Foodservice Adapts to the ‘New Normal’

As the economy slowly recovers, foodservice operators address the challenge of getting consumers to open their wallets by adding value through customization, local and fresh ingredients, and bolder flavors.

There’s no question that the recent economic recession has had a devastating impact on the foodservice industry. While in the past year the economy has shown positive signs of recovery, the road has been bumpy. Rising foods prices caused by droughts, spikes in gas prices, and the payroll tax increase have left consumers hesitant and cautious when it comes to eating out.

“Consumers are not going back to conspicuous consumption or their free-spending ways,” explained Bonnie Riggs, Restaurant Analyst for NPD Group. In fact, today’s consumers differ vastly from those pre-2008; they have been shaped by cost-consciousness and it is up to the foodservice industry to entice and showcase value to bring consumers back in the door. Whether it be bolder, more diverse ethnic flavors or local sourcing and transparency, today’s consumer demands customization and choices. These will be the factors that drive the foodservice industry forward for the foreseeable future.

Hazy Outlook

At the 2013 National Restaurant Association (NRA) show, Hudson Riehle, Senior Vice President of the Research & Knowledge Group at NRA, presented a graphical representation of the past 43 years of restaurant industry sales. Since 1970, the years 2008 and 2009 were the only time that the industry’s growth rate dipped below -1%. In fact, it experienced a startling -3% in 2009, the lowest on record. Riehle explained that the recovery period, while optimistic, still leaves the industry with a much lower growth level than prior to the recession.

“The industry growth rates are definitely much more moderate than before the 2008 timeframe,” said Riehle. “If you look at the history of growth rate for the industry over the past four plus decades, the compound annual growth rate is a solid, respectable 6.6%. In the past decade, that has moderated down to about 4.3%. The challenge, as operators and suppliers in the industry, is that going forward this moderate growth environment is expected to continue.”

To temper that outlook, it should be kept in mind that industry growth will continue due to the fundamental shift in how consumers spend their money on food in the United States. In 1955, just one out of every four dollars was spent at restaurants by consumers. Today, that number is closer to one out of every two dollars. In fact, despite a sluggish recovery, consumers still made over 61 billion restaurant visits in 2012, and the industry had $660 billion in sales (Riehle, 2013).

The forecast for the next few years is a little more difficult to predict. Consumers continue to face rising gas prices, a payroll tax hike, and higher cost of food that quell their spending. Meanwhile, the industry faces high wholesale food/ingredient prices and operational cost increases stemming from soon-to-come government mandates, such as nutrition disclosure (see Online Extra “Menu Regulations: What to Expect”). These factors make it difficult to predict how the restaurant industry will fare from one quarter to the next. However, both NRA and Technomic are predicting 3.8% growth for 2013, and for 2014, Technomic is expecting more improvement with a forecasted growth rate of 4.1% (Riehle, 2013 and Technomic, 2013).

But as mentioned previously, today’s consumers are driven by a completely different value set than the pre-2008 consumer. Spending is a very deliberative process. “The current ‘new normal’ marketplace requires operators and their suppliers to develop or realign their marketing strategies to address the needs of today’s consumer, like incentives that keep customers happy and deliver perceptions of value,” said Riggs. “It’s going to be those that are innovative and creative and best meet consumers’ needs that will alter their forecast and win the battle for market share.”

Segment Winners & Losers

Segment Winners & Losers

While every segment of the foodservice industry took a hit during 2008 and 2009, full-service restaurants suffered the most as consumers traded down to more affordable options. According to NRA’s Riehle, the fullservice segment still represents the largest in terms of dollar share with $202 billion in 2012, but it is also the slowest growing segment. It is only expected to experience a 2.9% growth rate to reach $208 billion in 2013 (Riehle, 2013).

Meanwhile, as consumers tightened their purse strings, eating at home increased, or if they did choose to eat out, they often patronized quick-service or fastcasual establishments. We know these as the McDonald’s and Paneras of the industry. The NRA number for these two categories combined is still forecasted to be lower than their full-service competition at $188 billion for 2013, but the growth rate is substantially higher at 4.9% (Riehle, 2013). Technomic forecasts the fast-casual segment alone to grow 8% this year (Henkes and Crecca, 2013). And, according to The NPD Group’s CREST research, quick-service and fastcasual represent 78% of all foodservice industry visits (NPD, 2013).

The foodservice industry is certainly taking notice of these consumer behavior shifts. “A big pattern that we are watching is the lateral moves made by the foodservice industry,” revealed Suzy Badaracco, President of Culinary Tides Inc. “So, for example, if you have a quick-service restaurant, you are opening a fast-casual operation. Everybody wants to be a fast-casual right now.”

Full-service brands are bolstering their competitive standing with fast-casual brand extensions and spinoff concepts. For example, Florida-based fine-dining brand Shula’s Steak Houses has 15 locations in the United States. In this new marketplace, however, the company has realized its future success lies in a new fast-casual concept—Shula Burger, which trades white tablecloths and crystal stemware for hamburgers and hand-dipped Häagen-Dazs milkshakes. With five Shula Burger stores in Florida, Shula’s is betting that its fine-dining knowhow applied to a more casual and economical environment will make Shula Burger a national concept that can propel the parent company to new heights.

--- PAGE BREAK ---

Even celebrity chefs are taking notice. Recently, James Beard winner Stephanie Izard opened Little Goat Diner in Chicago, Ill., across the street from her alwayspacked upscale Girl & The Goat restaurant. While it can take months to secure reservations to Girl & The Goat, the new diner concept doesn’t take reservations and is open practically 24/7, serving updated diner food in a hip, casual environment.

Additionally, some of the more casual full-service eateries are learning to adapt. Famous Dave’s, a wellknown barbeque restaurant chain with locations across the United States, has dipped its toe into the fast-casual space with the launch of Famous Dave’s BBQ Shack, offering a more casual, neighborhood atmosphere and affordable food. While the Famous Dave’s brand knows its future growth will primarily come from its new fastcasual eateries, many other casual-dining restaurants aren’t adapting fast enough. According to NPD, these mid-priced, sit-down restaurants have seen on average about 2% fewer customer visits each year since 2008, which amounts to almost 600 million visits lost each year. “They’ve been around a while and many have not stayed relevant to consumers. They are no longer meeting the consumer’s needs and wants,” said Riggs.

It seems that Americans are opting for quick-service or fast-casual locations for those everyday eating-out times, or they are splurging a little more and choosing trendier, fine-dining restaurants for those special occasions. For the first quarter of 2013, NPD’s CREST research showed steady traffic at quick-service and full-service restaurants, and 5% visit gains at fine dining/upscale restaurants (NPD, 2013). The midscale and casual-dining locations experienced traffic losses (Figure 1). In order to survive, these more-established chains, such as Olive Garden and Macaroni Grill, will have to either morph into something more upscale or become faster and less expensive.

Fine-dining and casual-dining entities aren’t the only ones learning from other successful segments. Convenience stores and supermarkets are upping their game when it comes to prepared foods, offering speed and fresh ingredients at fair prices. Whole Foods Market even hires chefs and prep teams for their stores to prepare dozens of dishes daily, breakfast through dinner. 7-Eleven aims to have 20% of its sales from fresh foods in its North American stores by 2015, while the Sheetz chain offers an extensive menu of food and beverages and touch-screen ordering (Hartman Group, 2013). Consumers are increasingly turning to these stores as an alternative to quick-service and fast-casual restaurants, sometimes even viewing them as a dining destination in their own right.

Daypart Expansion

With moderate growth and no clear lines between industry segments anymore, the competition for every food dollar has increased tremendously. The question for restaurants becomes how to get the consumer in the door. As the economy dipped, operators scrambled to maintain visits, and now as the economy slowly recovers consumers need to be enticed to coming back. To do this, many restaurants are expanding into dayparts that they haven’t taken part in previously. And the daypart that has rocketed in popularity over the past few years is breakfast.

The breakfast daypart is experiencing great activity, with increased emphasis and more diverse product development in both the foodservice and retail channels. Competition has become more complex as choices for “the most important meal of the day” have expanded and lifestyle shifts continue to drive changing consumer patterns.

Taco Bell debuted its breakfast (FirstMeal) platform in select markets at the beginning of 2012 with menu items such as breakfast burritos and wraps, Cinnabon cinnamon roll bites, and Seattle’s Best coffee drinks. The company hopes to launch its breakfast items nationally in 2014. Meanwhile, it is testing more morning options, including fruit-topped oatmeal, yogurt parfaits, and hot and iced coffee. But perhaps its most buzz-worthy breakfast experiment has been the Waffle Taco, which features sausage and scrambled eggs in a folded waffle with a syrup packet. This product takes advantage of portability—the key to successful quick-service breakfast items.

Taco Bell debuted its breakfast (FirstMeal) platform in select markets at the beginning of 2012 with menu items such as breakfast burritos and wraps, Cinnabon cinnamon roll bites, and Seattle’s Best coffee drinks. The company hopes to launch its breakfast items nationally in 2014. Meanwhile, it is testing more morning options, including fruit-topped oatmeal, yogurt parfaits, and hot and iced coffee. But perhaps its most buzz-worthy breakfast experiment has been the Waffle Taco, which features sausage and scrambled eggs in a folded waffle with a syrup packet. This product takes advantage of portability—the key to successful quick-service breakfast items.

Portability is also driving the popularity of sandwiches in the breakfast scene. According to Technomic’s MenuMonitor, in early 2013, breakfast sandwiches were up 8.1% annually on the menus of the top 500 limited-service restaurants (this designation includes quick-service and fast-casual). In fact, a separate Technomic survey found that one-third of consumers eat breakfast sandwiches at least once a week (Technomic, 2013). This, according to Badaracco, is a positive sign for the overall economy. “One of the main things we look for in recovery is breakfast numbers. Because breakfast, out of all the meals, is the easiest and cheapest thing to eat at home,” said Badaracco.

--- PAGE BREAK ---

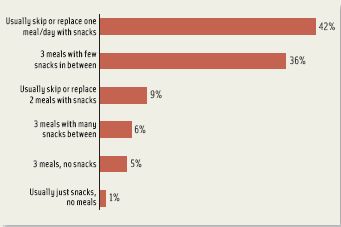

The other major driver for daypart expansion is the trend towards snacking. Americans are increasingly substituting snacks for meals. In fact, according to a Technomic survey, 42% of consumers say they usually skip or replace one meal a day with snacks. And only 5% of consumers are eating three meals a day and no snacks (Kruse, 2013) (Figure 2). Foodservice operators should no longer be content to merely serve breakfast, lunch, and dinner when consumers show a willingness to snack and socialize wherever there is food and an opportunity. To meet these demands, many restaurants are using two tactics: miniaturization and beverage specials.

Smaller, snackable portions offer consumers the flexibility to have a mid-day snack that is calorie-controlled and low-priced. Some eateries have opted to shrink their current entrées, while others have developed new items aimed just at snacking. For example, Wendy’s salad program offers consumers three sizes: entrée size, half portion, and a side salad. This program has been so successful that the chain sold 100+ million salads in 2012 (Kruse, 2013). McDonald’s introduced its Snack Wraps in 2006 and today has seven different flavors ranging in calories from 250–350. And just earlier this year, the chain added chicken McWraps, a more substantial version of its Snack Wraps, to its permanent menu.

Filling out the menu with varying portion sizes will help meet consumers’ snacking needs, but many operators still struggle with how to get customers to choose them over the plethora of competitors. Increasingly, operators are using beverage specials to bring customers in the door. For consumers, beverages are low-risk and low-cost, while for restaurants it offers the perfect chance to upsell. Recently, Dunkin Donuts, which experiences a majority of its sales in the morning daypart, started offering beverage specials, such as any size iced tea for $0.99, in the afternoon hours. Taco Bell’s Happier Hour from 2–5 p.m. offers customers a deal on a snackable food item—their Loaded Grillers—and a choice of their beverage for only $1.

Adult beverages can also drive daypart sales. Some fine-dining locations have capitalized on the idea of happy hour and late-night promotions as an opportunity to appeal to younger guests, deliver attractive price points, and increase occasions and visits.

Value Beyond Price

While operators are still offering promotions to increase foot traffic, they increasingly resist the type of deep discounting that they embraced during the recession, realizing that it could not provide a route to long-term profitability. However, for many customers, particularly in quick-service settings, price remains the main focus. New value strategies to drive revenue along with traffic include not only discounts and specials, but also increased emphasis on flexible portion sizes; bold, ethnic flavors; more customized forms of bundling; and fresh, seasonal ingredients.

Customization: Consumers are increasingly demanding when it comes to what they want and expect from foodservice operators. They want more control over how they put their meals together when they are eating out. To meet this demand, restaurants have started adding items and options to their menu, allowing consumers to customize their experience. According to Technomic’s Menu Innovation Report, new item intros hit record high levels in the first half of 2012 with 1,640 new entrées debuting just among the top 250 chains restaurants (Kruse, 2013).

Customization: Consumers are increasingly demanding when it comes to what they want and expect from foodservice operators. They want more control over how they put their meals together when they are eating out. To meet this demand, restaurants have started adding items and options to their menu, allowing consumers to customize their experience. According to Technomic’s Menu Innovation Report, new item intros hit record high levels in the first half of 2012 with 1,640 new entrées debuting just among the top 250 chains restaurants (Kruse, 2013).

“Your patrons are being programmed by this in terms of consumer expectation,” said Nancy Kruse, The Kruse Co., as she addressed foodservice operators during her “Menu Trends 2013” session at the 2013 NRA show. “You have to be on top of your game.”

According to Mintel’s “The Dining Out Experience” report, 94% of customers say that menu selection and variety are the most important components for a restaurant. On top of that, customers want to be able to alter, or customize, the product to their liking. This isn’t a new idea; after all, Burger King’s “Have it Your Way” slogan was introduced back in 1974. However, the cautious spending habits of today’s consumers have led to the idea that if they can’t have it their way then they probably won’t spend the money.

This is the same approach that has led to the growing success of chains such as Subway and Chipotle. Other new ventures are basing their entire restaurant concept on the idea of customization. At U-Sushi in San Francisco, Calif., cutting-edge machines allow customers to select their desired ingredients (choices of rice, nori or soy, fish, vegetables, and sauces) and have a tailor-made roll ready in about one minute. As its slogan says, “You design. We roll.”

Another reason customization has become increasingly important is because it provides consumers the opportunity to alter their calorie intake by substituting or leaving out ingredients. Given that 64% of consumers agree that it is important to eat healthy and pay attention to nutrition, it makes sense for foodservice operators to offer healthier options, sides, and beverage choices (Technomic, 2012).

--- PAGE BREAK ---

Another way to satisfy consumers looking for healthier choices is to offer smaller portion sizes of already popular menu items. For example, Sbarro offers a “skinny” slice that has cheese and veggies at only 270 calories. Having these smaller options on a menu will become increasingly important as nutrition information (calories, fat, etc.) become more transparent with pending menu legislation.

Local & Fresh Ingredients: Consumers’ definitions of health have veered to a more holistic, nourishing approach to wellness. Low-calorie, lowfat, and lowsugar descriptors remain highly important to consumers’ health perceptions, but consumers are also increasingly interested in local, natural, organic, and sustainable attributes for food and drink. These offerings can help consumers strike a balance between health and indulgence as part of a wholesome, balanced, or nutritious lifestyle.

According to Technomic, nearly nine out of 10 consumers say fresh food is healthier. Attributes that relate to freshness and quality also have the strongest impact on consumers’ taste perceptions. And as everyone knows, taste is king. More than two-thirds of consumers say fresh, homemade, and made-from-scratch descriptors have a positive effect on their taste perceptions. “Fresh” carries strong associations with nutrition, quality, and taste, which is why more than 40% of consumers are willing to spend more for foods described as fresh (Technomic, 2012). Offering smaller portions with premium local or natural ingredients can add the value customers are looking for, enabling operators the chance to increase the perceived value and charge just as much as a full-size portion.

Freshness is also defined by the location from which ingredients are sourced. Ingredients from local farmers’ markets, for example, are seen as fresher and healthier than those from the grocery store. Foodservice operators can take advantage of the value consumers place on fresh and local by introducing items containing seasonal produce and locally-grown/raised ingredients.

Hannah’s Bretzel, a chain of fast-casual sandwich restaurants in Chicago, Ill., is the epitome of fresh. The company, which now has four locations in Chicago with plans to expand nationally, features ingredients such as organic grass-fed sirloin, mango chutney, whole grain bread baked fresh daily, and fresh veggies. The premium ingredients communicated in a clear fashion throughout the restaurant cue customers to the food’s value and translate to a willingness to pay nearly twice the price of a Subway sandwich.

Ethnic flavors: Cooking methods and the use of unusual spices can also attribute to the value perception of a dish. During economic recovery, people tend to be more daring and are willing to experiment with bolder flavors and different food preparations. “During recovery, you start to see wider releases of ethnic food and extreme flavors coming back in,” said Badaracco. “In addition, you have different cooking, like dry heat methods, or open-flame cooking, and charring. Pickling and fermenting are also really popular right now.”

According to Technomic’s “Ethnic Food & Beverage Consumer Report,” only 23% of consumers are satisfied with the availability of ethnic foods at quick-service and fast-casual restaurants. Even fullservice restaurants, which tend to be known as featuring more ethnic dishes, have the opportunity to expand their ethnic flavor profiles; only 28% of consumers were satisfied with their ethnic food offerings. Furthermore, 33% of consumers either agree completely or agree and another 30% agree somewhat that they would like to see more ethnic options at restaurants (Technomic, 2012).

The three big “ethnic” cuisines in the United States are Chinese, Mexican, and Italian (Technomic, 2012). These are long-standing favorites among consumers. What we see happening today is taking the foods of these cultures to the next level. This could mean that restaurants are focusing more on regional Chinese food, such as the growing popularity of “hot pot” meals where meat and vegetables are simmered in stock at the dining table with guests adding their own choice of ingredients.

In addition, there are more ethnic cuisines that are just now being introduced to a majority of Americans. These include many Middle Eastern cuisines, such as Moroccan food. With its emphasis on slow-cooked preparations, robust spices and seasonings, Moroccan cuisine answers the call for big, bold flavors and satisfying global comfort foods. Latin American cuisines are also expanding to include Peruvian, Jamaican, Cuban, and Argentine influences.

And these less well-known ethnic cuisines are not just seen in fine dining or independent eateries. They are becoming fused into American cuisine. For example, Stephanie Izzard’s Little Goat Diner is well known for its Naamelette, a breakfast to-go item containing egg enrobed in Indian naan bread. Using an ethnic ingredient in a dish can raise the value of the item for the customer. Another way to do this is through sauces. Curry sauce, for example, can impact the ethnic perception of a dish.

Moving Forward

Giving customers the opportunity to customize their dining experience and featuring bolder, ethnic flavors and fresh ingredients on the menu are ways to add value for today’s consumers. Of course, foodservice operators still have to keep costs and taste in mind—it has to taste good and be priced to suit cautious spenders. The foodservice industry has always been competitive, but it is even more so today as the line between segments blurs. However, the good news is that there remains an unfilled demand for restaurant services. According to the NRA, almost one out of two adults are not dining out as often as they would like to. As Riehle concluded in his State of the Industry presentation at the NRA show, “They [consumers] like going to restaurants. There are 93% of Americans who enjoy going to restaurants. You can’t get 93% of Americans to agree on anything.”

Food Technology Online Extra

The final Nutrition Disclosure regulation is expected as early as this fall, with a rumored short six months to one year period before enforcement begins. What will be included in the proposed regulation and what are the impacts on foodservice operations? Read Dan Roehl’s insights from the 2013 NRA show in the Online Exclusive “Menu Regulations: What to Expect.”

Kelly Hensel

Kelly Hensel

is Senior Digital Editor of Food Technology magazine

([email protected]).

References

Hartman Group Inc. 2013. Ideas in Food 2013. A Cultural Perspective. The Hartman Group Inc., Bellevue, Wash. www.hartman-group.com.

Henkes, D. and Crecca, D. 2013. New Rules for the Road Ahead. Presented at the International Wine, Spirits & Beer Event 2013, Chicago, Ill., May 19–20.

Kruse, N. 2013. Menu Trends 2013: What’s Hot, What’s Not, What’s Next? Presented at the National Restaurant Association Show, Chicago, Ill., May 18–21.

Mintel Group Ltd. 2013. The Dining Out Experience – US – April 2013. Mintel Group Ltd. www.mintel.com.

NPD Group/CREST®. 2013. U.S. Restaurant Traffic Holds Steady in First Quarter 2013 and Spending Increases, Reports NPD. NPD Group, Chicago, Ill. www.npd.com.

Riehle, H. 2013. State of the Foodservice Industry. Presented at the National Restaurant Association Show, Chicago, Ill., May 18–21.

Technomic Inc. 2012. The Ethnic Food & Beverage Consumer Trend Report. Technomic Inc., Chicago, Ill. www.technomic.com.

Technomic Inc. 2012. The Healthy Eating Consumer Trend Report. Technomic Inc., Chicago, Ill. www.technomic.com.

Technomic Inc. 2013. Technomic Reveals Initial 2014 Foodservice Industry Forecast. Technomic Inc., Chicago, Ill. www.technomic.com.

Technomic MenuMonitor. 2013. Technomic’s MenuMonitor Finds Uptick in Breakfast Sandwich Offerings. Technomic Inc., Chicago, Ill. www.technomic.com.