Tiny Organisms, Huge Potential

Microbial fermentation is establishing itself as a true third pillar of the alternative protein industry, on par with—and enabling—parallel advances in plant-based proteins and cultivated meat.

Article Content

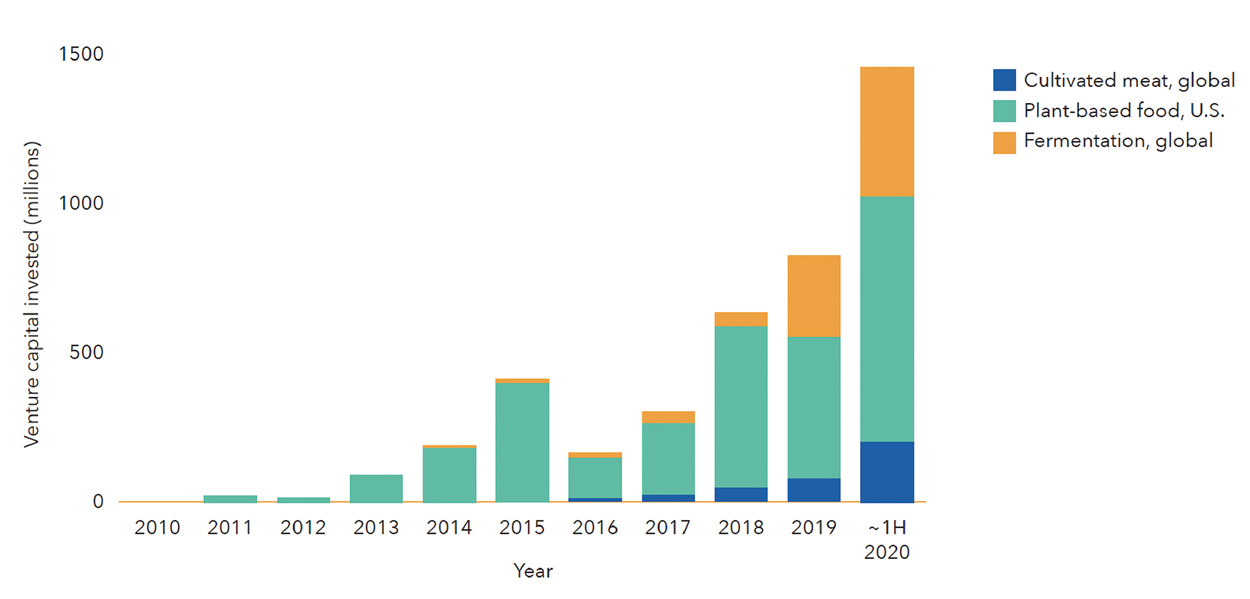

The rise of alternative proteins is among the most prominent food industry transformations of the past decade, and disruptions from COVID-19 have only cemented and accelerated this trend. The vast majority of commercial launches, investment activity, and media attention in alternative proteins have focused on plant-based meats from brands like Impossible Foods or Beyond Meat, or their animal cell–based counterparts—also known as cultivated meat—from companies like Memphis Meats and Blue Nalu, which plan to launch commercially within the next couple of years.

But there is a rising star on the alternative protein scene—a versatile platform that is simultaneously familiar and well established yet completely underexplored and untapped for its true potential within the alternative protein sector. Microbial fermentation can create a novel center-of-plate experience as a standalone ingredient or provide a functional or sensory boost so subtle that the consumer may be oblivious to its behind-the-scenes magic. The adaptability of fermentation enables it to play across virtually the whole alternative protein landscape, expanding product categories in unique ways while also empowering plant-based and cell-cultivated approaches to meet consumer expectations for taste, price, and accessibility.

Microbes Three Ways

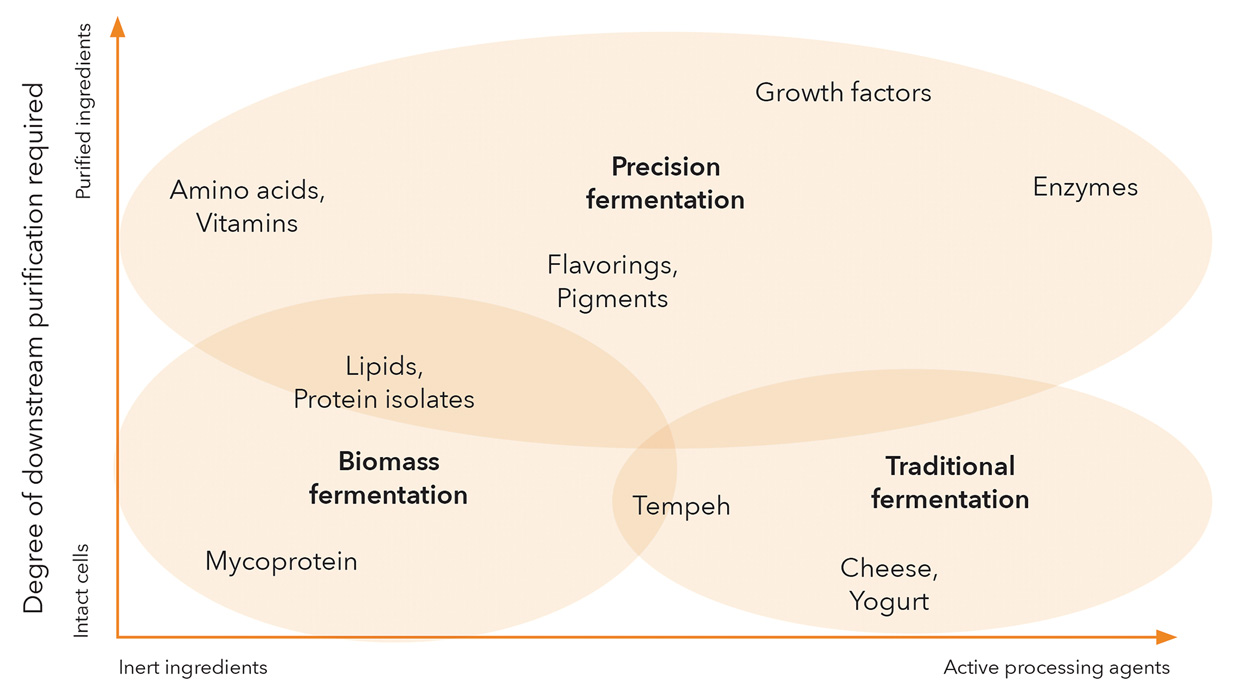

While many companies and approaches will inevitably blur the boundaries of any segmentation within this versatile category, fermentation can contribute in three primary ways to alternative protein products (Figure 1).

1) Traditional fermentation uses microorganisms as processors of raw materials, metabolizing and transforming plant-derived ingredients into enhanced products with unique flavor and nutritional profiles or with modified textures. Historical examples include fermenting soybeans into tempeh with Rhizopus fungi and using lactic acid bacteria to produce the sophisticated palette of flavors found in cheeses and yogurts. A new wave of companies is expanding this concept to address key challenges facing plant proteins—such as limited functionality, undesirable flavors, or low protein content or quality—by using microbial fermentation as a method of biological processing. For example, Planterra Foods, a plant-based subsidiary of global meat giant JBS, uses a fermented rice and pea protein mixture from MycoTechnology in its OZO line of products launched this year.

2) Biomass fermentation leverages the fast growth, high protein content, and neutral or umami flavor of many microorganisms to produce large quantities of protein in a scalable, efficient manner for use as a primary ingredient. One of the oldest and most successful alternative meat brands, Quorn, first pioneered this concept in the 1980s using the filamentous fungus Fusarium venenatum, whose fibrous strands can be arranged like muscle fibrils. In the past few years, nearly a dozen new companies have emerged in this realm, commercializing new strains and new production processes that tap into the vast biological diversity offered within the microbial domains of life.

3) Precision fermentation, a term coined by the economic think tank RethinkX, uses microbial host cells as factories for producing specific functional ingredients that can enhance and enable end products predominantly made of plant proteins, cultivated animal cells, or even other microbial biomass. Examples include proteins such as Perfect Day’s dairy proteins, Clara Foods’ egg proteins, and Impossible Foods’ heme protein as well as enzymes, flavoring agents, vitamins, natural pigments, and fats. Precision fermentation is also used to make animal-free growth factors, an essential element for making cultivated meat economically viable.

Innovation is occurring equally across all of these areas. Some of the splashiest business-to-consumer startups have taken root in the biomass fermentation realm, leveraging the unique structures and textures that fungi offer. By contrast, much of the activity in traditional fermentation and precision fermentation is happening in the business-to-business realm, often propelled by partnerships between innovators and incumbents to rapidly commercialize and scale ingredient-based solutions with wide applicability across the alternative protein industry.

The Holy Grail: Whole-Muscle Cuts

One of the most compelling attributes of fermentation—particularly of filamentous fungi or mycelia—is the opportunity to generate fibrous, aligned, intact tissues akin to whole-muscle cuts without processes like high-moisture extrusion, which is used in the plant-based meat industry but presents a range of technical challenges and production bottlenecks. Creating animal-free whole cuts is a massive market opportunity, representing the highest-margin and most desirable segment of the $1.7 trillion global meat market (Bashi et al. 2019).

Meati has developed a line of whole-cut steak and chicken products, and Atlast Food Co.—a spinout from sustainable biomaterials company Ecovative—uses solid-state fermentation to produce whole-cut meats like bacon. Prime Roots, which was founded by two University of California, Berkeley, students based on a class project in the Alt: Meat Lab, uses the filamentous fungus Aspergillus oryzae (also known as koji) to make whole cuts as well. The company soft-launched a direct-to-consumer bacon that sold out within hours, and it has just announced a partnership with Whole Foods for prepared meals made with koji-based chicken and beef.

Exponential Growth

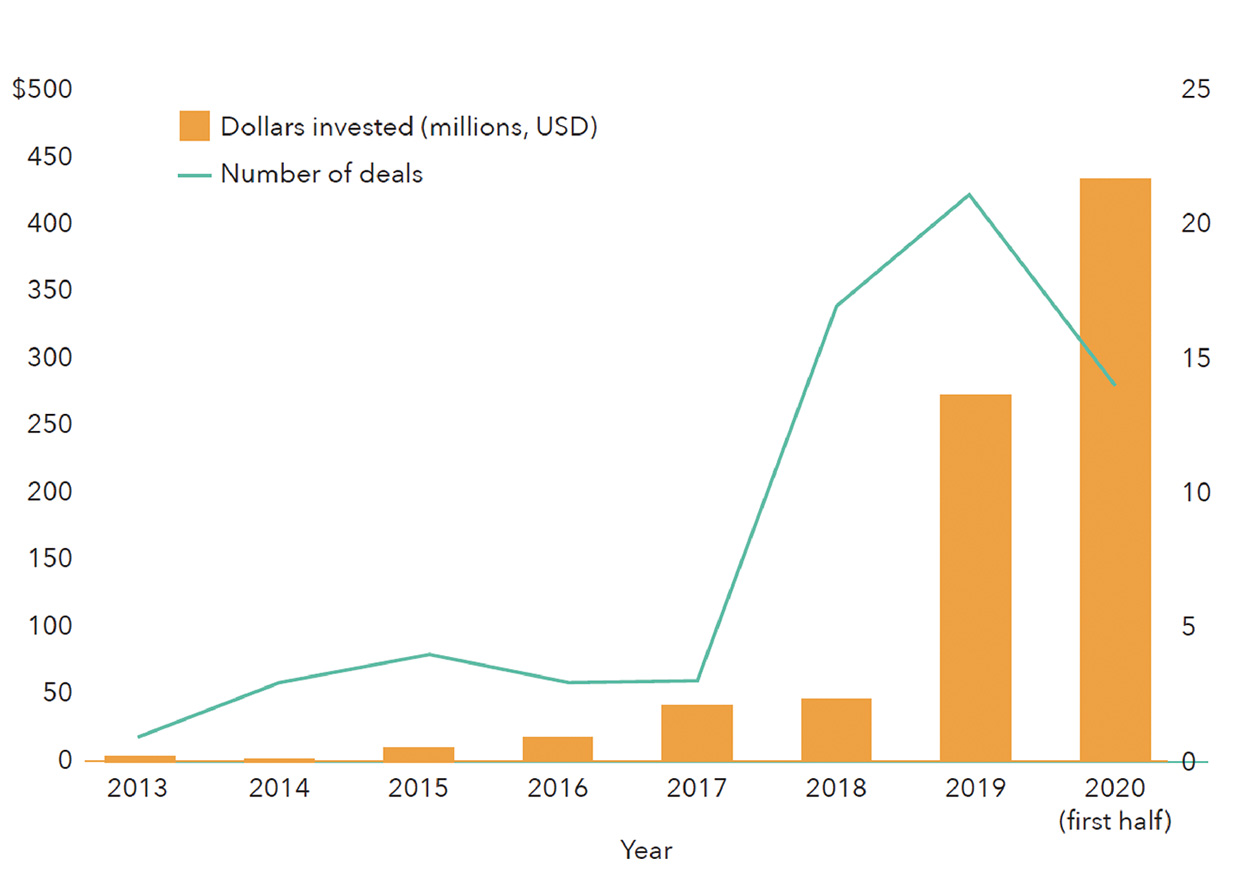

Venture capital investment in fermentation companies dedicated to alternative protein applications did not surpass $10 million until 2015, but fermentation has since rapidly taken root within the investment landscape in alternative proteins (Figure 2). In 2019, fermentation companies raised nearly four times more capital than all cultivated meat companies did that year, propelled by large fundraising initiatives from Perfect Day, Motif FoodWorks, Clara Foods, Nature’s Fynd, and Myco-Technology. In 2020, investment in fermentation-powered alternative proteins had already reached its highest level ever by midsummer (Figure 3).

Incumbents in the fermentation industry have a crucial role to play as well. Manu-facturers of food processing enzymes, flavoring ingredients, vitamins, and live microorganisms include Cargill, DuPont, AB Enzymes, Enzyme Development Corp., Biocatalysts, Novozymes, Kerry, ADM, DSM, Amano, and Ajinomoto. With their deep expertise in enzyme engineering, strain development, and large-scale manufacturing, these companies recognize the growing importance of alternative proteins and are eager to position themselves as go-to solution providers. DuPont launched a new line of live microbial cultures optimized for plant-based dairy as part of its push to develop comprehensive ingredient solutions for the plant-based industry. Novozymes has highlighted its enzymes’ capabilities for improving the flavor and functionality of plant proteins, with tailored enzyme toolkits to support product development around specific plant ingredients. DSM also recently launched a portfolio of enzyme solutions targeting plant-based product developers.

These companies can also deploy their massive fermentation capacity and operational expertise to serve as scaling or joint venture partners with emerging fermentation companies. For example, ADM and Perfect Day have entered a joint development agreement to scale Perfect Day’s animal-free dairy proteins. Such relationships enable new players to leverage existing infrastructure and manufacturing know-how to scale more quickly and cost-effectively.

Technological Opportunity Areas

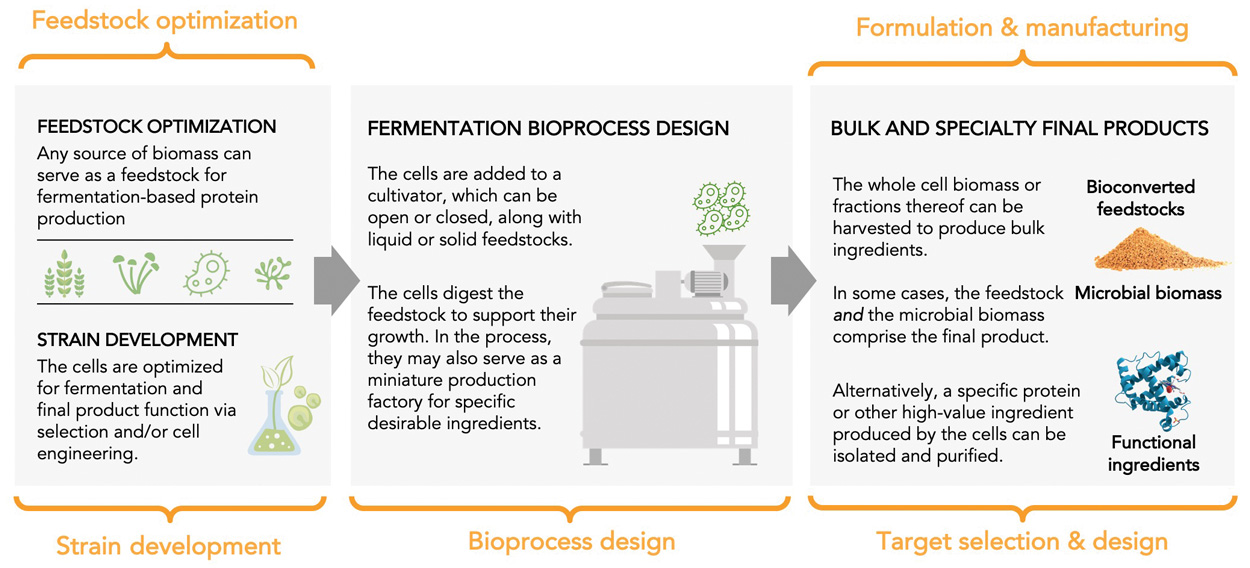

Despite fermentation’s long history of use in the food industry and the flurry of investment and startup activity in recent years, we have barely scratched the surface of what microbes are capable of contributing to alternative proteins. The alternative protein sector presents a playground for technological innovation across five key areas (Figure 4).

Target Selection and Design

This innovation applies exclusively to precision fermentation, where the microorganism is used as a cellular factory to produce a specific molecule of interest, referred to as the target. The target can be a protein, lipid, flavoring, fragrance, enzyme, growth factor, pigment, or any type of molecule that can be made through biosynthesis. Fermentation allows for a decoupling between the original source of a target molecule and its production method, which vastly expands the landscape for identifying biomolecules with unique and valuable functions. Ideal targets may originate in species that are rare, difficult to harvest, expensive, or otherwise inaccessible or impractical. Fermentation provides a mechanism for manufacturing these molecules at scales and prices suitable for commercial viability.

For example, there is increasing interest in using fermentation to produce animal-free saturated fats because of the limited global supply and environmental impact of palm and coconut farming. C16 Biosciences and Nourish Ingredients use microorganisms with altered lipid synthesis pathways to produce these same fats, and fermentation companies Perfect Day and Motif have also announced new fat solution initiatives.

Strain Development

As many as one trillion species of microorganisms are estimated to exist on earth, exceedingly few of which have ever been commercialized for use in food. Compared with the few dozen animal species and several hundred plant species that humans routinely eat, microbes offer virtually endless opportunities. High-throughput methods of strain selection and screening enable innovators to refine new strains with greater speed and precision. While some of the strain development work in this sector is likely to involve biotechnological tools like gene editing and genetic engineering, vast progress is possible through simple adaptation and breeding strategies powered by genomic insights.

Innovators can select for more nuanced attributes—such as precise flavor-enhancing metabolite profiles—in addition to traits with profound implications for cost and process robustness, such as prolonged generational stability to support long-term continuous culture or the presence of metabolic pathways that accommodate a wide range of feedstocks.

Feedstock Optimization

Much of the resiliency and adaptability of fermentation derives from microbes’ ability to use diverse feedstocks—including, in some cases, feedstocks that are entirely outside the agricultural system, such as natural gas and carbon dioxide. At the same time, feedstocks are currently a major cost driver for most fermentation processes. Thus, a great deal of optimization is possible by designing fermentation processes to use side streams from other industries. This presents potential gains for both economic viability and environmental sustainability.

An increasing number of companies and researchers are capitalizing on precisely this opportunity: the potential to convert waste products or agro-industrial byproducts into high-quality protein biomass. Nature’s Fynd and Mycorena both tout their ability to use diverse and sustainable feedstocks. Feedstock optimization should be considered in the context of global demand fluctuations across many biological raw materials. On top of transitions within the protein sector, increased demand for fermentation feedstocks will also be driven by a wholesale shift toward a bioeconomy model of production, leveraging microbial platforms for manufacturing not just food but also chemical, bioplastics, pharmaceuticals, and fuels.

Bioprocess Design

Microbial fermentation currently operates at massive scales, with individual cultivation tanks reaching the hundreds of thousands of liters. However, there is still room for innovation in bioprocess design to meet the unique needs of the alternative protein industry. The scale, cost sensitivity, and sustainability considerations associated with alternative protein applications may warrant a departure from classical paradigms used routinely in the production of other fermentation-derived ingredients like acids and enzymes, such as submerged fermentation and stirred-tank bioreactors. Some fermentation companies have successfully commercialized using novel bioprocess and bioreactor designs, but relatively little effort has gone toward further optimization or iteration of these designs simply because of their rarity. For example, Quorn pioneered its commercial launch with an air-lift fermentation design, which requires substantially less energy than conventional impeller-stirred bioreactors while accommodating particularly large volumes and high viscosities (Ritala et al. 2017).

Downstream purification and post-harvest processes also merit fresh thinking, as these requirements will vary widely according to the form and function of the ingredient being manufactured. For many of the flavoring ingredients or functional proteins used in alternative protein products, high purity may not be necessary as it typically is for enzymes. In some cases, crushing the host cells without further purification or even simply drying the intact cells may be sufficient.

Retrofitting existing manufacturing facilities and equipment to suit the needs of alternative protein applications is another key opportunity area. Most existing fermentation infrastructure was built for anaerobic fermentation for bioethanol production. As the world moves increasingly toward renewable energy and electrification, these facilities may be decommissioned in the coming decades. However, converting them into fermentation facilities for alternative protein applications may prove challenging without creative approaches. For example, while most microorganisms currently used for alternative protein fermentation require aerobic growth, White Dog Labs’ subsidiary Brewed Foods uses a microorganism that tolerates anaerobic growth, allowing the company to more

easily leverage existing large-scale infrastructure.

End Product Formulation and Manufacturing

Fermentation companies making business-to-consumer products have the same opportunities for innovation in formulation and manufacturing as plant-based meat companies. There is ample room to develop relatively low-tech and low-cost structuring solutions that can improve texture without the capital costs associated with intensive processes like high-moisture extrusion used to produce many current plant-based proteins. Even relatively simple post-harvest processing steps—such as the controlled freezing step Quorn uses to consolidate delicate mycelial strands into more durable, aligned bundles resembling animal muscle fibers—can be used to optimize structure and texture of fermentation-derived proteins.

Alternative protein companies using fermentation-derived ingredients will iteratively improve on their recipes, potentially incorporating additional fermentation-sourced flavorings, fats, binders, and enzymes to achieve more craveable sensory profiles that ultimately meet or exceed those of their animal-derived counterparts. And, of course, these same flavor and functionality solutions can be equally adopted by plant-based companies and, in the coming years, cultivated meat companies. As Impossible Foods CEO Pat Brown said in an interview, “Unlike the cow, we get better at making meat every single day” (Kerr 2019).

A Fermentation-Forward Future

If the past two to five years are any guide to the future, we can expect fermentation to play an increasingly visible and vital role across the alternative protein sector. Microbial fermentation exhibits versatility and untapped potential as a means of processing and functionalizing plant-based ingredients, as a source of primary protein-rich biomass, and as a flexible platform for producing a wide array of high-value ingredients that will power the next generation of alternative protein products. Efforts in strain development and target selection will expand the capabilities and drive up the efficiencies of fermentation as a production platform, and initiatives in bioprocess design and feedstock optimization offer the promise of capturing even greater sustainability benefits while simultaneously lowering costs. Continued innovation will solidify fermentation’s role as a key component of the global shift toward more sustainable, resilient, and nimble methods of protein production.

REFERENCES

Bashi, Z., R. McCullough, L. Ong, et al. 2019. “Alternative proteins: The race for market share is on.” https://www.mckinsey.com/industries/agriculture/our-insights/alternative-proteins-the-race-for-market-share-is-on.

Kerr, D. 2019. “Impossible Burger 2.0 tastes like beef. Really.” CNET, Jan. 7. https://www.cnet.com/news/impossible-burger-2-0-tastes-like-beef-really/.

Ritala, A., S. T. Häkkinen, M. Toivari, et al. 2017. “Single Cell Protein—State-of-the-Art, Industrial Landscape and Patents 2001–2016.” Front. Microbiol., Oct. 13. https://doi.org/10.3389/fmicb.2017.02009.