New Product Startups: Dealing With the Unexpected

Sudden problems related to product quality or production economics can arise during a new product launch. Here are some practical tips to overcome these challenging surprises.

Unexpected events at the startup of a new product can present difficult trade-off decisions between product quality and project economics. These occurrences of “Murphy’s Law” can be dealt with more rationally by having tools in place to link internal measures of product quality (sensory or instrumental) to consumer acceptance. Some of these post-startup crises can also be avoided by more thorough pretesting of the commercial manufacturing process and by basing manufacturing specifications on consumer acceptance data generated during product development.

Most organizations engaged in new food product development follow a rigorous series of steps, starting with defining a strategic area of interest and proceeding through idea generation, concept development, product development, and commercialization (Cooper, 1990; Graf and Saguy, 1991; Moskowitz, 1994). Throughout the process, there is constant revalidation of the two sets of assumptions that originally indicated that this was a worthwhile project. These assumptions are the level of consumer acceptance of the product and the economic dimensions of the product—projected sales volume, profitability, return on investment, and manufacturing feasability (Earle et al., 2001; Gorton, 2002; Stone and Sidel, 2004).

Most organizations engaged in new food product development follow a rigorous series of steps, starting with defining a strategic area of interest and proceeding through idea generation, concept development, product development, and commercialization (Cooper, 1990; Graf and Saguy, 1991; Moskowitz, 1994). Throughout the process, there is constant revalidation of the two sets of assumptions that originally indicated that this was a worthwhile project. These assumptions are the level of consumer acceptance of the product and the economic dimensions of the product—projected sales volume, profitability, return on investment, and manufacturing feasability (Earle et al., 2001; Gorton, 2002; Stone and Sidel, 2004).

Once product startup is underway, however, the pressures to compromise standards can become enormous. The organization is moving simultaneously against three imperatives: matching the product that won consumers over in the defining concept/product home use test; matching the economic dimensions assumed in the final business proposition (manufacturing cost, marketing expense, price, and profit margin); and supplying the product in the quantities needed to meet the introduction timetable committed to by Sales and Marketing.

These three goals can suddenly seem to be mutually incompatible if serious issues with product quality, cost, and/or throughput rate arise during startup. Organizations that have faithfully followed the new product development process up to this point can panic and start making subjective trade-off decisions that undermine all the discipline that went before.

To address unanticipated events that occur after commercial startup, we will consider three post-launch scenarios: product quality is out-of-specification; product quality leaving the plant is within specification, but consumer complaints are alarmingly high; and product quality is within specification, but manufacturing economics (cost and throughput rate) are unfavorable to what was assumed in the final business proposition.

Quality Out of Spec

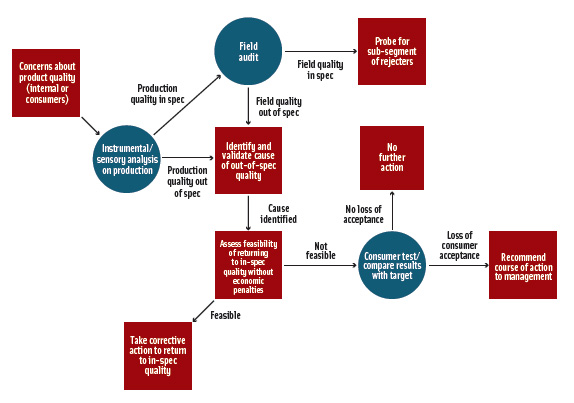

Concern that the new product’s quality is not within specification is typically first raised either by consumers or by someone in the organization. In this scenario, the concern would be confirmed by expert sensory panel profiling and/or instrumental data indicating that the product is out of specification (Muñoz, 1992).

--- PAGE BREAK ---

The determinants of finished-product quality are raw materials (ingredients and packaging material), equipment design, and process conditions (including packaging). For each of these factors, the following questions need to be answered when quality is out of specification (Figure 1):

The determinants of finished-product quality are raw materials (ingredients and packaging material), equipment design, and process conditions (including packaging). For each of these factors, the following questions need to be answered when quality is out of specification (Figure 1):

• Do either sensory tests or instrumental measurements suggest that the observed quality difference vs design is significant?

• Can it be demonstrated in a controlled experiment that the suspected determining factor (e.g., raw material, equipment design, process conditions) is, in fact, the cause of out-of-specification quality?

• How feasible is it to bring this determining factor back to the state needed to reproduce design quality? What are the economic implications of making these revisions?

• If the feasability of matching original quality looks difficult and/or economic consequences look significant, would there be a significant loss of consumer acceptance if quality is allowed to stay as it is (Peryam and Muñoz, 1997)? If the answer is yes, then the organization faces a difficult decision, pitting consumer acceptance against economics, that needs to be addressed by all functions in a joint recommendation to senior management.

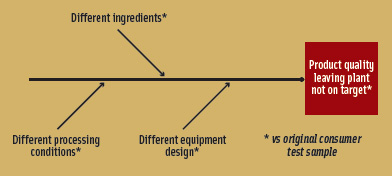

Let’s review each of these potential areas of causation for out-of-specification quality and suggest how to deal with them (Figure 2).

Let’s review each of these potential areas of causation for out-of-specification quality and suggest how to deal with them (Figure 2).

Changes in the properties of an ingredient or packaging material can directly affect the flavor, texture, appearance, or storage stability of the finished product that reaches the consumer or indirectly affect how the manufacturing process runs (e.g., the yeast whose leavening power has diminished or the packaging film whose “sealability” characteristics have changed).

Such post-startup changes in raw materials can occur for a number of reasons: seasonality, which can significantly alter the quality and functionality of agricultural ingredients; scarcity of supply, forcing use of a substitute; and changes in the vendor’s practices, including how the supplier is sourcing his raw materials.

Confirming whether a raw material change is the cause of a shift in product quality away from design will depend on how well that raw material’s own specifications were established in the first place. If such a change is suspected, but cannot be found by analyzing vs specification, and a supply of the original material still exists, then the current product should be tested internally for quality and/or “processability” vs a control sample prepared from the original material and then, if necessary and as a last resort, tested side-by-side by consumers.

--- PAGE BREAK ---

Changes in equipment design can also be a cause of out-of-specification quality. Often, the final commercial equipment to process and package a new product will not be delivered until shortly before scheduled startup, the defining consumer test having been run on pilot-plant or jury-rigged commercial-scale equipment. Commitments to introduce the product have already been made to the trade, advertising is scheduled, and consumer promotional events are locked in. Shakedown of the tardily delivered final equipment must be done on a crash basis. And then, when it is too late to postpone the launch, it is discovered that quality is off-target because the just-delivered commercial equipment is not producing the same quality as the pilot plant or semi-works equipment that was used to make the defining consumer test sample.

For example, the commercial oven may have different thermodynamic parameters and does not produce the same flavor development. Or the commercial homogenizer may emulsify differently and produce a sauce with a different texture. Or the commercial packaging machine may have a different feeding device and break up the powdered mix more. The examples are endless.

Why do these scale-up mishaps happen? The two major reasons, in my opinion, are that equipment delivery times are often overly optimistic, leaving inadequate time for shakedown and that the relationship of product quality to equipment design parameters are very often not completely understood by the developers of the new product and process, and even when they are understood, the importance of these relationships are not communicated to the local engineering department and/or the equipment vendor.

A similar sequence of quality “surprises” can happen when a second plant goes on stream with different equipment design from the plant in which all the development work was done, if the second plant did not undergo a shakedown for quality before commercial startup.

What course of action should be taken when it is discovered that imperfect scale-up is causing out-of-specification quality? Ideally, a side-by-side quality comparison with the original pilot plant or semi-works equipment would confirm that differences in design account for the quality shift. If such a comparison is not feasible because the pilot plant or semi-works equipment is no longer available, a “paper” comparison of sensory descriptive profiles is the next-best alternative.

Then, as discussed above under raw materials, further questions may need to be answered. How big is the quality difference, according to the sensory panel? If the difference is significant, do consumers care? What will it take to correct the equipment design’s effect on product quality? Can the correction be made by making compensatory changes in processing conditions or with just minor modifications to the equipment, without damage to manufacturing economics or throughput rates? Or are major design changes, or even wholesale replacement, going to be needed? How long will it take to institute the changes? Is the gap in consumer acceptance large enough to justify the additional investment needed? What are the risks to the success of the launch if several weeks or months are needed to make the correction?

If the answers to these questions are that there is both the risk of a loss in consumer acceptance and significant economic cost to get product quality back in specification, then it becomes the joint responsibility of the cross-functional team to advise senior management on the right course of action.

--- PAGE BREAK ---

Differences in processing conditions are another cause of out-of-specification product quality. How does this happen? One reason is that the relationship of product quality to some process variable was not well understood when process specifications were written before startup. The specification was either made too broad or there simply was no specification for that process variable (e.g., temperature, mixing speed, holdup time, etc.) because the variable’s influence on product quality was not appreciated.

A second reason has to do with the unpredictable effects of the passage of time on equipment performance, even when the design of the equipment has been perfectly scaled. The effects on equipment performance of such time-dependent influences as wear and seasonal environmental changes may not be immediately understood during the pre-launch shakedown. Hubbard (2003) gives some examples of such in-process oddities: a seasonal change in wind patterns affecting the performance of a dryer, and a gradual accumulation of fines in a hopper periodically discharging and disrupting the operation of a packaging machine.

Once it is revealed that process operating conditions are the cause of out-of-specification quality, the corrective steps to be taken are generically similar to those outlined above for raw materials and equipment design: confirm in a controlled manner that the suspected process variable is, in fact, influencing quality; quantify with sensory and/or instrumental methods the degree of quality variation; estimate the cost of fixing the problem (e.g., by slowing throughput rates or by investing in equipment modifications; quantify through sensory testing and, if necessary, with consumers, how significant the quality variation is; and, if the quality-vs-cost trade-off is serious enough, put functional heads together and recommend a course of action to senior management.

Quality in Spec, But Consumers Complain

A consumer complaint rate for a new product which is significantly above the rate normally experienced for an established product in the same category can be cause for alarm. For example, a complaint rate of 200 per million packages for a category that normally produces a rate of 40 should be viewed with concern.

Let’s now assume that analyses, both by sensory panel and by instrument, of samples from across the entire production period since startup indicate that quality has been consistently within specification.

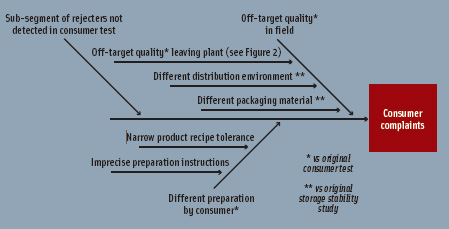

So why are consumers complaining? Several explanations are possible (Figure 3). First, the product leaving the plant may be within quality specifications, but what is reaching consumers is not. Second, consumers are not preparing the product correctly. And third, there is a sub-segment of consumers, who were not detected in the original consumer tests conducted during development, who simply do not like the product.

So why are consumers complaining? Several explanations are possible (Figure 3). First, the product leaving the plant may be within quality specifications, but what is reaching consumers is not. Second, consumers are not preparing the product correctly. And third, there is a sub-segment of consumers, who were not detected in the original consumer tests conducted during development, who simply do not like the product.

Let’s review each of these potential sources of consumer complaint and consider how to handle them.

• The product leaving the plant may be within quality specifications, but what is reaching consumers is not. This situation occurs when the This situation occurs when the product undergoes changes while it is in distribution. Typically, very thorough storage stability studies will have been done on the new product before the decision was made to launch.

--- PAGE BREAK ---

But these studies may have suffered from one or both of two common predictive weaknesses or flaws:

The first flaw is if the studies were not done on product and/or package produced from commercial raw materials and on the final commercial processing and packaging equipment. Either the commercial product or the commercial package may have different storage characteristics from what was studied during the development project, because of differences in raw material or equipment.

The second flaw has to do with assumptions made about the environment that a product will be exposed to when it is in the field. Even a well-designed simulated storage study cannot always predict or capture all of the permutations of time, temperature, humidity, and physical handling that a product will see in the real world.

Dealing with this type of post-launch quality issue should begin with an audit of product in the field to confirm that the consumer complaints are, in fact, being triggered by a storage stability problem.

The next steps are similar to those described above for other types of post-launch quality issues: determine just how serious the quality problem is through a combination of sensory evaluation, analysis of consumer complaints, and, if necessary, consumer testing; quantify what it will cost in terms of adjustments in raw materials, processing, packaging, or the distribution environment (e.g., controlled temperatures) to fix the problem; and make the necessary trade-off decisions between quality and economics.

• Some consumers may not be preparing the product correctly. It should be relatively easy, It should be relatively easy, through telephone interviews, to confirm suspicions that faulty product preparation is the cause of complaints. Following such confirmation, there are three options: (1) revise preparation instructions on the package to make them more explicit. (2) reformulate the product to improve its recipe tolerance, in which case sensory evaluation and, if warranted, consumer testing would need to confirm that the reformulated product had not lost its overall level of consumer acceptance; or (3) accept that a limited number of consumers are going to experience off-quality because of incorrect preparation, without jeopardizing the overall marketplace success of the product.

• A subset of consumers, who were not detected in the consumer tests conducted during the development project, simply do not like this product. How did we miss How did we miss these consumers? A comparison of the statistical basis of consumer complaints vs that of consumer tests may provide an answer.

Let’s assume that only 4% of consumers who were unhappy with the product bothered to phone or write to company headquarters (Goodman, 2005; Goodman and Newman, 2003). That assumption leads to the conclusion that the real level of discontent on first trial is not 200 per million packages produced but 5,000. Assuming that few consumers have had the opportunity to buy the new product and to complain about it a second time, we can then say that 0.5% of consumers trying the product for the first time are dissatisfied with it.

The typical consumer test during a development project is based on 150–300 judgments. Even with close examination of the distribution of individual consumers’ ratings, as suggested by Moskowitz (1994), it would be difficult to have predicted on such a base that 0.5% of the population would dislike the new product enough to complain about it after first trial.

--- PAGE BREAK ---

What actions should be taken in this situation? If it appears certain, based on thorough auditing of both sensory and instrumentally measured quality in the field, that product is consistently within specification, and if the product is also garnering praise from consumers and overall initial consumption volumes appear healthy, then no immediate action should be taken. But if after several weeks, when accepting consumers have had the opportunity to repeat their initial purchase one or two times, the complaint rate is still abnormally high, then some investigation is in order.

Such research will be most useful if conducted among those consumers who have complained. How has the consumers’ purchase intent been affected by their experience with the product? In some cases, the answer may be that, despite their complaint, they intend to continue purchasing the product either because it offers benefits that outweigh the faults the consumers have found, or because the consumers suspect that the sample they got was atypical and that they would like to try it again.

But if a significant number of complaining consumers say that they will no longer purchase the product and the complaint rate is not declining, or worse, the complaint rate is not declining but sales are, then consideration may need to be given to redesigning the product. Any significant trade-offs in either overall consumer acceptance or product economics caused by the reformulation need to be quantified, discussed by the team, and reviewed with senior management.

Quality in Spec, But Economics Poor

Sometimes the bombshell surprises that occur after startup are related not to product quality but to product economics. Examples include:

• A sudden increase in product cost because of an unforeseen increase in the price of an important ingredient or because of lower-than- planned in-package yield.

• An increase in labor cost because some new supposedly automatic operation (usually at the packaging end of the process) is not functioning and additional manual labor is needed.

• Throughput rate is not matching the assumptions made in the original cost and return-on-investment calculations.

If no relief from these economic ills appears in sight, R&D will frequently be asked to look for cost-reduction opportunities in product or process design, such as lowering the level of some expensive ingredient in the formula or allowing the process to run faster than specified.

But beware. These cost-cutting tactics, designed to rescue manufacturing economics, may risk lowering product quality as perceived by the consumer. Preventing such quality risks can be done by using some of the same tools described above for dealing with post-launch quality surprises. In the case of reducing formula cost, the development of response surface curves will show how sensitive sensory profiles and consumer acceptance are to changes in the level of some economically important ingredient in the finished product (e.g., the level of meat in a frozen dinner, the level of freeze-dried fruit in a ready-to-eat cereal, or the level of chocolate in a confectionery bar).

Speeding up a process to meet demands from the field and/or to reduce fixed manufacturing costs can be fraught with risks to product quality and consumer acceptance. For example, running a product through a baking or toasting oven faster than originally designed could result in less development of important “brown” flavor notes. Again, as with formula modifications, the appropriate way to quantify such risks is to execute controlled experiments at different throughput rates on the commercial process and to compare product quality against control through sensory evaluation and, if necessary, consumer testing.

These exercises may not produce easy black-and-white answers on how to optimize quality and economics, but at least they will provide the team and management with some objective data on which to base their judgment on the course of action to be taken.

Understanding the Trade-Offs

In all discussions of trade-offs between quality and economics, it is a given that no trade-offs can be taken in product safety or in meeting the legal requirements of a product, including ingredient labeling requirements, nutritional claims, net weight declarations, and meeting any other claims, such as “organic.” Any discussion of adjusting product quality targets relates only to the product’s sensory attributes as perceived by consumers, not to any compromising of microbiological or chemical specifications or of standards of product purity, including those related to the presence of allergens or foreign material. Similarly, any discussion of adjusting processing conditions is exclusive of any changes that would risk either product safety or the fulfillment of legal requirements.

by Michael H. Mansky ([email protected]), a Professional Member of IFT, is located at 33 Forest Ave., New Rochelle, NY 10804-4202. He is retired Vice President of R&D/QA at Pepperidge Farm, Inc.

References

Cooper, R.G. 1990. Stage-gate systems: A new tool for managing new products. Business Horizons 33(3).

Earle, M., Earle, R., and Anderson, A. 2001. “Food Product Development.” Woodhead Publishing, Ltd., Cambridge, England.

Goodman, J.A. 2005. Misplaced data cause questions, confusion (letter). Quality Progress 38(11): 8, 10.

Goodman, J. and Newman, S. 2003. Understand customer behavior and complaints. Quality Progress 36(1): 51-55.

Gorton, L. 2002. 2002 Wholesale baker of the year: Pepperidge Farm. Baking & Snack, March.

Graf, E. and Saguy, I.S. 1991. R&D process. Chpt. 3 in “Food Product Development: From Concept to the Marketplace,” ed. E. Graf and I.S. Saguy, pp. 49–89. Avi/Van Nostrand Reinhold, New York.

Hubbard, M.R. 2003. “Statistical Quality Control for the Food Industry,” 3rd ed., Kluwer Academic/Plenum Publishers, New York.

Moskowitz, H.R. 1994. “Food Concepts and Products: Just-in-Time Development,” Food & Nutrition Press, Trumbull, Conn.

Muñoz, A.M. 1997. Importance, types, and applications of consumer data relationships. Chpt. 1 in “Relating Consumer, Descriptive, and Laboratory Data to Better Understand Consumer Responses,” ed. A.M. Muñoz, pp.1-7. ASTM, West Conshohocken, Pa.

Peryam, D.R. and Muñoz, A.M. 1997. Validity. Chpt. 3 in “Relating Consumer, Descriptive, and Laboratory Data to Better Understand Consumer Responses” ed. A.M. Muñoz, pp. 27-38. ASTM, West Conshohocken, Pa.

Stone, H. and Sidel, J.L. 2004. “Sensory Evaluation Practices,” 3rd ed. Elsevier Academic Press, San Diego, Calif.