Developing Foods for an Aging Population

Consumer needs are shifting as people are living longer and looking to foods and beverages to improve their health. To successfully target older shoppers, marketers must do a better job of addressing health issues, sensory challenges, and more.

Age is just a number. And the numbers are certainly on the rise. Around the world, people are living longer, thanks in part to improvements in medicine and healthcare. The United Nations estimates that the global population age 60+ will increase from 11% in 2000 to 22% by 2050. This means that the number of people in this age category is expected to climb from 605 million to around 2 billion (Leatherhead Food Research, 2012).

However, just because people are living longer doesn’t mean they consider themselves “old.” Today, it isn’t uncommon for people to feel like 50 is the new 30 and 70 is the new 50. They want to live active, healthier lives as they age. This population shift is a global challenge with social, political, and economic implications. At the crux of the challenge are age-related health problems, which reduce the quality of life and create an economic burden on both the individual and the healthcare system. As consumers become increasingly aware of food’s impact on health and wellness, more will begin to turn to food to solve or prevent health issues. Yet, to date, relatively few food and drink products have been actively targeted to these aging consumers, which means that this segment of the population represents both a challenge and an opportunity for food and beverage manufacturers.

A Shifting Consumer Market

The majority of food and beverage consumer packaged goods (CPG) are marketed primarily to the younger generations (children and those ages 18–49). According to Nielsen Co. & BoomAgers LLC, once a group of consumers reaches the so-called “cut-off” age of 49, marketers renew their focus on a new crop of consumers ages 18–49. This has been successful for many brands due to the unprecedented number of consumers in that bracket. However, now the baby boomer consumers are aging out of that young sweet spot market. In addition, as many families wait until later in life to have children and as the birth rate in the United States drops, the youth market’s numbers aren’t replenishing at the rate previously experienced. Between now and 2030, the age 18–49 segment in the United States is expected to grow at +12%, while the 50+ segment will expand +34% (Nielsen, 2012).

Food and beverage manufacturers are beginning to realize that their product development and marketing efforts need to change to refocus on the baby boomer market. Today, U.S. boomers—consumers born 1946–1964—are 80 million strong and account for nearly 50% of CPG sales, or $230 billion (Nielsen, 2012). In addition, seniors (born 1925–1945) are living longer. Between 2000 and 2050, the number of people worldwide age 80+ is expected to quadruple to almost 400 million (Leatherhead, 2012). Even today, they represent a sizeable market at more than 130 million (Symphony IRI Group, 2012). This aging consumer population is vast, and yet it is estimated that less than 5% of advertising dollars are targeted to American adults 35–64, and even less to those 64+ (Nielsen, 2012).

What are the reasons behind the lack of consumer packaged goods positioned for this aging population? One reason is that these consumers are not easily put into a bracket. The baby boomer segment spans nearly 20 years so it’s not surprising that consumers within this segment have many different needs. Young boomers tend to be more open to food and beverage products offering preventive messages, and may spend more on consumer packaged goods than the senior population segment, whose members don’t trust functional messages on food and have less disposable income. A commonality between seniors and baby boomers is their quest to live their golden years to the fullest—in good health and with vibrant energy. Marketers must walk a thin line of letting these consumers know about products that can help them achieve this goal without making them feel old.

“You’ve got to find a balance between getting the message across, being human, and not patronizing them,” said Diana Cowland, Health and Wellness Analyst at Euromonitor International. “And I think that’s always going to be hard and perhaps that’s why we haven’t seen that many products directly targeted to that age group.”

Perhaps because of this, manufacturers are opting to market products that help prevent or treat age-related health issues rather than pushing products to consumers based solely on their age.

--- PAGE BREAK ---

Addressing Health Issues

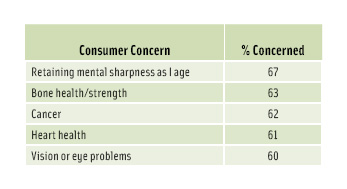

More than 60% of U.S. adults ages 50–64 have been diagnosed with at least one chronic health condition such as arthritis, cancer, diabetes, heart disease, high cholesterol, or high blood pressure (Perishables Group, 2009), which is one of the main factors behind the exponential growth of functional foods and beverages in recent years. Between goods that contain some kind of wellness claim and those in the medical/clinical foods segment, the global market value is estimated at $200+ billion. “Consumers are buying into these categories in order to lessen the perceived risk of contracting these conditions and to maintain health levels well into middle age and beyond” (Leatherhead, 2012). In fact, a majority of older consumers are concerned about age-related health issues, such as cognitive decline and heart disease (Figure 1).

In the past, a majority of consumers have turned to medicine and supplements to fight age-related illnesses, but a change is under way. “The food industry is adapting its model—there is a continued shift towards healthier foods,” said Lu Ann Williams, Head of Research at Innova Market Insights. “We are at point where the industry and consumers have woken up to the fact that there has to be a change. Healthy aging is a term we will be hearing a lot in the coming decade.” Baby boomers have tapped into this and are using healthy eating as a key strategy in their goal of aging successfully, defined as minimal loss of physiological functions as one ages. Indeed, 87% of American consumers over the age of 65 are trying to eat healthier. When it comes to specific food-related behaviors, adoption tends to increase with age. For instance, 35% of younger boomers eat whole grains on most days, while 44% of seniors are doing so. And 21% of young boomers consume omega-3 foods or supplements on a daily basis, while 30% of seniors are doing so (SymphonyIRI Group, 2012). However, when it comes to a variety of foods that are generally accepted as offering “functional benefits,” such as refrigerated teas, sports drinks, and energy drinks, spending in these areas tends to drop as age increases. There is skepticism with older consumers (especially the elderly) surrounding the functional health claims on certain foods and beverages.

“The most important thing is that if these products are going to be successful they have to have a strong efficacy,” said Cowland. Certainly the crackdown on health claims both in the United States and in Europe could have an impact on consumers’ belief in the products. Showing that these claims are backed by scientific research will go a long way to educating consumers about what kinds of ingredients can benefit their health.

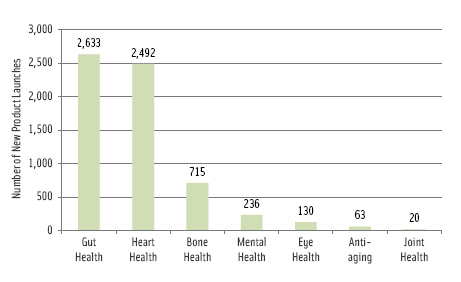

Despite the more stringent regulations behind health claims, there were still 5,770 products launched globally during 2011 that made a claim regarding the health of older consumers. As can be seen in Figure 2, the majority of functional food and drink launches targeted to aging consumers were positioned as either digestive or heart health products. In both instances, the number of launches was well over 2,000 (Leatherhead, 2012).

“We are also noticing a growth in brain health and memory,” said Cowland, “which I think really aligns with the fact that consumers want to maintain their mental ability as they get older.”

A Functional Approach

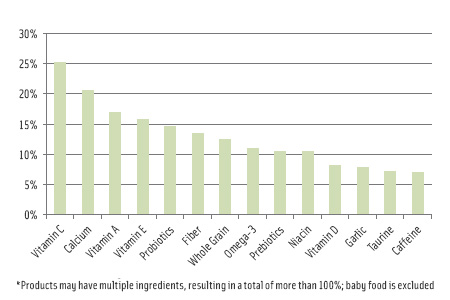

The food and beverage industry is showcasing a growing array of ingredients that can be used to add functional properties to address aging consumers’ health concerns (Figure 3). Some have been available for some time in supplement form, but have been cleared for use in food and beverages and therefore are featured prominently in new product development.

--- PAGE BREAK ---

• Yogurt. One of the first functional food products to make a health benefit connection with consumers was yogurt containing probiotics, and the yogurt sector forms the mainstay of the market for dairy products touted as offering digestive health benefits. Malnourishment in the gut can lead to damage of the epithelial cells, which in turn can cause a decrease in local immunity, reduced absorption of dietary components, and loss of appetite (Raats et al., 2009). A popular product in the probiotic yogurt category is Dannon’s Activia, which contains an exclusive probiotic culture, Bifidus Regularis, which has been proven to aid in digestive health. In the summer of 2012, the brand launched a new Breakfast Blend that contains low-fat yogurt mixed with grains, which provides 11 g of protein. Protein helps prevent sarcopenia—the degenerative loss of skeletal muscle mass and strength associated with aging.

• Yellow fats. Margarines and spreads—or yellow fats—are a major product segment in Europe and the United States for ingredients designed to help prevent cardiovascular disease and lower cholesterol. Although very little in the way of specific purchasing data exists, it is believed that older age groups represent a key target market for functional yellow fats. These products are increasingly known to include plant stanols and omega-3 fatty acids, which help control cholesterol levels and maintain heart health. Raisio’s Benecol spread is a major player in this segment and contains a front-of-pack health claim stating that 0.5 g of plant stanols a day is proven to lower cholesterol.

• Bread and cereal. The emphasis on adding whole grains to the diet has risen dramatically, especially after the launch of the 2010 Dietary Guidelines for Americans, which recommend everyone eat 3–5 servings or more of whole grains daily. A study in the American Journal of Clinical Nutrition showed that consuming high amounts of whole grains may help achieve significant weight loss and help lower cholesterol, which reduces the risk of chronic diseases such as diabetes and cardiovascular disease (Katcher et al., 2008). This health claim has been approved in the U.S. by the Food and Drug Administration (FDA). Despite the increased focus on whole grains, the average daily consumption of whole grains by ages 55+ was less than one serving in 2008, less than 14% of the recommended amount (Leatherhead, 2012).

Breads containing or fortified with whole grains are a growing feature in the bakery segment, especially in the United States. Whole grain products now account for almost 10% of the U.S. market for white bread (Leatherhead, 2012). In addition to whole grains, bread is now being fortified with ingredients such as calcium, vitamin D, and omega-3 fatty acids to address bone and heart health. In 2011, Hostess Brands’ Nature’s Pride launched Hearty Wheat with Flax bread, which is a good source of omega-3 fatty acids.

In addition to whole grains, fiber is another ingredient being promoted as delivering digestive health benefits, especially in fortified processed foods such as breakfast cereals. For example, Kellogg’s Fiber Plus Antioxidants cereal is marketed as a good source of fiber, whole grains, antioxidants, and vitamins C and E.

• Milk and other beverages. As is the case with yogurt, dairy foods such as milk are often perfect carriers for functional ingredients and probiotics. Over the past 10 years, dairy manufacturers have been developing milks fortified with ingredients such as plant stanols, omega-3 fatty acids, and calcium with vitamin D. In 2011, Stonyfield Farm extended its range of organic milk with new varieties fortified with omega-3 fatty acids with the front-of-pack claim that it is for “heart, brain, and eye health.” In addition, health ingredients such as inulin (a prebiotic linked with digestive health) and CoQ10 (an antioxidant linked with immune and brain health) are beginning to debut in fortified milks.

--- PAGE BREAK ---

Other beverages, such as soft drinks, juices, and sports energy drinks, have proven to be successful carriers for a range of health ingredients. A large number of functional beverages are marketed as offering heart health benefits. The global market for such drinks is believed to be worth approximately $850 million, with the majority of sales accounted for by chilled fruit juices and drinks featuring either plant sterols or potassium and beverages made from superfruits (Leatherhead, 2012).

Despite the health benefits of these beverages, there isn’t much to suggest that they are being targeted to older consumers. One company, pomegranate juice drink marketer POM Wonderful, changed this when it introduced a series of ads in 2010 depicting the POM Wonderful bottle in various scenarios claiming health benefits for aging consumers. In one ad, the POM bottle walks a tightrope and the ad copy says “Death Defying. The Antioxidant Superpower.” The other ads make several claims, such as protecting against prostate cancer and cardiovascular disease, and offering beauty benefits. While these ads may be successful in terms of marketing directly to an aging consumer segment, it should be noted that the U.S. Federal Trade Commission (FTC) took issue with them. Soon after the ads appeared, the FTC sued POM Wonderful for deceptive health claims, and the FDA, FTC, and the company have been battling for the past two years. No ruling has yet been issued (McClatchy-Tribune News, 2012).

“The regulatory environment is in transition, and it will take more time before companies can start making hard claims again,” said Williams. “There are some claims approved, but the list is quite limited. Until then, we’ll continue to see general wellness claims.” However, the POM Wonderful example shows that as an increasing number of health claims are approved, it is possible to address an aging population’s health concerns in a light-hearted, nonpatronizing way.

Product Development Considerations

When developing food and beverage products for the aging consumer, manufacturers have a number of factors to take into consideration in addition to functional and nutritional qualities. The aging process is accompanied by decreased efficiency in sensory perception, which is defined as the combination of olfaction (smell), gustation (taste), chemical and non chemical skin senses, vision, audition, and kinesthesis (body movements). This is how an individual receives information about a food’s flavor, temperature, color, appearance, and texture so this functional decline can lead to decreased palatability of food and a failure to develop sensory-specific satiety. This could account for the fact that in Western countries the elderly population is the single largest demographic group at risk of inadequate diet and malnutrition (Raats et al., 2009). Product developers have to keep in mind the sensory losses older consumers experience when formulating their food and beverages, while at the same time realizing that all senses and consumers are not affected in the same way.

• Taste and smell. “Both taste and smell depend on continuous turnover of the receptor mechanism,” said Beverly Cowart, a staff member with the Monell Chemical Senses Center and Director of the Chemosensory Clinical Research Program. She explained that olfactory primary nerve cells are the only nerve cells in the body that interact directly with the environment so they are exposed to much more damage. The gustatory system, on the other hand, is made up of epithelial cells, not nerve cells. New nerve cells do grow, but it is not a perfect process. This is one reason why olfactory loss is much more common than gustatory loss. “The taste system is a more hard-wired system and a simpler system than the olfactory system,” said Cowart.

With olfactory loss, the difference between similar flavor components such as strawberry and banana is so subtle it is easily lost. This is because it is the olfactory system that is responsible for the ability to perceive the array of food flavors, by sniffing or during chewing, when volatile flavor compounds are released and are sensed as flavor as they stimulate the olfactory system retronasally. Not only does the ability to detect an odor decline with age, but the ability to identify it does as well. Sweet taste seems to be more stable, followed by salty. Bitter tastes may be more affected because they are pharmacologically active and therefore cause more damage to the cells.

--- PAGE BREAK ---

According to Cowart, losing the sense of smell causes some people to lose weight because food begins to taste bland. This is called the “anorexia of aging,” and presents serious risk of nutrition-related illnesses. On the other hand, some people gain weight because they are snacking more often and seeking out the foods that they still find enjoyable. However, since the normal deterioration of the olfactory system with age is gradual, many consumers’ food liking doesn’t change (Kremer et al., 2007). The fact that this decline is gradual introduces a food safety risk for aging consumers, who may no longer be able to perceive when food such as milk or meat is spoiled.

As a product developer, it might seem like it would be a safe bet to just amp up the flavor of foods targeted to older consumers. However, the problem is individual variability. While there is some evidence that older people prefer foods enhanced with flavor additives over foods without them, sensory loss is a very individual trait that is dependent on many factors including environment and genetics.

• Texture. Often taken for granted, the acts of chewing (mastication) and swallowing play a huge role not only in nutrient intake, but also in an enjoyable eating experience. This becomes difficult when dental health starts to degrade and salivary flow diminishes. Missing teeth and wearing dentures both impact the act of chewing and decrease biting forces. Chewing efficiency can also be affected by a decrease in biting and chewing forces attributed to age-related changes in muscle strength. The process of mastication is also very dependent upon accurate sensory feedback from the oral cavity. Receptors in the oral cavity respond to pressure, vibration, position, pain, and temperature, as well as to taste. Tactile feedback allows determination of the food position in the mouth, of the proper force needed for chewing, and the formation of the correct size and consistency of the food for swallowing (Fillion et al., 2001).

“About 40% of elderly people have difficulty chewing and swallowing food, and this difficulty has an obvious flow on effect for their health in terms of nutrition, wellbeing, and general quality of life,” said Peter Halley, Associate Professor at the Australian Institute for Bioengineering and Nanotechnology. The use of food thickeners or gelatin can help the texture of certain foods. How to make food more palatable while still easy to swallow is an area of ongoing research.

Halley leads a multidisciplinary team at the University of Queensland, Australia, in studying texture-modified foods to better improve food for the elderly. “By applying rheology (the study of the flow of fluids), developing new texture models, and looking at the nutrition and swallowing behavior of the foods, this project aims to bring a more scientific approach to the formulation and design of novel texture-modified food. The outcome will hopefully be more-appealing, safe-to-swallow foods that will improve the general well-being of the elderly,” said Halley.

• Packaging. While taste is the most important aspect for all consumers, packaging can make or break an item aimed at an older consumer segment. First, it is vital to have legible labels, with larger font and less text for those who are visually impaired. In addition, as consumers age, strength declines and products become more difficult to open. A study conducted among consumers age 55+ found that 64% of respondents described hard-to-open food packaging as “a big nuisance,” while 25% claimed to struggle with packages at least once a week. Over a third (34%) said they would switch to a different product or brand in the future as a result of encountering packaging problems (Leatherhead, 2012). Easy-grip shapes, along with resealable, flexible packaging enable food to be easily opened and stay fresher longer.

--- PAGE BREAK ---

“We are starting to see new easy-open packaging technologies addressing this concern,” said Williams. “This is a very easy way to target an older consumer. If your jar or pouch is easy-to-open and your competitor’s is not, it’s an easy win.”

Older consumers, especially seniors and the elderly, find meal preparation increasingly difficult, and often seek out ready-to-eat meals. Studies have demonstrated that increased effort can affect food selection and can result in reduced intake. Therefore, it is important that foods directed at this segment are nutrient dense and conveniently packaged.

As the market develops, more packaging aimed at older consumers will likely appear. Technological innovations may be more widely applied to create more helpful and sympathetic forms of packaging and improve the shelf-life of perishable foods.

Capturing the Growing Market

There’s no denying that the aging world population is going to affect the food and beverage industry. The question remains how the industry will choose to approach this growing consumer segment. Older consumers are likely to demand food and drinks offering clear and understandable health benefits, and manufacturers need to communicate these benefits without patronizing their consumers.

In a presentation at the 2010 Institute of Medicine Food Forum, Jim Kirkwood from General Mills explained the importance of combining science and consumer desires when considering how to formulate foods that older consumers will purchase and eat. “Food is only an enabler for the things that really matter to consumers. . . . If we can tie food to what matters, then we will be able to inject good things into their lives,” said Kirkwood. This is not necessarily a new idea in product development, but in order to be successful, companies like General Mills need to understand the diverse needs of an aging population.

“I think one of the biggest challenges is choosing which space to play in,” said Williams. “It’s important to find a benefit that your brand can successfully deliver; it has to make sense in the product. This is key. And after that, it still has to taste good.” Add to that the importance of effectively communicating a product’s health benefits to consumers so they see it as a way to achieving a longer, happier life. That, after all, is what really matters to the aging consumer.

Kelly Hensel is Digital Media Editor of Food Technology magazine ([email protected]).

References

Fillion, L. and Kilcast, D. 2001. Food texture and eating difficulties in the elderly. Food Ind. J. 4(1): 27–33.

Katcher, H., Legro, R., Kunselman, A., et al. 2008. The effects of a whole grain-enriched hypocaloric diet on cardiovascular disease risk factors in men and women with metabolic syndrome. Am. J. Clin. Nutr. 87(1): 79–90.

Kirkwood, J. 2009. Formulating for aging boomer consumers. Presented at Institute of Medicine Food Forum, Washington D.C., Oct. 29-30.

Kremer, S., Bult, J., Mojet, J., et al. 2007. Food perception with age and its relationship to pleasantness. Chem. Senses 32(6): 591–602.

Leatherhead Food Research. 2012. An ageing population—trends & opportunities for the food industry. Leatherhead Food Research, Surrey, U.K. www.leatherheadfood.com/ageing-population.

McClatchy-Tribune News. 2012. Maker of Pom Wonderful presses battle over health claims. http://www.ift.org/food-technology/past-issues/2012/october/features/the-chronic-disease-foodremedy.aspx?page=viewall. Accessed Oct. 20, 2012.

Nielsen Co. & BoomAgers LLC. 2012. Introducing boomers: marketing’s most valuable generation. Nielsen Co. & BoomAgers LLC, New York, N.Y. www.nielsen.com.

Perishables Group (Nielsen Co.). 2009. Feeding an aging population. Presented at AMI Worldwide Food Expo, Chicago, Ill., Oct. 28-31.

Raats, M., Groot, L., and Staveren, W. 2009. Food for the Ageing Population. Woodhead Publishing Ltd., Cambridge, England.

Symphony IRI Group. 2012. Baby boomers: riding the wave of diversity. SymphonyIRI Group, Chicago, Ill. www.symphonyiri.com.