Demographic Disruptors

Aging Baby Boomers with new priorities, cash-strapped young foodies, and Millennial parents who want products and services on demand have the potential to turn the food industry upside down.

Article Content

The food industry needs an intervention. Too many companies are chasing trendy niches and disproportionately developing “experiential” products for food-fickle young adults while virtually ignoring two of the most dramatic demographic opportunities of all time: a new generation of Millennial parents and their children and the emerging needs of one of the oldest and wealthiest populations in the world, aging Baby Boomers. In 2018, 109 million Americans were aged 50 or older (U.S. Census 2018).

It’s time to refocus. The still massive Baby Boomer cohort, whose members have been the highest per capita spenders at restaurants for the past decade, have cut back on their foodservice visits, creating an unprecedented opportunity to drive further growth in at-home meals for consumers aged 55 years and older (Sloan 2018). Only half of Boomers (52%) now visit a restaurant at least once a week versus 80% of Millennials, 70% of Gen Z, and 67% of Gen X (Technomic 2018).

Conversely, Millennial parents and children have increased their visits to restaurants faster than any other group, up 5% in 2018. One in five family meals purchased by a Millennial consumer was eaten at home last year (NPD 2019).

While older Gen Zers aged 18–24—the first generation of foodie parents—had the highest proportion of specialty/gourmet food buyers last year, the older demographic subsets are keeping pace. In 2018, 67% of Millennials bought gourmet foods, 65% of Gen X, and 60% of Boomers (SFA 2018).

Those aged 55 and older are significantly more interested than their younger counterparts in eating Chinese food at a restaurant, cooking it themselves, or purchasing it in fresh prepared form (Mintel 2019).

While older Millennials, especially those with children, have long driven interest in natural, organic, clean, and plant-based foods, they appear to be surprisingly receptive to food technology. Forty-five percent of Millennials would consider buying meat/poultry developed from cell technology (FMI 2019a). They’re also most aware and receptive to hydroponic produce production (FMI 2019b).

While older Millennials, especially those with children, have long driven interest in natural, organic, clean, and plant-based foods, they appear to be surprisingly receptive to food technology. Forty-five percent of Millennials would consider buying meat/poultry developed from cell technology (FMI 2019a). They’re also most aware and receptive to hydroponic produce production (FMI 2019b).

Moreover, while older Millennials (30–39) and higher-income households are being credited with driving the fast-emerging trend to vegan living, true vegans (3%) and vegetarians (5%) are more than twice as likely to have household incomes of less than $30,000 (Gallup 2019).

Lastly, there hasn’t been a more influential lifestyle shift in the past few decades than the desire of aging Baby Boomers to lead an active, healthy, and convenience-oriented life. New conditions of aging, an increase in the number of infants/young children, and pervasive concerns over a lack of energy (with greater stress and anxiety) will cause consumers—both young and old—to further embrace functional foods.

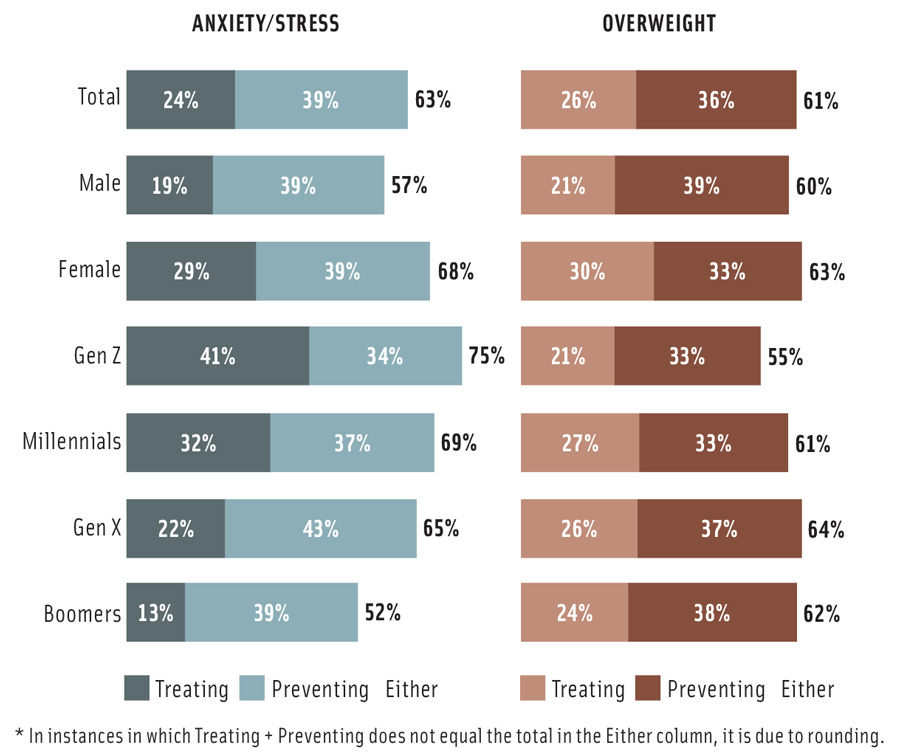

For the first time, the Hartman Group (2019) reports that stress/anxiety has replaced being overweight as the top health condition America’s households are actively trying to treat or prevent (Figure 1). The trend is driven primarily by Millennials and Gen Z.

Moving Targets

For the first time, there are five distinct generations of food shoppers. In 2019, Matures are aged 76-plus, Baby Boomers are 55–75, Gen Xers are 40–54, and Millennials are 25–39. Gen Z is defined by some demographers as everyone under age 24 and by others as those aged 11–24; either way, it makes them the largest and fastest-growing generation although it’s impossible to accurately assess its size because of the lack of accurate statistics on the immigrant population.

In 2015, the U.S. Census Bureau projected that Millennials would number 73 million in 2020, Boomers 69 million, Gen Xers 61 million, and Matures 21 million. Those aged 24 and younger were expected to top 81 million, depending on immigration (U.S. Census Bureau 2015).

Though they have delayed parenthood, Millennials are parents to half of today’s children. Moreover, 80% of Millennials are expected to be parents by 2026. Nearly half of those who haven’t had kids yet say they plan on having them in the future. One million Millennials became new mothers in 2018 (Ypulse 2019).

Two-thirds of Millennial moms primarily do the cooking for their children. Three-quarters consider nutrition information before they buy a food item; 53% are positively influenced by an “all-natural” label. Even with their interest in nutrition, however, confectionery brand Reese’s is the favorite brand of Millennial parents (Ypulse 2019).

Gen Zers are just becoming full-fledged consumers. In 2017, 51% of young men and 57% of young women aged 18–24 lived in their parents’ household; one-third lived in their own household (Packaged Facts 2018a).

Nearly half of those aged 18–22 and one-quarter of those aged 23–24 were in college. One-fourth of those aged 18–24 worked full-time. The average annual income for those 18–24 in 2017 was $20,123 (Packaged Facts 2018a).

In 2018, there were 128 million households in the United States. Couples with no children at home accounted for 32%, couples with children at home accounted for 29%, and those living alone made up 26% of households. Fifty-one million kids live with both parents; 17 million live with their mom (U.S. Census 2018).

With households with children eating only 7.4 meals together at home per week, convenient, kid-specific meals/snacks are a very big idea (FMI 2017). One-quarter of adult dinners, 45% of lunches, and 53% of breakfasts were eaten alone (Hartman 2017a).

The U.S. population continues to diversify. In 2017, 61% of adults were white, 18% Hispanic, 12% African-American, and 6% Asian American (U.S. Census 2018).

With many ethnic consumers suffering from disproportionately higher rates of high blood pressure/cholesterol, stroke, and diabetes, formulating healthier authentic ethnic foods/ingredients, (e.g., Goya’s low-/reduced-sodium Sazon Goya seasoning line) is a very good idea (AHA 2019).

Seniors (67%) are the most likely to report their financial situation as healthy versus 53% of Millennials (Driggs 2019). The unemployment rate fell to 3.6% in April 2019; the median household income topped $62,175 in 2018 (U.S. Bureau of Labor Statistics 2019).

Savvy marketers are targeting America’s 42 million affluent food consumers with household incomes over $150,000. Affluents’ food spending is 74% higher than other shoppers and accounts for 18% of all retail food/beverage sales. Affluent shoppers are more likely to buy value-added seafood, fresh chicken, bagels, pita bread, organic yogurt, and imported cheese. They have a greater tendency to watch calories and buy more healthy snacks and lower-calorie drinks (Packaged Facts 2019a).

Savvy marketers are targeting America’s 42 million affluent food consumers with household incomes over $150,000. Affluents’ food spending is 74% higher than other shoppers and accounts for 18% of all retail food/beverage sales. Affluent shoppers are more likely to buy value-added seafood, fresh chicken, bagels, pita bread, organic yogurt, and imported cheese. They have a greater tendency to watch calories and buy more healthy snacks and lower-calorie drinks (Packaged Facts 2019a).

In 2018, 40 million Americans were enrolled in the U.S. Department of Agriculture’s Supplemental Nutrition Assistance (food stamp) Program, down from 47 million in 2014. One-third of Millennials say they have difficulty affording the groceries they need (Driggs 2019).

Pet parents are another fast-growing demographic. In 2018, 26% of U.S. households had a cat and 39% had a dog. Sales of dog and cat foods are projected to reach $32 billion in 2019 (APPA 2019).

The Boomers Go Home

While dinners prepared at home—whether from scratch or from a combination of prepared/fresh items—are down across all demographics, Boomers are the most likely to prepare a meal at home—on average 5.0 nights per week versus 4.6 for Gen Xers. Older Millennials prepare a meal at home 4.5 nights weekly; for younger Millennials, the figure is 4.2 (FMI 2018a).

Fifty-eight percent of Millennials say they are more likely to incorporate restaurant-prepared items into their home meals than two years ago, and 43% of Gen Xers and 38% of Boomers say that is the case (Riehle 2019).

Half of Millennials report having more food delivered than two years ago; one-third of Boomers say that they are doing so. Pizza, sandwiches, Chinese food, salad, and chicken wings were the most often delivered foods last year (Riehle 2019).

Households with children living at home are much more likely than those without children at home (74% versus 47%) to buy fresh retail prepared meals (FMI 2018a). With Millennial parents spending 49% of their food dollars on specialty foods, upgrading family and kid-specific prepared food offerings is very important (SFA 2018).

Global flavors, gourmet products, and healthful and whole grain items are among the hot culinary trends for kids’ menus in 2019 (NRA 2018).

Millennials, especially those with children aged 7–12, over-index for frozen food use across all frozen food types. Frozen vegetables are most often purchased by Millennials, followed by meat/poultry, fruit, breakfast items, pizza, single-serve entrées, sides, and appetizers. Boomers are the most likely to buy ice cream (AFFI 2019).

One-quarter of older Millennials often bring frozen food to work. Men, African Americans, and higher-income workers are most likely to do so. Two-thirds of Millennials specifically buy frozen entrées to sample a new cuisine (AFFI 2019).

“Real” and “no artificial” ingredient claims on frozen foods are important to half of Boomers; “all-natural” and “organic” claims are important to nearly 30% of Millennials and Gen Xers (AFFI 2019).

Affluent consumers drove meal kit growth online and in-store in 2018, with sales up 6.1% and 9.0%, respectively. Across both channels, those aged 35–44 led meal kit growth with sales up 4.3% online and 9.2% in-store. Purchases by older adults (45–54) fell 2.8% online and 7% in-store. Sales were down 2.7% online and up 2.8% in-store for those aged 25–34 for the year ended Nov. 12, 2018 (Nielsen 2019).

Just about half of Millennials and older Gen Zers (aged 18–24) say that cooking instructions/recipes and ease of preparation are among the greatest influences on their willingness to buy a food product (Ypulse 2018a).

The NPD Group reported that 58% of Gen Z meals and 46% of Millennial meals were made without an appliance (NPD 2018a). Seven in 10 Gen Zers would love to learn how to cook more (Hartman 2018a).

In a typical week, Gen Zers and Millennials are most likely to eat (in descending order) chicken, pasta, pizza, vegetables, and beef for dinner. Ramen/Asian noodles, Mexican fare, smoothies, and rice are other foods frequently consumed by the younger generations (Ypulse 2018a).

Boomers are significantly less likely than their younger counterparts to prepare meat/poultry on the stovetop; they prefer to use the oven. One-quarter of older Millennials and Gen Xers frequently grill or use their Crock-Pot to cook meat/poultry; 20% use a microwave oven, 15% an Instant Pot, and just under 10% an air fryer (FMI 2019a).

Millennials are the most likely to buy fully cooked and ready-to-eat meat/poultry. Baby Boomers are most likely to choose leaner cuts of meat (FMI 2019a).

Gen Z and younger Millennials are most likely to choose a protein source other than meat/poultry (FMI 2019a). Meat substitutes have the highest purchase intent with older Millennials, men, and upper-income consumers (Johnson 2018).

Over half (54%) of Boomers, 38% of Gen X, 24% of Millennials, and 23% of Gen Z said they would “absolutely buy” alternative meats. Blended meats, which are real meats blended with something plant based, (e.g., the Sonic Signature Slinger, a combination beef and mushroom burger) appear to be a more highly acceptable alternative; only 24% of all consumers say they would “absolutely not” be interested in purchasing them (FMI 2019a).

Over half (54%) of Boomers, 38% of Gen X, 24% of Millennials, and 23% of Gen Z said they would “absolutely buy” alternative meats. Blended meats, which are real meats blended with something plant based, (e.g., the Sonic Signature Slinger, a combination beef and mushroom burger) appear to be a more highly acceptable alternative; only 24% of all consumers say they would “absolutely not” be interested in purchasing them (FMI 2019a).

One-quarter of Millennials eat fish, 16% have seafood, and 14% eat sushi occasionally for a weekday lunch; for dinner, the figures are 30%, 26%, and 16%, respectively (Ypulse 2018a).

Nearly half (48%) of Millennials are interested in ordering Mediterranean cuisines in foodservice; 46%, Japanese/sushi; 39%, Thai/Vietnamese; 36%, Indian; 20%, Middle Eastern; and 19%, Korean (FMI 2018a).

Nearly half (48%) of Millennials are interested in ordering Mediterranean cuisines in foodservice; 46%, Japanese/sushi; 39%, Thai/Vietnamese; 36%, Indian; 20%, Middle Eastern; and 19%, Korean (FMI 2018a).

Contrary to popular belief, 67% of Gen Zers enjoy classic American cooking. In addition, 70% of Millennials, 73% of Gen X, and 67% of Boomers say they enjoy it. Just about two-thirds of all age groups say they enjoy eating the food they grew up with (Hartman 2019).

Taste preferences are also decidedly different by generation. For example, sweet is the most preferred flavor for Gen Z versus savory for the general population. Fruity, smoky, spicy, bold, salty, tangy, herbal, and sour flavors are also significantly more appealing to Gen Z (Technomic 2017).

Gen Z sourced more than 40% of lunches and dinners from foodservice in 2018 (Technomic 2018). Chick-fil-A, McDonald’s, and Taco Bell are Gen Z’s favorite fast-food restaurants; Panera Bread, Chipotle Mexican Grill, and Five Guys are their favorite fast casual eateries (Ypulse 2018a).

Vegging Out….

Millennials are significantly more likely to try and eat more fruits and vegetables for breakfast and lunch and in beverages; members of Gen X and Baby Boomers are more likely to have them for dinner and as a snack. Forty percent of young adults want more recipes and serving suggestions on produce packages (FMI 2019b).

One-quarter of Millennials often buy cold-pressed juices, produce shakes/smoothies, and produce-infused waters; this is more than double the rate of their older counterparts (FMI 2019b).

Those aged 18–39 are significantly less likely than those aged 50 and over to buy bananas, carrots, celery, cucumbers, onions, peppers, potatoes, sweet potatoes, and tomatoes (Johnson 2019). Those aged 50 and older are much more likely to buy kale, mushrooms, oranges, pineapple, cantaloupe, strawberries, peaches, watermelon, and honeydew; young adults buy Asian pears, kiwi, papaya, mangoes, pomegranates, and specialty peppers (Johnson 2019).

Rising demand for calling out specific health benefits on produce packages is being driven by Millennials, especially those with children. Interest in origin information—whether the country, region, or farm—rises along with age to a high of two-thirds of Boomers (FMI 2019b).

Young adults are also significantly more likely to shop at farmers markets and to buy directly from the farm. “Locally raised” and “locally grown” is most important to Baby Boomers (FMI 2019b).

Integrating plant-based protein/ingredients into their diet is most common among Gen Z and Millennials, households with kids, and households with income of $75,000 or more (FMI 2019b).

Beans/chickpeas/lentils/legumes top the list of the types of plant protein used by the 49% of consumers who serve vegetable protein–based meals at least occasionally for dinner, followed by nuts/seeds, veggie burgers, quinoa or other grains, and tofu/tempeh (FMI 2019b).

Just over one-third of adults are daily users of nondairy milks; 40% drink them several times per week. Consumption has increased significantly among those aged 18–34, those over 55, and especially those 65 and over; Asian households have the highest consumption (Packaged Facts 2017a).

Just over one-third of adults are daily users of nondairy milks; 40% drink them several times per week. Consumption has increased significantly among those aged 18–34, those over 55, and especially those 65 and over; Asian households have the highest consumption (Packaged Facts 2017a).

Millennials spent 14% more on organic products and made 9.8% more trips to buy organic products last year versus the prior year. Hispanic spending for organic products jumped 13% (Nielsen 2018). Urban shoppers and those in the Northeast and West have above average organic use (FMI 2019b).

Four in 10 Millennials, one-third of Gen Xers, and one-quarter of Baby Boomers buy organic private label foods/drinks (Hartman 2018b).

Consumers who tried to avoid genetically modified foods at least somewhat in 2018 tended to be aged 25–34, from the Northeast/West, have children at home, or be African-American (IFIC 2018a).

Those aged 18–39 and those in households with children are most interested in eating clean; interest declines with age (HealthFocus 2019).

Mealtimes, Munchies, and Treats

Boomers and their older counterparts are the most likely to eat breakfast, desserts, sandwiches, seafood/fish, and soup and the most likely to serve a balanced plate at dinner with an entrée, side, vegetable, and sometimes salad or bread (NPD 2018b). Steak is their favorite celebratory meal (Technomic 2018).

Households with children eat breakfast on average 5.5 days a week as a family (FMI 2017). Cereal is the most common breakfast for Gen Zers and Millennials; one-third eat a breakfast sandwich (Ypulse 2018a).

Two-thirds are very interested in breakfast snacks, especially Hispanics, African Americans, and those aged 25–34. Nearly six in 10 Millennials frequently order a second breakfast from foodservice during the week (Smuckers 2018a).

Six in 10 Millennials would like more ethnic breakfast items on menus; 55% of Boomers and 62% of Matures would be willing to try them (Smuckers 2017).

Over the past five years, the number of consumers eating lunch later in the day (between 1 p.m. and 5 p.m.) and eating dinner between 8 p.m. and 11 p.m. has increased. Hispanics are nearly twice as likely as the rest of the population to consider lunch the most important meal of the day (Packaged Facts 2019b).

Chicken is the most consumed lunch item by Millennials, followed by sandwiches, leftovers, pizza, salad, and burgers (Ypulse 2018a).

“Snackified entrées” or mini versions of popular main dishes have high appeal among Millennials as a lunch or snack. One-quarter of those aged 18–34 like to order snacks at restaurants instead of full meals (Smuckers 2018b).

Larger households and Hispanics are the heaviest users of fresh packaged breads, buy a wider variety of breads, and are the most likely to buy baking supplies/mixes (Mintel 2016).

Boomers are most likely to look for smaller portion sizes, real ingredients, whole grain, fiber, sugar and sodium content, and fat/cholesterol claims in the bakery; younger adults look for gluten-free, vitamins/minerals, carbohydrates, and protein. Interest in artisan breads increases with age (ABA 2019).

Over the past two years, the percentage of those aged 35–44 who snack more than three times per day increased 9%; among those aged 25–34, the increase was 13%; and among those 18–24, it was 2% (Lyons Wyatt 2019).

Women are more likely to purchase all sweet snack varieties except for pie. After cookies and brownies, the next favorite sweet choice for those aged 18–24 and 45 and older is candy; those aged 25–34 favor cake and candy equally (Smuckers 2018c).

Women are more likely to purchase all sweet snack varieties except for pie. After cookies and brownies, the next favorite sweet choice for those aged 18–24 and 45 and older is candy; those aged 25–34 favor cake and candy equally (Smuckers 2018c).

Four in 10 Millennials ate more organic snacks over the past two years, up 10%; 30% of Gen Xers did so, up 6%; and 25% of Boomers, up 7%. Millennial purchases of vegan snacks increased 20% albeit from a very small base. Gen Xers’ vegan snack purchases increased by 11%, and Boomers’ purchases were up 8% (Lyons Wyatt 2019).

Seven in 10 adults under age 44 want snacks that provide an energy boost; half of those 55 and older want snacks that are lower in salt and sugar (Lyons Wyatt 2019).

Mothers of young children and Millennials continue to drive consumption of snacks made with chickpeas, lentils, beans, or dried peas (Packaged Facts 2017b).

Two-thirds of consumers often choose a beverage as a snack, up 8% over the past two years; 71% of young adults aged 18–24 do so (Lyons Wyatt 2019).

Six in 10 consumers aged 18–29 and half of those aged 30–39 strongly believe that beverages can provide the same nutrition as foods (HealthFocus 2019).

Consumers are most interested in drinkable products that provide health benefits, such as lowering cholesterol, weight management, nutrient fortification, and sustained energy (HealthFocus 2019).

Consumers are most interested in drinkable products that provide health benefits, such as lowering cholesterol, weight management, nutrient fortification, and sustained energy (HealthFocus 2019).

Just over one-quarter of adults under age 54 buy shakes/beverage mixes; about 45% buy bars; for older adults, the figures are just over 10% and 30%, respectively. Blacks and Hispanics are significantly more likely to buy shakes (Packaged Facts 2017c). Women are significantly more likely to buy shakes for protein, followed by nutritional support, taste/convenience, weight loss, and to get superfoods.

Those aged 18–24 are more than twice as likely as the general population to consume drinkable yogurt; households with kids also over-index for consumption (Packaged Facts 2018b).

Water is the most consumed beverage by both Millennials and Gen Z; one in five Millennial and Gen Z consumers drink smoothies (Ypulse 2018a).

Water is the most consumed beverage by both Millennials and Gen Z; one in five Millennial and Gen Z consumers drink smoothies (Ypulse 2018a).

More than half of Gen Zers and four in 10 Millennials would like smoothies to have more functional benefits. For juices, the figures are 50% and 39%, respectively; for tea, it’s 41% and 31%, respectively (Datassential 2018).

Parents with children at home are significantly more likely to buy energy and sports drinks for themselves (Packaged Facts 2017d).

A Functional Future

Interest in functional foods is highest among Millennials, Gen Xers, women, those in the upper-income category, and Asian American consumers (Datassential 2018).

Three-quarters of older consumers define health and wellness as being physically fit, being alert/bright-minded, and having the energy to live an active lifestyle (Hartman 2017b).

Half (50%) of Gen Z consumers believe that their eating patterns are healthy; 58% of Millennials think so, 55% of Gen X, and 60% of Boomers (Hartman 2017b).

Expect the trend to experimenting with trendy eating plans to continue; 28% of older Gen Z consumers aged 18–24 tried the Paleo diet last year, 26% tried a gluten-free diet, 24% whole 30, and 7% vegetarian (IFIC 2018b).

Heart and muscle top the list of health issues those aged 50 and over find extremely/very important, followed by energy, brain function (memory, focus, cognition), weight, and immunity (IFIC 2018c).

Retaining mental sharpness as they grow older and the ability to continue with normal activities as they age are extremely/very important to six in 10 individuals over age 50 and half of those aged 40–50 (HealthFocus 2019).

After stress/anxiety, younger adults are extremely/very concerned about tiredness/lack of energy, sleep problems, mental sharpness, memory, vision, and skin health (HealthFocus 2019).

Older adults aged 55 and over are the most likely to use dietary supplements. More than three-quarters (78%) do so versus 77% of those aged 35–64, and 69% of those aged 18–34 (CRN 2018). One-quarter of Gen Z teens take a supplement; 27% work out one or two times per week; and 23% do so three to four times weekly (Ypulse 2018b).

Those aged 55 and older are the most likely to take vitamin D, calcium, and magnesium. Those aged 35–54 are the most likely to take B vitamins; and those aged 18–34 are the most likely to supplement with protein, vitamin C, fiber, green tea, a sport supplement, and amino acids (CRN 2018).

Members of Gen X are the most likely to think they are not getting enough specialty nutrients (FMI 2018b). In descending order, omega-3s, fiber, probiotics, digestive enzymes, and collagen are the most often taken specialty supplements by Millennials (CRN 2018).

Young adults are increasingly buying supplements for specific conditions versus general health; supplements for energy, mental/brain health, beauty, and immunity lead the list (HealthFocus 2019).

Of the 27% of supplement users who took a protein supplement last year, 44% opted for plant protein; Millennials were the most likely to do so (CRN 2018). Adults under age 44 are by far the most likely to consume protein drinks/mixes, with 25% across all subgroups using them in 2018 (Mintel 2018).

Sales of all products with a protein claim on the package grew 9% in 2018. Sales of products with a protein claim plus “no preservatives” and a protein claim plus “no hormones” were each up 15%; sales of products with a protein plus “GMO-free” claim were up 21%; protein plus “whole grains,” up 27%; protein plus “no antibiotics,” up 41%; and protein plus “probiotics,” up 59% (Dubois, Parker, and Swanson 2019).

Additionally, Millennials are most likely to pay a premium for foods that go beyond basic nutrition (Driggs 2019).

Two-thirds of those aged 18–29 work out for 30 minutes or more three or more days per week versus half of those aged 65 and older (Gallup 2018). Twenty million individuals over age 65 are exercise walkers, 8 million are aerobic exercisers, and 5 million work out at a gym (NSGA 2018). Seven in 10 Millennials are taking a holistic view of health as do 67% of Boomers (Lyons Wyatt 2018).

Two-thirds of those aged 18–29 work out for 30 minutes or more three or more days per week versus half of those aged 65 and older (Gallup 2018). Twenty million individuals over age 65 are exercise walkers, 8 million are aerobic exercisers, and 5 million work out at a gym (NSGA 2018). Seven in 10 Millennials are taking a holistic view of health as do 67% of Boomers (Lyons Wyatt 2018).

“Grass-fed” tops the list of production claims consumers of all ages would like their meat department to carry more of. Baby Boomers place a priority on “antibiotic-/hormone-free” claims, “raised in the USA,” and “locally raised” while young adults go for “natural” and “organic” (FMI 2019a).

Contrary to popular belief, older Boomers and Matures are the most likely to recycle cans, paper, and plastic. Nearly all generations are equally likely to buy fair trade products and sustainable seafood (FMI 2018).

Editor’s Note

Population data projected in this article should be used only directionally. A number of factors make it impossible to provide a completely accurate estimate. These factors include the fact that the most recent U.S. Census data is from 2015, reliable immigration statistics by which to accurately size a generation are not available, and a formal Census Department definition of the age brackets associated with the Millennial and Gen X cohorts does not exist.

Food Technology Articles

Better Juice and Ingredion Collaborate and More Ingredient News

News about food industry suppliers

How to Formulate for Food Intolerances

In this column, the author describes the global prevalence of food intolerances and provides insight into state-of-science ingredient replacement and removal methods when formulating gluten-free and lactose-free foods.

Vickie Kloeris Shares NASA Experiences in New Book, Consumers Are Confused About Processed Foods’ Definition

Innovations, research, and insights in food science, product development, and consumer trends.

Top 10 Functional Food Trends: Reinventing Wellness

Consumer health challenges, mounting interest in food as medicine, and the blurring line between foods and supplements will spawn functional food and beverage opportunities.

Keeping Chocolate Sweet While Cutting Sugar

Penn State food scientist Gregory Ziegler experiments with substituting rice flour and/or oat flour to reduce the sugar content of chocolate.

IFT Podcasts

EP 7: Microalgae - Modern Uses of an Ancient Ingredient

Microalgae: Modern uses of an ancient ingredient.

EP 4: Consumers Don’t Want to Change, So Why Are They

With up to 40,000 products in a grocery store, many consumers are on auto-pilot when deciding what products to buy.

EP 3: The Fuzzy Front End of Product Development

How human connection drives trends. Where do businesses start when they want to develop a new product and how do you know this product will be a hit with consumers?