New Insights into Food & Health

Food Technology’s Wellness 10 conference delivered an integrated perspective on emerging technologies, scientific evidence, and consumer trends.

The fact that diet and health are closely connected is not a mystery to consumers. Eight-six percent of those polled by the Natural Marketing Institute (NMI) in 2009 said they see a definite connection between the two. And 72% of participants in a 2009 International Food Information Council (IFIC) survey believe that food and nutrition play a role in improving overall health.

But statistics like the preceding—both cited by presenters at Food Technology’s Wellness 10 conference in Chicago earlier this spring—don’t tell the whole story. One doesn’t have to dig too deeply to see that U.S. consumers are not universally health conscious. NMI divides consumers into five groups based on their approach to diet and health, conference presenter Steve French explained. While 19% are categorized as “Well Beings” and another 18% as “Food Actives,” that leaves 63% who are much less focused on healthful eating. The latter group includes “Magic Bullets” (24%) hoping for a quick fix; “Fence Sitters” (17%), who take an inconsistent approach to diet and exercise; and “Eat, Drink, and Be Merrys” (22%), a group whose members place little emphasis on prevention and base food choices on taste and cost.

A 2008 American Dietetic Assn. (ADA) survey found fairly similar attitudes among consumers. According to ADA President Jessie Pavlinac, also a Wellness 10 presenter, when the organization polled members of the general public about their nutrition-related behaviors, 43% of respondents said they were eating healthfully, 38% could be categorized as interested but not entirely committed, and 19% were of the “don’t bother me” mindset.

“Health and wellness is one of the most complicated, convoluted, and contradictory constructs humankind has ever invented,” said innovation consultant and Wellness 10 speaker Mark Payne in a session titled “Beyond BFY (Better for You): A New Manifesto for Wellness Innovation.” Payne’s new manifesto calls for dispelling entrenched myths about health and wellness and their relationship to successful product development. Myth No. 1, according to Payne, is that consumers are getting smarter about what they eat. If that’s the case, he observed drolly, then “knowledge must be very fattening” because, while the body of available nutrition knowledge has increased in recent decades, the size of the average body has also increased.

What is more accurate, Payne contended, is this statement: “Some consumers are getting more knowledgeable about what they eat, but they’re really not eating that much smarter. We can’t mistake consumers’ rapidly growing preference for healthy-sounding products for bona fide healthy eating.”

Payne’s Myth No. 2 is that the food industry needs to educate consumers to make healthier choices. “It’s not untrue,” Payne said of the preceding statement, “but it misses the real point. We need to give eating right a fighting chance against eating wrong.”

One of the problems, Payne contended, is that food companies have conditioned consumers to lower their taste expectations. Consumers have come to believe that “smart choices are likely to leave us yawning.” What successful product developers need to do, according to Payne, is to embrace “the pleasure principle” and to adopt “a new playbook” for product development.

“This is about innovations that taste better than what came before and just happen to be healthier. … We need to entice consumption over to the good side,” continued Payne. He cited the example of Pringles Rice Infusions, a line extension that his company, Fahrenheit 212, played a role in developing. Thanks to its flavorful taste profile, the new offering helped the Pringle’s brand grow market share in Europe, Payne said.

Another strategy for successful new product development involves coming up with “next wave hybrids,” i.e., products that straddle more than one category. Fahrenheit 212 worked with New Zealand dairy cooperative Fonterra to develop such a hybrid—Whole, flavored water formulated with a clear milk protein extract to deliver a satiety benefit.

--- PAGE BREAK ---

Building Better Food Products

In a session titled “Change the Food to Change the Consumer?” presenter Kantha Shelke of food science research firm Corvus Blue LLC also urged the food industry to change the existing product development paradigm.

“We know that consumers accept the concept of healthful eating,” Shelke observed, but she added that “people aren’t always knowledgeable about how to eat well.”

“How do we get from I must do well to I can do well?” she asked rhetorically. Shelke offered recommendations that, if adopted by the food industry, might allow consumers to move further along the path to healthful eating. She suggested changing food composition to add healthful ingredients in unexpected product categories—like cookies formulated with vegetables. Offering a wider array of products that deliver satiety benefits—a cereal product formulated from healthful nuts, for example—would help consumers eat better, she said. Food manufacturers and marketers might also consider “altering the delivery mode,” Shelke said, offering the example of a Lunchables variety that substitutes baby carrots for cookies.

“Why aren’t we doing this [kind of thing] instead of beating down consumers to eat less?” Shelke challenged the Wellness 10 audience. She emphasized that it’s important for manufacturers to provide products with tangible benefits that consumers understand and accept and to formulate products using processes that do not compromise nutrient value. “Only the honestly healthful [products] will succeed in the marketplace,” Shelke summarized.

What Moms Want

It’s likely that the concept of “honestly healthful” would resonate with the five women who took the stage for the conference’s consumer panel discussion, “Let’s Hear It for the Moms,” a session organized by Lu Ann Williams of Innova Market Insights. Before the conference, the panelists were asked to shop for food and beverage items that they felt would deliver a variety of health benefits, and Williams guided them through a wide-ranging discussion about their perceptions of health and wellness products, their purchasing patterns, and their perspectives on feeding their families well. One of the recurring themes in the discussion was the importance the women placed on clean labels.

“I don’t mind giving them [her kids] sugar, but I do mind giving them foods with a long list of ingredients,” said one mom, explaining her rationale for choosing Breyers ice cream with just three ingredients listed on the label. Another mom, a vegetarian who consumed few processed foods, offered this advice to the product developers and marketers on hand for the conference: “If you want us to buy more products, give us products with fewer ingredients,” she said. Asked to share her perception of the meaning of the word “natural,” another panelist said that, to her, it means “with the least possible amount of ingredients.”

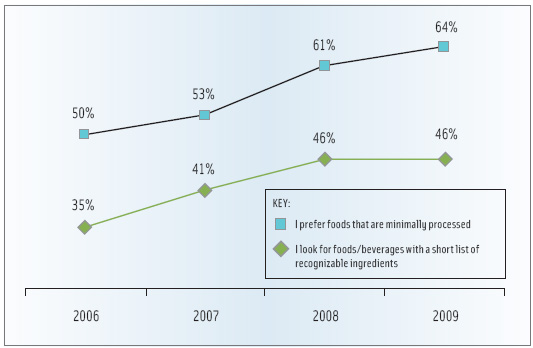

The panelists’ observations matched up well with NMI data French shared in his presentation. According to French, 46% of the consumers NMI polled in 2009 said that they seek out foods/beverages with a short list of recognizable ingredients, and 64% said they prefer foods that are minimally processed (Figure 1).

The panelists’ observations matched up well with NMI data French shared in his presentation. According to French, 46% of the consumers NMI polled in 2009 said that they seek out foods/beverages with a short list of recognizable ingredients, and 64% said they prefer foods that are minimally processed (Figure 1).

Members of the mom panel also said they had a tendency to become overwhelmed by the vast array of food and beverage choices available to them and sometimes, as a result, tend to stick with regular grocery-list favorites. It is no surprise then that products that are naturally functional (as opposed to those that are fortified with health-promoting ingredients) are resonating especially strongly with consumers, according to conference keynote presenter and Food Technology contributing editor A. Elizabeth Sloan.

Of course, avoiding foods formulated with new functional ingredients because they cannot be categorized as natural may be limiting to consumers because emerging technologies are delivering new ways to incorporate functional ingredients into product formulations. A series of conference presentations highlighted new research into ingredients that, if given a chance by consumers, may positively affect health and well-being in a variety of ways.

--- PAGE BREAK ---

Improving Digestive Health

One area where consumers are starting to realize that foods and beverages can make a difference is in the area of digestive health. According to a Wellness 10 presentation by Lisa Sanders of Tate & Lyle, 81% of Americans agree that foods and beverages can provide digestive health benefits. And given that almost half (46%) of Americans say that digestive problems impact their lives on a daily basis, more and more people are turning to foods and beverages as a solution.

What are consumers looking for when they go to the store? More than half of consumers who complain of digestive problems are consuming fiber, but there is growing awareness of other ingredients that can affect digestive health. Probiotics is a term that more consumers are now associating with digestive health (72% in 2009, up from 58% in 2007, according to IFIC data cited in the “Gut Reactions” session). What most consumers don’t know is how probiotics work to create a healthy digestive system. In their Wellness 10 presentation, Sanders and Joseph Sturino of Texas A&M University explained what probiotics and prebiotics can do and how they work.

Probiotics—live microorganisms that when administered in adequate amounts confer a health benefit on the host—can relieve symptoms of irritable bowel syndrome, alleviate diarrhea from multiple causes, and improve lactose digestion. Digestive health benefits of prebiotics—ingredients that allow specific changes, both in the composition and/or activity in the gastrointestinal microflora—include reducing inflammatory response in inflammatory bowel disease, establishing infant microflora, and treating constipation.

There has been a lot of research into the potential mechanisms for probiotics, and one possible way they work is by producing antimicrobial agents known as bacteriocins. In addition, it is possible that they prevent the adhesion of pathogenic bacteria to the intestinal wall. A third mechanism is that probiotics modulate the immune response. While there is far less research on how prebiotics work, it is known that in order to produce beneficial effects they must be able to survive the digestion process. Once inside the large intestine, they promote growth and activity of resident beneficial bacteria that then utilize mechanisms similar to those of probiotic bacteria.

Fats: Good or Bad?

Fats have always played a key role in consumers’ understanding of nutrition. In the presentation “Emerging Fat and Oil Applications,” Penny Kris-Etherton of Pennsylvania State University and John Keller of Dow AgroSciences Healthy Oils discussed the evolution of Americans’ relationship with fats and how the selected use of fats in foods may impact dietary consumption.

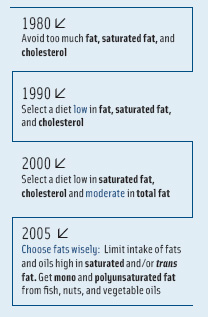

The 1980s and the first half of the 1990s were the low-fat era, when all fats were widely perceived as unhealthful. In the new millennia, a moderate-fat diet was recommended. The elimination of trans fats became the focal point of the food industry, with restaurants, fast-food chains, and food manufacturers cutting the trans fats from products as fast as possible. In just the past couple of years, the guidelines have shifted once again to advise consumers to limit intake of trans and saturated fats but to get mono- and polyunsaturated fats by consuming fish, nuts, and vegetable oils (Figure 2).

The 1980s and the first half of the 1990s were the low-fat era, when all fats were widely perceived as unhealthful. In the new millennia, a moderate-fat diet was recommended. The elimination of trans fats became the focal point of the food industry, with restaurants, fast-food chains, and food manufacturers cutting the trans fats from products as fast as possible. In just the past couple of years, the guidelines have shifted once again to advise consumers to limit intake of trans and saturated fats but to get mono- and polyunsaturated fats by consuming fish, nuts, and vegetable oils (Figure 2).

Unfortunately, during the rush to eliminate all trans fatty acids from foods, some food manufacturers compensated by upping the amount of saturated fats. And now the recommendations for saturated fats are getting lower; the latest recommendation is that saturated fats should make up less than 7% of energy intake. It is critical to examine the nutrition facts label carefully to see how much and what kinds of fat are included in a product, the speakers pointed out. Unsaturated fats like mono- and poly- (shown on some labels but not required by the U.S. Food and Drug Administration) help lower risk of heart disease. On the other hand, trans fats—partially hydrogenated oil—raise bad cholesterol and lower the good. Saturated fats, while not as unhealthy as trans fats, are also a bad idea because they increase risk of heart disease. The presenters noted that, once again, consumers need more education on the different types of fats and what type to look for when shopping.

--- PAGE BREAK ---

DHA and Cognition

Can adding docosahexaenoic acid (DHA) to the diet help improve cognitive ability and perhaps even stave off dementia in the elderly? Susan Carlson of the University of Kansas and James Astwood of Martek Biosciences believe it is possible. DHA is a long-chain omega-3 fatty acid that facilitates synaptic transmission in the brain and influences the speed that information is acquired and processed. DHA begins to accumulate in the brain during gestation, and after birth babies acquire it from human milk and infant formula. After infancy until the age of 20, we continue to accumulate DHA from foods such as fish, eggs, and chicken. Carlson shared studies that show early supplementation of DHA in infancy may have later benefits such as faster processing, longer sustained attention, and less distractibility. It is still not known what the optimal amount of DHA would be to achieve the best cognitive results.

Astwood explored adult dietary intake of omega-3 and the effects on cognitive ability in the elderly. Epidemiology studies on cognitive performance in the elderly show that greater fish consumption leads to better cognitive scores or less cognitive decline. In fact, studies show that consuming fish more than once a week led to a 40–60% reduction in risk of dementia. What does this mean for the food industry? Astwood shared some case studies of products that have been fortified with DHA. Minute Maid juice with DHA is strongly outperforming the brand’s other fortified juices, he said. In addition, sales of Horizon Organic milk with DHA are growing consistently and at a faster rate than regular milk, he noted. It is logical to conjecture then that once consumers are educated about the health benefits of DHA, products enhanced with DHA may even appeal to those consumers who are currently trending toward only naturally functional foods.

Weight Management

Weight Management

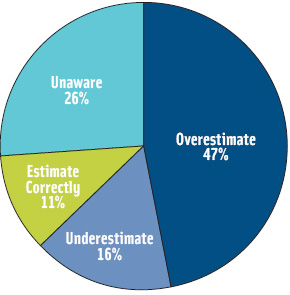

A discussion of consumer trends in health and wellness would be incomplete without the inclusion of weight management. Because more than 65% of Americans are either overweight or obese, weight is the second-highest health concern among consumers (cardiovascular disease is the first). Consequently, most Americans are trying to either lose or maintain their weight. Consumers are aware that exercise and physical activity are the main tools to manage their weight; however, a healthful dietary intake is also integral to weight management. During the session “Understanding Americans’ Approach to Weight Management,” presenter Wendy Reinhardt Kapsak of IFIC revealed that the average consumer believes that his or her diet is healthful, yet most consumers do not use any resources to help them make better dietary choices. To that end, Kapsak said that although most consumers will change the amount of food they eat to lose weight, few of them know what their daily caloric intake should be (Figure 3). Thus, when consumers fail to see quick results from their efforts, they become frustrated or bored and give up.

Obviously, consumers need assistance in making the right food choices that over time will achieve their goals. Kapsak pointed out that this is a great opportunity for new products in the food industry: The global weight loss market will be worth $586.3 million by 2014. Taste is still the No. 1 factor that consumers use to purchase food, so tapping into that market requires producing weight-management food products that are highly appetizing.

Kids and Diet

According to presenter Adam Drewnowski of the University of Washington, children tend to stick with foods that they know; if they have never tasted or tried it, they conclude that they will not like it. Meanwhile, obesity in children is on the rise, and everyone from the U.S first lady and government agencies to parents and healthcare professionals are seeking solutions to the problem. Convincing adult consumers to try weight-management foods is far easier than convincing children to do the same.

Perhaps even more problematic is that children tend to like low-cost foods that are energy dense. Energy-dense foods have low water content; fruits and vegetables, two healthy food options that kids manage to avoid, are often more expensive. Drewnowski emphasized that the cheaper a diet is, the less nutritious it is and that the most expensive ingredient in healthful foods such as fruits and vegetables is water because it increases perishability. So parents purchase low-cost energy-dense food that their children prefer to eat, and as a result, more children are facing health problems such as Type 2 diabetes and high blood pressure, which were rarely seen in juveniles 15 years ago.

--- PAGE BREAK ---

The U.S. government is making an earnest effort to address childhood obesity. In the session “Staying Within the (Guide)lines,” presenters Wendy Braund of the U.S. Dept. of Health and Human Services (HHS) and Robert Post of the U.S. Dept. of Agriculture (USDA) discussed the 2010 Dietary Guidelines for Americans, providing an overview of the guidelines and new tools that empower consumers to make better dietary choices. One of the biggest success stories for USDA has been the MyPyramid.gov website: It emphasizes the guidelines as the epitome of the best nutrition science, provides consumer-friendly nutrition education, and focuses on methods that promote behavioral change.

The USDA has plans to reach more people where they live, learn, play, exercise, work, and shop by using Web 2.0 technology and increasing communicative materials in supermarkets, fitness centers, and restaurants. Braund and Post suggested that the food industry can use the 2010 Dietary Guidelines to stimulate product innovation and marketing claims about diet, health, and wellness. In addition, the two presenters urged food manufacturers to make food choices more healthful and appealing by reducing calories, sugar, and sodium; using more whole grains and fiber; and ensuring that healthy options taste good.

Another means that the U.S. government has at its disposal to counter childhood obesity is the School Lunch and Breakfast Program (SLBP). Initiated in 1946, the national school lunch program is based on the U.S. Dietary Guidelines for Americans; breakfast was added to the program in 1966. Because 99% of U.S. public schools participate in the SLBP with 60% of children consuming school breakfasts and lunches, the SLBP is an integral tool in the fight against childhood obesity. Presenter Virginia Stallings of the University of Pennsylvania School of Medicine said that efforts are under way to increase the amount of fruits, vegetables, and whole grains in school meals. In addition, Stallings suggested that USDA, HHS, and state agencies should collaborate with the food industry to develop strategies to reduce sodium, saturated fat, and sugar in prepared foods and increase the availability of whole-grain foods and healthful fats.

A third measure to reduce the incidence of childhood obesity is the reformulation of kid-friendly food products. In the session “Reformulating Products to Nutritionally Improve Foods Targeted to Children,” presenter Yeonhwa Park of the University of Massachusetts discussed developing food products for children. She emphasized that foods offered in school meal programs need more calcium; potassium; magnesium; fiber; and vitamins A, C, and E. In particular, school-aged females between the ages of 14 and 18 years old are disproportionately deficient in nutrients. Park suggested that less fruit juice should be available during school meals to prevent more than half of the daily fruit or vegetable intake coming from juices.

Presenter Elaine Kolish of the Children’s Food and Beverage Advertising Initiative pointed out that many food and beverage companies such as Coca-Cola, Cadbury, and Hershey have refrained from marketing certain products to children. In addition, companies such as PepsiCo, ConAgra Foods, General Mills, and Kellogg have reformulated products directly marketed to children to improve nutrition content. Presenter Adelaide Geik of Edelman observed that parents rely on food and beverage companies to develop healthier food products that they can feed to their children. Moreover, parents and other consumers obtain information about food and nutrition predominantly from food labels, so transparency is key to earn consumer trust. Geik suggested that food companies disseminate information about reformulated products early and often but only for significant reformulations.

Presenters in the closing session of Wellness 10—IFIC’s Kapsak, ADA’s Pavlinak, and IFT incoming President-Elect Roger Clemens of the University of Southern California—called for more and better partnerships to strengthen the interface between food and health and to translate consumer interest into healthful behaviors. It’s time to better integrate scientific evidence, emerging technologies, and consumer trends, the speakers emphasized. “We have a responsibility for public health,” Clemens stressed.

Kelly Frederick is IFT Digital Media Editor ([email protected]).

Mary Ellen Kuhn is Managing Editor of Food Technology magazine ([email protected]), and

Toni Tarver is Senior Writer/Editor for Food Technology ([email protected]).