the most popular ethnic flavors among global new product launches in 2010 (Innova, 2011; Figure 1). Tikka, jalfrezi, masala, and korma variations are appearing in snack, soup, and ready meal products worldwide.

Italian, followed by Indian, were the most popular ethnic flavors among global new product launches in 2010 (Innova, 2011; Figure 1). Tikka, jalfrezi, masala, and korma variations are appearing in snack, soup, and ready meal products worldwide.

Emerging Indian flavors include bhuna, pasanda, mulligatawny, and karahi; chakalaka, rooibos, peri peri, and baobab are from Africa.

Ethnic flavor descriptors are becoming more specific, e.g., curry as Madras or masala; orange, as Valencia or Sicilian. Regional ethnic foods, e.g., Tuscany, authentic recipes, and gourmet ingredients (e.g., mascarpone cheese, pesto, and prosciutto) are being used in flavor names. Exotic mushrooms and mint are being added for flavor.

--- PAGE BREAK ---

Tropical flavors including coconut, mango, and mandarin and combination fruit/vegetable flavors are gaining in popularity. Gooseberry, cloudberry, and loganberry are among the new berries. The African marula fruit and mangosteen are strong superfruit contenders.

Flowers including lavender, rose, and jasmine are adding an aromatic component to foods. In Italy, Muller Crema di Yogurt Magro Morae Violetta comes in blackberry and violet varieties. Colorful edible flower petals are being mixed into bagged salad mixes.

Grilled meat flavors (e.g., Hunan beef), brown flavors (e.g., maple, caramel, and international barbecue) are ubiquitous savory platforms.

A new group of intense flavor shots such as Puri Puri shots and Blue Dragon Chilli Coconut shots are another hot trend; these products are designed to spike stir-fry flavors. Extremely hot seasonings such as McCormick’s Screamer Buffalo Wings Seasoning Mix and very hot Mustard for Men in Germany also represent an ongoing strong global trend.

Glaze and basting sauces are now mildly creamy; fusion sauces join two or more cuisines; and fruit bits have begun appearing in sauces (e.g., President’s Choice Thai Mango Coconut Cooking Sauce, which is available in Canada).

Mayo ketchup in Belgium, Mazzetti’s Black Mustard in South Africa, and a diversity of banana ketchups are among the hot condiment trends. Mustard/mayonnaise, “extra thick and rich,” and the addition of spices to traditional condiments, such as chili with coriander, are other new directions.

Kiwi, watermelon, and coconut flavors have entered the sweet spreads category; nuts, herbs, and spices have paired up with jelly. Rice crisps add crunch to peanut butter. Comtes De Provence has launched Organic Smoothie jams.

Dessert seasoning exemplified by Johann Lafer Selection Dessertgewurz premium seasoning mix from Germany is a product category with great potential in the marketplace. Real citrus pieces can now be found in dried spice mixes.

--- PAGE BREAK ---

Spices are being preserved for flavor. In the UK, Marks & Spencer offers a garlic puree stored in white wine vinegar; canned salmon is sold packaged in lemon and dill spring water.

Indulgent Inspirations

Chocolate accounted for nearly two-thirds of new confectionery product introductions in 2010; hard candies/gummies were just under 30%, and gum was 4% (Innova, 2011). Dessert-inspired flavors, new berries (e.g., yumberry), new fillings (e.g., passion fruit/yogurt), exotic fruit (e.g., chocolate pomegranate), and hot and spicy combinations were among the new chocolate confectionery trends.

Claims about cocoa content percentage continue to rise; for example, Russian Hachez chocolate contains 88% cocoa. Alcohol infusions (e.g., champagne), added cereals for crunch, and hybrid chocolate and chip snacks (e.g., Nestlé’s White Chocolate Chips available in Germany) also represent creative approaches to product development.

New shapes and sizes (e.g., twists, curls, and rolls) are adding extra crunch in global snack aisles. Super-sized, jumbo, or extra-long chips and variations in thickness and cut (i.e., ridge and wavy) are also adding excitement in the marketplace. Pasta- and bread-based snacks are other new options.

In the UK, Pringles are available in Prawn Cocktail and Kebab flavors. Crispy coconut fruit chips, chickpea snacks, and black and green olive flavors are other unique concepts. Alternative grains (e.g., spelt, soy, oats, and quinoa) and extreme flavors continue to differentiate products. Salt/flavor sachets are now being placed in-pack.

Packaging grab-and-go ethnic chips with a complementary ethnic dip (e.g., Kraft’s Light Philadelphia Splendips with Poppadoms & Mango Chutney, which are available in Portugal) is a very big idea as are dips targeted specifically to kids. In addition, more companies are positioning their dips as cholesterol-free.

With home entertaining increasing worldwide, gourmet dips and snacks for entertaining are in high demand. In the Netherlands, Jumbo Exotische Smaakmakers offers four exotic dipping sauces in a black plastic ready-to-serve tray. Australia’s Simply Special Thai Collection includes upscale Thai appetizers, dip, and tray. Larger-size pots of spreadable cracker toppings (e.g., salmon mousse), make upscale hors d’oeuvres a snap.

In Belgium, Boursin Salade & Aperitif Cheese Cubes contain hazelnuts and walnuts. Fruit cheeses are gaining in popularity, and an unlikely sounding concept—chicken-flavored cheese—has debuted in Sweden.

--- PAGE BREAK ---

Nuts are being combined with yogurt-coated and juicy dried fruits. Cola, coffee, maple, intense flavors, and marinated flavors all represent new trends in snack nut offerings.

Cheese is being positioned as a dessert more frequently. Pottyos 10 Pontos Coconut and Almond Filled Semi-Fat Sweet Cottage Cheese Bites, available in the Hungarian marketplace, are covered with chocolate.

Local desserts are also gaining attention; Lion Baking Mixes’ Hummingbird Cake is one example of a dessert with a strong local flavor. Panna cotta is also moving mainstream as popular minis excite nearly every indulgent category.

Naturally Speaking

Use of natural ingredients in new foods/beverages continues to soar worldwide. Innova Market Insights reports that no additive/preservative claims outpace both natural and organic on a global scale. No additive/preservative claims are more popular in Europe; in the U.S., natural claims are more popular.

Marketers are reinforcing the natural positioning of their products with the use of descriptors such as “simply” or “pure” in the product name and with short/simple and/or pictorial ingredient lists on packaging.

Packaging with “windows” that allow consumers to inspect the product and label illustrations that expose the real ingredients are other effective strategies for communicating a natural positioning.

Although the number of minimally processed front-of-pack claims is relatively small, Innova Market Insights experts believe that they will become more prominent as the “non-reprocessed” trend progresses. In Canada, McCain’s Garlic Fingers bread snacks carry a flag encouraging consumers to “read our ingredient list.”

The U.S., the UK, France, Germany, and the Netherlands are the top five countries tracked for organic food launches, with the size of the global organic market estimated at $55 billion, according to the Canadian Organic Trade Association. Tea, vegetables, chocolate, juice/juice drinks, baby meals, stocks/seasonings/herbs, and sweet goods were the most active organic categories in terms of new product introductions.

--- PAGE BREAK ---

Innova Market Insights reports that the current sustainability trend is forcing marketers to deliver more than just organic. Albert Heijn’s Pure & Honest yogurt is now produced “with extra care for humans, animals, nature, and the environment.”

At the same time, the number of marketers making “natural goodness” and “naturally high in...” claims continues to grow. Juice/juice drinks, fruits, and vegetables were the most active “natural goodness” categories (Innova, 2011). Heinz Balanz Tomato Ketchup contains “less sugar, more tomatoes” and features a “contains natural lycopene” claim.

Real ingredient claims/clean labels are becoming more prevalent across all markets, with the dairy category at the forefront in this area. In Belgium, Danone’s Greek Yogurt sur Lit de Poires has a layer of pear and is perfectly positioned for an inherent naturally functional claim.

Cheese bars are one of the most exciting new entries into the global bar market; some of the product rollouts targeted to children are especially noteworthy. Russia’s Wimm Bill Dann Chocolate Glazed & Apricot Peach Flavored Curd Bar is made with soft curd cheese. In Belgium, Danone Gervais Fraise Banane flavored sweetened cheese contains only 2% fat and boasts high levels of calcium and vitamin D.

Innova Market Insights reports that superfruit fusions, yogurt, dark chocolate, real fruit pieces, and multiple nuts, seeds, and grains for flavor and function are the main ingredients and flavors driving new product development in the snack bar category.

Flax, barley, quinoa, amaranth, buckwheat, soy, spelt, kamut, whole rye, rice, millet, sorghum, triticale, wheat, corn, and oats are increasingly being used in new products as are seeds such as chia, hemp, and flax (Innova, 2011). Il Vecchio Forno has introduced mini six-grain toast points under the Panvivis brand.

Favoring Functional

Digestive/gut health, vitamin/mineral fortified, and energy/alertness were the top three most popular functional food claims on new foods/beverages worldwide last year; yogurt, dairy drinks, tea, breakfast cereals, and energy/sports drinks were the most active new product categories (Innova, 2011).

Use of the word proven has doubled on new food product introductions since 2008. Dietitian/doctor/specialist recommended and guaranteed results are other new claim categories (Innova, 2011). Becel Pro-Activ Fermented Milk Drinks marketed in Portugal are guaranteed to lower cholesterol with plant sterols in 21 days or your money back.

--- PAGE BREAK ---

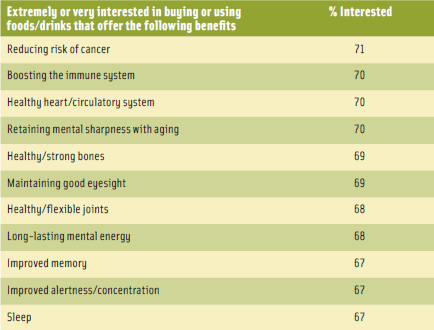

Consumers around the world are very/extremely interested in buying foods/drinks that help reduce the risk of cancer, boost the immune system, or promote a healthy heart.

Avoiding cancer, maintaining mental sharpness, and heart health are among the top 10 global health issues (HealthFocus, 2011; Figure 2.).

Avoiding cancer, maintaining mental sharpness, and heart health are among the top 10 global health issues (HealthFocus, 2011; Figure 2.).

Vitamin K-2 for bone health, chromium for weight control, and lysine for energy and heart health are new fortification ingredients (Innova, 2011). Some yogurts now deliver 30% of the daily requirement for omega-3s.

Fortifying kids foods that are not traditionally viewed as healthful is another important trend. Samyang’s Our Kid Wellbeing Cookie Mix marketed in South Korea is fortified with nine vitamins and calcium.

The number of new foods/drinks carrying a heart health claim rose 10% worldwide from 2009 to 2010. Whole grains and vitamin E were the top heart health ingredients; niacin, flaxseed, soy protein, magnesium, omega-3s, phytosterols, betaglucan, and grape seed extract were used to a lesser extent (Innova, 2011).

Breakfast cereals, dairy drinks, and breads were the most popular heart health product categories; pasta/noodles and yogurt are fast emerging. Available in the Philippines, Maya Think Heart Whole Wheat Pancake Mix lowers blood pressure and aids in weight loss.

AM/PM positioning is just beginning in the marketplace; it makes sense because many nutrients are better absorbed when consumed more than once a day. BelVita Start cereal in Romania delivers morning energy via a “gradual release of carbohydrates, vitamins B-1 and E, iron, magnesium, and fiber.

In Malaysia, Magnolia offer Good Night Milk formulated to help deliver a good night’s sleep and Good Morning Milk to supply an energy boost for starting the day. Fiber, low Glycemic Index (GI) certification, protein, and alternative protein sources are the top ingredients to achieve weight loss naturally. Ingredients positioned for satiety have yet to take off, but the concept is still being marketed. Products claiming to contain the right balance of protein, fiber, and carbohydrates are popular.

Magnesium and “double calcium” are the hot new trends in the bone health segment of the market. In Portugal, Danoninho yogurt for kids carries an approved “helps the growth of strong bones” claim. Danone’s Densia yogurt with vitamin D and double calcium has performed well in Spain and Italy since its launch a year ago (Innova, 2011).

--- PAGE BREAK ---

Product introductions that are gluten-, wheat-, nut-, and lactose-free comprise one of the fastest-growing categories around the globe. Low GI claims are back on the radar screen and are a strong value-added claim for those watching their carbs (Innova, 2011).

In Germany, Chio Hangover Chips contain guarana. “Fructose-friendly” is a new health claim coming from Australia. Perhaps most importantly, even traditional convenience foods are jumping on the healthy bandwagon. Maggi 2-Minute Noodles with Chicken Flavor from South Africa feature “high in fiber” and “promotes digestive and gut health” claims.

Coffee, Tea, and More

In the coffee and tea category, premium collections (e.g., Russia’s Carte Noire Grated Black Coffee), naturally high antioxidant blends, origin-specific, and Fair Trade offerings are all significant trends. In addition, high quality instant coffees are coming on strong.

Shelton Imports’ instant Magic Flavor Coffee Cubes, available in sambuca or amaretto varieties, is only 30 calories per cup. In Germany, Swiss Delice Grande Espresso is sold in a single-serve, restaurant-style cup with lid; it is microwaveable in two minutes. In Hungary, Jacobs Irish Cream instant cappuccino powder sticks deliver “extra foam.”

Sugar-free diet coffees, special energizing breakfast coffees, and coffees flavored with Asian ginger, mocha, or chocolate are among the up-and-coming trends.

Stronger tea products with higher caffeine content are poised to lure coffee addicts. Tea products for children, naturally decaffeinated tea, and fragrance teas also hold great appeal. Tea is also the dominant market category for improved sleep claims (Innova, 2011).

Nut-flavored teas, teas with maple, caramel, and chocolate flavors, and Japanese matcha green tea with more antioxidants than regular green tea, are other significant product trends. In Singapore, Lipton’s 3-in-1 Milk Tea powdered stick sachets contain milk.

Leading Israeli dairy company Tnuva has created a high calcium milk for children with double the calcium content of regular milk and increased levels of vitamin D. Lassi, a traditional Indian dairy drink, is gaining in popularity worldwide (Innova, 2011).

Innova Market Insights reports that the “four Rs: relax, revive, revitalize, and reinvigorate” are platforms marketers are using to differentiate from the “energy” trend. Ingredients to watch in this space are GABA (gammaamino butyric acid), L-theanine, melatonin, valerian root, and Siberian ginseng. Chamomile, lavender, and linden are being used in relaxation beverages, which have enjoyed significant growth over the past two years.

According to Innova, 60% of the soft drinks launches in 2010 had a health positioning. Approximately one-third had a natural attribute; more than one-fifth were low-calorie or sugar-free/reduced-sugar/no-added sugar or both, and 6% had an antioxidant positioning (Innova, 2011).

--- PAGE BREAK ---

Drinks using energy and alertness claims accounted for 8% of soft drinks launches in total. This type of claim overtook vitamin and mineral fortification at the head of the functional healthy beverage segment in 2010; sports/recovery claims remained in third place in this segment of the market (Innova, 2011).

Innova Market Insights reports that more than half of the products with a sports/recovery positioning that were tracked in 2010 came from outside the sports and energy drink space. They included dairy lines and even bakery and cereal products. L-Carnitine, whey protein, vitamin/minerals, amino acids, and glucosamine/chondroitin were the top ingredients in sports beverages. Growth in the use of stevia as a natural high intensity sweetener is also noteworthy (Innova, 2011).

Import/Export Opportunities

It’s important to remember when adapting/importing foods, drinks, and concepts from abroad, that it is a two-way street. Currently, importers/brokers for the pacesetting U.S. specialty food industry cite products from the Mediterranean as most important for their business, followed by Latin (other than Mexican foods), and Indian cuisine. One in five importers name Italian, Spanish, and Middle Eastern cuisine; Thai, Caribbean, Greek, Vietnamese, and Japanese are in the third-lowest tier (NAFST, 2011). Three-quarters (75%) of brokers/importers are looking to bring in natural products, 41% organic, 23% Fair Trade, 18% sustainable, and 15% ecofriendly products (NAFST, 2011).

Innova Market Insights reports that new food products with an ethnic positioning grew from 3.7% of new products to 6% in the U.S. between April 2010 and March 2011. The U.S accounted for 25% of all new global food products with a Fair Trade positioning.

At the same time, U.S. brands and technology are finding great success abroad. For example, microwave steaming, bake-in-the-oven bags, and grill marks on non-grilled foods have been quickly welcomed overseas. With the growing popularity of American “cowboy” and foreign foodie interest in American regional cuisine, why not cross the border with traditional barbecue items, classic American side dishes, and desserts?

With Americans among the first to experience a boom in the home entertainment trend, which is now a global phenomenon, why not export concepts like party platters, buffalo wings, and marinated meats ready to cook in a pan?

The U.S. has perfected the “restaurant crossover” business, has solid experience in developing naturally functional products like V-8 Fusion, and has successfully created some truly global concepts such as Taco Bell’s chalupa. Lastly, let’s not forget that there are certain product forms like grab-and-go cups with dip-in treats that are so unique they transcend any border.

A. Elizabeth Sloan, Ph.D., a Professional Member of IFT and Contributing Editor of Food Technology, President, Sloan Trends Inc., 2958 Sunset Hills, Suite 202, Escondido, CA 92025 ([email protected]).

The author thanks Innova Market Insights (www.innovadatabase.com) for access to its Innova Food & Beverage Database, monthly newsletters, and photos.

References

GIA. 2011. Global strategic business reports, 2010-2011. Global Industry Analysts, San Jose, Calif. www.strategyr.com.

HealthFocus. 2010. Global trend study. HealthFocus International, St. Petersburg, Fla. www.healthfocus.com.

Innova. 2011. Taste the trend. Presentation at Annual Meeting, Institute of Food Technologists, New Orleans, La., June 11-14. www.innovadatabase.com.

NASFT. 2011. The state of the specialty foods industry. National Assn. of the Specialty Food Trade. New York, N.Y. www.nasft.org.

Nielsen. 2011a. Global online consumer confidence, concerns and spending intentions. July. The Nielsen Co. Schaumburg, Ill. www.nielsen.com.

Nielsen. 2011b. The rise of the value-conscious shopper. March.

Nielsen. 2011c. Women of tomorrow: A study of women around the world. June.