Searching for the Sweet Spot in Confectionery

Consumers are definitely considering health and wellness when choosing candy, but flavor, quality, and enjoyment might just trump everything.

According to the National Confectioners Assoc. (NCA), most people in the United States enjoy candy about twice a week, and the U.S. confections industry is worth $35 billion (NCA 2015). IRI data, which tracks sales in supermarkets, mass merchandisers, drug stores, and convenience stores, puts the chocolate category sales at $13.6 billion, up 1.8% for the 52-week period ending April 17, 2016. Nonchocolate candy sales grew even more, up 3.5% to $7.8 billion in the same time period, something the NCA attributes to solid performances from fruity candies, gummies, and sour candies (NCA 2016c).

Adding Innovation to Mainstream Chocolate

Adding Innovation to Mainstream Chocolate

Eighty-five percent of women and 76% of men eat chocolate, according to Packaged Facts; although home is the most common place for consumption, they are also eating it at work, at the movies, and on the go (Packaged Facts 2014), making it ever more important for manufacturers to create candies that are easy to take along. In 2014, Packaged Facts forecast that U.S. chocolate sales would surpass $26 billion by 2018, but growth appears to be slowing; 28% of consumers report buying less chocolate than they did a year ago (Mintel 2016a). In 2015, confectionery markets in Europe and North America saw flat volume sales and declining per capita consumption. In developing markets like India, Indonesia, and China, however, volume sales and per capita consumption are growing (Mintel 2016a).

According to data from IRI for the 52-week period ending April 17, 2016, Hershey, Mars, Nestlé, and Lindt & Sprüngli led dollar sales for chocolate box/bag/bar products both greater than 3.5 ounces and less than 3.5 ounces; for the former category, Ghirardelli comes in fifth, and for the latter, Ferrero does. In these two categories combined, dollar sales totaled about $9.2 billion.

While classic mainstream chocolate candies such as Reese’s, Snickers, and M&Ms still top the list when it comes to dollar sales, some mainstream companies are hoping to strike a chord with consumers looking for something new and exciting in their everyday candy.

Mars launched Snickers Crisper, a combination of crisp rice, milk chocolate, caramel, and peanuts that the company created to answer consumer desire for new textures in their snacking occasions. Hershey’s Reese’s brand is also focusing on texture with its brand-new Reese’s Peanut Butter Cups Stuffed With Reese’s Pieces. The complex candy, which took Best In Show at the Sweets & Snacks Show, “is leading to an entirely new, but trusted, confection experience,” according to Ryan Riess, senior marketing manager of the Reese’s brand for The Hershey Co., in a 2016 post on the company’s blog.

In addition, some companies are looking to packaging for that twist. Hershey’s Take 5 brand swapped out its red wrapping for sleeker green packaging that the company hopes will capture the attention of Millennials, according to Business Insider. Lindt recently introduced its HELLO collection of emoji-inspired chocolates, which Lindt USA master chocolatier Ann Czaja says “are an approachable and fun chocolate option for consumers”; each chocolate coin features a peel-off emoji sticker.

Mainstream companies are also facing other demands from consumers, leading companies such as Mars and Nestlé to announce plans to reformulate their lines with natural colors. Natural colors can be a bit of a challenge to work with, says Rose Potts, corporate manager, sensory and product guidance, for Blommer Chocolate, but she believes that consumers will come to accept faded colors as more companies make the switch. Twenty-five percent of the world’s confectionery consumers look for natural ingredients when indulging, according to Mintel data presented by FONA International (FONA 2015), and some new brands are presenting a better-for-you twist on mainstream candy types. Little Secrets, a Boulder, Colo., company, uses premium Fair Trade 55% dark chocolate to create its naturally colored candy-coated chocolate drops. OCHO Candy, meanwhile, calls its nougat-, coconut-, and peanut butter–based bars an “organic twist on familiar favorites.”

--- PAGE BREAK ---

Inside the World of Premium Chocolate

“There is no established definition for premium chocolate,” according to Mintel, “but there are some parameters that define the subcategory, based on price, perception, and positioning” (Mintel 2016b). Consumers expect premium chocolate to contain high-quality ingredients and sophisticated packaging, but they do not limit their purchases to what Mintel calls “boutique premium” candies found in standalone stores; “mainstream premium” chocolate can be found in supermarkets, restaurants, and bookstores and be easily integrated into consumers’ lives (Mintel 2016b).

Whatever the definition, premium chocolate seems to be on the rise. Globally, premium chocolate confection claims have risen 50% since 2013, according to Mintel data (FONA 2016a), and the NCA says premium chocolate sales increased 56% over the last three years (NCA 2016b). According to Mintel, the “premiumization” of chocolate has the potential to help spur new growth in chocolate consumption as consumers give themselves permission to indulge in higher-quality options (Mintel 2016b).

According to the NCA, dark chocolate sales increased 8% in 2014, but milk chocolate remains the largest chocolate segment in the United States. Sales of dark chocolate are driven by people older than 35, Potts explains, but that preference is also influenced by where consumers are living: people on the coasts (California and New York) and those in urban centers are more drawn to dark chocolate while Midwesterners prefer milk chocolate, according to Potts.

Dark milk chocolate may serve as a bridge for those who are interested in darker chocolate but find traditional dark chocolate too bitter, according to Mintel (Mintel 2016b); Katrina Markoff, CEO of Vosges Haut-Chocolat in Chicago, agrees that deeper milk chocolate is on trend, and she will be working with it in the near future. Still, dark chocolate has been embraced by many companies that are pairing it with interesting inclusions or simply showcasing the beauty of the cocoa. “You can’t make good chocolate without good cocoa,” says Lindt’s Czaja. “Chocolate is the protagonist. It has to be about the chocolate first.”

For that reason, perhaps, consumers have been drawn to single-origin cocoa bars; “in addition to flavor selection, ingredient origin is another way brands are giving premium position to their chocolates,” writes FONA International (FONA 2016a). Including the origin of a bar’s beans also lends a level of transparency and authenticity to products. An interesting shift, though, can be seen in just where these beans are coming from. Cocoa production has begun to extend out of Africa, according to Mintel, and the amount of chocolate made from beans grown in Asia, Latin America, and the Caribbean is growing (Mintel 2016b).

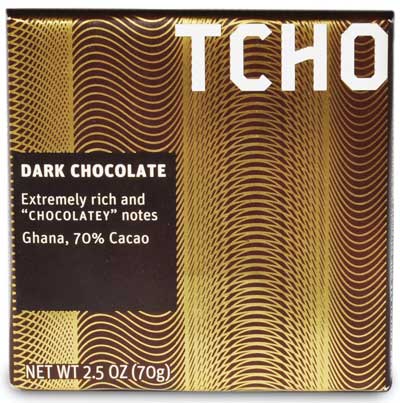

Taza Chocolate debuted an 84% bar with single-origin Haitian beans, and Willie’s Cacao’s new 100% Pure Gold bar uses cacao sourced from Venezuela’s Sur del Lago region. Dick Taylor Craft Chocolate’s 70% Bolivia Alto Beni bar uses wild-harvested beans from ancient cacao trees in Bolivia, and TCHO offers PURE NOTES single-origin chocolates that are marketed by both their place of origin and flavor profiles; Chocolatey comes from Ghana, while Fruity is sourced from Amazonian Peru.

Taza Chocolate debuted an 84% bar with single-origin Haitian beans, and Willie’s Cacao’s new 100% Pure Gold bar uses cacao sourced from Venezuela’s Sur del Lago region. Dick Taylor Craft Chocolate’s 70% Bolivia Alto Beni bar uses wild-harvested beans from ancient cacao trees in Bolivia, and TCHO offers PURE NOTES single-origin chocolates that are marketed by both their place of origin and flavor profiles; Chocolatey comes from Ghana, while Fruity is sourced from Amazonian Peru.

Whatever the origin of the ingredients, companies have to be honest about where they come from. “Do what you say, just be honest about it,” says Potts. “There’s a consumer for everything, so you just have to be honest about whatever practices your company does.”

Including Texture and Flavor in Chocolate Bars

Great chocolate makes for great chocolate bars, but flavors, fillings, and inclusions can transform them into unique and satisfying eating experiences. When it comes to inclusions, the sky’s the limit; according to Mintel, the most popular global inclusion—hazelnut—is used in only 7% of launches (Mintel 2016b).

“Chocolate producers have learned that consumers are open to creative products, and they are exploring many ways to generate new product excitement,” Packaged Facts explains. “At the same time, there are time-tested chocolate classics, so producers aim for the right balance between the classics and pushing the envelope toward new flavor directions” (Packaged Facts 2014).

Chocolate and fruit or chocolate and nut combinations have performed increasingly well over the last three years—increasing 116% and 63%, respectively—according to the NCA, and “new mouthwatering fruit and flavor pairings will emerge this year, such as mango, blueberry, açaí, and fig” (NCA 2016b). As the market is changing, more consumers are looking for nuts and fruit in their chocolate, says Kevin Coen, president of Fannie May, and in a webinar sponsored by the Almond Board of California (ABC), Lu Ann Williams, director of innovation for Innova Market Insights, said that nuts are the No. 1 inclusion in chocolate.

“Globally, 70% of survey consumers prefer nuts in chocolate,” says Harbinder Maan, senior marketing manager, trade stewardship for the ABC, and in the ABC’s 2014 Global Chocolate Study, consumers rated almonds as the “No. 1 nut that delivers on taste, crunch, and being more nutritious in chocolate confections,” says Jeff Smith, director of marketing, Blue Diamond Almonds Global Ingredients Division. Although Maan says that 37% of consumers named almonds as the first nut that comes to mind when they think about chocolate, the NCA observes that new nuts are emerging within confectionery, including hazelnuts, pistachios, and cashews.

--- PAGE BREAK ---

The addition of ingredients with health benefits in chocolate is not limited to nuts, though. Coconut experienced 21% growth in launches from 2011–2015 (ABC 2016), and passion fruit and blueberry are also growing quickly; blueberries provide antioxidants—along with a nice acidic note—to chocolate confections, according to the U.S. Highbush Blueberry Council. Theo Chocolate released an 85% bar that touts black rice and protein-rich quinoa, and Minneapolis-based K’UL offers a line of Superfood Bars intended for athletes to use to replace energy bars. Its Endurance bar contains cranberries, pumpkin seeds, protein, and guarana and just 15 grams of sugar.

The addition of ingredients with health benefits in chocolate is not limited to nuts, though. Coconut experienced 21% growth in launches from 2011–2015 (ABC 2016), and passion fruit and blueberry are also growing quickly; blueberries provide antioxidants—along with a nice acidic note—to chocolate confections, according to the U.S. Highbush Blueberry Council. Theo Chocolate released an 85% bar that touts black rice and protein-rich quinoa, and Minneapolis-based K’UL offers a line of Superfood Bars intended for athletes to use to replace energy bars. Its Endurance bar contains cranberries, pumpkin seeds, protein, and guarana and just 15 grams of sugar.

Cocoa and coffee are a classic combination, and Seattle Chocolate Co. infuses its chocolate with CoffeeFlour, which converts coffee fruit pulp into a nutrient-rich ingredient. Tea, especially matcha, has also found its way into chocolate thanks to its health benefits (Mintel 2016b), and turmeric—an ingredient that has begun showing up in everything from tea to snack mixes—is also appearing in chocolate, according to Potts. Vosges’ Markoff likes to pair turmeric with black pepper.

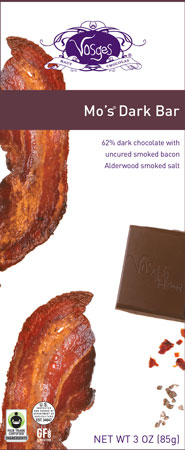

According to Williams, there is still great opportunity for sea salt within chocolate since it can complement many flavors (ABC 2016), and smoked and naturally flavored salts can also add flavor, color, and a unique twist to bars, according to Megan O’Keefe, media relations representative for Woodinville, Wash.–based SaltWorks; the company’s offerings include gray, pink, and red sea salts as well as flavors such as Fusion Espresso Brava Salt and Salish Alderwood Smoked Salt, which pair well with dark chocolate.

Perhaps sea salt has opened the gates for the savory elements that have made their way into chocolate. Markoff has included bacon in several of her company’s products, and many other chocolate makers have followed suit. Markoff says that while the market is still receptive to bacon, she is ready to move on from it, though she has continued to embrace other savory elements. She uses beef jerky and barbecue potato chips in two of her Wild Ophelia brand bars. Potts agrees, saying that bacon is not the “crazy, crazy thing in confection anymore.” She observes that brown butter notes and caramelized flavors reminiscent of protein are really big.

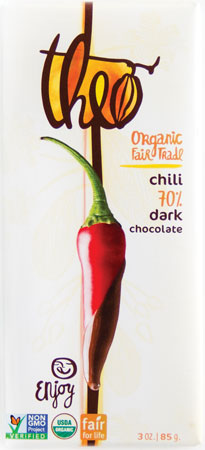

Fire—in the form of burnt caramel or smoked and charred desserts—can elevate chocolate, according to Potts, and Vosges’ line includes a Coconut Ash & Banana Super Dark Chocolate Bar with charcoal coconut ash. Its Smoke & Stout Caramel Bar includes Alderwood smoked salt and dark chocolate stout, which also touches on a current trend of including alcohol flavors in chocolate to add adult appeal. Speaking of fiery, “chili has never been more on trend,” according to Williams (ABC 2016). It experienced a 22% growth last year, and she predicts that the market will see specific peppers being called out in the future. Combining sea salt with chilies can elevate both flavors, says Williams. New York–based Little Bird coats jalapeño pieces with dark chocolate for a smooth candy with a slow burn.

Fire—in the form of burnt caramel or smoked and charred desserts—can elevate chocolate, according to Potts, and Vosges’ line includes a Coconut Ash & Banana Super Dark Chocolate Bar with charcoal coconut ash. Its Smoke & Stout Caramel Bar includes Alderwood smoked salt and dark chocolate stout, which also touches on a current trend of including alcohol flavors in chocolate to add adult appeal. Speaking of fiery, “chili has never been more on trend,” according to Williams (ABC 2016). It experienced a 22% growth last year, and she predicts that the market will see specific peppers being called out in the future. Combining sea salt with chilies can elevate both flavors, says Williams. New York–based Little Bird coats jalapeño pieces with dark chocolate for a smooth candy with a slow burn.

For a more traditional treat, including dessert-like flavors is a sound idea. Potts observes that confections are a ripe place for celebrating “things we’re familiar with … in different forms.” Cookie dough and cookie pieces add crunch and interest without asking consumers to step too far out of their comfort zones, and Bay Area TCHO offers a Mint Chip Gelato bar made with freeze-dried local gelato that has been smashed into pieces; the resulting texture is akin to astronaut ice cream, says chocolate maker Brad Kintzer.

Whatever manufacturers choose to include in their bars, they should aim to interest and delight consumers while delivering a product they are happy to pay a little extra for. With many consumers watching how many treats they indulge in, they want to be sure that the sugar, fat, and calories they consume are worth it. “The indulgent motto for many appears to be, ‘If you’re going to do it, do it well,’” concludes FONA International (FONA 2016b).

--- PAGE BREAK ---

Tasting a Rainbow of Candy

Tasting a Rainbow of Candy

According to Jill Manchester, senior vice-president of marketing and brand strategy for Forest Park, Ill.–based Ferrara Candy Co., nonchocolate confections are all about variety. “You want to try something different,” she says. “Nobody usually says, I have one favorite nonchocolate brand … there’s a repertoire of brands that [I’ll pick] depending on what my mood is.”

As Manchester attests, the world of nonchocolate confections is vast. Fruit chews are the largest segment in nonchocolate, according to a 2016 Ferrara Candy Co. press release, and they appear in a range of forms. Hershey’s Jolly Rancher hard candy brand includes a Chews product, and Starburst has expanded its classic line with several new flavors, including Superfruit and Fruit Slushies. In addition, the original flavor range comes in a miniature form. Just Born Quality Confections’ Mike and Ike brand also comes in minis, and the smaller pieces help with flavor delivery, says Matt Pye, vice-president of trade relations and corporate affairs for Just Born.

Gummies, though, have driven more category growth than any form over the past three years, according to research presented by Wm. Wrigley Jr. Co. at the Sweets & Snacks Show; its new Starburst Gummies was named the most innovative new product in the nonchocolate category at the 2016 Sweets & Snacks Show. And when it comes to gummies, sour is in … provided companies can find the sweet spot between fun and engaging and harsh and extreme.

“Sour candy continues to be popular because consumers are seeking intense flavor experiences,” explains Pye, and nonchocolate confection is filled with examples of sour power. Just Born’s Mike and Ike Sour-Licious Zours offer sour power in five fruit flavors, and Perfetti Van Melle’s Airheads Xtreme Sourfuls, a filled licorice-type candy, “starts sour, stays sour,” according to the company. Worms are the No. 1 shape in sour gummies, and 84% of consumers want to try them, according to Impact Confections, maker of the WarHeads line.

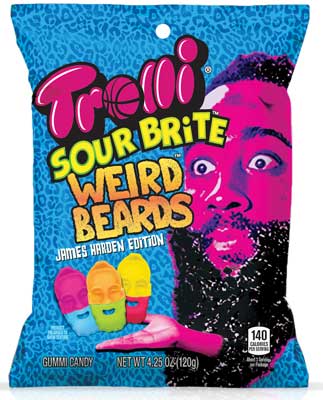

According to Manchester, consumers are drawn to sour because it helps wake up their mouths; for teens and college students in particular, these candies can function as an ideal energizing study break that doesn’t require caffeine. Ferrara Candy Co. offers a wealth of sour treats in its Trolli brand, including Weird Beards, a limited release that was developed in collaboration with NBA star James Harden.

According to Manchester, consumers are drawn to sour because it helps wake up their mouths; for teens and college students in particular, these candies can function as an ideal energizing study break that doesn’t require caffeine. Ferrara Candy Co. offers a wealth of sour treats in its Trolli brand, including Weird Beards, a limited release that was developed in collaboration with NBA star James Harden.

There is more room for innovation in nonchocolate in terms of shapes and forms, adds Manchester, and Ferrara Candy Co.'s Trolli Eggs put a spin on jelly beans by panning a candy shell around a gummy instead of a chewy center. Its Sour Brite Blasts, meanwhile, have a liquid center and gummy outside to draw on duality and create two different flavors and textures. Tic Tac Mixers feature first-of-its-kind, dual-flavored pills that change from one flavor to another, and Bazooka Candy Brands recently introduced Juicy Drop Gummies, which allow consumers to top gummies with packets of sour gel to customize how sweet or sour their candy is, explains Nicole Rivera, marketing and innovation director at Bazooka.

Another kind of innovation has come in the form of organic nonchocolate confections. “Interest in organic foods has been growing for more than 10 years with no signs of slowing down,” says Rob Swaigen, vice-president of global marketing for Jelly Belly Candy Co., which recently released its Organic Jelly Beans. “Many consumers are looking for ways to enjoy their favorite treats in a way that supports their lifestyle choices.”

Ferrara Candy Co.'s Black Forest organic line recently expanded from cherries, worms, and bears into four other organic offerings based on the candies’ success. According to Manchester, this line was developed to provide an organic option to the everyday consumer at a good price point, but she cautions that the flavor can’t suffer. “[Our organic] has to beat the national standard of quality in taste tests,” she says.

Torie & Howard cocreator Torie Burke focused on flavor when creating her line of organic fruit chews and hard candies. The company’s fruit-forward flavors include combinations such as Blood Orange & Honey and Pomegranate & Nectarine. “Today’s consumers are well-educated about the benefits of healthful eating and many are excited about sophisticated flavor combinations in candy,” Burke observes.

--- PAGE BREAK ---

Balancing Health and Indulgence

Consumers are looking to eat better, and while candy is still a permissible indulgence, it’s competing with other categories like snacks. According to Mintel, sales of snack-sized chocolates have declined because consumers feel like they do not need to rely on small sizes for portion control (Mintel 2016a). Instead, companies are positioning chocolate and other candies in resealable bags meant for snacking over time. According to Packaged Facts, 44% of chocolate consumers now buy chocolate candy in standup pouches, and according to Rivera, gusseted standup bags are growing. “Resealable is a thing that makes us feel good,” says Potts. “You have the illusion of not eating it all at once.”

When it comes to what’s inside those bags, “thin and crunchy is in. It makes everything seem more snackable,” Potts adds. “Crunching gives the illusion you’re eating more for the same calories.” The NCA named barks and thins a top trend for this year’s Sweets & Snacks Show; chocolate bark may not be new, but it’s “become sexy because we’re putting new things in it,” observes Potts.

One brand, barkTHINS, is hoping to disrupt the way consumers think about chocolate by providing a functional, better-for-you snacking option filled with healthful ingredients like blueberry and quinoa and coconut and almond, according to Stephanie McGregor, director of marketing. The resealable packaging also allows consumers to choose their own level of reward, she says. Brown & Haley offers Mountain Thins, chocolate bark studded with trail mix, peanuts, or blueberries and raspberries, and the company also introduced ROCA THINS snacking chocolate, which are milk or dark chocolate pieces with ROCA toffee.

As for bites, many chocolate makers are creating bite-sized versions of their bars; in a similar vein, Godiva recently took some classic pieces from its boxed chocolate line and individually wrapped them for its Godiva Masterpieces line. Russell Stover also made the move from box to bag, and Chicago-based Sulpice Chocolate recently introduced its Better Chocolate Bites, which feature 7 grams of protein, 3 grams of fiber, and chia and flaxseed in a resealable standup pouch. Enjoy Life Foods rolled out ProBurst Bites, a protein-rich, allergy-friendly treat with a smooth creamy chocolate center rolled in seeds and spices, and LÄRABAR launched its LÄRABAR Bites, “truffle-like bites made from real food” that allow consumers to have “just a little bit of sweet” without having to compromise, says Sidd Singhal, associate marketing manager at General Mills.

In addition, some companies are creating snack-confection hybrids. Hershey’s Snack Mix line combines candies such as Reese’s Pieces and mini Hershey Bars with nuts and pretzels for a more snackable product, while Mars introduced its goodnessknows snack squares in 2015. Each four-piece “bar” contains nuts, fruit, and chocolate for a less guilt-inducing way to snack. Bixby Craft Candy Snack Bars, which are organic, gluten-free, and vegan-friendly, are positioned as “energy covered in chocolate”; they contain 3–5 grams of protein and 2–4 grams of fiber.

For chocolate in particular, there is opportunity to add a healthy halo even to traditional bars. Chocolate itself is considered a superfood, and incorporating healthy inclusions such as nuts, fruit, and raisins can make consumers feel better about indulging, as well as help to reduce sugar content. Marketers can also focus on the benefits of flavanols found in chocolate as well as the emotional well-being it can provide; “even in a time when the importance of healthy snacking is being emphasized, the importance of chocolate confectionery as a wellness tool cannot be ignored,” writes Mintel (Mintel 2016b). Both chocolate and nonchocolate confectioners might also consider using organic ingredients, as organic is perceived as healthier than nonorganic; organic launches have more than doubled in the last five years, and 6% of global launches carry the claim, according to Mintel data presented by FONA (FONA 2016b).

In addition, companies can focus on making the nutritional information about their products as clear as possible. “Consumers increasingly expect more transparency when it comes to calorie counts and ingredients in what they eat and drink,” says Susan Whiteside, vice-president of public relations and marketing communications for the NCA. “From front-of-pack calorie labels that put information right at consumers’ fingertips to creating a wide variety of options that can bring a little enjoyment to any occasion, candy companies are providing consumers with the information, support, and options they need to make the choices that are right for them.”

In the end, it’s possible for consumers to have their candy and eat it too by practicing self-control. “Consumers understand the role of confections in their lives and choose to enjoy candy in moderation,” the NCA says (NCA 2016c). By focusing on ways to combine the delicious, comforting, fun aspects of candy with attributes that are perceived to be healthier—such as natural flavors and colors, organic ingredients, and healthful inclusions—confectioners might just be able to find the sweet spot consumers are searching for.

Seasonal Candy Sales

In 2015, seasonal candy saw sales of nearly $8 billion, or roughly 23% of total candy sales, according to National Confectioners Assoc. data.

Valentine’s Day: $1.1 billion

Easter: $2.3 billion

Halloween: $2.6 billion

Christmas: $1.7 billion

Chocolate With Purpose

Chocolate With Purpose

Many confections brands are focusing on finding ways to give back to their communities. DOVE Chocolate announced at the 2016 Care National Conference that it was partnering with Care to launch a women’s empowerment program in Cote d’Ivoire. TCHO, meanwhile, has created a system with its cocoa farmers in Peru that helps train them to understand the

sensory aspects of the cacao they grow; according to chocolate maker Brad Kintzer, many had never tasted the final product made with their ingredients. Farmers participating in the TCHOSource program are taught to evaluate their beans for the qualities chocolate makers are looking for, supplying them to manufacturers whose specifications match up with their beans’ qualities and creating a more efficient, mutually beneficial system. Katrina Markoff’s Wild Ophelia brand benefits girls who want to become food entrepreneurs; she says that this assistance made founding her company possible, and she wants to provide that help to the next generation. Chuao Chocolatier, meanwhile, partnered with Girls Inc. to create its Lovely by Chuao Chocolatier bars that raised $1 for every seven bars sold, and Endangered Species donates 10% of net profits to its charity partners to support species preservation around the world.

Melanie Zanoza Bartelme is associate editor of Food Technology magazine ([email protected]).

References

ABC. 2016. Increasing Consumer Appeal of Chocolate Products with Trending Inclusions like California Almonds webinar. March 17. Almond Board of California, Modesto, Calif. almonds.com.

FONA. 2015. Category Insight Report: Fun, Flavorful, Fabulous: The World of Gummies.

FONA. 2016a. Category Insight Report: Chocolate Confectionery.

FONA. 2016b. Category Insight Report: 4 Trends in Indulgence.

Mintel. 2016a. Chocolate Confectionery—U.S. March. Mintel Group, Chicago. mintel.com.

Mintel. 2016b. Chocolate Confectionery Global Annual Review.

NCA. 2015. “Candy Industry Supports 465,000 Jobs Nationwide, Drives 1:7 Multiplier Effect.” Press release, Sept. 17. National Confectioners Assoc., Washington, D.C. candyusa.com.

NCA. 2016a. State of the Industry report.

NCA. 2016b. “Luxury, Fruits and Innovative Ingredients Named Among Confectionery Trends for 2016.” Press release, May 23.

NCA. 2016c. “Americans Enjoy Valentine’s Day Treats in Moderation.” Press release, Feb. 8.

Packaged Facts. 2014. Chocolate Candy in the U.S., 10th Edition. July. Packaged Facts, Rockville, Md. packagedfacts.com.