Spices and Ethnic Foods

As the growth in use of spices and seasonings in ethnic cuisines continues, it has become more important than ever for buyers to work closely with their suppliers to ensure that they receive the right ingredients for their products.

The Spice Market Expands

Spices are the oldest traded commodity, dating back at least two millennia. Today, the United States is both the world’s largest consumer as well as the major importer of spices, bringing in products from 88 countries in addition to its significant domestic production.

According to the American Spice Trade Association (ASTA, 2001), U.S. consumption of spices exceeds 1 billion lb/year. Of that quantity, approximately two-thirds is imported. In addition, U.S. per capita consumption continued to grow from 2.1 lb in 1980 to approximately 3.6 lb in 2000.

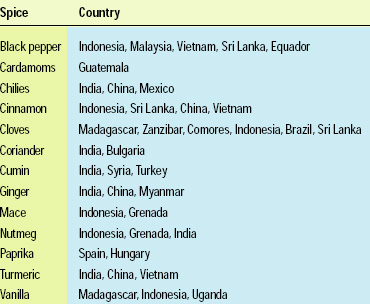

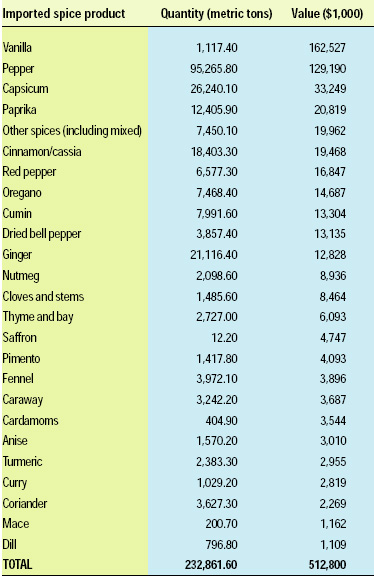

According to the International Trade Centre of the United Nations Conference on Trade and Development/World Trade Organization (UNCTAD/WTO, 2002), the world market for imported spices and culinary herbs is large, valued at just over $2.3 billion, with India accounting for 30% of exports. Annual worldwide imports grew at an average 8.5% a year, indicating that consumption of spices continues to grow. Fig. 1 shows some typical tropical spices. Table 1 illustrates some of the most important tropical spices and their main producing countries. And Table 2 illustrates the value and tonnage of U.S. spice imports by product for 2002.

While the average consumer uses the term spices for the most part to refer to the traditional ones such as black pepper, cinnamon, and cloves, the spice trade generally uses four categories to further define the term: tropical aromatics or spices; herbs; spice seeds or seeds; and dehydrated vegetables. ASTA defines spices as “any dried plant product used primarily for seasoning purposes.” Included are tropical aromatics, more commonly referred to in the trade as “spices” (pepper, cinnamon, cloves, etc.), herbs (basil, oregano, marjoram, etc.), spice seeds (sesame, poppy, mustard, etc.), and dehydrated vegetables (onions, garlic, etc.). The definitions can be found at www.astaspice.org/spice/frame_spice.htm, under “Spice Definitions and Glossary.” The Food and Drug Administration defines spices similarly, except that dehydrated vegetables are not included in the label definition of “spices.” Seasonings is the common term used for various spice blends.

How the Spice Trade Operates

Historically, the spice trade has operated with a fairly clear and fixed structure. The channels of distribution included importers and domestic growers; brokers and agents; and grinders and processors. In recent years, the structure has blurred, with many companies performing multiple roles within the chain. For instance, many grinders and processors import their own merchandise from overseas, often without the services of an importer or broker.

The pricing and trading of spices is unregulated. Thus, market prices are determined by supply and demand. Generally, there is a spot market value for spices in the U.S., which is based on the overseas supply situation, the market demand, current availability, and quality, which is a major factor in determining the price, especially when there is more than one source for the product.

--- PAGE BREAK ---

Quality and specifications have played an increasingly significant role in the supply chain and purchasing decisions. So, too, have issues such as food safety and bioterrorism. All of these factors have made it more important than ever before for buyers to have a level of understanding and knowledge with respect to the merchandise they are buying and the sellers who are supplying them. Equally important is the need for sellers to understand the technical and economic needs of their buyers. Thus, marketing—especially relationship marketing—is likely to be more important in the future.

As Beckwith (2000) points out, “Business is about people. A service succeeds when it makes significant numbers of people feel their lives are somehow better than they would have been without that service. The role of marketing is to ask, How might we do that? How might we make people feel better? What is it that they want, and need, and how might we answer that?” This is the essence of relationship marketing—the ongoing process of identifying and creating new value with individual customers over the lifetime of the relationship and, therefore, the creation of a significant level of customer loyalty.

While more and more spices and herbs are cultivated, many grow naturally and in the wild. In most countries, the chain of supply follows a typical harvesting and processing cycle, with various people performing different functions in the chain:

• Gatherers or harvesters pick or harvest the goods, usually from the wild or in the mountains, but also from cultivated land.

• Accumulators buy the goods from the smaller gatherers or harvesters and put together enough quantity to then sell to the processors or dealers.

• Processors or dealers take possession of the goods and generally do a full cleaning or at least some significant amounts of manipulation to the goods.

• Exporters actually export the goods.

Many companies cover overlapping areas. For instance, a company may be both a processor and an exporter. However, it is very rare that someone is both a gatherer and an accumulator. The level of processing varies greatly among countries and spices. However, the trend has been to have more and more cleaning and value-added processing done overseas.

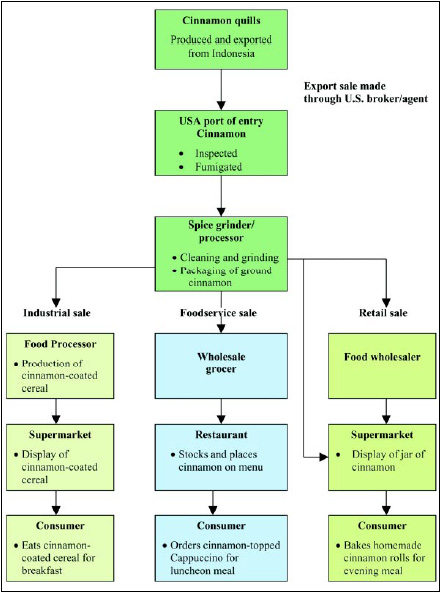

Fig. 2 uses cinnamon as a typical example of how almost all spices are marketed and consumed.

--- PAGE BREAK ---

Specifications Improve Spice Quality

The U.S. government plays a significant role in the importation, trade, and sale of spices to users, both the food industry and consumers. Government regulates the industry in areas such as sanitation, pesticides, sterilants, labeling, tariffs, and now bioterrorism.

Both FDA and ASTA set guidelines and specifications for importation and trade of spices. These include FDA’s Defect Action Levels and ASTA’s Cleanliness Specifications.

Under the Federal Food, Drug, and Cosmetic Act, FDA prohibits the distribution or importation of spices that are adulterated or misbranded. The term adulterated includes products that are defective, unsafe, filthy, or otherwise produced under unsanitary conditions. The term contaminated is generally used to describe these conditions. More detailed information about FDA’s Defect Action Levels can be found at www.cfsan.fda.gov/~dms/dalbook.html.

ASTA adopted its first Cleanliness Specifications for Spices, Seeds, and Herbs (Foreign and Domestically Produced) in 1969. Subsequent revisions in the late 1980s and early ’90s produced a unified set of macroscopic standards which are at least as stringent as and certainly more comprehensive than FDA’s Defect Action Levels. ASTA’s standards (available at www.astaspice.org/pubs/genpubs.cfm) are used throughout the world today and provide the basis for many macroscopic spice specifications at all levels of the food industry.

As ASTA’s members sought cleaner and better raw materials, they realized early on that the source or producing countries needed to be more aware of the standards and specifications demanded by FDA, ASTA, and the food processors in the U.S. Therefore, the trade association embarked on a program in the 1980s to send members to producing countries to “educate the growers and exporters.” This educational program became known as the Clean Spices Program. It was felt strongly that if the quality could be improved at the source, then the value of exports would be higher and FDA detention and the need for re cleaning of the product in the U.S. would be eliminated or at least minimized.

The program was very successful, as missions to large producing countries such as Egypt, India, and Turkey saw substantial improvement in their exports. The improvement in quality entering the major markets led to a closer relationship between suppliers and buyers. In most cases, suppliers were able to receive a true and full market value for their products. Additionally, new opportunities were created for investment in source countries for value-added products.

As in any business, the reliability of the supplier is very important. The buyer expects that the shipment will meet the specifications on which the purchase order was based. The terms and conditions must also be met. As with many commodities, some unreliable and unscrupulous shippers will try to avoid the terms of a contract, particularly when the market price has increased. Their excuse is usually that their supply is not available, and the game being played is to force the buyer to increase the price. Alternatively, some buyers will falsely claim that the merchandise does not meet the purchase contract specifications in terms of quality and therefore they discount their payment. These types of fraudulent actions happen less and less today. However, there are importers and traders who feel that they can take advantage of a shipper located many miles away. For this reason, ASTA maintains a strong and credible arbitration process through which contract disputes are settled. By and large today, most suppliers and importers honor the terms of the contract, and problems are settled quickly and amicably.

The Market Expands

Like the rest of the food industry, the spice industry in the U.S. has seen significant consolidation over the past 15–20 years. Until the mid-1980s, many large national and smaller regional companies processed and packaged spices and seasonings for the industrial, foodservice, institutional, and retail trades. These included well-known household brand names, such as McCormick, Schilling, Spice Islands, French’s, Durkee, and Tone’s. Many smaller brand names have disappeared today through mergers and acquisitions and consolidation with other brands.

The industry giant, McCormick & Co., has increased its market share in the U.S. and worldwide. Its share of the U.S. spice and seasoning market as a whole—including industrial, foodservice/institutional, and retail/consumer—is estimated to be in excess of 40%, and its market share of the retail/consumer trade alone is estimated to be significantly higher than 50%. Its worldwide market share was increased significantly in 2000 through the acquisition of the French company Ducros, the largest spice company in Europe.

--- PAGE BREAK ---

Consolidation of the spice industry since the 1980s has spawned a number of new, smaller spice processors. Many of them cater to a premium market, which is high end and includes organic and natural products. Some of these companies and others, such as seasoning manufacturers like Newly Weds Foods and Griffith Laboratories, have been able to carve out a profitable niche. They were able to find selected markets in the industrial and food sectors of the food industry, as well as a ready private-label market, with accounts such as Whole Foods and Dean & Deluca. Other spice retailers, such as The Spice Hunter, Morton & Bassett, Vann’s Spices Ltd., and Penzey’s Spices, have been able to position themselves as high-end niche players in the retail trade. This niche market grew extensively in the 1990s as specialty food retailing expanded and the natural foods and organic segment multiplied.

With a growing recognition of the importance of this new market segment, exporters and domestic growers now realize that there is an increasing demand for some special or premium products, especially organic spices and herbs. This allows them to obtain premium pricing, in some cases as much as 30% above their average product pricing. Both food processors and consumers have an expanding interest in and ability to pay for premium products. As a result, spice processors who realize this trend are now contracting with growers/exporters for an ever-expanding range of premium and organic products.

Spice exporters and growers are also continually examining ways of adding value to their products by developing further-processed products ready for use by the seasoning manufacturer or food processor, intermediary products which can be used as ingredients with little or no further processing, or new items, all of which give added value, instead of shipping raw agricultural materials. The following are some examples:

• The production of allspice berry oil in Jamaica for use as an ingredient in food and liquors.

• The processing of spices and spice blends in countries such as Turkey, Lebanon, and Egypt, some of which is shipped in bulk for further use as an ingredient or in retail production in the U.S. and Europe, and some of which is packaged ready to market to the consumer.

• The production of botanical and herbal teas in overseas countries, some of which are at a quality and specifications level ready to be used without further processing in the production of teas in the U.S. and Europe.

• The production of infused olive oils, using herbs and essential oils from herbs to create a specialty gourmet food.

Meeting Consumer Desires

As consumers continue to seek to healthy lifestyles, they have become more skeptical about their nutritional intake. The appeal of natural products such as herbs and spices, with their implied product safety and contributions to wellness, is driving the consumer interest in these items. Consumers continue to reduce their intake of salt in their daily diet and continue to increase the use of spices to provide desired taste and flavor. Additionally, various ethnic groups who have migrated into the U.S have brought many of their culture’s dishes with them. Some have been able capture the mainstream consumer because these cuisines are tasty and healthy. One such group is the Hispanics, the fastest-growing ethnic group in the U.S. All of these trends have contributed to an expansion of the market for spices and seasonings in the U.S.

The American market for spices, herbs, and seasonings will continue to grow at an impressive pace, whether it is through ice cream or beverage manufacturers’ using more vanilla, pastry manufacturers’ demanding more cinnamon, food processors’ using more spices and seasonings to differentiate their prepared and frozen foods, or fast-food chains and bakeries’ requiring more seeds on their buns. The driving force is that today, more than ever before, the consumer continues to demand healthier and better-tasting products. Herbs and spices will continue to play an expanded and important role in meeting these consumer demands.

Author Furth, former CEO of the American Spice Trade Association, is CEO, FFF Associates, Inc., 1127 High Ridge Rd., PMB 137, Stamford, CT 06905 1203. Author Cox, former Chairman of ASTA’s International Group and Senior Consultant to FFF Associates, Inc., is President, International Trade Promotion Ltd., 295 Madison Ave., Suite 1125, New York, NY 10017. Send reprint requests to author Furth ([email protected]).

References

ASTA. 2001. Statistics report. Am. Spice Trade Assn., Washington, D.C.

Beckwith, H. 1000. b�0;0;0;0;0;0;0;0;0;0;0;0;0;1C;The Invisible Touch.b�0;0;0;0;0;0;0;0;0;0;0;0;0;1D; Warner Books, New York.

Buzzanell, P.J., Dull, R., and Gray, F. 1995. The Spice Market in the United States: Recent Developments and Prospects. Agriculture Information Bull. 709, July. U.S. Dept. of Agriculture, Washington, D.C.

FAS. 2004. HS 10-digit imports. Foreign Agricultural Service, U.S. Dept. of Agriculture, www.fas.usda.gov/ustrade/USTImHS10.asp?QI=.

UNCTAD/WTO. 2002. Global spice marketsb�0;0;0;0;0;0;0;0;0;0;0;0;0;14;Imports 1996b�0;0;0;0;0;0;0;0;0;0;0;0;0;13;2000. Market Development Section, International Trade Centre, United Nations Conference on Trade and Development/World Trade Organization, Geneva, Switzerland.