Restaurants Reposition for Growth

Older diners, a renaissance for bread, and explosive interest in everything veggie are driving new opportunities in the foodservice sector.

Fueled by a somewhat stronger economy and pent-up demand, restaurant sales are projected to hit a record high of $683.4 billion in 2014, up 3.6% from 2013 (NRA, 2014). Although the NPD Group reports that Americans made 61 billion visits to restaurants in the year ending May 2014, about the same as last year, traffic is nearly 1.3 billion annual dining out occasions below pre-recession levels (Glazer, 2014).

Times are still tough. When asked to describe their personal financial situation in May 2014, 12% said they were struggling and 42% said they were just getting by; only 7% said they were extremely well off (Technomic, 2014a).

Real median household income fell 8.3% in 2013 from its most recent cyclical high in 2007, while elevated food prices continue to pressure restaurant operators’ bottom lines (NRA, 2014).

But there is some good news. Four in 10 adults (43%) are frustrated that they are not eating at restaurants as often as they would like and 42% are frustrated that they are not purchasing as much takeout/delivery as they would like (NRA, 2014).

In 2013, the number of households with incomes over $75,000 rose 3%, the first time in five years. High-income households (incomes > $100,000) contribute 38% of total spending on food consumed away from home; households in the range of $70,000 to $99,000 contribute 19% (NRA, 2014).

--- PAGE BREAK ---

Chains and Menu Gains

Chains and Menu Gains

Looking ahead, food/beverage sales are projected to grow 4.4% in limited-service restaurants and 2.6% in full-service eateries in 2014 (NRA, 2014).

Hotel/lodging restaurants, hospitals/nursing homes, cafeterias/grill-buffets, social caterers, snack and nonalcoholic beverage bars, and retail/host restaurants are expected to lead the industry with sales growth in excess of 5% (NRA, 2014).

Sales at manufacturing/industrial plant foodservice outlets and mobile caterers are projected to exceed 4% growth in 2014; foodservice sales at primary/secondary schools, colleges/universities, recreational/sport arenas, hospitals, and sports clubs (e.g., country clubs) will grow by more than 3% (NRA, 2014).

McDonald’s—with U.S. sales up a meager 0.7% in 2013—remains the largest U.S.–based restaurant chain with sales of $35.9 billion. Rounding out the list of America’s 12 largest restaurant chains are Subway with sales of $12.7 billion, +5.2%; Starbucks $11.7 billion, +10.6%; Wendy’s $8.8 billion, +1.3%; Burger King $8.5 billion, -1.1%; Taco Bell, $7.8 billion, +4.0%; Dunkin’ Donuts $6.7 billion, +7.6%; Pizza Hut $5.7 billion +0%; Chick-fil-A $5.0 billion, +9.3%; Applebee’s $4.5 billion, +0.2%; KFC $4.2 billion, -6.7%; and Panera Bread/St. Louis Bread Co. $4.1 billion, +11.8% (Technomic, 2014b).

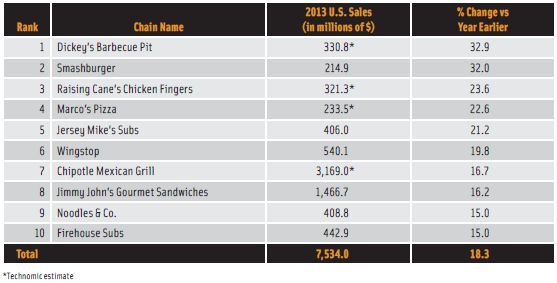

Dickey’s Barbecue Pit was the fastest-growing limited-service chain in 2013 with sales up 32.9% (Technomic, 2014; Figure 1). Chipotle Mexican Grill, Wingstop, Jimmy John’s Gourmet Sandwiches, Noodles & Co., and Firehouse Subs have been on the list of fastest-growing restaurants since 2010 (Technomic, 2014b, 2010).

Asian/noodle, with sales up 10.3%, was the fastest-growing limited-service menu category in 2013, followed by bakery cafés and coffee cafés. Sales at Panda Express jumped 10.7% to $2.0 billion, and Noodles & Co. sales were up 15% to $409 million in 2013 (Technomic, 2014b).

Bakery café limited-service-restaurant sales rose 9.3%, led by Panera Bread with sales up 11.8%. Coffee café sales jumped 9.3%, led by Starbucks with sales up 10.6% (Technomic, 2014b).

Steak houses led growth in the full-service menu category, with sales up 6.2%. Texas Roadhouse, with sales up 11.1% to $1.7 billion, and LongHorn Steakhouse, +12.8% to $1.3 billion, were the top gainers (Technomic, 2014b).

--- PAGE BREAK ---

Varied menu was a distant second in the full-service sector, led by $2.8 billion Buffalo Wild Wings’ explosive 12.9% gains (Technomic, 2014b). Mexican also had a strong showing when limited to the top 500 chains, up 6.1% in limited-service restaurants and 3.4% in the full-service sector (Technomic, 2014b).

Bakery café and Asian are the menu categories projected to lead growth overall in the restaurant industry this year, each at 7% growth, followed by chicken, steak, and “other sandwich,” each at 3% growth (Technomic, 2014b).

Bakery café and Asian are the menu categories projected to lead growth overall in the restaurant industry this year, each at 7% growth, followed by chicken, steak, and “other sandwich,” each at 3% growth (Technomic, 2014b).

Restaurants continue to go retail as a way to expand their business; one-quarter offer packaged food items for retail sale in their operations or in grocery stores (NRA, 2014).

Two in five consumers purchased items from a food truck in 2013, and nearly seven in 10 said they would be interested in doing so (NRA, 2014).

With 39% of adults now choosing a restaurant because it offers takeout or delivery, operators are focused on improving their services; 55% of consumers would order takeout/delivery from quick-service restaurants, and 56% would do so from table-service establishments (NRA, 2014). Burger King’s BK Delivers program is now available in more than a dozen metropolitan markets.

New Customers and Competition

Restaurant traffic overall remained flat for the year ended May 2014, according to NPD. Full-service restaurants were hardest hit, with midscale/family dining restaurant traffic declining 3% and casual dining down 2% (Glazer, 2014).

Visits to fine dining and upscale hotel restaurants grew 4%; quick-service restaurants, which include fresh casual, held steady for the same period (Glazer, 2014). With Technomic reporting sales gains of 11% in 2013, fast casual restaurants remain the industry bright spot (Jennings, 2014).

Nine in 10 consumers visited a fast food restaurant in 2013; 75% went to a burger place, 59% pizza, 58% sandwich, 50% chicken, 46% Mexican, 27% Asian, 21% seafood, 20% snacks, and 18% beverage (Mintel, 2013a).

An average check per eater at a fine dining restaurant was $28.55 in 2013, $13.75 in casual dining, and $5.32 for quick-service (NPD, 2014a).

Restaurant traffic at the breakfast and evening snack dayparts, which account for 21% and 14% of all restaurant visits, respectively, each grew 2% for the year ended May 2014. Lunch traffic, which accounts for 35% of all visits, fell 1%, and traffic at dinner, which accounts for 31% of all visits, was down 2% (Glazer, 2014).

--- PAGE BREAK ---

Consumers age 50 and older are now making more visits than their younger counterparts to every segment of the restaurant business. Annual visits by consumers ages 25–49 have dropped a total of 44 visits per person over the last three years (NPD, 2014b; 2013a).

With younger adults traditionally being the heaviest users of restaurants for dinner, foodservice outlets increasingly will have to cater to older adults to drive dinner traffic; since 2006, restaurants lost over 650 million dinner visits (NPD, 2013b). Older diners are the top consumers of fish/seafood, duck, pork, veal, lamb, ham, potatoes, salad, fruit, soup, breakfast, coffee, and hot tea (Sloan, 2014).

Restaurant visits by families with kids under age 13 have been declining since 2008; this group made one billion fewer visits to restaurants over the past year; adult parties made 306 million fewer visits (NPD, 2014c).

Hispanics are more likely to visit all types of quick-service restaurants than non-Hispanics and to visit them for lunch, snacks, dinner, and late-night fare; non-Hispanics are more likely to visit for breakfast (Mintel, 2013a).

NPD’s forecast is for foodservice industry traffic to grow less than 1% annually for the next several years (NPD, 2014a). At the same time, the competition for America’s away-from-home food dollars is stronger than ever.

Foodservice sales at convenience stores, which accounted for 15% of in-store sales, rose 5.5% in 2013; fresh prepared foods are the largest category, up 9.5% (Mastroberte, 2014). Sales of salads, up 13.6%, led growth in fresh prepared c-store items; pizza, sandwiches, chicken, and burgers also enjoyed double-digit growth. Soup grew 9.7%, bakery 8.7%, and hot dogs 8.4% (Mastroberte, 2014).

Lunch accounts for the largest share of foodservice sales (30.3%), followed by breakfast (26.4%), dinner (14.7%), morning snack (9.6%), midday snack (8.9%), evening snack (7.2%), and late night (2.9%) (Mastroberte, 2014).

Upgraded retail prepared foods are another fast-growing source of competition. Over one-third (37%) of consumers now buy ready-to-eat and heat-and-eat fresh prepared foods once a week or more, up from 22% in 2013 (Technomic, 2014c).

--- PAGE BREAK ---

What’s Center Stage

What’s Center Stage

Burgers, chicken, sandwiches, bagels, salty snacks, cookies, and frozen treats were the foods that showed the biggest increase in incremental servings at restaurants for the year ended March 2014 (Glazer, 2014).

Nearly three-fourths of consumers—or 225 million Americans—purchased gourmet foods in 2013, and 41% of all eating occasions are labeled as “savoring,” a more sophisticated culinary experience defined by freshness, distinctive flavors, and foodie narratives (Tanner, 2013; Hartman, 2013a). Clearly, it’s time to kick the culinary complexity of menus up a notch. Rice, Chinese favorites, salads, eggs, beans, burgers, potatoes, vegetables, sweets, and cuts of meat are the top 10 food items consumers want upgraded (Hartman, 2013a).

Consumer preferences for hot and spicy, bold, coupled (e.g., chili-lime), and ethnic flavors have grown dramatically over the past two years; interest in totally new and unique flavors is down (Technomic, 2013a).

Street food–inspired main courses (e.g., kebabs); specialty/gourmet sandwiches and burgers; half portions for a smaller price; tapas, meze, and dim sum; and meatless/vegetarian items are among the hot center-of-the-plate restaurant trends for 2014 (NRA, 2013).

New cuts of beef (e.g., Sierra and merlot steaks and New York pork chops) as well as inexpensive/underused cuts of meat (e.g., brisket), are grabbing diners’ attention (Major, 2014).

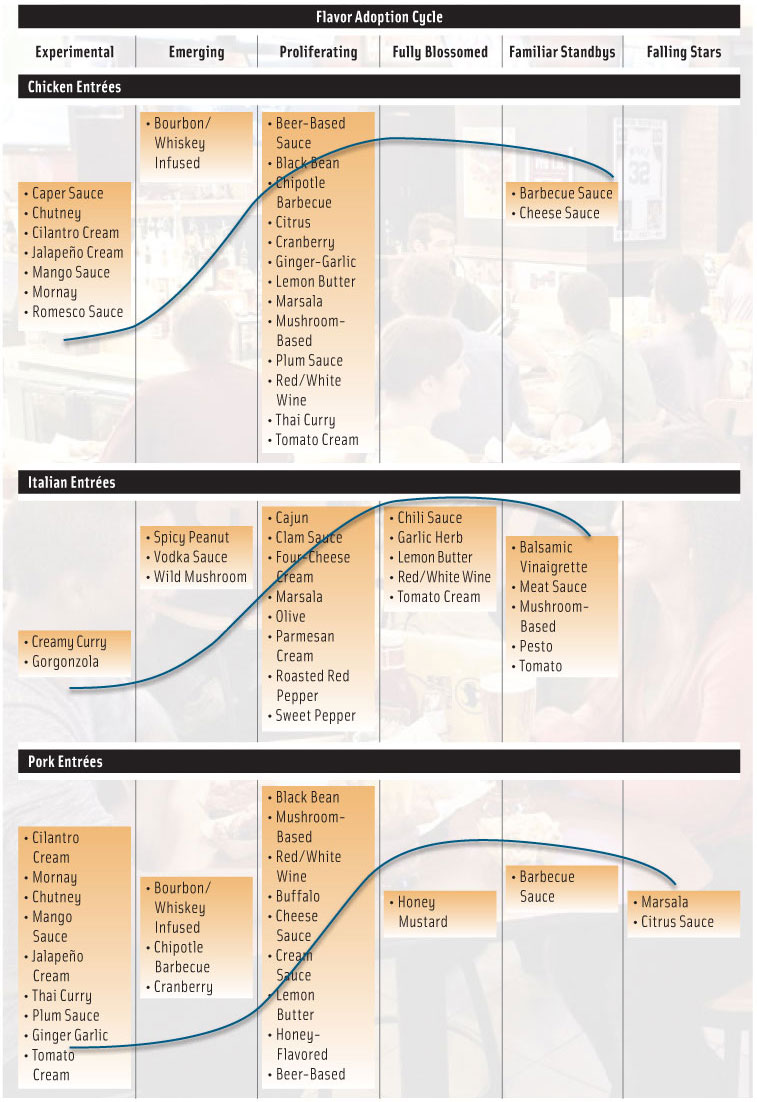

As culinary sophistication grows, it will be important to experiment with more interesting flavors for staples like chicken, pork, or even Italian entrees (Technomic, 2013a; Figure 2).

--- PAGE BREAK ---

Grass-fed, bourbon, Kobe, Greek, turkey, veggie, Southwestern, and Hawaiian are among the fastest-growing burger varieties in restaurants in 2013; fried eggs, brisket, pulled pork, and sausage are among the fastest-growing burger proteins (Datassential, 2014).

Tzatziki, garlic aioli, cilantro, chipotle, and bourbon are among the fastest-growing burger sauces, spices, and flavors; gruyere, goat, brie, and queso the top burger cheeses (Datassential, 2014).

Tzatziki, garlic aioli, cilantro, chipotle, and bourbon are among the fastest-growing burger sauces, spices, and flavors; gruyere, goat, brie, and queso the top burger cheeses (Datassential, 2014).

Shrimp, tuna, salmon, pollack, tilapia, pangasius, catfish, crab, cod, and clams are the most frequently consumed seafood (NFI, 2013). Less-familiar fish (e.g., branzino and barramundi) as well as underutilized species (e.g., mackerel and bluefish) are other trendy seafood options this year (NRA, 2013).

According to American Culinary Federation (ACF) chefs, pickling leads cutting-edge culinary preparations for 2014, followed by fermenting, smoking, sous vide, liquid nitrogen chilling/freezing, oil-poaching, braising, raw, and dusting (NRA, 2013).

The trend away from basic Italian pizza continues. Barbecue chicken, pesto, taco, Sicilian, Mediterranean, and gluten-free were among the fastest-growing pizzas on menus in 2013; chili, Thai peanut, Giardiniera, olive, jerk, and balsamic are among the fastest-growing pizza sauces (Datassential, 2014).

Four in 10 consumers ate specialty grains in 2013; 30% had couscous and/or barley, 25% quinoa, 23% millet/spelt, 22% bulgur wheat, and 21% buckwheat (Mintel, 2013b).

Non-wheat and Asian noodles (e.g., soba) are among the trendy sides for 2014; black beans are among the fastest-growing side dishes on menus (NRA, 2013; Datassential, 2014). Interest in ethnic foods continues to climb. After Italian, Mexican, and Chinese, the cuisines Americans most report eating in 2014 include Southern U.S., sushi, Thai, Greek, and Spanish (FMI, 2014a).

One-third of consumers are more interested in ethnic flavors and cuisines than they were two years ago; half of those ages 18–34 feel that way (Technomic, 2013a). Peruvian, Korean, Southeast Asian (e.g., Thai, Vietnamese, etc.), regional ethnic, and ethnic fusion top the list of cuisines more than half of ACF chefs cite as trendy in tablecloth restaurants this year (NRA, 2013).

--- PAGE BREAK ---

Veggies Are Trending Up

Vegetables are among the major new culinary/restaurant trends. Subway’s new advertising campaign focuses on the quality, variety, and daily preparation of the chain’s vegetables. Jamba Juice is focused on whole fresh food blending with fruits/vegetables, and Starbucks recently introduced Organic Ruby Roots vegetable juice.

Kale, oyster mushrooms, pickled vegetables, brussels sprouts, and sweet potato fries were among the vegetables that diners ordered with increasing frequency in 2013 (Datassential, 2014). Carrot and celery are also among the fastest-growing juices in restaurants along with pomegranate, apple, cranberry, and pineapple as well as juices described as natural, organic, and fresh-squeezed and those containing ginger. Tomato, carrot, mango, mixed fruit, and grape moved into the top 10 varieties of juice ordered in 2013 (Datassential, 2014).

Fruit and vegetable side items for kids’ meals and local produce were among the hot menu trends in limited-service restaurants in 2014 (NRA, 2014).

Unusual/uncommon herbs (e.g., chervil, lovage, lemon balm, papalo); dark greens (e.g., mustard greens, collards); hybrid fruits/vegetables (e.g., plumcot, Grāpple® grape-flavored apples, brocco-flower); specialty potatoes; heirloom fruits/vegetables; unique micro-greens; root vegetables; and lesser-known varietals of beans, mushrooms, and peppers are among the new trendy produce options. Pickled, grilled, and pureed are the trendy vegetable preparations (NRA, 2013).

One-third of consumers say they would be willing to pay more for a soup described as containing a serving of vegetables, heart healthy, or high in protein (Technomic, 2014d).

Bread Mania

Although one in five consumers still look for low carb on the label, interest in specialty breads, sandwich carriers, and breakfast breads is soaring (FMI, 2014a). Pretzel, brioche, English muffins, Texas toast, onion rolls, multigrain, artisan, panini, flatbread, and Cuban are among the fastest-growing burger and sandwich carriers; focaccia, rye, baguettes, ciabatta, and pizzas are gaining popularity at breakfast (Datassential, 2014).

Brioche French toast and flat-bread are among the fastest-growing menu items at breakfast; parfaits, frittatas, and chilaquiles are other hot new early morning items (Datassential, 2014).

Banh mi, lobster roll, muffaletta, pulled pork, brisket, torta, shrimp po boy, and Cubano are among the most popular sandwich varieties; tilapia, chorizo, fried oyster, and slow-roasted pork are among the fastest-growing sandwich proteins (Datassential, 2014).

Non-wheat flours (e.g., rice, millet, and peanut) and ethnic flours (e.g., fufu, teff, and cassava/yucca) are among the hot culinary trends for 2014 (NRA, 2014). Watch for high-protein and vegetable breads to arrive on the culinary scene.

Chefs are driving a new trend to natural sweeteners, which are used in breads and baked goods. These include agave, honey, concentrated fruit juice, maple syrup, muscovado, and demerara sugars (NRA, 2013).

--- PAGE BREAK ---

Snacks: The New Meal

With snacks accounting for 53% of all eating occasions in 2013 and 36% of consumers buying gourmet snacks for everyday use, the opportunities for unique, culinary-focused food-service snacks and appetizers are enormous (Hartman, 2013a; Tanner, 2013). Healthier snacks and savory snacks continue to outpace traditional snacks (Wyatt, 2014).

While boneless Buffalo wings, chicken strips/nuggets, popcorn chicken, and sliders remain America’s favorite protein appetizers, chicken skewers, chicken rolls/wraps/sliders, bite-size portions of seafood, and meatballs are coming on strong (Technomic, 2014e).

There is strong interest in breaded vegetables, both as a snack and a side dish, and especially with salad entrees. Stuffed mushrooms/jalapenos and sampler cheese plates are other currently popular appetizer items (Technomic, 2014e).

Bread is an overlooked appetizer opportunity. Consumers would be more likely to order garlic bread, bread sticks, or cheese bread as an appetizer than salsa or various dips (Technomic, 2014e).

House-cured meats/charcuterie; vegetarian appetizers; ethnic/street food–inspired appetizers (e.g., tempura, taquitos, and kebabs); ethnic dips (e.g., tabbouleh, baba ghanoush); and classic chef-inspired appetizers/bite-sized hors d’oeuvres led the list of higher-end hot appetizer trends for 2013 (NRA, 2013).

Hybrid desserts such as the cronut (croissant/doughnut) or townie (tart/brownie) remain among the top sweet culinary trends for 2014 (NRA, 2013). Panna cotta, cupcakes, coconut cake, churros, and vanilla custard were among the fastest-growing desserts in 2013; red velvet, peanut butter, and caramel were among the cake varieties grabbing attention.

Shortbread, lemon, mini, macaroon, and Italian were among the trendy cookie varieties last year; ganache, mini pies/tarts, coconut/banana cream, and almond made the list of pies growing in popularity on menus (Datassential, 2014).

With beverages being more frequently consumed as snacks and proving successful as a strong restaurant competitive differentiator, offering cutting-edge culinary and calorie-controlled beverages is a must for foodservice operators.

House-made and signature soft drinks/soda/pop; gourmet lemonade; coconut water; specialty iced teas; dairy-free milks, including soy, rice, and almond; and mocktails are the top hot nonalcoholic beverage trends for 2014 (NRA, 2013).

With sparking water sales up 31% in the retail marketplace, expect flavored waters made with real fruit/juice and fruit-infused waters to be in high demand (Packaged Facts, 2014).

Pomegranate now leads the list of the top smoothie/shake flavors in restaurants, followed by avocado, chocolate peanut butter, vanilla bean, mixed berry, apple, açai, cinnamon, and passion fruit (Datassential, 2014).

Classic international/ethnic fruit drinks (e.g., San Pellegrino’s Limonata and Aranciata) are among the fastest-growing nonalcoholic beverages in restaurants (Datassential, 2014). Watch for agua fresca, lassi, bubble tea, and horchata beverages to gain in popularity.

Savory culinary cocktails, flavored herbed tonics, skinny/lower-calorie cocktails/wine, and organic cocktails are among the hot alcoholic beverage trends for 2014 (NRA, 2013).

--- PAGE BREAK ---

Healthy and Humane

More than eight in 10 restaurant operators say their customers pay more attention to nutrition than they did two years ago. Sixty percent of those who frequently opt for full-service, quick-service, and take-out/delivery dining say that healthy menu items impact their restaurant choices (NRA, 2014).

In 2013, 28% of consumers ordered more healthy items at a fast food restaurant; 38% of fast food patrons want lower-calorie menu items (Mintel, 2013a). The majority of consumers think a low-calorie restaurant meal is between 400 and 500 calories (Mintel, 2013a). About one-third of consumers often think about calories (IFIC, 2014).

Four in 10 consumers strongly agree that they would be more likely to visit a foodservice establishment if it offered better-for-you options. Gen Z, Millennials, and Gen Xers are more likely than Baby Boomers to say this is an important restaurant criteria (Technomic, 2014f).

Lack of healthy options for children’s breakfast is one of consumers’ biggest complaints about fast food (Technomic, 2013b).

Fresh remains the most important purchase influencer in restaurants, cited by 83% of consumers; local is cited by 73%, natural 72%, and farm-raised 63% (Technomic, 2014f).

How do diners define a healthy menu at restaurants? They expect the food to be fresh, prepared with techniques like grilling or steaming, use more fruits/vegetables than average, and not be deep-fried (Mintel, 2013a).

Healthful kids’ meals top the list of hot children’s culinary trends for 2014, along with whole-grain items in kids’ meals, fruit/vegetable sides, ethnic-inspired kids’ dishes, and oven-baked chicken fingers and fries (NRA, 2013).

Nearly six in 10 consumers (58%) say they are likely to make a restaurant choice based on its eco-friendly practices; 55% say they’re more likely to pick a restaurant that offers menu items that were grown or raised in an organic or sustainable manner (NRA, 2014).

Animal welfare is very important to 52% of diners. Grass-fed, pasture-raised, free-range, and cage-free all add up in diners’ minds to healthier and more flavorful fare (Hartman, 2013b). As for causes, consumers would most like to see restaurants support those that fight hunger (Technomic, 2014g).

With one-third of consumers purchasing organic meat/poultry, expect more demand for that in restaurants along with locally sourced products, sustainable proteins, grass-fed beef, and free-range pork/poultry (FMI, 2014b).

--- PAGE BREAK ---

Chipotle Mexican Grill and Panera Bread are the undisputed leaders when it comes to addressing sustainability and transparency issues. Chipotle’s “Food with Integrity” program is focused on “finding the very best ingredients, raised with respect for the animals, the environment, and the farmers.” It is the first major chain to embrace non-GMO products.

Panera Bread has a long and strong history of being committed to clean label, transparency, and the fight against hunger. The Panera Bread Foundation’s nonprofit Panera Cares Community Cafés work with customers to help feed those in need.

A. Elizabeth Sloan, Ph.D., a professional member of IFT and contributing editor of Food Technology, is president, Sloan Trends Inc., Escondido, Calif. ([email protected]).

A. Elizabeth Sloan, Ph.D., a professional member of IFT and contributing editor of Food Technology, is president, Sloan Trends Inc., Escondido, Calif. ([email protected]).

References

Datassential. 2014. Datassential. Food and menu trends from Datassential. QSR 189(1): 4-25.

FMI. 2014a. U.S. grocery shopper trends. Food Marketing Institute, Arlington, Va. www.fmi.org.

FMI. 2014b. The power of meat.

Glazer, F. 2014. Traffic stuck in neutral. Nation’s Restaurant News 48(15): 58.

Hartman. 2013a. Eating occasions compass. The Hartman Group, Bellevue, Wash. www.hartman-group.com.

Hartman. 2013b. Sustainability report. Nov.

IFIC. 2014. 2014 food & health survey. International Food Information Council, Washington, D.C. www.ific.org.

Jennings, L. 2014. Upscale evolution. Nation’s Restaurant News 48(15): 18, 26.

Major, M. 2014. Meating in the middle. Progressive Grocer 93(2):59-60, 62, 64, 67.

Mastroberte, T. 2014. High expectations. Convenience Store News 50(8): 44, 45-47, 48, 50.

Mintel. 2013a. Quick service restaurants—U.S. Aug. Mintel International Group Ltd.,

Chicago, Ill. www.mintel.com.

Mintel. 2013b. Dry pasta, rice, noodles and ancient grains—U.S. Feb.

NFI. 2013. Top 10 consumed seafood. National Fisheries Institute, MacLean, Va. www.aboutseafood.com.

NPD. 2013a. Boomers increase restaurant visits while millennials cut back. Press release, Jan. 15. NPD Group, Port Washington, N.Y. www.npd.com.

NPD. 2013b. Restaurant supper visits will fare better over next ten years and recessionary traffic losses will be recovered. Press release, June 5.

NPD. 2014a. U.S. fine dining restaurants increase visits for last three years vs double-digit declines during recession. Press release, April 8.

NPD. 2014b. U.S. restaurant traffic remains in the doldrums with no tailwind in sight. Press release, July 23.

NPD. 2014c. Families with kids continue to cut down on restaurant visits. Press release, May 14.

NRA. 2013. What’s hot chef’s survey. National Restaurant Assn., Washington, D.C. www.restaurant.org.

NRA. 2014. 2014 forecast.

Packaged Facts. 2014. Bottled water in the U.S. April. Packaged Facts, Rockville, Md. www.packagedfacts.com.

Sloan, A.E. 2014. What, when and where America eats. Food Technology 68(1): 20-22, 24, 26-28, 30-31.

Tanner, R. 2013a. Today’s specialty food consumer. Specialty Food 43(7): C-2-16.

Technomic. 2010. Top 500 chain restaurant report. Technomic Inc., Chicago, Ill. www.technomic.com.

Technomic. 2013a. The flavor consumer trend report.

Technomic. 2013b. The breakfast consumer trend report.

Technomic. 2014a. Financial situation trend barometer. Am. Express Market Briefing, June.

Technomic. 2014b. Top 500 chain restaurant report.

Technomic. 2014c. Prepared foods trend barometer. Am. Express Market Briefing. Aug.

Technomic. 2014d. The left side of the menu: soup & salad consumer trend report.

Technomic. 2014e. The starters, small plates & sides consumer trend report.

Technomic. 2014f. The generational consumer trend report.

Technomic. 2014g. The gift that keeps on giving: restaurants and charity. Am. Express Market Briefing, June.

Wyatt, Lyons, S. 2014. The state of the snack food industry. Presented at SNAXPO, Snack Food Assn. Ann. Mtg., Dallas, Texas, March 1-4.