The New Future of Sweet

Emerging consumer trends and technical innovations in sweeteners are changing the taste of America’s foods and beverages.

While historically sugar has rarely been the hero, it’s certainly been the villain in more recent times with “good fats” and the power of protein taking center stage in consumers’ minds. The current anti-carb culture gained traction with the Atkins and South Beach diet regimens over two decades ago and continues its momentum with diets of the moment like Whole30 and Bulletproof. Many consumers have a love-hate relationship with sweetness: wanting full flavor but with less sugar. With the announced changes to nutrition facts labeling to require calling out added sugars and having a % Daily Value based on a Daily Reference Value (DRV) of 50 grams going into effect as well as recommendations from the American Heart Assoc. and World Health Organization to substantially limit sugar intake, the sugar content of foods is being further highlighted and scrutinized (AHA 2016). Consumer confidence in institutions and experts has been eroding in general, and recent revelations of a decades-old effort to speciously shift attention away from sugar to fat as related to occurrence of cardiovascular disease further fuels mistrust (O’Connor 2016). Consumers have become more wary of expert guidance at the same time they are exposed to nutrition messages from a wide range of sources and levels of credibility in an ever-hastening social media information cycle. Additionally, as consumers become more discerning of the food ingredients on labels, developers face the challenge of creating clean label products—with natural, familiar, and shorter ingredient lists—that also meet consumer desires for foods with reduced sugar or no added sugars. In order to future-proof their product portfolios, food manufacturers are finding it is critical to anticipate consumer attitudes about ingredients and start designing products for where consumers will be moving. This is critical because even with the nimblest of concept-to-launch cycles, the process of building sales distribution takes time, and with the need to maintain high consumer relevance in the near and long term, manufacturers must be thinking about not only where the consumer is today in terms of food and nutrition attitudes, but also where the consumer will be five to 10 years from now.

Less Sugar, but More Flavor Please!

Less Sugar, but More Flavor Please!

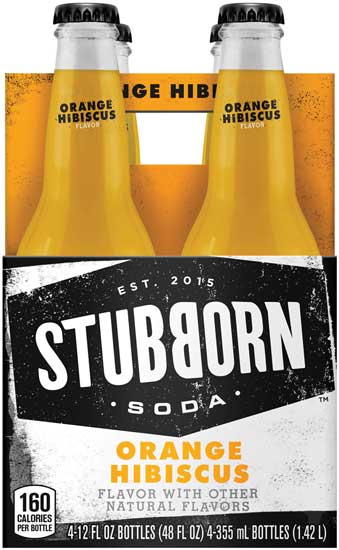

As consumers demand more options that are less sweet, but not bland, even traditionally sweet categories, such as sodas and yogurt, have diverged in flavor profiles, with new products that include salty, acidic, bitter, or spicy tastes. In the beverage category, products with natural flavors and less sugar are getting traction. La Croix, a sparkling water with added natural flavors, has gained a cult-like following among Millennials and is a favorite stocked item at tech companies like Yelp and GrubHub (Ding 2016). Spindrift sparkling waters, made with real fruit juices and less sugar than traditional sodas, recently won “Carbonated Beverage of the Year” during “BevNET’s Best of 2015” awards competition. Additionally, both product platforms tout clean and simple labels along with great taste. New flavor profiles that explore sweet and sour and sweet and spicy are beginning to take off with fermented beverages like Synergy Kombucha that celebrates tangy and pungent notes and Dry Soda, which has introduced seasonal flavors like Malawi Watermelon and Serrano Pepper. New-to-the-world sugar-free beverages like Koa Okalino, which is made by centrifuging juice from 11 fruits and vegetables, are entering the market. Even core-to-the-category producers like Coke and Pepsi have been broadening their offerings, in part by launching versions of their popular colas such as Coca-Cola Life and Pepsi True that use stevia and sugar to deliver soft drinks that have about one-third less sugar than the flagship versions. However, even large producers have been adding craft options with more experiential flavors. Stubborn Soda from PepsiCo, Purchase, N.Y., is sweetened with fair trade–certified sugar and stevia and is positioned around no artificial sweeteners, no high fructose corn syrup, and no azo dyes. Stubborn rolled out in bottles this summer after premiering on fountain in 2015 with flavors like Black Cherry with Tarragon and Orange Hibiscus (Arthur 2016).

In the yogurt category, the emergence of Greek-style and Icelandic-style yogurts like Fage and Siggi’s reintroduced thicker textures and tangy flavors to an otherwise predominantly sweet category. Small producer Blue Hill Yogurt, Pocantico Hills, N.Y., introduced its line of savory yogurts, including tomato, beet, and carrot, and featuring lower sugar content. In fermented products, the balance between added sweetness and natural acidity is being redefined and reverting to more traditional flavor profiles. In all of these products, reducing sugar means not only reducing the sweetness of the product, but boosting and balancing other basic tastes and the flavor profile to a desirable place. The hope is that changing consumer tastes will also buoy major reformulation efforts since making any change to a beloved product or iconic brand can be challenging to do without upsetting loyal consumers. Last year Yoplait Yogurt implemented a 25% sugar reduction to the Yoplait Original line, a further improvement to the line that removed high fructose corn syrup several years earlier, acknowledging that the taste would be less sweet but a flavor consumers would still love (Yoplait 2015). As consumers seek less sugar and products that are less sweet, it’s still a mandate that companies deliver on products with full flavor and clean labels.

In the yogurt category, the emergence of Greek-style and Icelandic-style yogurts like Fage and Siggi’s reintroduced thicker textures and tangy flavors to an otherwise predominantly sweet category. Small producer Blue Hill Yogurt, Pocantico Hills, N.Y., introduced its line of savory yogurts, including tomato, beet, and carrot, and featuring lower sugar content. In fermented products, the balance between added sweetness and natural acidity is being redefined and reverting to more traditional flavor profiles. In all of these products, reducing sugar means not only reducing the sweetness of the product, but boosting and balancing other basic tastes and the flavor profile to a desirable place. The hope is that changing consumer tastes will also buoy major reformulation efforts since making any change to a beloved product or iconic brand can be challenging to do without upsetting loyal consumers. Last year Yoplait Yogurt implemented a 25% sugar reduction to the Yoplait Original line, a further improvement to the line that removed high fructose corn syrup several years earlier, acknowledging that the taste would be less sweet but a flavor consumers would still love (Yoplait 2015). As consumers seek less sugar and products that are less sweet, it’s still a mandate that companies deliver on products with full flavor and clean labels.

The Better Sweet

The Better Sweet

With a negative perception of commonly used sweeteners such as high fructose corn syrup and sometimes even granulated white beet and cane sugar, manufacturers are exploring less refined alternative sources of sweetness such as turbinado cane sugar, sugar brown rice syrup, maple syrup, coconut sugar, date paste, and sweet potato puree. The product range of sugars and sweeteners from Wholesome!, Sugar Land, Texas, are speaking directly to consumers in a contemporary way as being “committed to providing the most delicious Fair Trade Certified, organic, natural, and Non-GMO Project Verified sweeteners sourced from ethically and environmentally responsible growers and manufacturers” (Wholesome Sweeteners 2016). As an example, coconut sugar is increasing in popularity, although sales volume is still low, because of a consumer perception that it is a wholesome, less refined alternative from a recognizable source. Some coconut sugar producers are promoting that it contains key vitamins, minerals, and phytonutrients as a benefit, as well as other attributes that contribute to a higher food ethos—that their product is high-end, artisanal, organic, and non-GMO Project Verified. Coconut sugar is also considered a low glycemic index sugar, so it may have additional appeal to consumers concerned about spiking their blood sugar or who are diabetic or prediabetic.

Individual sweeteners can also have their own unique challenges (real or perceived), so it is critical to understand what matters most to a particular consumer target. For example, brown rice or tapioca syrup may be a functionally equivalent alternative to some corn syrups but have a source that is compatible with the food values for consumers in the natural channel. However, some segments of consumers may associate brown rice syrup with the potential for containing higher levels of arsenic from the environment, which has been reported in the media over time (Allen 2012). In general, moving to sugars that are perceived as less refined or are pantry-recognizable ingredients where appropriate is one formulation strategy that companies are exploring. However, it is important to realize the specific ingredient may have its own unique tradeoffs and perceptions that will evolve over time. Even while researchers continue to clarify biochemical advantages of specific sweeteners, ingredients with common or recognizable names with “kitchen logic” will likely be more readily acceptable by consumers. Consumers will likely still continue to make food choices based on taste and nutrition but in an accelerating manner on the provenance of ingredients versus the foundational science.

Other once-heralded artificial noncaloric sweeteners like sucralose and acesulfame-K are losing appeal with Millennials and more health- and label-conscious consumers. Two natural noncaloric sweeteners have increasingly become popular alternatives: stevia fractions and monk fruit extracts. Each of these ingredients has been improved by supplier efforts to improve the raw material supply chain and refine and improve the extraction process, resulting in a better raw material for developers. Also, sweetness enhancers and bitter blocker flavors have done much to improve the perceptions by modulating the sweetness time-intensity curve. For these natural sweeteners, the main challenge has been to reduce the sweetness linger or “tail” and shift the taste impact to be more similar to sucrose and also sometimes block the associated bitter flavors. In general, these technical flavors and sweetener tools have improved, with most flavor houses offering proprietary versions with the advantage of being labeled as natural flavors. Consumer desires for increased transparency may drive producers to divulge the role for each natural flavor in the future (e.g., label “natural cinnamon flavor” versus just “natural flavor”), but ingredients that label as natural flavors would seem to meet the standard of what many consumers would consider a clean label at the present time.

Stevia fractions continue to be purified, optimized, and more targeted for specific applications. The best-known fraction, Reb A, is available in 95% purity but is now also being complemented by other fractions, either from continued isolation and extraction or potentially also fermentation. This is a boon to product developers as these natural ingredients start to become cleaner in taste profiles and very tunable to specific applications. However, as the stevia glycosides become more refined, there are concerns that some consumers may reject products formulated with these highly purified and engineered versions of stevia.

Structure and Function, Not Just Flavor

Reducing sugar in products may not be solely a flavor challenge because sugar plays many functional roles in addition to flavor for many products. Sugar’s functional roles include controlling water activity, serving as a bulking agent, providing structure in baked goods, impacting mouthfeel in combination with hydrocolloids, acting as a binder in bars, and providing softer textures in a range of products—just to name a few. Many of the high-intensity sugar substitutes on the market today do not replace the physical functions of sugar. Reducing or removing sugar from a product formulation may require additional ingredients or changes to the process to maintain flavor, texture, quality, and shelf life. Sugar alcohols (e.g., erythritol) may be acceptable for some consumers in some applications where the sugar and its physical structure and purity are truly responsible for the product experience, such as in confections.

Sweeteners 3.0: Developing Game-Changing Ingredients

With the need from both consumers and food companies for great-tasting, reduced-sugar or sugar-free products, new innovations are being explored by flavor houses, suppliers, and food technology start-ups. It’s difficult to provide an exhaustive list of the innovations taking place in the sweetener technology space, with one author citing more than 40 new sweetener ingredient development launches in a 12-month period just a few years ago (Pszczola 2013). However, a few innovations from emerging start-ups stand out.

Start-up company Miraculex, Davis, Calif., is developing a line of plant protein–based sweeteners with the potential to revolutionize the definition of sweet in terms of taste and health. The company is starting with miraculin, the active component in miracle fruit. Miracle fruit gained attention several years ago as a culinary novelty with its ability to be eaten and then change one’s taste perception of sour foods like lemon to sweet. In the past, the hurdle to commercializing protein-based sweeteners included both price and stability. With the company’s research and development, Miraculex CEO Alan Perlstein believes miraculin and other protein-based sweeteners have potential to fulfill the need for great-tasting sweeteners from natural products without the downside of metabolic issues or off-tastes.

“We’ve discovered things that others have missed. Miraculin is more than just turning sour into sweet—it can amplify and smooth out other flavors,” says Perlstein. “We’re developing ingredient products and stand-alone products and currently testing in sorbets, ice creams, and ketchups.” Perlstein believes the potential for miraculin goes beyond sugar replacement but includes flavor potentiation and modulation as well as therapeutic applications for chemotherapy patients who often lose some of their olfactory abilities during treatment. By combining agricultural technology and molecular biology, Miraculex is developing a variety of products, including both non-GMO and GMO, for different consumers. The company is currently producing prototype products, developing its portfolio, and addressing regulatory issues and scale-up in the next two years.

Suppliers also are exploring new avenues, such as how fermentation can help generate new, higher-quality sweeteners. Flavor houses are offering solutions by masking the off-notes of alternative sweeteners, such as a new ingredient from a partnership between GLG Life Tech, Richmond, British Columbia, Canada, and MycoTechnology, Aurora, Colo., that is created from mushroom mycelium to block bitterness from stevia and monk fruit (Watson 2016). With increasing consumer desire for less sugar in food and beverages, more stringent labeling regulations, and the increasing health recommendation to reduce sugar in the diet, there’s an undeniable appetite for innovation in the sweetener category, not only at the molecular level, but also through smart formulation and creative culinary applications.

--- PAGE BREAK ---

Designing for Future Tastes and Desires

With emerging technical innovations, consumers’ increasing desire for transparency about foods and ingredients, and opinions being shared more widely and rapidly via social media, the future of sweet is rapidly changing. As food innovators, we need to renovate and innovate in the current environment as well as look forward to where consumers are going to future-proof product portfolios. As formulators, we need to understand the total role of sugar in a product—from function to taste—considering the full flavor experience from desired intensity to the temporal flavor profile. We must explore synergies from multiple sweetener ingredients as well as understand flavor potentiation. While it’s required for developers to approach formulating sweet products with technical rigor, it’s no longer enough. We must develop as food scientists, but also think holistically like consumers. We must create ingredient labels and the nutrition facts that meet consumers’ needs while also perfecting taste profiles and optimizing quality. As the connection between food and health continues to grow, the way we approach the role and value of sweetness in our foods and beverages must also change and evolve.

Sweet New Substitutes for Sugar

When Michelle Francis-Winer and her husband, Corey Winer, decided that they wanted to reduce their sugar intake several years ago, they couldn’t find a sweetener that delivered what they were looking for, particularly since Francis-Winer had recently been diagnosed with a number of food sensitivities. So she decided to create her own non-sugar sweetener.

The result—after several years of formulation experimentation, including assistance from a family friend who is a food chemist—was ZenSweet, a blend of monk fruit, erythritol, and the soluble prebiotic fiber polydextrose. ZenSweet contains just 0.34 calories per gram, has no glycemic impact, and is not genetically modified.

The result—after several years of formulation experimentation, including assistance from a family friend who is a food chemist—was ZenSweet, a blend of monk fruit, erythritol, and the soluble prebiotic fiber polydextrose. ZenSweet contains just 0.34 calories per gram, has no glycemic impact, and is not genetically modified.

The new natural sweetener is sold in one-pound stand-up bags for a suggested retail price of $9.99 and is available in the Midwest in Whole Foods Markets and the Roundy’s Supermarket chain. “ZenSweet is easy to use since it measures cup for cup to sugar and truly tastes like sugar right out of the bag,” says Francis-Winer.

Given consumers’ concerns about both sugar and artificial sweeteners, the timing appears to be right for sweeteners made from natural ingredients, and the Winers’ Libertyville, Ill.–based ZenSweet Co. isn’t alone in its bid to capitalize on market opportunities. This past spring Minneapolis-based Cargill began shipping Truvia Nectar, a liquid stevia-based sweetener blend that also contains honey, sugar, water, and citric acid; it is twice as sweet as honey and contains about 20 calories per teaspoon.

Currently available in retail chains including Target, Publix, and Hyvee, among others, Truvia Nectar comes in 100 gram and 300 gram bottles with a suggested retail price of $3.99 and $6.99, respectively. It’s positioned as a lower-calorie alternative to honey, suitable for use in hot and cold beverages, on toast, or as an add-in to oatmeal or yogurt.

Currently available in retail chains including Target, Publix, and Hyvee, among others, Truvia Nectar comes in 100 gram and 300 gram bottles with a suggested retail price of $3.99 and $6.99, respectively. It’s positioned as a lower-calorie alternative to honey, suitable for use in hot and cold beverages, on toast, or as an add-in to oatmeal or yogurt.

Just last month, Starbucks Corp. announced that it would begin offering packets of the zero-calorie sweetener Nature Sweet in nearly 9,000 cafés (Giammona 2016). Made with stevia, monk fruit, erythritol, and chicory root fiber, Nature Sweet is marketed by the Whole Earth Sweetener Co., South Bend, Ind., a subsidiary of Chicago-based Merisant Co. Each packet has the sweetening power of two teaspoons of sugar.

—Mary Ellen Kuhn

Justin Shimek, PhD, a professional member of IFT, is the CEO of Mattson, Foster City, Calif. ([email protected]).

Lauren Shimek, PhD, a professional member of IFT, is the founder of Food.Tech.Design, San Ramon, Calif. ([email protected]).

References

Allen, J. 2012. “Organic Brown Rice Syrup: Hidden Arsenic Source.” ABC News, Feb 16. http://abcnews.go.com/Health/Diet/arsenic-organics-rice/story?id=15642428.

AHA. 2016. “Children should eat less than 25 grams of added sugars daily. American Heart Assoc. Scientific Statement.” Press release, Aug. 22. American Heart Assoc., Dallas. heart.org.

Arthur, R. 2016. “Pepsi’s Stubborn Soda hits U.S. shelves: Heralding ‘the next generation of carbonated soft drinks’.” BeverageDaily.com, Aug 8. http://www.beveragedaily.com/Manufacturers/PepsiCo-Stubborn-Soda-hits-US-shelves.

Ding, E. 2016. “LaCroix Crazy: Chicago’s Tech Employees Addicted to Fizzy Beverage.” Chicago Tribune, Aug. 15. http://www.chicagotribune.com/bluesky/originals/ct-lacroix-chicago-tech-employees-bsi-20160815-story.html.

Giammona, C. 2016. “Starbucks to Begin Serving Stevia.” Bloomberg, Sept. 6. http://www.bloomberg.com/news/articles/2016-09-06/starbucks-to-begin-serving-stevia-as-splenda-rival-makes-inroads.

O’Connor, A. 2016. “How the Sugar Industry Shifted Blame to Fat.” New York Times, Sept 12. http://www.nytimes.com/2016/09/13/well/eat/how-the-sugar-industry-shifted-blame-to-fat.html?_r=0.

Pszczola, D. 2013. “Why Today’s Sweetener ‘Rush’?” Food Technol. 67(5): 56–77.

Watson, E. 2016. “GLG utilizes MycoTech’s mushroom-fueled bitter blocking technology to tackle bitterness in stevia, monk fruit.” FoodNavigator-USA.com, Jan 25. http://www.foodnavigator-usa.com/Suppliers2/GLG-uses-MycoTech-bitter-blockers-to-tackle-stevia-s-bitterness.

Wholesome Sweeteners. 2016. “About Us”. http://wholesomesweet.com/company.

Yoplait. 2015. “Yoplait Original Reduces Sugar Content by 25 Percent With No Artificial Sweeteners or Flavors.” Press release, May 4. http://www.prnewswire.com/news-releases/yoplait-original-reduces-sugar-content-by-25-percent-with-no-artificial-sweeteners-or-flavors-300076301.html.