Getting Specific With Functional Beverages

Consumers are increasingly turning to beverages containing ingredients that address specific health issues.

Today’s consumers expect beverages to be part of their lifestyles, not just thirst quenchers. Consumers of different ages and sexes define their own lifestyles and choose specific beverages accordingly. Functional beverages address these different lifestyles and needs—excitement, energy boost, targeting specific disease, aging, fighting fatigue and stress, and making up for lack of healthy eating.

This is why the market—valued at $9.8 billion in sales through food, drug, and mass merchandiser (FDM) channels excluding Wal- Mart in 2007—exhibited 14% inflation-adjusted growth from 2002 to 2007, according to market research company Mintel (Mintel, 2007a). This outpaced the 13% growth in ready-to-drink noncarbonated beverages and 3% decline in soft drinks during the same period (Mintel, 2007b, c).

This is why the market—valued at $9.8 billion in sales through food, drug, and mass merchandiser (FDM) channels excluding Wal- Mart in 2007—exhibited 14% inflation-adjusted growth from 2002 to 2007, according to market research company Mintel (Mintel, 2007a). This outpaced the 13% growth in ready-to-drink noncarbonated beverages and 3% decline in soft drinks during the same period (Mintel, 2007b, c).

Based on findings published in Mintel’s report on functional beverages in the U.S., published in August 2007, this article explores growth-driving attributes, new product trends, growth and decline in different market segments, consumer insights through Mintel’s exclusive research, and future trends and opportunities in the functional beverage market.

Addressing Health Issues

Growing interest in functional beverages has primarily come from a consumer shift toward healthier eating. Based on Simmons NCS and population estimates from the U.S. Census Bureau (Mintel, 2007a), the number of people trying to eat healthier grew by 30 million between 2002 and 2006.

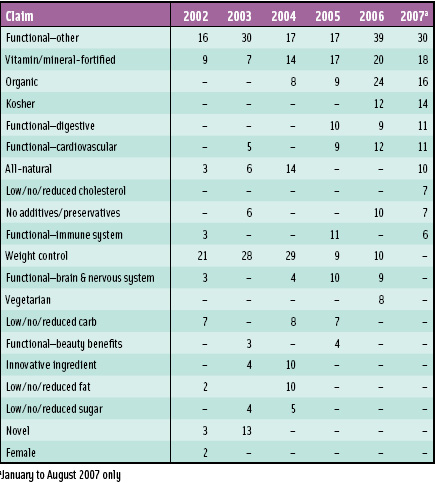

Moreover, consumers are heeding the proliferation of news linking food and beverage consumption with health. In 2005, the U.S. Dept. of Agriculture released a study revealing that the diet of 93% of Americans lacks the recommended amounts of essential vitamin E. Additionally, some 30% of Americans are deficient in vitamin C, some 44% do not take enough vitamin A, and 50% do not get an adequate intake of magnesium (Anonymous, 2005). Of the consumers who purchase functional beverages, 43% do so to make up for sometimes less than healthy eating and 34% do so to supplement already healthy eating habits (Mintel 2006). Unsurprisingly, brands featuring essential vitamins and minerals have found a favorable consumer response among a population looking to supplement its eating. Moreover, the number of new functional beverage products touting vitamin/mineral benefits steadily increased between 2002 and 2006 (Table 1).

Moreover, consumers are heeding the proliferation of news linking food and beverage consumption with health. In 2005, the U.S. Dept. of Agriculture released a study revealing that the diet of 93% of Americans lacks the recommended amounts of essential vitamin E. Additionally, some 30% of Americans are deficient in vitamin C, some 44% do not take enough vitamin A, and 50% do not get an adequate intake of magnesium (Anonymous, 2005). Of the consumers who purchase functional beverages, 43% do so to make up for sometimes less than healthy eating and 34% do so to supplement already healthy eating habits (Mintel 2006). Unsurprisingly, brands featuring essential vitamins and minerals have found a favorable consumer response among a population looking to supplement its eating. Moreover, the number of new functional beverage products touting vitamin/mineral benefits steadily increased between 2002 and 2006 (Table 1).

Consumers are paying attention to their growing waistlines as well. The incidence of obesity among adults age 18 and older increased from 56% in 1994 to 66.3% in 2004, according to the Centers for Disease Control and Prevention (CDC, 2005). Empty calories consumed in the form of beverages may be partially responsible for this trend, as Americans consume 22% of all calories from beverages (Milk PEP, 2006). Most of these calories come from a combination of regular soft drinks, fruit drinks, and presweetened teas, which all add calories but do not contribute significantly to the daily requirement of essential nutrients.

Faced with the adverse consequences of obesity—cardiovascular diseases, diabetes, and even low self-esteem in a society where thin celebrities are considered the ultimate icons—consumers are getting motivated to choose beverages that aid in weight loss and management. In fact, of those who buy functional drinks, one in four do so to avoid consuming empty calories and one in three make that decision to lose or maintain weight (Mintel, 2006).

--- PAGE BREAK ---

But consumers are not picking up just low- or no-calorie beverages to manage their weight anymore; instead, they prefer nutrient-dense, no-calorie beverages. This again reinforces the increasing consumer belief in total health management rather than just weight management. The trend is evidenced by a declining number of new products for weight control from 2004 to 2006 (Table 1). This has helped drive positive growth in functional beverages such as enhanced water, a non-caloric source of vitamins and minerals that grew 241% to $1,233 million in 2007 from $362 million in 2002 (Mintel, 2007a).

Functional ingredients (and claims) provide a convenient platform to address specific health issues. The trend toward consuming natural foods and beverages has prompted consumers to address specific health issues—cancer prevention, digestion, and heart health—through scientifically proven natural ingredients, rather than chemically derived pills. Of the consumers who purchase functional beverages, nearly a third do so to address a specific health issue (Mintel, 2006). Increased research and media attention linking natural ingredients—such as tea, soy, antioxidants, and omega-3s—to disease aid and prevention has contributed to heightened consumer interest in such functional ingredients (Table 2).

Functional ingredients (and claims) provide a convenient platform to address specific health issues. The trend toward consuming natural foods and beverages has prompted consumers to address specific health issues—cancer prevention, digestion, and heart health—through scientifically proven natural ingredients, rather than chemically derived pills. Of the consumers who purchase functional beverages, nearly a third do so to address a specific health issue (Mintel, 2006). Increased research and media attention linking natural ingredients—such as tea, soy, antioxidants, and omega-3s—to disease aid and prevention has contributed to heightened consumer interest in such functional ingredients (Table 2).

As shown in Table 2, calcium is the most popular ingredient consumers seek in functional beverages. According to USDA, about 79% of Americans do not consume the recommended Adequate Intake (AI) for calcium—1,000 mg/day for individuals age 19–50 and 1,200 mg/day for those over 50. Bone health–conscious consumers are likely reaching for calcium-fortified beverages to rectify this problem. Capitalizing on the shortfall of calcium among the U.S. population, PepsiCo launched Propel enhanced water line extension Propel Calcium, which provides 10% of the Daily Required Intake (DRI) of calcium per 8-oz serving. The extension grew an estimated 45% to $46 million during 2006–07.

Antioxidants have become a must-have ingredient because of their health-promoting properties. They are naturally found in tea, berries, and exotic fruits. Demand for antioxidant-rich pomegranate has become a market driver, forming the juice base for many best-selling functional beverages. In the U.S., about 60% of respondents who purchase functional beverages report looking for antioxidants in those beverages (Mintel, 2007a). The demand for these ingredients also translates into impressive sales growth for functional beverages containing them. In late 2005, Odwalla, a Coca-Cola brand, launched PomaGrand—a pomegranate-based juice that garnered $10 million in FDM sales in 2005–06.

Women and Baby Boomers Undertargeted

Women remain the gatekeepers to family health and nourishment. Being the primary food shoppers for the family, they are more likely than men to purchase functional beverages for their spouse/partner (42% vs 37%, respectively) and children (19% vs 11%), according to Mintel (2007a). Moms are a uniquely attractive target when taking into account the 35.9 million children age 3–11 on whom parents spent an estimated $4.3 billion on beverages in 2006 (Fuhrman, 2007). Mott’s Plus, a vitamin-fortified juice brand targeted at children, nearly doubled from $8 million in sales (FDM excluding Wal-Mart) in its inaugural year 2005 to $15.8 million in 2006.

Moreover, women are more likely than men to practice healthy lifestyle habits, such as taking regular vitamins (64% vs 48%), engaging in regular exercise routine (51% vs 44%), and using herbal remedies (21% vs 13%), according to Mintel (2007a). In addition to women’s predisposition toward healthier lifestyles, they experience certain health problems—osteoporosis and menopause—that are addressable through functional beverage use. But this population group remains undertargeted in the functional beverage market. For example, 80% of all osteoporosis patients in the U.S. are women, according to the National Osteoporosis Foundation (NOF, 2007). But there are no functional beverages that target women specifically to address the issue of calcium deprivation.

--- PAGE BREAK ---

Similarly, women remain undertargeted in the fast-growing energy drinks segment, where most brands cater to men through racy names and advertising messages. During 2006 and 2007, however, a number of brands—including Tab Energy from Coca-Cola and Go Girl from Nor-Cal Beverage Co.—successfully targeted women, suggesting that women are an important growth-driving group for the segment. The number of women age 18 and older who drank energy drinks more than doubled from 5.5 million in 2002 to 11.5 million in 2006 (Mintel, 2007d).

Baby Boomers are a generation looking for the perennial fountain of youth and wellness, so they are an ideal target for functional beverages. The overall U.S. population is aging, as Baby Boomers begin to move into their 60s. In 2007, the Baby Boomers account for more than 75 million people who were born between 1946 and 1964. This massive generation becomes more attractive when their $2.1-trillion spending power is taken into account.

However, the incidence of using functional foods and beverages declines precipitously among those over 55 (Mintel, 2007a). Beverages addressing age-specific problems such as aging, heart health, and immunity could potentially attract Baby Boomers. To that end, MitoPharm—a drug, dietary supplement, and functional beverage manufacturer—targets the $59-billion anti-aging market with its new product, Restorade, an anti-aging product available in capsule and beverage form.

How the Various Beverages Fare

Enhanced bottled water and energy drinks shine, but functional fruit juices and drinks disappoint.

• Fruit Juices. Consumers have long been deriving health benefits from fruit juices in general, primarily from the natural presence of vitamins and minerals. However, functional juices suffer from the consumer trend away from fruit juice and juice drinks in general, as they find comparable no-calorie options (enhanced water) and lifestyle beverages (energy drinks). This difference makes some consumers see juice as just an occasional drink, while teas and water become anytime beverages. As a result, functional juice and juice drinks—the biggest segment of the market, with $5.6 billion in sales and 58% of the total FDM market share in 2007—have experienced an 18% inflation-adjusted decline from 2002 to 2007 (Mintel, 2007a).

One way that juice companies are trying to change the tide is by positioning functional juice and juice drinks as sources of well-balanced nutrition through fortification with functional ingredients. For example, Odwalla’s sales rose 38% to $75 million from 2005 to 2007. The company is well known for its back-to-nature juices, many of which are in line with today’s market trend of incorporating organic ingredients and antioxidants.

• Enhanced Water and Sports Drinks. These products have taken the market by storm, exhibiting 175% inflation-adjusted growth (FDM excluding Wal-Mart) from 2002 to 2007. The segment aligns well with the general consumer trend toward intake of no-calorie, healthful beverages. Three brands—Dasani (Coca-Cola), Propel (PepsiCo), and Glaceau (Energy Brands)—primarily contributed to the growth in the segment and accounted for 75% of total segment sales of $1.5 billion in 2007 (Mintel, 2007a). Glaceau Vitamin Water and extensions alone contributed a net of $153 million or nearly 14% to the total functional beverage market growth of $1,093 million (FDM excluding Wal-Mart) during 2004–06. Gauging the increasing popularity of enhanced water, Coca-Cola acquired Energy Brands in June 2007 for $4.1 billion. Powered by Coca-Cola’s distribution muscle, national distribution of Glaceau Vitamin Water is set to drive further growth in the segment.

Capitalizing on the popularity of enhanced water, manufacturers are launching products with claims beyond vitamin-fortified hydration. For example, Vital Lifestyle Water offers the brand Vitality, which is claimed to improve the appearance of the skin with ingredients like cucumber, lime, white tea, and aloe vera. Targeting a different wellness goal, Kellogg launched Special K20 protein water in 2006. It is positioned as a nutritious “shape management” tool to be used in conjunction with other Special K products that help consumers lose weight.

--- PAGE BREAK ---

• Energy Drinks. These products grew a whopping 513% to $784 million (FDM excluding Wal-Mart) from 2002 to 2007. Consumers age 18–34 are swapping their soft drinks with energy drinks, attracted by fast-paced sports marketing and the functional attribute of supporting a fast-paced lifestyle. Energy drinks claim to improve sports performance and concentration, and they also serve as a mixer in alcoholic drinks. Red Bull remains the segment leader, riding on its first-mover advantage in a relatively young market. The segment, however, appears to be getting crowded with “me-too” products, where one brand presents little differentiation from another. Medical authorities are also shifting their attention from soft drinks to energy drinks, warning consumers of the presence in energy drinks of too much sugar and the ill effects of too much caffeine.

• Functional Tea. These products registered a healthy inflation-adjusted growth of 59% from $417 million in 2002 to $756 million in 2007. Three main types of functional tea drive growth: ready-to-drink functional teas offering convenience, functional teas promoting a holistic lifestyle, and premium functional teas. For example, the top three RTD tea companies—AriZona, Fuze, and SoBe—accounted for 77% of growth in this category from 2004 to 2006. But holistically positioned teas like Traditional Medicinals and Yogi Tea—said to provide health benefits such as common cold remedy, digestion aid, and immunity boost—grew by more than 40% during 2004–06. And premium-positioned functional tea brands like the Republic of Tea, Tazo, and Stash are contributing to category growth, gaining 33% in additional sales from 2004 to 2006.

• Functional Smoothies and Yogurt. These products grew by 239% during 2002–07. With $557 million in FDM sales in 2007, the segment remained buoyed by weight-management and energy-boost claims in smoothies and digestion and immunity-boost benefits in yogurt drinks. Dannon’s Danactive, which contains a unique combination of beneficial live cultures and is clinically proven to help naturally strengthen the body’s defense system—grew nearly three-fold to $28 million during 2005–07.

• Functional Soy Drinks. These products have garnered consumer attention on the strength of soy’s heart-healthy claim approved by the Food and Drug Administration in 1999. The $546-million segment (in 2007), however, has displayed slowing growth, likely in response to the American Heart Association’s recent withdrawal of its support for the heart-health claim.

Future Trends and Opportunities

As consumers continue to move toward healthy food and beverages, manufacturers increasingly promote beverages—functional or nonfunctional—on the strength of their health-promoting attributes. For example, Lipton communicates the health positioning of regular tea, which contains naturally occurring antioxidants, through its proprietary AOX seal. This trend is leading to a blurring of boundaries between functional beverages that are fortified and regular beverages that are marketed on the strength of inherent healthy attributes.

• Soft drinks are also moving into the functional realm amid consumers’ concern for empty calories. Soft drink manufacturers have launched products to attract consumers back to the category through “good-for-you” and “functional” positioning. In 2007, PepsiCo launched Diet Pepsi Max with ginseng—a tress reducer and nourishing stimulant—and an increased dose of caffeine. The product is targeted at adults age 25–34 and appears to be an effort to bring young energy drinkers back to soda. In 2007, Coca-Cola introduced Diet Coke Plus. The sugar-free product contains niacin, vitamins B-6 and B-12, and minerals, including magnesium and zinc. It is the first nutrient-enhanced soft drink brand offered by a major company.

• Energy hybrids abound amid high growth in the energy drink segment. To that end, energy-enhancing tea is starting to hit the market. This is no real stretch, since tea has naturally occurring caffeine, and once it is infused with guarana or taurine, touting energizing benefits is the logical next step. Additionally, energy-enhancing water is starting to show up in the market. In 2006, AriZona launched AriZona Green Tea Energy Drink. Available in regular, diet, and pomegranate varieties, the beverage is lightly carbonated with a blend of vitamins, minerals, and herbs. In 2006, Rockstar introduced Rockstar Juiced, a fruit-juice/energy-drink hybrid with 70% fruit juice.

• Hispanic consumers remain undertargeted in the functional beverage market. Only a handful of the products are targeted specifically at Hispanic consumers, yet Hispanics are high-index consumers for eight of the 11 types of functional beverages Mintel analyzed through exclusive consumer research—orange juice, other fruit juice, tea, energy drinks, sports drinks, smoothies, coffee, and yogurt drinks. This fast-growing population group presents innumerable opportunities in the functional beverage category.

• Functional beauty beverages are on the radar, as some 70% of women who had bought a functional beverage in the past three months expressed interest in trying a functional beauty beverage (Mintel, 2007a). Women are almost twice as likely as men to be “very interested” in functional beauty beverages. To that end, Coca-Cola partnered with L’Oréal to create Lumaé, a brand of beauty tea boasting ingredients that help women take care of their skin. Targeted at women age 25 and older, the brand is scheduled for launch in 2008.

by Garima Goel Lal is Beverage Industry Specialist, Mintel International Group Ltd., 351 Hubbard St., Floor 8, Chicago, IL 60610 ([email protected]).

References

Anonymous. 2005. Diets are lacking in key nutrients.Chain Drug Rev. Oct.

CDC. 2005. National Health Examination and Nutrition Survey, United States, 2005. Natl. Center for Health Statistics, Centers for Disease Control and Prevention, Atlanta, Ga.

Fuhrman, E. 2007. Health & wellness happenings: Consumers continue to demand functional and healthful beverage options for all age groups. Special report. Bev. Ind. 98(2): 20.

Milk PEP. 2006. What America drinks. Milk Processor Education Program, Washington, D.C. www.milkpep.org.

Mintel. 2006. Functional foods and beverages—US, Nov. Mintel Intl., Chicago. www.mintel.com.

Mintel. 2007a. Functional beverages—US, Aug.

Mintel. 2007b. Carbonated beverages—US, April.

Mintel. 2007c. Ready-to-drink non-carbonated beverages, May.

Mintel. 2007d. Energy drinks—US, March.

NOF. 2007. Fast facts. Natl. Osteoporosis Foundation, Washington, D.C. www.nof.org/osteoporosis/diseasefacts.htm.