Top 10 Functional Food Trends

From super-satiating smoothies to mood-enhancing bars, functional foods are targeting a broadening assortment of consumer health and wellness needs.

Health is on the front burner as Americans return to tried and true practices that they believe will be effective in helping them to stay fit and healthy. Influenced by the recession and a new belief that maintaining their health is a long-term method of cost control, today’s “do-it-yourself,” wellness-focused consumers are turning to functional foods and beverages in record numbers. In 2009, nearly half (46%) of food shoppers said they were very concerned about nutrition, up 5% over 2008 (FMI, 2009). Vitamins enjoyed solid gains in unit sales in food, drug, and mass retailers, including Wal-Mart, up 5.7% for the year ended (Y/E) 2/10/10 (IRI, 2010a).

Healthful positioning was a dominant factor in the success of new foods and drinks that reached blockbuster sales status in 2009. Campbell’s Select Harvest soup, “made with real ingredients and no artificial or MSG added,” topped Information Resources Inc.’s (IRI) Pacesetter list of the most successful new product introductions in 2009, with year one sales of $202 million in food, drug, and mass channels excluding Wal-Mart (FDMx) (IRI, 2010b). Bud Light Lime ranked second with sales of $133 million, followed by multi-grain Arnold Select Sandwich Thins, $87 million; Green Giant Valley Fresh Steamers, $85 million; Dreyer’s/Edy’s Fun Flavors, $72 million; Gatorade Tiger/Focus, $65 million; Miller’s MGD 64, $53 million; Mountain Dew DEWmocracy, $52 million; Bush’s Grillin’ Beans, $45 million; and Kellogg’s FiberPlus bars with added antioxidants, $35 million (IRI, 2010b).

Healthful positioning was a dominant factor in the success of new foods and drinks that reached blockbuster sales status in 2009. Campbell’s Select Harvest soup, “made with real ingredients and no artificial or MSG added,” topped Information Resources Inc.’s (IRI) Pacesetter list of the most successful new product introductions in 2009, with year one sales of $202 million in food, drug, and mass channels excluding Wal-Mart (FDMx) (IRI, 2010b). Bud Light Lime ranked second with sales of $133 million, followed by multi-grain Arnold Select Sandwich Thins, $87 million; Green Giant Valley Fresh Steamers, $85 million; Dreyer’s/Edy’s Fun Flavors, $72 million; Gatorade Tiger/Focus, $65 million; Miller’s MGD 64, $53 million; Mountain Dew DEWmocracy, $52 million; Bush’s Grillin’ Beans, $45 million; and Kellogg’s FiberPlus bars with added antioxidants, $35 million (IRI, 2010b).

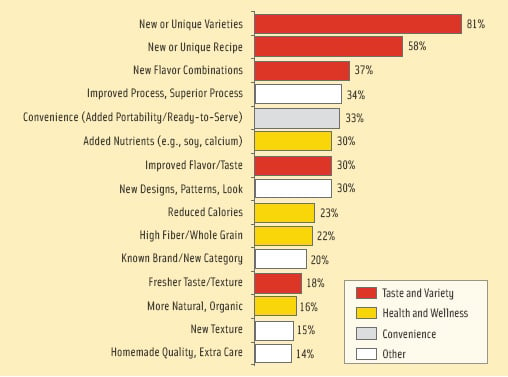

One in three (30%) of the new food products on IRI’s Pacesetters list (criteria for inclusion on the list is first-year sales in excess of $7.5 million) carried an added nutrient claim, e.g., calcium, soy, etc.; 23% made a reduced-calorie claim; and 22% a high-fiber/whole-grain claim (IRI, 2010b; Figure 1).

One in three (30%) of the new food products on IRI’s Pacesetters list (criteria for inclusion on the list is first-year sales in excess of $7.5 million) carried an added nutrient claim, e.g., calcium, soy, etc.; 23% made a reduced-calorie claim; and 22% a high-fiber/whole-grain claim (IRI, 2010b; Figure 1).

U.S. sales of functional foods and beverages reached $37.4 billion in 2009, up 2.7% over the prior year (NBJ, 2010). While down from an 8% gain in 2008, functional products still outpaced the overall food industry growth rate of 1.6%. At $21.6 billion, beverages remain the largest functional products segment, up 3%. The $6.7 billion functional breads/grains category grew 3%; the $2.7 billion snack food and $1.8 billion dairy segments were both up 2%; and the $4.4 billion packaged/prepared foods sector rose 1% (NBJ, 2010). Six in 10 adults bought a functional food or drink in 2009, up from 48% who did so in 2008 (Mintel, 2009a). Cereal with a heart-health/cholesterol claim (chosen by 54% of consumers) or cereal with a fortified claim (bought by 52%) were the most-purchased functional foods in 2009, followed by heart-healthy margarines/spreads (44%), fortified yogurt (32%), nutrition bars (29%), prebiotic/probiotic yogurt (20%), and eggs with omega-3 fatty acids (18%) (Mintel, 2009a).

Fifty-eight percent of consumers said they consumed a functional food last year in order to supplement their diet; 38% did so for digestive health, 36% weight loss, 35% to address a specific health issue, 24% for an energy boost, 17% for mental focus, and 14% to eliminate stress (Mintel, 2009a). The top two reasons for non-use involve the believability of claims and the perceived higher expense.

Four in 10 food shoppers (42%) choose foods for specific medical purposes; 42% do so to provide a protective/preventive health benefit; and 35% choose them to improve their daily performance (HealthFocus, 2009). More than half (51%) said they read a label the first time they bought a food product (FDA, 2010).

“Retaining mental sharpness as I age” tops the list of health issues consumers are extremely/very concerned about, with 65% expressing interest for this reason, followed by heart disease (62%), cancer (61%), bone health/strength (61% ), maintaining ability to continue with normal activity while aging (59%), eye health (57%), arthritis (53%), appearance/skin health (51%), joint health (51%), and tiredness (50%) (HealthFocus, 2009).

Globally, vitamin/mineral fortification, gut health, and energy/alertness were the top functional food categories for new product introductions last year; in North America, digestion, vitamin/mineral fortification, heart health, and energy topped the list in 2009 (Innova, 2010). Read on for a detailed look at the Top 10 Functional Food Trends of 2010.

--- PAGE BREAK ---

1 Retro Health

Americans continue to demonstrate their voracious appetite for “avoidance” foods as they seek to make choices that are lower in fat, calories, and sodium and to refocus on traditional strategies for improving their diets. Thus, it’s no surprise that information about a product’s fat content is very important to consumers; in 2009, 58% sought information on trans fat content, and 56% wanted to know saturated fat content and overall fat content, according to Food Marketing Institute data. Calorie count and salt/sodium content were very important to 49% of consumers and sugar/artificial sweeteners very important to 47%. Rounding out the list of concerns were cholesterol, very important to 44%, and carbohydrates, very important to 38% (FMI, 2009).

Food products with claims about fat content again dominated the healthy market segment with sales of $46 billion for Y/E 12/27/09, down a modest 3%, resulting from a decrease in milk consumption due to high prices (Nielsen, 2010). Foods that promised to lower cholesterol lost ground in 2009, with sales falling 5% to $10.6 billion, likely affected by the increased use of statin drugs (Nielsen, 2010). Products that made a reduced-calorie claim enjoyed a 6% sales bump to $11.7 billion in 2009; those with sodium claims remained flat with sales of $14.9 billion; and the $1.8 billion low-carb category fell 5% (Nielsen, 2010).

Whole grains once again topped the list of the most sought after package claims as ancient grains continued to gain appeal among grocery shoppers. American Culinary Federation (ACF) chefs named quinoa the No. 1 side dish for 2010, also citing brown rice, buckwheat, barley, and lentils (NRA, 2009a).

Consumers are increasingly attuned to protein content; it is now very important to 39% (FMI, 2009). Seven in 10 adults (69%) made a strong effort/some effort to eat fortified foods in 2009, and 39% took that approach with fortified beverages (MSI, 2009). Fiber, omega-3 fatty acids, vitamins, calcium, and antioxidants are the top five ingredients consumers sought in a functional food in 2009 (Mintel, 2009a). Dollar sales of foods/beverages touting an omega-3 claim jumped 42% for Y/E 12/27/09 (Nielsen, 2010). A recent review by the American Heart Assn. will clear the way for omega-6 (AHA, 2010).

Nearly one-third (31%) of consumers are eating more fish and seafood at home and in restaurants (Mintel, 2008a). Just over four in 10 adults plan to order more baked, grilled, and broiled items; only 4% are seeking more deep-fried foods (Technomic, 2009a). Sales of French fries have dropped 14% over the past five years (Rhynalds, 2010).

Moreover, consumers have embraced nutrient-retaining microwave steaming technology. Steam-in-bag frozen vegetables are credited with a 14% jump in the frozen side dish category for Y/E 12/27/09 (Angrisani, 2010). Half (47%) of consumers believe frozen is as nutritious as fresh (IRI, 2008a).

2 Naturally Functional

Delivering health benefits by blending foods/drinks naturally high in nutrients and phytochemicals to achieve an end health benefit—as with Green Giant’s new Healthy Heart frozen vegetables, Campbell’s V8 Fusion juices, or Blue Bunny’s Light Superfruit yogurts—is clearly the most viable functional foods strategy.

Nearly nine in 10 shoppers (88%) say it is very important to eat foods naturally rich in nutrients; 53% say that it is very important to consume fortified foods (HealthFocus, 2009). Delivering electrolytes naturally in sports drinks, e.g., with coconut juice, is among the hot new “naturally functional” trends.

Antioxidants remain a kingpin in naturally functional foods; 53% of adults bought a food/drink for antioxidants in 2009 (Packaged Facts, 2009). The American Heart Assn. does not recommend use of antioxidant vitamin supplements, but consumers continue to strongly associate antioxidants with heart health benefits and also to make health linkages with antioxidants and cancer, free radicals, aging, and skin, according to the Sloan Trends TrendSense™ model (Sloan, 2010).

--- PAGE BREAK ---

Interest in phytochemicals reached mass market status in 2008 (Sloan, 2010). Eight in 10 consumers (80%) believe phytochemicals help with existing health problems, 74% believe they reduce risk of disease in the long term, and 56% think that they can replace some drugs (HealthFocus, 2009). Flavonoids and polyphenols are currently the strongest mass market phytochemical ingredients; carotenoids, resveratrol, and anthocyanins are the next up-andcoming wave (Sloan, 2010). Enhancing bioavailability by mixing phytochemicals is the latest new formulation direction.

Again this past year, ACF ranked superfruits—açai, goji berry, mangosteen, and purslane—11th overall on their hot list (NRA, 2009a). Superfruit shots like Pom Wonderful’s POMx Shot represent an exciting new direction in product development. Spices/seasonings will be the next generation of superfoods (Sloan, 2010).

Food/drinks with pulp or real fruit additions, e.g., Fruit2day with “real fruit bits,” represent another new trend. Flower syrups/essences and flower aromas, e.g., lavender, orange blossom, and rose, are healthy culinary and confectionery trends.

Lastly, sales of food products carrying a natural claim reached $22.8 billion in 2009, up 4% vs 2008 and outselling organics by more than four to one in mass channels (Nielsen, 2010). Organic sales growth dropped 2.1% in traditional channels and 4.3% in natural channels, but still totaled $6.2 billion. Private-label/store-brand organics grew to capture 24% of category sales (Nielsen, 2010).

3 Functional Fill-ins

Slightly fewer than one-third (31%) of consumers feel that snacks are an important part of a healthy eating plan; 40% are looking for snacks that go beyond basic nutrition (Lyons, 2010). Perhaps most exciting for the healthy snack segment is the fact that young adults—those ages 18–24, followed by those ages 25–34—are now regularly making the most-frequent healthy snack choices (Mintel, 2008b). Healthier snacks continue to outpace indulgent snacks, with 2009 sales volume up 1% while indulgent snack volume fell 1%. Overall, sales in the snack category fell 1% (Lyons, 2010).

Grain led the list of the fastest-growing wellness attributes in the snack category last year, followed by low-fat, low-sodium, and low-calorie. In 2010, 57% of consumers are looking for snacks with no trans fat, 48% low-fat, 44% low-sugar, and 43% whole-grain/low-sodium/low-calorie. An impressive 62% are looking for added nutrients in their snacks, up 19% over 2008 (Lyons, 2010).

Trail mixes, sugarless gum, dry fruit snacks, sensible salty snacks, and picante sauce were other bright spots in the snack market. Indulgent products including chocolate-covered salty snacks, refrigerated/frozen appetizers/snack rolls, upscale salty snacks, and toaster pastries also performed well in the marketplace, suggesting opportunities for marketers with more-healthful versions of such offerings (Lyons, 2010). Candy and gum sales were up 4.3% for Y/E 12/29/09 (NCA, 2010).

While healthier candies (e.g., sugar-/gluten-/allergy-free, all-natural/organic) are racking up strong sales around the globe, the functional segment is exploding. Candies focused on boosting immunity/energy, aiding digestion with prebiotics/probiotics, easing sore throats, promoting sleep, assisting with weight control/satiety, and supporting skin care are coming on strong. Candy makers around the globe are formulating sweet treats with antioxidants, fruits/vegetables, flowers, smoothies, real juice, and yogurt (Innova, 2010).

Although half (50%) of consumers are trying to control portion size when snacking, two-thirds of those with household incomes of $55,000 or less cut back on 100-calorie portion packs (IRI, 2009b). With 39% looking for snacks that satisfy a specific craving and 29% seeking to satisfy immediate hunger, satiety for weight loss and snacking is a natural fit for snack positioning (Lyons, 2010). Half (53%) of adults want weight-control food products focused on satiety (Mintel, 2009a).

Lastly, healthful restaurant snacks represent an enormous untapped market, ranking third on the hot list for quick-service operators in 2010 (NRA, 2009b). In quick-service outlets, the average snack price is $3.53, rivaling breakfast at $3.89 (NPD, 2009a).

--- PAGE BREAK ---

4 Prime Timers

There are currently 100.7 million Americans age 50 or older; 31 million adults will turn age 65 in the next decade. Ironically, use of functional foods/beverages declines with age, although when they do use them, older consumers tend to consume them more regularly (Mintel, 2009a). Eight in 10 (79%) of those ages 18–24 used functional foods/drinks in 2009 vs 41% of those ages 55–64 and 37% of those 65+.

Older adults also are the least likely to believe in phytochemicals and to use fortified foods (HealthFocus, 2009). They are the heaviest users of dietary supplements. Seniors are twice as likely as the rest of the population to consume omega-3s, vitamin E, and calcium; they are heavy users of vitamins C, B-12, and B complex and of herbals and antioxidants (Packaged Facts, 2008).

“To address a specific health concern” (cited by 46%) is the top reason consumers age 65+ buy a functional food, followed by “to supplement my diet” (41%), and weight loss/digestion (28%) (Mintel, 2009a). Margarine/spreads with heart/cholesterol claims are the functional food most purchased by older consumers, followed by cereal with cholesterol claims/fortified cereal. Yogurt with a cholesterol-lowering claim was a distant third (Mintel, 2009a).

In fact, lowering cholesterol is the top benefit those 65+ say they would like in a functional food (cited by 78%). Other desired benefits include immunity (cited by 66%); digestion and lower blood pressure (each cited by 65%); maintaining a healthy weight (64%); and promoting healthy blood sugar levels (61%) (Mintel, 2009a).

Retaining mental sharpness tops the list of health concerns for those 50+, followed by avoiding heart disease, preventing cancer, maintaining bone health/strength, and preserving the ability to continue with normal activity. Eye health, arthritis, skin health, joint health, and tiredness are other concerns (HealthFocus, 2009).

Six in 10 of those age 65+ suffer from arthritis, half from high cholesterol, one-third from osteoporosis, and one in five from diabetes (IRI, 2008b). Eye and gastrointestinal problems were the biggest gainers in self-reported conditions in this age group over the past two years (HealthFocus, 2009). As baby boomers confront a greater risk of heart attack and stroke, ingredients such as cocoa flavanols, which increase circulation and prevent dangerous clots, will find a receptive audience.

Older adults are the most likely to be on a special diet. Of those 65+, 38% are on a low-fat diet, 34% low-salt, 28% low-sugar, and 26% high-fiber (IRI, 2008b). Half of those ages 55–64 have hypertension, two-thirds of those 65+ are hypertensive (AHA, 2010a).

Those 50+ are the fastest-growing group of exercisers. Walking is their most popular sport; weightlifting the fastest-growing (NSGA, 2009). While older adults index among the lowest for use of sports/energy drinks, liquid nutritional supplements, and nutrition bars, they’re as likely to select foods for energy and sport as those ages 18–29 (HealthFocus, 2009).

Boomers are nearly twice as likely as the rest of the population to be overweight and to be currently trying to lose weight (Harris Interactive, 2008). They’re more likely to restrict their diet to lose weight, making portion-controlled and high-satiety products well suited for this group.

Products to promote body toning are now crossing over from the sports nutrition category and are right on target for boomers whose muscle tone isn’t what it used to be. No doubt that products to prevent age-related muscle loss (sarcopenia), which causes frailty and falls, will be another promising functional food/drink market segment.

--- PAGE BREAK ---

5 Chemical Warfare

Serious concerns about chemicals, additives, preservatives, and artificial colors in foods are mounting. In fact, 30% of consumers cite chemicals in foods as the most important food safety issue today, compared with 52% who name bacteria (IFIC, 2009).

Just over four in ten grocery shoppers (44%) say no chemical additives claims are very important, up 7% in 2009 over 2008; 34% of shoppers ranked no preservatives as very important, up 6% (FMI, 2009).

Globally, no additives/preservatives leads the list of better-for-you claims; in the United States, this claim ranks third, behind natural and organic (Innova, 2010). Antibiotics and hormones used on poultry and live-stock—considered a serious health hazard by more than one-third (36%) of shoppers—saw the biggest increase in consumer concern levels in 2009, up 9% over 2008 (FMI, 2009). Sales of products with no hormone/antibiotic-free claims—a $2.2 billion category—fell 2% for Y/E 12/27/09, more a reflection of milk pricing than an indicator of a shift in consumer preferences (Nielsen, 2010).

One-quarter (25%) of shoppers believe that biotechnology and genetically modified organisms pose a serious health risk, up 5% in 2009 vs 2008. In 2009, 31% of shoppers stopped purchasing certain food items due to safety concerns—up from 27% in 2008 (FMI, 2009).

Half of shoppers (51%) are extremely/very concerned about flavor enhancers such as monosodium glutamate (MSG), and 44% are concerned about artificial flavors (HealthFocus, 2009).

Calories from added ingredients are an extremely/very important concern to 51% of shoppers. Eight in 10 consumers tried to consume fewer added sugars in 2009; 68% attempted to consume less high fructose corn syrup (HFCS) (HealthFocus, 2009). Nielsen reports that sales of HFCS-free products reached $13 billion in 2009, up 28% vs the prior year (Nielsen, 2010).

Wariness about artificial sweeteners continues to grow; 45% of consumers are very/extremely concerned about ingesting them (HealthFocus, 2009). Six in 10 consumers (62%) who check the ingredient listing on foods look for a description of the sweetener content, just behind those who check the fat profile (IFIC, 2009).

In 2009, sales of gluten-free products rose 16% over the prior year to $1.7 billion (Nielsen, 2010). One in 10 consumers (11%) look for allergen information on labels; 16% of those who check the ingredient listing do so (IFIC, 2009). Three-quarters (74%) of ACF chefs ranked gluten-free as a hot issue for restaurants in 2010; 54% of quick-service restaurant operators did so (NRA, 2009a, b). Massachusetts is among the first states to require training of restaurant employees to help prevent allergic reactions (Elan, 2010).

Concern over chemicals migrating from packaging is poised to be another explosive issue as microwave steamer technology gains in popularity and brings foods into closer contact with packaging. Bisphenol A has already been banned in Connecticut, Washington, Minnesota, and Wisconsin; bans are pending in Illinois, California, Maryland, Massachusetts, and Oregon.

Lastly, 58% of consumers are not at all or not too comfortable with food grown or raised outside of the U.S. (FMI, 2009). Three-quarters (73%) are very/extremely concerned about foods from China; for Southeast Asia, the figure is 51%, Mexico 49%, and India 43%.

--- PAGE BREAK ---

6 Ailing Adolescents

As America raises its first generation of overweight kids, the demand—not only for more-healthful products for children, but also for products that will help prevent and perhaps even treat risk factors for serious diseases later in life—will escalate. One in 10 children is already afflicted with a chronic ailment (Van Cleave et. al., 2010).

One in eight kids has two or more risk factors for heart disease; one in 10 teens has high cholesterol; and 24% of boys and 16% of girls have at least one abnormal lipid level (CDC, 2010). Moreover, the American Academy of Pediatrics (AAP) and the American Heart Assn. recommend treatment of these risk factors with prescription medications. Although medical authorities now approve use of a lower-fat diet for children, low-fat kids’ foods have not yet become an industry norm.

One in three children is overweight, and one in five is obese. Perhaps most surprisingly, one in seven pre-schoolers is obese, which indicates a clear need for infant and toddler foods positioned to address this situation (AAP, 2010). And the pressure will get greater still. Recent AAP physician guidelines call for monitoring calcium and blood pressure in children beginning at age three and taking a lipid profile between the ages of two and eight (AAP, 2010).

Not surprisingly, two-thirds (67%) of mothers of children under age 12 monitor their child’s diet very closely, up 11% since 2004 (MSI, 2008a). Moms are making a strong effort to limit caffeine (56%), sugar (37%), HFCS (37%), trans fat (36%), low-/no-calorie sweeteners (35%), and artificial colors (27%).

Thirty-eight percent of moms report trying to increase calcium in pre-teens’ diets followed by vitamins/minerals (36%), whole grains (35%), vitamin D (33%), vitamin C (33%), fiber (25%), and omega-3 (20%) (MSI, 2008a). Nearly two-thirds (64%) of families with children practice some sort of healthy eating strategy, led by eating more fruits/vegetables, whole grains, and low-fat dairy; avoiding trans fats; monitoring portion sizes and sugar/sweets; and including more fish/seafood in their diets (FMI, 2008).

With more than one-quarter (27%) of the calories consumed by children coming from snacks, it’s not surprising that parents are focused on healthier snack choices (Piernes, 2010). Half (49%) of parents would like the industry to offer more snacks with added nutrients; 57% smaller portion sizes; 44% fresh, un-processed items; 37% low-fat products; and 32% lower-calorie snacks (Lyons, 2010).

Mothers of pre-teens report strong interest in purchasing beverages that are specially formulated to build strong bones (68%), aid in brain development/function (65%), provide vitamins/minerals (64%), strengthen the immune system (57%), and promote a healthy digestive tract (51%) (MSI, 2008b).

7 Meddling in Medications

The rising cost of prescription and over-the-counter medications coupled with fear of their side effects has prompted consumers to look for more natural medical solutions, including functional foods. More than eight in 10 consumers (84%) believe that functional foods/drinks are very or somewhat helpful in preventing or delaying hypertension (MSI, 2009a). Two-thirds (64%) of adults would like to see more cholesterol-lowering products; 54% would like to see more products to help reduce blood pressure (Mintel, 2009a).

Eight in 10 food shoppers (83%) know that whole grains can benefit their heart; 78% are aware of the benefits of B vitamins and heart health, 70% folic acid, and 45% plant sterols (Angrisani, 2010). Plant sterols, omega-3s, omega-6s, calcium, magnesium, peptides, potassium, and fiber remain key heart health ingredients worldwide (Innova, 2010).

One-quarter (25%) of adults bought a functional food/beverage for digestive health in 2009; one in five (20%) purchased a prebiotic/probiotic yogurt (Mintel, 2009a). In unaided research, however, consumers are nearly eight times more likely to associate dietary fiber with digestive health than they are to link probiotics with digestive benefits (MSI, 2009). With half (47%) of consumers looking for added fiber in functional foods and 15% seeking it in functional beverages, super fibers and prebiotic ingredients are an untapped digestive health opportunity. Low-acid foods such as the very successful Folgers Simply Smooth Coffee represent another approach to targeting consumers concerned about their digestive health.

More than 80 million people suffer from arthritis or some form of joint pain, so it is safe to predict that functional joint health products will be in demand. One in 10 consumers looks for glucosamine in a functional food, 12% in a beverage (Mintel, 2009a).

With 1.6 million new cases of diabetes a year, 57 million adults with pre-diabetes, and a strong belief among consumers that blood sugar swings cause energy loss, cravings, and mood swings, products that promote healthy blood sugar levels will be well positioned; 53% of consumers would like to see more such products (Mintel, 2009).

Sleep problems regularly plague nearly 70 million Americans, and concern about side effects from sleep medications is growing, which suggests that foods and beverages that help promote sleep represent a promising market opportunity. Dreamerz Foods’ Dreamerz™ Chocolate Pillows is one such product now on the market.

--- PAGE BREAK ---

8 Daily Dynamics

Functional foods and beverages have long been recognized for their ability to serve as effective lifestyle aids—delivering benefits that range from improving everyday performance to affecting beauty and exercise routines. Energy is second only to taste on the list of reasons for buying a functional beverage (Mintel, 2009b). Low-calorie/low-sugar, sugar-free, naturally sweetened, all natural, and long-lasting are all on the list of key attributes that consumers seek in energy beverages.

In 2009, functional sodas, waters, and sports/energy drinks racked up sales of $13.7 billion, a 4% increase over the prior year, but the lowest growth rate since they came onto the market (NBJ, 2010). Makers of functional beverages are serving up multiple benefits in a single product. Watch for energy beverages that also offer immunity, mental acuity, and anti-aging benefits and sports drinks with weight loss, digestive health, and even exercise enhancers targeted to specific dayparts (Innova, 2010).

Nearly half (47%) of functional food/drink users want more products that enhance memory; 41% seek offerings that improve mental focus. In 2009, 17% bought a functional food for mental focus, 23% purchased a beverage seeking that benefit. Most important, 62% say functional foods are very effective in preventing/delaying normal age-related memory loss (MSI, 2009).

One in five adults (20%) used a functional drink to alleviate stress in 2009; 14% consumed a functional food for that purpose. Moreover, 44% would like to see more relaxation/anti-stress options, including more than half (53%) of those ages 18–24 (Mintel, 2009a, b). Half (52%) of consumers associate tea with relieving stress and tension (MSI, 2009).

Mood-enhancing foods/beverages are in demand; 31% of consumers want to see more of them (Mintel, 2009a). With one-quarter of dieters reporting mood/stress a barrier to losing weight, multi-functional products that reduce stress and boost energy/mood should find a receptive audience (IFIC, 2009).

Nearly two-thirds (64%) of adults want more functional foods that help them to maintain/lose weight; 54% seek products that enhance metabolism (Mintel, 2009a). Watch as body-building protein powders, once targeted mainly to serious athletes, cross over to mainstream use.

Meal replacement bars/beverages continue to fill a strong need. Although most bars (58%) are still eaten as a snack, 40% are regularly used as a meal replacement (Mintel, 2009a). About one in 10 bar consumers (13%) eat smaller meals frequently throughout the day; this group mostly skews younger (Mintel, 2009c).

Sports performance remains a strong bar market segment: 47% of bar users purchase them to help with exercise recovery, 39% to build muscle, and 30% for their protein content (Mintel, 2009d). Nearly six out of 10 (59%) of consumers are now aware of amino acids; 39% are aware of whey protein benefits (MSI, 2009).

Nearly one in three (30%) bought a functional food or beverage in 2009 for improving their appearance/beauty; 38% would like to see more products that help make facial skin look younger; those ages 35–44 were the most interested (Mintel, 2009a).

9 Get the Lowdown

Lower-income shoppers, the fastest-growing income group, are projected to generate $84 billion in incremental consumer product goods spending over the next decade (IRI, 2009b). Despite the size and scope of this market, however, marketers of healthful products have failed to accord it the attention it deserves.

In 2010, 39% of all U.S. households are estimated to have total income of less than $35,000; 20% have incomes of $35,000–$55,000; and 40% have incomes of more than $55,000. The average household income is $48,000; 60% of households have income below that level (IRI, 2009b).

--- PAGE BREAK ---

Healthy foods are very important to 76% of lower-income consumers (IRI, 2009b). Half of households with incomes under $55,000 reported difficulty simply buying the groceries they needed last year (IRI, 2009a). Still, however, only 38% of households with incomes of less than $35,000 reported purchasing fewer healthy products (IRI, 2009b).

Concern about eating more healthfully is growing among lower-income consumers; 42% of grocery shoppers in households with incomes of less than $35,000 say they are very concerned about nutrition, up 6% from 2008; in households with incomes in the range of $25,000–$35,000, that total was up 14%. Moreover, the attitude of lower-income consumers is not substantially different from that of middle-income consumers, 45% of whom categorized themselves as very concerned about nutrition (FMI, 2009). One-third (31%) of those in households with income of less than $15,000 feel their diet could be a lot healthier; 18% of those in the $25,000–$35,000 bracket feel that way (FMI, 2009).

Members of lower-income households are also interested in healthy products: 57% of those with household incomes of less than $50,000 report interest in products with no trans fats, 55% in low-cholesterol products, 46% low-calorie, 48% lower-fat, 54% lower-sodium, 48% all-natural, 44% low-sugar, and 41% low-carb (Mintel, 2009e).

Shoppers with household incomes of $30-$59,000 are just as likely as members of higher-income groups to prefer to buy foods/beverages with specific nutritional benefits rather than taking supplements. Within this segment, 50% say they bought an item for antioxidants, 47% for vitamins/minerals, 40% calcium, 36% fiber, 29% protein, and 26% omegas (Packaged Facts, 2009).

Of those with household incomes of less than $50,000, 80% have purchased drinks for special nutritional reasons: 51% orange juice, 45% cranberry juice, 40% green tea, 24% pomegranate, 22% red wine, 19% black tea beverages, and 16% yogurt drinks (Packaged Facts, 2009).

Lower-income shoppers will be the single most important target audience for private-label products for the next five years (IRI, 2009b). Store-branded foods/drinks carrying a health claim enjoyed impressive growth in 2009, albeit in smaller dollar categories. Private-label now accounts for 40% of products with no-preservative claims and one-fifth of those with natural and fat reduction claims in traditional channels (Nielsen, 2010).

For Y/E 12/27/09, sales of store-branded, GMO-free foods/beverages in traditional channels jumped 67% to $60 million; for gluten-free store brands, sales were up 62% to $279 million; and sales of store-brand probiotics climbed 39% to $79 million (Nielsen, 2010).

10 Finally Foodservice

Restaurant operators are putting more healthful choices on the menu—something that consumers say they are craving. Three-quarters (73%) of adults say they’re eating healthier away from home than they did two years ago (NRA, 2010a).

Nutritionally balanced children’s dishes ranked sixth overall among ACF chefs’ hot trends for 2010; gluten-free food/allergy consciousness ranked ninth; organic produce was 12th; and fruit/vegetable children’s side dishes were 20th (NRA, 2009a).

--- PAGE BREAK ---

Healthy options in kids’ meals were the No. 1 hot food trend for 2010 in the quick-service segment, cited by 72% of all operators (NRA, 2009b). Energy drinks, gluten-free products, organics, sports drinks, smoothies, lower-calorie offerings, whole-grain bread, lower-fat items, side fruit, vegetarian entrees, and entrée salads also made the Top 25 list.

Nearly two-thirds of quick-service restaurant operators are offering more healthful children’s choices than they did two years ago; this is true for 47% of family-oriented restaurants, two in five casual restaurants, and one-third of fine dining establishments (NRA, 2010a).

Foodservice patrons draw a strong correlation between freshness and healthfulness. Fresh ingredients are important when choosing a healthy restaurant meal for 49% of diners; lower-fat offerings are important to 39%; more vegetables important to 29%; lower-calorie important to 26%; and made with natural, non-processed ingredients important to 23% (Mintel, 2009e). Only 17% of menu items that use fresh produce carry a “fresh” descriptor on the menu, which suggests that foodservice operators are missing an opportunity to tout healthful products (FRI, 2010).

About one-third of consumers (34%) regularly try to avoid trans fat when dining out; 33% practice portion control; 33% avoid sweets/desserts; 30% minimize eating fried foods; 28% cut fat intake; 20% avoid fried foods all together; 19% avoid processed foods; and 17% avoid carbohydrates (Technomic, 2009a).

Half of consumers who visited a restaurant with posted nutrition information said it had a great impact or somewhat of an effect on what they ordered; 34% said it affected where they dined (Technomic, 2009b). After seeing nutrition information, 61% of diners opted for a lower-calorie alternative, and 36% chose smaller portions.

Moreover, if a menu has items labeled with claims such as “heart healthy,” 36% of diners say they are more likely to choose such offerings (Mintel, 2009e). Healthy dining is also about adding whole grains, fiber, omega-3s, and antioxidants. Subway offers Fuze® fresh-brewed iced tea with antioxidants and vitamin C, for example.

What signifies healthy to consumers? Inclusion of fresh fruit/vegetables was the top nutrition cue, cited by 38% of those who sought a nutritious restaurant lunch. Protein in the meal was cited by 32%, fiber 27%, lower-calorie 27%, food cooked on site 26%, lower in salt 24%, and low in saturated fat 20% (Mintel, 2009e).

Lastly, hospitals and nursing homes are projected to remain a bright spot in the restaurant business with sales in real terms projected to increase 4.1% in 2010 vs a decline of 1.5% for full-service restaurants and an increase of 0.4% for quick-service restaurants. This translates to a $5.9 billion venue for new medical foods, foods for special dietary use, and also for condition-specific functional foods (NRA, 2010b).

by A. Elizabeth Sloan, a Professional Member of IFT and Contributing Editor of Food Technology, is President, Sloan Trends Inc., 2958 Sunset Hills, Suite 202, Escondido, CA 92025 ([email protected]).

References

AAP. 2010. Panel recommends obesity screening beginning in early childhood. Press release, Jan. 22. Am. Acad. of Pediatrics, Elk Grove Village, Illinois. www.aap.org.

AHA. 2010. Heart health statistics. American Heart Assn. Dallas, Texas. www.americanheart.org.

Angrisani, J.C. 2010. Heat and veg. Supermarket News 58(5): 23-24.

CDC. 2010. CHD study shows too many teens have high cholesterol. Press release, Jan 24. Centers for Disease Control and Prevention, Atlanta, Ga. www.cdc.gov.

Dept. of Commerce. 2005. U.S. Census Bureau: population predictions. Washington, D.C.

Elan, E. 2010. Massachusetts unveils food allergy rules. Nation’s Restaurant News. Feb. 15. www.nrn.com.

FDA. 2010. FDA survey finds more Americans read information on food labels. Press release, March 3. Food & Drug Administration, Silver Springs, Md.

FMI. 2008. Shopping for health. Food Marketing Institute, Arlington, Va. www.fmi.org.

FMI. 2009. U.S. food shopper trends.

FRI. 2010. MenuMine Database, Feb. Foodservice Research Institute, Oak Park, Ill.

Harris Interactive. 2008. Self-medication Wall Street Journal joint survey. Nov. New York, N.Y. www.harrisinteractive.com.

Hartman Group. 2008. Organic report. Bellevue, Wash. www.hartman-goup.com.

HealthFocus. 2009. International trend study. HealthFocus Intl., St. Petersburg, Fla. www.healthfocus.com.

IDDBA. 2008. Health and wellness: The purpose driven consumer. International Dairy Deli Bakery Assn., Madison, Wis. www.iddba.org.

IFIC. 2009. Food & health survey. International Food Information Council. Washington, D.C. www.ific.org

Innova. 2010. The Innova Database. Innova Market Insights, Duiven, The Netherlands. www.innova-food.com.

IRI. 2008a. Consumer trend watch. Times & Trends, Feb. Information Resources Inc., Chicago, Ill. www.infores.com.

IRI. 2008b. 55+: The new “must win” market webinar.

IRI. 2009a. Competing in a transforming economy webinar. July 9.

IRI. 2009b. Lower-income II report. Feb.

IRI. 2010a. 2009 CPG year in review. Times & Trends, Feb.

IRI. 2010b. 2009 New product pacesetters. Times & Trends, March.

Lyons, S. 2010. State of the industry. Presented at Snaxpo, the Annual Meeting of the Snack Food Assn., Fort Worth, Texas, March 3-5.

Mintel. 2008a. Fish and seafood—U.S. Dec. Mintel International, Chicago, Ill. www.mintel.com.

Mintel. 2008b. Healthy snacking—U.S. Feb.

Mintel 2008c. Chocolate confectionery—U.S. July.

Mintel. 2009a. Functional foods—U.S. Aug.

Mintel. 2009b. Functional beverages—U.S. Sept.

Mintel. 2009c. Portion control—U.S. April.

Mintel. 2009d. Nutrition and energy bars—U.S. March.

Mintel. 2009e. Healthy dining trends—U.S. May.

MSI. 2008a. Gallup study of preteen nutrition and eating habits. Multi-Sponsor Surveys Inc., Princeton, N.J. www.multisponsorsurveys.com

MSI. 2008b. Gallup study of children’s beverage habits.

MSI. 2009. Gallup study of nutrient knowledge & consumption.

NBJ. 2010. U.S. functional sales slow, but category outpaces overall food sector in ’09. Nutr. Bus. J. Feb. 1. www.nutritionbusinessjournal.com.

NCA. 2010. Robust December and Christmas seasonal sales data YE Dec. 27, 2009, IRI Sales

Summary. Press release, Feb. 1. National Confectioners Assn., Washington, D.C. www.candyusa.org.

Nielsen. 2010. U.S. healthy eating trends part 1: commitment trumps the economic pinch. Press release, Jan. 26. Nielsen Co., Schaumburg, Ill. www.nielsen.com.

NPD. 2009. Consumer scorecard: check averages increase for most dayparts. Nation’s Restaurant News 43(40): 3.

NRA. 2009a. American Culinary Federation chef survey: what’s hot in 2010? Oct. National Restaurant Assn., Washington, D.C. www.restaurant.org

NRA. 2009b. Quickservice operators’ survey. Oct.

NRA. 2010a. Food and healthy living.

NRA. 2010b. 2010 Restaurant industry forecast.

NSGA. 2009. Exercise statistics. National Sporting Goods Assn., West Palm Beach, Fla. www.nsga.org.

Packaged Facts. 2008. Nutritional supplements in the U.S. Nov. Packaged Facts, New York, N.Y. www.packagedfacts.com.

Packaged Facts. 2009. Functional food and beverages in the U.S. May.

Piernes, C. 2010. Trends in snacking among American U.S. children. Health Affairs 29(3): 398-404.

Rhynalds, C. 2010. The future of sweet potatoes. Presented at the IFT Louisiana Food Processors Conference, Baton Rouge, La., March 17.

Sloan, A.E. 2010. Sloan Trends Inc. TrendSense.

Technomic. 2009a. The future of fried foods. American Express Market Brief, May. Technomic Inc., Chicago, Ill. www.technomic.com.

Technomic. 2009b. Nutrition disclosure on restaurant menus: a plus or minus for diners? Am. Exp. Market Brief., Sept.

Van Cleave, J., Gortmaker, S., and Perrin, J. Dynamics of obesity and chronic health conditions among children and youth. JAMA 303(7): 623-630.