A Modest Melt for Frozen Pizza

Sales aren’t surging as they did in year one of the pandemic, but the retail pizza category still has plenty of potential for companies that tap into key market drivers.

Article Content

After a strong year in 2020 during the pre-vaccine stage of the COVID-19 pandemic, CPG pizza sales dipped somewhat in 2021, although they remained well above pre-pandemic levels, according to market research firms. Frozen pizza brands—whose sales account for 14% of the total pizza market, according to Technomic—are working to maintain momentum by providing restaurant-quality products and delivering healthier formulations without ignoring consumers’ desire for convenient comfort food.

Frozen pizza sales shot up by 20.4% to nearly $6.0 billion for the 52 weeks ending Dec. 5, 2020, but sales fell 3.6% to about $5.8 billion for the 52 weeks ending Dec. 4, 2021, according to NielsenIQ. Multi-serve pizza sales comprised the bulk of the category, at $4.7 billion, down 4.2% in the latter time frame, while single-serve SKUs saw just over $1 billion in sales, down 0.2%.

Center-store pizza-related sales, which are considerably smaller than those of frozen, also saw a small drop-off in 2021 after a major increase in the earlier phase of the pandemic. Total center-store sales of pizza products rose 38.1% to $173.4 million for the 52 weeks ending Dec. 5, 2020, then dropped 6.2% to $162.6 million for the 52 weeks ending Dec. 4, 2021, NielsenIQ figures show. Crusts comprise the bulk of that category, at $142.6 million, down 5.2% for the more recent 52 weeks.

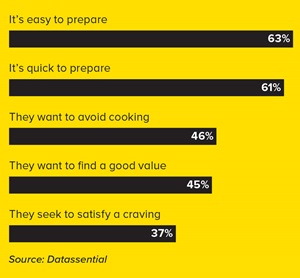

Two years into the pandemic, consumers who are working remotely, navigating economic uncertainty, and experiencing cooking fatigue will continue to rely on convenient, affordable meal solutions, according to Kaitlin Kamp, food and drink analyst for market research firm Mintel.

“Still, future growth [for the pizza category] is somewhat stifled as consumers renew their health aspirations and return to pre-pandemic routines, leading to slow and modest growth through 2026,” she says. “Brands will find growth opportunities in remote workers, homemade pizza, and improved quality that rivals foodservice operators,” Kamp predicts.

Baking in Health Appeal

Mintel research found that nearly two-thirds (65%) of those who live in households that eat pizza wish it were healthier, most often citing all-natural ingredients (44%), extra vegetables (41%), low fat (30%), low carb (29%), high protein (27%), and organic (25%) as attributes that would further the health halo.

Globally, “vegetarian” was the most frequent positioning for new pizza launches between April 2020 and September 2021, featured on 14% of such SKUs, according to data from Innova Market Insights. Less often seen are callouts such as no additives/preservatives (11%), gluten-free (10%), traditional (7%), and high source of protein (7%). In contrast, gluten-free positioning (34%) topped the list for U.S. launches during that period, followed by high source of protein (24%), no additives/preservatives (22%), GMO-free (15%), and traditional (14%).

During the first year of COVID, consumers were leaning into more indulgent and cheaper comfort foods like “mac-and-cheese and pepperoni-laden, $3.99 pizzas—belly fillers,” says cauliflower crust pizza pioneer Gail Becker, founder and CEO of Caulipower.

“In 2021, people realized, ‘Hey, I have to wear jeans again,’” she continues. “They noted the ‘COVID 15’ and are now choosing much healthier options. … That has served Caulipower very well.”

The company has worked assiduously to stay on top of sourcing the right ingredients, with an eye toward beating the supply-chain snarls, Becker says. “People are definitely more cognizant of what they’re eating,” she says. “They want cleaner labels and more transparent, healthier options. The year of eating whatever you want to make you feel better is over. Now, people want to feel good about what they’re eating. It’s not as much food as comfort, as it is food as nourishment.”

The Cappello’s pizza brand has amped up its health orientation in the past year, launching low-carb and no-sugar-added, keto-certified pizzas with crusts made from turnips and almonds. The line includes Buffalo ranch, cheese, and a crust-only SKU, says company president Rajesh Babu, who came on board in 2021.

“There’s this increased emphasis on pantry-loading,” he says. “People are looking for nutritious, healthy foods that can last a bit. … The pandemic became the world’s largest trial-driver. If you’re on the shelf, people are going to try you. We had a nice jump during the pandemic. The nice thing is, we’ve sustained that lift.”

As cauliflower has become more ubiquitous as a crust base, brands are trying other formulations to catch the eye of health-oriented consumers, as well as using plant-based cheese and meat substitutes, and higher-quality toppings like uncured meats, Babu says.

Schwan’s has noted a surge in protein and plant-based innovation and claims, given consumers’ desire to eat healthier foods that they still enjoy, says Brian Schiegg, president of Schwan’s Consumer Brands, which includes Red Baron, Tony’s, and Freschetta in its stable of pizza brands.

“Protein, in particular, is viewed as a healthy way to fill up families and keep them full longer,” says Schiegg. “These may result in innovations using alternative food ingredients, or simple renovation of existing items, or packaging callouts. However, it is imperative that these new product attributes do not sacrifice taste.”

Keeping the Quality High

The loss of access to favorite restaurants didn’t cause consumers to lose their taste for foodservice-quality pizza, Schiegg emphasizes. “In fact, the desire for satisfying, restaurant-quality pizza at home continued throughout 2021, and we expect it to continue into 2022 and beyond,” he says.

“The perceptions of frozen food products as ‘less than fresh’ have started to erode, with more consumers recognizing the benefits of the frozen category, including price point, shelf life, nutrition, and convenience,” Schiegg notes. “We know there’s room to grow retail’s piece of the pie.

“We know that a reduction in out-of-home eating occasions and a desire for comfort food and indulgence during challenging times have added tailwinds to what was already a strong growth trend in the premium segment of frozen pizza,” he adds. “We also know that a large number of new consumers have been drawn to the frozen pizza aisle for the first time, or perhaps the first time in a while, seeking stress-free and family-pleasing options.”

In a report on the retail pizza category released in October 2021, Mintel identified value as a key selling point, best demonstrated “by loading products with extra toppings and sides and upgrading product quality, with specialty flavors and premium ingredients.” Brands should expand product offerings and upgrade sauces, crusts, and toppings to rival those of foodservice, targeting the at-home lunch occasion with messaging that underscores convenience and “energizing ingredients,” the report suggests.

The frozen pizza category has evolved to include an influx of “pizzeria” brands as consumers’ expectations for higher quality have been raised, says Nick Fallucca, chief production and innovation officer at Palermo Villa, a manufacturer of branded and private label pizza. “Many of these products are rooted in strong regional chains that are both popular and familiar,” he says. “For example, our Connie’s Frozen Pizza has experienced strong growth in the Midwest and has expanded to other markets where consumers are seeking the Chicago pizzeria experience.”

Palermo Villa added two new flavors in 2021 to its ‘Za Brewski line of pizza with beer-infused crust, which it developed in partnership with Jacob Leinenkugel Brewing Company. The company believes consumers are challenging frozen pizza brands to elevate their game to restaurant-style offerings, says Fallucca. “We think we’ve done this with our high-quality crusts, such as Artisan Stone Fired Butter Crust used on Screamin’ Sicilian, or our Artisan Thin Pastry Crust used on Urban Pie [pizzas],” he adds.

Homemade Appeal

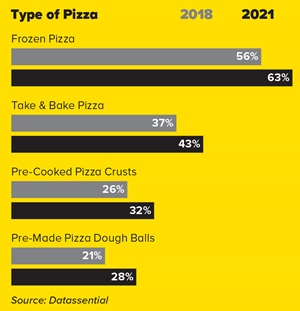

When Mintel asked consumers what type of retail pizzas they had eaten in the past three months, a small but growing segment cited “pizza I made myself” (32% in 2021, up from 29% in 2020). The percentage who said they prepared pizza at home from a kit had also increased to 16% in 2021 versus 13% in 2020.

Mintel sees the potential for growth in the latter subcategory. “The kits and components segment makes up only 8.2% of category sales currently, leaving ample opportunity for expansion,” the report says. “Brands should explore premium foodservice-inspired crusts, sauces, and toppings, such as deep-dish dough or margherita pizza sauce; 65% of households that eat pizza are interested in premium ingredients to make their own pizza at home.”

Product Development Priorities

Innova Market Insights reports that new product development in the United States has tailed off considerably. Between the second quarter of 2019 and the second quarter of 2020, 119 new pizza products were introduced, but in the same time frame between 2020 and 2021, that total fell to just 70.

For the period from April 2020 through September 2021, the top flavors for U.S. pizza launches were pepperoni (21%), mozzarella cheese (10%), margherita (9%), cheese (8%,) and cauliflower (7%), according to Innova.

Caulipower unveiled a number of new products in 2021. “We used 2020 to innovate like crazy,” says CEO Becker. The company rolled out a Buffalo chicken SKU, larger versions of barbecued chicken and half-pepperoni/half-cheese offerings, and artisanal stone-fired products, as well as the brand’s first-ever packaging redesign.

Schwan’s released two new offerings in October 2021: the Red Baron Stuffed Crust Pizza, in three flavors—Pepperoni, Four Cheese, and Meat Trio—and the Red Baron Fully Loaded Pizza, also in three flavors—Pepperoni, Five Cheese, and Supreme. This followed two releases in the summer of 2020: Red Baron Pizza Melts in Pepperoni, Supreme, and Four Cheese flavors, and Freschetta Thin Crust Pizza in Premium Pepperoni, Five Cheese, and Garden Veggie varieties. The brand will launch a Freschetta Margherita and Roasted Garlic SKU this year.

Fallucca of Palermo Villa believes the trend toward frozen pizza featuring health-oriented claims has lost momentum. “Gluten-free is still popular in some channels but doesn’t have the same growth trajectory as before,” he says. Still, he thinks that plant-based SKUs are “here to stay.” His company’s Urban Pie line, which includes varieties like Sweet Potato BBQ Chicken, Broccoli & Cheddar Bianco, and Cauliflower Margherita, tout their veggie-based crusts.

Key Takeaways

- After skyrocketing at the start of the pandemic, frozen pizza sales declined slightly in 2021.

- Growth opportunities exist for frozen pizza brands that focus on healthier formulations and restaurant quality.

- Consumer interest in making pizza at home is increasing.