Bridging Generational Food Divides

Mature consumers, Baby Boomers, and members of Gen X and Gen Y all display distinctive attitudes and behaviors related to food, and savvy product developers and marketers must address those differences in order to succeed in the marketplace.

While it has probably always been true that food preferences are affected by age bracket, fast-emerging “generational food divides” are now shaping the marketplace. For the first time in history, dramatic differences in food preferences, eating styles, and attitudes/behaviors related to health, nutrition, safety, and greener living will force food companies to more directly target flavors, foods, and food messages to different generations.

What’s causing these “great divides”? For one thing, consider that 100 million Americans ages 50+ were raised on classic European cooking and a “basic 4” approach to nutrition while 68 million Gen Y adults are fixated on gourmet, ethnic, and on-the-go fare. Over the next 10 years, eating patterns will be influenced by behaviors that occur with aging and the different preferences inherent in each generation.

With consumers ages 55–64 now the highest per capita spenders at restaurants, foodservice operators will need to re-orient their menus, too (NRA, 2010). Visits by young adults, traditionally frequent visitors to restaurants, have fallen steadily over the past four years. For the year ended May 31, 2009, per capita annual visits to restaurants increased by 9 visits for those 65+ and 4 visits for those ages 50–64. Visits by those 18–24 fell by 16, and visits by those 25–34 were down by 7 (NPD, 2009a).

While burgers, fries, Mexican food, and breakfast sandwiches are still on the list of top 10 foods ordered by Baby Boomers at restaurants, Boomers choose them less frequently than their younger counterparts. Most importantly, non-fried vegetables, main dish salads, side dish salads, and shellfish are also on the list (Glazer, 2009a).

Based on age dynamics, prior/current eating patterns, and trend momentum, the NPD Group predicts that the five food groups for which consumption is expected to increase are salty/savory snacks; easy meals; center of the plate proteins, e.g., meat entrees; sweet snacks/desserts; and heat/eat breakfasts (NPD, 2009b).

As Boomers age, they’ll create tremendous growth opportunities for specific food products, e.g., coffee, snack nuts, breakfast meats, soup, wine, cookies, and crackers. As shoppers move into their 60s, they prefer noncarbonated drinks, shifting them from beer to wine and to fewer soft drinks and more coffee (IRI, 2009).

Demographic Delineation

This article identifies and contrasts the dramatic differences in the food, flavor, and form preferences, cooking behaviors, and attitudes toward healthy/functional foods, food safety, and natural/green practices for the four major adult generations including Matures, Baby Boomers, Gen X, and Gen Y.

In this report, Matures refers to Americans over age 65, who currently number more than 40 million. In the next five years, another 17 million Boomers will turn age 65 (U.S. Census, 2010).

Baby Boomers, born between 1946 and 1964, are now ages 46 to 64. There are close to 80 million Boomers in the United States today.

--- PAGE BREAK ---

Gen Xers, born between 1965 and 1976, are ages 34–45 and, with a population of about 30 million, comprise the smallest adult generation. They are the most family-oriented generation; 71% still have children under age 18 at home.

Adult Gen Yers, those born between 1977 and 1996 (ages 14–33), now number approximately 68 million. The children of the Baby Boomers, Gen Yers, are beginning to drive dramatic changes in our food world.

Meal Preparation and Home Cooking

The trend to preparing and eating more meals at home continues, especially among younger consumers, whose penchant for restaurant-style, gourmet, and natural foods will create a wealth of new product opportunities and force a reinvention of convenience foods.

Younger consumers—58% of Gen Yers and 54% of Gen Xers—topped the list of those making more meals at home last year vs 44% of Boomers and 32% of Matures (Gallup, 2009a). Eight in 10 Gen Yers (82%) ate a home-cooked meal three or more nights a week, up a whopping 23% from two years ago (FMI, 2009a).

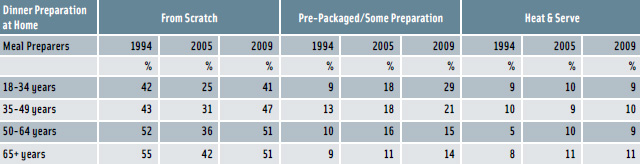

Scratch cooking, which is fast approaching levels not seen since 2004, increased most dramatically among younger meal preparers over the past five years, creating an enormous opportunity for more wholesome and highly flavored ingredients/basic meal components (Gallup, 2009a; Figure 1).

Gen Y meal preparers were the only group to increase their use of prepackaged foods at dinnertime, and marketers would be well advised to keep pace with their new view of convenience foods (Gallup, 2009a). When asked what help younger cooks needed to make restaurant-quality food at home, 59% wanted only prepackaged ingredients and/or flavorings, e.g., steak rub or ethnic sauce; 18% a complete kit with premeasured ingredients that still requires some preparation; and 7% heat-and-serve items requiring no preparation; 16% prefer to make meals from scratch (Hartman, 2008).

Although all four generations are fairly equal when it comes to owning/using microwaves, Boomers are significantly more likely to own/use a crock pot, and Matures are more likely to own/use a toaster, toaster oven, coffee maker, hand-held mixer, and blender (Gallup, 2009a).

While Gen Xers are the most frequent grillers, Gen Yers are the fastest-growing segment of grillers (NPD, 2009c). Pizza, roasts, appetizers, and whole birds are trendy grilling choices among younger consumers.

With more than half of Gen Yers (54%) describing themselves as inexperienced cooks, the need for clearer directions, cooking aids (e.g., pop-up timers), and simple recipes is unprecedented. Half of Gen Yers (50%) don’t know how to do some of the steps in a recipe; one-third don’t understand some cooking terms (Gallup, 2009a).

--- PAGE BREAK ---

Only half of Matures (52%) describe themselves as experienced bakers, and that figure is far lower in other generational subsets, which means that the opportunity for more upscale, natural, and unique recipe breads and baking mixes is at an all-time high.

Flavor Focus

Older Gen Yers (ages 25–33) make up the largest contingent among America’s 31 million “foodies,” followed by Gen Xers; interest then falls markedly with age. They’re the most likely to be “foodie cooks,” to try new recipes/ingredients, and to most enjoy eating foreign and spicy foods (Packaged Facts, 2009a).

However, younger Gen Yers (ages 18–24) are the most likely to eat gourmet foods whenever they can, prefer food presented as an art form, and like to try new and exotic food products (Packaged Facts, 2009a).

Young adults ages 18–24 remain the heaviest purchasers of gourmet/specialty foods, followed by older Gen Yers and Gen Xers; they’re also the most likely to buy healthful gourmet foods (NASFT, 2009). Older Boomers and Matures are the most frequent purchasers of gourmet oils, breads, salad dressings, condiments/mustards, tea, crackers, jams/jelly, olives/pickles/relish, spices, and vinegars (NASFT, 2009).

Those ages 18–24 are the most likely to purchase specialty chocolates, cold beverages, cheeses, cookies, meats, salty snacks, pasta sauce, prepared/ready-to-eat foods, salsas, nonchocolate candy, and pasta; they’re least likely to buy gourmet coffee (NASFT, 2009).

Gen Xers and Baby Boomers are significantly more likely than other age groups to eat Italian and Mexican foods/flavors on a regular basis, either at home or in a restaurant (Gallup, 2009b). While about six in 10 adults regularly enjoy Asian/Oriental foods, Boomers are much more likely to eat Chinese and Vietnamese food than other age groups; those ages 18–34 are more likely than other demographic subsets to opt for Japanese and Korean fare.

Among second-tier ethnic cuisines, Gen Yers and Boomers are the most likely to eat Caribbean, Indian, Middle Eastern and Cajun foods; Boomers and Gen Xers are the most likely to eat Greek food. Soul food, Spanish selections, and Creole items are also standouts for Boomers; those 65+ tend to enjoy Tex Mex and German cuisine (Gallup, 2009b).

Gen Yers are by far the most likely to buy American regional foods, ensuring their long-term success as one of the hottest new cuisines (NASFT, 2009). They’re more likely to enjoy California cuisine, while Boomers favor New England fare (Sloan, 2009). Gen Yers would most like to be able to make restaurant-quality Mexican, regional Italian, Spanish, Japanese, and Greek food at home; one in 5 (20%) would like to make tapas (Hartman, 2008). Growing demand for bolder flavors is not limited to a single age group. Spicy peppers and chipotle topped the list of 2009’s top-growing flavors, followed by citrus, Asian, Mexican/Latin/Spanish, Italian, hot/spicy, garlic, pepper, jalapeno, cilantro, and chocolate, according to NPD (Glazer, 2009b). Fast-emerging flavors for Matures include Asian, berry, cinnamon, and garlic; cinnamon, citrus, jalapeno, and cilantro are popular among younger Gen Yers (Glazer, 2009b).

Half of Gen Yers (55%) want to make restaurant-style, uniquely seasoned meat at home; 76% want more marinating sauces, 71% more rubs/spice mixes, 59% stir fry sauces, 44% Mexican cooking spices, and 6% Indian simmer sauces (Hartman, 2008).

--- PAGE BREAK ---

Food Preferences

Because they were raised on the “basic 4” concept of nutrition, it’s not surprising that Boomers and Matures are far more likely to opt for a “balanced plate” at dinner-time—with an entrée, vegetables, side starch, and sometimes bread (Gallup, 2009b).

Conversely, eating pizza or sandwiches for dinner is highest among youngest consumers and decreases directly with age (Gallup, 2009b). Gen Xers are by far the most likely to eat a casserole for dinner. Gen Y consumers are the most likely to eat pasta dishes and macaroni and cheese for dinner. Matures are the most likely to eat a stir-fry meal or chili for dinner; this behavior increases directly with age.

Historically, when given a choice of entrees in restaurants, Gen Yers have tended to select chicken or pasta, Gen Xers beef/red meat, and Boomers and Matures, fish or seafood. Matures are the least likely to order chicken away from home.

Perhaps the biggest generational change in protein consumption is the increased consumption of fish and seafood by younger adults. Gen Yers are now just as likely to order seafood as Matures. Moreover, their fish consumption both in-home and in restaurants has jumped dramatically, although still lagging behind older adults (Mintel, 2009a).

Older Matures, and to a slightly lesser extent, Boomers, are the most frequent consumers of pork, turkey, ribs, ham, lamb, duck, and veal (NPD, 2009c). Older Gen Yers and younger Gen Xers are the most likely to purchase organic meat (FMI, 2009b).

When it comes to side dishes, Matures are the heaviest consumers of potatoes by far and the least likely to purchase prepared salads such as cole slaw (Mintel, 2009b). Consumption of baked beans also increases with age.

Gen Yers ages 18–24 are big fans of macaroni and cheese and instant mashed potatoes as sides; Gen Xers go for flavored rice mixes and stuffing. These younger generations are also the heaviest consumers of refried beans, pasta mixes, and couscous.

Mangos, avocados, sprouts, pears, citrus, berries, bananas, kiwifruit, and papaya are among the preferred fruits for Gen Yers. Apricots, cantaloupe, honeydew, cherries, and nectarines are likely to appeal to an older audience (Anonymous, 2010).

Boomers and Matures are the most frequent consumers of asparagus, cabbage, cauliflower, celery, cucumber, eggplant, green beans, and green onions; Gen Xers enjoy artichokes, broccoli, grapefruit, and grapes (Anonymous, 2010).

--- PAGE BREAK ---

Gen Y consumers are the most likely to have bought a superfruit drink with açai, goji, Noni, or mangosteen last year (Packaged Facts, 2009b). Consumption of green tea, yogurt, and black tea drinks skew younger; consumption of cranberry drinks and red wine is highest among Boomers and Matures.

Older generations are the top consumers of natural cheeses, soup, desserts, and sandwiches prepared at home. They’re the most likely to order fruit and/or vegetables and dessert at a restaurant and/or to eat breakfast (NPD, 2009c).

Gen Yers ages 18–24 are by far the most likely to order a sandwich away from home (52% vs 44% for consumers overall) (Technomic, 2010). More than twice as many Gen Yers chose taco/burrito as their favorite lunch sandwich compared with all other age groups. Gen Yers prefer burger sandwiches for dinner; older Boomers and Matures opt for deli-style sandwiches.

In addition to driving late night foodservice purchases, members of the Gen Y segment are strong consumers of breakfast sandwiches. At their most recent breakfast outside the home, 45% of younger Gen Yers had a breakfast sandwich, and 20% had a donut (Technomic, 2010).

Meal Occasions/Emerging Markets

Matures are by far the most likely to eat three complete meals per day, while Boomers tend toward one or two meals per day, and their younger counterparts are most likely to eat three complete meals plus snacks. With the exception of Matures, about 11–17% of adults graze/snack throughout the day. Fifteen percent of Gen Yers opt for frequent small meals, consuming up to six small meals daily. Gen Yers are not only the most frequent snackers, but also the healthiest and trendiest snackers (Mintel, 2008). They are the most likely to want snacks that are all natural/ organic, provide an energy boost, or contain added vitamins or protein. Snacks that are low in fat and calories and/or high in fiber have the greatest appeal to older adults.

Gen Yers are also the most likely to use energy/nutrition/diet bars for exercise recovery, to build muscle, to provide a vitamin/mineral supplement, or to function as a part of a weight-gain program. Older consumers use bars on a more limited basis, mostly as meal replacements or snacks; 46% would eat more nutrition bars if they came in smaller sizes. One-third (31%) of younger Gen Yers regularly used energy drinks in 2009 (Mintel, 2009d).

Boomers (39%), followed by Gen Xers (35%), are the most likely to bring their lunch from home. While all generations are surprisingly equal for ordering lunch at a fast food restaurant, Gen Yers are twice as likely to order lunch at a drive-through window compared with the rest of the population. Gen Xers, especially males, are the heaviest users of supermarket take-out, followed by Matures (FMI, 2009a).

Gen Yers are the biggest home entertainers, with 56% having friends/family over at least once a month, vs 51% of Gen Xers, and 38% of Boomers (GfK Roper, 2009). When friends visit, they are likely to watch television or movies, play games, and serve snacks.

Boomers (61%) are most likely to celebrate a special occasion at home. Older segments are most likely to have a sit-down meal while entertaining. One-third of Gen Xers (35%) frequently entertain with potluck meals and are most likely to use appliances for guest meal preparation, e.g., crock-pots, or to use take-out foods (GfK Roper, 2009).

--- PAGE BREAK ---

Gen Yers are the most likely to buy specialty foods for a special occasion, e.g., a birthday party, home dinner party, or entertaining. They are twice as likely as the rest of the population to use specialty foods to impress their guests (NASFT, 2009).

Health Challenges by Age

The importance of healthy eating increases with age (Hartman, 2010a). More than half of Matures (56%) were very concerned about the nutritional content of the food they ate last year vs 48% of Boomers, 39% of Gen Xers, and 30% of Gen Y consumers (FMI, 2009a).

Boomers and Matures are the most likely to feel their diets are already healthy enough and are the No. 1 supplement users. As a result, they often represent a tougher sell for fortified/functional food and drinks (FMI, 2009a).

Two-thirds of Gen Yers and Gen Xers (66%), feel their diets could be some/a lot healthier, which makes members of these demographic segments prime targets for products focused on supplementing the diet (FMI, 2009a).

When it comes to their approach to healthy eating, older and younger generations differ markedly. Boomers and Matures are far more likely to cite fruits and vegetables as important components; Gen Yers and Gen Xers tend to focus more on avoiding processed foods; 38% of Gen Yers vs 22% of the population overall rely on consuming a lot of protein as a healthful eating strategy (Mintel, 2009e).

Avoidance behavior among Gen Xers is increasing and becoming very similar to Boomer practices; avoiding saturated fat, followed by cholesterol, trans fat, and sodium are priorities for both demographic segments (Hartman, 2010a).

Boomers are the most likely to avoid refined sugar; Gen Xers try to steer clear of high fructose corn syrup, MSG, and artificial sweeteners; Gen Yers are tops for avoiding caffeine (Hartman, 2010a).

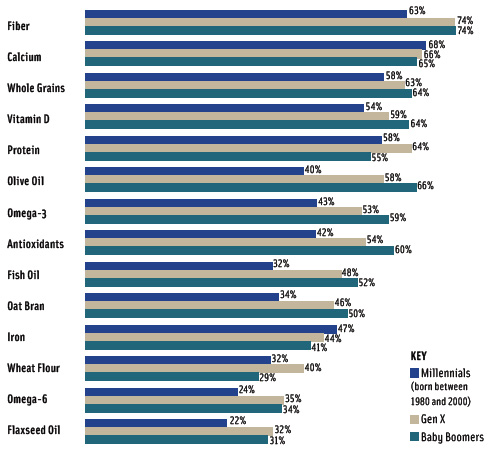

Although all generations are trying to add more fiber, calcium, whole grains, and vitamin D to their daily diet, Boomers are the most focused of any age group on getting more vitamin D, olive oil, omega-3s, and antioxidants. The only ingredients Gen Y seeks to add more of than the other age groups do are calcium and iron (Hartman, 2010a; Figure 2). Mental sharpness tops the list of wellness concerns for Matures, followed by heart disease, bone health, cancer, and the ability to continue normal activity as they age (HealthFocus, 2009).

Among the younger generations, Boomers are the most likely to be concerned about cholesterol, high blood pressure, aches/pains, joint health, heart health, and diabetes. For Gen Xers, key concerns are anxiety/stress, aches/pains, depression, digestive disorders, and sleep. In all generations, about half of all consumers worry about weight (Hartman, 2010a). Gen Yers are the most likely to worry about tiredness, appearance, and skin (HealthFocus, 2009).

--- PAGE BREAK ---

Gen Yers are also the most likely to buy a functional food/beverage. In 2009, 79% of Gen Yers ages 18–24 bought a functional food or beverage vs 45% of adults age 65+ (Mintel, 2009b). In 2008, younger adults were the most likely to buy breakfast bars, yogurt, or cereal—three relatively convenient forms of functional foods. They’re more likely to view functional foods as a supplement to their not-so-healthy eating habits.

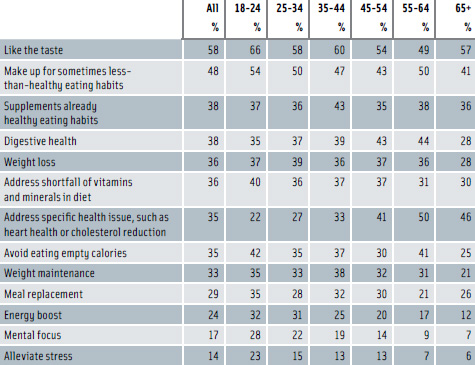

Gen Yers are particularly likely to seek out performance benefits not traditionally associated with food, and they top the list of those who buy functional products for stress reduction, mental focus, or an energy boost. They’re more open to the idea that one’s diet can be manipulated to provide specific lifestyle-oriented benefits that go beyond general wellness (Mintel, 2009d; Figure 3).

Boomers and Matures are considerably more likely to cite heart health and cholesterol or a specific health issue as a reason for buying functional foods and were the top users of cereals and margarines with a heart health claim in 2009 (Mintel, 2009d). They were the most likely to buy a functional food product for digestive health last year. When they do use functional foods, older adults are more likely to report frequent use, likely due to greater attention to health issues, e.g., cholesterol levels (Mintel, 2009d).

While weight and immunity are among the most desired benefits for functional foods, lowering cholesterol/blood pressure and promoting healthy blood sugar levels are most important to older Boomers and Matures (Mintel, 2009d). Gen Xers are interested in foods that also enhance metabolism and help them to maintain a healthy body weight. Taste is a priority across all age groups, Mintel reports, underlining the importance of product offerings that are both healthful and good-tasting.

Going Greener

Members of Gen Y are the most frequent consumers of organic foods; 82% of Gen Yers use organic products vs 76% of Gen Xers and 67% of Boomers (Hartman, 2010b). In 2009, despite ongoing controversy as to the definition of organic foods, nearly three-quarters of those in the three older generational segments say that they trust the USDA organic seal (Hartman, 2010b).

About half of all consumers across generations report that they are deliberately trying to avoid/reduce the amount of preservatives in their daily diet. Boomers (50%) and Gen Xers (49%) are more likely than the rest of the population to try to avoid MSG, artificial flavors, and artificial colors/dyes (Hartman, 2010a).

While freshness is the most important food selection criteria for all generations, it is a particular priority for Gen Yers. Its importance to consumers declines slightly with age; 81% of Gen Y consumers rate it as very important vs 72% of Matures (IDDBA, 2008).

The “locally raised or grown” preference has a strong age skew to Boomers and Matures: 61% of Matures would prefer to buy local vs 39% of Gen Yers. Older consumers are most interested in local foods because they link them to freshness, followed by the fact that purchasing them benefits the local economy. In addition, there is the matter of taste; 69% of Matures think locally grown products taste better vs 60% of Boomers and 43% of Gen Y consumers who feel that way (FMI, 2009a).

Farmers markets are frequented more by Matures than by the other population segments (NASFT, 2009). Farm-raised is very important to 35% of Boomers and Matures but to only 29% of Gen Yers (IDDBA, 2008).

--- PAGE BREAK ---

Humane treatment, free range/cage-free is slightly more important to Gen Yers and Boomers than to other groups. Among Boomers, humane treatment is very important for 34% compared with 32% of Gen Y consumers, 28% of Gen Xers, and 26% of Matures who consider it very important (IDDBA, 2008). Older Boomers are the most likely to purchase kosher foods—32% vs 25% of consumers overall (NASFT, 2009).

Gen Yers are the most comfortable with foods grown/raised outside of the U.S. The degree of comfort declines with age, going from 54% of Gen Yers being confident or somewhat confident of the safety of foods from outside the U.S. vs 33% of Matures who share that view (FMI, 2009a).

One in five Gen Yers (21%) say farmers should be responsible for making sure the food supply is safe (FMI, 2009a). In addition, Gen Y is the consumer segment most interested in Fair Trade products (Datamonitor, 2008). Green efforts on the part of their primary food/ grocery stores are more important to the younger generations than to Boomers or Matures (FMI, 2009a).

All of this diversity creates a challenging environment for food manufacturers and marketers. Understanding the preferences, behaviors, and nuances of each generation is becoming increasingly important as the great food divides become wider. With the more sophisticated and broad global preferences of the upcoming kids’ generation, sometimes referred to as Gen Z, coming into further play in future years, generational gaps in consumer tastes and preferences can be expected to grow.

by A. Elizabeth Sloan, a Professional Member of IFT and Contributing Editor of Food Technology, is President, Sloan Trends Inc., 2958 Sunset Hills, Suite 202, Escondido, CA 92025 ([email protected]).

References

Anonymous. 2010. Fresh trends 2010. The Packer, Feb.

Datamonitor. 2008. Global ethical revolution. Press release, March. Datamonitor, London, UK. www.datamonitor.com.

FMI. 2009a. Grocery shopper trends. Food Marketing Institute, Washington, D.C. www.fmi.org.

FMI. 2009b. The power of meat.

Gallup. 2009a. The 2009 Gallup study of cooking knowledge & skill. Multi-Sponsor Surveys, Princeton, N.J. www.multisponsor.com

Gallup. 2009b. The 2009 Gallup study of dinner trends. Multi-Sponsor Surveys.

Gfk Roper. 2009. The Home. Teleconference, Jan. 29. GfK Roper Custom Research, New York, N.Y. www.gfkamerica.com.

Glazer, F. 2009a. NPD: Baby boomers represent potential boon to industry traffic. Nation’s Restaurant News, Feb. 2.

Glazer, F. 2009b. Consumers go for bold flavors they can’t make at home. Nation’s Restaurant News, Dec. 7.

Hartman. 2008. Reimagining convenience foods. The Hartman Group, Bellevue, Wash. www.hartman-group.com.

Hartman. 2010a. Reimagining health & wellness, June.

Hartman. 2010b. Beyond organic & natural, Feb.

HealthFocus. 2009. U.S. trend report. HealthFocus International, St. Petersburg, Fla. www.healthfocus.com.

IDDBA. 2008. Health and wellness: The purpose driven consumer. International Dairy Deli Bakery Assn., Madison, Wis. www.iddba.org.

IRI. 2009. The baby boomer II report, July. Symphony IRI Group, Chicago, Ill. www.symphonyiri.com.

Mintel. 2008. Healthy snacking—U.S., Feb. Mintel International Group Ltd., Chicago, Ill. www.mintel.com.

Mintel. 2009a. Fish and seafood—U.S., April.

Mintel. 2009b. Side dishes—U.S., June.

Mintel. 2009c. Portion control—U.S., April.

Mintel. 2009d. Functional foods—U.S., Aug.

Mintel. 2009e. Attitudes toward food: Weight and diet—U.S., May.

NPD. 2009a. NRN consumer scorecard, June 8. The NPD Group, Port Washington, N.Y. www.NPD.com.

NPD. 2009b. NPD reports on how generational differences and aging dynamics will influence future of eating, Press release, Dec. 2.

NPD. 2009c. National eating trends survey, U.S., Canada. The NPD Group.

NASFT. 2009. Today’s specialty food consumer. National Association for the Specialty Food Trade, New York, N.Y. www.specialtyfood.com.

NRA. 2010. Restaurant forecast, 2010. National Restaurant Assn., Washington, D.C. www.restaurant.org.

Packaged Facts. 2009a. Foodies in the U.S., Jan. Packaged Facts, New York, N.Y. www.packagedfacts.com.

Packaged Facts. 2009b. Functional foods and beverages in the U.S., May.

Sloan, A.E. 2009. Rediscovering American foods and flavors. Food Technol. 63(12): 16.

Technomic. 2010. The sandwich consumer trend report. Technomic Inc., Chicago, Ill. www.technomic.com.

U.S. Census. 2010. 2009 National characteristics estimates, June 10. U.S. Census Bureau, Population Division, Washington, D.C. www.census.gov.