Yogurt Innovation and the Next Kale

NEW PRODUCT EXPLORATIONS

In this edition of New Product Explorations, we take a look at what the next “it” fruit or vegetable might be, examine what’s new in the world of yogurt, and share the backstory of a new probiotic-packed smoothie product.

Predicting the Produce World’s Next Kale

Fresh produce is in demand, drawing $61 billion in annual sales and up 4% over last year, according to research released by the Food Marketing Institute (FMI) in its Power of Produce report. During the FMI Show keynote address in June, FMI President and CEO Leslie Sarasin asked session speakers and celebrity chefs Mario Batali and Robert Irvine to predict the next kale—the next hot fruit and vegetable consumers might expect to see popping up on menus and in the produce aisle. Irvine chose to abstain, but Batali suggested cardoon, a thistle-like plant in the sunflower family, and jicama, a crunchy root vegetable that can be eaten cooked or raw.

“I don’t think it’s going to be cardoon: it tastes like a dirty shoe,” says Karen Caplan, president of produce wholesaler Frieda’s, which has been introducing new produce to the United States for 54 years, beginning with the kiwi in 1962. For Caplan, what constitutes a hot new product in produce depends on who’s asking; something that is new to consumers may have been around for years, being used by bleeding-edge trendsetters such as restaurant chefs and on television.

In fact, Caplan attributes the Food Network show Chopped as a primary way that consumers are beginning to recognize the specialty produce her company imports. Once consumers begin asking for these items, grocery stores begin to stock them. This process, though, can seem to move at a glacial pace; kiwi took 18 years to catch on, and while Frieda’s has been selling passion fruit since the ‘70s, only recently has it begun to appear in retail products and in the produce department consistently. In addition, manufacturers who wish to integrate these new ingredients in their products must be sure to secure a consistent and dependable supply of the raw product, something that can be difficult when these fruits and vegetables are being grown on small scales by independent farmers.

To Caplan, several currently trending fruits and vegetables show potential to move into the mainstream, where manufacturers can more easily access them. Jackfruit, which Frieda’s started selling 20 years ago in dried form, is being used by several companies, including Upton’s Naturals and The Jackfruit Co., as a meat substitute; it resembles pulled pork or beef. Caplan warns that this product currently appeals mainly to niche markets, but that it could become more mainstream over time. In addition, raw jackfruit, which tastes like tropical tea, may soon find its way into restaurant desserts and in juices, according to Caplan.

One of her other picks, turmeric, is already the subject of much trade show buzz, and it has been included in a range of products, including tea, chocolate, and curries, and in golden milk, a combination of almond milk and powdered turmeric that boasts anti-inflammatory properties. Meanwhile, kimchi, a fermented cabbage dish from Korea, provides probiotics and may appeal to Millennials looking for authentic ethnic foods.

Although Caplan says that kohlrabi has been around for years, it seemed to be gaining more consumer appeal at the FMI Show, where at least two companies showcased the root that’s part of the Brassica family along with cabbage and broccoli. Bejo’s Kool Robbi kohlrabi sticks provide more vitamin C than oranges and look like string cheese. Each variety of Mann’s Nourish Bowls, meanwhile, contain kohlrabi as well as other trending vegetables such as sweet potatoes and butternut squash. These bowls, which were created with three San Francisco Bay Area chefs, were developed as a healthy, warm single-serve meal with fresh veggies, grains, and sauces, according to the company. “Healthy bowl-based meals are very popular in foodservice, so it’s natural to bring a product like Nourish Bowls to retail,” says Lorri Koster, company chairman and CEO. “We fully expect this new line to do for the cut-veg category what single-serve salad bowls have done for the salad category.”

To determine which veggies to include in the bowls, Mann’s looked at Nielsen data and U.S. foodservice trends, which showed an increased use of the ingredients that were chosen, including broccoli, cauliflower, Brussels sprouts, sugar snap peas, and kale.

Speaking of kale, Caplan doesn’t think it’s going anywhere. “Is it in or out? It’s just kale,” she says, noting that while kale might not be the must-have ingredient it once was, its moment in the spotlight has served to increase consumer awareness of the benefits it can provide.

A Culture of Innovation in the Yogurt Category

According to Innova Market Insights data, yogurt products accounted for 22% of global dairy category launches in 2015. Within the United States, the yogurt category has transformed in recent years, beginning with the explosion of Greek yogurt when Chobani burst onto the scene, and consumers should expect even more innovation in this category as time goes on. “Consumers’ increasing health and wellness demands, their snacking obsession, and fast-paced lifestyles all are contributors to various changes in the yogurt segment,” writes FONA International in its recent Trend Report on the category. Although spoonable yogurt’s growth has slowed as Greek yogurt’s novelty has begun to wear off, according to research firm Mintel, the category’s retail sales are expected to grow 4.6% by 2020, and drinkable yogurt is emerging as a convenient way to experience the health benefits yogurt can provide.

Innovation is taking place in both of these areas, and according to dairy consultant Donna Berry, several product development trends stand out. Nonfat sales are down, she notes, and whole milk varieties are rising because consumers are attracted to the richness and satiety they offer. Inaddition, creating handcrafted and authentic products is key for smaller local producers, who are able to include local fruits and milk in their products. For larger companies that may not be able to tap into this trend, opportunity lies in creating unique flavor and mix-in combinations, though Berry notes that some of these sweet and spicy flavors might be better suited to other dairy applications, such as dips or cream cheeses.

Several new products in the refrigerated section highlight these trends.

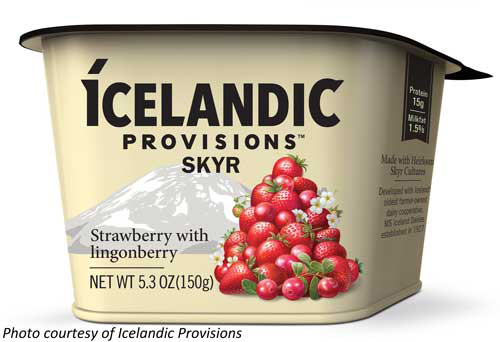

Icelandic Provisions launched the first-ever line of traditional Icelandic skyr products available in the United States. The yogurt-like dairy products are made in Iceland using centuries-old preserved heirloom skyr cultures and milk from the oldest and largest dairy co-op in Iceland, and three of the flavors include native Nordic fruits such as cloudberries, bilberries, and lingonberries.

Icelandic Provisions launched the first-ever line of traditional Icelandic skyr products available in the United States. The yogurt-like dairy products are made in Iceland using centuries-old preserved heirloom skyr cultures and milk from the oldest and largest dairy co-op in Iceland, and three of the flavors include native Nordic fruits such as cloudberries, bilberries, and lingonberries.

“U.S. consumers are developing a palate for the thick, creamy taste of skyr,” says Einar Sigurðsson, Icelandic Provisions’ chairman. “They value products with a high protein content that aren’t packed with the sugar levels you find in the cultured dairy populating grocery shelves across the U.S. We are proud to … expand the skyr category with a product that comes directly from the country that invented it and is made with ingredients that are native to the Nordic region.”

Noosa Yoghurt has added sweet heat flavors to its portfolio, bringing Australian-style yogurt into this trend. Eight-ounce tubs come in flavors such as Raspberry Habanero, Pineapple Jalapeño, Blackberry Serrano, and limited-edition Bhakti Chai, which combines spicy chai tea from Colorado company Bhakti Chai with Noosa’s yogurt to create an eating experience reminiscent of the traditional beverage. In addition, Mexican Chocolate, which is available in 4-ounce cups, combines cinnamon, chocolate, and chili for a spice-forward dessert-like indulgence. “[We] literally use our guts to come up with new flavor combinations,” says founder Koel Thomae. This line was inspired by her recent visits to high-dairy-consumption cities, where she witnessed a plethora of savory and spicy yogurt combinations.

Noosa Yoghurt has added sweet heat flavors to its portfolio, bringing Australian-style yogurt into this trend. Eight-ounce tubs come in flavors such as Raspberry Habanero, Pineapple Jalapeño, Blackberry Serrano, and limited-edition Bhakti Chai, which combines spicy chai tea from Colorado company Bhakti Chai with Noosa’s yogurt to create an eating experience reminiscent of the traditional beverage. In addition, Mexican Chocolate, which is available in 4-ounce cups, combines cinnamon, chocolate, and chili for a spice-forward dessert-like indulgence. “[We] literally use our guts to come up with new flavor combinations,” says founder Koel Thomae. This line was inspired by her recent visits to high-dairy-consumption cities, where she witnessed a plethora of savory and spicy yogurt combinations.

As for the Mexican Chocolate flavor, Thomae says it was created because Noosa has seen more and more yogurt being consumed outside of the breakfast occasion. “Consumers are seeking indulgent snacks or dessert swaps, so [Noosa is] paying attention to trends like these to make sure they’re delivering what the consumer wants,” she adds. She also says to expect to see more savory flavor combinations in early 2017.

Greek dairy cooperative Kourellas recently began producing organic “Greek yogurt made by Greeks,” importing Greek fruit and cultures and blending them with local New York milk. According to Berry, the copacker the Greek company uses ensures that at least two workers on the product line at all times hold Greek passports. The premium yogurt will be sold for about $2.50 per 3.5-ounce cup.

Greek yogurt brand Fage recently introduced Crossovers, a line of sidecar-style yogurts that promise “chef-level snacking … for any time, place, and palate.” The sophisticated line includes sweet and savory offerings such as Carrot Ginger With Pistachios, Olive Thyme With Almonds, Coconut Curry With Cashews, Caramel With Almonds, and Tomato Basil With Almonds. The low-fat yogurts are made with skimmed milk and provide 190–220 calories.

Greek yogurt brand Fage recently introduced Crossovers, a line of sidecar-style yogurts that promise “chef-level snacking … for any time, place, and palate.” The sophisticated line includes sweet and savory offerings such as Carrot Ginger With Pistachios, Olive Thyme With Almonds, Coconut Curry With Cashews, Caramel With Almonds, and Tomato Basil With Almonds. The low-fat yogurts are made with skimmed milk and provide 190–220 calories.

Snowville Creamery, an Ohio dairy processing company, sells a line of yogurts made from A2 milk. A2 cow’s milk contains only the A2 type of beta-casein protein instead of the more common A1 protein commonly found in regular milk, which some believe can be hard for humans to digest. Snowville’s milk comes from Guernsey and Jersey cows, and herds of these breeds have a higher concentration of A2-producing animals than Holstein herds, according to Warren Taylor, Snowville president and a self-proclaimed “dairy evangelist.” The cows are also grass-grazed, which makes the milk and products made from it tastier and healthier, he says; this milk has a high omega-3 fatty acid content.

Snowville’s yogurt comes in a range of flavors and types, including 1%, 2%, and 6% butterfat. The 2% low-fat is available in Lemon-Ginger and Gingamon, or ginger-cinnamon, and the Coffee-Cardamom cream top yogurt offers bittersweet notes and pairs well with toppings such as granola and nuts.

In July, Liberté released its Liberté Organic line of whole-milk yogurts made without artificial colors or flavors and high fructose corn syrup. Organic positioning adds value to a product, according to Berry, and in addition to that claim, these yogurts are also interesting because of their flavors. Almost every one of the eight varieties in the line is named for a very specific location where one of its ingredients comes from, such as Ecuadorian Mango, Washington Black Cherry, Baja Strawberry, and French Lavender.

In July, Liberté released its Liberté Organic line of whole-milk yogurts made without artificial colors or flavors and high fructose corn syrup. Organic positioning adds value to a product, according to Berry, and in addition to that claim, these yogurts are also interesting because of their flavors. Almost every one of the eight varieties in the line is named for a very specific location where one of its ingredients comes from, such as Ecuadorian Mango, Washington Black Cherry, Baja Strawberry, and French Lavender.

Kite Hill uses non-GM almonds from California’s San Joaquin Valley to create the almond milk base for its five yogurt flavors, which include blueberry, strawberry, and peach. The company follows traditional methods for processing yogurt, simply swapping nut milk for cow’s milk. The company’s cultured products are also made using proprietary cultures and enzymes grown exclusively on a vegetable-based medium, ensuring they are appropriate for consumers who are sensitive to dairy or follow a vegan diet.

Boosting Avocado’s Goodness With Probiotics

Boosting Avocado’s Goodness With Probiotics

During IFT16, Ganeden announced the winner of its contest that sought to find and fund the next big probiotic food startup. The winner, AVOKE Spoonables, received $25,000 and launch support for its release this fall. The product is an avocado smoothie bowl that contains the company’s GanedenBC30 probiotic packaged with a popout, eco-friendly spoon in a resealable plastic tub that mimics the shape of the fruit; inside where the pit would be, toasted quinoa is separated from the smoothie and can be mixed into the bowl to add texture. Each variety—Berry Mint, Greens & Ginger, Spicy Carrot, and Coconut Curry—contains half an avocado, two servings of fruits and vegetables, and 1 billion CFU of GanedenBC30. The smoothies are high pressure processed and will likely be merchandised with produce versus yogurt.

According to judges Caroline Beckman, cofounder and CEO of Nomva, and Jennifer Love, CEO of Entrepreneurist and One More Woman, AVOKE was chosen because of the marketing opportunities it has and how scalable the product is, in addition to hitting all the marks for what they consider a successful product in today’s market: allergen-friendly, filled with healthy fats, and high in protein.

AVOKE was created by two sisters and entered in the contest by AVOKE’s consulting COO, Daniel Karsevar. “The use of avocados as a healthy snack is growing immensely in popularity, yet there continues to be a huge void in ready-to-go avocado products in retail,” he says. “AVOKE Spoonables provide a solution by offering a healthy, vegan snack with a unique design that is convenient for on-the-go lifestyles.”