Sandwiches Fit the Bill in Tight Times

For a whole stack of reasons, sandwiches and handhelds are appetizing to restaurant operators and diners alike in a post-pandemic environment in which the foodservice industry faces ongoing operational challenges and consumers are keeping a careful eye on their wallets.

“Given what’s going on with foodservice—shortages of labor, skilled individuals leaving, supply chain issues, and variable traffic—sandwiches are very appealing to operators for whom sandwiches make sense when it comes to brand strategy,” says Maeve Webster, president of consulting firm Menu Matters. “They’re very, very versatile. Once you get the elements in, you can do a million different things with them. They don’t require a lot of skill. You can offer them at a broad spectrum of prices.”

For consumers, sandwiches can be a budget-friendly menu option. “It usually is a good moment for sandwiches whenever there’s inflation,” says Claire Conaghan, associate director, content, for research firm Datassential. “It’s typically the lowest-priced thing on foodservice menus.”

What’s more, the use of sauces and condiments allows for wide-scale exploration of new flavors and cuisine types to ramp up customization. “It’s very approachable from a consumer point of view, without getting so close to someone’s comfort [zone] edges,” Webster says.

As the pandemic has waned, many consumers have been looking to food in a bid to add an element of excitement to their lives. “They’re wanting to have food that is more interesting than what they’ve been forced to eat in the last two-plus years,” Webster observes.

“Even in the sandwich category, we will begin to see pickup in international cuisines, and their influences on flavors, ingredients, sandwich formats, and carriers,” she says. “There are so many different options internationally that can become familiar to a consumer. Let’s say a bocadillo. If you called it a bocadillo sandwich—though that might be redundant—consumers get what a sandwich is.”

Still, though, Webster advises foodservice operators to be judicious with their pricing strategies because consumers are likely doing the same when it comes to their spending. Many are thinking carefully about their cash flow and deciding what they’re willing to spend more on.

“Operators … will need to be very reliable in what they offer and use a combination of premium ingredients at a higher price point but offset those with less expensive ingredients, without compromising overall integrity,” Webster says. “That allows them to attract consumers who want to spend more for things that are worth that additional money to them.”

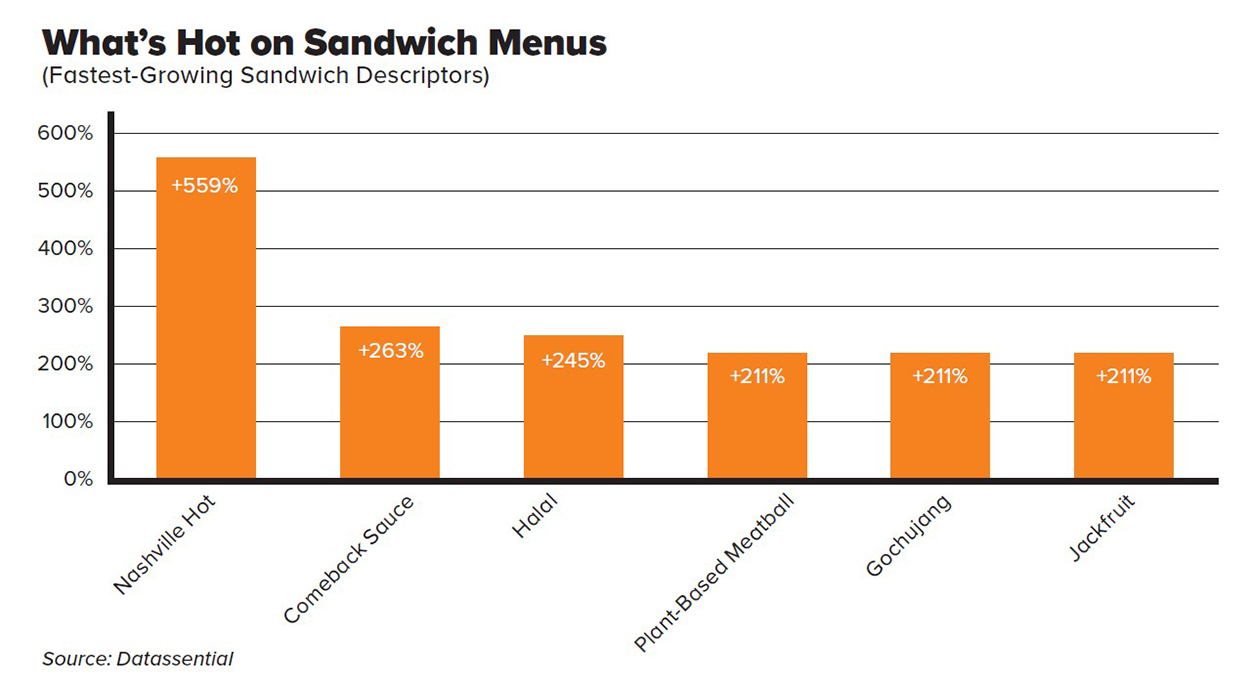

Sandwiches made with jackfruit as a meat substitute are trending on foodservice menus.

© bhofack2/iStock/Getty Images Plus

Opportunities for CPG Products

As the cost of living has shot up and with the threat of recession looming, the current environment may present opportunities for the sandwich/handheld category at retail. After all, while the cost of eating at home has gone up more than the cost of eating away from home, the latter is still significantly more expensive, says Scott Dicker, senior market insights analyst at SPINS, a business intelligence company.

“With some fast-food chains raising their prices, consumers may be opting for similar at-home frozen and refrigerated options, both meat- and plant-based, to cut down food costs,” says Dicker.

The deli sandwich category at retail saw $5.4 billion in sales for the 52 weeks ending Oct. 2, 2022, up 15.4%, while unit sales were up 5.3% to nearly 1.3 billion as prices rose by 9.6%, according to multi-outlet data from IRI. Chicken sandwiches sold the most at retail, up 13.3% to $952.1 million, followed by turkey, up 15.0% to $867.0 million, and the combination of hamburgers, cheeseburgers, hot dogs, corn dogs, and sausage, up 30.2% to $766.9 million.

The European market had the largest number of sandwich/handheld new product introductions for the five-year period ending in June 2022, with nearly half (48%) of all rollouts occurring on that continent, according to Innova Market Insights. North America, with 24%, and Asia, with 16%, were second and third on the list of regions in terms of new product development.

Top Concepts

Nathan’s Famous, Slim Chickens, toasted subs maker Cheba Hut, and Primo Hoagies are among the fastest-growing sandwich and handheld restaurant concepts, says Conaghan.“Street tacos still matter,” she says. “Empanadas still matter. Arepas, thanks to Encanto, are having a moment.”

Among the newly introduced chain sandwich and handheld concepts that Datassential has found noteworthy are the Pepperoni Pizza Egg Sandwich at Einstein Bros. Bagels, the Burrata Parm Burger at Shake Shack, and the Orange Chicken Sandwich Bao at Panda Express.

The term “fried” is now found on 37.1% of sandwich menus, up 10% in the past four years. Conaghan credits the fried chicken sandwich craze for that.

Technomic Ignite menu data shows growth in both chicken and plant-based options between the second quarters of 2021 and 2022. The number of menu items in the category rose 2.4% during that time. The fastest-growing types of sandwiches include meat analogues (+40.0%), eggplant Parmesan (+6.4%), cheesesteak (+5.4%), chicken Caesar (+5.1%), and chicken Parmesan (+5.0%).

Vegetarian sandwich options appeal to mainstream eaters as well as vegetarians.

© PamelaJoeMcFarlane/E+/Getty Images

Indulgent Versus Healthy

For many consumers, the pandemic triggered heightened health consciousness, but the sandwich category is trending toward a marriage of healthy and indulgent products ranging from fried chicken to new vegetarian and vegan options. “The mindset has expanded, where healthy is coexisting easily with indulgence,” Webster maintains.

Conaghan agrees. “It’s more common that places will build out entire veggie sandwich sections,” she says. “It’s very early stage, but it’s starting to show up in the data. It’s going to pretty much always be some of both. We’re not going to see any slowing down of chicken sandwiches, but we’re seeing movement toward seemingly healthy items,” she predicts.

“We’re seeing interesting approaches toward what vegetarian and vegan sandwiches might look like, and most importantly be appealing to consumers who are not vegetarians and vegans,” Webster says, adding that those types of offerings are less about hyper-processed plant-based and more about whole ingredients. “How do I take vegetables, and maybe even fruit and all those other elements, and make them really interesting through high-impact preparation techniques, different types of condiments, and how the build actually works—what kind of bread it’s going to be on?” she says.

Of course, consumers aren’t moving away entirely from indulgence. According to Webster, it’s just taking more of a backseat. “Well-executed pesto or premium cheese, could be in a plant-forward sandwich,” she says. “You could have very small amounts of a high-end animal protein, like really good prosciutto. It’s about indulgence applied mindfully, and probably on a more premium level.”

Those introducing full-on indulgent sandwiches with expensive ingredients are finding that “it’s less likely to be a traffic driver,” Webster adds. “It’s probably going to be featured more as a callout item that gets you a lot of press but isn’t necessarily your lead seller.”

On the retail side, “high protein/source of protein” was the most frequently seen health-related claim on newly introduced sandwiches and handheld foods in the United States, with 31% of such products featuring that claim between July 2021 and June 2022, according to Innova Market Insights. Globally, clean label claims were most commonly found on new launches in the category, with “no additives/preservatives” appearing on 16% of them.

Sandwiches and handheld food makers have adapted, with more options featuring vegetables and plant-based meat alternatives. Plant-based claims were found on 13% of new retail launches in the United States between July 2021 and June 2022, for example.

Dicker sees consumers combining indulgence and healthfulness—with a focus on flavor. “Products with international flavors are growing, and we are seeing a wider variety of product lines that include untraditional and international flavors such as wasabi, ube, pandan, and chipotle,” he says.

“During the pandemic,” Dicker continues, “consumers were cooking almost exclusively at home, and many of them liked knowing exactly what was going into their foods and have adapted that practice into their lives. That being said, there is now a greater market for indulgent products that consumers can’t make themselves, or don’t want to make at home.”

Hero Image: © Vaaseenaa/iStock/Getty Images Plus

Authors

-

Ed Finkel Freelance

Is a freelance journalist based in Evanston, Ill. (edfinkel@edfinkel.com).

Categories

-

Food Business Trends

-

Foodservice

-

Consumer and Marketplace Trends

-

Food Categories

-

Food Product Development

-

Refrigerated and Frozen Foods

-

Food Technology Magazine