Global Consumer Close-Up

A worldwide appetite for crossover cuisines, rapidly aging populations, and widespread budgetary concerns are creating new market opportunities for food and beverage companies.

© JohnnyGreig/E+/Getty Images

Concerns about COVID-19 are no longer near the top of consumers’ worry lists, but around the globe, shoppers are prioritizing food and beverage products related to health with a focus on aging well, preserving appearance, optimizing everyday performance, and maintaining mental well-being. More than half of consumers globally are aggressively seeking out healthier foods, Euromonitor reports. COVID-19 has fallen to No. 17 on the list of global consumer concerns tracked by Ipsos, the lowest level the research organization has recorded since April 2020.

Inflation/high prices remain the top global consumer concern for the seventeenth consecutive month, per Ipsos surveys conducted in 29 countries, creating opportunities for value-driven product positioning. People in Argentina, Australia, Belgium, Canada, France, Germany, Hungary, India, Poland, Singapore, the United States, and Turkey have the highest degree of concern about inflation. In this environment, it will be critical for food and beverage marketers to address consumers’ ongoing desire for quick and easy meal solutions that don’t break the bank—and also satisfy their appetite for products that deliver culturally authentic taste experiences.

Climate change ranks seventh among global worries, reinforcing the importance of planet-friendly fare. Those in Singapore, the Netherlands, France, Australia, Canada, Italy, and Japan are the most concerned.

Eating for Health

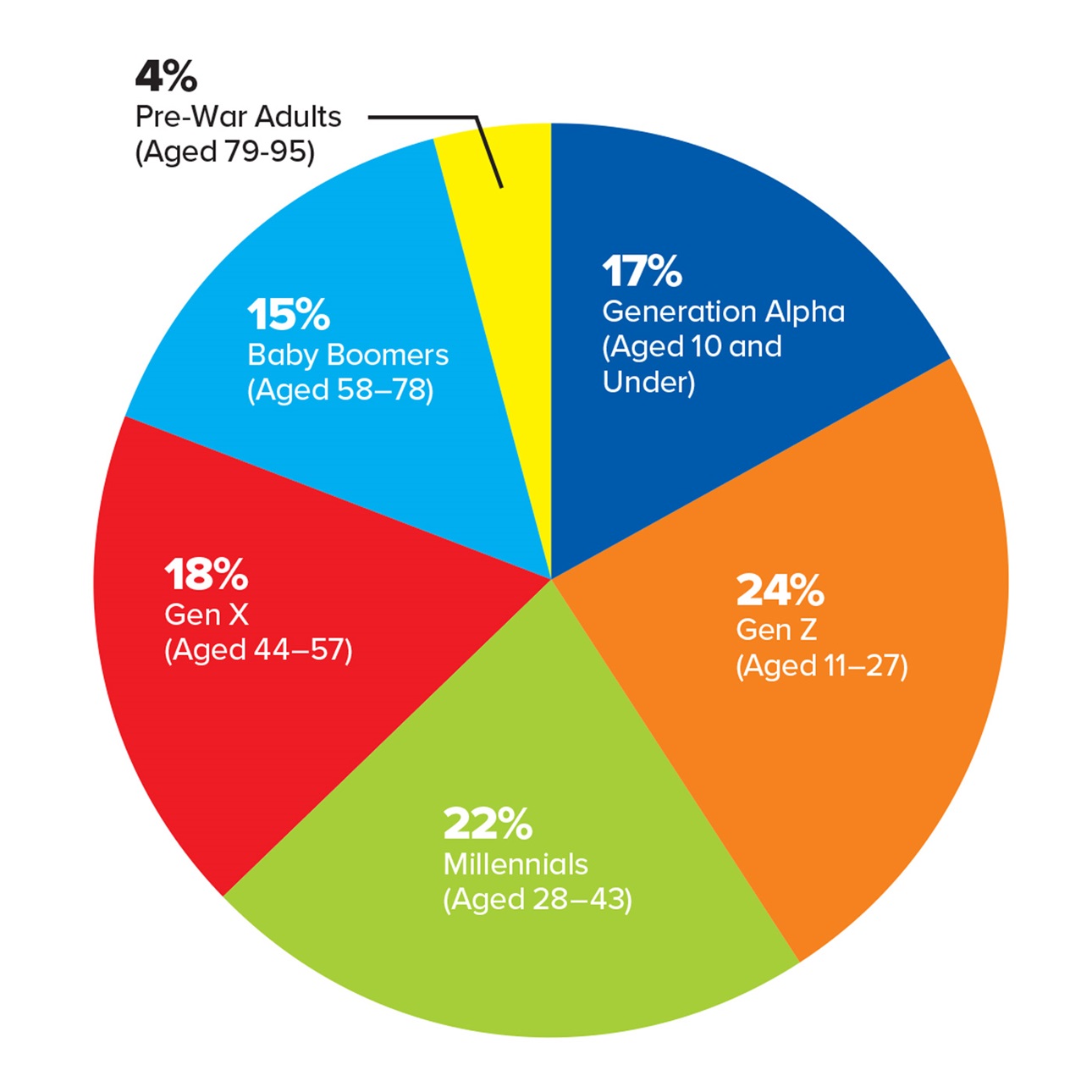

One of the factors driving interest in healthful eating is the aging of the global population. Lower fertility rates and healthier living are causing the relative size of the older generations to grow in nearly all of the world’s largest economies, coming close to a majority in some Asian and European markets, according to Ipsos data. One-third of China’s population is now over age 50. Italy, South Korea, the United Kingdom, and the United States are among the countries where the fertility rate has been below the population replacement rate for decades. Ipsos reports that a new analysis shows that the population is already declining in 36 countries.

Targeting seniors with favorite foods and healthy aging solutions is among the food world’s largest untapped opportunities. Less than one percent of global food, drink, and dietary supplement launches between October 2017 and September 2022 carried a claim related to senior consumers, according to Mintel.

Two-thirds of global shoppers, led by those living in households with kids, are extremely or very interested in functional foods and drinks; 57% of those aged 40–49 and 45% of those aged 50-plus have that level of interest. HealthFocus reports that one in five consumers is buying more functional foods now than a year ago.

After general health, global shoppers are most likely to choose foods and drinks that improve their everyday performance, HealthFocus reports. Immunity, energy, bone strength, gut health, healthier aging, enhanced mood, mental performance, heart health, and weight management also make the list of top health-related purchase motivators.

Eight in 10 consumers in the Asia-Pacific area now define “being healthy” as a combination of mental well-being and a healthy immune system, according to Euromonitor. One in four Gen Zers around the world say stress/anxiety is having a severe impact on their lives.

Mintel reports that Korean ginseng and ashwagandha were the most popular ingredients in global foods and drinks making a claim related to brain/nervous system function over the past two years. B vitamins, choline, and alternative caffeine ingredients are the ones to watch for mood/cognition.

After overall health and immunity, global consumers most often link the gut/microbiome to mental well-being, daily energy levels, and mood, HealthFocus says. More than half (56%) choose foods to improve digestion. Those in Southeast Asia and Latin America are most likely to do so.

Those living in Germany, Indonesia, France, and Italy are most likely to seek out probiotics for immune support, according to Euromonitor. Innova Market Insights reports that the number of confectionery product launches with a prebiotic claim grew by 39% from 2021 to 2022. Prebiotic breakfast foods, such as 3 Bears Cherry Banana Prebiotic Porridge, which is available in Germany, are another fast-emerging category.

Euromonitor projects that the total volume of energy drink sales will grow 7% between 2022 and 2027. Meal replacements, rapid hydration beverages, carbonated soft drinks, coffees, and teas with gut health ingredients/prebiotics are other segments with explosive growth. Expect carbonated, low-sugar yogurt drinks, including doogh, ayran, and lassi, to gain traction.

One-quarter of global consumers look for carbonated beverages fortified with vitamins or minerals, according to Innova Market Insights. Mintel reports that 40% of Chinese consumers say they would buy juices with electrolytes. Gatorade, which is marketed in 80 countries, will introduce Gatorade Water with electrolytes for all day–hydration.

Innova also reports that one in five consumers is interested in weight management beverages. Latin America and parts of Asia are the only regions where consumers are now more focused on weight loss/weight management than they were two years ago, per HealthFocus.

More than half of consumers globally want more foods and drinks that help them feel fuller longer, HealthFocus says. Two products in the Australian market tout their ability to help consumers “feel fuller”—Uncle Toby’s Protein Muesli Bars featuring a “Yoghurty Drizzle,” which have 20% protein content, and Kellogg’s Sultana Bran Cereal, which contains 11 grams of dietary fiber per 100 grams of cereal.

High protein, high fiber, no added sugar, organic/natural, non-GMO, and gluten-free remain the most sought-after healthy food claims, according to Euromonitor. Fibra, a UHT-processed milk drink from Central Lechera Asturiana in Spain, delivers 40% of the daily fiber recommendation per serving. Fibreworks Chocolate Cookies, offered in Singapore, contain probiotic fermented fiber to improve gut health, support satiety, and lower cholesterol.

Looking healthy is the new beauty trend in the Asia-Pacific region, per Euromonitor. Collagen is the most sought-after “inner beauty” ingredient. Hair and skin edibles targeted to men and those linking appearance to gut health, sleep, and relaxation are new market directions globally. New Blender Bites Tropical Glow 1-Step Smoothie contains amla berry, an Ayur-vedic ingredient associated with promoting hair growth, and biotin, a vitamin linked to healthy hair.

Products that target those with health risk factors like high blood glucose have a large potential audience; the International Diabetes Federation reports that 537 million people aged 20–79 worldwide are living with diabetes.

In 2021, 1.4 billion people had hypertension and 620 million suffered from heart/circulatory diseases, according to the British Heart Foundation. The World Health Organization reports that 650 million adults, 340 million adolescents, and 39 million children are obese.

Superfood condiments are on the rise. Oswald’s Chia Smash, available in the United States and the United Kingdom, is sweetened with dates and contains chia seeds. The company bills it as a “superfood jam” and notes that it’s Upcycled Certified.

Meal Deals

Consumers are paying close attention to food prices. At least six in 10 consumers in the vast majority of the 29 major markets Ipsos surveyed say that they expect food costs to rise over the next year. The expectation of price increases is particularly high in Great Britain, Argentina, and Australia, where about four-fifths of respondents feel that way.

Heightened interest in at-home meal prep that emerged during the COVID-19 pandemic hasn’t fallen by the wayside. Recent FMCG research found that more than three-quarters of consumers globally say they have cut back on spending in restaurants and cafés. And more than six in 10 are concerned that the higher cost of living (including food prices) will affect their ability to eat healthfully.

The global eating-at-home sector, which includes retail packaged food and delivery/takeout foodservice combined, reached $3.8 trillion in sales in 2022 and is projected by Euromonitor to reach $4.6 trillion by 2027. Euromonitor predicts that by 2027, one in three meals eaten at home globally will come from foodservice (i.e., takeout/delivery).

Four in 10 meal preparers in the United Kingdom want food marketers to teach them new cooking skills; more than half of consumers in New Zealand use a time-saving cooking appliance like an air fryer daily or weekly, according to Mintel data. Mintel also notes that three-quarters of French consumers report making lunch from scratch more often because it is cost-effective.

Nestlé introduced a shelf-stable plant-based minced meat alternative for making dishes like tacos or spaghetti Bolognese under the Maggi Veg banner in Chile, Canada, Spain, and other global markets. Nissin Foods launched its signature shelf-stable spicy Geki Chili Infused Asian Noodles into the U.S. market.

Frozen food sales reached $226 billion worldwide in 2022 and are projected by Euromonitor to grow 2% per year through 2027. About half of the growth will come from ice cream and frozen food staples, including fruits and vegetables. Sales of ready meals in China and frozen pizza in the United States will account for the rest of the growth.

Celebrity chef Gordon Ramsay’s new frozen entrée line features UK favorites like shepherd’s pie and fish and chips. Loblaw’s new private label PC Black Label frozen pizzas are handmade in Italy.

Meal kits (including those available via home delivery and at retail) are one of the fastest-growing meal categories, with sales reaching $14 billion globally, up 13% in 2022, per Euromonitor. The markets in the United Kingdom, Canada, Italy, and Spain are expected to enjoy strong growth; Australia and New Zealand have the highest penetration of meal kit use.

Australia’s Go! Kidz is one of the first child-oriented meal delivery services. Nestlé’s ready-to-heat, shelf-stable plant-based meal kits in China feature local favorites like Mala Xiang Guo and Curry Chicken.

With nearly one-quarter (23%) of global consumers trying to reduce meat consumption, per Euromonitor, plant-based, vegetarian, and vegan ready meals will continue to be well-received. Each variety of Ben’s Original 10 Medley ready-to-heat side dish mixes, which are available in Canada and the United States, includes 10 different grains, vegetables, legumes, and herbs and provides at least 10 grams of fiber and 10 grams of protein.

The Gardein Supreme Falafel Burgers come two to a package and are available in Canada. Nestlé’s Garden Gourmet brand has enhanced its local appeal, adding a Weiner Schnitzel Style to its global plant-based brand, describing it on the package as “made for schnitzel lovers.”

Gourmet shortcut products like Ferns’ Butter Chicken Curry Paste, offered in India, or Italian-made CiboCrudo Organic Seaweed Salad pieces continue to command a premium price.

Entenmann’s new Refrigerated Ready-to-Bake Cookie Dough, available in the United States, and Well & Good Lemon Coconut Cake Mix with Goji Berry Icing, offered in Australia, are set to make home baking easier.

In 2022, 71% of global consumers snacked at least twice a day, according to Mondelēz. One-quarter ate a snack before breakfast; in the Asia-Pacific region, nearly one-third (32%) of consumers did so. Just over half (55%) say they make a meal out of snacks at least weekly; 64% of consumers report doing so in the Asia-Pacific region.

Frozen All-Day Breakfast Mini Quick Cook Hash Brown Patties from Cavendish Farms in Canada are a tasty snack any time of day. The popularity of Brazilian cheese breakfast bread has inspired U.S.-based Brazi Bites to introduce Cheesy Waffles. Vaalia Probiotic Kefir Vanilla Yoghurt, available in Australia, offers a healthful morning snack option.

Eight in 10 consumers globally snack on bread/rolls/wraps in a typical week; 65% snack on cookies/sweet biscuits; more than half snack on savory biscuits/crackers, crisps, popcorn, pretzels, and cake/bakery sweets, according to Mondelēz. Between 2021 and 2022, nuts/seeds, potato-based products, and fruit snacks were the kinds of snacks launched most frequently, according to Innova Market Insights.

One-quarter of global consumers say protein claims are a factor in their snack selection, Innova reports. Three-quarters of Chinese snack consumers say they would love to try more snacks with exotic flavors, according to Mintel data.

Plant-based snack claims have posted an average annual growth of 62% over the past five years, per Innova Market Insights. Rauch Happy Day Family Pear Drink in Hungary, Pampa Vida Pecan Drink in Argentina, and Australia’s Norco P2 Pea Protein White Mylk are among the new plant-based drinkable snacks currently available.

Introduced in France, Lindt Pavola Framboise milk chocolate bars are filled with milk meringue and raspberry coulis. In Australia, Patons Dark Chocolate Macadamias come in a variety that is roasted with blood orange and chili.

Cuisine Crossovers

Whatever their geographic location, consumers have an appetite for foods that reflect cultures outside of their own. Nearly half (47%) of global consumers say they are increasingly looking for cuisines from other countries, according to a 2022 survey by Innova Market Insights.

In the United States, nearly six in 10 Gen Zers (58%) ate globally inspired foods other than Italian, Mexican, or Chinese in a recent week; that’s versus 48% of millennials, 34% of Gen X consumers, and 19% of baby boomers, Datassential reports.

Italian is the most popular cuisine worldwide, followed by Japanese, Indian, Korean, Mexican, and Thai, according to a global survey by The Picky Eater website. After pizza, global barbecue styles (e.g., Korean barbecue, tandoori), brunch favorites, sushi, seafood, steak, and pub food are the world’s favorite foods, according to The Picky Eater.

Celebrity chef Giada De Laurentiis’ Giadzy pasta line is introducing Americans to lesser-known forms of pasta, such as pappardelle, paccheri, and bucatini, all made in Italy. Available in the United Kingdom, FullGreen Riced Sweet Potato is a lower-carb alternative to white rice.

Watch for more new global varietals, regional product descriptors, and seasonal flavors. Esselunga Top Sugo Tomato Sauce is made from hand-picked Sicilian tomatoes. The United Kingdom’s Morrisons brand offers The Best Madagascan Vanilla Yogurt. South African Woolworths Food positions its new Christmas Gooseberry Jam with Gin & Mint Flavour as a special holiday treat.

Nearly two-thirds of U.S. consumers say they are familiar with and interested in sriracha, curry, or chili as a sauce or dressing flavor, according to flavor company T. Hasegawa. In addition, T. Hasegawa reports that four in 10 are also familiar with and interested in bulgogi (Korean beef barbecue) and peri-peri hot chile pepper sauce.

Black garlic/sesame, hoisin/Sichuan, kalamata olive, za’atar, and tikka masala are other emerging global dip and dressing flavors, per T. Hasegawa. Labneh dip/spread, typically found in the Mediterranean diet, has the potential to become a snacking staple.

The global flavors U.S. consumers would most like to try at dinner are tomatillo, adobo, Thai chili paste, marjoram, paneer, curry, and chaat masala, per T. Hasegawa. Coconut, turmeric, shawarma, tamarind, harissa, miso, and togarashi are flavors consumers they say they would enjoy on meat/protein, according to T. Hasegawa. In North America, the Osmow’s restaurant chain offers beef, chicken, lamb, and meat alternative shawarma-style wraps.

Demand for more vegetable flavors is on the rise. Santa Maria Carrot Tortillas are offered in Germany. Kallø Caramelised Onion Chutney Veggie Cakes made with lentils and peas are available in the United Kingdom.

Western Family Tempura Pickle Chips are a new fried appetizer available in Canada. Greek spanakopita, Brazilian coxinha (chicken croquettes), Puerto Rican tostones (fried plantains), Filipino lumpia (pork egg rolls), falafel, and Italian arancini (fried risotto) are poised to move onto U.S. appetizer menus.

Mexican sopaipillas (fried pastries), Bolivian sarnitas (bread with a cheesy crust), South American marraquetas (crusty rolls), Norlander (dark rye bread popular in Northern Europe), Native American fry bread (fried flatbread), and Jamaican bammy (flatbread made from cassava) are among the globally inspired bread and rolls getting attention from foodservice operators.

UK-based Dina Foods created Tannour, which it describes as “authentic Middle Eastern flatbread” and touts as “high in vitamin D.” Country Harvest Everything Bread from Wonderbrands was introduced in Canada, inspired by the popularity of everything bagels.

Churros, pot de crème, mochi, and halwa are among the international desserts trending on U.S. menus this year. Limoncello, beignets, baklava, dulce de leche, fennel cakes, cannoli, and tiramisu also continue to post strong gains, per Datassential.

A coconut- and vanilla-flavored panna cotta mix is available under the Biovegan label in Germany. In China, Dehua ice cream bars come in a White Peach Cheese flavor.

Amaretti, madeleines, alfajores, småkager, and ma’amoul are among the most popular cookies in the world, according to TasteAtlas, which tracks flavors and menu items.

Planetary Priorities

Euromonitor reports that seven in 10 companies plan to launch products with environmentally friendly claims and 66% plan rollouts of sustainably packaged products. Other claims that food and beverage companies are prioritizing include low carbon/carbon neutral, sustainably sourced, vegan/vegetarian, and plant-based.

A survey from Ipsos found that in addition to being sustainably positioned, products must have an additional benefit (i.e., be cheaper, easier to use, or healthier) in order to drive purchase.

Available in Singapore, the new Cadbury Dairy Milk Marble Bar features a blend of milk and white chocolate with a hazelnut praline center and is made with 100% sustainably sourced cocoa.

Asia-Pacific consumers, led by those in China and Indonesia, are driving a growing movement to protect local natural resources and businesses, Mintel reports. Makers of The Pahadi Story Jamun Honey from India are tapping into the ethical beekeeping practices of a close-knit community of honey producers.

New Zealand’s Anchor brand offers organic butter that has been “carbon zero certified” by an independent certifying organization. Arla LactoFREE Fresh Cheese in Denmark is crafted using milk from Danish farmer-owned sources.

France’s Bjorg No-Sugar Almond Milk is made with “100% green electricity.” Britain’s Pukka Tulsi Clarity Herbal Tea uses vegetable-based inks on each sustainably sourced, recyclable tea sachet packet. Moreo Primo Extra Virgin Olive Oil in Australia comes in a 100% recycled plastic “eco bottle.”

Improved land use, nutrient management, soil health, and a reduced carbon footprint are all issues of importance in regenerative agriculture, which is becoming more of a priority to food companies and more familiar to consumers. Seeking food products that use less plastic in their packaging is a top-of-mind concern for two-thirds of global consumers, according to Euromonitor.ft

Related Articles

How to Achieve EPR-Forward Packaging

In this two-part series, the author explores the history of Extended Producer Responsibility (EPR), what is needed to help EPR succeed, and how brands can best prepare for EPR.

How to Formulate for Food Intolerances

In this column, the author describes the global prevalence of food intolerances and provides insight into state-of-science ingredient replacement and removal methods when formulating gluten-free and lactose-free foods.

Latest From IFT

How to Achieve EPR-Forward Packaging

In this two-part series, the author explores the history of Extended Producer Responsibility (EPR), what is needed to help EPR succeed, and how brands can best prepare for EPR.

How to Formulate for Food Intolerances

In this column, the author describes the global prevalence of food intolerances and provides insight into state-of-science ingredient replacement and removal methods when formulating gluten-free and lactose-free foods.

Vickie Kloeris Shares NASA Experiences in New Book, Consumers Are Confused About Processed Foods’ Definition

Innovations, research, and insights in food science, product development, and consumer trends.