Consumers Get Serious About Snacking

As consumers’ lives get busier and busier, they are turning to snacks to power through their demanding days and in some cases, forgoing traditional meals altogether.

Snacking is the new normal. Gone are days punctuated by three square meals eaten at the family table. In today’s fast-paced world, those routines have given way to a new kind of eating: round-the-clock solo snacking whenever and wherever hunger strikes. Today’s consumers live in a world where food is available all around them, all the time, and they are increasingly taking advantage of convenient ways to take in nutrition in forms that work for them.

“We really value independence and individualism here in America and getting things done,” says Melissa Abbott, director of culinary insights for The Hartman Group, Bellevue, Wash. “This idea of always working, always feeling like we need to be accomplishing something is very American, and that’s why our eating occasions are so vast. It’s no longer three times a day with a couple snacks here and there. We are snacking all the time.”

Indeed, we are a nation of snackers. Ninety-four percent of adults snack at least once daily, and 50% snack two to three times a day (Mintel 2015a). Between 1977 and 2002, the percentage of Americans snacking three or more times a day increased from 11% to 42% (Hartman 2010). We know that consumers are snacking all the time, but what exactly is a snack? The better question might be: what can’t be? From leftovers to lattes to portable cereal cups, Americans are making use of what they have on hand to fight their hunger. It turns out that the definition of snack has shifted alongside its rise in popularity.

“A snack is really anything smaller than a full meal,” says Pamela Oscarson, consumer insights manager at FONA International, Geneva, Ill. “What’s interesting is we’re seeing more and more that consumers consider any kind of food a snack, and they’re snacking at any time of day. From mini meals to drinkable soups, lines are definitely getting blurred in the snacking realm.”

This doesn’t mean, though, that Americans are snacking mindlessly. On the contrary, consumers are becoming more deliberate in their snacking choices. Eighty percent of consumers are snacking with a purpose, whether that be to address hunger or fulfill an emotional need, says Abbott, and 62% of consumers snack to fulfill a craving (Mintel 2015a). In addition, they are making different choices depending on time of day, choosing healthier snacks earlier and more indulgent ones in the evening (NPD 2015a).

This doesn’t mean, though, that Americans are snacking mindlessly. On the contrary, consumers are becoming more deliberate in their snacking choices. Eighty percent of consumers are snacking with a purpose, whether that be to address hunger or fulfill an emotional need, says Abbott, and 62% of consumers snack to fulfill a craving (Mintel 2015a). In addition, they are making different choices depending on time of day, choosing healthier snacks earlier and more indulgent ones in the evening (NPD 2015a).

While consumers might turn to whatever they have on hand to fight hunger, there are some categories of food products that might be top of mind when consumers think about what to snack on. Snack food sales increased by nearly 30% from 2007 to 2012, according to Mintel research presented by Ganeden, and according to Nielsen data, the snacking industry represents more than $124 billion in retail sales in North America (FONA 2015a). With snacking only expected to keep growing—37% of Millennials says they expect to snack more in the future (SHS 2015)—it’s important to understand some of the considerations consumers factor in when they choose their snacks: good-for-you ingredients, clean labels, convenience, and of course, flavor.

--- PAGE BREAK ---

Reaching for Health and Energy

“Healthy snacks is a growing food trend that shows no sign of slowing down,” says Teresa DeJohn, public relations manager for Cleveland-based Ganeden. “Snack products that offer a health benefit give them an instant edge in this evolving market.” The number of consumers that consider themselves “healthy snackers” has grown from 29 million to 41 million since 2004, according to Packaged Facts, and according to Mintel, one-third of consumers said they were making better snacking choices than they did last year (FONA 2015a, 2016).

According to Lesley Nicholson, marketing manager for WILD Flavors & Specialty Ingredients, Erlanger, Ky., health-minded consumers are driving innovation in the snacks category. “Consumers want nutritious ingredients, especially with plant-based protein and better-for-you or free-from snacks such as gluten-free or snacks with natural flavors and colors.”

A growing number of snack bases are made with fruits, vegetables, seeds, beans, or combinations thereof, agrees AnnMarie Kraszewski, lab manager at Wixon, St. Francis, Wis. “These can provide more fiber or protein for the consumer and, in the salty snack category, provide a healthy snacking option.”

A growing number of snack bases are made with fruits, vegetables, seeds, beans, or combinations thereof, agrees AnnMarie Kraszewski, lab manager at Wixon, St. Francis, Wis. “These can provide more fiber or protein for the consumer and, in the salty snack category, provide a healthy snacking option.”

While the market has seen a plethora of healthy snacks appear, 60% of snackers wish for even more healthy snack options, including 70% of households with children (Bemis 2015). However, manufacturers must ensure that they keep flavor in mind when answering this demand: according to Mintel, 51% of consumers agree taste and flavor matter more than health, and if it doesn’t taste great, they won’t eat it no matter how good it is for them (FONA 2016).

According to Abbott, consumers aren’t necessarily turning to healthier options to lose weight as they might have in the past. Instead, she says they are looking for ways to achieve lasting energy throughout their days. “Conceptually, energy is almost as important as concerns surrounding weight management and physical fitness. This rise in importance is a change from the past,” writes Laurie Demeritt, CEO of The Hartman Group, in IFT’s Wellness newsletter. “For the majority of consumers (61%), the very definition of health and wellness is having the energy to live an active life.”

A growing number of snacks are making energy claims, and it’s becoming a trend, according to an Almond Board of California webinar presented by Lu Ann Williams, director of innovation for Innova Market Insights. She said the percentage of total snack product launches making this claim has grown from 2.7% in 2012 to 4.1% in 2015. GLUKOS, an energy product company, offers bars and other items made with glucose instead of maltodextrin or sucralose for “twice the energy, twice as fast,” according to its website.

Consumers also look to protein and fiber for this sustained energy, with 54% of Americans saying they are trying to get a certain amount of protein or as much as possible and 55% saying the same for fiber (Packaged Facts 2016a). More than 20% of consumers expect added nutrition from their snacks (FONA 2016), but Williams says these snacks have to be “naturally functional”—they should get their benefits from ingredients such as ancient grains, nuts, and dark chocolate.

“Consumers are seeking more functional food options, including foods that deliver the benefits normally promoted by over-the-counter medications. … While few foods can make actual health claims, manufacturers are seeking foods that have strong science behind them,” says Jeff Manning, chief marketing officer for the Cherry Marketing Institute. Montmorency tart cherries can answer this demand, according to Manning, who says that the ingredient is a natural way to bind dry ingredients, increase moisture, and create texture.

When it comes to sugar and sodium levels in snacks, many consumers are not overly concerned, according to Abbott. Older individuals with health problems monitor the sodium levels in foods, she says, but for Millennials, these aren’t a concern, and they may not even think about sodium in products that aren’t explicitly salty—just one-third of global respondents think it’s very important that snacks be low in sugar (34%) and salt (34%) (Nielsen 2014). Dax Schaefer, director of culinary innovation for Asenzya, Oak Creek, Wis., says he has seen requests for lower sugar and sodium levels in snack formulations, but he says “sugars and salt are natural ingredients and when used in moderation are good for us.”

--- PAGE BREAK ---

Clearing Up Labels

Consumers’ desire for clean label products is hardly new, and it may not be surprising that this trend is also a driver in the snack development arena. Consumers want to recognize and understand the ingredients contained in the foods they purchase—even their snack foods (FONA 2015a). More than half of consumers say they worry quite a bit about potentially harmful ingredients in the foods they buy (Wixon 2016), and they prefer free-from foods, such as non-GM, organic, hormone-free, gluten-free, cage-free, and free from additives. And with more and more large companies committing to labeling GM ingredients in their products, consumers will be looking at labels even more carefully.

A number of snack products are drawing on cleaner and clearer labels to attract consumers. RXBAR, a Chicago-based brand of whole food protein bars founded by Peter Rahal and Jared Smith, uses its labeling to show consumers exactly what is—and is not—in each bar. The Coconut Chocolate flavor’s label, for example, lists “3 egg whites, 6 almonds, 4 cashews, 2 dates, and no B.S.” Nature Valley’s Simple Nut Bar, which contains “simple ingredients from nature,” features just seven ingredients and is free from gluten and high fructose corn syrup. According to Mintel, the single SKU reached $2 million in sales in just 15 weeks (Dornblaser 2016).

A number of snack products are drawing on cleaner and clearer labels to attract consumers. RXBAR, a Chicago-based brand of whole food protein bars founded by Peter Rahal and Jared Smith, uses its labeling to show consumers exactly what is—and is not—in each bar. The Coconut Chocolate flavor’s label, for example, lists “3 egg whites, 6 almonds, 4 cashews, 2 dates, and no B.S.” Nature Valley’s Simple Nut Bar, which contains “simple ingredients from nature,” features just seven ingredients and is free from gluten and high fructose corn syrup. According to Mintel, the single SKU reached $2 million in sales in just 15 weeks (Dornblaser 2016).

Thirty-nine percent of consumers agree that gluten-free products can be beneficial for everyone, not just those with an allergy or intolerance (Dornblaser 2016), and gluten-free claims can be seen in a variety of snacks products. Quinn Snacks, which attests on its website that it is “dedicated to clean ingredients,” offers “farm to bag” pretzels made with gluten-free, non-GM ancient grains, while Simple Mills Almond Flour Crackers draw on a blend of almond flour, sunflower seeds, and flaxseeds.

In addition to good ingredients, consumers are also looking to feel good about producers. “People want their food to have been made by nice people,” says Hartman Group’s Abbott. Lynn Dornblaser, director, CPG Trend Insight, for Mintel, says that it’s important for companies big and small to tell a story about their products, but they need to be honest about how they are produced. “Craft” and “handmade” claims can seem disingenuous unless they are literally true. She points to Häagen-Dazs Artisan Collection as a successful example; the company collaborated with local chefs to create the ingredients used in flavors such as Ginger Molasses Cookie.

Grab and Go, Go, Go

Grab and Go, Go, Go

Snacks have to offer health benefits and clean labels, but if consumers are going to incorporate them into their lives, they have to be portable, too. On-the-go snacking is a growing trend, up 5% since 2009 with 45% looking for convenient, easy-to-pack snacks, according to the 2013 State of the Industry Report from Snack World (FONA 2015a). Ready-to-eat snacks are important to 77% of snackers, with 60% of consumers saying that portability is an important factor when they choose a snack (Bemis 2015).

A growing number of consumers keep packaged snacks such as granola bars and jerky in their backpacks and purses as “emergency insurance” against sudden hunger, says Abbott, and consumers continue to seek out minis, single packs, and other products for on-the-go snacking. In addition, resealable pouches allow consumers to decide how much of a product they want to consume at once, enabling them to determine their own portions and giving larger products the opportunity to enter snack territory.

Some examples of conveniently packaged products include “pairs,” such as the Justin’s brand Snack Pack Classic Almond Butter with Pretzels and Good Foods Group’s Grab & Go snack cups that match guacamole and salsa with tortilla chips. Mini cheeses, such as Babybel and Ile de France single-serve brie bites, might pair with a bag of pretzels or be eaten on their own, and it’s easy for snackers to enjoy poppable bites such as Fisher’s Nut Exactly and E&C’s Hunkola while driving or on a hike. Compartmentalized snack packs, such as Starbuck’s Protein Bistro Box, allow snackers to build a mini meal out of several healthy foods, such as apple slices, cheese, and hard-boiled eggs.

In addition, convenience plays easily into the trend of consumers spending more eating occasions alone. Some may choose to do so to maximize the hours in their busy days, while others might fall into the 31 million single-person households or 57 million two-person households looking for smaller-sized products, according to research from the U.S. Census Bureau (Wixon 2016). Still others look to snack time as “me time,” an opportunity to take a break and recharge and indulge in whatever snack they so desire, according to Abbott. Whatever their motivation, all of these groups benefit from “right-sized” food products that are easy to consume in one sitting with minimal effort and waste.

Convenient also doesn’t have to mean “processed”; there are ways to indicate freshness on packaged foods, such as made-on dates (IDDBA 2015). Since one-third of consumers say there aren’t enough conveniently packaged snacks (Mintel 2015a), manufacturers should continue to create healthy boxes, packs, and mini-sized portions of favorite foods to make them an easy and obvious choice for snackers.

--- PAGE BREAK ---

Big Flavor in Small Sizes

Snacks allow consumers to try something fun, new, and exciting at a minimal risk and without committing to a lot of calories, and they allow for a combination of familiar food types with new flavors, such as snack mixes, pretzels, chips, and popcorn. According to Packaged Facts, “an explosion in terms of flavor profiles has hit the snack segment, combinations of tastes and spices that would have been virtually unthinkable even a decade ago” (Packaged Facts 2016b).

That makes sense to Abbott. “[Snacks] are where we get to explore and experiment and try global flavors and step outside of the realm a little bit,” she says. “In a lot of ways it’s also a diversion. It’s our entertainment as well.” Snackers may also be looking for something to break the boredom they are experiencing with the foods they have always consumed, according to Nicholson. “[They] want new flavors such as spicy Thai or savory flavors as well as the texture of nuts and seeds or real fruit pieces.”

Because snacking is being driven by Millennials, according to Jeff Caswell, vice-president and general manager of Hillshire Snacking, this group’s passion for food exploration has caused companies to include an expanded variety of options to satisfy a more sophisticated palate (Choi 2016). Schaefer agrees, saying that an ethnic-flavored snack provides an “easy, inexpensive way to explore other parts of the world.”

“Flavor profiles continue to become more adventurous and ethnic [in snacks]…,” observes Kraszewski. “As the consumer continues to expand their knowledge of different types of food, they will want to see those flavors move into their everyday eating patterns.” Her colleague, Renee Santy, food technologist for Wixon, observes that global flavors are migrating into snacks, even from regions consumers might not expect, such as Africa and smaller Asian countries. These flavors are often bold and spicy, and it makes sense to Schaefer that Millennials would embrace them in their snacks. “The Millennials and Generation Z almost seem to have a gravitational pull to spicy; they can’t seem to get enough of it,” he says.

According to Gary Augustine, executive director of market development for Kalsec, Kalamazoo, Mich., “Consumers are looking for more variety and adventure in their eating experiences, and peppers provide a unique, fun, and flavorful way of adding heat to a snack product.” He notes that peppers such as jalapeño, chipotle, habanero, serrano, and ghost pepper are trending in products such as meat snacks, chips, nuts, and popcorn. Still, it’s not enough for a food to just be bold and hot; increasingly, these flavors must also feel specific. “Watching new product launches and growth, it seems like they are moving out of the fear factor heat launches and moving to a more flavorful heat that may have some authentic heritage behind it,” says Schaefer.

According to Gary Augustine, executive director of market development for Kalsec, Kalamazoo, Mich., “Consumers are looking for more variety and adventure in their eating experiences, and peppers provide a unique, fun, and flavorful way of adding heat to a snack product.” He notes that peppers such as jalapeño, chipotle, habanero, serrano, and ghost pepper are trending in products such as meat snacks, chips, nuts, and popcorn. Still, it’s not enough for a food to just be bold and hot; increasingly, these flavors must also feel specific. “Watching new product launches and growth, it seems like they are moving out of the fear factor heat launches and moving to a more flavorful heat that may have some authentic heritage behind it,” says Schaefer.

Santy says she is seeing more regionality and specificity in product descriptions, such as calling out specific peppers or Meyer lemons. This naming “provides products with more of an identity and origin, which allow many consumers the ability to relate better to the specific names,” says Augustine. Schaefer also observes that consumers are more attracted to descriptive combinations, preferring an IPA Cheddar Kettle Chip to a regular beer cheese-flavored chip. “You can see how they are both the same concepts but deliver a different feel,” he says.

Breaking Snacks Out by Category

While anything can be a snack, there are some categories that consumers turn to often. Bars, meat snacks, and salty snacks represent some of snackers’ favorite go-to options, and a great deal of innovation is occurring in these segments to appeal to new and longtime consumers.

• Bars. Sixty-nine percent of consumers purchase bars, and snack bars make up 48% of total U.S. sales (Mintel 2015b). Health is huge in the bar category, and many offerings include a protein boost. It makes sense, as these portable snacks are easy for consumers to take along with them and replace or supplement meals when they are strapped for time. One-third of high-protein products coming from the snacking category are bars, though there are still opportunities for super high-protein bars that contain 15 grams of protein or more (FONA 2015b).

More and more, makers of bars are turning to plant-based proteins, such as peas, hemp seeds, and even watermelon seeds, as in the Go Raw Grow Sprouted bar. Protein sources, however, run the gamut from whey and soy protein to pulses, nuts, and seeds—or more than one of these; combining types of protein allows producers to achieve the greatest nutritional profile while improving sensory impressions related to flavor, texture, and appearance (Packaged Facts 2016a).

Almonds, which are the No. 1 nut associated with cereal/energy bars, are still popular in bars, and they represent a 30% share of all nuts used in bars, according to Almond Board research. According to Molly Spence, director of North America, Almond Board of California, almonds work well in bars and other snack products because consumers are looking for filling, healthy snacks to help tide them over; she adds that research shows consumers say there is a gap in the kinds of products available to meet this need state.

Because the bar market is saturated, it is more important than ever for brands to find ways to differentiate their products. Products that stand out include the LÄRABAR with Superfoods line, which comes in flavors such as Turmeric, Ginger & Beet and Hazelnut, Hemp & Cacao. ReGrained makes bars from grains used by local craft breweries to make beer, and New Grounds Food CoffeeBars pair Fair Trade coffee with dates, oats, nut butter, and chia.

--- PAGE BREAK ---

Abbott Laboratories designed its new Curate line of bars for consumers who “really love food and appreciate complex flavors and combinations.” The culinary-forward bars are inspired by consumers who make bars in their own homes, and flavors include Dark & Tempting Balsamic Fig & Hazelnut and Harmonious Blend Marcona Almond & Apricot, which also includes balsamic vinegar, honey, lemon, and quinoa. Each bar contains fewer than 200 calories, and each ingredient was chosen for flavor as well as the nutritional and textural properties it provided.

Abbott Laboratories designed its new Curate line of bars for consumers who “really love food and appreciate complex flavors and combinations.” The culinary-forward bars are inspired by consumers who make bars in their own homes, and flavors include Dark & Tempting Balsamic Fig & Hazelnut and Harmonious Blend Marcona Almond & Apricot, which also includes balsamic vinegar, honey, lemon, and quinoa. Each bar contains fewer than 200 calories, and each ingredient was chosen for flavor as well as the nutritional and textural properties it provided.

As bars supplement or in some cases replace meals, consumers have begun to move away from sweet and are embracing more savory bars. These may be a way for bars to compete with the salty snacks category (Mintel 2015b). “As a culture, we’re gravitating toward more savory types of flavors, [and] we’re finding that the consumer doesn’t want something that’s sweet for the sake of being sweet,” observes Hartman’s Abbott. KIND introduced a Black Truffle Almond & Sea Salt bar, and Kashi released a line of Savory Bars inspired by specific regions. The Quinoa, Corn & Roasted Pepper bar has ties to Andean culture, and the Basil, White Bean & Olive Oil bar is inspired by the Mediterranean. Sola Snacks, meanwhile, launched its Sola Bar, a line of savory gluten-free, non-GM, and vegan bars made from crunchy seeds and peanuts; flavors include Jalapeño and Roasted Garlic + Sea Salt.

Only 8% of bars launched in 2014 made low-sugar claims, so there is an opportunity here for manufacturers to create options for those consumers who are watching their sugar (FONA 2015b). KIND recently released a line of simple bars with no added sugars; the Pressed by KIND bars provide two servings of fruit and 110–130 calories per serving. Packaging explains that the bars contain “only fruits & veggies” or “only fruit & chia,” depending on the variety.

• Meat Snacks. According to IRI data presented by NPR’s The Salt, Americans spent $2.8 billion on dried meat snacks last year, and sales grew 12.5%. Americans have gone jerky crazy, for many of the same reasons that these foods appealed to the ancient humans who first created them: they’re portable, they’re lightweight, and they don’t spoil (Burnett 2016).

The meat snacks category is filled with players, from mainstream companies like market leader Jack Link’s to small, artisanal producers focusing carefully on their production methods and ingredients. Some of these smaller companies have been acquired by the larger ones, including General Mills’ purchase of EPIC meat bars and snacks and Hershey’s acquisition of Krave. Most recently, Jack Link’s announced it had acquired Grass Run Farms Beef Snacks, noting in a press release that it understands that “many consumers are seeking out grass-fed, locally and responsibly raised beef.”

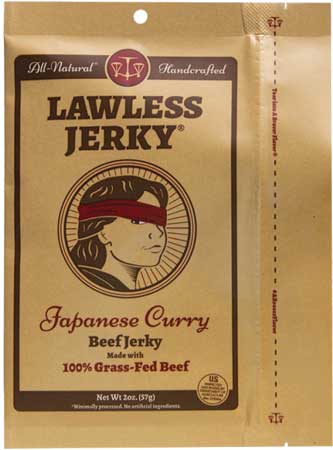

For big companies, a focus on regional and specific exotic flavors will show that they know and understand today’s food culture, says Abbott, and for the dozens and dozens of smaller producers competing with each other, attention to specific ingredients and a compelling personal story will help provide differentiation. One such company is Lawless Jerky, a Philadelphia-based producer making small-batch, boldly flavored craft jerkies from grass-fed New Zealand beef. The company founder, Matt Tolnick, left the legal field to found the company, hence the brand’s name and logo, which features Lady Justice. He warns, though, that flavor innovation isn’t enough to set companies apart; big companies can do bold flavors, but they likely can’t incorporate the same level of detail in their processing, which in Lawless’s case includes labor-intensive hand-slicing and marinating.

For big companies, a focus on regional and specific exotic flavors will show that they know and understand today’s food culture, says Abbott, and for the dozens and dozens of smaller producers competing with each other, attention to specific ingredients and a compelling personal story will help provide differentiation. One such company is Lawless Jerky, a Philadelphia-based producer making small-batch, boldly flavored craft jerkies from grass-fed New Zealand beef. The company founder, Matt Tolnick, left the legal field to found the company, hence the brand’s name and logo, which features Lady Justice. He warns, though, that flavor innovation isn’t enough to set companies apart; big companies can do bold flavors, but they likely can’t incorporate the same level of detail in their processing, which in Lawless’s case includes labor-intensive hand-slicing and marinating.

Meat snacks are also taking different forms, including EPIC’s line of meat bites and its Hunt & Harvest Mix, a combination of meat and dried fruit, WILD ZORA Beef & Veggie Bars, and Tanka Bar, which blends meat with fruit inclusions, a trend that Abbott thinks will grow. This category may be tempered by the fact that a growing number of consumers are hoping to get protein from non-animal sources, providing an opportunity for bars and other protein-enhanced snacks to grab some of the spotlight from meat.

• Salty Snacks. “When it comes to snacking, consumers want it all. They want indulgent salty snacks, but they want them to be healthier as well” (Packaged Facts 2016b). According to Mintel, “While concerns about the nutrition and ingredients in salty snacks remain top of mind for many consumers, category sales have not been impacted”; the category reached sales of $5.6 billion in 2014, and it is on track to reach $6.8 billion in 2019 (Mintel 2015c).

Ninety percent of U.S. households purchase salty snacks (Mintel 2015c), and salty snacks will grow moderately over the next five years despite competition from products such as yogurt, cheese, and meat snacks. Potato chips continue to be the top salty snack seller in the United States, with them found in 83.7% of U.S. households (Packaged Facts 2016b).

Consumers are looking for bold, spicy flavors and an element of fun in their snacks (General Mills 2016), and manufacturers can entice salty snack consumers in a number of ways, including broadening flavor profiles through regional and global flavors and pairing salty and sweet flavors together (Packaged Facts 2016b). According to Land O’Lakes, which recently launched a snacking blog, “Spicy, bold, and ethnic flavors will help bolster sales of salty snacks as consumers seek adventure when it comes to flavors.”

--- PAGE BREAK ---

Makers of salty snacks are introducing an array of products designed to appeal to consumers’ desire for healthy snacks. With its health halo and low calorie count, ready-to-eat popcorn also offers salty snackers a way to experience interesting and often ethnically inspired flavors. This subcategory has experienced a surge in popularity in recent years, with multi-outlet-tracked sales climbing 12.8% in 2015 (Packaged Facts 2016b), and popcorn is expected to see 34% growth from 2014 to 2019 (Mintel 2015c).

In addition, manufacturers are introducing better-for-you versions of favorite snack types. Way Better Snacks’ Nacho Flavor tortilla chips include sprouted chia, flaxseed, and quinoa, and popchips Ridges contain 72% less fat and 55% less calories than the leading ridged chip brand. Mondelēz International’s new crackers, Good Thins, which are free from artificial flavors, colors, cholesterol, partially hydrogenated oils, and high fructose corn syrup, were designed for consumers who believe they “shouldn’t have to give up enjoyment in order to live well.”

Snacking Forward

Snacking Forward

“Snacks has gotten complicated because there are so many kinds of snacks and trying to find out what consumers want is pretty challenging,” says Williams. She sees opportunity in ambient products thanks to newer processing methods.

For Abbott, the future of snacking might lie in versatility. She says that some consumers decide to eat vegan or vegetarian one meal and consume meat the next, and giving consumers access to a range of options to meet their current needs is key. She sees potential in mix-and-match refrigerated snacks and mini meals such as those offered by Whole Foods, as well as a snacks-focused version of a salad bar, where on-the-go snackers could create their own personalized snack boxes.

Some up-and-coming product types may include seaweed snacks, whose sales are outpacing those of kale snacks (New Nutrition Business 2015), though Abbott thinks some American consumers may need some time to come around on them. She also sees potential for the concept of “fat bombs”—fat-laden balls featuring nut butters—to take off; ProBurst Bites from Enjoy Life feature a crunchy blend of seeds and spices with a creamy chocolate center, and it wouldn’t be a stretch to imagine a similar product filled with peanut butter or an alternative nut butter.

Whatever the next big snack may be, it will be important for manufacturers to create products that are affordable, convenient, and offer healthy ingredients—items that provide value while addressing consumers’ personal values, according to Abbott. They may consider reducing the size of premium products to make them more affordable and more appealing to snackers, and they should consider creating products that can serve multiple eating occasions to widen the possibilities for consumer use.

“Marketers may find that their view of their food or beverage is much narrower than that of its consumers. The very same food product may function as an in-between-meal ‘snack’ one day, as lunch the next, and as an afternoon munchie the following day,” according to The Hartman Group (Hartman 2016). Producers should work to expand the usefulness of their products by promoting different uses for them, such as bagels that can be eaten for breakfast but also used for sandwiches or served as an appetizer when topped with hummus or cheese.

Generational Snacking Habits

Generational Snacking Habits

Snacking is definitely on the rise across all consumer segments, but Millennials and Boomers take different approaches to how they snack.

Millennials are the main driver in the increase of snacking occasions; this group is 40% more likely to snack a few times a day or more compared with Boomers, who are 23% more likely than Millennials to snack less than once a day (SHS 2015). In addition, Millennials’ preferences are shaping the composition of snacks. They prefer bold, strong flavors, and this younger generation is also driving the rise of healthier snacks.

“Plant-based proteins continue to be one of the most requested ingredients [in snacks],” says Lesley Nicholson, marketing manager for WILD Flavors & Specialty Ingredients. “These include beans, soy, nuts, and seeds. Millennials recognize the importance of protein since snacks have become meal replacements in many cases.” According to Melissa Abbott, director of culinary insights for The Hartman Group, Millennials say they’re stressed and tired, and they turn to snacking to keep their energy levels high throughout their busy days.

Boomers, meanwhile, snack less often. “Our research shows that Millennials are more likely to snack compared to older generations as a means to fulfill emotional and functional needs, including combating boredom or stress and increasing energy and focus,” says Amanda Topper, food analyst at Mintel. “Older consumers did not grow up with all-day snacking and may continue to view snacks as treats” (Mintel 2015d). Despite the lower frequency, Boomers are a larger group, and their annual eatings of ready-to-eat snacks are 20% higher overall than those of Millennials (NPD 2016).

--- PAGE BREAK ---

When Boomers do snack, it tends to be between meals to satisfy a craving and to avoid preparing big meals eaten alone (NPD 2016), and they tend to watch sodium and sugar content in the snacks they choose (NPD 2015b). Boomers may feel that choices designed for their needs are limited (FONA 2015c), and manufacturers have an opportunity to create options for them that provide an element of fun and adventure while answering their health needs, such as increased fiber.

Whatever the differences between these groups may be, they are both important to the snacks market. “Don’t ignore Millennials or Boomers,” says Sally Lyons Watt, executive and general manager of client insights for IRI, in a press release about generational snacking. “The snacking industry will hit at least $200 billion in 2020, with 60% of sales coming from these two consumer segments. Snacking is important to them and innovation opportunities abound.”

Online Exclusive:

Snacking Across Categories

For an in-depth look at some additional snack subcategories, including sweets, mini meals, and nuts, check out an online exclusive at ift.org/food-technology/current-issue.aspx.

Melanie Zanoza Bartelme is associate editor of Food Technology magazine ([email protected]).

References

Almond Board. 2016. Mapping the Snack Category: Identifying Key Trends in Snacking & Areas of Opportunity On-Demand Webinar. Almond Board of California, Modesto, Calif. almonds.com.

Bemis. 2015. Snack Attack. Bemis Co., Neenah, Wis. bemis.com.

Burnett, J. 2016. “Crazy For Jerky: An Ancient Trail Food Finds New Fans.” The Salt, Feb. 1. http://www.npr.org/sections/thesalt/2016/02/01/463954925/crazy-for-jerky-an-ancient-trail-food-finds-new-fans.

Choi. 2016. “Snacks Nation: Food Makers Turning Everything Into Snacks.” ABC News. Feb. 24.

Dornblaser, L. 2016. “North American Food & Drink Trends.” Presented at FONA International’s Flavor University, Geneva, Ill., March 14. fona.com.

FONA. 2015a. Snacking: The Snacking Society.

FONA. 2015b. Category Insight Report: Bars.

FONA. 2015c. Consumers: Millennials. Kids. Teens. Boomers.

FONA. 2016. Trend Insight Report: Snack Happy.

General Mills. 2016. “C-Store Shoppers’ Take on Salty Snacks.” General Mills Convenience, Minneapolis. generalmillscf.com/industries/convenience.

Hartman. 2010. “Cultural Occasions for Snacking.” The Hartman Group, Bellevue, Wash. hartman-group.com.

Hartman. 2016. “Spotlight on Snacking: A Hartbeat Special Edition.”

IDDBA. 2015. Snacking Opportunities: Building Better Snacks. International Dairy-Deli-Bakery Assoc., Madison, Wis. iddba.org.

Land O’Lakes. 2016. “Flavor Trends in the Snack Landscape.” The Snackscape, Jan. 19. http://www.landolakes-ingredients.com/the-snackscape/january-2016/flavor-trends-in-the-snack-landscape.

Mintel. 2015a. Snacking Motivations and Attitudes—U.S. April. Mintel Group, Chicago. mintel.com.

Mintel. 2015b. Snack, Nutrition, and Protein Bars. March.

Mintel. 2015c. Salty Snacks. Jan.

Mintel. 2015d. “A snacking nation: 94% of Americans snack daily.” Press release, July 5.

New Nutrition Business. 2015. The next big opportunity in snacking: Five steps to success in seaweed. New Nutrition Business, London. new-nutrition.com.

Nielsen. 2014. “Global Snack Food Sales Reach $374 Billion Annually.” Press release, Sept. 30. Nielsen, New York. nielsen.com.

NPD. 2015a. “Time of Day Dictates Sweet and Savory Snack Consumption, But Place Is Predictor for Eating Better-For-You Snacks.” Press release, Oct. 27. NPD Group, Port Washington, N.Y. npd.com.

NPD. 2015b. “Consumers Like Their Snacks With a ‘Healthy’ Twist.” Press release, June 9.

NPD. 2016. “Millennials Have Nothing on Boomers When It Comes to Snacking.” Press release, March 8.

Packaged Facts. 2016a. Food Formulation and Ingredient Trends: Plant Proteins. Feb. Packaged Facts, Rockville, Md. packagedfacts.com.

Packaged Facts. 2016b. Salty Snacks in the U.S., 4th Edition. March.

SHS. 2015. FoodThink: Issue No. 5. Sullivan Higdon & Sink, Kansas City, Mo. wehatesheep.com.

Wixon. 2016. “Wixon Summarizes High Impact Trends Influencing Food and Beverage Purchases.” Press release, Feb. 29. St. Francis, Wis. wixon.com.