Consumers Have the Munchies

CONSUMER TRENDS

Consumers are snacking more than ever. On average, U.S. adults are eating 2.7 snacks per day, with an increasing number of younger adults consuming five or more snacks daily, according to an August IRI State of the Snack Industry webcast.

U.S. snack sales were up 5% for the period from January 1 to June 13, 2021, versus a year ago, per IRI. Indulgent snacks now hold the largest market share (33%, up from 28% in 2019), followed by “permissibly indulgent,” i.e., slightly healthier snacks.

The increase in snacking isn’t limited to the U.S. market. Around the globe, nearly half (46%) of consumers say they are snacking more than before the pandemic, according to Mondelēz’s 2021 State of Snacking report. Sales in the global snack industry reached $1.2 trillion in 2020, Mondelēz reports.

In the United States, the top 10 snack categories are enjoying above average sales growth. Sales of frozen novelties are up 26% versus a year ago for the period from January 1 to June 13, 2021, according to IRI; sales of “other” salted snacks grew by 22%. Other strong snack and treat product categories and their sales growth are as follows: nonchocolate candy, +14%; tortilla chips, +12%; chocolate candy/ice cream, each +10%; cookies/potato chips, each +8%; crackers, +6%; and yogurt, +4%. Meat snacks, natural cheese cubes, rice/popcorn cakes, and frozen snacks/appetizers are additional pockets of growth.

Early morning and late night are the fastest-growing snacking dayparts, according to IRI Executive Vice President Sally Lyons Wyatt. The Hartman Group’s Redefining Normal: Spring 2021 Eating Occasions report notes that the average number of foods/drinks consumed at all snack occasions has increased since 2019, led by early morning at 3.3 versus 2.5 in 2019; mid-morning, 3.1 versus 2.1; and late night, 2.7 versus 2.2.

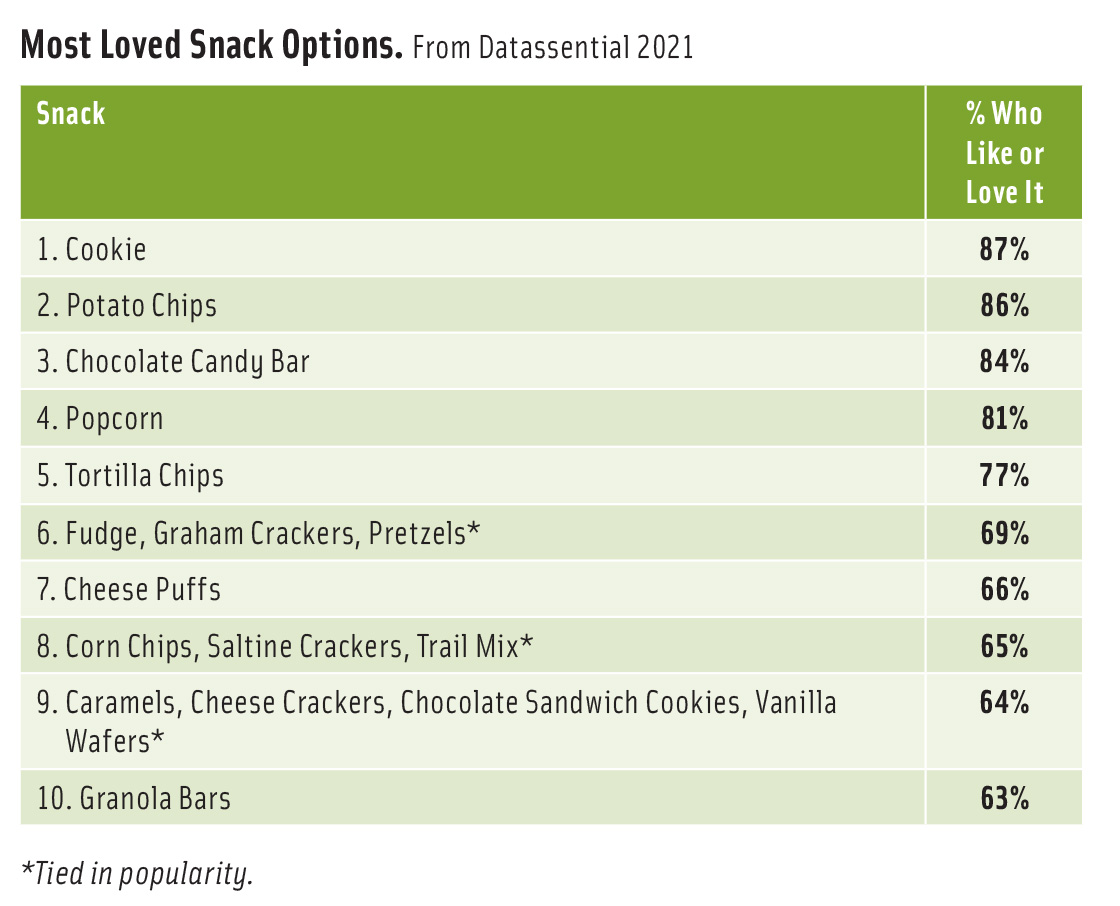

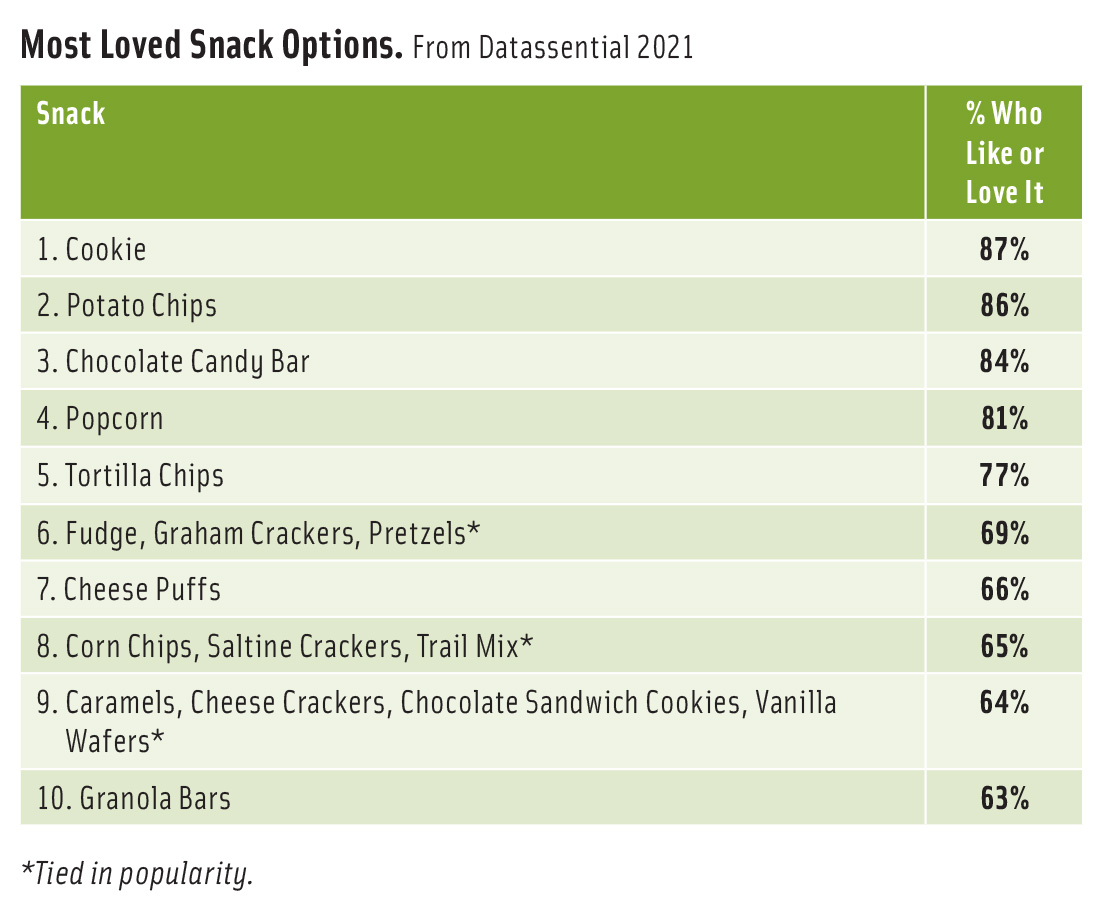

According to Datassential’s 2021 FLAVOR Database, cookies are America’s most loved snack.

Emerging Opportunities

With the ongoing work-from-home trend estimated to add roughly 33 million at-home lunch and breakfast occasions, portable ethnic mini meals that do double duty as snacks, such as Saffron Road’s new fusion Artisan Wraps in varieties including Samosa With Chickpeas and Butter Chicken, will find a welcome market. Jimmy Dean’s bite-sized Omelet Minis packaged in a microwaveable cup are perfectly positioned as an early morning snack.

Sales of fresh snack kits have regained momentum. Refrigerated lunch product sales grew 36.4% for the year ending June 2, 2021,according to IRI data. In the first quarter, fresh snacking/salad vegetables ranked seventh among the food categories posting the highest absolute dollar gains.

New Hillshire Farm SNACKED! refrigerated snack packs for kids combine pepperoni, salami, or turkey with cheese and a sweet treat and include a Pepperoni with Confetti Cake Bites and String Cheese variety.

Frozen appetizer/snack sales topped $3.1 billion, up 14.6% for the year ended May 16, 2021, per IRI. Sales of Asian appetizers and hot/spicy morsels, driven by the popularity of buffalo sauce, each jumped 28%. Multi-serve snacks are gaining share.

Non-European ethnic flavors and forms are go-to frozen snack options. Feel Good Foods introduced Uncured Bacon & Cheddar Mini Pierogies for snacking. Regional styles, including Korean, Shanghai, and Vietnamese, grew faster than Asian snacks overall.

With one-quarter of consumers making more snacks at home, and sales of baking products/ingredients up 18.7% versus two years ago for the year ended May 15, 2021, per IRI, unique baking mixes/kits and refrigerated doughs will stay center stage. Pillsbury’s new bite-sized Cookie Dough Poppins can be eaten raw or baked.

IRI also reports that one-third of consumers plan to socialize more at home, which suggests there are market opportunities for products that cater to home-entertaining needs. Sales of fresh produce party trays and deli trays both showed strong growth this spring and summer.

Consumers are increasingly embracing more traditional foods such as eggs, pizza, and soup as snacks, according to IRI data. Feel Good Foods’ new gluten-free Detroit-Style Square Pan Pizza comes in a Truffle Mushroom variety and includes a baking tray. Campbell Soup introduced Well Yes! Power Bowl single-serve soups.

With half of millennials being frequent seafood consumers, according to FMI’s 2021 Power of Seafood report, fish, seafood, and sea vegetables are snack product development options with high market potential. Neptune Fish Jerky comes in four varieties, including Sweet Citrus Ginger and Spicy Cajun.

Foodservice Influences

Late afternoon and after-dinner restaurant snack visits increased 3% over last year as of February 2021, while traffic at other day-parts is down, per NPD’s CREST service. More substantial meal offerings, including pizza and burgers, have been the best performers.

Sliders, followed by chicken bites, corn dogs, crab cakes, meatballs, pizza, quiche, calzones, and egg rolls, are the most menued savory minis in restaurants, per Datassential’s September 2021 MenuTrends.

The Shake Shack’s Korean-style Gochujang Chick’n Bites, Captain D’s Lobster Bites and Shrimp, and Meatloaf Roadies sliders from Logan’s Roadhouse are among the best-performing new restaurant snack introductions, per Datassential’s SCORES September 2021 database.

Restaurant-branded snacks, such as Utz’s On-the-Border Mexican Grill & Cantina Thins, are well positioned for growth. Chef-inspired snack flavors are a missed opportunity for food marketers.

Gourmet chips, pretzels, snacks, and appetizers were the third fastest-growing specialty food category in 2020, up 19%, according to the Specialty Food Association’s 2021 State of the Specialty Food Industry report.

Protein, ethnic, plant-based, and healthier versions are driving the dip category, where sales were up 28.6% versus 2019, per IRI. DiscoverFresh Foods now offers a Pepperoni Pizza dip. Lakeview Farms’ Rojo’s Cantina Dips include real beef or chicken and come in varieties such as Chicken Fajita Dip and Beef Taco Dip. Vermont Creamery introduced fresh Goat Cheese Dips in varieties such as Red Pepper & Lemon.

Add excitement to the most consumed savory snack flavors—cheddar, barbecue, garlic, ranch, peanut butter, and onion—with the addition of specialty salts (e.g., pink Himalayan), regional barbecue flavors, or specialty cheese flavors, per a T. Hasegawa report titled 2021 Flavor Flash: Snacks.

Hot/spicy snacks remain in vogue. Pepperidge Farm unveiled a limited-edition Jalapeno Popper Goldfish cracker variety, and Setton Farms offers Scorpion Pepper Pistachios.

Younger consumers want more international snacks and flavors, including Asian (especially Japanese and Thai), Latin beyond Mexican, and bolder Middle Eastern tastes, according to T. Hasegawa data. Emerging global snack flavors include kimchi, adobo, sesame, olive, and curry.

Meal flavors in snacks, such as Pringles Cheeseburger chips and Chile Con Queso crisps in the United Kingdom, are an exciting flavor twist, as are charcuterie, coffee, and liquor flavors emerging in the United States.

According to Kerry’s 2021 Botanical State of Mind global consumer survey, black pepper, followed by ginger, basil, turmeric, and rosemary, are the most appealing botanical flavors for salty snacks.

Healthier Preparations

More than half of consumers want functional snacks that offer health benefits beyond nutrition, according to IRI’s Lyons Wyatt; 41% look for organic and natural snacks. Nearly one in five looks for snacks that are vegan (18%) or vegetarian (19%).

Just over one-quarter of those who claim to be following a trendy diet such as keto or paleo say that they buy specialty snacks to support their program, IRI reports.

Healthier on-trend preparations such as pop bitties air-popped ancient grain chips from Mark’s Mindful Munchies are grabbing the spotlight. Tyson Air Fried Spicy Chicken Bites can be prepared in either an oven or an air fryer, and the company says they contain 75% less fat and 35% fewer calories than fast-food versions.

Mondelēz International’s Dirt Kitchen brand is testing a better-for-you snack bar that uses mechanical pressure/ultrasound technology to eliminate the use of binders and added sugar.

RIND Snacks makes crispy, thin-cut fruit chips, including its latest offering, Orange Chips, and advises consumers to “Keep it Real. Eat the Peel.” Don Pancho Authentic Mexican Foods launched Grain Free Tortillas and Grain Free Chips this summer.

According to Datassential’s 2021 Plant-based HotShot report, one-third of meat alternative users have increased their consumption of meat alternative snacks and appetizers in the past year; 35% are eating more plant-based jerky; and 30% are having plant-based charcuterie.

Four in 10 parents with kids at home purchased alternative salty snacks in early 2021, according to T. Hasegawa, and 34% of millennials did so.